444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India software services export market represents one of the most dynamic and rapidly evolving sectors in the global technology landscape. This comprehensive market encompasses a wide range of services including application development, maintenance, testing, system integration, and emerging technologies like artificial intelligence and cloud computing. India’s dominance in the global software services export arena has been established through decades of strategic investments in education, infrastructure, and technology capabilities.

Market dynamics indicate robust growth trajectory with the sector experiencing consistent expansion driven by digital transformation initiatives worldwide. The market demonstrates remarkable resilience and adaptability, with Indian software service providers successfully transitioning from traditional IT services to next-generation digital solutions. Growth rates in the sector have consistently outpaced global averages, with the industry maintaining a compound annual growth rate of approximately 8.2% over recent years.

Geographic diversification has become a key characteristic of the market, with Indian companies expanding their service delivery capabilities across multiple regions. The sector’s contribution to India’s overall exports remains substantial, accounting for approximately 55% of total services exports from the country. Technology adoption and innovation continue to drive market evolution, with companies investing heavily in emerging technologies to maintain competitive advantages in the global marketplace.

The India software services export market refers to the comprehensive ecosystem of Indian companies that develop, deliver, and support software solutions and services for international clients across various industries and geographical regions. This market encompasses traditional IT services such as application development and maintenance, as well as emerging digital services including cloud migration, data analytics, and artificial intelligence solutions.

Software services export in the Indian context includes both product-based and service-based offerings delivered to overseas markets. The sector represents a critical component of India’s services economy, leveraging the country’s skilled workforce, cost advantages, and technological capabilities to serve global demand for software solutions. Export activities span multiple delivery models including onshore, offshore, and hybrid approaches to meet diverse client requirements.

Market participants range from large multinational corporations with Indian operations to specialized boutique firms focusing on niche technologies. The ecosystem includes both pure-play software service providers and companies offering integrated technology solutions combining hardware, software, and services components for comprehensive client engagement.

India’s software services export market continues to demonstrate exceptional growth momentum, driven by accelerating global digitalization trends and increasing demand for cost-effective, high-quality technology solutions. The market has successfully evolved from its traditional focus on basic IT services to encompass advanced digital transformation capabilities, positioning Indian companies as strategic partners for global enterprises.

Key performance indicators reveal sustained expansion across multiple service categories, with particularly strong growth in cloud services, data analytics, and artificial intelligence solutions. The sector’s resilience was notably demonstrated during global economic uncertainties, with many Indian software service providers reporting continued client acquisition and revenue growth despite challenging market conditions.

Strategic positioning of Indian companies has shifted toward higher-value services, with digital transformation services accounting for approximately 42% of total export revenues. This transition reflects the market’s successful adaptation to changing client requirements and the industry’s commitment to innovation and capability development. Geographic expansion remains a priority, with companies establishing stronger presence in emerging markets while maintaining dominance in traditional strongholds.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of India’s software services export sector. The industry demonstrates remarkable adaptability in responding to evolving client needs and technological disruptions while maintaining its competitive cost structure and quality standards.

Digital transformation acceleration across global enterprises represents the primary driver propelling India’s software services export market forward. Organizations worldwide are investing heavily in modernizing their technology infrastructure, creating substantial demand for the specialized services that Indian companies excel in delivering. Cloud adoption continues to surge, with businesses seeking expert guidance in migrating legacy systems and optimizing cloud-native architectures.

Cost optimization pressures faced by global enterprises drive continued outsourcing of software development and maintenance activities to Indian service providers. The compelling value proposition offered by Indian companies, combining competitive pricing with high-quality deliverables, remains attractive to cost-conscious organizations seeking to maximize their technology investments while maintaining operational efficiency.

Emerging technology adoption creates new service categories and revenue opportunities for Indian software exporters. The growing demand for artificial intelligence, machine learning, blockchain, and Internet of Things solutions provides Indian companies with opportunities to develop specialized capabilities and capture market share in high-growth technology segments. Data analytics requirements across industries fuel demand for specialized analytics services and business intelligence solutions.

