444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India retail fuel market has witnessed significant growth over the years. Retail fuel refers to the sale of gasoline, diesel, and other petroleum products to individual customers through various retail outlets such as petrol stations, fuel stations, and convenience stores. This market plays a crucial role in meeting the energy needs of the country and driving economic growth.

Meaning

The term “retail fuel” refers to the sale of petroleum products to individual customers through retail outlets. These outlets are commonly known as petrol stations or fuel stations, where consumers can conveniently purchase gasoline, diesel, and other related products for their vehicles. The retail fuel market serves as a vital link between oil refineries and end-users, providing a convenient and accessible source of energy for transportation.

Executive Summary

The India retail fuel market has experienced steady growth in recent years. Factors such as increasing vehicle ownership, rising disposable income, and urbanization have contributed to the growing demand for retail fuel products. The market is characterized by intense competition among players, leading to constant innovation and expansion of retail outlets. Additionally, government initiatives and policies to promote clean energy alternatives are driving the adoption of eco-friendly fuels in the retail fuel sector.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The India retail fuel market is primarily driven by several factors. Firstly, the increasing number of vehicles on the road has led to a surge in the demand for retail fuel products. As disposable income continues to rise, more individuals can afford private vehicles, thereby boosting the consumption of gasoline and diesel.

Furthermore, urbanization plays a significant role in driving the market’s growth. As cities expand and transportation infrastructure improves, the need for retail fuel outlets also increases. The rising number of petrol stations and fuel stations in urban areas caters to the growing demand for fuel among both private vehicle owners and commercial transportation services.

Moreover, government initiatives aimed at promoting clean energy alternatives have a positive impact on the retail fuel market. The introduction of policies encouraging the use of compressed natural gas (CNG), electric vehicles, and biofuels has led to increased adoption of these eco-friendly fuels. Retail fuel outlets are adapting to these changes by incorporating alternative fuel options, further driving market growth.

Market Restraints

Despite the favorable market conditions, the India retail fuel market also faces certain challenges. One of the primary restraints is the volatility of crude oil prices. Fluctuations in international oil prices directly impact the cost of fuel production, leading to uncertainty in retail fuel prices. This volatility affects both retailers and consumers, making it challenging to forecast demand and plan business strategies effectively.

Additionally, regulatory changes pose another significant restraint to the market’s stability. Government policies and regulations related to fuel quality standards, taxation, and licensing can have a substantial impact on retail fuel operations. Frequent changes in regulations require retailers to adapt quickly, which can increase operational costs and pose challenges to market players.

Market Opportunities

The India retail fuel market offers several opportunities for growth and expansion. One significant opportunity lies in the adoption of alternative fuels. As the government emphasizes the use of eco-friendly fuels, retail fuel outlets can explore partnerships and collaborations with clean energy providers. By offering a diversified range of fuel options, retailers can cater to the changing preferences of consumers and tap into new market segments.

Moreover, there is immense potential for technological advancements in the retail fuel sector. The integration of digital technologies, such as mobile payment systems, smart fueling stations, and online fuel delivery services, can enhance the customer experience and streamline operations. Retailers that embrace these innovations can gain a competitive edge and attract a larger customer base.

Market Dynamics

The India retail fuel market operates in a dynamic environment characterized by intense competition, changing consumer preferences, and evolving regulatory frameworks. Market players continuously strive to differentiate themselves by offering superior customer service, competitive pricing, and innovative fueling solutions. Expansion of retail outlets, strategic partnerships, and mergers and acquisitions are common strategies employed by companies to strengthen their market position.

Consumer behavior and preferences also play a vital role in shaping the market dynamics. As awareness about environmental sustainability increases, consumers are showing a growing interest in eco-friendly fuel options. Retailers need to adapt to these changing preferences and invest in infrastructure to support the adoption of clean energy alternatives.

Furthermore, government policies and regulations significantly influence the market dynamics. The introduction of initiatives promoting clean energy and the imposition of quality standards impact the operations and profitability of retail fuel outlets. Market players must stay updated with regulatory changes and proactively adapt their business models to comply with the evolving requirements.

Regional Analysis

The India retail fuel market exhibits regional variations in terms of market size, growth rate, and competitive landscape. The metropolitan cities, such as Mumbai, Delhi, Chennai, and Kolkata, are major hubs for retail fuel consumption due to their high population density and extensive transportation networks. These regions offer significant opportunities for market players to expand their presence and capture a larger customer base.

