444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India UPVC doors and windows market is undergoing a remarkable transformation, driven by the growing demand for energy-efficient and aesthetically pleasing building solutions. Unplasticized Polyvinyl Chloride (UPVC) doors and windows offer a winning combination of durability, thermal insulation, and low maintenance. As urbanization accelerates and sustainable construction gains traction, UPVC doors and windows play a pivotal role in enhancing the comfort and efficiency of Indian living spaces.

Meaning

UPVC doors and windows are constructed using unplasticized polyvinyl chloride, a rigid and highly durable material. These doors and windows are designed to offer superior thermal insulation, noise reduction, and weather resistance compared to traditional materials. With their versatile design options and ability to withstand harsh weather conditions, UPVC doors and windows have become a popular choice for residential and commercial buildings.

Executive Summary

The India UPVC doors and windows market is witnessing rapid growth due to shifting consumer preferences towards energy-efficient and low-maintenance building components. UPVC doors and windows are highly valued for their ability to enhance indoor comfort, reduce energy consumption, and elevate the aesthetic appeal of structures. The market’s expansion is fueled by the nation’s increasing focus on sustainable building practices.

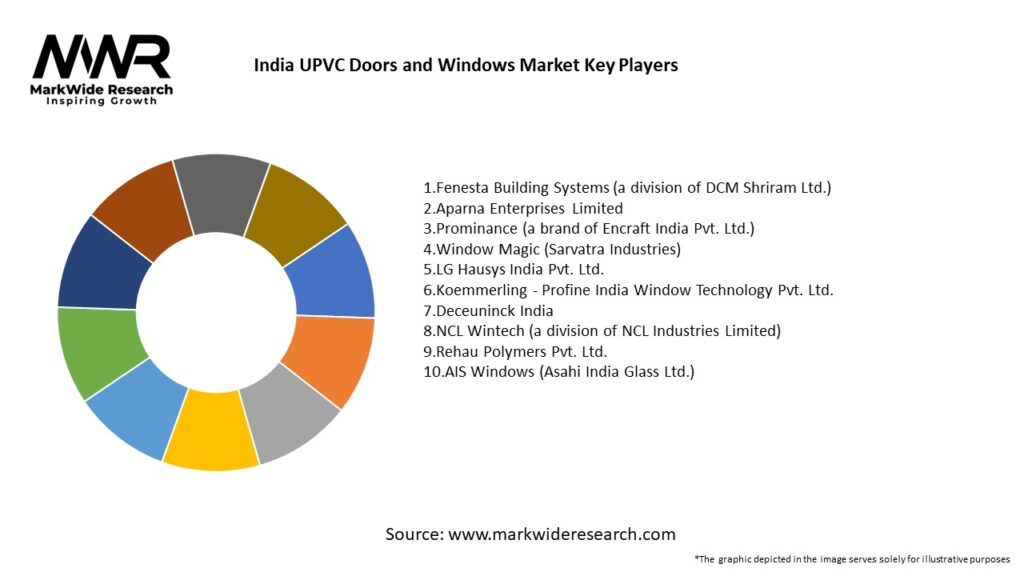

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Metros and premium housing markets are adopting uPVC first, while adoption in tier-2/tier-3 cities is rising gradually.

Consumers increasingly view windows and doors as architectural features, not just functional elements, demanding varied colors, finishes, and shapes.

Energy codes (e.g., ECBC) and green building certifications push demand for thermally efficient window systems.

Glass and hardware quality matter: performance depends heavily on glazing performance, gaskets, and sealing design.

Distribution and fabrication networks matter: local fabricators and trusted brands influence decision in non-metro areas.

Market Drivers

Urbanization & Housing Growth: Large-scale housing projects, luxury apartments, and commercial complexes drive fenestration demand.

Energy Efficiency & Green Norms: Policies promoting efficient buildings encourage adoption of uPVC systems with insulated glazing.

Rising Consumer Awareness: Buyers increasingly favor low-maintenance, noise-insulating, aesthetic window systems.

Retrofitting & Modernization: Old structures upgrade to better windows and doors for comfort and efficiency.

Technology & Design Innovation: Multi-chamber profiles, thermal breaks, color finishes, and captive hardware boost appeal.

Market Restraints

Competition from Aluminum/Wood: Traditional materials remain entrenched, especially in lower-budget segments.

Initial Cost Premium: Compared to cheaper alternatives, uPVC may still carry a higher upfront cost in some markets.

