444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India surveillance storage market represents a rapidly expanding segment within the country’s broader security infrastructure ecosystem. This market encompasses specialized storage solutions designed to handle the massive volumes of video data generated by surveillance systems across various sectors including government, commercial, residential, and industrial applications. India’s surveillance storage market is experiencing unprecedented growth driven by increasing security concerns, smart city initiatives, and the widespread adoption of IP-based surveillance systems.

Digital transformation across Indian enterprises and government institutions has accelerated the deployment of advanced surveillance technologies, creating substantial demand for robust storage infrastructure. The market is characterized by the integration of cloud-based solutions, network-attached storage (NAS) systems, and hybrid storage architectures that can efficiently manage both real-time monitoring and long-term data retention requirements. According to MarkWide Research, the surveillance storage sector is growing at a compound annual growth rate of 12.5%, reflecting the critical importance of data storage in modern security ecosystems.

Government initiatives such as the Smart Cities Mission and Digital India program have significantly contributed to market expansion, with municipalities and state governments investing heavily in comprehensive surveillance infrastructure. The market encompasses various storage technologies including traditional hard disk drives, solid-state drives, and emerging storage-as-a-service models that offer scalable solutions for organizations of all sizes.

The India surveillance storage market refers to the comprehensive ecosystem of data storage solutions specifically designed to capture, store, manage, and retrieve video surveillance data across various applications and industries throughout India. This market encompasses hardware components, software platforms, and integrated solutions that enable organizations to effectively manage the substantial data volumes generated by modern surveillance systems while ensuring compliance with regulatory requirements and operational efficiency.

Surveillance storage systems in the Indian context typically involve network video recorders (NVRs), digital video recorders (DVRs), cloud storage platforms, and hybrid solutions that combine on-premises and cloud-based storage capabilities. These systems must accommodate varying retention periods, support multiple video formats and resolutions, and provide reliable access to stored footage for security analysis, forensic investigations, and compliance purposes.

The market significance extends beyond simple data storage, encompassing intelligent video analytics, automated data management, and integration with broader security management platforms that enable proactive threat detection and response capabilities across diverse Indian market segments.

India’s surveillance storage market is positioned for substantial growth as organizations across sectors recognize the critical importance of robust data storage infrastructure in comprehensive security strategies. The market is driven by increasing urbanization, rising security threats, and government mandates for surveillance deployment in public spaces and critical infrastructure facilities.

Key market dynamics include the transition from analog to digital surveillance systems, growing adoption of high-definition and ultra-high-definition cameras, and increasing integration of artificial intelligence and machine learning capabilities in storage solutions. The market benefits from 65% of organizations planning to upgrade their surveillance storage infrastructure within the next two years, indicating strong future demand.

Technology evolution toward cloud-based and hybrid storage solutions is reshaping market dynamics, with organizations seeking scalable, cost-effective alternatives to traditional on-premises storage systems. The integration of edge computing capabilities and intelligent video analytics is creating new opportunities for storage solution providers to deliver value-added services beyond basic data storage functionality.

Regional distribution shows concentrated demand in major metropolitan areas and industrial corridors, with emerging opportunities in tier-2 and tier-3 cities as digital infrastructure development accelerates across India’s diverse geographic landscape.

Strategic market insights reveal several critical trends shaping the India surveillance storage landscape. The market demonstrates strong correlation between economic development and surveillance infrastructure investment, with higher adoption rates in states with robust industrial and commercial activity.

Market maturation is evident through the emergence of specialized storage solutions tailored to specific industry requirements, including banking, retail, transportation, and government applications, each with unique data retention, access, and security specifications.

Primary market drivers for India’s surveillance storage sector encompass a complex interplay of security, technological, and regulatory factors that collectively fuel sustained market expansion. The increasing frequency and sophistication of security threats across urban and rural areas have created urgent demand for comprehensive surveillance infrastructure capable of supporting real-time monitoring and forensic analysis capabilities.

Government initiatives represent a fundamental driver, with substantial investments in smart city development, public safety infrastructure, and critical facility protection creating sustained demand for advanced storage solutions. The Smart Cities Mission alone has catalyzed surveillance storage deployments across more than 100 cities, with 78% of participating municipalities prioritizing integrated surveillance systems in their development plans.

Digital transformation across Indian enterprises has accelerated surveillance system modernization, with organizations recognizing the strategic value of video analytics and data-driven security insights. The transition from traditional analog systems to IP-based surveillance networks requires sophisticated storage infrastructure capable of handling increased data volumes and supporting advanced analytical capabilities.