Moreover, with the government’s focus on infrastructure development in Tier II and Tier III cities, retail fuel demand is expected to grow in these regions as well. The expansion of highways, construction of new road networks, and increasing economic activities create favorable conditions for the establishment of retail fuel outlets. Market players that strategically target these emerging regions can gain a competitive advantage and contribute to the overall market growth.

Competitive Landscape

Leading Companies in India Retail Fuel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India retail fuel market can be segmented based on fuel type, distribution channel, and end-user.

By fuel type:

By distribution channel:

By end-user:

Category-wise Insights

Gasoline: Gasoline is the most widely used fuel for private vehicles in India. The demand for gasoline is primarily driven by the increasing number of passenger cars and motorcycles on the road. Market players focus on maintaining fuel quality, competitive pricing, and establishing a strong network of retail outlets to capture a significant market share.

Diesel: Diesel fuel is essential for commercial vehicles, including trucks, buses, and agricultural machinery. The demand for diesel is influenced by economic activities and infrastructure development. Retailers target logistics companies, public transportation providers, and industries to cater to the diesel fuel demand.

Compressed natural gas (CNG): The adoption of CNG as an alternative fuel has gained momentum in recent years. CNG is primarily used in passenger cars, taxis, and auto-rickshaws. Retail fuel outlets that offer CNG fueling services are strategically located in urban areas to cater to the growing demand from eco-conscious consumers.

Liquefied petroleum gas (LPG): LPG is commonly used as a cooking fuel in households and restaurants. Retail fuel outlets provide LPG cylinders and refilling services to meet the demand of residential and commercial consumers. Market players focus on ensuring the availability of LPG cylinders and providing efficient distribution channels.

Biofuels: Biofuels, including ethanol and biodiesel, are gaining prominence as clean energy alternatives. Market players are collaborating with biofuel producers and incorporating biofuel blending options in their retail outlets. The availability of biofuels provides consumers with environmentally friendly fuel choices.

Key Benefits for Industry Participants and Stakeholders

The India retail fuel market offers numerous benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the India retail fuel market. The nationwide lockdowns and travel restrictions imposed to contain the spread of the virus led to a sharp decline in fuel demand. With restricted mobility and reduced economic activities, the consumption of gasoline, diesel, and other fuel products dropped significantly.

The retail fuel sector faced numerous challenges during this period, including declining revenue, excess inventory, and disrupted supply chains. Many retail outlets were temporarily closed or operated with limited staff and hours of operation. The decline in fuel demand and volatile oil prices affected the profitability of market players.

However, as the restrictions eased and economic activities gradually resumed, the retail fuel market showed signs of recovery. The easing of travel restrictions and increased mobility led to a gradual improvement in fuel consumption. Market players adapted to the changing circumstances by implementing safety protocols, introducing contactless payment options, and leveraging digital technologies to enhance customer experience.

The pandemic also accelerated certain trends in the market. The focus on clean energy alternatives gained further prominence, with consumers and policymakers increasingly prioritizing environmental sustainability. Retail fuel outlets that offered alternative fuels and embraced sustainability practices were better positioned to attract customers and adapt to the evolving market landscape.

Key Industry Developments

Analyst Suggestions

Future Outlook

The India retail fuel market is poised for steady growth in the coming years. The increasing vehicle ownership, expanding transportation infrastructure, and government initiatives promoting clean energy alternatives will continue to drive market demand. The transition towards alternative fuels and the adoption of digital technologies will reshape the retail fuel sector and offer new opportunities for market players.

Additionally, the growing focus on sustainability and environmental responsibility will influence market dynamics. Retail fuel outlets that proactively invest in eco-friendly practices and offer clean energy alternatives will be better positioned to thrive in the evolving market landscape.

However, market players should remain vigilant and adapt to changing consumer preferences, technological advancements, and regulatory requirements. Continuous innovation, strategic partnerships, and customer-centric approaches will be essential for staying competitive in the dynamic retail fuel market.

Conclusion

The India retail fuel market plays a vital role in meeting the energy needs of the country and driving economic growth. With increasing vehicle ownership, rising disposable income, and urbanization, the demand for retail fuel products is on the rise. The market presents opportunities for industry participants to diversify their offerings, embrace alternative fuels, and invest in digital technologies.

