444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India wall decor market represents a dynamic and rapidly evolving segment within the country’s home furnishing and interior design industry. This comprehensive market encompasses a diverse range of decorative elements including wall art, paintings, mirrors, wall stickers, tapestries, and sculptural pieces that enhance residential and commercial spaces across India. Market dynamics indicate substantial growth driven by increasing urbanization, rising disposable incomes, and evolving consumer preferences toward aesthetic home environments.

Consumer behavior patterns reveal a significant shift toward personalized and culturally-inspired wall decoration solutions, with traditional Indian motifs and contemporary designs gaining equal prominence. The market demonstrates robust expansion with a projected CAGR of 8.2% through the forecast period, reflecting strong demand across metropolitan cities and emerging tier-2 urban centers. Digital transformation has revolutionized market accessibility, with online platforms capturing approximately 35% market share in wall decor sales.

Regional distribution shows concentrated demand in major urban centers including Mumbai, Delhi, Bangalore, and Chennai, while smaller cities demonstrate accelerating adoption rates. The market benefits from India’s rich artistic heritage combined with modern manufacturing capabilities, creating unique positioning for both domestic consumption and export opportunities. Demographic trends indicate millennials and Gen-Z consumers driving 65% of purchase decisions, emphasizing Instagram-worthy and social media-friendly decorative solutions.

The India wall decor market refers to the comprehensive ecosystem of decorative products, services, and solutions designed specifically for wall enhancement and interior beautification across residential, commercial, and institutional spaces throughout India. This market encompasses traditional handcrafted items, modern manufactured products, and innovative digital printing solutions that cater to diverse aesthetic preferences and cultural sensibilities.

Market definition includes various product categories such as framed artwork, canvas paintings, metal wall sculptures, wooden decorative pieces, ceramic tiles with artistic designs, wall decals, mirrors with decorative frames, and textile-based wall hangings. The scope extends beyond mere product sales to include customization services, installation support, and design consultation offerings that enhance overall customer experience.

Cultural significance plays a crucial role in market definition, as Indian consumers seek wall decor solutions that reflect regional traditions, religious themes, and contemporary lifestyle aspirations. The market bridges traditional craftsmanship with modern manufacturing techniques, creating unique value propositions that resonate with diverse consumer segments across India’s varied demographic landscape.

Market performance demonstrates exceptional resilience and growth potential within India’s expanding home decor sector. The wall decor segment benefits from favorable demographic trends, increasing housing construction activities, and evolving consumer preferences toward personalized living spaces. Key growth drivers include rapid urbanization affecting 42% of India’s population, rising middle-class prosperity, and widespread adoption of social media platforms showcasing interior design trends.

Competitive landscape features a diverse mix of organized retail chains, local artisan networks, e-commerce platforms, and international brands establishing Indian market presence. Traditional handicraft segments maintain strong positioning alongside modern manufacturing companies offering mass-produced decorative solutions. Market fragmentation creates opportunities for niche players specializing in specific design themes, price segments, or regional preferences.

Technology integration transforms market dynamics through augmented reality visualization tools, customization platforms, and direct-to-consumer manufacturing models. Digital marketing strategies prove particularly effective in reaching younger demographics, with social media influence driving 58% of purchase inspiration among urban consumers. Future prospects remain highly positive, supported by continued economic growth, infrastructure development, and evolving lifestyle aspirations across India’s diverse consumer base.

Consumer preferences reveal distinct patterns favoring authentic Indian artistic traditions combined with contemporary design aesthetics. The market demonstrates strong demand for customizable solutions, with personalized wall decor options experiencing significant growth across all consumer segments.

Urbanization acceleration serves as the primary catalyst driving wall decor market expansion across India. Rapid urban development creates millions of new residential units annually, each requiring interior decoration solutions that reflect modern lifestyle aspirations while honoring cultural preferences. Housing sector growth directly correlates with wall decor demand, as new homeowners prioritize aesthetic enhancement alongside functional requirements.

