444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India urology devices market represents a rapidly expanding segment within the country’s healthcare infrastructure, driven by increasing prevalence of urological disorders and growing awareness about advanced treatment options. Market dynamics indicate substantial growth potential as healthcare facilities across India invest in modern urological equipment and minimally invasive surgical technologies. The market encompasses a comprehensive range of devices including endoscopes, lithotripters, laser systems, catheters, and dialysis equipment, serving both diagnostic and therapeutic applications.

Healthcare transformation across India has accelerated the adoption of sophisticated urology devices, with private hospitals and specialty clinics leading the modernization efforts. The market demonstrates strong growth momentum, expanding at a robust CAGR of 8.2% as medical institutions prioritize patient outcomes and treatment efficiency. Government initiatives supporting healthcare infrastructure development and medical device manufacturing have created favorable conditions for market expansion.

Regional distribution shows concentrated growth in metropolitan areas and tier-1 cities, where approximately 65% of advanced urology procedures are currently performed. The market benefits from increasing medical tourism, rising disposable incomes, and growing elderly population requiring specialized urological care. Technology adoption rates continue to accelerate as healthcare providers recognize the clinical and economic benefits of modern urology devices.

The India urology devices market refers to the comprehensive ecosystem of medical equipment, instruments, and technologies specifically designed for the diagnosis, treatment, and management of urological conditions within the Indian healthcare system. This market encompasses devices used for treating disorders of the urinary tract, kidneys, bladder, prostate, and male reproductive organs, serving both adult and pediatric patient populations.

Market scope includes diagnostic equipment such as ultrasound systems and endoscopes, therapeutic devices including laser systems and lithotripters, surgical instruments for minimally invasive procedures, and consumable products like catheters and stents. The market serves diverse healthcare settings from large tertiary care hospitals to specialized urology clinics and ambulatory surgical centers across India’s expanding healthcare network.

Strategic analysis reveals the India urology devices market as a high-growth segment characterized by technological advancement, increasing disease prevalence, and expanding healthcare access. The market demonstrates strong fundamentals with growing demand for minimally invasive procedures driving adoption of advanced surgical equipment and diagnostic technologies.

Key growth drivers include the rising incidence of kidney stones, prostate disorders, and urinary tract infections, with approximately 12% annual increase in reported urological conditions. The market benefits from improving healthcare infrastructure, increasing insurance coverage, and growing awareness about early diagnosis and treatment options. Technology trends favor robotic-assisted surgery, laser-based treatments, and digital imaging systems that enhance precision and patient outcomes.

Market segmentation shows strong performance across multiple device categories, with endoscopy equipment and laser systems leading growth trajectories. The competitive landscape features both international medical device manufacturers and emerging domestic players, creating a dynamic environment for innovation and market expansion. Future prospects remain highly positive with sustained investment in healthcare modernization and expanding patient access to specialized urological care.

Market intelligence reveals several critical insights shaping the India urology devices landscape:

Primary growth catalysts propelling the India urology devices market include demographic shifts, lifestyle changes, and healthcare system evolution. The increasing prevalence of urological conditions, particularly among urban populations, creates sustained demand for advanced diagnostic and treatment technologies.

Demographic factors play a crucial role, with India’s aging population experiencing higher rates of prostate disorders, kidney stones, and bladder dysfunction. The growing middle class with increased healthcare spending capacity drives demand for quality urological care and advanced treatment options. Lifestyle-related factors including sedentary behavior, dietary changes, and increased stress levels contribute to rising incidence of urological disorders across age groups.

Healthcare infrastructure development represents another significant driver, with government initiatives promoting medical device manufacturing and hospital modernization. The establishment of new specialty hospitals and expansion of existing facilities creates opportunities for urology device adoption. Medical tourism growth attracts international patients seeking cost-effective urological treatments, encouraging hospitals to invest in state-of-the-art equipment.

Technology advancement drives market expansion through improved treatment outcomes and reduced recovery times. The development of minimally invasive surgical techniques and robotic-assisted procedures appeals to both patients and healthcare providers seeking better clinical results. Insurance expansion and government healthcare schemes improve patient access to expensive urological procedures, supporting market growth.

Significant challenges constrain the India urology devices market despite its growth potential. High equipment costs represent a primary barrier, particularly for smaller healthcare facilities and hospitals in tier-2 and tier-3 cities with limited capital budgets for advanced medical equipment.

