444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India student accommodation market represents a rapidly evolving sector driven by the country’s expanding higher education landscape and increasing student mobility. Educational infrastructure development across major metropolitan cities and tier-2 urban centers has created substantial demand for purpose-built student housing solutions. The market encompasses various accommodation types including private hostels, co-living spaces, university-managed dormitories, and shared apartments specifically designed for student communities.

Market dynamics indicate robust growth potential with the sector experiencing a compound annual growth rate of 12.5% over recent years. This expansion is primarily attributed to rising enrollment in higher education institutions, increasing preference for quality accommodation facilities, and growing parental willingness to invest in premium student housing options. Urban centers like Delhi, Mumbai, Bangalore, Pune, and Chennai serve as primary growth hubs, collectively accounting for approximately 65% of organized student accommodation demand.

Technology integration has emerged as a key differentiator in the market, with operators implementing smart building solutions, digital booking platforms, and comprehensive student management systems. The sector has witnessed significant institutional investment from real estate developers, private equity firms, and specialized student housing operators, indicating strong confidence in long-term market prospects.

The India student accommodation market refers to the organized sector providing purpose-built housing solutions specifically designed for students pursuing higher education across the country. This market encompasses professionally managed residential facilities that offer comprehensive living experiences including furnished rooms, common areas, study spaces, recreational facilities, and support services tailored to student needs and preferences.

Student accommodation in this context extends beyond traditional hostel concepts to include modern co-living spaces, premium dormitories, and fully-serviced residential complexes that prioritize safety, community building, and academic support. These facilities typically feature amenities such as high-speed internet connectivity, laundry services, meal plans, security systems, and social spaces designed to enhance the overall student living experience.

Market participants include specialized student housing operators, real estate developers, educational institutions, and hospitality companies that have diversified into student accommodation services. The sector focuses on creating environments that support academic success while fostering social interaction and personal development among student residents.

India’s student accommodation market stands at a transformative juncture, characterized by unprecedented growth opportunities and evolving consumer expectations. The sector has emerged as a critical component of the country’s educational infrastructure, addressing the housing needs of millions of students pursuing higher education across diverse academic disciplines and geographic locations.

Key market drivers include the rapid expansion of higher education institutions, increasing interstate student migration patterns, and growing demand for quality living standards among student populations. Approximately 78% of students now prioritize accommodation quality as a significant factor in their educational institution selection process, highlighting the strategic importance of this market segment.

Investment activity has intensified significantly, with major real estate developers and international student housing operators establishing substantial market presence. The sector has attracted considerable attention from institutional investors, recognizing the stable demand patterns and attractive return profiles associated with student accommodation assets.

Operational excellence has become increasingly important, with successful operators focusing on technology-enabled service delivery, community building initiatives, and comprehensive student support programs. Market leaders are implementing innovative approaches to space utilization, sustainability practices, and digital engagement platforms to differentiate their offerings in an increasingly competitive landscape.

Market intelligence reveals several critical insights that define the current trajectory of India’s student accommodation sector:

These insights underscore the market’s evolution toward more sophisticated, service-oriented accommodation solutions that prioritize student experience and operational efficiency.

Educational expansion serves as the primary catalyst driving India’s student accommodation market growth. The establishment of new universities, colleges, and specialized institutions across tier-2 and tier-3 cities has created substantial accommodation demand in previously underserved markets. Government initiatives promoting higher education accessibility have resulted in increased enrollment rates, particularly among students from rural and semi-urban backgrounds seeking quality educational opportunities.

Interstate migration patterns have intensified significantly, with students increasingly willing to relocate for specialized academic programs and career opportunities. This mobility trend has created consistent demand for temporary accommodation solutions that offer flexibility, convenience, and community support. Professional course popularity in fields such as engineering, medicine, management, and information technology has concentrated student populations in specific geographic clusters.

