444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India residential real estate industry represents one of the most dynamic and rapidly evolving property markets in the global economy. This sector encompasses the development, construction, marketing, and sale of residential properties across urban and suburban areas throughout India. The market has experienced significant transformation over the past decade, driven by urbanization trends, demographic shifts, and evolving consumer preferences.

Market dynamics indicate substantial growth potential, with the industry experiencing a compound annual growth rate (CAGR) of approximately 8.5% over recent years. This growth trajectory reflects increasing demand from both end-users and investors, supported by favorable government policies and infrastructure development initiatives. The sector has demonstrated remarkable resilience despite economic challenges, maintaining its position as a cornerstone of India’s economic development.

Regional distribution shows that metropolitan cities continue to dominate market activity, accounting for approximately 65% of total residential transactions. However, emerging tier-2 and tier-3 cities are gaining significant traction, contributing to market diversification and expansion. The industry’s evolution reflects broader socioeconomic changes, including rising disposable incomes, changing lifestyle preferences, and increased access to housing finance.

Technology integration has become increasingly prominent, with digital platforms facilitating property discovery, virtual tours, and streamlined transaction processes. This technological advancement has enhanced market transparency and accessibility, attracting a broader demographic of potential homebuyers and investors.

The India residential real estate industry market refers to the comprehensive ecosystem encompassing all activities related to residential property development, sales, and investment within India’s geographical boundaries. This market includes various property types such as apartments, independent houses, villas, plotted developments, and affordable housing projects designed to meet diverse consumer needs and income segments.

Market participants include real estate developers, construction companies, financial institutions, property consultants, and individual investors who collectively contribute to the industry’s growth and development. The sector operates within a regulatory framework established by the Real Estate Regulation and Development Act (RERA), which has enhanced transparency and consumer protection.

Residential real estate encompasses both primary and secondary market transactions, including new project launches, resale properties, and rental markets. The industry serves multiple stakeholders, from first-time homebuyers seeking affordable housing solutions to high-net-worth individuals investing in premium residential properties.

India’s residential real estate industry continues to demonstrate robust growth momentum, supported by favorable demographic trends and government initiatives promoting homeownership. The sector has successfully navigated regulatory changes and market volatility, emerging as a more transparent and organized industry that attracts both domestic and international investment.

Key performance indicators reveal that housing demand remains strong across multiple segments, with affordable housing witnessing particularly impressive growth rates of approximately 12% annually. This segment’s expansion reflects successful government programs and increased focus on inclusive development strategies.

Market consolidation has accelerated, with established developers gaining market share through strategic acquisitions and partnerships. This trend has improved overall project quality and delivery standards while enhancing consumer confidence in the sector.

Digital transformation initiatives have revolutionized customer engagement and operational efficiency, with online property platforms experiencing over 40% growth in user engagement during recent periods. These technological advancements have streamlined property search processes and improved market accessibility for diverse consumer segments.

Market insights reveal several critical trends shaping India’s residential real estate landscape:

Demographic advantages serve as primary growth catalysts for India’s residential real estate industry. The country’s young population, increasing nuclear family formations, and rising income levels create sustained demand for residential properties across various segments and price points.

Government policy support through initiatives like Pradhan Mantri Awas Yojana (PMAY) has significantly boosted affordable housing demand. These programs provide financial assistance and incentives that make homeownership accessible to previously underserved population segments, driving substantial market expansion.

Infrastructure development projects, including metro connectivity, highway expansion, and smart city initiatives, enhance property values and attract residential development in previously underdeveloped areas. This infrastructure growth creates new residential hubs and expands market opportunities.

Financial sector evolution has improved housing finance accessibility through competitive interest rates, flexible repayment options, and streamlined approval processes. Banks and non-banking financial companies have expanded their housing loan portfolios, facilitating increased homebuying activity.

Corporate expansion and job creation in tier-2 and tier-3 cities drive residential demand as professionals relocate for employment opportunities. This trend supports market diversification beyond traditional metropolitan centers, creating balanced regional growth patterns.

Regulatory complexity continues to challenge market participants, despite RERA implementation. Varying state-level regulations and approval processes can delay project launches and increase development costs, impacting overall market efficiency and developer profitability.