Regulatory compliance needs in various industries create ongoing demand for specialized software solutions and services. Indian companies have developed expertise in helping global clients navigate complex regulatory environments, particularly in highly regulated sectors such as financial services, healthcare, and telecommunications.

Talent acquisition challenges pose significant constraints on market growth, with increasing competition for skilled professionals driving up compensation costs and creating resource allocation difficulties. The rapid pace of technological change requires continuous skill development and training investments, straining organizational resources and potentially impacting service delivery capabilities.

Currency fluctuation risks create ongoing challenges for Indian software exporters, with exchange rate volatility affecting revenue predictability and profit margins. Companies must implement sophisticated hedging strategies and pricing models to mitigate currency-related risks while maintaining competitive positioning in global markets.

Geopolitical tensions and trade policy uncertainties in key markets create potential disruptions to established business relationships and market access. Changing visa regulations and immigration policies in major export destinations can impact the deployment of Indian professionals for onsite client engagement, affecting service delivery models and client satisfaction.

Increasing competition from other low-cost destinations and the emergence of alternative service delivery models, including automation and artificial intelligence, challenge traditional Indian advantages. Companies must continuously innovate and differentiate their offerings to maintain market position against evolving competitive landscapes.

Emerging market expansion presents substantial growth opportunities for Indian software service exporters, with developing economies increasingly investing in digital infrastructure and technology modernization. Countries in Africa, Latin America, and Southeast Asia offer untapped potential for Indian companies seeking to diversify their geographic revenue base and reduce dependence on traditional markets.

Industry 4.0 transformation creates significant opportunities in manufacturing and industrial sectors, where Indian companies can leverage their expertise in IoT, automation, and data analytics to help clients modernize production processes and supply chain operations. Smart city initiatives worldwide provide platforms for Indian companies to showcase integrated technology solutions combining multiple service capabilities.

Healthcare digitization accelerated by global health challenges opens new avenues for specialized healthcare IT services, telemedicine solutions, and health data analytics. Indian companies with healthcare domain expertise are well-positioned to capture market share in this rapidly expanding sector, particularly in areas such as electronic health records and patient management systems.

Sustainability and green technology initiatives create demand for specialized software solutions supporting environmental compliance, energy management, and carbon footprint reduction. Indian companies can develop expertise in sustainability-focused software services to address growing corporate environmental responsibilities and regulatory requirements.

Competitive dynamics within the India software services export market continue to evolve as companies adapt to changing client expectations and technological disruptions. The market demonstrates increasing consolidation among mid-tier players while maintaining space for specialized niche providers to thrive in specific technology domains or industry verticals.

Client relationship models are shifting toward strategic partnerships rather than traditional vendor relationships, with Indian companies investing in deeper client engagement and outcome-based service delivery. This evolution requires enhanced business consulting capabilities and industry expertise beyond pure technical skills, driving organizational transformation across the sector.

Technology disruption continues to reshape service delivery approaches, with automation, artificial intelligence, and low-code platforms changing traditional development methodologies. Indian companies are adapting by incorporating these technologies into their service offerings while retraining their workforce to handle higher-value activities that complement automated processes.

Pricing pressures remain constant as clients seek greater value from their technology investments, forcing Indian service providers to optimize their operational efficiency and demonstrate clear return on investment for their services. Companies are responding by developing outcome-based pricing models and performance guarantees that align provider incentives with client success metrics.

Comprehensive market analysis for the India software services export sector employs multiple research methodologies to ensure accuracy and reliability of insights. Primary research activities include extensive interviews with industry executives, client organizations, and technology experts to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of industry reports, government statistics, company financial disclosures, and technology trend studies from reputable sources. This approach provides quantitative foundation for market assessments while identifying emerging patterns and potential disruptions that may impact future market development.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and assumptions. MarkWide Research employs rigorous analytical frameworks to ensure consistency and reliability of market intelligence while maintaining objectivity in assessment and projection development.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop realistic projections for market growth and evolution. The methodology considers multiple variables including technological change, competitive dynamics, regulatory impacts, and macroeconomic factors that influence market performance.

