444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India video surveillance market represents one of the fastest-growing security technology sectors in the Asia-Pacific region, driven by increasing security concerns, government initiatives, and rapid urbanization. The market encompasses a comprehensive range of surveillance solutions including IP cameras, analog cameras, video management software, and storage systems deployed across various sectors from smart cities to retail establishments.

Market dynamics indicate robust growth potential with the sector experiencing significant expansion at a CAGR of 12.8% during the forecast period. This growth trajectory is supported by increasing adoption of advanced technologies such as artificial intelligence, machine learning, and cloud-based surveillance solutions. The integration of smart city projects and government security initiatives has created substantial demand for sophisticated video surveillance infrastructure.

Technology evolution within the Indian market shows a clear shift from traditional analog systems to IP-based solutions, with digital transformation accounting for approximately 68% of new installations. The market benefits from favorable government policies, increasing foreign investments, and growing awareness about security among residential and commercial users. Regional distribution shows concentrated growth in metropolitan areas, with tier-1 cities representing 45% of market adoption while tier-2 and tier-3 cities demonstrate accelerating growth rates.

The India video surveillance market refers to the comprehensive ecosystem of security monitoring technologies, equipment, and services deployed across the Indian subcontinent for real-time observation, recording, and analysis of activities in various environments including public spaces, commercial establishments, residential areas, and critical infrastructure facilities.

This market encompasses multiple technology segments including closed-circuit television (CCTV) systems, internet protocol (IP) cameras, video analytics software, network video recorders (NVR), digital video recorders (DVR), and associated infrastructure components. The market serves diverse applications ranging from crime prevention and traffic monitoring to business intelligence and operational efficiency enhancement.

Key components of the market include hardware manufacturers, software developers, system integrators, installation services, and maintenance providers. The ecosystem supports various deployment models from on-premises solutions to cloud-based surveillance-as-a-service offerings, catering to different customer requirements and budget considerations across India’s diverse economic landscape.

The India video surveillance market demonstrates exceptional growth momentum driven by government smart city initiatives, increasing security awareness, and technological advancement. The market landscape is characterized by strong demand across multiple sectors including government, retail, banking, transportation, and residential segments, with each contributing to overall market expansion.

Technology adoption patterns reveal significant migration toward IP-based solutions, with network cameras representing 72% of new deployments. The integration of artificial intelligence and video analytics capabilities has enhanced system functionality, enabling proactive security management and business intelligence applications. Cloud-based solutions are gaining traction, particularly among small and medium enterprises seeking cost-effective surveillance options.

Market segmentation shows diverse growth opportunities across product categories, with IP cameras leading market share followed by video management software and storage solutions. Geographic distribution indicates strong concentration in urban centers while rural and semi-urban areas present emerging opportunities. The competitive landscape features both international technology leaders and domestic manufacturers, creating a dynamic market environment with continuous innovation and competitive pricing strategies.

Strategic market analysis reveals several critical insights shaping the India video surveillance landscape. The market demonstrates strong resilience and growth potential supported by favorable regulatory environment and increasing investment in security infrastructure.

Primary growth drivers for the India video surveillance market stem from multiple converging factors that create sustained demand across various sectors. Government initiatives represent the most significant catalyst, with smart city projects and security modernization programs generating substantial infrastructure investment.

Security concerns continue escalating across urban and rural areas, driving both public and private sector investments in surveillance technology. Rising crime rates, terrorism threats, and the need for public safety monitoring create consistent demand for advanced surveillance solutions. The COVID-19 pandemic has further accelerated adoption as organizations implement health monitoring and compliance verification systems.

Technological advancement serves as a crucial driver, with artificial intelligence, machine learning, and cloud computing capabilities making surveillance systems more effective and accessible. The declining cost of high-definition cameras and storage solutions has democratized access to professional-grade surveillance technology, enabling broader market penetration across different economic segments.

Urbanization trends contribute significantly to market growth as expanding cities require comprehensive security infrastructure. The development of commercial complexes, residential projects, and industrial facilities creates continuous demand for integrated surveillance solutions. Additionally, increasing awareness about business intelligence applications of video surveillance drives adoption beyond traditional security use cases.

Market growth faces several significant challenges that impact adoption rates and expansion potential across different segments. High initial investment costs remain a primary barrier, particularly for small and medium enterprises seeking comprehensive surveillance solutions. The complexity of system integration and ongoing maintenance requirements create additional financial burdens for many potential users.