Skilled workforce shortage poses substantial challenges, with insufficient numbers of trained urologists and technicians capable of operating sophisticated urology devices. The learning curve associated with new technologies requires extensive training programs and ongoing education, creating implementation delays and increased operational costs. Maintenance complexities and limited local service support for advanced equipment create operational challenges for healthcare facilities.

Regulatory hurdles including lengthy approval processes for new medical devices can delay market entry and increase costs for manufacturers. Import dependencies for high-end components and complete systems expose the market to currency fluctuations and supply chain disruptions. Reimbursement limitations restrict patient access to expensive procedures, particularly in rural areas where insurance coverage remains limited.

Infrastructure constraints in smaller cities and rural areas limit the deployment of advanced urology devices that require specialized facilities and support systems. Power supply reliability and technical support availability remain concerns for sophisticated medical equipment in certain regions.

Emerging opportunities in the India urology devices market present significant potential for growth and innovation. The government’s focus on healthcare infrastructure development through initiatives like Ayushman Bharat creates favorable conditions for medical device adoption and market expansion.

Rural healthcare expansion represents a substantial untapped opportunity, with telemedicine and mobile health units enabling specialized urological care delivery to underserved populations. The development of cost-effective, portable urology devices specifically designed for resource-constrained settings could unlock significant market potential. Medical device manufacturing under the Make in India initiative offers opportunities for local production, reducing costs and improving accessibility.

Technology integration opportunities include artificial intelligence applications for diagnostic imaging, IoT-enabled device monitoring, and digital health platforms for patient management. The growing acceptance of minimally invasive procedures creates demand for advanced surgical equipment and innovative treatment technologies. Public-private partnerships in healthcare delivery can accelerate device adoption and improve patient access to specialized care.

Export potential exists for Indian manufacturers developing innovative, cost-effective urology devices suitable for emerging markets. The combination of engineering expertise, cost advantages, and growing domestic market provides a foundation for global expansion. Training and education programs for healthcare professionals create opportunities for device manufacturers to build long-term relationships and ensure proper equipment utilization.

Complex interactions between various market forces shape the India urology devices landscape, creating a dynamic environment characterized by rapid technological evolution and changing healthcare delivery models. The interplay between supply and demand factors influences pricing strategies, product development priorities, and market entry approaches for both domestic and international players.

Supply chain dynamics reflect the market’s dependence on imported components and finished products, with local manufacturing capabilities gradually expanding. The balance between cost considerations and quality requirements drives procurement decisions across healthcare facilities. Competitive pressures encourage innovation and price optimization, benefiting end users through improved product offerings and more accessible pricing structures.

Regulatory evolution continues to shape market dynamics, with streamlined approval processes and quality standards promoting both safety and innovation. The government’s emphasis on medical device manufacturing creates opportunities for domestic players while maintaining quality standards. Healthcare policy changes including insurance reforms and public health initiatives directly impact market demand and growth trajectories.

Technology convergence drives market dynamics through the integration of digital health solutions, artificial intelligence, and advanced materials in urology device development. The shift toward value-based healthcare models influences purchasing decisions and emphasizes clinical outcomes over initial equipment costs. Patient expectations for minimally invasive treatments and faster recovery times continue to drive demand for advanced urology devices.

Comprehensive research approach employed for analyzing the India urology devices market combines primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporates multiple data sources and analytical techniques to provide a holistic view of market dynamics, trends, and future prospects.

Primary research activities include structured interviews with key stakeholders across the healthcare ecosystem, including urologists, hospital administrators, medical device distributors, and regulatory experts. Survey methodologies capture quantitative data on device utilization patterns, procurement preferences, and market trends from healthcare facilities across different geographic regions and facility types.

Secondary research encompasses analysis of government healthcare statistics, medical device import/export data, clinical literature, and industry publications. Market intelligence gathering includes monitoring regulatory developments, policy changes, and healthcare infrastructure investments that impact the urology devices market. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification.

Analytical frameworks applied include market sizing methodologies, competitive landscape analysis, and trend identification techniques. The research incorporates both quantitative and qualitative analysis approaches to provide comprehensive market understanding and actionable insights for stakeholders.

Geographic distribution of the India urology devices market reveals significant regional variations in adoption rates, healthcare infrastructure, and market penetration. Northern and western regions demonstrate higher market concentration due to established healthcare facilities and greater economic development.

