444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

India’s stainless steel plumbing pipes and fittings market represents one of the fastest-growing segments within the country’s construction and infrastructure sector. The market has experienced remarkable transformation over the past decade, driven by rapid urbanization, increasing disposable income, and growing awareness about hygiene and durability in plumbing systems. Stainless steel plumbing solutions have gained significant traction among residential, commercial, and industrial consumers due to their superior corrosion resistance, longevity, and aesthetic appeal.

Market dynamics indicate robust growth potential, with the sector expanding at a CAGR of 8.2% during the forecast period. This growth trajectory is supported by government initiatives promoting smart cities, infrastructure development projects, and the increasing adoption of premium plumbing solutions across urban and semi-urban areas. Regional distribution shows that western and southern states account for approximately 65% of market consumption, primarily due to higher construction activities and better economic conditions.

Consumer preferences have shifted significantly toward stainless steel alternatives, replacing traditional materials like PVC, copper, and galvanized iron. This transition is particularly evident in tier-1 and tier-2 cities, where quality consciousness and willingness to invest in durable plumbing solutions have increased substantially. The market encompasses various product categories including pipes, fittings, flanges, valves, and specialized components designed for diverse applications.

The India stainless steel plumbing pipes and fittings market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of corrosion-resistant steel-based plumbing components across residential, commercial, and industrial sectors in India. This market encompasses all grades of stainless steel products specifically designed for water supply, drainage, and specialized fluid handling applications.

Stainless steel plumbing systems are characterized by their exceptional durability, hygienic properties, and resistance to various environmental factors including temperature fluctuations, chemical exposure, and mechanical stress. The market includes various product categories such as seamless and welded pipes, compression fittings, threaded fittings, flanged connections, and specialized components for specific industrial applications.

Market scope extends beyond basic plumbing infrastructure to include sophisticated applications in pharmaceutical facilities, food processing plants, chemical industries, and high-end residential projects. The definition also encompasses the entire value chain from raw material procurement and manufacturing to distribution networks and end-user installation services.

India’s stainless steel plumbing market stands at a pivotal juncture, experiencing unprecedented growth driven by multiple converging factors. The market has demonstrated remarkable resilience and adaptability, particularly in the post-pandemic era where hygiene and durability have become paramount considerations for consumers and businesses alike. Market penetration has increased significantly, with stainless steel solutions now accounting for approximately 28% of the premium plumbing segment.

Key growth drivers include accelerating urbanization rates, rising construction activities, and increasing awareness about the long-term benefits of stainless steel plumbing systems. The market has witnessed substantial investments in manufacturing capabilities, with domestic production capacity expanding to meet growing demand while reducing dependence on imports. Technology adoption has also played a crucial role, with manufacturers implementing advanced production techniques and quality control measures.

Regional analysis reveals strong performance across major metropolitan areas, with emerging opportunities in tier-2 and tier-3 cities as infrastructure development accelerates. The market structure includes both organized and unorganized players, with increasing consolidation expected as quality standards become more stringent and customer preferences evolve toward branded solutions.

Market intelligence reveals several critical insights that shape the current landscape and future trajectory of India’s stainless steel plumbing pipes and fittings sector. Understanding these insights is essential for stakeholders seeking to capitalize on emerging opportunities and navigate potential challenges effectively.

Urbanization acceleration serves as the primary catalyst driving India’s stainless steel plumbing market expansion. With urban population growing at an unprecedented rate, the demand for reliable, durable plumbing infrastructure has increased exponentially. Smart city initiatives launched by the government have further amplified this demand, as these projects prioritize sustainable and long-lasting infrastructure solutions.

Rising disposable income among middle-class households has enabled greater investment in premium plumbing solutions. Consumers are increasingly willing to pay higher upfront costs for products that offer superior longevity and reduced maintenance requirements. This shift in consumer behavior has been particularly pronounced in urban areas where awareness about product quality and lifecycle costs is higher.

Health and hygiene consciousness has reached new heights, especially following the COVID-19 pandemic. Stainless steel’s inherent antimicrobial properties and ease of cleaning have made it the preferred choice for health-conscious consumers and institutions. Water quality concerns in many Indian cities have also contributed to the preference for non-reactive plumbing materials that don’t affect water taste or quality.

