444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India surveillance camera market represents one of the fastest-growing security technology sectors in the Asia-Pacific region, driven by increasing urbanization, rising security concerns, and government initiatives for smart city development. Digital transformation across various industries has accelerated the adoption of advanced surveillance systems, with organizations prioritizing comprehensive security solutions to protect assets and ensure operational continuity.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% over the forecast period. This expansion is primarily attributed to the increasing deployment of IP-based surveillance systems, integration of artificial intelligence technologies, and growing demand from commercial, residential, and government sectors.

Technological advancements in video analytics, cloud-based storage solutions, and mobile surveillance applications have revolutionized the traditional security landscape. The market encompasses various camera types including dome cameras, bullet cameras, PTZ cameras, and thermal imaging systems, each serving specific surveillance requirements across diverse applications.

Government initiatives such as the Smart Cities Mission and Digital India program have significantly contributed to market expansion, with substantial investments in urban surveillance infrastructure. Additionally, the growing awareness of security threats and the need for real-time monitoring capabilities have driven widespread adoption across retail, banking, transportation, and residential sectors.

The India surveillance camera market refers to the comprehensive ecosystem of video monitoring devices, systems, and associated technologies deployed across the country for security, monitoring, and surveillance purposes. This market encompasses the manufacturing, distribution, installation, and maintenance of various camera types designed to capture, record, and transmit visual information for security applications.

Surveillance cameras in the Indian context include analog and digital systems, ranging from basic CCTV installations to sophisticated IP-based networks with advanced analytics capabilities. The market covers both hardware components such as cameras, lenses, and recording equipment, as well as software solutions including video management systems, analytics platforms, and cloud-based storage services.

Market participants include international technology providers, domestic manufacturers, system integrators, and service providers who collectively contribute to the development and deployment of surveillance infrastructure across urban and rural areas. The sector serves multiple stakeholders including government agencies, commercial enterprises, residential complexes, and industrial facilities.

India’s surveillance camera market demonstrates exceptional growth momentum, positioning itself as a critical component of the nation’s security infrastructure modernization efforts. The market benefits from favorable government policies, increasing security awareness, and rapid technological evolution in video surveillance technologies.

Key growth drivers include the expanding retail sector, growing concerns about public safety, and the need for enhanced security in commercial and residential properties. The integration of artificial intelligence and machine learning capabilities has transformed traditional surveillance systems into intelligent monitoring solutions capable of real-time threat detection and automated response mechanisms.

Market segmentation reveals strong demand across multiple verticals, with the commercial sector accounting for approximately 35% of total market share, followed by government applications at 28% and residential installations at 22%. The remaining market share is distributed among industrial, transportation, and other specialized applications.

Regional distribution shows concentrated growth in metropolitan areas and tier-1 cities, with emerging opportunities in tier-2 and tier-3 cities as infrastructure development accelerates. The market’s future trajectory appears promising, supported by ongoing digitalization initiatives and increasing investment in smart infrastructure projects.

Strategic market insights reveal several critical trends shaping the India surveillance camera landscape:

Primary market drivers propelling the India surveillance camera market include a combination of technological, economic, and social factors that create sustained demand for advanced security solutions.

Government initiatives represent the most significant driver, with substantial investments in smart city projects and urban surveillance infrastructure. The Smart Cities Mission has allocated considerable resources for implementing comprehensive surveillance networks across 100 selected cities, creating massive opportunities for market participants.

Rising security concerns across urban and semi-urban areas have intensified the need for robust surveillance systems. Increasing incidents of theft, vandalism, and security breaches in commercial establishments have prompted businesses to invest in advanced monitoring solutions. The retail sector, in particular, has witnessed 45% growth in surveillance system adoption over the past three years.

Technological advancement in camera resolution, night vision capabilities, and wireless connectivity has made surveillance systems more accessible and effective. The availability of 4K and ultra-high-definition cameras at competitive prices has accelerated adoption across various market segments.

Digital transformation initiatives across industries have created demand for integrated security solutions that complement broader technology modernization efforts. Organizations are increasingly viewing surveillance systems as essential components of their digital infrastructure rather than standalone security tools.

Market restraints present challenges that could potentially limit the growth trajectory of India’s surveillance camera market, requiring strategic approaches from industry participants to address these limitations effectively.