Installation Skill Gap: Poor installation (leaks, misalignment, weak sealing) can harm reputation and lead to rework.

Raw Material Volatility: Fluctuating prices of PVC resin, steel reinforcement, and hardware affect profitability.

Perception & Habit: Some homeowners and builders still distrust uPVC’s durability compared to wood or aluminum.

Market Opportunities

Tier‑2 / Tier‑3 City Penetration: Expanding brand presence and fabrication partnerships beyond metros.

Color & Aesthetic Customization: Offering wood-grain finishes, pastel/metallic hues, and architectural shapes.

Smart & Automated Systems: Integrating motorized opening, sensor control, and smart-home connectivity.

Hybrid Frames: Combining uPVC interior with aluminum exterior for structural strength and aesthetics.

After-Market Upgrades: Offering services to retrofit glass into existing wood or aluminum frames with uPVC segments.

Market Dynamics

Supply-Side Factors:

Profiles, hardware, and glass suppliers collaborate with local fabricators.

Capacity scaling in local extrusion units accelerates supply and reduces lead time.

Backward integration by large brands (owning resin pipelines, hardware sourcing) reduces margin pressure.

Demand-Side Factors:

Builders and developers prefer packaged fenestration solutions rather than piece-by-piece procurement.

Homeowners demand warranties, performance data, and after-sales service to commit to uPVC.

Economic & Policy Factors:

Subsidies or incentives for green buildings boost adoption in premium projects.

Credit availability for housing stimulates purchases.

Foreign brands compete, but local presence and service network are key differentiators.

Regional Analysis

Delhi NCR / NCR Corridor: High demand driven by premium residential and commercial projects, favorable legislation, and mature supplier base.

Mumbai / Western India: Coastal conditions increase demand for corrosion-resistant windows; luxury and high-rise demand is strong.

Bengaluru / Hyderabad / Southern Markets: Rapid tech-city expansion means strong demand for modern fenestration solutions.

Pune / Ahmedabad / Gujarat Region: Industrial and residential growth fosters adoption and fabrication capacity.

Tier-2 Cities (Lucknow, Jaipur, Kochi, Indore): Growing awareness and availability of local fabricators accelerate market penetration.

Competitive Landscape

Leading Companies in India UPVC Doors and Windows Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Product Type:

Sliding Window / Door Systems

Casement / Casement Windows

Tilt & Turn / Awning / Hopper Windows

Folding / Accordion Doors

Specialty Shapes (arched, curved)

By End Use:

Residential (Standalone homes, apartments, villas)

Commercial (Offices, malls, hotels)

Institutional (Hospitals, schools)

By Region / State:

Northern (Delhi, Punjab, Haryana)

Western (Maharashtra, Gujarat)

Southern (Karnataka, Tamil Nadu, Telangana)

Eastern / Central India

By Price Segment:

Premium / Luxury

Mid-range

Value / Budget Segment

Category-wise Insights

Sliding Systems: Common for balcony and terrace access; ease of use, space-saving, and aesthetic demand.

Casement & Tilt-Turn Systems: Provide better sealing and insulation; preferred in energy-efficient buildings.

Folding & Specialty Doors: Used in luxury villas, resorts, showrooms—paired with panoramic glass.

Hybrid Frames: Blending aesthetics and structural benefits appeals to architect-driven projects.

Smart / Motorized Units: Attractive in luxury segment with automation and remote control features.

Key Benefits for Industry Participants and Stakeholders

Energy Savings & Comfort: Reduced cooling and heating costs through better insulation.

Brand Differentiation: Premium window systems help developers market quality.

After-Sales Service & Warranty: Ability to guarantee sealing and performance boosts trust.

Long-Term Cost Economy: Lower maintenance and replacement costs versus wood or metal.

Design Freedom: Wide color, shape, and opening options support architectural expression.

SWOT Analysis

Strengths:

Excellent durability, low maintenance, and energy benefits.

Growing consumer preference in metro markets.

Local fabrication networks enabling customization and service.

Weaknesses:

High initial cost relative to alternatives in budget segments.

Dependence on quality control and installation execution.

Raw material and glass cost volatility impacting margins.

Opportunities:

Expand to tier‑2 / tier‑3 cities using distribution and fabrication models.

Green building incentives push adoption in sustainable real estate.

Innovation in smart windows, hybrid frames, and retrofit solutions.

Tie-ups with developers to specify uPVC in new projects early.

Threats:

Competition from aluminum-clad, composite, or advanced wood alternatives.

Poor installations causing leaks or damage, harming market reputation.