North American markets continue to represent the largest destination for Indian software services exports, accounting for approximately 62% of total export revenues. The region’s mature technology adoption, substantial IT budgets, and openness to offshore service delivery models make it an attractive market for Indian companies across all service categories. Digital transformation initiatives in North American enterprises drive consistent demand for specialized services.

European markets demonstrate steady growth in adoption of Indian software services, with particular strength in the United Kingdom, Germany, and Nordic countries. European clients increasingly value the combination of technical expertise and regulatory compliance capabilities that Indian companies provide, especially in highly regulated industries such as financial services and healthcare.

Asia-Pacific expansion represents a significant growth opportunity, with regional revenues growing at 11.7% annually as local enterprises invest in digital modernization. Countries such as Australia, Japan, and Singapore offer substantial potential for Indian service providers, while emerging markets in Southeast Asia present longer-term expansion opportunities.

Middle East and Africa markets show increasing receptivity to Indian software services, driven by government digitization initiatives and private sector modernization efforts. The region’s growing technology investments and infrastructure development projects create opportunities for Indian companies to establish strategic partnerships and long-term client relationships.

Market leadership in India’s software services export sector is characterized by a diverse ecosystem of companies ranging from large multinational corporations to specialized boutique firms. The competitive landscape demonstrates healthy competition across different service categories and client segments, fostering innovation and service quality improvements throughout the industry.

Competitive differentiation increasingly focuses on specialized capabilities, industry expertise, and innovative service delivery models rather than pure cost competition. Companies are investing in developing unique intellectual property and proprietary platforms to create sustainable competitive advantages in their target market segments.

Service category segmentation reveals diverse revenue streams within India’s software services export market, with traditional application development and maintenance services continuing to generate substantial revenues while newer digital services categories show rapid growth rates and higher profit margins.

By Service Type:

By Industry Vertical:

By Delivery Model:

Application development services remain the cornerstone of India’s software services export market, with companies demonstrating expertise across multiple programming languages, frameworks, and development methodologies. Agile development practices have become standard, with Indian teams successfully implementing DevOps and continuous integration approaches that accelerate time-to-market for client applications.

Cloud services category shows exceptional growth momentum, with cloud-related services growing at 18.5% annually as enterprises accelerate their cloud adoption strategies. Indian companies have developed comprehensive capabilities spanning cloud strategy, migration, and ongoing management across major cloud platforms including Amazon Web Services, Microsoft Azure, and Google Cloud Platform.

Data analytics and artificial intelligence services represent high-growth, high-value segments where Indian companies are building specialized expertise. The category encompasses business intelligence, predictive analytics, machine learning model development, and AI-powered automation solutions that help clients extract actionable insights from their data assets.

Cybersecurity services have emerged as a critical category driven by increasing global security threats and regulatory compliance requirements. Indian companies are investing heavily in security expertise, developing capabilities in threat detection, incident response, and security architecture design to address growing client concerns about data protection and system security.

Cost optimization advantages remain a fundamental benefit for global clients engaging Indian software service providers, with typical cost savings ranging from 30% to 60% compared to domestic alternatives while maintaining comparable quality standards. These cost efficiencies enable clients to allocate resources to strategic initiatives while ensuring essential technology operations continue effectively.

Access to specialized expertise provides clients with capabilities that may be difficult or expensive to develop internally, particularly in emerging technologies such as artificial intelligence, blockchain, and advanced analytics. Indian companies invest heavily in training and certification programs, ensuring their teams maintain current knowledge of evolving technology landscapes.

Scalability and flexibility offered by Indian service providers enable clients to adjust their technology resources based on business requirements without the overhead of permanent staff expansion or reduction. This flexibility proves particularly valuable for organizations with seasonal demand patterns or project-based technology requirements.