High implementation costs remain a significant barrier, particularly for small and medium enterprises seeking comprehensive surveillance solutions. The total cost of ownership, including cameras, storage systems, networking infrastructure, and ongoing maintenance, can be prohibitive for budget-conscious organizations.

Privacy concerns and regulatory uncertainties surrounding data collection and storage have created hesitation among potential adopters. The lack of comprehensive data protection frameworks specifically addressing surveillance systems has led to cautious adoption approaches, particularly in residential and commercial sectors.

Technical complexity associated with advanced surveillance systems requires specialized expertise for installation, configuration, and maintenance. The shortage of skilled technicians and system integrators in tier-2 and tier-3 cities limits market penetration in these regions.

Infrastructure limitations including unreliable power supply and inadequate network connectivity in certain regions pose operational challenges for surveillance system deployment. These infrastructure gaps particularly affect rural and semi-urban market segments where growth potential remains significant.

Cybersecurity vulnerabilities in connected surveillance systems have raised concerns about potential security breaches and unauthorized access to sensitive video data. Organizations are increasingly cautious about deploying IP-based systems without robust cybersecurity measures.

Emerging opportunities in the India surveillance camera market present substantial growth potential for established players and new entrants willing to address evolving customer needs and technological trends.

Smart city development initiatives across multiple states offer unprecedented opportunities for large-scale surveillance system deployments. The government’s commitment to developing 100 smart cities creates a addressable market with long-term growth prospects and stable revenue streams.

Artificial intelligence integration represents a transformative opportunity, with demand growing for AI-powered analytics capabilities including facial recognition, crowd management, and behavioral analysis. Organizations are willing to pay premium prices for systems that provide actionable insights beyond basic video recording.

Residential market expansion presents significant untapped potential, particularly in gated communities, apartment complexes, and individual homes. Growing affluence and security awareness among middle-class families are driving demand for affordable yet sophisticated home surveillance solutions.

Industry-specific solutions offer opportunities for specialized product development targeting sectors such as healthcare, education, hospitality, and manufacturing. Each vertical has unique surveillance requirements that can be addressed through customized solutions and service offerings.

Rural market penetration remains largely unexplored, with potential for growth as infrastructure development reaches smaller towns and villages. Government initiatives for rural digitalization could accelerate surveillance system adoption in these markets.

Market dynamics in the India surveillance camera sector reflect a complex interplay of technological innovation, regulatory evolution, and changing customer expectations that collectively shape industry growth patterns and competitive landscapes.

Supply chain dynamics have evolved significantly, with increasing emphasis on local manufacturing and assembly to reduce costs and improve delivery timelines. The government’s Make in India initiative has encouraged international companies to establish domestic production facilities, creating a more resilient and cost-effective supply ecosystem.

Competitive dynamics show intensifying rivalry between international technology leaders and emerging domestic players. While established global brands maintain advantages in advanced technology and brand recognition, local companies compete effectively on pricing, customization, and after-sales service capabilities.

Technology adoption cycles demonstrate accelerating pace of innovation, with new features and capabilities being introduced regularly. The market has witnessed rapid adoption rates of 65% for cloud-based solutions and 40% growth in AI-enabled systems over the past two years.

Customer behavior patterns indicate increasing sophistication in procurement decisions, with buyers evaluating total cost of ownership, scalability, and integration capabilities rather than focusing solely on initial purchase prices. This shift has encouraged vendors to develop comprehensive solution portfolios rather than standalone products.

Regulatory dynamics continue evolving, with new guidelines and standards being developed for surveillance system deployment, data protection, and cybersecurity. These regulatory changes create both compliance requirements and market opportunities for solution providers.

Comprehensive research methodology employed for analyzing the India surveillance camera market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of insights presented in this market assessment.

Primary research activities included extensive interviews with industry executives, technology providers, system integrators, and end-users across various market segments. These interactions provided firsthand insights into market trends, customer preferences, competitive dynamics, and emerging opportunities within the surveillance camera ecosystem.

Secondary research encompassed analysis of industry reports, government publications, company financial statements, and technology trend assessments. This research foundation enabled comprehensive understanding of market structure, historical growth patterns, and regulatory environment affecting the surveillance camera industry.

Market sizing methodology utilized bottom-up and top-down approaches, incorporating data from multiple sources including industry associations, government statistics, and company disclosures. Cross-validation techniques ensured consistency and accuracy of market estimates and growth projections.

