444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India structural steel market represents one of the most dynamic and rapidly expanding sectors within the country’s industrial landscape. Structural steel serves as the backbone of modern construction, infrastructure development, and industrial applications across India’s growing economy. The market encompasses various steel products including H-beams, I-beams, channels, angles, and hollow sections that are essential for constructing buildings, bridges, industrial facilities, and transportation infrastructure.

Market dynamics indicate robust growth driven by India’s ambitious infrastructure development programs, urbanization trends, and industrial expansion initiatives. The sector benefits from government policies promoting Make in India and substantial investments in smart cities, transportation networks, and industrial corridors. Construction activities across residential, commercial, and industrial segments continue to fuel demand for high-quality structural steel products.

Regional distribution shows concentrated activity in major industrial states including Maharashtra, Gujarat, Tamil Nadu, Karnataka, and West Bengal. The market experiences strong growth momentum with increasing adoption of prefabricated steel structures and advanced construction technologies. Quality standards and regulatory compliance have become increasingly important as the market matures and international best practices gain acceptance.

The India structural steel market refers to the comprehensive ecosystem encompassing the production, distribution, and application of engineered steel products specifically designed for load-bearing and structural applications in construction and infrastructure projects. Structural steel includes rolled steel sections, fabricated steel components, and specialized steel products that provide the skeletal framework for buildings, bridges, industrial facilities, and other constructed works across India’s diverse economic sectors.

Market scope extends beyond basic steel production to include value-added services such as steel fabrication, surface treatment, quality testing, and technical consulting. The sector encompasses both primary steel producers and secondary processors who transform raw steel into finished structural components. End-user industries include construction, infrastructure development, manufacturing, energy, and transportation sectors that rely on structural steel for their operational requirements.

Technology integration plays a crucial role in modern structural steel applications, with advanced manufacturing processes, computer-aided design, and precision fabrication techniques enhancing product quality and performance. The market also includes supporting services such as logistics, installation, and maintenance that ensure effective deployment of structural steel solutions across various applications.

India’s structural steel market demonstrates exceptional growth potential driven by unprecedented infrastructure development initiatives and rapid urbanization trends. The sector benefits from strong government support through policy frameworks promoting domestic manufacturing and infrastructure investment. Market participants include major integrated steel producers, specialized structural steel manufacturers, and regional fabricators serving diverse customer segments.

Key growth drivers include massive infrastructure projects such as dedicated freight corridors, metro rail networks, industrial corridors, and smart city developments. The construction sector’s shift toward steel-intensive building methods and growing preference for sustainable construction practices further accelerate market expansion. Industrial growth across manufacturing, energy, and logistics sectors creates additional demand for specialized structural steel applications.

Market challenges include raw material price volatility, environmental regulations, and competition from alternative construction materials. However, technological advancement in steel production, improved quality standards, and enhanced fabrication capabilities position the market for sustained growth. Regional expansion into tier-2 and tier-3 cities presents significant opportunities as infrastructure development spreads beyond major metropolitan areas.

Market segmentation reveals diverse applications across multiple industry verticals with construction and infrastructure representing the largest demand segments. Product categories include hot-rolled sections, cold-formed sections, and fabricated structural components, each serving specific engineering and architectural requirements. Quality grades range from standard structural steel to high-strength and weather-resistant variants for specialized applications.

Government infrastructure initiatives serve as the primary catalyst for structural steel market growth in India. National Infrastructure Pipeline projects worth substantial investments create sustained demand for high-quality structural steel products. Smart Cities Mission and Housing for All programs accelerate urban development projects requiring extensive steel infrastructure.

Urbanization trends drive construction activity across residential, commercial, and institutional segments. Population growth in urban areas necessitates expanded housing, office complexes, shopping centers, and public facilities. Industrial expansion across manufacturing, logistics, and service sectors creates additional demand for specialized structural steel applications in factory construction and warehouse development.

Transportation infrastructure development represents a major growth driver with projects including metro rail systems, highway expansion, airport modernization, and port development. Energy sector growth through power plant construction, renewable energy installations, and transmission infrastructure expansion creates specialized demand for structural steel products. Make in India initiatives promote domestic manufacturing capabilities and reduce import dependency.

Raw material price volatility poses significant challenges for structural steel manufacturers and end-users. Iron ore and coking coal price fluctuations directly impact production costs and market pricing dynamics. Energy costs associated with steel production create additional cost pressures, particularly for smaller manufacturers with limited economies of scale.

Environmental regulations and pollution control measures increase compliance costs and operational complexity for steel producers. Land acquisition challenges for new manufacturing facilities and infrastructure projects can delay market expansion. Skilled labor shortage in specialized fabrication and installation services limits market growth potential in certain regions.