Parental investment priorities have shifted toward ensuring safe, comfortable living conditions for their children during higher education pursuits. Rising household incomes and changing lifestyle expectations have increased willingness to pay premium rates for quality accommodation facilities. Safety concerns particularly drive demand for professionally managed, secure accommodation options with comprehensive support services.

Technology integration has emerged as a significant market driver, with students expecting digital convenience in accommodation booking, facility management, and community interaction. Smart building features, high-speed internet connectivity, and mobile app-based services have become standard expectations rather than premium amenities.

High capital requirements represent a significant barrier to market entry, particularly for smaller operators seeking to establish quality accommodation facilities. The substantial upfront investment needed for land acquisition, construction, furnishing, and technology infrastructure limits market participation to well-capitalized entities. Regulatory complexities across different states and municipalities create additional challenges for operators seeking to scale their operations nationally.

Seasonal demand fluctuations pose operational challenges, with accommodation facilities experiencing varying occupancy levels throughout academic calendars. Summer breaks and examination periods typically result in reduced occupancy rates, impacting revenue stability and operational efficiency. Location constraints in prime educational areas limit expansion opportunities and increase real estate acquisition costs.

Quality standardization remains inconsistent across the market, with significant variations in facility standards, service levels, and pricing structures. This inconsistency creates consumer confusion and limits market development potential. Skilled workforce availability for facility management, student services, and maintenance operations presents ongoing challenges, particularly in emerging markets.

Economic sensitivity affects demand patterns, with accommodation preferences shifting during economic downturns or periods of reduced household income growth. Competition from informal accommodation options, including private room rentals and shared apartments, continues to challenge organized sector growth in price-sensitive market segments.

Tier-2 city expansion presents substantial growth opportunities as educational institutions establish campuses in emerging urban centers. Cities like Coimbatore, Indore, Bhubaneswar, and Kochi demonstrate strong potential for organized student accommodation development. Government policy support for educational infrastructure development creates favorable conditions for market expansion and investment attraction.

Technology-enabled services offer significant differentiation opportunities, including artificial intelligence-powered matching systems, virtual reality facility tours, and comprehensive mobile applications for resident engagement. Sustainability initiatives present opportunities to attract environmentally conscious students while reducing operational costs through energy-efficient building systems and waste management programs.

Partnership opportunities with educational institutions, corporate training centers, and professional development organizations can create stable demand streams and enhance market positioning. International student segments represent untapped potential, particularly as India positions itself as a global education destination for students from neighboring countries.

Ancillary service integration including meal delivery, laundry services, academic support, and recreational programming can create additional revenue streams while enhancing student satisfaction. Real estate investment trust structures and institutional investment vehicles present opportunities for market consolidation and professional management enhancement.

Supply-demand equilibrium varies significantly across different geographic markets, with major educational hubs experiencing consistent demand pressure while emerging markets show more volatile patterns. MarkWide Research analysis indicates that supply additions have generally lagged behind demand growth in prime locations, creating opportunities for premium pricing and high occupancy rates.

Competitive intensity has increased substantially as established real estate developers, hospitality operators, and specialized student housing companies compete for market share. This competition has driven improvements in facility standards, service quality, and technology integration while maintaining relatively stable pricing structures in most markets.

Consumer behavior evolution reflects changing expectations regarding accommodation quality, community features, and digital convenience. Students increasingly prioritize facilities that support both academic success and social interaction, driving demand for comprehensive service packages and community-oriented design approaches.

Investment flows have accelerated significantly, with both domestic and international capital seeking exposure to India’s student accommodation sector. This investment activity has enabled rapid capacity expansion and facility upgrades while introducing international best practices and operational standards to the market.

Comprehensive market analysis was conducted through multiple research methodologies to ensure accurate and reliable insights into India’s student accommodation market. Primary research involved extensive interviews with industry stakeholders including accommodation operators, real estate developers, educational institution administrators, and student residents across major markets.

Secondary research encompassed analysis of industry reports, government publications, educational statistics, and real estate market data to establish market sizing, growth trends, and competitive dynamics. Quantitative analysis included examination of occupancy rates, pricing trends, investment flows, and operational performance metrics across different market segments and geographic regions.

