444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India wire and cable market represents one of the most dynamic and rapidly expanding sectors within the country’s electrical infrastructure landscape. Market dynamics indicate robust growth driven by massive infrastructure development, urbanization initiatives, and the government’s ambitious renewable energy targets. The sector encompasses a comprehensive range of products including power cables, control cables, communication cables, and specialized wiring solutions for diverse industrial applications.

Infrastructure modernization across India has created unprecedented demand for high-quality wire and cable solutions. The market benefits from significant investments in smart city projects, industrial corridors, and rural electrification programs. Growth projections suggest the sector will maintain a strong CAGR of 12.5% over the forecast period, supported by expanding manufacturing capabilities and technological advancements in cable design and production.

Regional distribution shows concentrated demand in major industrial hubs including Maharashtra, Gujarat, Tamil Nadu, and Karnataka. The market structure includes both organized and unorganized players, with leading manufacturers investing heavily in capacity expansion and product innovation. Quality standards and regulatory compliance have become increasingly important factors influencing purchasing decisions across commercial and residential segments.

The India wire and cable market refers to the comprehensive ecosystem of manufacturers, distributors, and end-users involved in the production, distribution, and application of electrical wiring and cable solutions across the Indian subcontinent. This market encompasses various product categories including power transmission cables, building wires, automotive cables, telecommunication cables, and specialized industrial wiring systems designed to meet diverse electrical connectivity requirements.

Market scope extends beyond traditional electrical applications to include emerging technologies such as fiber optic cables, high-voltage transmission systems, and smart grid infrastructure components. The sector plays a crucial role in supporting India’s electrical infrastructure development, enabling power distribution, communication networks, and industrial automation systems across urban and rural areas.

Industry classification includes copper cables, aluminum cables, fiber optic cables, and hybrid solutions that combine multiple functionalities. The market serves various end-user segments including residential construction, commercial buildings, industrial facilities, telecommunications infrastructure, and renewable energy projects, each with specific technical requirements and quality standards.

Market performance in India’s wire and cable sector demonstrates exceptional resilience and growth potential, driven by fundamental infrastructure development needs and government policy support. The industry has evolved from basic commodity production to sophisticated manufacturing of specialized cable solutions meeting international quality standards and technical specifications.

Key growth drivers include the government’s Make in India initiative, which has attracted significant foreign investment and technology transfer in the cable manufacturing sector. Domestic production capacity has expanded substantially, with major players establishing state-of-the-art manufacturing facilities equipped with advanced automation and quality control systems. The sector benefits from 85% domestic demand fulfillment through local production capabilities.

Competitive landscape features a mix of large-scale organized players and numerous small-scale manufacturers serving regional markets. Leading companies have focused on product diversification, technological innovation, and strategic partnerships to strengthen market position. Export opportunities are expanding as Indian manufacturers gain recognition for quality and cost-effectiveness in international markets, particularly in neighboring South Asian and African countries.

Strategic insights reveal several critical factors shaping the India wire and cable market landscape:

Primary growth drivers propelling the India wire and cable market include comprehensive infrastructure development initiatives supported by both central and state government policies. The National Infrastructure Pipeline represents a massive investment commitment creating sustained demand for electrical infrastructure components including high-quality cable solutions across multiple sectors.

Urbanization acceleration continues driving residential and commercial construction activities, with urban population growth expected to reach 40% by 2030. This demographic shift necessitates extensive electrical infrastructure development including power distribution networks, building wiring systems, and smart city infrastructure components requiring advanced cable technologies.

Industrial expansion across manufacturing sectors creates substantial demand for specialized industrial cables, control systems, and automation infrastructure. The government’s production-linked incentive schemes have attracted significant investment in manufacturing facilities, each requiring comprehensive electrical infrastructure and specialized wiring solutions.

Renewable energy targets established by the government drive demand for specialized cables designed for solar installations, wind farms, and energy storage systems. These applications require cables with enhanced durability, weather resistance, and performance characteristics, creating premium market segments with higher profit margins for manufacturers.

Raw material price volatility represents a significant challenge for wire and cable manufacturers, with copper and aluminum prices subject to global commodity market fluctuations. These price variations impact production costs, profit margins, and pricing strategies, creating uncertainty in long-term contract negotiations and project planning.