Qualitative analysis focused on understanding market dynamics, competitive positioning, and strategic trends that influence industry development. Expert interviews and focus group discussions provided insights into future market evolution and emerging customer requirements.

Data validation processes included triangulation of findings from multiple sources, expert review of conclusions, and sensitivity analysis of key assumptions. This rigorous validation approach ensures reliability and credibility of research findings and market projections.

Regional market distribution across India reveals significant variations in adoption patterns, growth rates, and market maturity levels, reflecting diverse economic conditions, infrastructure development, and security requirements across different geographical areas.

Northern region demonstrates strong market presence, with Delhi NCR accounting for approximately 25% of national market share. The region benefits from high concentration of government offices, commercial establishments, and affluent residential areas driving demand for advanced surveillance solutions. Major infrastructure projects and smart city initiatives in cities like Gurgaon, Noida, and Faridabad contribute to sustained market growth.

Western region leads in market size and technological adoption, with Maharashtra and Gujarat representing 30% of total market volume. Mumbai’s financial district, Pune’s IT corridor, and Gujarat’s industrial belt create substantial demand for sophisticated surveillance systems. The region’s advanced infrastructure and higher disposable income levels support premium product adoption.

Southern region shows rapid growth momentum, particularly in technology hubs like Bangalore, Hyderabad, and Chennai. The region accounts for 28% of market share and demonstrates strong preference for AI-enabled and cloud-based surveillance solutions. Government initiatives in states like Karnataka and Telangana have accelerated smart city surveillance deployments.

Eastern region presents emerging opportunities with growing infrastructure development and increasing security awareness. While currently representing 12% of market share, cities like Kolkata and Bhubaneswar show promising growth potential supported by government modernization initiatives.

Central region remains an developing market with significant untapped potential, particularly in tier-2 and tier-3 cities experiencing rapid urbanization and commercial development.

Competitive landscape in the India surveillance camera market features a diverse mix of international technology leaders, domestic manufacturers, and specialized solution providers, creating a dynamic and rapidly evolving market environment.

Market leaders include established international companies that have successfully adapted their global technologies to meet local market requirements:

Competitive strategies focus on product innovation, local manufacturing, channel partnerships, and customer service excellence. Companies are investing heavily in research and development to introduce AI-powered features, cloud integration, and mobile accessibility capabilities.

Market segmentation analysis reveals distinct customer groups, application areas, and technology preferences that shape demand patterns and growth opportunities within the India surveillance camera market.

By Technology:

By Application:

By Camera Type:

Category-wise analysis provides detailed understanding of specific market segments, revealing unique characteristics, growth drivers, and competitive dynamics within each surveillance camera category.

IP Camera Category dominates the market with sophisticated features including high-definition video quality, network connectivity, and advanced analytics capabilities. This category benefits from declining hardware costs and increasing demand for remote monitoring solutions. MarkWide Research analysis indicates strong growth momentum driven by enterprise adoption and government infrastructure projects.

Dome Camera Segment maintains strong position in indoor surveillance applications, particularly in retail and commercial environments. The category’s growth is supported by aesthetic appeal, vandal-resistant design, and wide-angle coverage capabilities. Integration with AI-powered analytics has enhanced the value proposition for security-conscious customers.

Bullet Camera Category serves outdoor surveillance requirements with robust weatherproof construction and long-range monitoring capabilities. This segment shows consistent growth in perimeter security applications and infrastructure monitoring projects. Advanced features like infrared night vision and motion detection drive premium product adoption.

PTZ Camera Segment represents the high-end market with sophisticated pan, tilt, and zoom functionality. While smaller in volume, this category generates significant revenue due to higher unit prices and specialized applications in large-scale surveillance deployments.

Wireless Camera Category demonstrates rapid growth potential, particularly in residential and small business segments where installation simplicity and cost-effectiveness are priorities. Cloud connectivity and mobile app integration enhance the appeal of wireless solutions.

Industry participants and stakeholders in the India surveillance camera market can realize substantial benefits through strategic positioning and value-added service offerings that address evolving customer needs and market opportunities.

Technology Providers benefit from expanding market opportunities driven by government initiatives, increasing security awareness, and technological advancement. The growing demand for AI-powered surveillance solutions creates premium pricing opportunities and competitive differentiation possibilities. Local manufacturing initiatives reduce costs while improving market responsiveness and customer service capabilities.

