444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

India’s small home appliances market has witnessed significant growth in recent years, driven by factors such as urbanization, rising disposable incomes, and changing consumer lifestyles. Small home appliances refer to electrical devices used for various household tasks, such as cooking, cleaning, personal grooming, and entertainment. These appliances offer convenience, efficiency, and time-saving solutions to consumers, making them an integral part of modern households.

Meaning

Small home appliances encompass a wide range of products, including kitchen appliances like blenders, toasters, and microwave ovens, as well as personal care appliances such as hairdryers, electric shavers, and grooming kits. Additionally, household appliances like vacuum cleaners, air purifiers, and water purifiers also fall under this category. These appliances are designed to simplify daily chores and enhance the overall living experience of consumers.

Executive Summary

The small home appliances market in India has experienced steady growth over the past few years, driven by factors such as increasing disposable incomes, urbanization, and the growing influence of technology in households. The market is highly competitive, with both domestic and international players vying for market share. Manufacturers are continuously innovating their products to offer improved features, energy efficiency, and smart connectivity options.

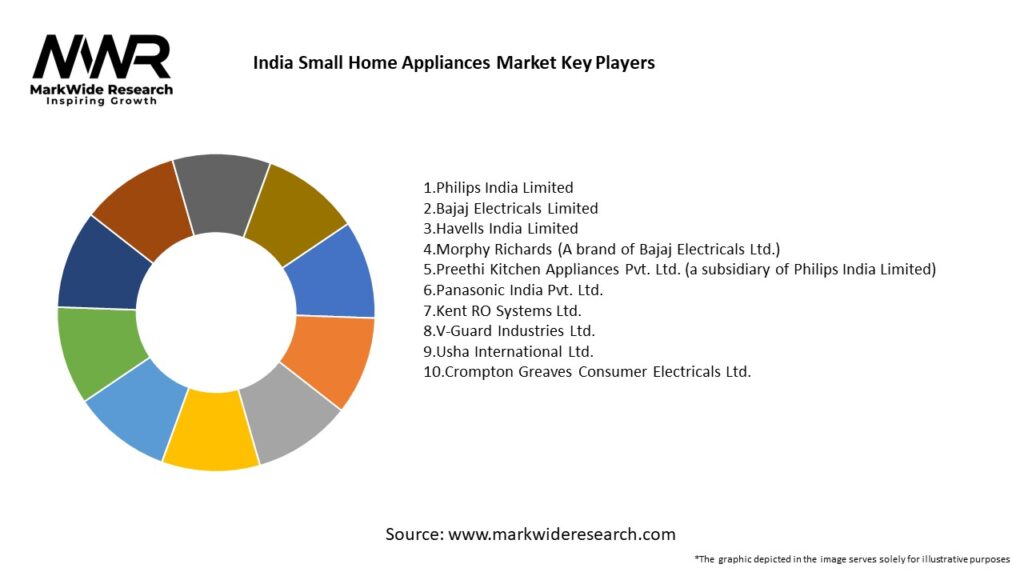

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The small home appliances market in India is highly dynamic, driven by consumer preferences, technological advancements, and competitive forces. Manufacturers need to stay agile and adapt to changing trends and customer demands to maintain a competitive edge. The market is characterized by intense competition, with both domestic and international players vying for market share by offering innovative products, competitive pricing, and effective marketing strategies.

Regional Analysis

The small home appliances market in India exhibits regional variations in terms of consumer preferences, purchasing power, and lifestyle patterns. Urban areas, especially metros and Tier I cities, account for a significant share of the market due to higher disposable incomes and greater awareness. However, the market potential in Tier II and Tier III cities is also on the rise, driven by improving living standards and increasing urbanization.

Competitive Landscape

Leading Companies in India Small Home Appliances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The small home appliances market in India can be segmented based on product type, including kitchen appliances, personal care appliances, and household appliances. Within these segments, further categorization can be made based on specific products, such as blenders, toasters, hairdryers, vacuum cleaners, and water purifiers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the small home appliances market in India. During the lockdown period, there was a surge in demand for appliances such as blenders, food processors, and air purifiers, as consumers spent more time at home and focused on cooking and maintaining a clean and healthy living environment. However, the market also witnessed disruptions in the supply chain and manufacturing due to restrictions and labor shortages. E-commerce platforms emerged as a popular channel for purchasing small home appliances during the pandemic, as consumers preferred online shopping to minimize physical contact.

Key Industry Developments

Analyst Suggestions

Future Outlook

The small home appliances market in India is expected to continue its growth trajectory in the coming years. Factors such as urbanization, rising disposable incomes, technological advancements, and changing consumer lifestyles will fuel the demand for small home appliances. The market will witness increased penetration in Tier II and Tier III cities and rural areas as awareness and affordability improve. Smart appliances will gain prominence, driven by the increasing integration of technology in households.

Conclusion

The small home appliances market in India presents significant growth opportunities for manufacturers, distributors, and retailers. The market is driven by factors such as urbanization, rising disposable incomes, changing consumer lifestyles, and technological advancements. Manufacturers need to focus on innovation, product differentiation, and expanding their distribution networks to stay competitive in this dynamic market. By addressing the needs of rural consumers, developing smart appliances, and promoting energy efficiency, industry participants can tap into the immense potential of the Indian small home appliances market.

What is Small Home Appliances?

Small home appliances refer to portable or semi-portable machines that assist in household tasks. These include items like blenders, toasters, and vacuum cleaners, which enhance convenience and efficiency in daily chores.

What are the key players in the India Small Home Appliances Market?

Key players in the India Small Home Appliances Market include companies like Philips, Bajaj Electricals, and Havells, which offer a wide range of products catering to various consumer needs, among others.

What are the growth factors driving the India Small Home Appliances Market?

The growth of the India Small Home Appliances Market is driven by increasing urbanization, rising disposable incomes, and a growing preference for convenience in cooking and cleaning tasks.

What challenges does the India Small Home Appliances Market face?

Challenges in the India Small Home Appliances Market include intense competition, fluctuating raw material prices, and the need for continuous innovation to meet changing consumer preferences.

What future opportunities exist in the India Small Home Appliances Market?

Opportunities in the India Small Home Appliances Market include the expansion of e-commerce platforms, increasing demand for energy-efficient appliances, and the potential for smart home technology integration.

What trends are shaping the India Small Home Appliances Market?

Trends in the India Small Home Appliances Market include a shift towards multifunctional devices, a growing emphasis on sustainability, and the rise of smart appliances that offer connectivity and automation.

India Small Home Appliances Market

| Segmentation Details | Description |

|---|---|

| Product Type | Microwave Ovens, Toasters, Blenders, Coffee Makers |

| End User | Residential, Commercial, Hospitality, Retail |

| Technology | Smart Appliances, Energy-Efficient, Conventional, Induction |

| Distribution Channel | Online Retail, Offline Stores, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in India Small Home Appliances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at