Time zone advantages facilitate round-the-clock development and support activities, enabling faster project completion and improved system availability for global operations. The ability to provide continuous coverage across multiple time zones enhances client satisfaction and operational efficiency.

Quality assurance standards maintained by leading Indian software service providers meet or exceed international benchmarks, with many companies achieving certifications such as CMMI Level 5, ISO 27001, and industry-specific compliance standards that provide clients with confidence in service delivery quality and security.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration has become a dominant trend across the India software services export market, with companies incorporating AI capabilities into traditional service offerings to enhance efficiency and deliver innovative solutions. Machine learning algorithms are being deployed for predictive maintenance, automated testing, and intelligent data processing, creating new value propositions for clients.

Platform-based service delivery is gaining momentum as Indian companies develop proprietary platforms and frameworks that accelerate project delivery while reducing costs. These platforms enable standardized approaches to common business challenges while maintaining flexibility for customization based on specific client requirements.

Outcome-based pricing models are increasingly replacing traditional time-and-materials contracts, with Indian service providers accepting greater responsibility for project success and business outcomes. This trend reflects growing client confidence in Indian capabilities and the industry’s maturation toward strategic partnership models.

Sustainability focus is emerging as companies develop green technology solutions and implement environmentally responsible practices in their operations. Carbon footprint reduction initiatives and sustainable software development practices are becoming important differentiators in client selection processes.

Hybrid workforce models combining onshore, offshore, and nearshore resources are becoming standard practice, optimizing cost efficiency while maintaining client proximity and cultural alignment. This approach enables companies to leverage global talent pools while addressing specific client preferences for service delivery locations.

Strategic acquisitions continue to reshape the competitive landscape as major Indian software service providers acquire specialized companies to enhance their capabilities in emerging technology areas. Recent acquisitions have focused on artificial intelligence, cybersecurity, and industry-specific software solutions that complement existing service portfolios.

Innovation center establishments in key client markets demonstrate Indian companies’ commitment to local presence and innovation. These centers serve as hubs for research and development activities while providing platforms for closer client collaboration and market-specific solution development.

Partnership agreements with global technology vendors have expanded Indian companies’ capabilities in implementing and supporting cutting-edge technologies. Strategic alliances with cloud providers, software vendors, and technology consultancies enable Indian firms to offer comprehensive solutions that combine multiple technology components.

Talent development initiatives including university partnerships, certification programs, and continuous learning platforms address skill requirements for emerging technologies. Companies are investing heavily in reskilling existing workforce while establishing pipelines for new talent acquisition in high-demand technology areas.

Digital transformation of internal operations demonstrates Indian companies’ commitment to practicing what they preach, with investments in automation, analytics, and cloud technologies improving their own operational efficiency and service delivery capabilities.

Strategic recommendations for Indian software service exporters emphasize the importance of continuous innovation and adaptation to maintain competitive advantages in an evolving global market. MWR analysis suggests that companies should prioritize investments in emerging technologies while strengthening their core service delivery capabilities to address diverse client requirements.

Market expansion strategies should focus on geographic diversification to reduce dependence on traditional markets while exploring opportunities in emerging economies with growing technology adoption. Companies should develop market-specific approaches that consider local business practices, regulatory requirements, and cultural preferences to ensure successful expansion.

Talent management remains critical for sustained growth, with recommendations including enhanced retention programs, comprehensive training initiatives, and strategic workforce planning to address skill gaps in high-demand technology areas. Companies should invest in creating attractive career development paths that encourage long-term employee commitment.

Client relationship evolution toward strategic partnerships requires Indian companies to develop deeper business consulting capabilities and industry expertise beyond pure technical skills. This transformation enables providers to participate in client strategic planning and deliver outcomes that directly impact business performance.

Technology investment priorities should focus on automation, artificial intelligence, and platform development that enhance service delivery efficiency while creating new revenue opportunities. Companies should balance investments between current service optimization and future capability development to maintain competitive positioning.

