444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India speaker market represents one of the most dynamic and rapidly evolving segments within the country’s consumer electronics landscape. This comprehensive market encompasses a diverse range of audio products, from traditional wired speakers to cutting-edge wireless and smart speaker systems. Market dynamics indicate robust growth driven by increasing consumer disposable income, technological advancements, and the growing popularity of digital entertainment platforms.

Consumer preferences in India have shifted significantly toward premium audio experiences, with wireless connectivity and smart features becoming increasingly important purchase factors. The market demonstrates strong growth potential with an estimated CAGR of 12.5% projected over the next five years. Regional penetration varies considerably, with urban markets showing higher adoption rates of advanced speaker technologies compared to rural areas.

Technology integration has become a key differentiator, with manufacturers focusing on Bluetooth connectivity, voice assistant compatibility, and multi-room audio capabilities. The market benefits from India’s expanding digital infrastructure and the increasing popularity of music streaming services, which collectively drive demand for high-quality audio reproduction systems across various price segments.

The India speaker market refers to the comprehensive ecosystem of audio reproduction devices designed for consumer, professional, and commercial applications within the Indian subcontinent. This market encompasses traditional passive speakers, active powered speakers, wireless Bluetooth speakers, smart speakers with voice assistants, soundbars, and specialized audio systems for various applications.

Market scope includes both domestic manufacturing and imported products, covering price ranges from budget-friendly options to premium audiophile-grade systems. The definition extends beyond hardware to include associated services, software integration, and ecosystem compatibility with various digital platforms and streaming services prevalent in the Indian market.

Product categories within this market span portable speakers, home audio systems, professional audio equipment, automotive speakers, and emerging categories like true wireless stereo systems. The market also encompasses the growing segment of smart speakers that integrate artificial intelligence and voice recognition technologies specifically adapted for Indian languages and cultural preferences.

Market performance in India’s speaker segment demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer behavior and technological adoption patterns. The market benefits from India’s young demographic profile, with approximately 65% of consumers under 35 years old showing strong preference for wireless and smart audio solutions.

Key growth drivers include the proliferation of smartphones, increased internet penetration reaching 78% of urban households, and the rapid expansion of music streaming platforms. MarkWide Research analysis indicates that wireless speaker adoption has accelerated significantly, with Bluetooth-enabled devices representing the fastest-growing segment within the overall market.

Competitive dynamics feature both international brands and domestic manufacturers competing across multiple price tiers. The market shows strong potential for continued expansion, supported by government initiatives promoting digital India and the growing entertainment industry. Premium segment growth outpaces budget categories, indicating evolving consumer preferences toward higher-quality audio experiences.

Consumer behavior analysis reveals several critical insights shaping the India speaker market landscape:

Demographic advantages position India as a highly attractive market for speaker manufacturers and retailers. The country’s young population demonstrates strong affinity for music and entertainment, creating sustained demand for quality audio products. Urbanization trends contribute significantly to market expansion, as city dwellers typically have higher disposable incomes and greater exposure to premium audio technologies.

Digital transformation across India accelerates speaker market growth through multiple channels. The widespread adoption of smartphones creates natural demand for companion audio devices, while the expansion of high-speed internet enables streaming services that require quality speakers for optimal experience. Government initiatives supporting digital infrastructure development indirectly boost the audio equipment market.

Entertainment industry growth serves as a powerful market driver, with Bollywood music, regional content, and international streaming platforms all requiring quality audio reproduction. The rise of content creation, podcasting, and home-based entertainment during recent years has elevated the importance of good audio systems in Indian households.

Technological convergence between speakers and smart home ecosystems creates new growth opportunities. Integration with voice assistants, home automation systems, and multi-room audio setups appeals to tech-savvy consumers seeking comprehensive digital lifestyle solutions.

Price sensitivity remains a significant constraint in the India speaker market, particularly affecting premium segment penetration. Many consumers prioritize value over advanced features, limiting the growth potential of high-end audio products. Economic fluctuations can impact discretionary spending on electronics, as speakers are often considered non-essential purchases compared to smartphones or laptops.

Infrastructure limitations in certain regions affect market development, particularly for smart speakers requiring stable internet connectivity. Power supply inconsistencies in some areas can impact the adoption of powered speakers and charging-dependent wireless devices. Rural markets face additional challenges with limited retail presence and after-sales service availability.

Cultural preferences for traditional audio systems in some demographic segments slow the adoption of modern speaker technologies. Language barriers affect smart speaker adoption, despite improvements in local language support. The complexity of setup and operation for advanced audio systems can deter less tech-savvy consumers.

Import dependencies for certain components and finished products create vulnerability to currency fluctuations and trade policy changes. Quality concerns regarding budget products can impact overall market perception and consumer confidence in newer brands or technologies.

