444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India road freight transportation market represents one of the most dynamic and rapidly evolving logistics sectors in the Asia-Pacific region. Road freight transportation serves as the backbone of India’s supply chain infrastructure, facilitating the movement of goods across diverse geographical terrains and connecting manufacturing hubs with distribution centers nationwide. The market encompasses a comprehensive ecosystem of trucking services, logistics providers, fleet operators, and technology-enabled transportation solutions that collectively support India’s growing economy.

Market dynamics indicate robust growth driven by increasing industrial production, expanding e-commerce activities, and government initiatives promoting infrastructure development. The sector demonstrates remarkable resilience with consistent annual growth rates exceeding industry benchmarks across emerging markets. Digital transformation initiatives are revolutionizing traditional freight operations, introducing advanced fleet management systems, route optimization technologies, and real-time tracking capabilities that enhance operational efficiency by approximately 25-30%.

Infrastructure modernization continues to reshape the competitive landscape, with dedicated freight corridors, improved highway networks, and strategic logistics parks creating new opportunities for market expansion. The integration of sustainable transportation practices and alternative fuel technologies positions the market for long-term growth while addressing environmental concerns and regulatory compliance requirements.

The India road freight transportation market refers to the comprehensive ecosystem of commercial vehicle operations, logistics services, and freight movement activities conducted via road networks throughout the Indian subcontinent. This market encompasses trucking services, cargo transportation, last-mile delivery solutions, and integrated logistics operations that facilitate the movement of goods between manufacturers, distributors, retailers, and end consumers across urban and rural markets.

Road freight transportation includes various service categories such as full truckload (FTL) operations, less-than-truckload (LTL) services, specialized cargo handling, temperature-controlled transportation, and express delivery solutions. The market integrates traditional fleet operations with modern technology-enabled platforms that optimize route planning, cargo matching, and supply chain visibility.

Market participants range from individual truck owners and small fleet operators to large-scale logistics companies and integrated supply chain service providers. The sector supports diverse industries including manufacturing, agriculture, retail, pharmaceuticals, automotive, and e-commerce through reliable and cost-effective freight transportation solutions.

Strategic analysis reveals the India road freight transportation market experiencing unprecedented transformation driven by digitalization, infrastructure development, and evolving customer expectations. The market demonstrates strong fundamentals with sustained growth momentum supported by increasing freight volumes, expanding industrial base, and rising consumer demand across tier-2 and tier-3 cities.

Technology adoption emerges as a critical differentiator, with fleet operators implementing GPS tracking, telematics systems, and mobile applications to enhance operational efficiency and customer service quality. Digital freight platforms are gaining significant traction, capturing approximately 15-20% market share in organized logistics segments while traditional operators adapt to technology-driven business models.

Regulatory developments including GST implementation, vehicle scrapping policies, and emission norms are reshaping market dynamics, encouraging fleet modernization and operational consolidation. Government initiatives such as the National Logistics Policy and dedicated freight corridors create favorable conditions for market expansion and efficiency improvements.

Competitive landscape features increasing consolidation as larger players acquire regional operators and technology startups, creating integrated service offerings that combine transportation, warehousing, and value-added logistics services. The market outlook remains positive with strong growth prospects driven by infrastructure investments and digital transformation initiatives.

Market intelligence indicates several transformative trends reshaping the India road freight transportation landscape. E-commerce growth continues driving demand for last-mile delivery services and express transportation solutions, with online retail contributing significantly to overall freight volumes.

Market segmentation reveals diverse opportunities across vehicle categories, cargo types, and service models, with organized players gaining market share from unorganized operators through superior service quality and technology integration.

Economic expansion serves as the primary catalyst for India road freight transportation market growth, with increasing industrial production, manufacturing output, and consumer spending driving freight demand across sectors. GDP growth correlation with freight movement demonstrates strong positive relationships, indicating sustained market expansion potential.

E-commerce proliferation creates substantial opportunities for transportation service providers, with online retail platforms requiring efficient last-mile delivery networks and express transportation capabilities. Digital commerce growth rates significantly exceed traditional retail expansion, generating new freight volumes and service requirements.