Disposable income growth among India’s expanding middle class enables increased spending on non-essential home improvement items. Rising prosperity levels encourage consumers to invest in quality decorative pieces that enhance living spaces and reflect personal style preferences. Lifestyle evolution toward Western-influenced home design concepts creates demand for diverse wall decor options beyond traditional Indian motifs.

Social media influence significantly impacts consumer behavior, with platforms like Instagram and Pinterest inspiring home decoration trends and purchase decisions. Digital connectivity exposes Indian consumers to global design concepts while simultaneously promoting appreciation for local artistic traditions. Celebrity endorsements and influencer marketing campaigns effectively drive brand awareness and product adoption across target demographics.

Festival and celebration culture inherent in Indian society creates consistent seasonal demand for decorative items. Religious festivals, weddings, and cultural celebrations require specific wall decor themes, ensuring steady market activity throughout the year. Gift-giving traditions further expand market opportunities, with decorative wall pieces serving as popular presents for housewarmings and special occasions.

Economic sensitivity represents a significant challenge, as wall decor purchases often rank lower in household priority compared to essential items during economic uncertainty. Price consciousness among Indian consumers limits premium segment growth, with many buyers seeking maximum value at minimal cost, potentially compromising quality expectations and profit margins for manufacturers.

Quality concerns persist regarding mass-produced decorative items, particularly those manufactured using inferior materials or substandard production processes. Durability issues with certain product categories, especially paper-based wall stickers and low-quality prints, create customer dissatisfaction and negative brand perceptions that impact repeat purchase behavior.

Installation challenges deter some consumers from purchasing wall decor items, particularly those requiring professional mounting or complex setup procedures. Maintenance requirements for certain decorative pieces, including regular cleaning and periodic replacement, create ongoing costs that some consumers prefer to avoid.

Cultural resistance in certain traditional communities limits acceptance of modern or Western-influenced wall decor designs. Space constraints in urban housing, particularly in metropolitan areas where apartment sizes continue shrinking, restrict opportunities for elaborate wall decoration schemes. Seasonal fluctuations create inventory management challenges for retailers, with significant demand variations throughout the year affecting cash flow and operational efficiency.

Rural market penetration presents substantial untapped potential as infrastructure development and internet connectivity reach previously underserved areas. Tier-2 and tier-3 cities demonstrate accelerating demand for wall decor solutions, driven by improving economic conditions and exposure to urban lifestyle trends through digital media platforms.

Customization services offer significant growth opportunities, with consumers increasingly seeking personalized decorative solutions that reflect individual preferences and family histories. Digital printing technology enables cost-effective production of custom designs, photographs, and artwork, creating new revenue streams for manufacturers and retailers.

Export potential remains largely unexplored, with Indian artistic traditions and competitive manufacturing costs creating advantages in international markets. Diaspora communities worldwide represent natural target segments for authentic Indian wall decor products, particularly those featuring traditional motifs and cultural themes.

Corporate and hospitality sectors present expanding opportunities as businesses recognize the importance of aesthetic environments in customer experience and employee satisfaction. Educational institutions and healthcare facilities increasingly invest in decorative elements that create welcoming and inspiring atmospheres. Sustainable product lines align with growing environmental consciousness, offering differentiation opportunities for forward-thinking manufacturers and brands.

Supply chain evolution transforms market dynamics through direct manufacturer-to-consumer models enabled by e-commerce platforms. Traditional distribution channels face disruption as online marketplaces provide broader reach and reduced intermediary costs. Inventory management becomes increasingly sophisticated, with data analytics driving demand forecasting and stock optimization strategies.

Consumer behavior shifts toward experiential purchases influence wall decor market dynamics, with buyers seeking products that create Instagram-worthy spaces and reflect personal brand identity. Impulse purchasing increases through social media marketing and influencer collaborations, particularly among younger demographics who prioritize aesthetic appeal over long-term durability.

Seasonal patterns create predictable demand cycles, with festival seasons generating 40% of annual sales for many retailers. Wedding season demand drives significant business for traditional and religious-themed wall decor categories. Market volatility during economic uncertainty affects discretionary spending patterns, requiring flexible business strategies and diverse product portfolios.