Regulatory compliance requirements across sectors including banking, healthcare, and transportation mandate specific data retention periods and security standards, driving demand for compliant storage solutions. Additionally, the growing emphasis on workplace safety and asset protection has expanded surveillance deployment beyond traditional security applications into operational monitoring and business intelligence use cases.

Significant market restraints challenge the growth trajectory of India’s surveillance storage market, primarily centered around cost considerations, technical complexity, and infrastructure limitations. The substantial capital investment required for comprehensive surveillance storage infrastructure presents barriers for small and medium-sized organizations, particularly in price-sensitive market segments.

Technical complexity associated with modern surveillance storage systems requires specialized expertise for deployment, configuration, and ongoing management, creating implementation challenges for organizations lacking internal technical capabilities. The integration of legacy surveillance systems with modern storage infrastructure often involves complex migration processes and potential compatibility issues.

Bandwidth limitations in certain geographic regions constrain the adoption of cloud-based storage solutions, forcing organizations to rely on more expensive on-premises infrastructure. Additionally, concerns regarding data privacy and security, particularly for sensitive surveillance footage, create hesitation around cloud storage adoption among security-conscious organizations.

Power infrastructure reliability issues in some regions pose challenges for continuous surveillance storage operations, requiring additional investment in backup power systems and redundant storage architectures. The rapid evolution of surveillance technologies also creates concerns about storage solution obsolescence and the need for frequent system upgrades.

Substantial market opportunities exist within India’s surveillance storage landscape, driven by emerging technologies, expanding application areas, and evolving customer requirements. The integration of artificial intelligence and machine learning capabilities into storage solutions presents opportunities for value-added services including automated threat detection, behavioral analysis, and predictive security insights.

Edge computing adoption creates opportunities for distributed storage architectures that can reduce bandwidth requirements while improving system responsiveness. The growing emphasis on intelligent video analytics opens markets for storage solutions that can support real-time processing and analysis of surveillance data at the point of capture.

Vertical market expansion presents significant growth opportunities, with sectors such as retail, healthcare, education, and manufacturing increasingly recognizing the value of comprehensive surveillance storage solutions. The emergence of storage-as-a-service models offers opportunities to serve organizations seeking flexible, scalable alternatives to traditional capital-intensive storage deployments.

Rural market penetration represents an untapped opportunity as digital infrastructure development extends beyond major urban centers. The integration of surveillance storage with broader IoT and smart building platforms creates opportunities for comprehensive security and operational monitoring solutions that deliver enhanced value propositions to end users.

Complex market dynamics shape the India surveillance storage landscape through the interaction of technological innovation, competitive pressures, and evolving customer expectations. The market demonstrates strong cyclical patterns aligned with government budget cycles and major infrastructure development initiatives, creating predictable demand fluctuations that influence supplier strategies and investment decisions.

Technology convergence between surveillance storage and broader IT infrastructure creates both opportunities and challenges, as organizations seek integrated solutions that can support multiple applications while maintaining security and performance requirements. The shift toward software-defined storage architectures enables greater flexibility and scalability but requires new technical competencies and management approaches.

Competitive dynamics are intensifying as global technology providers compete with domestic suppliers and system integrators for market share. This competition drives innovation and cost reduction while creating challenges for smaller players lacking the resources to compete on technology development and market reach. MWR analysis indicates that market consolidation trends are likely to accelerate as organizations seek comprehensive solutions from established providers.

Customer behavior evolution toward outcome-based procurement models is reshaping supplier relationships, with organizations increasingly seeking partners who can deliver measurable security improvements rather than simply providing storage hardware and software components.

Comprehensive research methodology employed for analyzing India’s surveillance storage market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. The research approach combines quantitative market analysis with qualitative industry expert interviews to develop a holistic understanding of market dynamics, competitive landscape, and future growth prospects.

Primary research activities include structured interviews with key market participants including storage solution providers, system integrators, end-user organizations, and industry consultants. These interviews provide insights into market trends, customer requirements, competitive dynamics, and technology evolution patterns that quantitative data alone cannot capture.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and technology trend analyses to validate primary research findings and provide broader market context. The research methodology incorporates regional analysis to account for geographic variations in market development, regulatory requirements, and competitive dynamics across different Indian states and territories.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review of findings, and statistical analysis of market trends and projections. The methodology accounts for market seasonality, economic factors, and policy changes that may influence surveillance storage demand patterns and growth trajectories.