Infrastructure development initiatives including highway expansion, dedicated freight corridors, and logistics park construction enhance transportation efficiency and reduce operational costs. Government investments in road infrastructure create favorable conditions for fleet expansion and service quality improvements.

Regulatory support through favorable policies, tax reforms, and infrastructure investments creates an enabling environment for market growth and operational improvements.

Operational challenges continue to impact the India road freight transportation market, with infrastructure bottlenecks, regulatory complexities, and fragmented market structure creating barriers to efficiency and growth. Traffic congestion in urban areas significantly increases transportation costs and delivery times, affecting service quality and profitability.

Fuel price volatility represents a major cost concern for fleet operators, with diesel price fluctuations directly impacting operational margins and pricing strategies. Rising fuel costs often cannot be immediately passed to customers, creating pressure on operator profitability and cash flow management.

Regulatory compliance requirements including vehicle fitness certificates, permits, and documentation create administrative burdens and operational delays. Interstate transportation involves complex regulatory frameworks that vary across states, increasing compliance costs and operational complexity.

Technology adoption barriers including high implementation costs and limited digital literacy among traditional operators slow market modernization and efficiency improvements.

Digital transformation presents significant opportunities for India road freight transportation market participants to enhance operational efficiency, improve customer service, and develop new revenue streams. Technology integration enables data-driven decision making, predictive maintenance, and optimized resource utilization that create competitive advantages.

Government initiatives including the National Logistics Policy, PM Gati Shakti program, and infrastructure development projects create favorable conditions for market expansion and modernization. Policy support for logistics sector development includes tax incentives, infrastructure investments, and regulatory simplification measures.

Emerging market segments such as pharmaceutical logistics, cold chain transportation, and specialized cargo handling offer premium pricing opportunities and sustainable growth prospects. Value-added services including warehousing, packaging, and supply chain management create additional revenue streams beyond basic transportation.

Sustainability initiatives including carbon footprint reduction and green logistics practices position forward-thinking operators for long-term success and regulatory compliance.

Competitive dynamics in the India road freight transportation market reflect ongoing transformation from traditional, fragmented operations toward organized, technology-enabled service providers. Market consolidation trends indicate larger players acquiring regional operators and technology startups to create integrated logistics platforms with comprehensive service offerings.

Technology disruption continues reshaping operational models, with digital freight platforms, IoT-enabled tracking systems, and artificial intelligence applications improving efficiency metrics by approximately 30-35%. Customer expectations for real-time visibility, reliable delivery schedules, and competitive pricing drive continuous innovation and service enhancement initiatives.

Pricing dynamics reflect supply-demand imbalances, fuel cost fluctuations, and competitive pressures, with organized players leveraging technology and scale advantages to offer competitive rates while maintaining service quality. Market segmentation enables specialized service providers to command premium pricing for value-added offerings such as temperature-controlled transportation and express delivery services.

Regulatory evolution including vehicle emission norms, driver welfare regulations, and digital documentation requirements influence operational strategies and investment priorities. Compliance costs create barriers for smaller operators while benefiting larger, well-capitalized players with resources for regulatory adherence and fleet modernization.

Supply chain integration trends indicate increasing collaboration between transportation providers, manufacturers, and retailers to optimize end-to-end logistics performance and reduce total supply chain costs through coordinated planning and execution.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India road freight transportation market. Primary research includes extensive interviews with industry executives, fleet operators, logistics service providers, and technology vendors to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of government publications, industry reports, trade association data, and regulatory filings to establish market baselines and identify key trends. Data triangulation methods ensure consistency and accuracy across multiple information sources and research approaches.

Market modeling techniques incorporate econometric analysis, trend extrapolation, and scenario planning to develop robust market forecasts and growth projections. Statistical analysis validates data relationships and identifies significant market drivers and constraints affecting industry performance.

Quality assurance protocols include peer review processes, data validation procedures, and cross-verification of key findings to ensure research accuracy and reliability for strategic decision-making purposes.