Technology integration reshapes market dynamics through augmented reality applications allowing virtual wall decor placement before purchase. Manufacturing automation reduces production costs while enabling greater design complexity and customization capabilities. Logistics optimization improves delivery efficiency and reduces damage rates for fragile decorative items, enhancing customer satisfaction and reducing return rates.

Primary research encompasses comprehensive consumer surveys conducted across major Indian cities, capturing demographic preferences, purchasing behavior patterns, and brand perception data. Focus group discussions provide qualitative insights into consumer motivations, cultural influences, and decision-making processes related to wall decor purchases.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements to establish market sizing and growth projections. Retail channel analysis examines sales data from organized retail chains, e-commerce platforms, and traditional distribution networks to understand market dynamics and competitive positioning.

Expert interviews with industry leaders, interior designers, and retail executives provide strategic insights into market trends, challenges, and future opportunities. Supplier assessments evaluate manufacturing capabilities, quality standards, and innovation potential across different market segments. MarkWide Research methodology ensures comprehensive coverage of both quantitative market metrics and qualitative industry insights, providing stakeholders with actionable intelligence for strategic decision-making.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and verification of market estimates through industry expert consultations. Trend analysis incorporates historical data patterns with forward-looking projections to identify emerging opportunities and potential market disruptions.

Northern India demonstrates strong market presence, with Delhi NCR region accounting for approximately 28% of national demand. Consumer preferences in this region favor traditional Mughal-inspired designs alongside contemporary minimalist aesthetics. Punjab and Haryana states show growing adoption of modern wall decor solutions, driven by increasing urbanization and prosperity levels.

Western India leads market development, with Maharashtra and Gujarat states representing significant consumption centers. Mumbai metropolitan area drives premium segment growth, while Pune and Ahmedabad demonstrate strong demand for mid-range decorative solutions. Cultural diversity in this region creates opportunities for varied design themes and artistic styles.

Southern India exhibits sophisticated consumer preferences, with Bangalore, Chennai, and Hyderabad serving as key growth markets. Technology sector influence in these cities drives demand for contemporary and international design concepts. Traditional art forms including Tanjore paintings and temple-inspired motifs maintain strong regional appeal alongside modern alternatives.

Eastern India shows emerging potential, with Kolkata leading regional market development. Cultural heritage influences create demand for Bengali artistic traditions and literary-themed wall decor. Economic development in this region gradually improves consumer purchasing power and market accessibility.

Market structure features diverse competitive dynamics with organized retail chains, traditional artisan networks, and emerging e-commerce platforms competing across different segments. Brand differentiation occurs through design uniqueness, quality positioning, and cultural authenticity rather than pure price competition.

Competitive strategies emphasize brand building, distribution expansion, and product innovation to capture market share. Price competition remains intense in mass market segments, while premium categories focus on design differentiation and quality positioning.

Product-based segmentation reveals distinct market categories with varying growth trajectories and consumer appeal. Traditional segments including paintings, mirrors, and sculptural pieces maintain steady demand, while emerging categories like wall decals and digital prints demonstrate rapid expansion.

By Product Type:

By Price Range:

Traditional Art Category maintains strong market position, with religious themes and cultural motifs driving consistent demand across all demographic segments. Regional variations create opportunities for specialized products reflecting local artistic traditions and cultural preferences. Seasonal demand patterns align with festival calendars and cultural celebrations throughout India.

Contemporary Design Category demonstrates rapid growth, particularly among urban millennials seeking modern aesthetic solutions. Minimalist designs gain popularity in metropolitan areas where space constraints favor clean, uncluttered wall decoration approaches. Abstract art and geometric patterns appeal to educated professionals and design-conscious consumers.

Personalized Decor Category emerges as high-growth segment, with custom photography, family portraits, and personalized artwork driving premium pricing and customer loyalty. Digital printing technology enables cost-effective customization, making personalized options accessible to broader consumer segments. Gift market potential expands category reach beyond individual home decoration needs.

Functional Decor Category combines aesthetic appeal with practical utility, including decorative mirrors, wall-mounted storage solutions, and artistic lighting fixtures. Space optimization becomes increasingly important in urban housing markets, driving demand for multi-functional decorative pieces. Smart home integration creates opportunities for technology-enabled decorative solutions.