Construction industry growth continues to fuel market expansion, with both residential and commercial segments showing robust activity. The government’s focus on affordable housing, infrastructure development, and industrial growth has created sustained demand for quality plumbing solutions. Green building initiatives and sustainability requirements have further boosted adoption of stainless steel systems due to their recyclability and environmental benefits.

High initial investment costs remain the most significant barrier to widespread adoption of stainless steel plumbing systems. Despite long-term cost benefits, the substantial upfront investment required often deters price-sensitive consumers, particularly in the mass market segment. This cost factor is especially challenging in rural and semi-urban areas where purchasing power is limited.

Lack of skilled installation expertise poses another significant challenge. Stainless steel plumbing systems require specialized knowledge and techniques for proper installation, welding, and maintenance. The shortage of trained technicians and plumbers familiar with stainless steel systems has led to installation issues and customer dissatisfaction in some cases.

Raw material price volatility creates uncertainty for both manufacturers and consumers. Fluctuations in nickel and chromium prices directly impact stainless steel costs, making pricing strategies challenging and affecting market predictability. This volatility can lead to sudden price increases that may temporarily reduce demand.

Competition from alternative materials continues to pressure market growth. Traditional materials like PVC and CPVC offer lower costs and easier installation, making them attractive options for budget-conscious projects. Additionally, newer composite materials and advanced polymers are emerging as viable alternatives with improved properties.

Rural market penetration presents enormous untapped potential as government initiatives focus on improving rural infrastructure and sanitation facilities. The Jal Jeevan Mission and similar programs create opportunities for stainless steel plumbing solutions in previously underserved areas. Awareness campaigns about the benefits of quality plumbing systems could accelerate adoption in these markets.

Industrial applications expansion offers significant growth prospects, particularly in pharmaceutical, food processing, and chemical industries where hygiene and corrosion resistance are critical. The growth of these sectors in India creates sustained demand for specialized stainless steel plumbing solutions with specific certifications and properties.

Export market development represents a substantial opportunity as Indian manufacturers build capabilities and quality standards. Neighboring countries and emerging markets present potential destinations for Indian-made stainless steel plumbing products, especially given the competitive cost structure and improving quality reputation.

Technology integration opportunities include smart plumbing systems, IoT-enabled monitoring, and predictive maintenance solutions. As digitalization accelerates across sectors, integrating technology with stainless steel plumbing systems could create new value propositions and market segments.

Supply chain evolution has become increasingly sophisticated, with manufacturers developing integrated approaches from raw material sourcing to end-user delivery. The market has witnessed significant improvements in logistics efficiency, with delivery times reducing by approximately 25% over the past three years. This improvement has enhanced customer satisfaction and enabled better project planning for contractors and builders.

Competitive intensity has increased substantially as both domestic and international players vie for market share. This competition has driven innovation in product design, manufacturing processes, and customer service standards. Price competition has moderated somewhat as players focus more on value proposition and quality differentiation rather than pure cost leadership.

Regulatory environment continues to evolve with stricter quality standards and environmental regulations. The implementation of BIS standards and growing emphasis on sustainable manufacturing practices have influenced market dynamics significantly. Companies investing in compliance and certification have gained competitive advantages in premium market segments.

Customer behavior patterns show increasing sophistication, with buyers conducting thorough research before making purchasing decisions. Digital influence on buying decisions has grown substantially, with online research and reviews playing crucial roles in product selection. This shift has prompted manufacturers to invest heavily in digital marketing and online presence.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary research methodologies. The study employed both quantitative and qualitative research techniques to ensure accuracy and depth of insights. Data collection spanned multiple sources including industry experts, manufacturers, distributors, contractors, and end-users across various market segments.

Primary research activities included structured interviews with key industry stakeholders, focus group discussions with contractors and plumbers, and detailed surveys of end-users across different geographic regions. The research covered all major market segments including residential, commercial, and industrial applications to ensure comprehensive market understanding.

Secondary research involved extensive analysis of industry reports, government publications, trade association data, and company financial statements. Market sizing and forecasting models were developed using historical data analysis and trend extrapolation techniques. Cross-validation of data from multiple sources ensured reliability and accuracy of findings.

