444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview The tequila market in India is experiencing steady growth, fueled by changing consumer preferences, increasing disposable incomes, and a growing interest in premium spirits. Tequila, a distilled alcoholic beverage made primarily from the blue agave plant, has gained popularity among Indian consumers, driven by factors such as globalization, urbanization, and the influence of Western culture.

Meaning Tequila is a type of distilled alcoholic beverage originating from Mexico, primarily produced in the Tequila region of Jalisco. It is made from the blue agave plant and comes in various categories, including Blanco (silver), Reposado (rested), Añejo (aged), and Extra Añejo (extra aged). Tequila is known for its unique flavor profile, ranging from sweet and fruity to earthy and complex, making it a versatile spirit for cocktails and sipping.

Executive Summary The India tequila market is witnessing growth driven by factors such as increasing urbanization, changing consumer preferences, and the rising popularity of cocktails and premium spirits. While the market is still relatively niche compared to other spirits categories, such as whisky and vodka, it presents significant opportunities for domestic and international tequila brands to capitalize on the growing demand for high-quality spirits in the country.

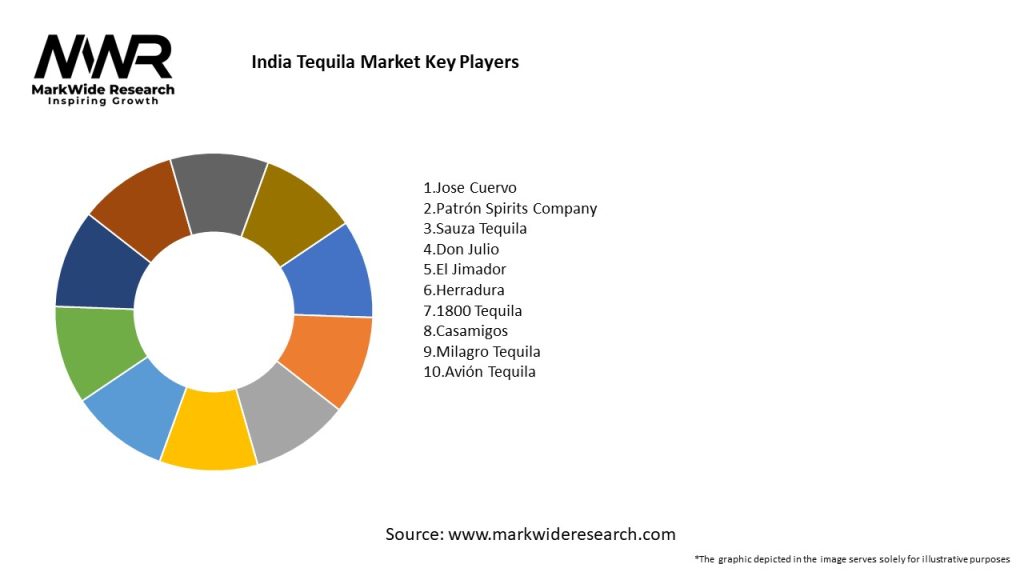

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics The India tequila market is characterized by dynamic shifts in consumer preferences, evolving regulatory landscapes, and increasing competition among domestic and international brands. Key dynamics shaping the market include:

Regional Analysis The consumption patterns and market dynamics of tequila vary across different regions of India. While metropolitan cities like Mumbai, Delhi, and Bangalore represent key consumption hubs, emerging markets in tier-2 and tier-3 cities offer growth opportunities for tequila brands. Regional factors such as cultural attitudes towards alcohol, income levels, and lifestyle preferences influence the demand for tequila products in each region.

Competitive Landscape

Leading Companies in India Tequila Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation The India tequila market can be segmented based on various factors, including:

Segmentation enables tequila brands to target specific customer segments with tailored product offerings, pricing strategies, and marketing campaigns, thereby maximizing market penetration and revenue potential.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis A SWOT analysis of the India tequila market reveals the following:

Market Key Trends

Covid-19 Impact The Covid-19 pandemic has had a mixed impact on the India tequila market, with factors such as lockdown restrictions, on-premise closures, and supply chain disruptions affecting consumption patterns and sales. Key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook The future outlook for the India tequila market is optimistic, with continued growth expected driven by factors such as urbanization, premiumization, and cultural integration. Key trends shaping the future of the market include:

Conclusion The India tequila market presents significant opportunities for industry participants and stakeholders to capitalize on changing consumer preferences, rising disposable incomes, and the growing popularity of premium spirits. By leveraging innovation, localization, and digital engagement strategies, tequila brands can position themselves for success in a dynamic and evolving market landscape. With a focus on authenticity, quality, and consumer-centricity, the future of the India tequila market is poised for growth, innovation, and cultural relevance in the years to come.

India Tequila Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blanco, Reposado, Añejo, Extra Añejo |

| Distribution Channel | Online, Retail, Bars, Restaurants |

| Customer Type | Millennials, Gen Z, Affluent Consumers, Tourists |

| Packaging Type | Glass Bottles, PET Bottles, Cans, Tetra Packs |

Leading Companies in India Tequila Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at