Technical challenges include inadequate network infrastructure in certain regions, limiting the effectiveness of IP-based surveillance systems. Power supply reliability issues and bandwidth constraints affect system performance, particularly in rural and semi-urban areas. The lack of standardization across different technology platforms creates compatibility issues and increases implementation complexity.

Privacy concerns and regulatory compliance requirements pose ongoing challenges for market expansion. Increasing awareness about data protection and surveillance ethics creates resistance among certain user segments. The absence of comprehensive privacy legislation specific to video surveillance creates uncertainty for both providers and users regarding compliance requirements.

Skills shortage in installation, maintenance, and system management limits market growth potential. The rapid pace of technological change requires continuous training and certification, creating challenges for service providers and end users. Additionally, cybersecurity threats targeting surveillance systems create concerns about data security and system integrity.

Emerging opportunities within the India video surveillance market present substantial growth potential across multiple dimensions. The expansion of smart city initiatives beyond tier-1 cities creates significant opportunities for comprehensive surveillance infrastructure deployment. Government focus on digital transformation and public safety modernization provides a strong foundation for sustained market growth.

Technology integration opportunities include the convergence of video surveillance with Internet of Things (IoT) platforms, creating comprehensive smart building and smart city solutions. The integration of video analytics with business intelligence systems opens new revenue streams beyond traditional security applications. Edge computing and 5G network deployment will enable more sophisticated surveillance capabilities and real-time processing.

Sector-specific opportunities emerge from healthcare, education, and transportation segments seeking specialized surveillance solutions. The retail sector presents significant potential for video analytics applications including customer behavior analysis, inventory management, and loss prevention. Industrial automation and manufacturing sectors offer opportunities for process monitoring and safety compliance applications.

Service-based opportunities include surveillance-as-a-service models, cloud-based storage solutions, and managed security services. The growing demand for remote monitoring and mobile access creates opportunities for software developers and service providers. Additionally, the need for cybersecurity solutions specifically designed for surveillance systems presents a growing market segment.

Market dynamics within the India video surveillance sector reflect complex interactions between technological advancement, regulatory changes, and evolving user requirements. The competitive landscape demonstrates increasing consolidation among technology providers while simultaneously witnessing the emergence of innovative startups focusing on niche applications and specialized solutions.

Supply chain dynamics show growing localization of manufacturing and assembly operations, driven by government policies promoting domestic production. The Make in India initiative has encouraged international manufacturers to establish local production facilities, reducing costs and improving supply chain resilience. This localization trend has resulted in 23% cost reduction for certain product categories while maintaining quality standards.

Demand patterns reveal seasonal variations with peak installation periods coinciding with budget cycles and festival seasons. The market demonstrates strong correlation with economic growth indicators, with commercial and industrial segments showing sensitivity to business confidence levels. Government procurement cycles significantly influence market dynamics, particularly for large-scale infrastructure projects.

Technology evolution continues reshaping market dynamics with artificial intelligence and machine learning capabilities becoming standard features rather than premium options. The shift toward software-defined surveillance solutions creates new business models and revenue streams. Cloud computing adoption accelerates market transformation, enabling smaller players to compete with established providers through innovative service offerings.

Comprehensive research methodology employed for analyzing the India video surveillance market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of insights. The research framework combines primary and secondary research methodologies to provide a holistic view of market dynamics, trends, and future projections.

Primary research activities include extensive interviews with industry stakeholders including manufacturers, distributors, system integrators, and end users across different sectors and geographic regions. Survey methodologies capture quantitative data on adoption patterns, technology preferences, and purchasing behaviors. Focus group discussions provide qualitative insights into user experiences, challenges, and future requirements.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements. Market intelligence gathering includes monitoring of trade publications, technology forums, and industry conferences. Patent analysis and technology trend assessment provide insights into innovation directions and competitive positioning.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Statistical analysis techniques including regression analysis, correlation studies, and trend extrapolation support market projections and growth estimates. Geographic and demographic segmentation analysis provides detailed insights into regional variations and sector-specific trends.

Regional market distribution across India reveals significant variations in adoption rates, technology preferences, and growth potential. The northern region, anchored by Delhi NCR, represents the largest market segment with 32% market share, driven by government installations, commercial developments, and high security awareness among businesses and residents.