Long-term growth prospects for India’s software services export market remain highly positive, driven by accelerating global digitalization trends and the country’s continued investments in technology infrastructure and talent development. Market projections indicate sustained expansion with growth rates expected to maintain momentum at approximately 9.1% annually over the next five years.

Technology evolution will continue reshaping service delivery approaches, with artificial intelligence, automation, and cloud-native technologies becoming integral components of standard service offerings. Indian companies that successfully integrate these technologies while maintaining their cost advantages will capture disproportionate market share in high-growth segments.

Geographic expansion will accelerate as Indian companies establish stronger presence in emerging markets while deepening their relationships in traditional strongholds. Regional market penetration is expected to increase significantly, with Asia-Pacific and Middle East regions showing particularly strong growth potential.

Industry specialization will become increasingly important as clients seek providers with deep domain expertise rather than generalist capabilities. Companies that develop specialized knowledge in specific industry verticals will command premium pricing and enjoy stronger client relationships based on their ability to understand and address sector-specific challenges.

Service portfolio evolution will continue toward higher-value offerings, with traditional services being augmented by strategic consulting, business process optimization, and outcome-based solutions. This evolution reflects the market’s maturation and Indian companies’ growing capabilities in addressing complex business challenges beyond pure technology implementation.

India’s software services export market stands at a pivotal juncture, with tremendous opportunities for continued growth and evolution driven by global digital transformation trends and the country’s established strengths in technology services delivery. The market’s successful transition from cost-focused services to value-driven solutions demonstrates the industry’s adaptability and strategic vision.

Competitive advantages including technical expertise, cost efficiency, and proven delivery capabilities provide a strong foundation for future expansion, while investments in emerging technologies and innovation ensure continued relevance in an evolving global marketplace. The sector’s resilience during economic uncertainties and its ability to adapt to changing client requirements underscore its strategic importance to India’s economy.

Future success will depend on continued innovation, strategic talent management, and the ability to evolve service offerings in response to technological disruptions and changing client expectations. Companies that successfully navigate these challenges while maintaining their core strengths will capture significant opportunities in the expanding global market for software services and establish India’s continued leadership in this critical sector.

What is India Software Services Export?

India Software Services Export refers to the provision of software development, IT services, and consulting offered by Indian companies to clients in other countries. This sector plays a crucial role in the global technology landscape, providing solutions across various industries.

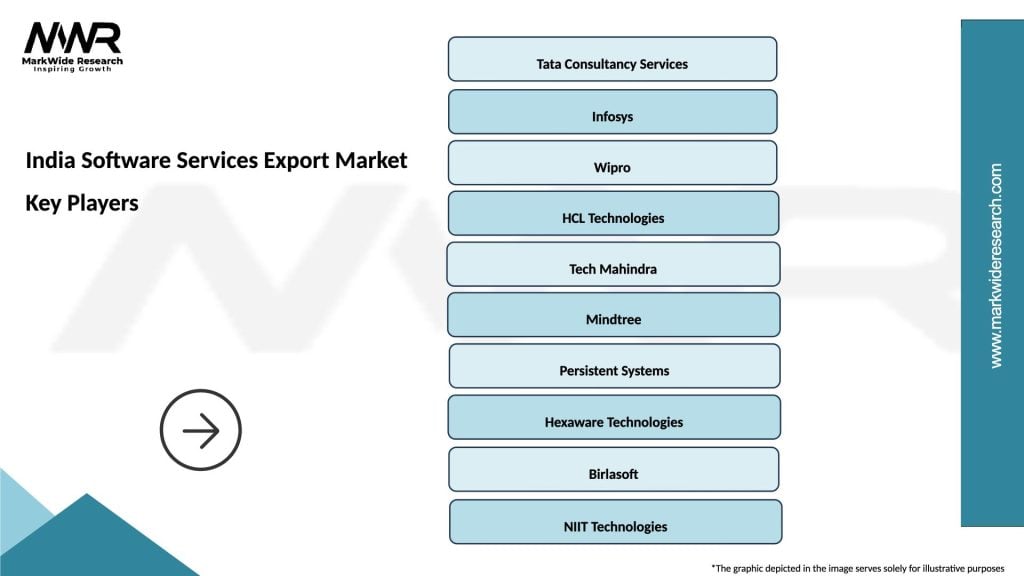

What are the key players in the India Software Services Export Market?