Rural market penetration presents substantial growth opportunities as internet connectivity improves and disposable incomes rise in smaller cities and towns. Government initiatives promoting digital literacy and infrastructure development create favorable conditions for speaker market expansion beyond traditional urban strongholds.

Local manufacturing opportunities align with India’s Make in India initiative, potentially reducing costs and improving product availability. Customization for Indian preferences offers competitive advantages, including support for regional languages, local music platforms, and culturally relevant features in smart speakers.

Professional audio segments show strong growth potential, driven by expanding corporate sectors, educational institutions, and entertainment venues. Automotive integration opportunities emerge as car ownership increases and consumers seek premium in-vehicle audio experiences.

Ecosystem partnerships with streaming services, smartphone manufacturers, and smart home platform providers create new distribution channels and integrated product offerings. Subscription-based models and audio-as-a-service concepts could address price sensitivity while ensuring recurring revenue streams.

Supply chain evolution significantly impacts the India speaker market, with manufacturers increasingly focusing on local assembly and component sourcing to reduce costs and improve availability. Distribution channels have diversified beyond traditional electronics retailers to include online platforms, which now account for a substantial portion of speaker sales, particularly in the wireless and smart speaker categories.

Consumer education plays a crucial role in market dynamics, as awareness of audio quality differences and feature benefits influences purchasing decisions. Brand positioning strategies vary significantly, with international brands emphasizing technology and quality while domestic manufacturers focus on value and local market understanding.

Seasonal demand patterns affect market dynamics, with festival seasons and wedding periods driving significant sales spikes. Product lifecycle management requires careful balance between innovation and affordability, as consumers expect regular feature updates while maintaining price competitiveness.

Regulatory environment influences market dynamics through import duties, quality standards, and environmental regulations. Technology standardization efforts ensure compatibility across devices and platforms, benefiting consumers and manufacturers alike.

Primary research methodologies employed in analyzing the India speaker market include comprehensive consumer surveys, retailer interviews, and manufacturer consultations across multiple geographic regions. Data collection encompasses both quantitative metrics and qualitative insights to provide a holistic market understanding.

Secondary research incorporates analysis of industry reports, government statistics, import-export data, and company financial statements to validate primary findings. Market sizing methodologies combine top-down and bottom-up approaches to ensure accuracy and reliability of growth projections and market share assessments.

Geographic coverage includes tier-1, tier-2, and tier-3 cities to capture regional variations in consumer preferences and market dynamics. Demographic segmentation analysis covers age groups, income levels, and lifestyle preferences to identify key target segments and growth opportunities.

Technology assessment involves evaluation of current and emerging audio technologies, connectivity standards, and smart features to predict future market trends. Competitive analysis includes market share evaluation, pricing strategies, and product positioning across major brands and emerging players.

Northern India demonstrates strong market performance, with Delhi NCR leading in premium speaker adoption and smart home integration. The region shows 38% market share in the premium segment, driven by high disposable incomes and technology awareness. Consumer preferences lean toward branded products with advanced connectivity features and multi-room capabilities.

Western India markets, particularly Mumbai and Pune, exhibit robust growth in both consumer and professional audio segments. Commercial applications drive significant demand, with corporate offices, educational institutions, and entertainment venues requiring quality audio solutions. The region accounts for approximately 32% of total market volume.

Southern India shows strong preference for value-oriented products with good performance characteristics. Technology adoption rates are high, with Bangalore leading in smart speaker penetration. The region demonstrates 28% growth rate in wireless speaker categories, supported by the strong IT industry presence and young professional demographics.

Eastern India represents an emerging market with significant growth potential, though currently accounting for a smaller market share. Cultural preferences for music and entertainment create natural demand, while improving economic conditions support market expansion. Rural penetration initiatives show promising results in this region.

Market leadership in India’s speaker segment features a diverse mix of international brands, domestic manufacturers, and emerging technology companies. The competitive environment demonstrates healthy rivalry across multiple price segments and technology categories.

Competitive strategies vary significantly, with established brands focusing on technology leadership and premium positioning while newer entrants compete on price-performance ratios and innovative features. Market consolidation trends indicate potential for strategic partnerships and acquisitions as companies seek to strengthen their market positions.

By Technology:

By Application:

By Price Range:

Portable Bluetooth Speakers dominate the wireless category with strong consumer appeal for outdoor activities and personal entertainment. This segment benefits from improving battery technology and enhanced connectivity features. Design innovation plays a crucial role, with waterproof and rugged variants gaining popularity among active lifestyle consumers.

Smart Speakers represent the most technologically advanced category, with voice assistants becoming increasingly sophisticated in understanding Indian accents and languages. MWR data indicates growing integration with smart home ecosystems and streaming services. Privacy concerns and internet dependency remain challenges for broader adoption.