Western region markets, particularly Maharashtra and Gujarat, demonstrate strong industrial and commercial adoption with 28% market share. Mumbai’s financial district and Pune’s IT corridor drive significant demand for advanced surveillance solutions. The region benefits from established infrastructure, higher disposable income, and progressive regulatory environment supporting technology adoption.

Southern region markets, led by Karnataka, Tamil Nadu, and Telangana, account for 25% market share with strong growth in IT parks, manufacturing facilities, and smart city projects. Bangalore and Hyderabad serve as technology hubs driving innovation in surveillance solutions. The region demonstrates high acceptance of advanced features including video analytics and cloud-based solutions.

Eastern and northeastern regions represent emerging markets with 15% combined market share but demonstrate the highest growth rates as infrastructure development accelerates. Government security initiatives and industrial expansion in these regions create significant opportunities for surveillance technology providers. Rural electrification and network connectivity improvements support market expansion in previously underserved areas.

The competitive landscape of the India video surveillance market features a diverse mix of international technology leaders, domestic manufacturers, and specialized solution providers. Market leadership positions are determined by technology innovation, distribution network strength, and ability to serve diverse customer requirements across different sectors and price points.

Competitive strategies focus on technology differentiation, cost optimization, and service excellence. International players leverage advanced R&D capabilities and global scale while domestic manufacturers compete through local market knowledge, competitive pricing, and rapid response capabilities.

Market segmentation analysis reveals diverse growth patterns across different product categories, applications, and end-user segments. The segmentation framework provides insights into specific market dynamics and opportunities within each category.

By Product Type:

By Technology:

By Application:

IP camera segment demonstrates the strongest growth trajectory with advanced features including high-definition resolution, night vision capabilities, and integrated analytics driving adoption. The segment benefits from declining prices and improved performance, making professional-grade surveillance accessible to broader market segments. Wireless IP cameras show particular strength in residential and small business applications.

Video analytics software represents the fastest-growing category with artificial intelligence and machine learning capabilities transforming surveillance from passive monitoring to proactive security management. Applications include facial recognition, behavior analysis, and automated threat detection. The integration of business intelligence features expands market potential beyond traditional security applications.

Cloud-based solutions gain momentum as organizations seek to reduce infrastructure investment and maintenance complexity. Software-as-a-service models enable smaller businesses to access enterprise-grade surveillance capabilities. Remote monitoring and mobile access features drive adoption among distributed organizations and residential users.

Storage solutions evolve toward hybrid models combining local and cloud storage to optimize cost and performance. Network video recorders with built-in analytics capabilities represent a growing segment. The increasing data volumes generated by high-definition cameras drive demand for scalable storage architectures and intelligent data management solutions.

Technology providers benefit from expanding market opportunities driven by government initiatives, increasing security awareness, and technological advancement. The diverse market segments enable specialization strategies and niche positioning. Local manufacturing incentives and import substitution policies create competitive advantages for domestic and localized international operations.

System integrators and service providers gain from the complexity of modern surveillance systems requiring professional installation, configuration, and maintenance. The shift toward integrated solutions combining multiple security technologies creates opportunities for comprehensive service offerings. Recurring revenue models through maintenance contracts and managed services provide stable income streams.

End users benefit from improved security capabilities, declining costs, and enhanced functionality. Advanced analytics and automation reduce operational requirements while improving effectiveness. Integration with other business systems enables surveillance investments to contribute to operational efficiency and business intelligence beyond security applications.

Government stakeholders achieve public safety objectives through comprehensive surveillance infrastructure supporting crime prevention, traffic management, and emergency response. Smart city initiatives benefit from integrated surveillance platforms providing data for urban planning and resource optimization. Economic benefits include job creation in manufacturing, installation, and maintenance sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the India video surveillance market. AI-powered analytics enable automated threat detection, behavioral analysis, and predictive security capabilities. Machine learning algorithms improve accuracy over time while reducing false alarms and operational overhead. The trend extends beyond security to include business intelligence applications such as customer analytics and operational optimization.

Cloud computing adoption accelerates as organizations seek to reduce infrastructure investment and improve scalability. Cloud-based video management systems enable remote monitoring, automatic software updates, and flexible storage options. The trend particularly benefits small and medium enterprises lacking IT resources for on-premises surveillance infrastructure. Hybrid cloud models combining local and remote storage optimize cost and performance.