Market surveys were conducted among student populations to understand accommodation preferences, decision-making factors, and satisfaction levels with existing facilities. Stakeholder consultations with industry experts, policy makers, and investment professionals provided insights into market challenges, opportunities, and future development prospects.

Data validation processes ensured accuracy and reliability of research findings through cross-referencing multiple sources and conducting follow-up interviews with key market participants. Trend analysis incorporated historical data patterns and forward-looking projections to provide comprehensive market intelligence for strategic decision-making.

North India represents the largest regional market, driven by the concentration of premier educational institutions in Delhi, Gurgaon, and Noida. The region accounts for approximately 35% of organized accommodation demand and features diverse facility types ranging from budget hostels to premium co-living spaces. Delhi NCR specifically demonstrates strong market maturity with established operators and consistent occupancy levels.

South India shows the highest growth momentum, led by Bangalore’s position as a major educational and technology hub. The region benefits from strong institutional presence, favorable climate conditions, and progressive urban development policies. Chennai, Hyderabad, and Coimbatore contribute significantly to regional market expansion with growing student populations and improving infrastructure.

West India maintains steady market development centered around Mumbai and Pune’s educational ecosystems. The region demonstrates strong demand for premium accommodation options and innovative facility concepts. Mumbai’s space constraints have driven development of efficient, technology-enabled accommodation solutions that maximize space utilization.

East India presents emerging opportunities with Kolkata serving as the primary market center. The region shows potential for significant growth as educational infrastructure development accelerates and student mobility increases. Bhubaneswar and other emerging centers demonstrate early-stage market development with substantial long-term potential.

Market leadership is distributed among several categories of operators, each bringing distinct capabilities and strategic approaches to student accommodation development and management:

Competitive differentiation increasingly centers on technology integration, community programming, and comprehensive service delivery rather than basic accommodation provision. Market consolidation trends suggest continued merger and acquisition activity as operators seek to achieve scale economies and geographic expansion.

By Accommodation Type:

By Price Segment:

By Target Student Category:

Co-living spaces demonstrate the strongest growth trajectory, appealing to students seeking community experiences and comprehensive service packages. These facilities typically achieve occupancy rates exceeding 90% and command premium pricing due to their enhanced amenities and social programming. Technology integration in co-living spaces includes smart room controls, mobile app-based services, and digital community platforms.

Private hostels continue to represent the largest accommodation category by volume, serving price-conscious students while gradually upgrading facility standards and service offerings. Operational efficiency improvements and standardization initiatives have enhanced the attractiveness of this segment to both students and investors.

Shared apartments appeal to students preferring smaller community settings and greater privacy compared to traditional hostel arrangements. This segment shows particular strength in markets with high real estate costs where space efficiency becomes critical. Flexible lease terms and customizable service packages enhance the appeal of shared apartment options.

Premium segment growth reflects increasing parental investment in student accommodation quality and safety. These facilities feature enhanced security systems, comprehensive meal programs, academic support services, and recreational amenities that justify higher pricing structures.

Students benefit from access to purpose-built accommodation facilities that prioritize safety, community building, and academic support. Professional management ensures consistent service quality, maintenance standards, and resident support services that enhance the overall educational experience. Technology integration provides convenience in booking, payment processing, and facility access while enabling community interaction through digital platforms.

Educational institutions gain strategic advantages through partnerships with quality accommodation providers, enhancing their ability to attract students from diverse geographic backgrounds. Reduced administrative burden allows institutions to focus on core educational activities while ensuring student housing needs are professionally managed.

Real estate developers access stable, long-term revenue streams with relatively predictable demand patterns and limited tenant turnover compared to traditional residential rentals. Asset appreciation potential combines with operational income to create attractive investment returns for properly positioned accommodation facilities.