Unorganized sector competition continues affecting market dynamics, with numerous small-scale manufacturers offering products at lower prices but potentially compromising quality standards. This competition pressures organized players to balance cost competitiveness with quality maintenance, affecting overall industry profitability and growth sustainability.

Regulatory compliance costs associated with quality certifications, environmental standards, and safety requirements create additional operational expenses for manufacturers. BIS certification requirements and evolving technical standards necessitate continuous investment in testing facilities, quality systems, and compliance infrastructure.

Infrastructure bottlenecks including transportation challenges, power supply issues, and logistics constraints affect manufacturing efficiency and distribution capabilities. These operational challenges particularly impact smaller manufacturers lacking resources to invest in comprehensive infrastructure solutions and supply chain optimization.

Export market expansion presents substantial growth opportunities for Indian wire and cable manufacturers, with neighboring countries and emerging markets seeking cost-effective, quality cable solutions. Trade agreements and diplomatic initiatives create favorable conditions for market entry and business development in international markets.

Smart grid development initiatives across India create demand for advanced cable technologies including smart sensors, communication capabilities, and enhanced monitoring systems. These applications require specialized products with higher technical specifications and value propositions, enabling premium pricing and improved profitability.

Electric vehicle infrastructure development represents an emerging market segment requiring specialized charging cables, high-voltage automotive wiring, and charging station infrastructure. The government’s electric mobility targets create substantial long-term demand for these specialized cable applications.

Data center expansion driven by digital transformation initiatives requires specialized cables for power distribution, cooling systems, and high-speed data transmission. This segment demands high-quality products meeting stringent technical specifications and reliability requirements, creating opportunities for premium product positioning.

Competitive dynamics in the India wire and cable market reflect ongoing consolidation trends as organized players strengthen market position through capacity expansion, technology upgrades, and strategic acquisitions. Market concentration among leading players has increased to approximately 60% market share, indicating growing dominance of established manufacturers with comprehensive product portfolios and distribution networks.

Technology evolution drives continuous product innovation with manufacturers investing in research and development capabilities to introduce advanced cable solutions. XLPE technology adoption has reached 75% penetration in medium voltage applications, reflecting industry preference for superior performance characteristics and reliability benefits.

Supply chain optimization has become increasingly important as manufacturers seek to reduce costs and improve delivery performance. Backward integration strategies including copper rod manufacturing and insulation material production enable better cost control and quality assurance throughout the production process.

Customer relationship management has evolved beyond traditional product supply to include technical support, project consultation, and comprehensive solution provision. This service-oriented approach creates competitive differentiation and strengthens customer loyalty in an increasingly competitive market environment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the India wire and cable sector. Primary research includes extensive interviews with industry executives, manufacturing leaders, distributors, and end-users across various market segments and geographic regions.

Secondary research encompasses analysis of government publications, industry reports, trade association data, and regulatory documentation to understand market structure, policy impacts, and growth trends. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market projections and insights.

Market modeling techniques incorporate economic indicators, infrastructure investment data, and industry capacity utilization metrics to develop comprehensive growth forecasts and trend analysis. Regional analysis considers state-wise industrial development patterns, infrastructure projects, and demographic trends affecting cable demand across different geographic markets.

Industry expert consultation provides qualitative insights into market dynamics, competitive strategies, and future growth opportunities. This approach ensures research findings reflect practical market realities and strategic considerations relevant to industry stakeholders and decision-makers.

Western India dominates the wire and cable market with 35% regional market share, led by Maharashtra and Gujarat states where extensive industrial infrastructure and manufacturing activities create substantial demand. Mumbai-Pune industrial corridor represents a major consumption center with diverse applications including automotive, chemicals, and information technology sectors requiring specialized cable solutions.

Southern India accounts for 28% market share with Tamil Nadu, Karnataka, and Andhra Pradesh driving growth through industrial expansion and infrastructure development. Bangalore technology hub creates significant demand for data center cables and telecommunications infrastructure, while Chennai’s automotive cluster requires specialized automotive wiring solutions.

Northern India represents 25% market share with Delhi NCR, Punjab, and Haryana contributing substantially to market growth. Government infrastructure projects including metro rail systems, smart city initiatives, and power transmission upgrades create sustained demand for various cable categories and applications.

