444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India waterproofing solutions market represents a dynamic and rapidly expanding sector within the country’s construction and infrastructure development landscape. With India’s aggressive urbanization initiatives and massive infrastructure projects, the demand for comprehensive waterproofing solutions has witnessed unprecedented growth. The market encompasses a diverse range of products including liquid applied membranes, sheet membranes, cementitious waterproofing, and specialized chemical solutions designed to protect structures from water ingress and moisture damage.

Market dynamics indicate robust expansion driven by India’s construction boom, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over the forecast period. The increasing awareness about building longevity, coupled with stringent building codes and environmental regulations, has positioned waterproofing solutions as essential components in modern construction projects. Residential construction accounts for approximately 45% of market demand, while commercial and industrial applications represent significant growth opportunities.

Regional distribution shows concentrated demand in major metropolitan areas, with Mumbai, Delhi, Bangalore, and Chennai leading consumption patterns. The market’s evolution reflects India’s transition toward sustainable construction practices, where waterproofing solutions play crucial roles in energy efficiency and structural integrity. Technology adoption rates have accelerated, with advanced polymer-based solutions gaining 35% market penetration in premium construction segments.

The India waterproofing solutions market refers to the comprehensive ecosystem of products, services, and technologies designed to prevent water penetration and moisture damage in buildings and infrastructure across the Indian subcontinent. This market encompasses various waterproofing methodologies, materials, and application techniques specifically adapted to India’s diverse climatic conditions, construction practices, and regulatory requirements.

Waterproofing solutions in the Indian context include both preventive and remedial measures applied to different structural elements such as roofs, basements, bathrooms, terraces, and external walls. The market covers traditional bituminous products, modern polymer-modified systems, crystalline waterproofing compounds, and innovative nanotechnology-based solutions. Application diversity spans residential buildings, commercial complexes, industrial facilities, infrastructure projects, and specialized structures requiring moisture protection.

Market scope extends beyond product supply to include professional installation services, technical consultation, warranty programs, and maintenance solutions. The definition encompasses both new construction applications and retrofit projects, addressing India’s vast existing building stock requiring waterproofing upgrades and repairs.

India’s waterproofing solutions market stands at the forefront of the country’s construction revolution, driven by unprecedented urbanization and infrastructure development initiatives. The market demonstrates exceptional resilience and growth potential, supported by increasing construction activities, rising consumer awareness, and evolving building standards. Market expansion is particularly pronounced in tier-1 and tier-2 cities, where rapid urban development creates substantial demand for reliable waterproofing systems.

Key market drivers include India’s ambitious housing programs, smart city initiatives, and industrial expansion projects. The government’s focus on affordable housing has created new market segments, while premium construction projects demand advanced waterproofing technologies. Product innovation has accelerated, with manufacturers developing climate-specific solutions addressing India’s diverse weather patterns, from monsoon-heavy regions to arid zones.

Competitive landscape features both international players and strong domestic manufacturers, creating a dynamic environment for technological advancement and market penetration. The market benefits from increasing professional awareness among architects, contractors, and building owners about waterproofing’s critical role in structural longevity and maintenance cost reduction.

Market segmentation reveals distinct patterns in product preferences and application methods across different construction categories. The insights demonstrate how India’s unique construction challenges drive specific waterproofing solution requirements:

Urbanization acceleration serves as the primary catalyst for India’s waterproofing solutions market expansion. The country’s rapid urban population growth, projected to reach 50% by 2030, creates unprecedented demand for residential and commercial construction projects requiring comprehensive waterproofing systems. Government initiatives including the Smart Cities Mission and Pradhan Mantri Awas Yojana directly contribute to market growth through large-scale construction activities.

Climate change awareness has elevated the importance of building resilience against extreme weather events. India’s increasing frequency of intense monsoons and flooding incidents drives demand for robust waterproofing solutions. Infrastructure development programs, including metro rail projects, airports, and industrial complexes, require specialized waterproofing technologies adapted to specific environmental conditions.