Soundbars and Home Theater Systems cater to consumers seeking cinematic audio experiences at home. This category benefits from larger screen TV adoption and streaming service popularity. Installation simplicity and wireless connectivity options drive consumer preference over traditional multi-speaker setups.

Professional Audio Equipment serves commercial and institutional markets with specialized requirements for coverage, durability, and integration capabilities. Growth drivers include expanding corporate sectors, educational infrastructure development, and entertainment venue proliferation across Indian cities.

Manufacturers benefit from India’s large and growing consumer base, offering substantial volume opportunities across multiple price segments. Local manufacturing advantages include reduced logistics costs, faster time-to-market, and alignment with government incentive programs. The diverse market allows for portfolio optimization across budget and premium categories.

Retailers enjoy healthy margins and strong consumer demand, particularly in wireless and smart speaker categories. Online platforms benefit from the convenience-focused purchasing behavior of younger consumers. Physical retailers maintain advantages in demonstration and immediate gratification for audio products where sound quality assessment is important.

Consumers benefit from increasing product variety, competitive pricing, and improving technology features. Innovation acceleration brings advanced features to mainstream price points faster than in many other markets. Local language support and culturally relevant features enhance user experiences for Indian consumers.

Technology Partners including streaming services, voice assistant providers, and connectivity solution companies benefit from the expanding ecosystem of connected audio devices. Integration opportunities create new revenue streams and enhanced user engagement across platforms.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless Technology Evolution continues to drive market transformation, with newer Bluetooth standards offering improved range, battery life, and audio quality. Multi-device connectivity capabilities allow users to seamlessly switch between audio sources, enhancing user experience and device utility.

Voice Assistant Integration becomes increasingly sophisticated, with improved natural language processing and support for Indian languages and dialects. Contextual awareness and personalized responses enhance user engagement and create stickier product experiences.

Sustainable Design gains importance as environmentally conscious consumers seek eco-friendly products. Recyclable materials, energy-efficient operation, and longer product lifecycles become competitive differentiators in premium segments.

Ecosystem Connectivity trends toward seamless integration between speakers, smartphones, smart home devices, and streaming services. Multi-room audio systems allow synchronized playback across multiple spaces, appealing to affluent consumers with larger homes.

Personalization Features including customizable sound profiles, user-specific recommendations, and adaptive audio optimization enhance individual user experiences. AI-powered features learn user preferences and automatically adjust settings for optimal performance.

Manufacturing Localization initiatives by major brands establish assembly facilities in India to reduce costs and improve market responsiveness. Supply chain optimization efforts focus on reducing import dependencies and building local supplier ecosystems for key components.

Strategic Partnerships between speaker manufacturers and streaming services create integrated offerings with exclusive features and content access. Telecom operator collaborations bundle speaker products with connectivity plans, expanding market reach and affordability.

Technology Licensing agreements enable domestic manufacturers to access advanced audio processing technologies and connectivity standards. Research and development investments focus on adapting global technologies for Indian market preferences and conditions.

Retail Channel Evolution includes expansion of experience centers where consumers can audition products before purchase. Online-to-offline integration strategies combine digital marketing with physical demonstration capabilities to enhance customer journey experiences.

Product Innovation accelerates with launches of India-specific features including regional language support, local music service integration, and culturally relevant voice assistant capabilities. Design adaptations consider Indian home environments, power conditions, and aesthetic preferences.

Market Entry Strategies should prioritize understanding regional preferences and price sensitivities across India’s diverse markets. MarkWide Research recommends focusing on tier-2 and tier-3 cities for volume growth while maintaining premium positioning in metropolitan markets.

Product Development should emphasize local language support, integration with popular Indian streaming services, and features relevant to Indian households. Battery life optimization and power efficiency become crucial given infrastructure challenges in some regions.

Distribution Strategy should balance online and offline channels, with strong emphasis on demonstration capabilities for audio products. Partnership approaches with local retailers and service providers can accelerate market penetration and customer support capabilities.

Pricing Strategy requires careful segmentation with clear value propositions for each price tier. Feature differentiation should justify premium pricing while ensuring basic functionality remains accessible to price-sensitive consumers.

Brand Building should leverage India’s music culture and entertainment preferences while building trust through quality and reliability. Influencer partnerships and music industry collaborations can enhance brand credibility and market visibility.

Growth trajectory for India’s speaker market remains strongly positive, supported by fundamental demographic and technological trends. Market maturation will likely see consolidation among smaller players while established brands strengthen their positions through innovation and ecosystem development.

Technology advancement will continue driving market evolution, with artificial intelligence, improved connectivity, and enhanced audio processing capabilities becoming standard features across price segments. 5G network rollout will enable new applications and higher-quality streaming experiences requiring better audio reproduction.