Regional market dynamics reveal significant variations in India road freight transportation demand, infrastructure quality, and competitive landscape across different states and geographical regions. Western India including Maharashtra and Gujarat demonstrates the highest freight density, accounting for approximately 35-40% market share due to concentrated industrial activity and port connectivity.

Northern regions encompassing Delhi, Punjab, and Haryana contribute substantially to agricultural and manufacturing freight volumes, with the National Capital Region serving as a major logistics hub for distribution across North India. Highway connectivity improvements and dedicated freight corridors enhance transportation efficiency and reduce transit times significantly.

Southern India markets including Karnataka, Tamil Nadu, and Andhra Pradesh demonstrate strong growth in technology, automotive, and pharmaceutical freight transportation. Bangalore-Chennai corridor represents one of the busiest freight routes, supporting IT industry logistics and manufacturing supply chains.

Infrastructure quality varies significantly across regions, with golden quadrilateral highways and major corridors offering superior connectivity compared to rural and remote areas. Regional specialization in specific industries creates concentrated freight flows and specialized transportation requirements.

Market leadership in the India road freight transportation sector reflects a diverse ecosystem of players ranging from large integrated logistics companies to specialized regional operators and technology-enabled platforms. Competitive positioning increasingly depends on technology capabilities, service quality, and geographic coverage rather than traditional factors such as fleet size alone.

Competitive strategies emphasize technology adoption, service diversification, and strategic partnerships to create differentiated value propositions. Market consolidation continues as larger players acquire smaller operators and technology companies to enhance service capabilities and geographic reach.

Innovation focus areas include electric vehicle adoption, artificial intelligence applications, and sustainable logistics practices that address environmental concerns while improving operational efficiency and cost competitiveness.

Market segmentation analysis reveals diverse opportunities across multiple dimensions including vehicle types, cargo categories, service models, and customer segments. Vehicle segmentation encompasses light commercial vehicles, medium trucks, heavy-duty trucks, and specialized vehicles such as container carriers and refrigerated trucks.

By Vehicle Type:

By Service Model:

By End-User Industry:

E-commerce logistics represents the fastest-growing category within India road freight transportation, driven by online retail expansion and changing consumer shopping behaviors. Last-mile delivery services experience particularly strong demand, with delivery density in urban areas improving operational economics and service quality.

Manufacturing freight maintains steady growth aligned with industrial production trends, with automotive, textiles, and consumer goods sectors generating substantial transportation volumes. Supply chain optimization initiatives drive demand for integrated logistics services combining transportation, warehousing, and value-added services.

Agricultural transportation demonstrates seasonal patterns with peak demand during harvest periods and festival seasons. Cold chain logistics within agriculture shows rapid growth as food processing industries expand and consumer preferences shift toward fresh and processed foods.

Technology integration varies significantly across categories, with e-commerce and pharmaceutical logistics leading in digital adoption while traditional sectors gradually embrace technology-enabled solutions for operational efficiency improvements.

Operational efficiency improvements through technology adoption enable freight transportation companies to reduce costs, improve service quality, and enhance customer satisfaction. Digital platforms provide real-time visibility, automated documentation, and optimized routing that streamline operations and reduce manual intervention requirements.

Market expansion opportunities arise from improved infrastructure, regulatory simplification, and growing freight demand across sectors. Geographic reach extension becomes feasible through strategic partnerships, technology platforms, and network optimization strategies that connect previously underserved markets.

Revenue diversification through value-added services including warehousing, packaging, and supply chain management creates additional income streams beyond basic transportation services. Customer relationships deepen through integrated service offerings that address comprehensive logistics requirements.

Sustainability benefits include reduced carbon footprint through route optimization, fuel-efficient vehicles, and consolidated freight movements that align with environmental regulations and corporate social responsibility objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital platform adoption emerges as the most significant trend transforming India road freight transportation, with technology-enabled marketplaces connecting shippers and transporters while providing real-time visibility and automated processes. Mobile applications and cloud-based solutions democratize access to advanced logistics capabilities for small and medium operators.