Manufacturers benefit from expanding market opportunities driven by urbanization and rising consumer spending on home improvement. Production scalability enables efficient serving of diverse market segments while maintaining quality standards and cost competitiveness. Technology adoption improves manufacturing efficiency and enables customization capabilities that differentiate products in competitive markets.

Retailers gain from increased consumer interest in home decoration and willingness to invest in aesthetic enhancement. Omnichannel opportunities allow traditional retailers to expand reach through online platforms while maintaining physical showroom advantages. Service integration including installation and design consultation creates additional revenue streams and customer loyalty.

Consumers enjoy expanding product variety, improved quality standards, and competitive pricing driven by market competition. Customization options enable personal expression and unique home decoration solutions. Online accessibility provides convenient shopping experiences and access to broader product ranges than traditional retail channels.

Artisans and Craftspeople find new market opportunities through e-commerce platforms and organized retail partnerships. Skill monetization becomes more accessible through digital marketing and direct customer connections. Cultural preservation benefits from commercial viability of traditional art forms and decorative techniques.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as dominant trend, with consumers increasingly seeking eco-friendly materials and sustainable manufacturing processes. Recycled materials and upcycled decorative pieces gain popularity among environmentally conscious buyers. Local sourcing preferences support regional artisans while reducing environmental impact of long-distance transportation.

Digital Customization revolutionizes consumer experience through online design tools and virtual visualization capabilities. Augmented reality applications enable customers to preview wall decor placement before purchase, reducing return rates and improving satisfaction. 3D printing technology opens possibilities for on-demand manufacturing and unique design creation.

Minimalist Aesthetics influence design preferences, with clean lines and simple forms gaining favor over elaborate traditional patterns. Neutral color palettes dominate contemporary design choices, reflecting urban lifestyle preferences and smaller living spaces. Multi-functional designs combine aesthetic appeal with practical utility, maximizing value in space-constrained environments.

Social Media Influence drives trend adoption and purchase decisions, with Instagram-worthy designs becoming important selection criteria. Influencer partnerships effectively reach target demographics and drive brand awareness. User-generated content creates authentic marketing opportunities and community engagement around home decoration themes.

Technology advancement transforms manufacturing capabilities through automated production systems and digital printing innovations. Quality improvements result from better materials and enhanced production processes, addressing historical consumer concerns about durability and finish quality. Design software integration enables rapid prototyping and customization capabilities that differentiate market offerings.

Retail evolution includes expansion of organized retail chains and sophisticated e-commerce platforms offering comprehensive product ranges. Omnichannel strategies integrate online and offline customer experiences, providing flexibility and convenience. Logistics improvements reduce delivery times and damage rates for fragile decorative items, enhancing customer satisfaction.

Partnership development between traditional artisans and modern retailers creates new distribution channels for authentic handcrafted products. Skill development programs enhance artisan capabilities and product quality standards. Export initiatives promote Indian wall decor products in international markets, leveraging cultural authenticity and competitive pricing.

Regulatory support through government initiatives promoting handicrafts and small-scale manufacturing benefits traditional artisan communities. Digital India programs improve internet connectivity and e-commerce accessibility in previously underserved areas. MWR analysis indicates these developments collectively strengthen market foundation and growth prospects.

Market participants should prioritize quality standardization and brand building to differentiate offerings in increasingly competitive landscape. Investment in technology including digital printing, design software, and e-commerce capabilities becomes essential for sustainable growth and market relevance. Customer education about product care and installation improves satisfaction and reduces return rates.

Manufacturers should develop sustainable product lines addressing growing environmental consciousness among consumers. Customization capabilities create competitive advantages and enable premium pricing strategies. Export market development provides growth opportunities beyond domestic demand limitations and seasonal fluctuations.

Retailers should integrate online and offline channels to maximize customer reach and convenience. Service offerings including design consultation and professional installation create additional revenue streams and customer loyalty. Inventory management systems must accommodate seasonal demand patterns while minimizing carrying costs and obsolescence risks.