Geographic coverage included all major states and union territories, with particular focus on high-growth regions and emerging markets. The research methodology incorporated seasonal variations, regional preferences, and local market dynamics to provide nuanced insights into market behavior patterns.

Western India dominates the stainless steel plumbing market, accounting for approximately 35% of total consumption. Maharashtra and Gujarat lead this region due to robust industrial activity, high construction rates, and strong economic fundamentals. Mumbai and Pune serve as major consumption centers, driven by premium residential projects and commercial developments.

Southern India represents the second-largest regional market with 30% market share, led by Tamil Nadu, Karnataka, and Andhra Pradesh. The region’s strong industrial base, particularly in automotive, textiles, and IT sectors, drives demand for quality plumbing solutions. Bangalore and Chennai show particularly strong growth in residential and commercial segments.

Northern India accounts for 25% of market consumption, with Delhi NCR, Punjab, and Haryana being primary contributors. The region benefits from government infrastructure projects and growing urbanization. However, price sensitivity remains higher compared to western and southern regions, influencing product mix and market strategies.

Eastern India represents an emerging market with 10% current share but showing rapid growth potential. West Bengal and Odisha are leading states in this region, with increasing industrial activity and infrastructure development creating new opportunities. The region’s growth is expected to accelerate as economic development initiatives gain momentum.

Market structure comprises a mix of large organized players, medium-sized regional manufacturers, and numerous small-scale producers. The competitive landscape has evolved significantly with increasing consolidation and the emergence of quality-focused brands that command premium positioning.

Competitive strategies have shifted toward value creation through innovation, quality improvement, and customer service enhancement. Companies are investing in advanced manufacturing technologies, quality certifications, and brand building activities to differentiate themselves in an increasingly competitive market.

Product-wise segmentation reveals distinct market dynamics across different categories. Pipes constitute the largest segment, followed by fittings, flanges, and specialized components. Each segment has unique growth drivers, competitive dynamics, and customer requirements that influence market strategies.

By Product Type:

By Application:

By Grade:

Seamless pipes category demonstrates the strongest growth momentum, driven by increasing quality consciousness and preference for superior performance characteristics. This segment commands premium pricing but offers better margins for manufacturers and superior value proposition for end-users. Demand patterns show particular strength in industrial and high-end residential applications.

Welded pipes segment serves as the volume driver for the market, offering cost-effective solutions for standard applications. Recent technological improvements in welding processes have enhanced quality and reliability, making welded pipes increasingly acceptable for demanding applications. Price competitiveness remains the key factor in this segment.

Fittings and accessories represent a high-value segment with diverse product requirements and customization opportunities. This category benefits from the growing complexity of plumbing systems and increasing demand for specialized components. Innovation opportunities are particularly strong in this segment, with scope for new product development and value-added solutions.

Industrial grade products constitute a niche but highly profitable segment requiring specialized certifications and quality standards. This category serves pharmaceutical, food processing, chemical, and other process industries with stringent requirements. Growth potential remains strong as industrial activity expands and quality standards become more stringent.

Manufacturers benefit from growing market demand, improving margins, and opportunities for capacity expansion. The shift toward quality and branded products enables better pricing power and customer loyalty. Investment opportunities in technology upgrades and capacity enhancement offer potential for market share gains and operational efficiency improvements.

Distributors and retailers gain from expanding product portfolios and improving margins on premium products. The growing market provides opportunities for geographic expansion and customer base diversification. Value-added services such as technical support and installation guidance create additional revenue streams and competitive differentiation.

Contractors and installers benefit from growing demand for their specialized skills and services. The premium nature of stainless steel systems enables better project margins and customer relationships. Training and certification programs create opportunities for skill development and professional advancement.

End-users enjoy superior product performance, reduced maintenance costs, and improved system reliability. The long-term cost benefits and aesthetic appeal provide excellent value proposition. Health and safety benefits from hygienic plumbing systems add significant value, particularly in residential and institutional applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus has emerged as a dominant trend, with customers increasingly valuing environmentally friendly products and manufacturing processes. Stainless steel’s recyclability and longevity align well with sustainability objectives, creating competitive advantages for the market. Green building certifications are driving adoption in commercial and institutional projects.