However, challenges such as volatile crude oil prices and regulatory changes need to be addressed. Market players should focus on sustainability, customer-centricity, and technological advancements to stay competitive. The transition towards clean energy alternatives and the government’s initiatives in promoting sustainable practices will shape the future of the retail fuel market in India. By staying proactive and adaptive, industry participants can capitalize on the market’s growth potential and contribute to a greener and more efficient energy ecosystem.

What is Retail Fuel?

Retail fuel refers to the sale of fuel products, such as gasoline and diesel, directly to consumers through service stations and convenience stores. This sector plays a crucial role in the transportation and logistics industries, impacting daily commuting and freight movement.

What are the key players in the India Retail Fuel Market?

The India Retail Fuel Market is characterized by major companies such as Indian Oil Corporation, Bharat Petroleum, and Hindustan Petroleum. These companies dominate the market by operating extensive fuel distribution networks and service stations across the country, among others.

What are the growth factors driving the India Retail Fuel Market?

Key growth factors for the India Retail Fuel Market include the increasing demand for transportation fuels due to urbanization, rising vehicle ownership, and the expansion of logistics and e-commerce sectors. Additionally, government initiatives to improve fuel infrastructure contribute to market growth.

What challenges does the India Retail Fuel Market face?

The India Retail Fuel Market faces challenges such as fluctuating crude oil prices, regulatory changes, and competition from alternative energy sources. These factors can impact profit margins and operational stability for fuel retailers.

What opportunities exist in the India Retail Fuel Market?

Opportunities in the India Retail Fuel Market include the growing adoption of electric vehicles, which may lead to diversification in fuel offerings, and advancements in fuel technology. Additionally, expanding rural markets present new avenues for growth.

What trends are shaping the India Retail Fuel Market?

Trends in the India Retail Fuel Market include the increasing integration of digital payment systems at fuel stations, the rise of fuel loyalty programs, and a focus on sustainability through cleaner fuel options. These trends are reshaping consumer experiences and operational efficiencies.

India Retail Fuel Market

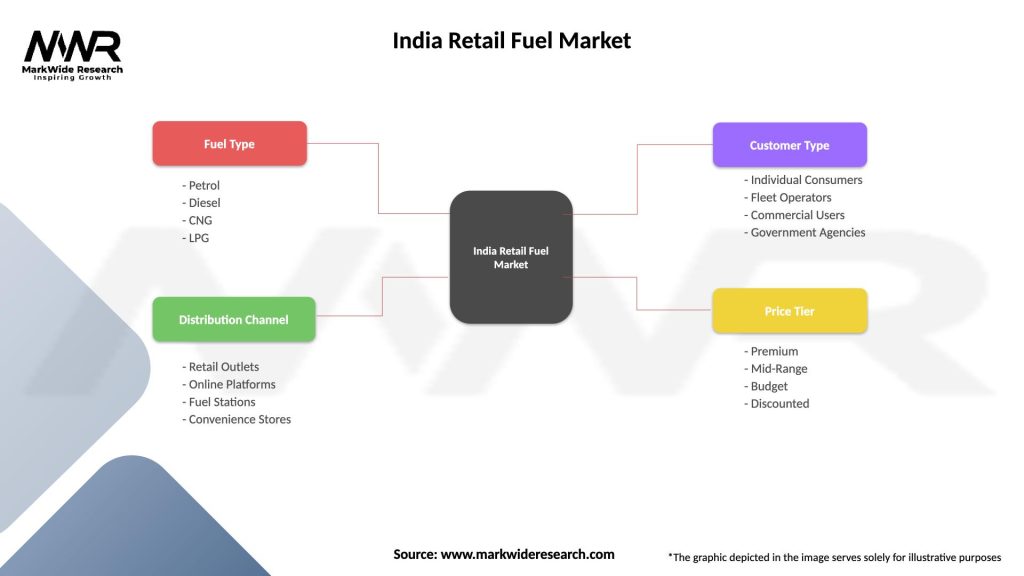

| Segmentation Details | Description |

|---|---|

| Fuel Type | Petrol, Diesel, CNG, LPG |

| Distribution Channel | Retail Outlets, Online Platforms, Fuel Stations, Convenience Stores |

| Customer Type | Individual Consumers, Fleet Operators, Commercial Users, Government Agencies |

| Price Tier | Premium, Mid-Range, Budget, Discounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in India Retail Fuel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at