Regional market distribution across India reveals significant variations in surveillance storage adoption, driven by economic development levels, urbanization rates, and government investment priorities. The western region, anchored by Maharashtra and Gujarat, represents the largest market segment with 32% market share, driven by substantial industrial and commercial activity requiring comprehensive security infrastructure.

Northern India demonstrates strong growth potential, particularly in the National Capital Region where government initiatives and corporate headquarters drive demand for advanced surveillance storage solutions. The region benefits from substantial government investment in public safety infrastructure and smart city development programs that require scalable storage architectures.

Southern India shows robust adoption rates, particularly in technology hubs like Bangalore, Hyderabad, and Chennai, where IT companies and manufacturing facilities require sophisticated surveillance storage capabilities. The region’s 28% market share reflects strong economic growth and technology adoption rates that support advanced security infrastructure investments.

Eastern and northeastern regions present emerging opportunities as infrastructure development accelerates and government security initiatives expand beyond traditional metropolitan areas. These regions show increasing adoption of cost-effective storage solutions that can support basic surveillance requirements while providing scalability for future expansion needs.

The competitive landscape in India’s surveillance storage market features a diverse mix of global technology leaders, regional specialists, and emerging solution providers competing across different market segments and customer categories. Market competition is intensifying as organizations seek comprehensive solutions that combine storage hardware, management software, and value-added services.

Competitive strategies focus on technology innovation, cost optimization, and comprehensive service offerings that address the complete surveillance storage lifecycle from initial deployment through ongoing management and maintenance.

Market segmentation analysis reveals distinct customer categories and application areas that drive surveillance storage demand across India’s diverse economic landscape. Segmentation by deployment model shows growing preference for hybrid solutions that combine on-premises and cloud storage capabilities to optimize cost and performance.

By Technology:

By Application:

By Storage Capacity: Market segmentation shows increasing demand for high-capacity solutions capable of supporting ultra-high-definition video streams and extended retention periods required by regulatory compliance and operational requirements.

Government sector insights reveal substantial investment in surveillance storage infrastructure driven by public safety mandates and smart city development initiatives. Government organizations prioritize solutions offering high reliability, regulatory compliance, and integration capabilities with existing security management platforms. The sector shows preference for on-premises storage solutions due to data security and sovereignty concerns.

Commercial sector adoption focuses on solutions that deliver operational insights beyond basic security monitoring, with retail organizations leading adoption of analytics-enabled storage platforms. The sector demonstrates growing interest in cloud-based solutions that offer scalability and reduced capital investment requirements while supporting multiple location deployments.

Industrial applications require specialized storage solutions capable of operating in challenging environmental conditions while supporting integration with broader facility management and safety systems. Manufacturing facilities prioritize storage solutions offering high availability and rapid data access for incident investigation and process optimization applications.

Residential market growth is driven by increasing security awareness and declining solution costs that make comprehensive surveillance storage accessible to individual homeowners and small businesses. This segment shows strong preference for plug-and-play solutions with minimal technical complexity and ongoing maintenance requirements.

Industry participants in India’s surveillance storage market benefit from multiple value creation opportunities spanning technology innovation, market expansion, and customer relationship development. Storage solution providers gain access to a rapidly expanding market with diverse customer segments and application requirements that support sustainable revenue growth and market share expansion.

Technology vendors benefit from opportunities to develop specialized solutions tailored to Indian market requirements, including cost-optimized products for price-sensitive segments and advanced solutions for premium applications. The market’s growth trajectory supports substantial investment in research and development activities that can drive competitive differentiation and market leadership.

System integrators and channel partners gain access to expanding business opportunities as organizations seek comprehensive surveillance storage deployments requiring professional services, ongoing support, and system integration capabilities. The market’s complexity creates sustainable competitive advantages for partners with specialized expertise and established customer relationships.

End-user organizations benefit from improved security capabilities, operational insights, and regulatory compliance through advanced surveillance storage solutions. The market’s evolution toward intelligent storage platforms enables organizations to extract greater value from surveillance investments while reducing total cost of ownership through automated management and optimization capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative market trends are reshaping India’s surveillance storage landscape through technology convergence, changing customer expectations, and evolving regulatory requirements. The integration of artificial intelligence and machine learning capabilities into storage platforms represents a fundamental shift toward intelligent surveillance systems that can provide proactive threat detection and automated incident response capabilities.

Cloud-first strategies are gaining momentum as organizations recognize the scalability and cost advantages of cloud-based storage solutions. This trend is supported by improving internet infrastructure and growing confidence in cloud security capabilities, with 58% of organizations planning cloud migration for surveillance storage within the next three years.