Digitalization impact is transforming market dynamics through online sales channels, digital marketing, and customer engagement platforms. E-commerce adoption has accelerated, particularly among smaller contractors and individual customers seeking convenience and competitive pricing. Digital tools for product selection and specification are becoming increasingly important.

Customization demand is growing as customers seek tailored solutions for specific applications and requirements. Manufacturers are responding with flexible production capabilities and value-added services. Just-in-time delivery and project-specific packaging are becoming standard expectations rather than premium services.

Quality consciousness continues to intensify across all market segments, with customers willing to pay premiums for certified products and reliable suppliers. Brand preference is strengthening, particularly in urban markets where quality reputation influences purchasing decisions significantly.

Manufacturing capacity expansion has been a significant trend, with major players investing in new production facilities and technology upgrades. Several companies have announced substantial capital investments to meet growing demand and improve production efficiency. Automation adoption in manufacturing processes has improved quality consistency and cost competitiveness.

Strategic partnerships between manufacturers and distributors have strengthened market reach and customer service capabilities. These collaborations focus on market development, technical support, and supply chain optimization. International collaborations have brought advanced technologies and global best practices to the Indian market.

Product innovation continues with development of new grades, improved manufacturing processes, and specialized products for niche applications. Research and development investments have increased significantly as companies seek to differentiate their offerings and address evolving customer needs.

Regulatory compliance improvements have been notable, with manufacturers investing in quality systems and certifications. The implementation of stricter standards has elevated overall market quality and customer confidence. Export quality initiatives have positioned Indian manufacturers competitively in international markets.

Market participants should focus on building strong brand recognition and customer loyalty through consistent quality delivery and superior customer service. MarkWide Research analysis suggests that companies investing in brand building and customer relationships are achieving better market positioning and pricing power.

Geographic expansion strategies should prioritize tier-2 and tier-3 cities where growth potential remains substantial but competition is less intense. Developing appropriate product mixes and pricing strategies for these markets will be crucial for success. Rural market entry requires different approaches focusing on education, demonstration, and value communication.

Technology investments in manufacturing processes, quality control, and customer service systems will become increasingly important for maintaining competitiveness. Digital transformation initiatives should encompass both internal operations and customer-facing processes to improve efficiency and customer experience.

Supply chain optimization remains critical for managing costs and ensuring reliable delivery performance. Companies should consider vertical integration opportunities and strategic supplier partnerships to enhance supply security and cost competitiveness.

Long-term growth prospects remain highly positive, supported by fundamental drivers including urbanization, infrastructure development, and rising quality consciousness. MWR projections indicate sustained growth momentum with the market expected to maintain robust expansion rates over the next decade. The increasing adoption of stainless steel solutions across various applications suggests strong structural demand growth.

Technology evolution will continue shaping market dynamics, with smart plumbing systems and IoT integration creating new value propositions and market segments. Efficiency improvements of approximately 15-20% are expected through technology adoption and process optimization initiatives.

Market maturation will likely lead to increased consolidation and the emergence of stronger market leaders. Quality standards will continue rising, potentially eliminating weaker players and creating opportunities for well-positioned companies. Export potential remains significant as Indian manufacturers build capabilities and quality reputation.

Sustainability requirements will become increasingly important, with circular economy principles and environmental considerations influencing product development and market strategies. Companies aligning with sustainability trends are expected to achieve competitive advantages and better long-term positioning.

India’s stainless steel plumbing pipes and fittings market stands at an inflection point, poised for sustained growth driven by multiple favorable factors. The market has demonstrated remarkable resilience and adaptability, successfully navigating challenges while capitalizing on emerging opportunities. Structural demand drivers including urbanization, infrastructure development, and quality consciousness provide strong foundations for continued expansion.

Market evolution toward premium products and branded solutions creates opportunities for value creation and improved profitability across the value chain. The increasing sophistication of customer requirements and growing acceptance of higher-quality solutions support optimistic growth projections. Technology integration and sustainability focus will likely drive the next phase of market development.

Success factors for market participants include maintaining product quality, building strong customer relationships, and adapting to evolving market dynamics. Companies that invest in capabilities, innovation, and customer service are well-positioned to capture the substantial growth opportunities ahead. The market’s trajectory suggests a bright future for stakeholders committed to excellence and customer value creation.