Consumer awareness evolution represents another significant driver, as property owners increasingly understand waterproofing’s role in preventing costly structural damage and maintaining property values. The growing middle class’s purchasing power enables investment in quality waterproofing solutions, while building code enforcement in major cities mandates proper waterproofing implementation. Technology advancement in waterproofing materials and application methods creates new market opportunities and drives replacement of traditional solutions.

Cost sensitivity remains a significant constraint in India’s price-conscious construction market, where developers and homeowners often prioritize immediate cost savings over long-term waterproofing benefits. This price pressure particularly affects the adoption of premium waterproofing solutions in affordable housing segments. Skilled labor shortage poses substantial challenges, as proper waterproofing application requires specialized training and experience that many contractors lack.

Quality control issues persist across the market, with substandard products and improper installation practices leading to waterproofing failures and market skepticism. Regulatory inconsistencies across different states create compliance challenges for manufacturers and contractors operating in multiple regions. The lack of standardized testing protocols and certification requirements allows inferior products to compete unfairly with quality solutions.

Seasonal demand fluctuations create operational challenges for manufacturers and service providers, with peak demand concentrated in pre-monsoon periods leading to capacity constraints and supply chain pressures. Traditional construction practices in rural and semi-urban areas resist modern waterproofing adoption, limiting market penetration in these segments. Maintenance awareness gaps result in inadequate post-installation care, leading to premature failures and negative market perception.

Retrofit market potential presents enormous opportunities as India’s vast existing building stock requires waterproofing upgrades and repairs. Millions of structures built without adequate waterproofing systems create a substantial addressable market for remedial solutions. Green building initiatives open new avenues for eco-friendly waterproofing products that contribute to LEED and other sustainability certifications increasingly demanded in commercial construction.

Technology integration opportunities include smart waterproofing systems with monitoring capabilities, addressing the growing demand for intelligent building solutions. Rural market expansion represents untapped potential as government rural development programs and increasing rural incomes create demand for quality construction materials. The rise of prefabricated construction methods creates opportunities for factory-applied waterproofing solutions.

Industrial segment growth driven by manufacturing expansion and infrastructure development offers opportunities for specialized waterproofing applications. Service sector development presents prospects for comprehensive waterproofing service providers offering design, installation, and maintenance packages. Export opportunities to neighboring countries leverage India’s manufacturing capabilities and cost advantages in waterproofing products.

Supply chain evolution reflects the market’s maturation, with manufacturers establishing extensive distribution networks reaching tier-2 and tier-3 cities. The dynamics show increasing integration between product manufacturers and application service providers, creating comprehensive solution offerings. Competitive intensity drives continuous innovation and price optimization, benefiting end consumers through improved product quality and value propositions.

Technology transfer from international markets accelerates local product development, with Indian manufacturers adapting global technologies to local conditions and requirements. Market consolidation trends emerge as larger players acquire regional manufacturers and service providers to expand market reach and capabilities. The dynamics demonstrate increasing professionalization of the waterproofing industry, with formal training programs and certification systems developing.

Customer behavior patterns show evolution toward comprehensive solution seeking rather than product-only purchases. Digital transformation impacts market dynamics through online product selection tools, virtual consultation services, and digital marketing channels. Regulatory environment changes influence market dynamics through updated building codes and environmental regulations affecting product specifications and application methods.

Comprehensive market analysis employs multi-faceted research approaches combining primary and secondary data collection methodologies. The research framework encompasses quantitative market sizing, qualitative trend analysis, and competitive intelligence gathering across India’s diverse regional markets. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, contractors, architects, and end-users across different market segments.

Secondary research leverages government statistical data, industry association reports, trade publications, and company financial disclosures to validate market trends and sizing estimates. Market segmentation analysis employs detailed categorization by product type, application method, end-user segment, and geographic region to provide granular market insights. The methodology incorporates seasonal demand pattern analysis and regional preference mapping.