Sustainability initiatives gain momentum as environmental regulations tighten and corporate customers prioritize carbon footprint reduction. Electric vehicle adoption accelerates in urban delivery segments, supported by government incentives and improving charging infrastructure availability.

Consolidation trends continue reshaping the competitive landscape as larger players acquire regional operators and technology startups to create integrated service platforms. Strategic partnerships between traditional logistics companies and technology providers enable rapid innovation and market expansion.

Customer experience focus drives development of user-friendly interfaces, transparent pricing, and proactive communication systems that enhance service quality and customer satisfaction levels significantly.

Recent developments in the India road freight transportation market reflect accelerating transformation driven by technology adoption, regulatory changes, and evolving customer requirements. Major acquisitions and strategic partnerships reshape competitive dynamics while creating integrated service platforms with enhanced capabilities.

Technology investments by leading players focus on artificial intelligence, machine learning, and IoT applications that optimize operations and improve customer service quality. MarkWide Research analysis indicates significant capital allocation toward digital transformation initiatives across market segments.

Regulatory developments including vehicle scrappage policies, emission norms, and digital documentation requirements drive fleet modernization and operational standardization. Government initiatives such as the National Logistics Policy create framework conditions for market growth and efficiency improvements.

Innovation focus areas include sustainable transportation solutions, autonomous vehicle development, and integrated supply chain platforms that address comprehensive customer logistics requirements through technology-enabled services.

Strategic recommendations for India road freight transportation market participants emphasize technology adoption, operational efficiency improvements, and customer-centric service development. Digital transformation initiatives should prioritize mobile applications, real-time tracking systems, and automated documentation processes that enhance operational efficiency and customer experience.

Market positioning strategies should focus on specialized service segments such as e-commerce logistics, pharmaceutical transportation, and cold chain services that offer premium pricing opportunities and sustainable competitive advantages. Geographic expansion into tier-2 and tier-3 cities presents significant growth potential as infrastructure improvements and economic development drive freight demand.

Partnership strategies with technology providers, financial institutions, and complementary service providers enable rapid capability development and market expansion without significant capital investment. Sustainability initiatives including electric vehicle adoption and carbon footprint reduction programs position companies for long-term regulatory compliance and customer preference alignment.

Risk management strategies should address fuel price volatility, regulatory changes, and competitive pressures through diversification, hedging mechanisms, and operational flexibility that enable adaptation to changing market conditions.

Long-term prospects for the India road freight transportation market remain highly positive, supported by sustained economic growth, infrastructure development, and digital transformation initiatives. Market evolution toward organized, technology-enabled operations creates opportunities for efficient players while challenging traditional business models.

Growth projections indicate continued expansion at rates exceeding 8-10% annually over the next five years, driven by e-commerce growth, manufacturing expansion, and improved infrastructure connectivity. Technology adoption will accelerate operational efficiency improvements and enable new service models that address evolving customer requirements.

Infrastructure investments including dedicated freight corridors, logistics parks, and highway improvements will significantly enhance transportation efficiency and reduce operational costs. MWR analysis suggests that infrastructure development will create competitive advantages for operators with strategic positioning and modern fleet capabilities.

Sustainability trends will drive adoption of electric vehicles, alternative fuels, and carbon-neutral transportation services as environmental regulations strengthen and corporate customers prioritize sustainable supply chain practices. Government support through incentives and policy frameworks will facilitate transition to cleaner transportation technologies.

Market consolidation will continue as larger players acquire smaller operators and technology companies to create integrated platforms with comprehensive service offerings. International expansion opportunities may emerge as Indian logistics companies develop capabilities and scale to compete in regional markets.

The India road freight transportation market stands at a transformative juncture, characterized by robust growth prospects, technological innovation, and evolving customer expectations. Market dynamics favor organized players with technology capabilities, operational efficiency, and customer-centric service models that address comprehensive logistics requirements.

Digital transformation emerges as the key differentiator, enabling operational optimization, cost reduction, and service quality improvements that create sustainable competitive advantages. Infrastructure development and regulatory support provide favorable conditions for market expansion and modernization initiatives.