Competition from alternative materials such as reinforced concrete, aluminum, and composite materials in specific applications creates market pressure. Import competition from low-cost producers in certain product categories affects domestic market dynamics. Credit availability and financing constraints for infrastructure projects can impact demand patterns and market growth timing.

Infrastructure modernization across India presents unprecedented opportunities for structural steel market expansion. Railway infrastructure upgrades including high-speed rail projects and station modernization create substantial demand for specialized structural steel products. Airport expansion and new airport construction require advanced structural steel solutions for terminal buildings and support facilities.

Industrial corridor development along major economic zones creates opportunities for integrated steel supply chains and value-added services. Renewable energy sector growth through solar parks, wind farms, and energy storage facilities generates demand for specialized structural steel applications. Data center construction and telecommunications infrastructure expansion create niche market opportunities.

Export potential to neighboring countries and emerging markets offers growth opportunities for Indian structural steel manufacturers. Technology partnerships with international companies can enhance product capabilities and market reach. Prefabricated construction adoption creates opportunities for integrated steel solutions and modular construction systems.

Supply chain dynamics in India’s structural steel market involve complex interactions between raw material suppliers, steel producers, fabricators, and end-users. Integrated steel plants maintain advantages in cost control and quality consistency, while specialized fabricators provide value-added services and customized solutions. Regional distribution networks play crucial roles in market accessibility and customer service.

Demand patterns show seasonal variations influenced by construction cycles, monsoon seasons, and government budget allocations. Project-based demand creates lumpy order patterns requiring flexible production and inventory management. Quality requirements continue to evolve with increasing emphasis on international standards and performance specifications.

Competitive dynamics involve both price competition and value-added service differentiation. Market consolidation trends create opportunities for economies of scale and integrated service offerings. Technology adoption drives operational efficiency improvements and product innovation across the value chain.

Market research methodology employed comprehensive primary and secondary research approaches to analyze India’s structural steel market dynamics. Primary research included extensive interviews with industry stakeholders including steel producers, fabricators, contractors, government officials, and end-users across different regions and market segments.

Secondary research involved analysis of government publications, industry reports, trade association data, and company financial statements. Market sizing utilized multiple validation approaches including top-down analysis from macroeconomic indicators and bottom-up analysis from company-level data aggregation.

Data validation processes included triangulation of information sources, expert consultations, and cross-verification of market trends and growth patterns. Regional analysis incorporated state-level data and local market dynamics to provide comprehensive geographic coverage. Forecasting models considered multiple scenarios including economic growth assumptions, policy impacts, and industry development trends.

Western India dominates the structural steel market with Maharashtra and Gujarat leading in both production and consumption. Mumbai metropolitan region serves as a major consumption center driven by extensive construction and infrastructure projects. Gujarat’s industrial corridor creates substantial demand for structural steel in manufacturing and logistics facilities.

Southern India shows strong growth momentum with Tamil Nadu, Karnataka, and Andhra Pradesh emerging as key markets. Bangalore’s IT sector expansion drives commercial construction demand, while Chennai’s automotive industry creates industrial infrastructure requirements. Hyderabad’s pharmaceutical and biotechnology sectors generate specialized structural steel demand.

Northern India benefits from Delhi NCR’s infrastructure development and Punjab’s agricultural infrastructure modernization. Eastern India shows growth potential with West Bengal’s industrial development and Odisha’s mining and steel industry expansion. Central India emerges as a growth region with Madhya Pradesh and Chhattisgarh developing industrial infrastructure.

Market leadership is shared among several major players with diverse strengths and market positioning strategies. Integrated steel companies leverage their raw material access and production scale advantages, while specialized structural steel manufacturers focus on quality, customization, and technical services.

Competitive strategies include capacity expansion, product diversification, quality enhancement, and customer service improvement. Market consolidation trends create opportunities for strategic partnerships and acquisition activities.

Product segmentation divides the market into distinct categories based on steel grades, product forms, and manufacturing processes. Hot-rolled structural sections represent the largest segment including beams, channels, angles, and hollow sections. Cold-formed sections serve specialized applications requiring precise dimensions and enhanced properties.

Application segmentation covers diverse end-use sectors:

Grade segmentation includes mild steel, high-strength steel, weathering steel, and specialty grades for specific performance requirements. Regional segmentation reflects varying demand patterns and growth opportunities across different states and economic zones.

Building construction category represents the largest market segment with residential construction driving substantial volume demand. Commercial construction emphasizes quality and architectural aesthetics, creating opportunities for premium structural steel products. Institutional construction including hospitals, schools, and government buildings requires compliance with stringent quality standards.