Land acquisition challenges remain significant obstacles for residential developers, particularly in prime urban locations. Limited land availability, complex acquisition procedures, and escalating land costs constrain supply expansion and affect project viability.

Construction cost inflation impacts project economics and affordability. Rising material costs, labor expenses, and compliance requirements increase development costs, potentially affecting housing affordability and developer margins.

Economic volatility and interest rate fluctuations influence consumer purchasing decisions and investment patterns. Economic uncertainty can delay homebuying decisions and impact market sentiment, affecting sales velocity and inventory levels.

Environmental concerns and sustainability requirements add complexity and costs to residential development projects. Compliance with environmental regulations and green building standards, while beneficial long-term, can increase initial development expenses.

Affordable housing expansion presents substantial growth opportunities, particularly in emerging urban centers and suburban areas. Government support and increasing focus on inclusive development create favorable conditions for developers specializing in this segment.

Technology integration opportunities include PropTech solutions, smart home features, and digital marketing platforms that enhance customer experience and operational efficiency. Early adopters of innovative technologies can gain competitive advantages and market differentiation.

Sustainable development initiatives offer opportunities for developers to create environmentally responsible projects that appeal to environmentally conscious consumers. Green building certifications and energy-efficient features can command premium pricing and attract quality tenants.

Regional market expansion in tier-2 and tier-3 cities provides opportunities for established developers to diversify their portfolios and capture emerging market demand. These markets often offer better land availability and lower development costs.

Alternative investment models such as co-living spaces, senior housing, and student accommodation represent emerging opportunities that cater to specific demographic needs and lifestyle preferences, creating niche market segments with strong growth potential.

Supply-demand equilibrium varies significantly across different market segments and geographical regions. While premium housing markets in major cities may experience oversupply conditions, affordable housing segments continue to face supply shortages, creating diverse market dynamics.

Price appreciation patterns reflect local market conditions, infrastructure development, and regulatory changes. Markets with strong job growth and infrastructure investments typically experience steady price appreciation, while oversupplied markets may face pricing pressures.

Consumer behavior evolution shows increasing preference for ready-to-move properties, branded developers, and amenity-rich projects. This shift influences developer strategies and project planning, emphasizing quality and timely delivery over speculative development.

Investment patterns indicate growing interest from institutional investors, including pension funds and sovereign wealth funds, seeking exposure to India’s residential real estate sector. This institutional participation brings professional management practices and long-term capital commitment.

Market cycles demonstrate increasing stability compared to historical volatility, reflecting improved regulatory oversight and professional market practices. However, local factors continue to influence individual market performance and investment returns.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into India’s residential real estate industry. Primary research includes extensive surveys with industry stakeholders, including developers, brokers, financial institutions, and end consumers across various market segments.

Data collection processes involve structured interviews with key industry participants, focus group discussions with potential homebuyers, and detailed questionnaires administered to real estate professionals. This primary research provides current market sentiment and forward-looking perspectives.

Secondary research encompasses analysis of government publications, industry reports, regulatory filings, and company financial statements. This information provides historical context and quantitative foundations for market analysis and trend identification.

Market modeling techniques utilize statistical analysis, trend extrapolation, and econometric modeling to project future market scenarios and growth trajectories. These analytical approaches consider multiple variables including demographic trends, economic indicators, and policy changes.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert consultations, and peer review procedures. This rigorous approach maintains research quality and reliability standards throughout the analysis process.

Northern India markets, anchored by Delhi NCR, continue to dominate residential real estate activity, representing approximately 28% of national market share. This region benefits from strong economic activity, government presence, and extensive infrastructure development, supporting sustained residential demand across all segments.

Western India markets, particularly Mumbai Metropolitan Region and Pune, account for roughly 32% of total market activity. These markets attract significant investment due to strong employment opportunities, established infrastructure, and diverse housing options catering to various income segments.

Southern India markets, including Bangalore, Chennai, and Hyderabad, represent approximately 25% of national residential transactions. The region’s technology sector growth and favorable business environment drive consistent housing demand from young professionals and corporate employees.

Eastern and Central India markets are emerging as significant growth drivers, collectively accounting for the remaining 15% of market share. These regions offer attractive investment opportunities due to lower entry costs, government development initiatives, and improving infrastructure connectivity.