Edge computing integration is emerging as a critical trend, enabling distributed storage architectures that can reduce bandwidth requirements while improving system responsiveness. This approach is particularly valuable for large-scale surveillance deployments spanning multiple locations or geographic regions where centralized storage may not be practical or cost-effective.

Sustainability considerations are increasingly influencing storage solution selection, with organizations seeking energy-efficient systems that can reduce operational costs and environmental impact. The trend toward green technology adoption is creating opportunities for storage providers who can demonstrate measurable efficiency improvements and reduced carbon footprint.

Significant industry developments continue to shape the competitive dynamics and technology evolution within India’s surveillance storage market. Major technology providers are establishing local manufacturing facilities and research centers to better serve the Indian market while reducing costs and improving customer support capabilities.

Strategic partnerships between storage providers and system integrators are creating comprehensive solution offerings that address the complete surveillance lifecycle from initial deployment through ongoing management and optimization. These partnerships enable smaller technology providers to compete more effectively against larger global competitors through enhanced market reach and customer support capabilities.

Government policy initiatives including the Production Linked Incentive (PLI) scheme for electronics manufacturing are encouraging domestic production of surveillance storage components, potentially reducing costs and improving supply chain reliability. These initiatives support the broader “Make in India” objectives while creating opportunities for local technology companies to participate in the growing surveillance storage market.

Technology standardization efforts are improving interoperability between different surveillance storage platforms, reducing deployment complexity and enabling organizations to select best-of-breed solutions from multiple vendors. These developments are particularly important for large-scale deployments requiring integration of diverse technology components and legacy system compatibility.

Strategic recommendations for market participants focus on technology innovation, customer relationship development, and market expansion strategies that can drive sustainable competitive advantages in India’s dynamic surveillance storage landscape. MarkWide Research analysis suggests that successful companies will need to balance technology leadership with cost optimization to serve diverse market segments effectively.

Product development priorities should emphasize solutions that can address the unique requirements of Indian customers, including cost-effective offerings for price-sensitive segments and advanced solutions for premium applications. Companies should invest in local research and development capabilities to ensure products are optimized for Indian market conditions and customer preferences.

Market expansion strategies should focus on tier-2 and tier-3 cities where surveillance infrastructure development is accelerating but competition remains limited. Companies should develop channel partner networks and local support capabilities to effectively serve these emerging markets while maintaining service quality and customer satisfaction.

Technology investment should prioritize artificial intelligence, cloud computing, and edge computing capabilities that can differentiate solutions in an increasingly competitive market. Companies should also focus on developing integrated platforms that can support multiple applications beyond basic surveillance storage, creating opportunities for expanded customer relationships and higher revenue per customer.

The future outlook for India’s surveillance storage market remains highly positive, supported by sustained government investment in security infrastructure, continued urbanization, and growing enterprise adoption of advanced surveillance technologies. Market growth is expected to accelerate as organizations recognize the strategic value of comprehensive surveillance storage solutions that can support both security and operational objectives.

Technology evolution toward intelligent storage platforms with integrated analytics capabilities will create new value propositions and market opportunities. The convergence of surveillance storage with broader IoT and smart building platforms will enable comprehensive monitoring solutions that deliver enhanced operational insights and automated response capabilities.

Market expansion into rural and semi-urban areas will drive sustained growth as digital infrastructure development extends beyond major metropolitan centers. Government initiatives supporting rural development and digital inclusion will create new market opportunities for cost-effective surveillance storage solutions tailored to smaller-scale deployments.

Competitive dynamics will continue to intensify as global technology providers compete with domestic suppliers for market share. Success will depend on the ability to deliver comprehensive solutions that combine technology innovation with local market expertise and customer support capabilities. The market is projected to maintain strong growth momentum with annual growth rates exceeding 12% through the forecast period.

India’s surveillance storage market represents a dynamic and rapidly expanding sector within the country’s broader security technology ecosystem. The market benefits from strong fundamental drivers including government investment in security infrastructure, increasing urbanization, and growing enterprise recognition of surveillance technology’s strategic value beyond traditional security applications.

Market evolution toward intelligent storage platforms with integrated analytics capabilities creates substantial opportunities for technology providers who can deliver comprehensive solutions addressing the complete surveillance lifecycle. The growing adoption of cloud-based and hybrid storage architectures reflects changing customer preferences toward scalable, cost-effective alternatives to traditional on-premises systems.