Eastern India holds 12% market share with West Bengal and Odisha showing growth potential through industrial development and mining sector expansion. Infrastructure investment in transportation, power generation, and industrial corridors creates opportunities for market expansion and capacity development in this region.

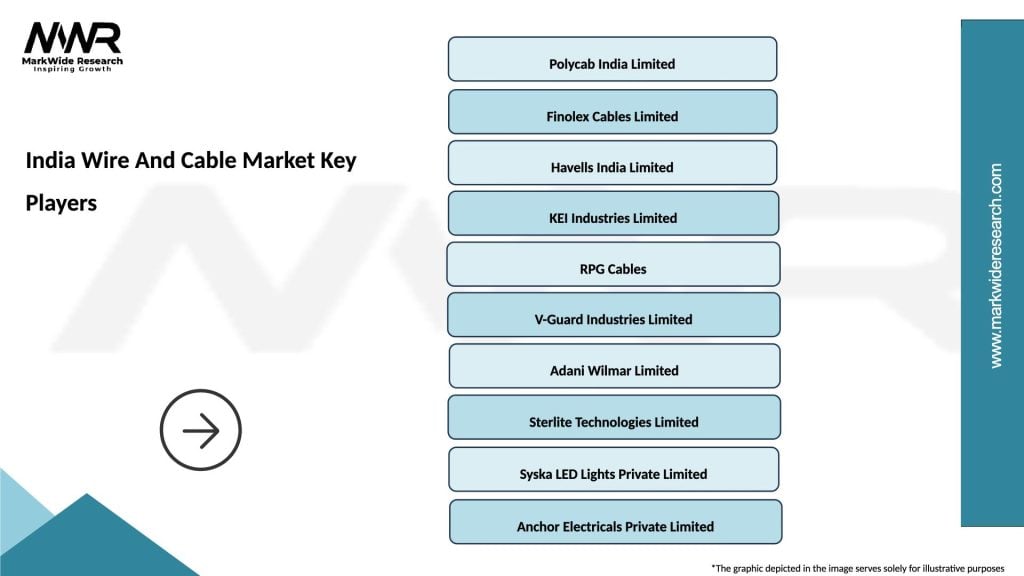

Market leadership in India’s wire and cable sector is characterized by strong competition among established players with comprehensive product portfolios and extensive distribution networks:

Competitive strategies focus on capacity expansion, product innovation, and market penetration through enhanced distribution networks and customer relationship management. Technology partnerships with international companies enable access to advanced manufacturing processes and product development capabilities.

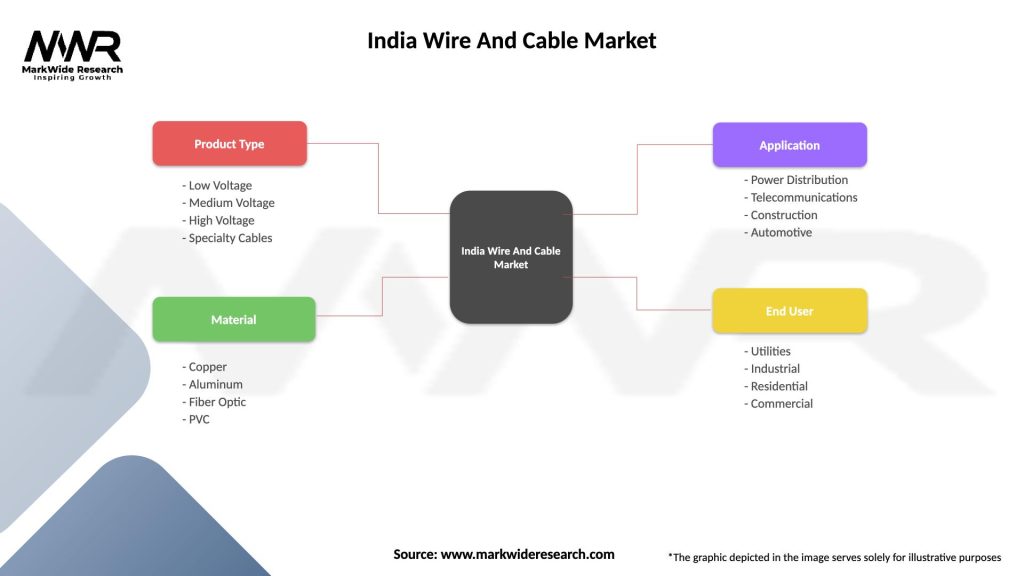

Product segmentation in the India wire and cable market reflects diverse application requirements and technical specifications:

By Product Type:

By Voltage Rating:

By End-User Industry:

Power cables segment represents the largest market category with 45% market share, driven by extensive power infrastructure development and grid modernization initiatives. XLPE cables have gained significant preference over traditional PVC cables due to superior performance characteristics including higher current carrying capacity, better thermal properties, and enhanced durability in challenging operating conditions.

Building wires category accounts for 30% market share with strong growth driven by residential and commercial construction activities. Fire-resistant cables are increasingly specified in commercial buildings and high-rise residential projects due to enhanced safety requirements and building code compliance.

Communication cables segment shows rapid growth with 15% market share, propelled by digital infrastructure expansion and 5G network deployment. Fiber optic cables demonstrate particularly strong demand as telecommunications operators invest in high-speed network infrastructure and fiber-to-home connectivity solutions.

Specialty cables category represents 10% market share but commands premium pricing due to specialized applications and technical requirements. This segment includes marine cables, mining cables, railway signaling cables, and other application-specific solutions requiring specialized design and manufacturing capabilities.

Manufacturers benefit from strong domestic demand growth, enabling capacity utilization optimization and economies of scale realization. Technology advancement opportunities allow companies to develop innovative products meeting evolving customer requirements and regulatory standards, creating competitive differentiation and premium pricing opportunities.

Distributors and retailers benefit from expanding market reach and product portfolio diversification opportunities. Digital transformation in distribution channels enables improved inventory management, customer service, and market penetration across urban and rural areas.

End-users gain access to improved product quality, enhanced technical support, and comprehensive solution provision from organized sector players. Quality assurance through standardization and certification processes ensures reliable performance and reduced maintenance requirements across various applications.

Government stakeholders benefit from increased domestic manufacturing capacity, reduced import dependency, and enhanced infrastructure development capabilities. Employment generation in manufacturing and allied sectors contributes to economic development and skill development initiatives across different regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization adoption is transforming the wire and cable industry through smart manufacturing processes, IoT integration, and data-driven decision making. Industry 4.0 technologies enable predictive maintenance, quality optimization, and supply chain efficiency improvements across manufacturing operations.

Sustainability focus drives development of eco-friendly cable solutions including recyclable materials, reduced environmental impact manufacturing processes, and energy-efficient products. Green building certification requirements increasingly specify environmentally responsible cable solutions in construction projects.

Customization demand grows as end-users seek application-specific solutions tailored to unique operational requirements and performance specifications. Engineering services become increasingly important as manufacturers provide comprehensive technical support and solution development capabilities.

Quality standardization accelerates with BIS certification becoming mandatory for various cable categories, driving market consolidation toward organized players with robust quality management systems. International certification adoption enables export market access and premium positioning in domestic markets.

Capacity expansion initiatives by leading manufacturers include establishment of new production facilities and modernization of existing plants with advanced automation and quality control systems. MarkWide Research analysis indicates substantial investment commitments totaling significant capital allocation for manufacturing infrastructure development across multiple states.

Technology partnerships with international companies enable access to advanced manufacturing processes, product development capabilities, and global market opportunities. These collaborations facilitate knowledge transfer and enhance competitive positioning in specialized market segments.

Merger and acquisition activities continue reshaping the competitive landscape as companies seek to strengthen market position, expand product portfolios, and achieve operational synergies. Consolidation trends favor organized players with strong financial capabilities and strategic vision.

Research and development investments focus on innovative product development including smart cables, enhanced performance materials, and application-specific solutions. Innovation centers established by leading companies drive technological advancement and competitive differentiation in the market.

Strategic recommendations for industry participants emphasize the importance of quality focus, technology investment, and market diversification to achieve sustainable growth and competitive advantage. Brand building initiatives should prioritize quality assurance, customer service excellence, and technical expertise development to differentiate from unorganized competition.

