444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The India winglets market represents a crucial segment of the country’s aerospace industry, characterized by the adoption of winglet technology in aircraft for improved fuel efficiency, reduced emissions, and enhanced performance. With India’s rapidly expanding aviation sector and growing emphasis on sustainability, the demand for winglet-equipped aircraft is on the rise.

Meaning

Winglets in the aviation context refer to aerodynamic devices installed at the tips of aircraft wings to reduce drag, increase lift, and improve overall efficiency. The India winglets market encompasses the design, manufacturing, installation, and aftermarket services related to these devices, catering to the needs of commercial airlines, military operators, and private aircraft owners.

Executive Summary

The India winglets market is experiencing significant growth driven by factors such as increasing air travel demand, rising fuel costs, and environmental consciousness. This market offers lucrative opportunities for aerospace companies involved in winglet production, retrofitting, and technology integration. Understanding market dynamics, regulatory requirements, and technological advancements is essential for industry stakeholders to capitalize on emerging trends and sustain growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India winglets market operates within a dynamic landscape influenced by factors such as technological innovation, regulatory compliance, market competition, and evolving customer preferences. Adapting to changing market dynamics and customer requirements is essential for industry stakeholders to sustain growth and competitiveness.

Regional Analysis

India’s strategic position as a rapidly growing aviation market and manufacturing hub underscores its significance in the regional winglets market. The country’s aerospace infrastructure, skilled workforce, and supportive regulatory environment foster innovation, investment, and market expansion opportunities in winglet technology. India’s winglets market is primarily concentrated in metropolitan regions with significant airline operations, such as Delhi, Mumbai, and Bengaluru. The increasing number of aircraft in these regions contributes to a higher demand for winglets. Additionally, the growth of regional airports is expanding market opportunities in tier-2 and tier-3 cities.

Competitive Landscape

Leading Companies in India Winglets Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

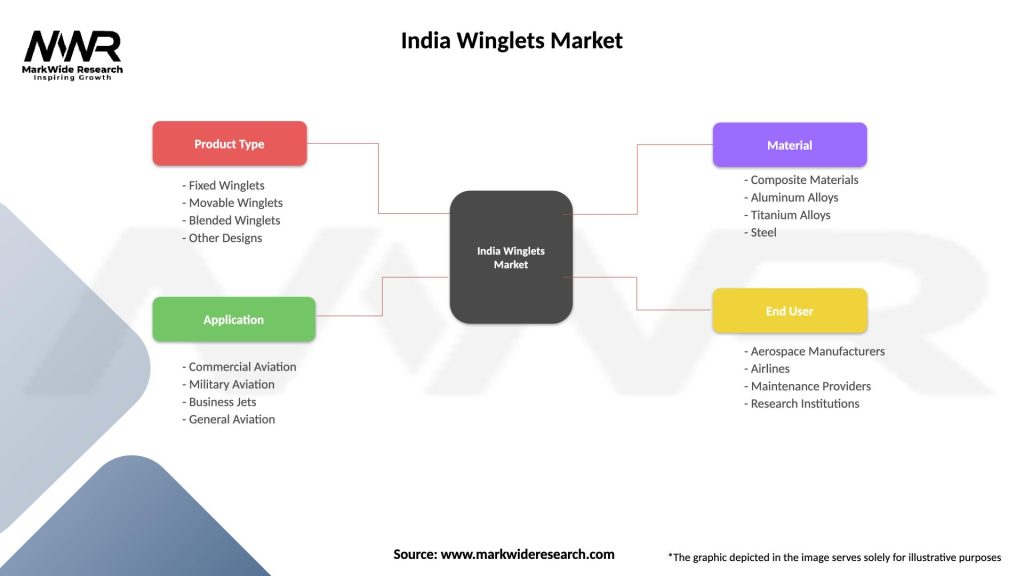

Segmentation

The India winglets market can be segmented based on aircraft type, winglet configuration, application (commercial, military), and end-user (airlines, aircraft operators, government agencies). Segmentation enables targeted marketing strategies and customized solutions tailored to diverse customer needs and preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Understanding these factors through a SWOT analysis enables Indian aerospace companies to leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats in the dynamic winglets market.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has profoundly affected the India winglets market, leading to disruptions in air travel, reduced passenger demand, and fleet groundings. However, as the aviation industry rebounds, there is renewed focus on efficiency-enhancing technologies like winglets to optimize operational costs and support recovery efforts.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the India winglets market remains optimistic, driven by factors such as increasing air travel demand, sustainability imperatives, and technological advancements in winglet design and manufacturing. Strategic investments in innovation, supply chain resilience, and market expansion position India as a key player in the global winglets market.

Conclusion

The India winglets market presents significant growth opportunities for aerospace companies, fueled by the country’s expanding aviation sector, sustainability goals, and technological advancements. While facing challenges such as regulatory complexities and market saturation, Indian aerospace stakeholders can leverage their technological expertise, strategic partnerships, and innovation initiatives to drive market growth, enhance competitiveness, and contribute to the global aerospace industry’s sustainability agenda. By embracing innovation, collaboration, and market diversification strategies, India remains poised to emerge as a leading hub for winglet technology and sustainable aviation solutions.

What is Winglets?

Winglets are vertical extensions at the tips of an aircraft’s wings designed to improve aerodynamic efficiency. They reduce drag and enhance fuel efficiency, making them a crucial component in modern aircraft design.

What are the key players in the India Winglets Market?

Key players in the India Winglets Market include Boeing, Airbus, and Bombardier, which are known for their innovative winglet designs and technologies. These companies focus on enhancing aircraft performance and fuel efficiency, among others.

What are the growth factors driving the India Winglets Market?

The India Winglets Market is driven by increasing demand for fuel-efficient aircraft and the rising need for reducing carbon emissions in aviation. Additionally, advancements in aerodynamics and materials technology are contributing to market growth.

What challenges does the India Winglets Market face?

Challenges in the India Winglets Market include high research and development costs and regulatory hurdles related to aircraft modifications. Additionally, the market faces competition from alternative technologies that may offer similar benefits.

What opportunities exist in the India Winglets Market?

The India Winglets Market presents opportunities for innovation in winglet design and materials, particularly with the rise of electric and hybrid aircraft. Furthermore, increasing air travel demand in India opens avenues for new aircraft models incorporating advanced winglet technologies.

What trends are shaping the India Winglets Market?

Trends in the India Winglets Market include the integration of smart technologies for real-time performance monitoring and the development of adaptive winglets that can change shape during flight. These innovations aim to further enhance fuel efficiency and overall aircraft performance.

India Winglets Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Winglets, Movable Winglets, Blended Winglets, Other Designs |

| Application | Commercial Aviation, Military Aviation, Business Jets, General Aviation |

| Material | Composite Materials, Aluminum Alloys, Titanium Alloys, Steel |

| End User | Aerospace Manufacturers, Airlines, Maintenance Providers, Research Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in India Winglets Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at