Strategic partnerships between modern retailers and traditional artisans can preserve cultural heritage while expanding market access. Data analytics should guide product development and inventory decisions based on consumer behavior patterns and preference trends. MarkWide Research recommends focusing on tier-2 city expansion as these markets demonstrate strong growth potential with less competitive intensity.

Market trajectory remains strongly positive, supported by continued urbanization, rising disposable incomes, and evolving lifestyle preferences toward aesthetic home environments. Growth acceleration is expected in tier-2 and tier-3 cities as infrastructure development and digital connectivity improve market accessibility. Demographic advantages including a large young population and expanding middle class create sustained demand potential.

Technology integration will reshape market dynamics through enhanced customization capabilities, improved manufacturing efficiency, and innovative customer experience solutions. Artificial intelligence applications in design recommendation and inventory management will optimize business operations and customer satisfaction. Sustainability requirements will drive innovation in materials and manufacturing processes, creating new product categories and market segments.

Export opportunities present significant growth potential as international recognition of Indian artistic traditions increases. Diaspora markets offer natural expansion opportunities for authentic cultural products. Digital platforms will continue expanding market reach and reducing traditional distribution barriers, particularly benefiting smaller manufacturers and artisan communities.

Market consolidation may occur as successful players expand through acquisitions and partnerships, while maintaining space for specialized niche providers. Innovation cycles will accelerate as competition intensifies and consumer expectations evolve. Long-term prospects remain highly favorable, with the market positioned to benefit from India’s continued economic development and cultural appreciation trends.

The India wall decor market demonstrates exceptional growth potential driven by favorable demographic trends, increasing urbanization, and evolving consumer preferences toward aesthetic home environments. Market dynamics reflect a healthy balance between traditional cultural elements and contemporary design innovations, creating diverse opportunities for manufacturers, retailers, and artisan communities across the value chain.

Strategic positioning requires understanding of regional preferences, price sensitivity, and quality expectations while leveraging technology for improved customer experience and operational efficiency. Sustainability integration and customization capabilities emerge as key differentiators in increasingly competitive market conditions. Digital transformation continues reshaping distribution channels and customer engagement strategies, particularly among younger demographic segments driving market growth.

Future success depends on balancing cultural authenticity with modern consumer needs, maintaining quality standards while achieving competitive pricing, and expanding market reach through innovative distribution strategies. The market’s strong foundation, supported by India’s rich artistic heritage and growing economic prosperity, positions it for sustained expansion and international recognition in the global home decor industry.

What is Wall Decor?

Wall decor refers to various decorative items and artworks used to enhance the aesthetic appeal of walls in residential and commercial spaces. This can include paintings, prints, wall hangings, and other decorative elements that contribute to interior design.

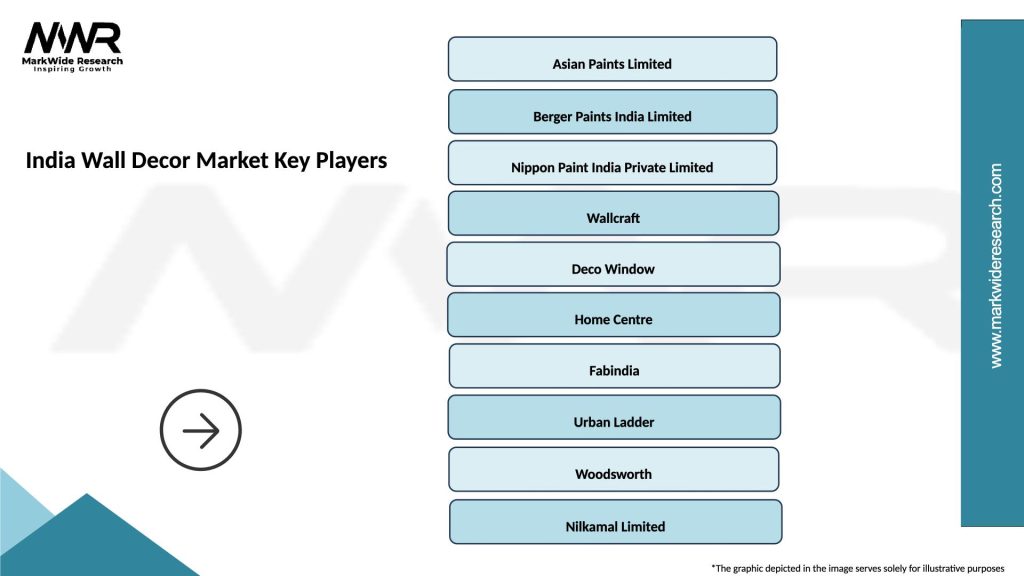

What are the key companies in the India Wall Decor Market?