Supply chain disruptions affecting availability of profiles, hardware, or glass.

Market Key Trends

Aesthetic & Color Options: Growth in wood-grain finishes, pastel shades, and dual-tone colors.

Hybrid & Composite Frames: Combining uPVC with metal exteriors for higher strength and design.

Smart Automation: Integration of motorized windows, sensors, and IoT-enabled controls.

Lightweight Profile Design: Reducing material without compromising strength to lower cost.

Sustainability Focus: Use of recycled content, greener resin blends, and circular manufacturing.

Key Industry Developments

Profile Capacity Additions: Extruders expanding capacity in India to meet rising demand.

Brand-Fabricator Partnerships: Vertical alignment between profile brands and installers to ensure quality.

Developer Tie-ins: Real-estate projects specifying uPVC early to lock demand.

Training & Certification Programs: Brands offering certification to installers to ensure proper installation quality.

Smart Glass Integration Trials: Some projects beginning to combine double glazing with smart (electrochromic) glass in uPVC frames.

Analyst Suggestions

Strengthen Tier‑2 Presence: Deploy fabricator networks, training, and logistics to reach emerging urban areas.

Emphasize Warranty & Performance: Back up with test data and fresh performance guarantees to build trust.

Bundle Smart Options: Offer automation, sensors, or shading control as an upsell in premium segments.

Optimize Supply Chain: Backward integrate resin or form global agreements to manage cost volatility.

Engage Developers Early: Influence window specification in design stage rather than as an add-on.

Future Outlook

Over the next decade, the India uPVC Doors and Windows Market is expected to mature and deepen. Adoption will increasingly shift to non-metros as consumer awareness and product availability improve. Hybrid and smart fenestration systems will gain prominence. Guarantees of performance, energy savings, and low maintenance will drive retrofit demand. Sustainability, circular manufacturing, and recycled content will become key differentiators.

As standards such as ECBC tighten and green building adoption spreads, uPVC systems will transition from a premium niche toward mainstream fenestration solutions. The market will reward brands and fabricators that combine aesthetic customization, technical performance, installation reliability, and service reach.

Conclusion

The India uPVC Doors and Windows Market stands at a high-growth intersection of consumer preference, environmental regulation, and construction modernization. Though challenges in price sensitivity, raw material cost, and installation quality remain, the long-term trajectory favors uPVC due to its durability, thermal performance, and design flexibility. Stakeholders that invest in reach, training, innovation, and sustainable practices will be well positioned to lead India’s fenestration transformation.

What is UPVC Doors and Windows?

UPVC Doors and Windows are made from unplasticized polyvinyl chloride, a durable and low-maintenance material. They are commonly used in residential and commercial buildings for their energy efficiency, weather resistance, and security features.

What are the key players in the India UPVC Doors and Windows Market?

Key players in the India UPVC Doors and Windows Market include Fenesta Building Systems, Ashiana, and Veka India. These companies are known for their innovative designs and high-quality products, catering to various consumer needs.

What are the growth factors driving the India UPVC Doors and Windows Market?

The growth of the India UPVC Doors and Windows Market is driven by increasing urbanization, rising disposable incomes, and a growing preference for energy-efficient building materials. Additionally, government initiatives promoting sustainable construction practices contribute to market expansion.

What challenges does the India UPVC Doors and Windows Market face?

The India UPVC Doors and Windows Market faces challenges such as fluctuating raw material prices and competition from alternative materials like aluminum and wood. Additionally, the lack of awareness about the benefits of UPVC products can hinder market growth.

What opportunities exist in the India UPVC Doors and Windows Market?

Opportunities in the India UPVC Doors and Windows Market include the increasing demand for eco-friendly building solutions and the expansion of the real estate sector. Furthermore, advancements in manufacturing technology can lead to innovative product offerings.

What trends are shaping the India UPVC Doors and Windows Market?

Trends in the India UPVC Doors and Windows Market include a growing focus on customization and aesthetic appeal, as well as the integration of smart technology in window and door systems. Additionally, there is an increasing emphasis on sustainability and energy efficiency.

India UPVC Doors and Windows Market

| Segmentation Details | Description |

|---|---|

| Product Type | Sliding Doors, Casement Windows, French Windows, Bi-fold Doors |

| End User | Residential, Commercial, Industrial, Institutional |

| Installation Type | New Construction, Renovation, Replacement, Custom Installation |

| Distribution Channel | Direct Sales, Retail Stores, Online Platforms, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in India UPVC Doors and Windows Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at