444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India veterinary market represents one of the fastest-growing segments within the country’s healthcare ecosystem, driven by increasing pet ownership, rising awareness about animal health, and expanding livestock farming operations. Market dynamics indicate robust growth potential as urbanization and disposable income levels continue to rise across major Indian cities. The veterinary sector encompasses a comprehensive range of products and services including pharmaceuticals, vaccines, diagnostics, medical devices, and professional veterinary care services.

Growth trajectory analysis reveals that the market is experiencing significant expansion, with projections indicating a CAGR of 12.8% over the forecast period. This growth is particularly pronounced in metropolitan areas where pet adoption rates have increased by 35% in recent years. The market benefits from supportive government initiatives promoting animal welfare, disease prevention programs, and modernization of veterinary infrastructure across rural and urban regions.

Regional distribution shows concentrated activity in states like Maharashtra, Karnataka, Tamil Nadu, and Delhi NCR, which collectively account for approximately 45% of the total market activity. The increasing focus on preventive healthcare for animals, coupled with growing awareness about zoonotic diseases, has created substantial opportunities for veterinary service providers and pharmaceutical companies operating in the Indian market.

The India veterinary market refers to the comprehensive ecosystem of products, services, and healthcare solutions designed specifically for animal health and welfare within the Indian subcontinent. This market encompasses veterinary pharmaceuticals, vaccines, diagnostic equipment, surgical instruments, feed additives, and professional veterinary services provided to companion animals, livestock, and poultry across diverse geographical regions.

Market scope includes both preventive and therapeutic healthcare solutions for various animal categories including dogs, cats, cattle, buffalo, goats, sheep, poultry, and other domesticated animals. The veterinary market serves multiple stakeholders including pet owners, livestock farmers, commercial breeding operations, veterinary clinics, animal hospitals, and government animal welfare programs throughout India’s diverse agricultural and urban landscapes.

Strategic analysis of the India veterinary market reveals a dynamic and rapidly evolving sector characterized by increasing demand for quality animal healthcare solutions. The market demonstrates strong fundamentals driven by changing consumer attitudes toward pet care, expanding livestock production, and growing awareness about animal welfare standards. Key growth drivers include urbanization trends, rising disposable incomes, and increasing pet adoption rates, particularly among millennials and urban professionals.

Market segmentation shows diversified revenue streams across companion animal care, livestock health management, and poultry healthcare solutions. The companion animal segment has emerged as a high-growth area, with pet healthcare spending increasing by 28% annually in major metropolitan areas. Technological advancement in veterinary diagnostics, telemedicine, and digital health monitoring systems is creating new opportunities for market participants.

Competitive landscape features both international pharmaceutical giants and domestic players, with increasing collaboration between global companies and local distributors to enhance market penetration. The market benefits from supportive regulatory frameworks and government initiatives promoting animal health and welfare across different sectors of the economy.

Market intelligence reveals several critical insights that shape the India veterinary market landscape:

Primary growth drivers propelling the India veterinary market include fundamental socioeconomic and demographic changes that create sustained demand for animal healthcare solutions. Urbanization trends have led to increased pet adoption rates, with urban households increasingly viewing pets as family members requiring comprehensive healthcare attention.

Rising disposable incomes among middle-class families enable higher spending on pet care, veterinary services, and premium animal healthcare products. The growing awareness about zoonotic diseases and their potential impact on human health has heightened focus on preventive veterinary care and regular health monitoring for animals.

Government initiatives supporting livestock development, dairy farming modernization, and animal welfare programs create substantial market opportunities. The National Livestock Mission and various state-level programs promote improved animal health management practices, driving demand for veterinary products and services across rural and semi-urban areas.

Technological advancement in veterinary diagnostics, treatment methodologies, and digital health platforms enhances service delivery capabilities and creates new market segments. The increasing focus on food safety and quality standards in livestock production necessitates comprehensive veterinary oversight and health management programs.

Market challenges facing the India veterinary sector include several structural and operational constraints that may limit growth potential in certain segments. Limited veterinary infrastructure in rural areas creates accessibility challenges for livestock farmers and pet owners seeking professional veterinary care and specialized treatment services.

Cost sensitivity among price-conscious consumers, particularly in rural markets, may restrict adoption of premium veterinary products and advanced treatment options. The shortage of qualified veterinarians and trained animal healthcare professionals limits service delivery capacity and market expansion potential in underserved regions.

Regulatory complexities surrounding veterinary drug approval processes and compliance requirements may slow product launches and market entry for new participants. Supply chain challenges in remote areas affect product availability and distribution efficiency, particularly for temperature-sensitive vaccines and biologics.

Awareness gaps regarding preventive animal healthcare and modern veterinary practices persist in certain rural communities, limiting market penetration for advanced veterinary solutions and professional services.