Key companies in the India Wall Decor Market include Urban Ladder, Home Centre, and FabIndia, which offer a range of wall decor products from traditional to contemporary styles, among others.

What are the growth factors driving the India Wall Decor Market?

The growth of the India Wall Decor Market is driven by increasing urbanization, rising disposable incomes, and a growing interest in home improvement and interior design among consumers. Additionally, the influence of social media on home aesthetics plays a significant role.

What challenges does the India Wall Decor Market face?

The India Wall Decor Market faces challenges such as fluctuating raw material prices and competition from unorganized sectors. Additionally, changing consumer preferences and the impact of economic downturns can affect market stability.

What opportunities exist in the India Wall Decor Market?

Opportunities in the India Wall Decor Market include the growing trend of online shopping, which allows consumers to access a wider variety of products. Furthermore, the increasing popularity of personalized and custom wall decor presents a significant growth avenue.

What trends are shaping the India Wall Decor Market?

Current trends in the India Wall Decor Market include the rise of eco-friendly materials and sustainable designs, as well as the popularity of minimalistic and multifunctional decor. Additionally, the integration of technology in home decor, such as smart wall art, is gaining traction.

India Wall Decor Market

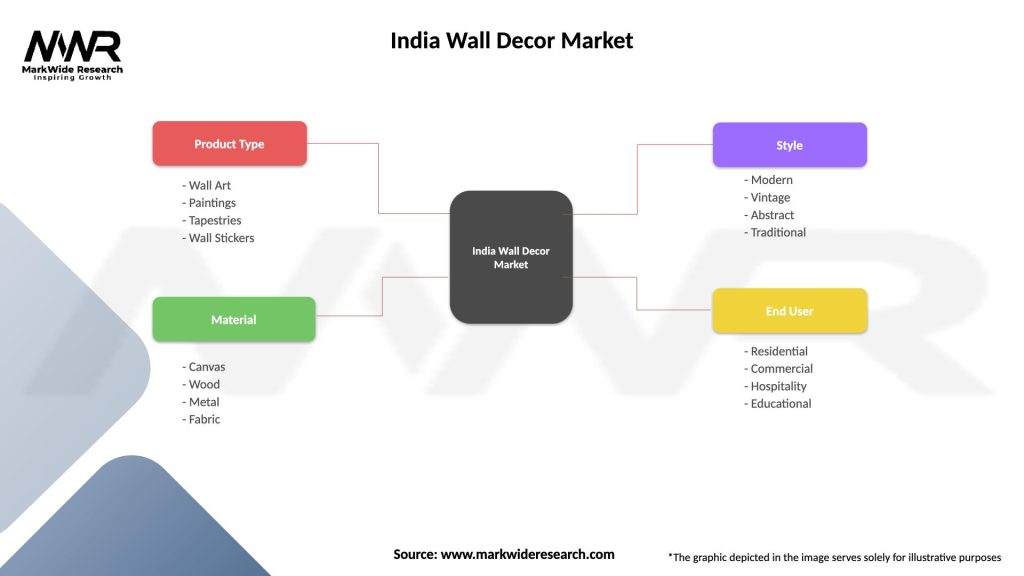

| Segmentation Details | Description |

|---|---|

| Product Type | Wall Art, Paintings, Tapestries, Wall Stickers |

| Material | Canvas, Wood, Metal, Fabric |

| Style | Modern, Vintage, Abstract, Traditional |

| End User | Residential, Commercial, Hospitality, Educational |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Wall Decor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at