Data validation processes ensure accuracy through cross-referencing multiple sources and expert opinion verification. Forecasting models utilize historical trend analysis, economic indicator correlation, and construction industry growth projections to develop reliable market projections. The research methodology addresses India’s market complexity through regional sampling and segment-specific analysis approaches.

Western India dominates the waterproofing solutions market, led by Maharashtra and Gujarat, accounting for approximately 35% of national demand. Mumbai’s coastal location and high-rise construction boom drive premium waterproofing solution adoption, while Gujarat’s industrial expansion creates demand for specialized applications. Northern India, particularly the Delhi-NCR region, represents the second-largest market with 28% market share, driven by rapid urbanization and infrastructure development projects.

Southern India demonstrates strong growth potential, with Karnataka, Tamil Nadu, and Andhra Pradesh leading regional demand. Bangalore’s IT sector expansion and Chennai’s industrial base create diverse waterproofing requirements. Eastern India shows emerging opportunities, particularly in West Bengal and Odisha, driven by infrastructure development and industrial growth initiatives.

Regional preferences vary significantly based on climatic conditions, with coastal areas demanding marine-grade solutions and inland regions focusing on thermal expansion management. Market penetration rates differ across regions, with metro cities showing 75% organized market penetration compared to 40% in tier-3 cities. Distribution network density correlates with regional market development, influencing product availability and service quality across different geographic segments.

Market leadership features a diverse mix of international corporations and strong domestic players, creating a competitive environment that drives innovation and market expansion. The competitive landscape demonstrates increasing consolidation as larger players acquire regional manufacturers and service providers to strengthen market positions.

Competitive strategies focus on product innovation, geographic expansion, and service integration. Market differentiation occurs through technology advancement, warranty programs, and comprehensive solution offerings combining products and services.

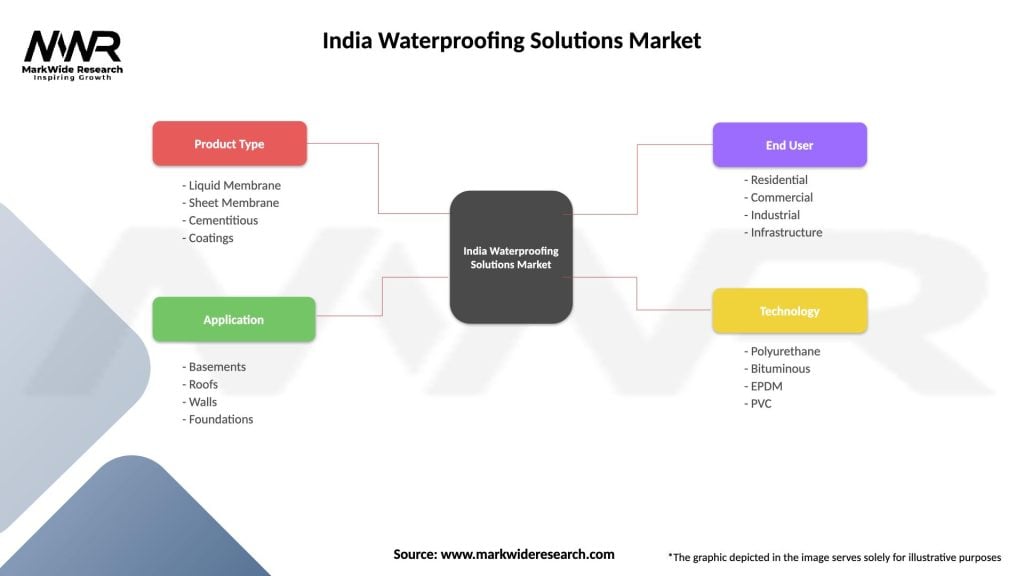

Product-based segmentation reveals distinct market preferences and growth patterns across different waterproofing solution categories. The segmentation analysis provides insights into market dynamics and future growth opportunities:

By Product Type:

By Application:

By End-User:

Residential category demonstrates the highest volume demand, driven by India’s massive housing construction activities and increasing homeowner awareness about waterproofing importance. This segment shows preference for cost-effective solutions with reliable performance and warranty support. Application methods in residential projects favor liquid applied systems due to ease of application and versatility across different surface types.