Capacity planning should align with long-term demand projections while maintaining flexibility to respond to market fluctuations and opportunity emergence. Geographic expansion into tier-2 and tier-3 cities offers growth potential as industrial development and infrastructure investment expand beyond traditional metropolitan areas.

Product portfolio optimization should focus on high-value segments including specialty cables, smart infrastructure solutions, and export-oriented products. Backward integration strategies can provide cost advantages and supply chain control in key raw materials and components.

Partnership development with international technology providers, major project contractors, and government agencies can create competitive advantages and market access opportunities. Digital transformation investments in manufacturing processes, customer engagement, and supply chain management will become increasingly important for operational efficiency and market responsiveness.

Long-term growth prospects for the India wire and cable market remain highly positive, supported by fundamental infrastructure development needs, government policy initiatives, and economic growth momentum. Market expansion is expected to continue at a robust pace with CAGR projections of 12-15% over the next five years, driven by sustained investment in power infrastructure, smart cities, and industrial development.

Technology evolution will drive product innovation and market differentiation, with smart cables, IoT integration, and advanced materials becoming increasingly important. MWR projections indicate substantial growth in specialty cable segments as applications become more sophisticated and performance requirements increase.

Export market development presents significant opportunities for Indian manufacturers to leverage cost competitiveness and quality improvements for international market penetration. Regional trade agreements and diplomatic initiatives create favorable conditions for market expansion in neighboring countries and emerging markets.

Industry consolidation will continue as organized players strengthen market position through capacity expansion, technology advancement, and strategic acquisitions. Quality standardization and regulatory compliance will increasingly favor established manufacturers with robust quality management systems and certification capabilities.

The India wire and cable market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by comprehensive infrastructure development, urbanization trends, and government policy support. Market fundamentals remain strong with sustained demand across multiple end-user segments and applications, creating opportunities for both established players and new market entrants.

Competitive dynamics favor organized manufacturers with strong quality focus, technological capabilities, and comprehensive distribution networks. The ongoing consolidation trend toward organized players reflects increasing emphasis on quality standards, regulatory compliance, and customer service excellence in market selection criteria.

Strategic success factors include quality leadership, technology innovation, operational efficiency, and market diversification across product segments and geographic regions. Companies that invest in manufacturing capabilities, brand development, and customer relationship management will be best positioned to capitalize on the substantial growth opportunities in this expanding market. The India wire and cable market continues to offer compelling prospects for sustainable growth and value creation across the entire industry value chain.

What is Wire And Cable?

Wire and cable refer to electrical conductors used for transmitting electricity and signals. They are essential components in various applications, including power distribution, telecommunications, and electronics.

What are the key players in the India Wire And Cable Market?

Key players in the India Wire And Cable Market include companies like Havells India Ltd., Polycab India Ltd., and Finolex Cables Ltd. These companies are known for their extensive product ranges and strong market presence, among others.

What are the growth factors driving the India Wire And Cable Market?

The growth of the India Wire And Cable Market is driven by increasing infrastructure development, rising demand for electricity, and the expansion of renewable energy projects. Additionally, urbanization and industrialization contribute significantly to market growth.

What challenges does the India Wire And Cable Market face?

The India Wire And Cable Market faces challenges such as fluctuating raw material prices and stringent regulatory standards. Additionally, competition from low-cost imports can impact local manufacturers.

What opportunities exist in the India Wire And Cable Market?

Opportunities in the India Wire And Cable Market include the growing adoption of smart grid technologies and the increasing focus on sustainable energy solutions. The rise in electric vehicle infrastructure also presents significant growth potential.

What trends are shaping the India Wire And Cable Market?

Trends in the India Wire And Cable Market include the shift towards environmentally friendly materials and the integration of advanced technologies like IoT in cable manufacturing. Additionally, there is a growing emphasis on energy-efficient products.

India Wire And Cable Market

| Segmentation Details | Description |

|---|---|

| Product Type | Low Voltage, Medium Voltage, High Voltage, Specialty Cables |

| Material | Copper, Aluminum, Fiber Optic, PVC |

| Application | Power Distribution, Telecommunications, Construction, Automotive |

| End User | Utilities, Industrial, Residential, Commercial |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Wire And Cable Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at