Infrastructure category shows strong growth momentum driven by government investment programs. Transportation infrastructure including metro rail projects and highway construction creates specialized demand for high-strength structural steel. Bridge construction requires weathering steel and advanced fabrication techniques.

Industrial category encompasses diverse applications from manufacturing facilities to logistics infrastructure. Warehouse construction emphasizes cost-effectiveness and rapid construction methods. Manufacturing facilities require specialized structural solutions for heavy machinery installation and process equipment support.

Energy category includes both conventional power plants and renewable energy installations. Solar mounting structures create growing demand for galvanized structural steel. Wind energy projects require high-strength steel for tower construction and foundation systems.

Steel producers benefit from diversified revenue streams and value-added product opportunities in the structural steel market. Long-term infrastructure projects provide predictable demand patterns and stable customer relationships. Premium pricing for specialized products enhances profitability margins compared to commodity steel products.

Fabricators and processors gain access to growing market opportunities through value-added services and customized solutions. Technical expertise in structural design and fabrication creates competitive advantages and customer loyalty. Regional presence enables responsive customer service and reduced logistics costs.

Construction companies benefit from reliable steel supply, quality assurance, and technical support services. Prefabricated steel solutions enable faster construction schedules and improved project economics. Standardized products simplify procurement processes and inventory management.

End-users gain access to durable infrastructure, cost-effective construction solutions, and sustainable building practices. Government agencies benefit from domestic manufacturing capabilities and employment generation in the steel sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Prefabricated construction emerges as a major trend transforming the structural steel market. Modular building systems enable faster construction, improved quality control, and reduced waste generation. Design standardization and mass customization create opportunities for economies of scale in fabrication and installation.

Sustainability initiatives drive demand for recyclable steel products and energy-efficient manufacturing processes. Green building certifications increasingly require sustainable material sourcing and lifecycle assessment documentation. Carbon footprint reduction becomes a key consideration in material selection and supplier evaluation.

Digital transformation impacts the structural steel market through Building Information Modeling (BIM), automated fabrication, and supply chain digitization. IoT integration enables real-time monitoring of structural performance and predictive maintenance. E-commerce platforms facilitate direct customer engagement and streamlined procurement processes.

Quality enhancement trends include adoption of international standards, advanced testing methods, and certification programs. Traceability systems ensure material authenticity and quality assurance throughout the supply chain.

Capacity expansion initiatives by major steel producers increase structural steel availability and market competition. Technology partnerships with international companies bring advanced manufacturing processes and product innovations to the Indian market. MarkWide Research indicates that strategic collaborations between steel producers and fabricators enhance integrated service offerings.

Government policy developments including quality standards, environmental regulations, and trade policies shape market dynamics. Infrastructure project announcements create demand visibility and investment opportunities for market participants. Skill development programs address workforce requirements in fabrication and installation services.

Merger and acquisition activities drive market consolidation and operational efficiency improvements. International investments bring capital, technology, and market access opportunities. Research and development initiatives focus on product innovation, cost reduction, and performance enhancement.

Sustainability certifications and green manufacturing practices become increasingly important for market acceptance and competitive positioning. Digital platform development enhances customer engagement and supply chain efficiency.

Market participants should focus on quality improvement and standardization to meet evolving customer expectations and regulatory requirements. Investment in technology including automated production systems and digital platforms will enhance operational efficiency and competitive positioning.

Strategic partnerships between steel producers, fabricators, and construction companies can create integrated value chains and improved customer service. Geographic expansion into tier-2 and tier-3 cities offers growth opportunities as infrastructure development spreads nationwide.

Sustainability initiatives including environmental compliance, energy efficiency, and circular economy practices will become increasingly important for long-term success. Skill development and workforce training programs should address technical requirements and safety standards.

Export market development can provide additional revenue streams and market diversification opportunities. Customer relationship management and technical support services will differentiate successful companies in an increasingly competitive market.

Long-term growth prospects for India’s structural steel market remain highly positive driven by sustained infrastructure investment and economic development. Government infrastructure programs including National Infrastructure Pipeline and Smart Cities Mission will continue generating substantial demand through the next decade.

Technology advancement will transform manufacturing processes, product capabilities, and customer service delivery. Automation and digitization will improve operational efficiency and product quality. MWR analysis suggests that integrated digital platforms will become essential for market competitiveness.

Market consolidation trends will continue as economies of scale and operational efficiency become increasingly important. International partnerships and technology transfer will enhance product innovation and market capabilities. Sustainability requirements will drive green manufacturing practices and circular economy adoption.

Regional growth will expand beyond major metropolitan areas as infrastructure development reaches smaller cities and rural areas. Export opportunities in neighboring countries and emerging markets will provide additional growth avenues for Indian structural steel manufacturers.