Emerging opportunities within the India veterinary market present significant potential for growth and expansion across multiple segments. Digital health solutions including telemedicine platforms, mobile veterinary apps, and remote monitoring systems offer innovative approaches to veterinary care delivery, particularly in underserved rural areas.

Pet insurance market development represents a substantial untapped opportunity, with growing awareness about pet healthcare costs driving interest in insurance coverage for companion animals. The expanding pet food and nutrition segment creates opportunities for integrated veterinary and nutritional solutions.

Livestock productivity enhancement programs supported by government initiatives create demand for advanced veterinary solutions, genetic improvement services, and modern farming practices. Export market development for Indian veterinary products and services to neighboring countries and emerging markets presents growth opportunities for domestic manufacturers.

Specialized veterinary services including oncology, cardiology, and orthopedic care for companion animals represent high-value market segments with limited competition and strong growth potential in metropolitan areas.

Market dynamics in the India veterinary sector reflect complex interactions between supply-side factors, demand drivers, and regulatory influences that shape overall market behavior. Demand-supply equilibrium varies significantly across different market segments, with companion animal care showing strong demand growth outpacing supply capacity in urban areas.

Price dynamics demonstrate varying patterns across product categories, with premium veterinary services commanding higher margins while commodity products face competitive pricing pressure. Seasonal variations affect certain market segments, particularly livestock healthcare, which experiences peak demand during breeding seasons and monsoon periods.

Technology adoption rates vary considerably between urban and rural markets, with metropolitan areas showing faster acceptance of digital health solutions and advanced diagnostic equipment. Market consolidation trends indicate increasing collaboration between international companies and local partners to enhance distribution networks and market reach.

Consumer behavior patterns show evolving preferences toward preventive healthcare, premium products, and professional veterinary services, particularly among urban pet owners and progressive livestock farmers.

Comprehensive research approach employed for analyzing the India veterinary market incorporates multiple data collection methodologies and analytical frameworks to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with veterinary practitioners, pet owners, livestock farmers, industry executives, and regulatory officials across different geographical regions.

Secondary research encompasses analysis of government publications, industry reports, trade association data, and academic studies related to veterinary healthcare and animal welfare in India. Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and growth projections across different segments.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure data accuracy and consistency. Regional analysis incorporates state-wise market assessment, urban-rural distribution patterns, and demographic factors influencing market dynamics.

Trend analysis utilizes historical data patterns, current market indicators, and forward-looking projections to identify emerging opportunities and potential challenges facing market participants.

Regional market distribution across India reveals significant variations in veterinary market development, with certain states demonstrating higher growth rates and market penetration. Western India, particularly Maharashtra and Gujarat, leads in market activity with approximately 25% of total market share, driven by strong livestock farming, dairy industry presence, and urban pet ownership trends.

Southern India represents another major market cluster, with Karnataka, Tamil Nadu, and Andhra Pradesh collectively accounting for 22% of market activity. The region benefits from advanced veterinary education institutions, research facilities, and progressive farming practices that drive demand for modern veterinary solutions.

Northern India shows robust growth potential, with Delhi NCR, Punjab, and Haryana emerging as key markets due to high disposable incomes, urbanization, and significant livestock populations. Eastern India presents untapped opportunities, particularly in West Bengal and Odisha, where increasing awareness about animal health creates market expansion potential.

Rural-urban distribution indicates that while urban areas drive premium veterinary services and companion animal care, rural markets represent the largest volume opportunity for livestock healthcare products and basic veterinary services across all regions.

Competitive environment in the India veterinary market features a diverse mix of international pharmaceutical companies, domestic manufacturers, and specialized service providers competing across different market segments. Market leadership positions vary by product category and geographical region, with no single player dominating the entire market.