Mobile integration becomes standard with smartphone and tablet applications enabling remote monitoring and control. Mobile-first design approaches prioritize user experience across different devices and network conditions. Push notifications and real-time alerts keep users informed of security events regardless of location. The trend supports the growing demand for flexible and accessible surveillance solutions.

Edge computing implementation reduces bandwidth requirements and improves response times by processing video data locally. Edge analytics enable real-time decision making without dependence on network connectivity. The trend supports privacy requirements by minimizing data transmission while maintaining surveillance effectiveness. Integration with 5G networks will further enhance edge computing capabilities and applications.

Government policy initiatives continue shaping market development through smart city projects, digital India programs, and security modernization efforts. The National Mission on Transformative Mobility and Battery Storage creates opportunities for transportation surveillance applications. State-level initiatives including safe city projects drive large-scale surveillance deployments across multiple urban centers.

Technology partnerships between international and domestic companies accelerate innovation and market penetration. Joint ventures enable technology transfer while supporting local manufacturing objectives. Strategic alliances between hardware manufacturers and software developers create integrated solution offerings. Partnerships with telecommunications providers facilitate network-based surveillance services and 5G integration.

Investment activities include venture capital funding for surveillance technology startups and expansion investments by established players. Private equity involvement in consolidation activities creates larger, more competitive domestic companies. Foreign direct investment in manufacturing facilities supports local production and technology transfer. Government funding for research and development promotes indigenous technology development.

Regulatory developments include data protection guidelines, cybersecurity standards, and surveillance system specifications. Industry standards development ensures interoperability and quality consistency. Professional certification programs improve service quality and technical competency. Export promotion policies support domestic manufacturers in accessing international markets.

MarkWide Research analysis suggests that market participants should prioritize artificial intelligence integration and cloud-based service models to capture emerging opportunities. Companies should invest in local manufacturing capabilities to benefit from government incentives and cost advantages. Strategic partnerships with system integrators and service providers will be crucial for market penetration and customer support.

Technology strategy recommendations include focusing on mobile-first design, edge computing capabilities, and cybersecurity features to address evolving user requirements. Companies should develop sector-specific solutions for healthcare, education, and retail applications to differentiate from generic offerings. Investment in research and development will be essential for maintaining competitive positioning in the rapidly evolving technology landscape.

Market expansion strategies should target tier-2 and tier-3 cities where infrastructure development and security awareness are accelerating. Rural market penetration requires affordable solutions and simplified installation processes. Service-based business models including surveillance-as-a-service and managed security services offer sustainable revenue growth opportunities.

Operational recommendations include building local technical support capabilities, establishing comprehensive distribution networks, and developing training programs for installation and maintenance personnel. Companies should focus on customer education and demonstration programs to drive adoption in price-sensitive segments. Compliance with emerging privacy regulations and cybersecurity standards will be critical for long-term market success.

The future outlook for the India video surveillance market remains highly positive with sustained growth expected across all major segments. MarkWide Research projects continued expansion driven by smart city initiatives, increasing security awareness, and technological advancement. The market is expected to maintain robust growth rates with annual expansion of 11-15% over the next five years.

Technology evolution will focus on artificial intelligence, machine learning, and edge computing integration creating more intelligent and autonomous surveillance systems. 5G network deployment will enable new applications including real-time video analytics, augmented reality interfaces, and massive IoT integration. Quantum computing developments may eventually transform video processing and analysis capabilities.

Market maturation will see consolidation among smaller players while creating opportunities for specialized solution providers. Service-based business models will gain prominence as customers seek comprehensive security solutions rather than individual products. The integration of surveillance with other smart building and smart city systems will create new market categories and revenue streams.

Geographic expansion will extend beyond metropolitan areas to include rural and semi-urban markets as infrastructure development continues. International expansion opportunities may emerge for successful domestic manufacturers and service providers. The market will likely see increased standardization and interoperability requirements supporting customer choice and system integration flexibility.

The India video surveillance market stands at a pivotal point with exceptional growth opportunities driven by government initiatives, technological advancement, and increasing security awareness. The market demonstrates strong fundamentals with diverse applications, expanding geographic coverage, and continuous innovation in product and service offerings.