Commercial category exhibits premium product preferences, with emphasis on long-term performance and minimal maintenance requirements. Building owners in this segment prioritize solutions that contribute to green building certifications and energy efficiency. The commercial segment drives innovation in waterproofing technologies and application methods.

Industrial category requires specialized solutions addressing unique challenges such as chemical resistance, thermal cycling, and heavy structural loads. Performance requirements in industrial applications often exceed standard building applications, creating opportunities for high-value specialized products. Infrastructure category focuses on durability and life-cycle cost optimization, with specifications often mandating international quality standards and extensive testing requirements.

Manufacturers benefit from India’s expanding construction market through increased demand for waterproofing products and opportunities for market share growth. The market provides platforms for innovation and technology development, enabling companies to create India-specific solutions that can be exported to similar markets. Revenue diversification opportunities exist through service integration and comprehensive solution offerings.

Distributors and retailers gain from the market’s geographic expansion and increasing product sophistication, creating opportunities for value-added services and technical support. Contractors and applicators benefit from growing demand for professional waterproofing services and opportunities for specialization in high-value applications.

Property owners realize significant benefits through reduced maintenance costs, improved building longevity, and enhanced property values. Architects and consultants gain access to advanced waterproofing technologies that enable innovative building designs and sustainable construction practices. Government stakeholders benefit through improved infrastructure durability and reduced public maintenance costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with manufacturers developing eco-friendly waterproofing solutions that reduce environmental impact and contribute to green building certifications. Technology convergence shows increasing adoption of smart waterproofing systems incorporating sensors and monitoring capabilities for predictive maintenance and performance optimization.

Service integration trends demonstrate market evolution toward comprehensive solution providers offering design, supply, installation, and maintenance services under single contracts. Customization demand increases as different building types and climatic conditions require specialized waterproofing approaches. Digital transformation impacts the market through online product selection tools, virtual consultation services, and digital project management platforms.

Quality standardization trends show increasing adoption of international quality standards and certification requirements, particularly in premium construction segments. Prefabrication integration creates opportunities for factory-applied waterproofing solutions that ensure consistent quality and faster installation. Warranty extension trends reflect increasing manufacturer confidence in product performance and customer demand for long-term protection assurance.

Product innovation acceleration has led to the introduction of nanotechnology-based waterproofing solutions offering superior performance characteristics and durability. Manufacturing capacity expansion by major players reflects confidence in market growth potential and commitment to serving increasing demand. Strategic partnerships between international technology providers and local manufacturers facilitate technology transfer and market penetration.

Regulatory developments include updated building codes in major cities mandating proper waterproofing implementation and performance standards. Industry association initiatives focus on standardizing application practices and training programs for waterproofing contractors. Research and development investments by leading companies target climate-specific solutions addressing India’s diverse environmental conditions.

Digital platform launches by manufacturers provide technical support, product selection guidance, and project management tools for contractors and consultants. Acquisition activities demonstrate market consolidation trends as larger players strengthen their market positions through strategic acquisitions. Export expansion initiatives by Indian manufacturers target neighboring countries and emerging markets with similar climatic conditions.

Market participants should focus on developing India-specific solutions that address unique climatic challenges and construction practices while maintaining cost competitiveness. Investment priorities should emphasize technology development, manufacturing capacity expansion, and distribution network strengthening to capture market growth opportunities. MarkWide Research analysis suggests that companies prioritizing service integration and comprehensive solution offerings will achieve superior market positioning.

Strategic recommendations include establishing regional manufacturing facilities to reduce logistics costs and improve market responsiveness. Partnership strategies with local contractors and distributors can accelerate market penetration in tier-2 and tier-3 cities. Quality assurance programs should be implemented to address market concerns about product consistency and application standards.