Key players in the India Software Services Export Market include Tata Consultancy Services, Infosys, Wipro, and HCL Technologies. These companies are known for their extensive service offerings and global reach, catering to diverse sectors such as finance, healthcare, and retail.

What are the growth factors driving the India Software Services Export Market?

The India Software Services Export Market is driven by factors such as the increasing demand for digital transformation, the rise of cloud computing, and the need for cybersecurity solutions. Additionally, the growing adoption of artificial intelligence and machine learning technologies is further propelling market growth.

What challenges does the India Software Services Export Market face?

The India Software Services Export Market faces challenges such as intense competition from other countries, fluctuating currency exchange rates, and the need for continuous skill development among the workforce. These factors can impact the sustainability and growth of the sector.

What opportunities exist in the India Software Services Export Market?

Opportunities in the India Software Services Export Market include expanding into emerging markets, leveraging advancements in automation, and enhancing service offerings in areas like data analytics and IoT. These trends can help Indian companies capture new client segments and increase their global footprint.

What trends are shaping the India Software Services Export Market?

Trends shaping the India Software Services Export Market include the increasing focus on remote work solutions, the integration of AI in service delivery, and the growing importance of sustainability in IT practices. These trends are influencing how services are developed and delivered to clients worldwide.

India Software Services Export Market

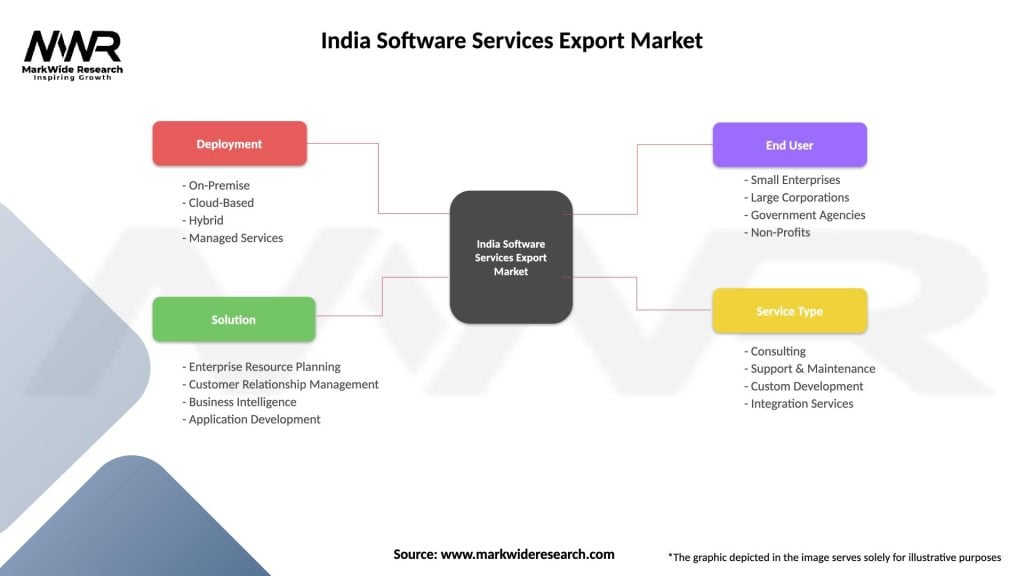

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, Managed Services |

| Solution | Enterprise Resource Planning, Customer Relationship Management, Business Intelligence, Application Development |

| End User | Small Enterprises, Large Corporations, Government Agencies, Non-Profits |

| Service Type | Consulting, Support & Maintenance, Custom Development, Integration Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Software Services Export Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at