Smart home integration will accelerate as Indian consumers become more comfortable with connected devices and voice control technologies. Interoperability standards will improve, allowing seamless integration between different brands and platforms.

Market expansion into rural areas will gain momentum as infrastructure development continues and disposable incomes rise. Affordable connectivity solutions and simplified user interfaces will facilitate broader adoption of advanced speaker technologies.

Sustainability focus will increase, with manufacturers emphasizing eco-friendly materials, energy efficiency, and product longevity. Circular economy principles including repair services and upgrade programs may become competitive differentiators in premium segments.

The India speaker market presents exceptional opportunities for growth and innovation, driven by favorable demographics, increasing digital adoption, and evolving consumer preferences toward quality audio experiences. Market dynamics indicate sustained expansion across multiple segments, with wireless and smart speakers leading growth while traditional categories maintain their relevance in specific applications.

Success factors in this market include understanding regional preferences, balancing feature innovation with price sensitivity, and building robust distribution networks that serve both urban and emerging rural markets. Technology integration with local services and cultural preferences will differentiate successful brands from generic offerings.

Future prospects remain highly positive, with the market positioned to benefit from India’s continued economic development, infrastructure improvements, and the growing importance of digital entertainment in consumers’ daily lives. Companies that can effectively navigate the complexity of India’s diverse market while delivering value across multiple price segments will capture the most significant opportunities in this dynamic and rapidly evolving market landscape.

What is a speaker?

A speaker is an electroacoustic transducer that converts electrical energy into sound waves, commonly used in various applications such as home audio systems, public address systems, and portable devices.

What are the key companies in the India Speaker Market?

Key companies in the India Speaker Market include JBL, Sony, and Bose, which are known for their innovative audio solutions and diverse product ranges, among others.

What are the growth factors driving the India Speaker Market?

The India Speaker Market is driven by increasing consumer demand for high-quality audio experiences, the rise of smart home technologies, and the growing popularity of portable and wireless speakers.

What challenges does the India Speaker Market face?

Challenges in the India Speaker Market include intense competition among brands, fluctuating raw material prices, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the India Speaker Market?

Opportunities in the India Speaker Market include the expansion of e-commerce platforms, the integration of smart technologies in audio devices, and the increasing trend of home entertainment systems.

What trends are shaping the India Speaker Market?

Trends in the India Speaker Market include the growing demand for wireless and Bluetooth speakers, advancements in sound technology, and the increasing focus on sustainable materials in speaker manufacturing.

India Speaker Market

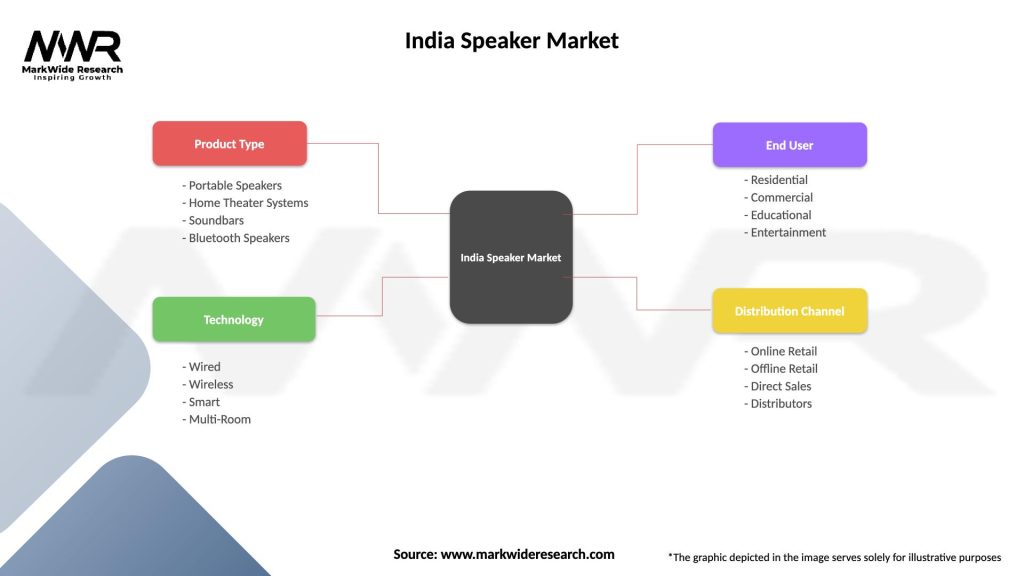

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Speakers, Home Theater Systems, Soundbars, Bluetooth Speakers |

| Technology | Wired, Wireless, Smart, Multi-Room |

| End User | Residential, Commercial, Educational, Entertainment |

| Distribution Channel | Online Retail, Offline Retail, Direct Sales, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Speaker Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at