North India represents approximately 28% of market share, with Delhi NCR serving as a major hub for advanced urological procedures and medical device distribution. The region benefits from well-established healthcare infrastructure, medical education institutions, and higher patient volumes. West India accounts for 32% of market activity, led by Maharashtra and Gujarat, where private healthcare investment and industrial development support market growth.

South India contributes 25% of market demand, with Karnataka, Tamil Nadu, and Andhra Pradesh showing strong growth in medical tourism and healthcare modernization. The region’s IT industry growth has created a affluent population with increased healthcare spending capacity. East India represents 15% of market share, with West Bengal leading regional development in urology device adoption.

Tier-1 cities dominate market activity with approximately 60% of total device installations, while tier-2 and tier-3 cities show emerging growth potential. Rural areas remain underserved but present significant opportunities for portable and cost-effective urology devices. Regional disparities in healthcare access and infrastructure continue to influence market development patterns and growth strategies.

Market competition in the India urology devices sector features a mix of established international manufacturers and emerging domestic players, creating a dynamic competitive environment characterized by innovation, pricing strategies, and market access approaches.

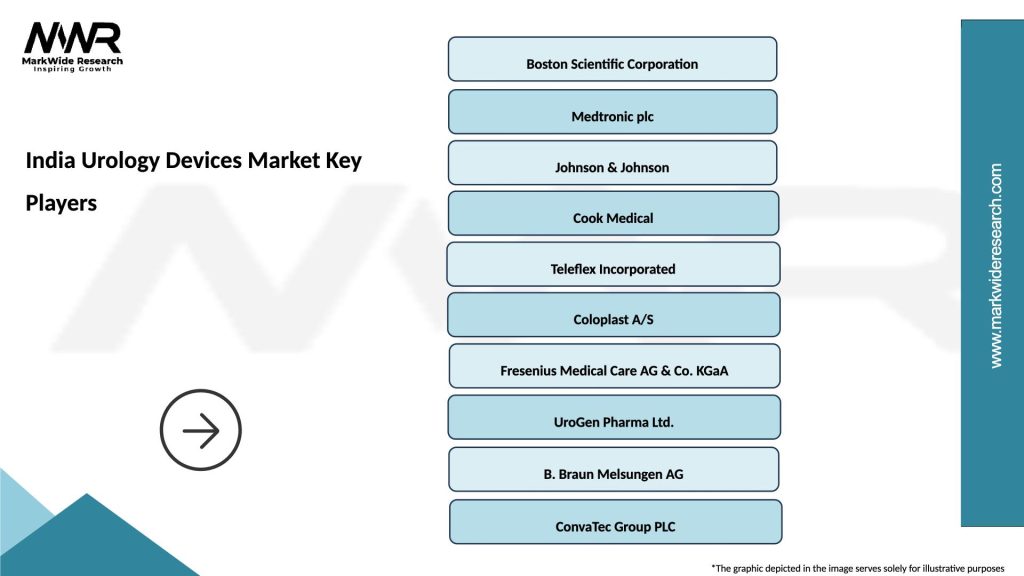

Leading international players include:

Domestic competitors are gaining market share through cost-effective solutions and local manufacturing capabilities. Companies like Poly Medicure and Hindustan Syringes focus on consumable products and basic surgical instruments. Competitive strategies emphasize product localization, pricing optimization, and comprehensive service support to address diverse market needs across India’s healthcare landscape.

Market segmentation analysis reveals diverse product categories and application areas within the India urology devices market, each demonstrating distinct growth patterns and market dynamics.

By Product Type:

By Application:

By End User:

Endoscopy equipment represents the largest product category, driven by increasing adoption of minimally invasive diagnostic and therapeutic procedures. The segment benefits from technological advancements in imaging quality, device miniaturization, and enhanced maneuverability. Market growth is supported by expanding applications beyond traditional procedures and integration with digital imaging systems.

Laser systems demonstrate strong growth momentum, particularly holmium lasers for kidney stone treatment and prostate surgery. The segment benefits from superior clinical outcomes, reduced patient recovery times, and expanding procedural applications. Technology evolution toward more efficient and versatile laser platforms drives replacement cycles and market expansion.