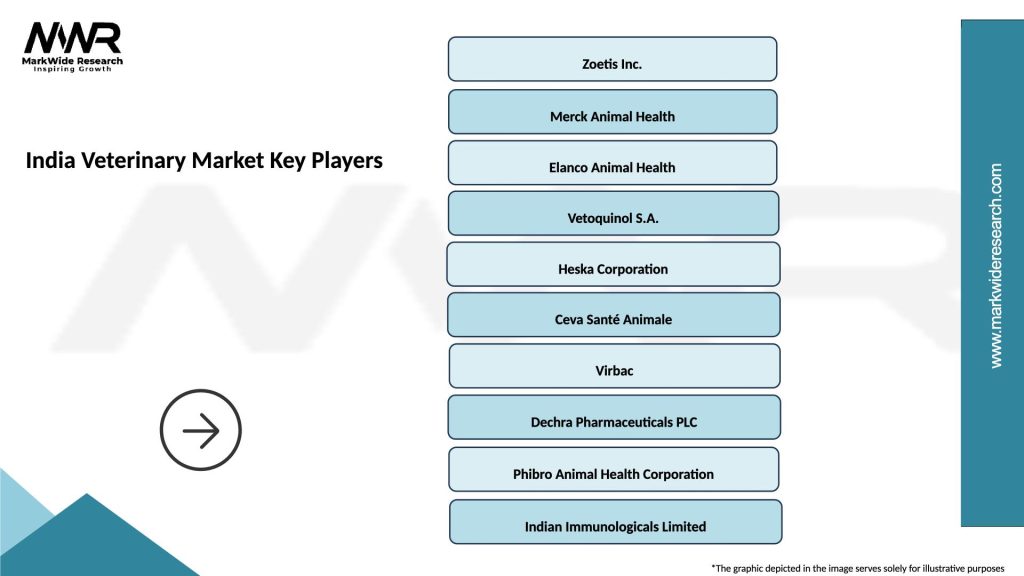

Key market participants include:

Competitive strategies include product innovation, distribution network expansion, strategic partnerships with local distributors, and development of region-specific solutions tailored to Indian market requirements.

Market segmentation analysis reveals multiple dimensions for categorizing the India veterinary market based on product types, animal categories, end-users, and geographical distribution patterns.

By Product Type:

By Animal Type:

By End-User:

Companion Animal Healthcare represents the fastest-growing segment within the India veterinary market, driven by increasing pet adoption rates and changing attitudes toward animal welfare. Premium pet care services including specialized treatments, preventive healthcare, and luxury grooming services show strong growth potential in metropolitan areas.

Livestock Healthcare remains the largest volume segment, with dairy farming and cattle health management driving consistent demand for veterinary products and services. Productivity enhancement programs focusing on genetic improvement, nutrition optimization, and disease prevention create opportunities for integrated veterinary solutions.

Poultry Healthcare demonstrates steady growth supported by expanding commercial poultry operations and increasing focus on food safety standards. Disease prevention and biosecurity measures drive demand for vaccines, diagnostics, and professional veterinary oversight in poultry farming operations.

Veterinary Pharmaceuticals category shows robust growth across all animal segments, with increasing emphasis on quality, efficacy, and safety standards. Vaccine market expansion reflects growing awareness about preventive healthcare and government immunization programs for livestock populations.

Market participants in the India veterinary sector enjoy several strategic advantages and growth opportunities that enhance business sustainability and profitability. Pharmaceutical companies benefit from expanding market demand, diverse product portfolio opportunities, and potential for premium pricing in specialized segments.

Veterinary service providers experience increasing demand for professional services, opportunities for specialization, and potential for geographic expansion into underserved markets. Technology companies find growing acceptance for digital health solutions, telemedicine platforms, and innovative diagnostic equipment.

Distribution partners benefit from expanding product portfolios, increasing market coverage requirements, and opportunities for value-added services. Educational institutions experience growing demand for veterinary professionals and opportunities for specialized training programs.

Investors find attractive opportunities in high-growth segments, potential for market consolidation, and strong fundamentals supporting long-term market expansion. Government stakeholders benefit from improved animal health outcomes, enhanced food safety standards, and economic development in rural areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend reshaping the India veterinary market, with telemedicine platforms, mobile applications, and digital health monitoring systems gaining widespread adoption. MarkWide Research analysis indicates that digital veterinary solutions have experienced 40% growth in user adoption over the past two years.

Preventive healthcare focus represents a significant shift from reactive treatment approaches toward proactive health management for both companion animals and livestock. Wellness programs and regular health check-ups are becoming standard practice among progressive pet owners and livestock farmers.

Personalized medicine trends include customized treatment protocols, genetic testing, and precision medicine approaches tailored to individual animal needs and characteristics. Nutraceuticals integration combines veterinary healthcare with nutritional supplements and functional foods for comprehensive animal wellness.

Sustainability initiatives drive demand for environmentally friendly veterinary products, sustainable packaging solutions, and eco-conscious farming practices. One Health approach emphasizes interconnections between animal health, human health, and environmental sustainability in veterinary practice.

Recent industry developments highlight significant progress in veterinary healthcare innovation, market expansion, and regulatory advancement across the India veterinary sector. Technology partnerships between international companies and Indian firms have accelerated product development and market penetration strategies.

Manufacturing expansion initiatives include establishment of new production facilities, capacity enhancement projects, and quality certification programs to meet growing market demand. Research collaborations between pharmaceutical companies, academic institutions, and government agencies drive innovation in veterinary drug development and treatment methodologies.

Digital platform launches include veterinary telemedicine services, online consultation platforms, and mobile applications for pet care management and livestock health monitoring. Regulatory approvals for new veterinary drugs, vaccines, and medical devices expand treatment options and market opportunities.