System Integrators gain from increasing complexity of surveillance deployments requiring specialized expertise in design, installation, and maintenance. The shift toward integrated security solutions creates opportunities for comprehensive service offerings and long-term customer relationships. Growing demand for cloud-based solutions enables recurring revenue models and scalable business growth.

End Users benefit from improved security capabilities, operational efficiency, and cost-effective monitoring solutions. Advanced analytics provide actionable insights beyond basic surveillance, enabling proactive security management and business intelligence applications. Remote monitoring capabilities reduce staffing requirements while enhancing security coverage and response times.

Government Agencies achieve enhanced public safety capabilities, improved traffic management, and comprehensive urban monitoring through advanced surveillance infrastructure. Smart city initiatives benefit from integrated surveillance systems that support multiple municipal functions and citizen services.

Investors find attractive opportunities in a rapidly growing market supported by favorable government policies, increasing security spending, and technological innovation. The market’s resilience and essential nature provide stable long-term growth prospects with multiple exit strategies.

Comprehensive SWOT analysis reveals the strategic position of India’s surveillance camera market, highlighting internal capabilities and external factors that influence industry development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the India surveillance camera industry reflect broader technological evolution, changing customer expectations, and emerging security requirements that drive innovation and market development.

Artificial Intelligence Integration represents the most significant trend, with AI-powered analytics becoming standard features in premium surveillance systems. Capabilities including facial recognition, behavior analysis, and automated threat detection are transforming traditional passive monitoring into proactive security management. The adoption rate for AI-enabled systems has reached 35% in enterprise segments.

Cloud-Based Solutions are gaining momentum as organizations seek scalable, cost-effective storage and management options. Cloud surveillance platforms offer remote accessibility, automatic updates, and reduced infrastructure requirements, making advanced surveillance capabilities accessible to smaller organizations. Market penetration of cloud-based solutions has grown to 28% over the past two years.

Mobile Integration continues expanding with smartphone and tablet applications enabling real-time monitoring and control capabilities. Mobile surveillance apps provide instant notifications, live video streaming, and remote system management, enhancing user convenience and response capabilities.

Edge Computing adoption is accelerating as organizations seek reduced latency and improved real-time processing capabilities. Edge-based analytics enable faster decision-making and reduced bandwidth requirements while maintaining data privacy and security.

Cybersecurity Focus has intensified with increasing awareness of surveillance system vulnerabilities. Secure communication protocols, encrypted data transmission, and regular security updates are becoming essential requirements for enterprise and government deployments.

Recent industry developments highlight the dynamic nature of India’s surveillance camera market, with significant technological advances, strategic partnerships, and regulatory changes shaping the competitive landscape and market evolution.

Technology Innovations have accelerated with introduction of 4K and 8K resolution cameras at competitive price points, making ultra-high-definition surveillance accessible to broader market segments. Advanced image processing capabilities and improved low-light performance have enhanced surveillance effectiveness across various applications.

Strategic Partnerships between international technology providers and local system integrators have expanded market reach and improved service capabilities. These collaborations combine global technology expertise with local market knowledge and customer relationships, creating competitive advantages for participating companies.

Manufacturing Investments under the Make in India initiative have resulted in establishment of local production facilities by major international companies. These investments reduce costs, improve supply chain reliability, and demonstrate long-term commitment to the Indian market.

Government Initiatives including the launch of comprehensive surveillance projects in major cities have created substantial market opportunities. MWR analysis indicates that government spending on surveillance infrastructure has increased significantly, supporting market growth and technology adoption.

Regulatory Developments have introduced new standards for surveillance system deployment, data protection, and cybersecurity compliance. These regulations create both challenges and opportunities for market participants while ensuring responsible technology deployment.

Acquisition Activities have increased as companies seek to expand capabilities, market presence, and technology portfolios. Strategic acquisitions enable rapid market entry, technology access, and customer base expansion for both domestic and international players.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges that could impact long-term growth and competitive positioning in India’s surveillance camera market.

Technology Investment Priorities should emphasize artificial intelligence capabilities, cloud integration, and mobile accessibility features that differentiate products in an increasingly competitive market. Companies should allocate significant resources to developing AI-powered analytics that provide actionable insights beyond basic video recording and monitoring.