Dialysis equipment represents a critical segment addressing the growing burden of chronic kidney disease in India. The market benefits from government healthcare initiatives and increasing insurance coverage for renal replacement therapy. Home dialysis solutions present emerging opportunities for market growth and improved patient quality of life.

Consumable products including catheters and stents provide recurring revenue opportunities with steady demand growth. The segment benefits from increasing procedure volumes and expanding patient populations requiring urological interventions. Product innovation focuses on biocompatible materials and infection prevention technologies.

Healthcare providers benefit from improved patient outcomes through advanced diagnostic capabilities and minimally invasive treatment options. Modern urology devices enable more precise procedures, reduced complications, and shorter hospital stays, improving both clinical results and operational efficiency. Cost benefits emerge through reduced readmission rates and improved resource utilization.

Patients experience significant advantages including less invasive procedures, faster recovery times, and improved treatment success rates. Advanced urology devices offer better diagnostic accuracy, leading to earlier detection and more effective treatment of urological conditions. Quality of life improvements result from innovative treatments for chronic conditions and minimally invasive surgical approaches.

Medical device manufacturers benefit from expanding market opportunities driven by increasing healthcare investment and growing disease prevalence. The market offers potential for both premium technology solutions and cost-effective devices tailored to local market needs. Innovation opportunities exist in developing India-specific solutions and expanding into underserved market segments.

Healthcare system benefits include improved efficiency in urological care delivery, reduced healthcare costs through preventive interventions, and enhanced capacity to serve growing patient populations. Economic advantages emerge through medical tourism growth and reduced need for overseas treatment seeking.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally invasive surgery represents the dominant trend shaping the India urology devices market, with increasing adoption of laparoscopic and robotic-assisted procedures. Healthcare providers and patients increasingly prefer techniques that reduce trauma, minimize scarring, and accelerate recovery times. Technology advancement continues to improve the precision and effectiveness of minimally invasive approaches.

Digital health integration emerges as a significant trend, with urology devices incorporating IoT connectivity, artificial intelligence, and data analytics capabilities. Smart devices enable remote monitoring, predictive maintenance, and improved clinical decision-making. Telemedicine applications expand access to specialized urological care in remote areas through connected diagnostic devices.

Personalized medicine trends influence urology device development, with equipment designed to support customized treatment approaches based on individual patient characteristics. Advanced imaging and diagnostic capabilities enable more precise treatment planning and improved outcomes. Precision surgery techniques benefit from enhanced visualization and navigation technologies.

Sustainability focus drives development of environmentally friendly medical devices and sustainable manufacturing practices. Reusable devices and eco-friendly materials gain importance in procurement decisions. Cost-effectiveness remains a critical trend, with emphasis on devices that provide superior clinical outcomes while maintaining affordability for the Indian healthcare system.

Recent industry developments highlight the dynamic nature of the India urology devices market, with significant investments in technology advancement, manufacturing capabilities, and market expansion initiatives by both domestic and international players.

Manufacturing investments include establishment of local production facilities by international medical device companies to serve the Indian market and reduce costs. Several companies have announced plans to manufacture urology devices in India under the Make in India initiative. Technology partnerships between Indian healthcare institutions and global device manufacturers facilitate knowledge transfer and innovation.

Regulatory developments include streamlined approval processes for medical devices and implementation of quality standards that align with international best practices. The Medical Device Rules 2017 and subsequent amendments have created a more favorable regulatory environment. Government initiatives supporting medical device manufacturing and healthcare infrastructure development continue to shape market dynamics.

Clinical advancements include introduction of new laser technologies, robotic surgical systems, and advanced imaging capabilities in Indian healthcare facilities. Training programs and educational initiatives have expanded the number of healthcare professionals capable of using advanced urology devices. Research collaborations between Indian institutions and international partners drive innovation in urology device development.

MarkWide Research analysis suggests that stakeholders in the India urology devices market should focus on developing cost-effective solutions tailored to local market needs while maintaining international quality standards. The emphasis should be on creating accessible technologies that can serve both urban and rural healthcare settings effectively.

Strategic recommendations for manufacturers include investing in local manufacturing capabilities to reduce costs and improve market access. Partnerships with Indian healthcare institutions and distributors can facilitate market penetration and provide valuable insights into local requirements. Product development should prioritize durability, ease of use, and serviceability in diverse operating environments.