Innovation focus should target sustainable solutions, smart waterproofing systems, and application method improvements that reduce labor requirements and installation time. Market education initiatives can drive demand by increasing awareness about waterproofing benefits and proper application practices. Export development strategies should leverage India’s cost advantages and manufacturing capabilities to access regional markets.

Market trajectory indicates sustained growth driven by India’s continued urbanization, infrastructure development, and increasing construction quality standards. The outlook shows technology adoption acceleration with advanced waterproofing solutions gaining broader market acceptance as awareness and purchasing power increase. Geographic expansion will extend market reach into smaller cities and rural areas as development programs and income levels advance.

Product evolution will continue toward more sustainable, durable, and application-friendly solutions that address India’s specific requirements. Service sector development will create comprehensive solution providers offering integrated waterproofing services from design to maintenance. Market maturation will lead to improved quality standards, professional practices, and customer service levels across the industry.

Growth projections suggest the market will maintain robust expansion rates, with premium segments growing faster than traditional products. MWR forecasts indicate that technological advancement and market education will drive increased per-project waterproofing investments. Export opportunities will expand as Indian manufacturers develop competitive advantages in cost-effective, climate-adapted waterproofing solutions suitable for regional markets.

India’s waterproofing solutions market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by urbanization, infrastructure development, and increasing quality consciousness. The market demonstrates strong fundamentals with diverse growth drivers, expanding applications, and continuous technological advancement. Market participants who focus on innovation, quality, and comprehensive service offerings will be best positioned to capitalize on emerging opportunities.

Strategic success in this market requires understanding India’s unique construction challenges, climatic diversity, and price sensitivity while delivering reliable performance and value. The market’s evolution toward sustainability, technology integration, and professional service delivery creates opportunities for differentiation and premium positioning. Future growth will be driven by retrofit market development, rural expansion, and increasing adoption of advanced waterproofing technologies across all construction segments.

What is Waterproofing Solutions?

Waterproofing solutions refer to various methods and materials used to prevent water from penetrating structures, ensuring durability and longevity. These solutions are essential in construction, particularly for basements, roofs, and foundations, where moisture control is critical.

What are the key players in the India Waterproofing Solutions Market?

Key players in the India Waterproofing Solutions Market include companies like Asian Paints, Pidilite Industries, and BASF. These companies offer a range of products such as liquid membranes, cementitious coatings, and waterproofing chemicals, among others.

What are the growth factors driving the India Waterproofing Solutions Market?

The growth of the India Waterproofing Solutions Market is driven by increasing urbanization, rising construction activities, and the need for sustainable building practices. Additionally, the growing awareness of water damage prevention among homeowners contributes to market expansion.

What challenges does the India Waterproofing Solutions Market face?

The India Waterproofing Solutions Market faces challenges such as the availability of low-cost alternatives and a lack of awareness regarding advanced waterproofing technologies. Additionally, fluctuating raw material prices can impact product pricing and availability.

What opportunities exist in the India Waterproofing Solutions Market?

Opportunities in the India Waterproofing Solutions Market include the increasing demand for eco-friendly and sustainable waterproofing products. Furthermore, advancements in technology, such as the development of smart waterproofing solutions, present new avenues for growth.

What trends are shaping the India Waterproofing Solutions Market?

Trends shaping the India Waterproofing Solutions Market include the rising adoption of liquid waterproofing membranes and the integration of smart technologies in construction. Additionally, there is a growing focus on energy-efficient building materials that enhance overall sustainability.

India Waterproofing Solutions Market

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Membrane, Sheet Membrane, Cementitious, Coatings |

| Application | Basements, Roofs, Walls, Foundations |

| End User | Residential, Commercial, Industrial, Infrastructure |

| Technology | Polyurethane, Bituminous, EPDM, PVC |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Waterproofing Solutions Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at