Market Expansion Strategies should target tier-2 and tier-3 cities where infrastructure development and security awareness are creating new demand opportunities. Localized service networks and affordable product portfolios will be essential for successful penetration of these emerging markets.

Partnership Development with local system integrators, channel partners, and technology providers can accelerate market penetration and improve customer service capabilities. Strategic alliances enable companies to leverage local expertise while focusing on core technology development and manufacturing activities.

Regulatory Compliance should be prioritized to address evolving data protection and cybersecurity requirements. Companies must invest in secure system architectures and compliance frameworks that meet current and anticipated regulatory standards while maintaining competitive performance and pricing.

Service Portfolio Expansion beyond hardware sales to include installation, maintenance, monitoring services, and managed security offerings can create recurring revenue streams and strengthen customer relationships. Comprehensive service models provide competitive differentiation and higher profit margins.

Innovation Focus should address specific Indian market requirements including power efficiency, extreme weather resistance, and integration with existing infrastructure. Localized product development can create competitive advantages and improve customer satisfaction.

Future market outlook for India’s surveillance camera industry appears highly promising, with multiple growth drivers converging to create sustained expansion opportunities and technological advancement across all market segments.

Market growth trajectory is expected to maintain strong momentum, driven by continued urbanization, infrastructure development, and increasing security awareness. MarkWide Research projections indicate that the market will experience robust growth with compound annual growth rates exceeding 12% over the next five years, supported by government initiatives and private sector investments.

Technology evolution will continue transforming the surveillance landscape with artificial intelligence becoming ubiquitous across all product categories. Advanced analytics capabilities including predictive threat detection, automated response systems, and integrated business intelligence will become standard features rather than premium options.

Market maturation in tier-1 cities will drive expansion into smaller urban centers and rural areas as infrastructure development reaches these regions. The addressable market will expand significantly as connectivity improves and security awareness increases across diverse geographical areas.

Industry consolidation may accelerate as companies seek scale advantages and comprehensive solution portfolios. Strategic mergers and acquisitions will likely reshape the competitive landscape while creating opportunities for specialized niche players.

Regulatory framework development will provide clearer guidelines for surveillance system deployment while ensuring privacy protection and data security. These regulations will create compliance requirements but also establish market standards that benefit established players.

Integration trends will see surveillance systems becoming components of broader smart infrastructure and IoT ecosystems, creating new value propositions and market opportunities beyond traditional security applications.

The India surveillance camera market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by technological innovation, government support, and increasing security awareness across all market segments. The convergence of favorable market conditions, advancing technology capabilities, and substantial infrastructure investments creates a compelling opportunity landscape for industry participants.

Market fundamentals remain strong with sustained demand from government, commercial, and residential sectors supporting continued expansion. The successful integration of artificial intelligence, cloud computing, and mobile technologies has transformed surveillance systems from passive monitoring tools into intelligent security platforms that provide comprehensive situational awareness and automated response capabilities.

Strategic positioning for long-term success requires focus on technology innovation, market expansion into emerging regions, and development of comprehensive service portfolios that address evolving customer needs. Companies that successfully balance global technology capabilities with local market requirements will be best positioned to capitalize on the substantial growth opportunities ahead.

The India surveillance camera market outlook remains highly positive, with multiple growth drivers supporting sustained expansion and technological advancement that will continue transforming the security landscape across the nation.

What is Surveillance Camera?

Surveillance cameras are devices used to monitor and record activities in a specific area, often for security purposes. They are widely utilized in various sectors, including retail, transportation, and public safety.