Success in this market requires a balanced approach combining technology innovation with deep understanding of local market requirements, customer preferences, and regulatory compliance needs. Companies that can effectively serve diverse market segments while maintaining competitive pricing and comprehensive support capabilities are positioned to capture significant market share in this expanding sector.

The long-term outlook remains highly favorable, with sustained growth expected across all major market segments and geographic regions. As India continues its digital transformation journey and invests in comprehensive security infrastructure, the surveillance storage market will play an increasingly critical role in supporting the country’s economic development and public safety objectives.

What is Surveillance Storage?

Surveillance Storage refers to the systems and technologies used to store video and data generated by surveillance cameras and security systems. This includes various storage solutions such as cloud storage, Network Video Recorders (NVRs), and Digital Video Recorders (DVRs).

What are the key players in the India Surveillance Storage Market?

Key players in the India Surveillance Storage Market include companies like Hikvision, Dahua Technology, and Axis Communications. These companies are known for their innovative storage solutions and extensive product offerings in the surveillance sector, among others.

What are the growth factors driving the India Surveillance Storage Market?

The growth of the India Surveillance Storage Market is driven by increasing security concerns, the rise in crime rates, and the growing adoption of smart city initiatives. Additionally, advancements in technology, such as AI and cloud computing, are enhancing storage capabilities.

What challenges does the India Surveillance Storage Market face?

The India Surveillance Storage Market faces challenges such as data privacy concerns and the high costs associated with advanced storage solutions. Additionally, the rapid pace of technological change can make it difficult for companies to keep up with the latest innovations.

What opportunities exist in the India Surveillance Storage Market?

Opportunities in the India Surveillance Storage Market include the increasing demand for integrated security solutions and the expansion of IoT devices. Furthermore, the growing trend of remote monitoring and management of surveillance systems presents significant growth potential.

What trends are shaping the India Surveillance Storage Market?

Trends shaping the India Surveillance Storage Market include the shift towards cloud-based storage solutions and the integration of AI for enhanced analytics. Additionally, there is a growing focus on cybersecurity measures to protect stored data from breaches.

India Surveillance Storage Market

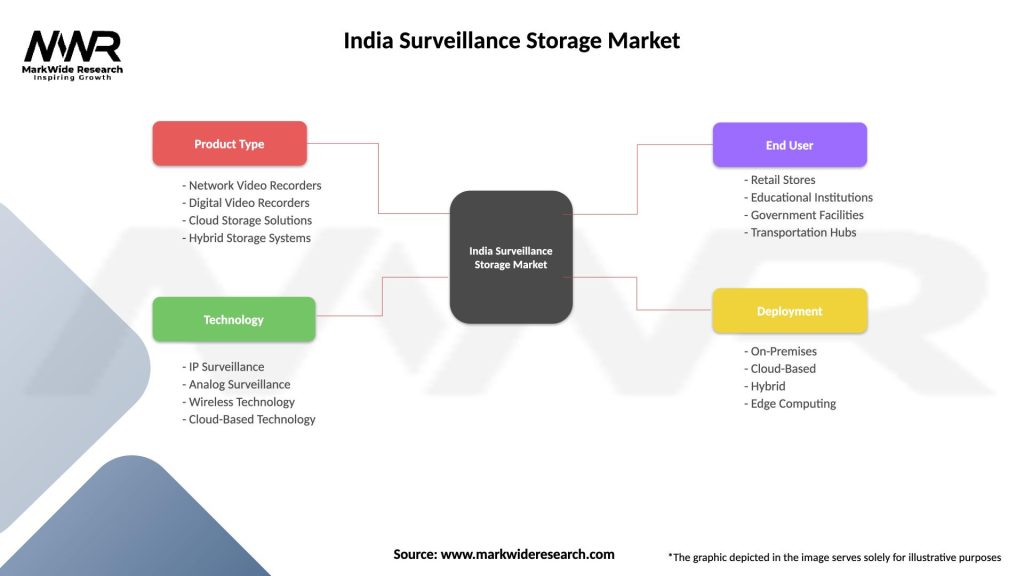

| Segmentation Details | Description |

|---|---|

| Product Type | Network Video Recorders, Digital Video Recorders, Cloud Storage Solutions, Hybrid Storage Systems |

| Technology | IP Surveillance, Analog Surveillance, Wireless Technology, Cloud-Based Technology |

| End User | Retail Stores, Educational Institutions, Government Facilities, Transportation Hubs |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Surveillance Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at