Healthcare providers should consider phased adoption strategies that balance advanced technology benefits with budget constraints. Investment in training programs and technical support infrastructure is crucial for successful device implementation. Collaborative approaches including equipment sharing and service partnerships can improve access to expensive technologies.

Policy recommendations include continued support for medical device manufacturing, improvement of reimbursement frameworks, and investment in healthcare infrastructure development. Regulatory streamlining and quality assurance programs can enhance market growth while ensuring patient safety. Public-private partnerships can accelerate technology adoption and improve healthcare access across diverse geographic regions.

Long-term prospects for the India urology devices market remain highly positive, with sustained growth expected across all major product categories and geographic regions. The market is projected to maintain strong growth momentum, driven by demographic trends, healthcare infrastructure development, and increasing disease prevalence.

Technology evolution will continue to drive market transformation, with artificial intelligence, robotics, and digital health solutions becoming increasingly integrated into urology devices. The development of India-specific technologies and cost-effective solutions will expand market accessibility and penetration. Innovation focus will emphasize improving clinical outcomes while reducing costs and complexity.

Market expansion into tier-2 and tier-3 cities presents significant growth opportunities, supported by improving healthcare infrastructure and increasing healthcare spending. Rural market penetration will benefit from telemedicine initiatives and portable device development. Export potential for Indian-manufactured urology devices will grow as local capabilities and quality standards improve.

Regulatory environment is expected to become more supportive of innovation and market growth, with continued emphasis on quality standards and patient safety. Government healthcare initiatives will create additional demand for urology devices and services. MWR projections indicate sustained market growth with expanding opportunities across all stakeholder categories, positioning India as a key global market for urology devices.

The India urology devices market represents a compelling growth opportunity characterized by strong fundamentals, expanding healthcare infrastructure, and increasing patient demand for advanced urological care. Market dynamics favor continued expansion across all major product categories, with particular strength in minimally invasive surgical devices and diagnostic equipment.

Key success factors for market participants include developing cost-effective solutions tailored to local needs, investing in manufacturing capabilities, and building comprehensive service and support networks. The market rewards innovation, quality, and accessibility, creating opportunities for both premium technology providers and cost-focused manufacturers.

Future growth will be driven by demographic trends, technology advancement, and healthcare system evolution, with sustained investment in medical infrastructure and expanding insurance coverage supporting market development. The India urology devices market is positioned for continued expansion, offering significant opportunities for stakeholders committed to serving this dynamic and growing healthcare sector.

What is Urology Devices?

Urology devices are medical instruments used for the diagnosis, treatment, and management of urological conditions. These devices include surgical instruments, diagnostic equipment, and therapeutic devices that assist in treating disorders related to the urinary tract and male reproductive organs.

What are the key players in the India Urology Devices Market?

Key players in the India Urology Devices Market include Boston Scientific, Medtronic, and Cook Medical, which are known for their innovative urology solutions. These companies focus on developing advanced technologies for minimally invasive procedures and improving patient outcomes, among others.

What are the growth factors driving the India Urology Devices Market?

The India Urology Devices Market is driven by factors such as the increasing prevalence of urological disorders, a growing aging population, and advancements in medical technology. Additionally, rising healthcare expenditure and awareness about urological health contribute to market growth.

What challenges does the India Urology Devices Market face?

The India Urology Devices Market faces challenges such as high costs associated with advanced urology devices and a lack of skilled professionals for operating complex equipment. Regulatory hurdles and varying healthcare infrastructure across regions also pose significant challenges.

What opportunities exist in the India Urology Devices Market?

Opportunities in the India Urology Devices Market include the potential for growth in telemedicine and remote monitoring solutions, as well as the development of innovative products tailored to local needs. Additionally, increasing investment in healthcare infrastructure presents avenues for market expansion.

What trends are shaping the India Urology Devices Market?

Trends shaping the India Urology Devices Market include the rise of minimally invasive surgical techniques and the integration of digital health technologies. There is also a growing focus on personalized medicine and patient-centric approaches in urology care.

India Urology Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Endoscopes, Catheters, Surgical Instruments, Diagnostic Devices |

| Technology | Robotic Surgery, Laser Therapy, Ultrasound, Imaging Systems |

| End User | Hospitals, Clinics, Ambulatory Surgical Centers, Research Laboratories |

| Application | Prostate Cancer, Kidney Stones, Urinary Incontinence, Bladder Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Urology Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at