Strategic success in this dynamic market requires balanced focus on technology adoption, service diversification, and operational excellence while maintaining financial discipline and regulatory compliance. Future opportunities lie in specialized segments, emerging markets, and sustainable transportation solutions that align with evolving industry requirements and environmental considerations.

Market participants who embrace change, invest in technology, and develop integrated service capabilities will be best positioned to capitalize on the significant growth opportunities in India’s evolving road freight transportation landscape.

What is India Road Freight Transportation?

India Road Freight Transportation refers to the movement of goods and cargo via road networks across the country. This mode of transport is crucial for logistics, connecting manufacturers, wholesalers, and retailers efficiently.

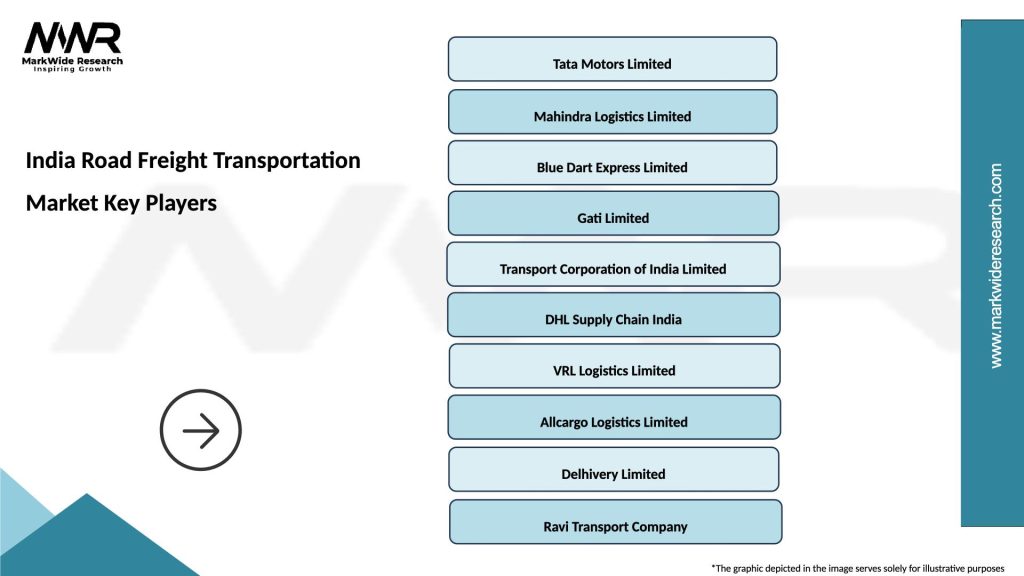

What are the key players in the India Road Freight Transportation Market?

Key players in the India Road Freight Transportation Market include companies like Gati Ltd, Blue Dart Express, and TCI Express, which provide various logistics and transportation services, among others.

What are the main drivers of the India Road Freight Transportation Market?

The main drivers of the India Road Freight Transportation Market include the growth of e-commerce, increasing demand for timely deliveries, and the expansion of infrastructure projects that enhance road connectivity.

What challenges does the India Road Freight Transportation Market face?

Challenges in the India Road Freight Transportation Market include traffic congestion, regulatory hurdles, and fluctuating fuel prices, which can impact operational efficiency and cost management.

What opportunities exist in the India Road Freight Transportation Market?

Opportunities in the India Road Freight Transportation Market include the adoption of technology for route optimization, the rise of electric vehicles for sustainable transport, and the potential for expanding logistics services in rural areas.

What trends are shaping the India Road Freight Transportation Market?

Trends shaping the India Road Freight Transportation Market include the increasing use of digital platforms for freight booking, the integration of AI for predictive analytics, and a growing focus on sustainability practices within the logistics sector.

India Road Freight Transportation Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Trucks, Trailers, Vans, Buses |

| Service Type | Full Truck Load, Less Than Truck Load, Intermodal, Dedicated Freight |

| End User | Manufacturing, E-commerce, Retail, Agriculture |

| Fuel Type | Diesel, CNG, Electric, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Road Freight Transportation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at