Local communities benefit from increased economic activity, employment opportunities, and infrastructure development associated with student accommodation projects. Ancillary business opportunities emerge in food service, transportation, retail, and entertainment sectors serving student populations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology-driven operations have emerged as a defining trend, with operators implementing comprehensive digital platforms for booking management, resident services, and facility operations. Artificial intelligence and machine learning applications optimize space allocation, predict maintenance requirements, and enhance resident matching processes.

Community-centric design increasingly influences facility planning, with operators creating spaces that encourage social interaction, collaborative learning, and cultural exchange among residents. Flexible space utilization allows facilities to adapt to changing student needs and optimize revenue generation throughout academic cycles.

Sustainability integration has gained momentum, with new developments incorporating energy-efficient systems, waste management programs, and environmentally responsible construction materials. Green building certifications become increasingly important for attracting environmentally conscious students and reducing operational costs.

Service package expansion reflects student expectations for comprehensive support including meal programs, laundry services, academic assistance, and recreational activities. Wellness focus drives incorporation of fitness facilities, mental health support, and healthy lifestyle programming into accommodation offerings.

Major investment rounds have provided leading operators with substantial capital for expansion and facility upgrades. International partnerships bring global best practices and operational expertise to the Indian market, enhancing service standards and facility management capabilities.

Technology platform launches have revolutionized student accommodation booking and management processes, providing greater transparency and convenience for students while improving operational efficiency for operators. Mobile applications now serve as comprehensive platforms for resident engagement, service requests, and community interaction.

Regulatory developments in various states have established clearer guidelines for student accommodation operations, improving market transparency and operational standards. Safety protocol enhancements following various incidents have strengthened security measures and emergency response capabilities across the industry.

Institutional partnerships between accommodation operators and educational institutions have created integrated campus experiences while ensuring consistent accommodation availability for student populations. MWR analysis indicates that such partnerships typically result in higher occupancy rates and improved student satisfaction levels.

Market participants should prioritize technology integration and operational excellence to differentiate their offerings in an increasingly competitive landscape. Investment focus on tier-2 cities presents significant growth opportunities while potentially offering more favorable real estate acquisition costs and regulatory environments.

Service standardization across facility portfolios will enhance brand recognition and student satisfaction while enabling operational efficiencies and cost optimization. Sustainability initiatives should be integrated into development planning to attract environmentally conscious students and reduce long-term operational costs.

Partnership strategies with educational institutions, technology providers, and service companies can create competitive advantages and revenue diversification opportunities. Data analytics capabilities should be developed to optimize pricing strategies, predict demand patterns, and enhance resident satisfaction through personalized services.

Financial planning should account for seasonal demand variations and economic sensitivity while maintaining sufficient capital reserves for facility maintenance and upgrades. Talent development in facility management and student services will become increasingly important as market competition intensifies and service expectations rise.

Market expansion is expected to continue at robust rates, driven by ongoing growth in higher education enrollment and increasing student mobility across geographic regions. MarkWide Research projects that the organized accommodation sector will capture an increasing share of total student housing demand as quality standards and service expectations continue to rise.

Technology integration will deepen significantly, with advanced solutions including Internet of Things sensors, predictive analytics, and virtual reality applications becoming standard features in premium facilities. Artificial intelligence will optimize various operational aspects from energy management to resident matching and service delivery.

Geographic expansion into tier-2 and tier-3 cities will accelerate as educational institutions establish new campuses and student populations grow in emerging markets. International student segments present substantial growth potential as India positions itself as a global education destination.

Sustainability focus will intensify, with green building standards becoming increasingly important for both regulatory compliance and student attraction. Service integration will expand to include comprehensive lifestyle support, academic assistance, and career development programming that enhances the overall student experience and justifies premium pricing structures.

India’s student accommodation market stands at a pivotal moment of transformation, characterized by substantial growth opportunities, evolving consumer expectations, and increasing institutional investment. The sector has matured from basic hostel provision to comprehensive lifestyle solutions that support academic success and personal development for student residents.