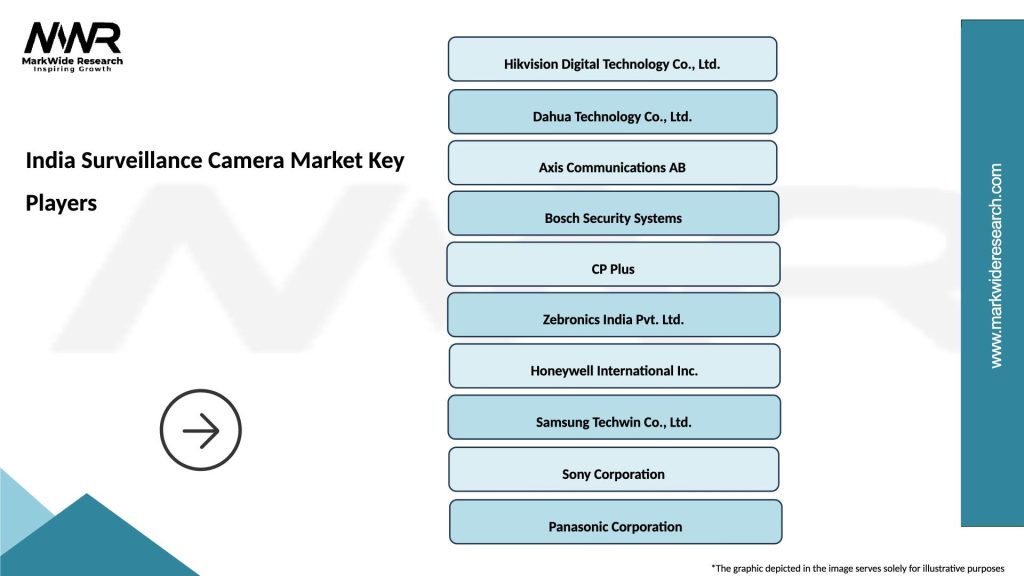

What are the key players in the India Surveillance Camera Market?

Key players in the India Surveillance Camera Market include Hikvision, Dahua Technology, and Axis Communications, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the India Surveillance Camera Market?

The growth of the India Surveillance Camera Market is driven by increasing security concerns, urbanization, and advancements in technology such as AI and IoT integration. Additionally, government initiatives for smart city projects are boosting demand.

What challenges does the India Surveillance Camera Market face?

The India Surveillance Camera Market faces challenges such as privacy concerns, high installation costs, and the need for skilled personnel for system management. These factors can hinder widespread adoption in certain areas.

What opportunities exist in the India Surveillance Camera Market?

Opportunities in the India Surveillance Camera Market include the growing demand for smart surveillance solutions and the integration of advanced technologies like facial recognition. Additionally, the expansion of e-commerce and retail sectors presents new avenues for growth.

What trends are shaping the India Surveillance Camera Market?

Trends in the India Surveillance Camera Market include the shift towards cloud-based surveillance systems and the increasing use of analytics for real-time monitoring. Moreover, the rise of mobile surveillance applications is enhancing accessibility and user engagement.

India Surveillance Camera Market

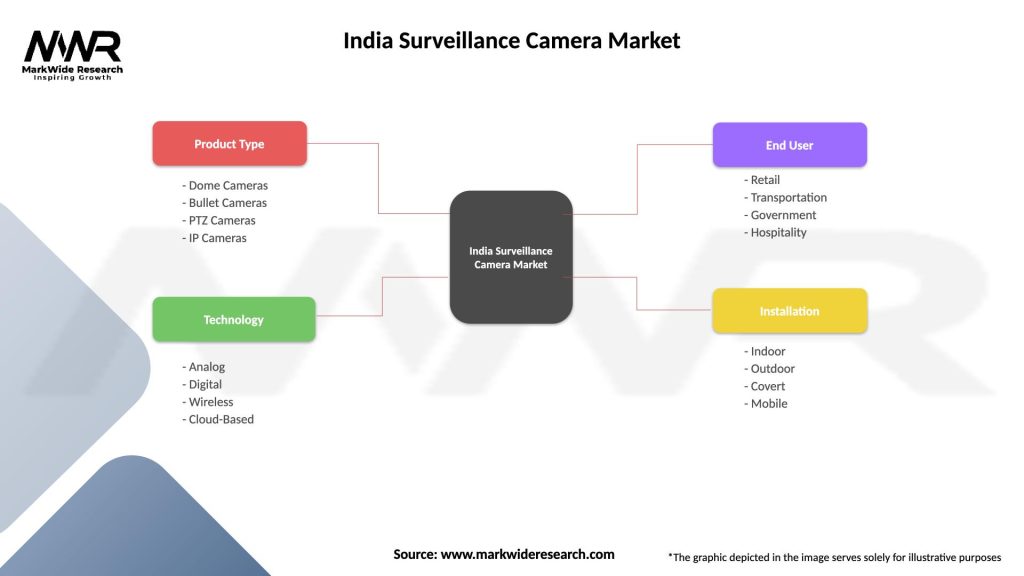

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, IP Cameras |

| Technology | Analog, Digital, Wireless, Cloud-Based |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Covert, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Surveillance Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at