Key success factors for market participants include embracing artificial intelligence and cloud technologies, developing comprehensive service capabilities, and building strong local presence through manufacturing and support operations. The shift toward integrated solutions and service-based business models creates opportunities for sustainable competitive advantage and recurring revenue growth.

Market challenges including infrastructure limitations, skills shortages, and privacy concerns require strategic attention but do not fundamentally alter the positive growth trajectory. The convergence of surveillance technology with broader digital transformation initiatives ensures continued relevance and expansion potential across multiple sectors and applications.

Long-term prospects remain highly favorable with the India video surveillance market positioned to become one of the world’s largest and most dynamic security technology markets. Success will depend on companies’ ability to adapt to evolving customer requirements, embrace technological innovation, and build sustainable competitive positions in this rapidly expanding market landscape.

What is Video Surveillance?

Video surveillance refers to the use of video cameras to transmit a signal to a specific place, on a limited set of monitors. It is commonly used for security purposes in various sectors, including retail, transportation, and public safety.

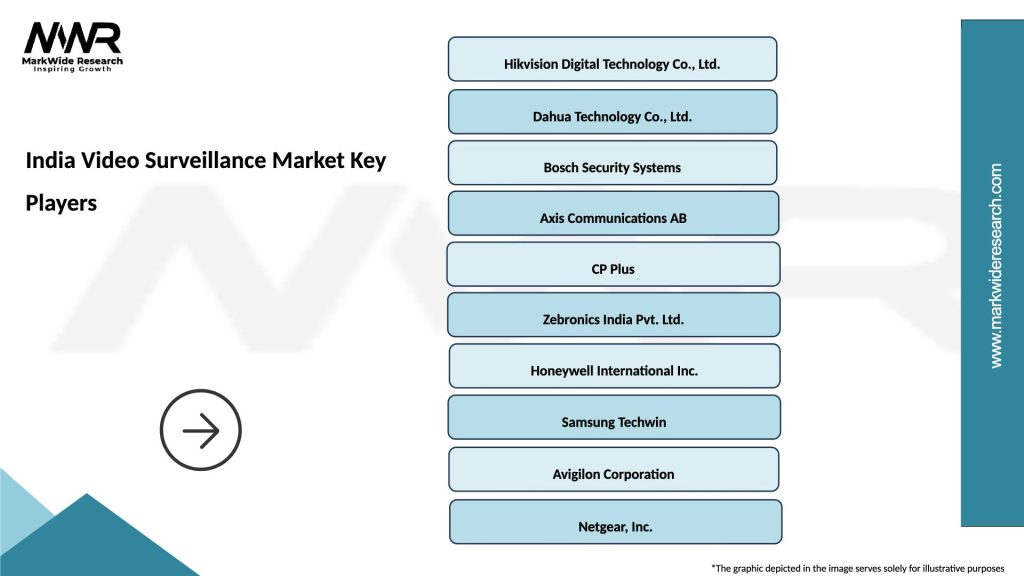

What are the key players in the India Video Surveillance Market?

Key players in the India Video Surveillance Market include Hikvision, Dahua Technology, and Axis Communications, among others. These companies are known for their innovative products and solutions in the field of video surveillance.

What are the main drivers of growth in the India Video Surveillance Market?

The main drivers of growth in the India Video Surveillance Market include increasing security concerns, the rise in crime rates, and the growing adoption of smart city initiatives. Additionally, advancements in technology, such as AI and IoT integration, are also contributing to market expansion.

What challenges does the India Video Surveillance Market face?

The India Video Surveillance Market faces challenges such as privacy concerns, high installation costs, and the need for skilled personnel to manage and maintain surveillance systems. These factors can hinder widespread adoption and implementation.

What opportunities exist in the India Video Surveillance Market?

Opportunities in the India Video Surveillance Market include the increasing demand for cloud-based surveillance solutions and the integration of advanced analytics. The growing focus on public safety and security in urban areas also presents significant growth potential.

What trends are shaping the India Video Surveillance Market?

Trends shaping the India Video Surveillance Market include the shift towards IP-based surveillance systems, the use of artificial intelligence for real-time analytics, and the growing importance of cybersecurity in protecting surveillance data. These trends are driving innovation and enhancing system capabilities.

India Video Surveillance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras |

| Technology | Analog, IP, Wireless, Cloud-based |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Covert, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Video Surveillance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at