Market fundamentals remain strong, supported by continued expansion in higher education enrollment, increasing student mobility, and growing parental investment in quality accommodation options. Technology integration and service innovation have emerged as key differentiators, enabling operators to enhance student experiences while optimizing operational efficiency.

Future success in this market will depend on operators’ ability to balance growth ambitions with operational excellence, technology adoption with human-centered service delivery, and premium positioning with accessibility for diverse student populations. The sector’s evolution toward more sophisticated, community-oriented accommodation solutions reflects broader changes in student expectations and lifestyle preferences that will continue shaping market development in the years ahead.

What is Student Accommodation?

Student accommodation refers to housing options specifically designed for students, including dormitories, shared apartments, and private rentals, catering to their unique needs and preferences.

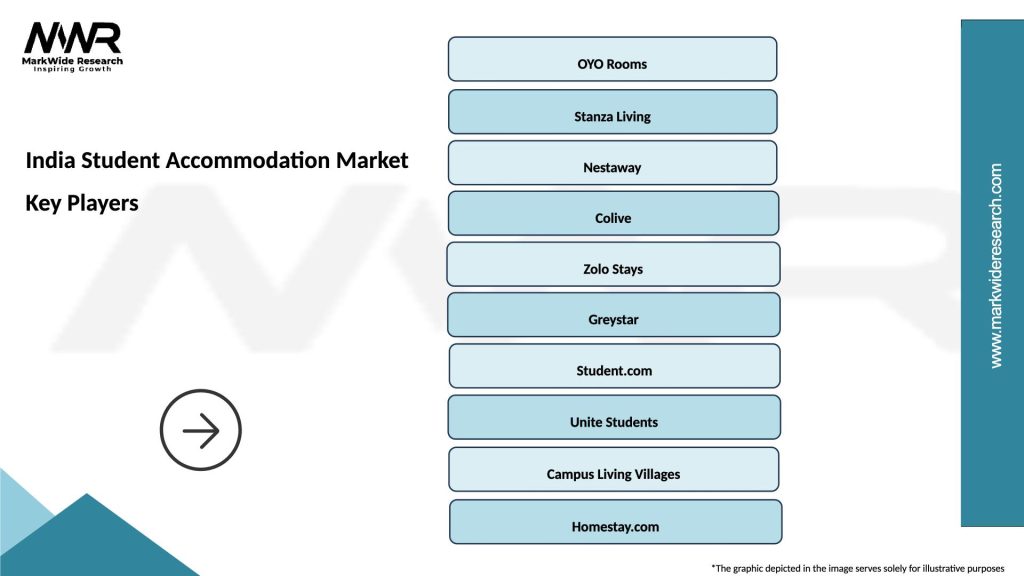

What are the key players in the India Student Accommodation Market?

Key players in the India Student Accommodation Market include companies like Nestaway, OYO Life, and Stanza Living, which provide various housing solutions tailored for students, among others.

What are the main drivers of growth in the India Student Accommodation Market?

The growth of the India Student Accommodation Market is driven by increasing student enrollment in higher education, urbanization leading to a demand for housing, and the rise of international students seeking accommodation.

What challenges does the India Student Accommodation Market face?

Challenges in the India Student Accommodation Market include regulatory hurdles, fluctuating demand based on academic cycles, and competition from traditional housing options.

What opportunities exist in the India Student Accommodation Market?

Opportunities in the India Student Accommodation Market include the potential for developing purpose-built student housing, expanding services to international students, and leveraging technology for better management and services.

What trends are shaping the India Student Accommodation Market?

Trends in the India Student Accommodation Market include the increasing popularity of co-living spaces, a focus on sustainability in housing design, and the integration of smart technology for enhanced living experiences.

India Student Accommodation Market

| Segmentation Details | Description |

|---|---|

| Type | Hostels, Shared Apartments, Private Residences, University Dormitories |

| Customer Type | Undergraduate Students, Postgraduate Students, International Students, Exchange Students |

| Location | Urban Areas, Suburban Areas, Near Campuses, City Centers |

| Price Tier | Economy, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Student Accommodation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at