What is Stainless Steel Plumbing Pipes & Fittings?

Stainless Steel Plumbing Pipes & Fittings refer to the components used in plumbing systems that are made from stainless steel, known for its durability, resistance to corrosion, and ability to withstand high temperatures. These products are essential in various applications, including residential, commercial, and industrial plumbing systems.

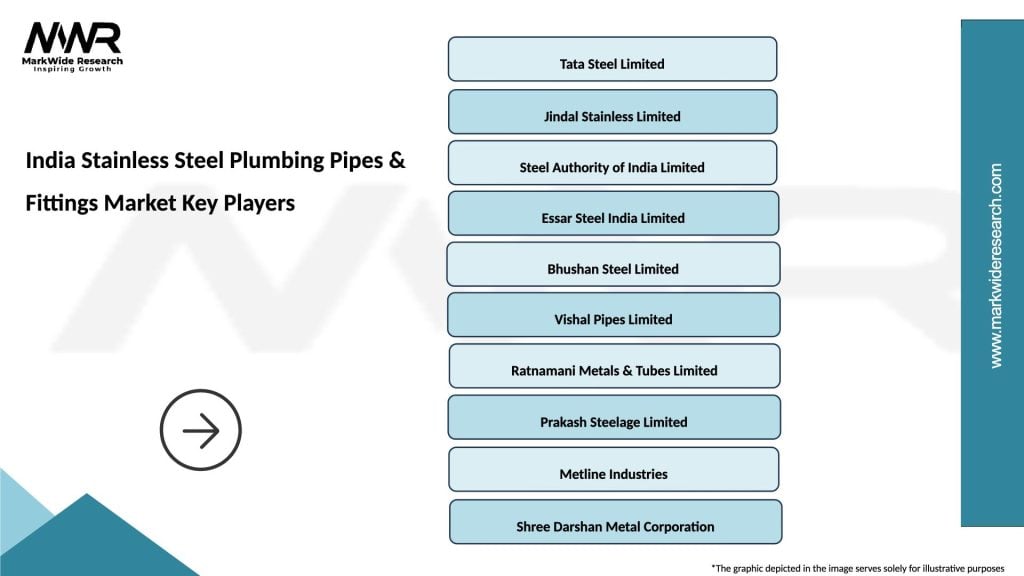

What are the key players in the India Stainless Steel Plumbing Pipes & Fittings Market?

Key players in the India Stainless Steel Plumbing Pipes & Fittings Market include Tata Steel, Jindal Stainless, and APL Apollo Tubes, among others. These companies are known for their extensive product ranges and contributions to the plumbing industry.

What are the growth factors driving the India Stainless Steel Plumbing Pipes & Fittings Market?

The growth of the India Stainless Steel Plumbing Pipes & Fittings Market is driven by increasing urbanization, rising demand for durable plumbing solutions, and the expansion of the construction industry. Additionally, the focus on sustainable building practices is boosting the adoption of stainless steel products.

What challenges does the India Stainless Steel Plumbing Pipes & Fittings Market face?

The India Stainless Steel Plumbing Pipes & Fittings Market faces challenges such as fluctuating raw material prices and competition from alternative materials like PVC and copper. These factors can impact profit margins and market growth.

What opportunities exist in the India Stainless Steel Plumbing Pipes & Fittings Market?

Opportunities in the India Stainless Steel Plumbing Pipes & Fittings Market include the growing demand for eco-friendly plumbing solutions and advancements in manufacturing technologies. The increasing focus on infrastructure development also presents significant growth potential.

What trends are shaping the India Stainless Steel Plumbing Pipes & Fittings Market?

Trends in the India Stainless Steel Plumbing Pipes & Fittings Market include the rising popularity of modular plumbing systems and the integration of smart technologies in plumbing solutions. Additionally, there is a growing emphasis on product innovation and design to meet consumer preferences.

India Stainless Steel Plumbing Pipes & Fittings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pipe, Fitting, Valve, Connector |

| Grade | 304, 316, 201, 430 |

| Application | Residential, Commercial, Industrial, Infrastructure |

| End User | Contractors, Plumbers, Builders, Engineers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Stainless Steel Plumbing Pipes & Fittings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at