India’s structural steel market stands at a pivotal juncture with exceptional growth opportunities driven by massive infrastructure development initiatives and rapid economic expansion. The market benefits from strong government support, abundant raw material resources, and growing industrial capabilities. Key success factors include quality improvement, technology adoption, sustainability practices, and customer service excellence.

Market dynamics indicate sustained growth momentum with expanding applications across construction, infrastructure, industrial, and energy sectors. Regional development patterns show opportunities beyond traditional industrial centers as economic activity spreads nationwide. Competitive landscape evolution toward consolidation and integration will enhance operational efficiency and market stability.

Future success will depend on addressing quality challenges, embracing technological advancement, and developing sustainable business practices. Strategic positioning through value-added services, customer relationships, and operational excellence will differentiate market leaders. The structural steel market represents a cornerstone of India’s industrial development and infrastructure modernization, positioning it for continued expansion and evolution in the years ahead.

What is Structural Steel?

Structural steel is a category of steel used for making construction materials in a variety of shapes. It is widely utilized in the construction of buildings, bridges, and other infrastructure due to its high strength-to-weight ratio and versatility.

What are the key players in the India Structural Steel Market?

Key players in the India Structural Steel Market include Tata Steel, JSW Steel, and Steel Authority of India Limited (SAIL), among others. These companies are known for their extensive production capabilities and contributions to various construction projects.

What are the growth factors driving the India Structural Steel Market?

The growth of the India Structural Steel Market is driven by increasing urbanization, infrastructure development, and the rising demand for residential and commercial buildings. Additionally, government initiatives aimed at enhancing infrastructure are further propelling market growth.

What challenges does the India Structural Steel Market face?

The India Structural Steel Market faces challenges such as fluctuating raw material prices and environmental regulations. These factors can impact production costs and operational efficiency for manufacturers in the sector.

What opportunities exist in the India Structural Steel Market?

Opportunities in the India Structural Steel Market include the growing demand for sustainable construction materials and advancements in steel manufacturing technologies. The push for green buildings and eco-friendly practices is likely to create new avenues for growth.

What trends are shaping the India Structural Steel Market?

Trends in the India Structural Steel Market include the increasing use of high-strength steel and the adoption of prefabricated steel structures. These innovations are aimed at improving construction efficiency and reducing project timelines.

India Structural Steel Market

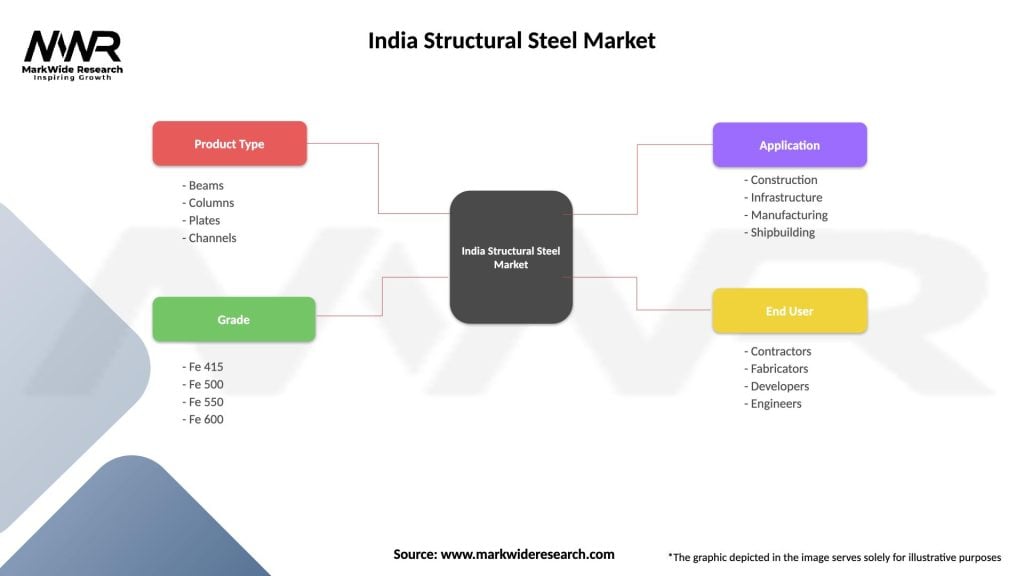

| Segmentation Details | Description |

|---|---|

| Product Type | Beams, Columns, Plates, Channels |

| Grade | Fe 415, Fe 500, Fe 550, Fe 600 |

| Application | Construction, Infrastructure, Manufacturing, Shipbuilding |

| End User | Contractors, Fabricators, Developers, Engineers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Structural Steel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at