Distribution network expansion efforts focus on reaching underserved rural markets, establishing cold chain infrastructure for vaccine distribution, and developing last-mile delivery solutions for veterinary products and services.

Strategic recommendations for market participants include focusing on digital transformation initiatives, expanding distribution networks, and developing region-specific products tailored to Indian market requirements. Investment priorities should emphasize technology integration, professional training programs, and infrastructure development in underserved markets.

Market entry strategies for new participants should consider partnerships with established local distributors, gradual geographic expansion, and focus on specific animal segments or product categories. Product development efforts should prioritize affordable solutions, preventive healthcare products, and innovative delivery mechanisms.

Distribution optimization requires investment in cold chain infrastructure, rural market penetration strategies, and digital platforms for customer engagement and service delivery. Regulatory compliance preparation should anticipate evolving standards and maintain high-quality manufacturing practices.

Competitive positioning strategies should emphasize differentiation through innovation, customer service excellence, and comprehensive solution offerings that address multiple aspects of animal healthcare and welfare.

Long-term market prospects for the India veterinary sector remain highly positive, supported by fundamental demographic trends, economic development, and evolving consumer attitudes toward animal welfare. Growth projections indicate sustained expansion across all major market segments, with companion animal healthcare expected to maintain the highest growth rates.

Technology integration will continue accelerating, with artificial intelligence, IoT devices, and blockchain technology finding increasing applications in veterinary diagnostics, treatment protocols, and supply chain management. MWR projections suggest that digital veterinary solutions will capture 15% of total market activity within the next five years.

Market consolidation trends may intensify as larger companies acquire specialized players, expand geographic coverage, and develop comprehensive product portfolios. Export opportunities for Indian veterinary products and services are expected to grow significantly, particularly in Southeast Asian and African markets.

Regulatory evolution will likely emphasize quality standards, safety protocols, and environmental sustainability requirements, creating opportunities for companies that proactively address these concerns. Rural market development represents the largest untapped opportunity, with potential for substantial growth as infrastructure and awareness levels improve.

India veterinary market presents exceptional growth opportunities driven by fundamental socioeconomic changes, increasing animal welfare awareness, and expanding pet ownership trends across urban and rural areas. The market demonstrates strong fundamentals with diverse revenue streams, supportive government policies, and growing consumer willingness to invest in animal healthcare solutions.

Strategic positioning for success requires understanding regional variations, consumer preferences, and technological trends that shape market dynamics. Companies that invest in digital transformation, distribution network expansion, and innovative product development are well-positioned to capture market share and achieve sustainable growth.

Future success factors include adaptability to changing market conditions, commitment to quality and safety standards, and ability to serve diverse customer segments across companion animals and livestock categories. The India veterinary market offers substantial opportunities for both established players and new entrants willing to invest in long-term market development and customer relationship building.

What is Veterinary?

Veterinary refers to the branch of medicine that deals with the diagnosis, treatment, and prevention of diseases in animals. It encompasses various aspects such as animal health care, surgery, and nutrition, focusing on both domestic pets and livestock.

What are the key players in the India Veterinary Market?

Key players in the India Veterinary Market include companies like Zoetis, Elanco Animal Health, and Bayer Animal Health, which provide a range of veterinary pharmaceuticals and vaccines. These companies are involved in various segments such as companion animal care and livestock health, among others.

What are the growth factors driving the India Veterinary Market?

The India Veterinary Market is driven by factors such as increasing pet ownership, rising awareness about animal health, and the growing demand for high-quality animal protein. Additionally, advancements in veterinary technology and services are contributing to market growth.

What challenges does the India Veterinary Market face?

The India Veterinary Market faces challenges such as a lack of awareness about veterinary services in rural areas and regulatory hurdles in drug approvals. Additionally, the high cost of advanced veterinary care can limit access for some pet owners.

What opportunities exist in the India Veterinary Market?

Opportunities in the India Veterinary Market include the expansion of telemedicine for veterinary services and the increasing trend of pet humanization. There is also potential for growth in the livestock sector due to rising meat consumption.

What trends are shaping the India Veterinary Market?

Trends shaping the India Veterinary Market include the growing focus on preventive healthcare and the use of digital platforms for veterinary consultations. Additionally, there is an increasing emphasis on sustainable practices in animal husbandry and veterinary care.

India Veterinary Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vaccines, Antiparasitics, Antibiotics, Nutraceuticals |

| End User | Veterinary Clinics, Animal Hospitals, Research Institutions, Livestock Farms |

| Application | Preventive Care, Treatment, Diagnostics, Surgical Procedures |

| Distribution Channel | Online Retail, Veterinary Distributors, Pharmacies, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Veterinary Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at