Tier-2 and tier-3 cities across all regions are experiencing accelerated growth, driven by corporate expansion, infrastructure development, and government initiatives promoting balanced regional development. These markets offer attractive returns and lower investment barriers compared to established metropolitan areas.

Market leadership is distributed among several established developers who have built strong brand recognition and delivery track records. The competitive landscape reflects ongoing consolidation trends and increasing emphasis on quality and customer satisfaction.

Competitive strategies emphasize brand building, customer experience enhancement, and operational efficiency improvements. Leading developers invest significantly in technology adoption, sustainability initiatives, and strategic partnerships to maintain market position.

By Property Type:

By Price Segment:

By End User:

Affordable housing segment demonstrates exceptional growth momentum, supported by government initiatives and increasing focus on inclusive development. This category benefits from subsidies, tax incentives, and streamlined approval processes that enhance project viability and consumer accessibility.

Premium housing markets show selective growth patterns, with buyers increasingly demanding quality construction, branded developers, and comprehensive amenities. This segment emphasizes location advantages, architectural design, and lifestyle features that justify premium pricing.

Apartment developments continue dominating urban markets due to land constraints and changing lifestyle preferences. Modern apartment projects offer extensive amenities, security features, and community living experiences that appeal to contemporary homebuyers.

Villa and independent house segments attract buyers seeking privacy, customization options, and larger living spaces. These properties typically command premium pricing but offer unique lifestyle benefits and potential for value appreciation.

Plotted development projects provide flexibility for buyers who prefer constructing customized homes. This segment appeals to buyers with specific architectural preferences and those seeking long-term investment opportunities in emerging locations.

Developers benefit from India’s favorable demographic trends, government policy support, and expanding market opportunities across multiple segments and regions. The industry offers potential for sustainable growth and profitability through strategic market positioning and operational excellence.

Financial institutions gain from expanding housing finance opportunities, with residential mortgages representing low-risk, high-volume business segments. The sector’s growth supports loan portfolio expansion and customer relationship development across various income segments.

Construction companies benefit from sustained demand for residential construction services, supporting revenue growth and capacity utilization. The industry’s evolution toward quality and sustainability creates opportunities for specialized construction expertise and innovative building techniques.

Technology providers find expanding opportunities in PropTech solutions, smart home technologies, and digital marketing platforms that enhance industry efficiency and customer experience. Early technology adoption can provide competitive advantages and market differentiation.

Investors gain from portfolio diversification opportunities, potential capital appreciation, and rental income generation. The sector offers various investment models catering to different risk profiles and return expectations, from direct property ownership to REIT investments.

End consumers benefit from improved housing options, enhanced transparency, and better financing accessibility. Market evolution has created more choices, competitive pricing, and higher quality standards that improve overall homebuying experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping the residential real estate industry, with virtual property tours, online booking platforms, and digital marketing strategies becoming standard practices. This trend enhances customer convenience and expands market reach beyond geographical constraints.

Sustainable development practices are gaining prominence as developers and consumers increasingly prioritize environmental responsibility. Green building certifications, energy-efficient features, and sustainable construction materials are becoming important differentiators in competitive markets.

Co-living and flexible housing models are emerging to address changing lifestyle preferences, particularly among young professionals and students. These innovative housing concepts offer affordable, community-oriented living solutions in prime urban locations.

Smart home integration is becoming increasingly common in new residential projects, with developers incorporating IoT devices, home automation systems, and digital connectivity features that appeal to tech-savvy buyers.

Wellness-focused developments emphasize health and well-being through amenities like fitness centers, meditation spaces, and air quality management systems. This trend reflects growing consumer awareness of lifestyle and health considerations in housing decisions.

MarkWide Research indicates that integrated township developments are gaining popularity, offering comprehensive living environments with residential, commercial, and recreational facilities within single projects.

Regulatory framework evolution through RERA implementation has significantly improved market transparency and consumer protection. This development has enhanced buyer confidence and encouraged more organized market practices among developers and intermediaries.

Financial sector innovations include introduction of Real Estate Investment Trusts (REITs) and fractional ownership platforms that democratize real estate investment and provide new funding sources for developers. These innovations expand investment accessibility and market participation.

Technology platform expansion has revolutionized property discovery and transaction processes, with major online platforms facilitating property search, virtual tours, and digital documentation. This development has improved market efficiency and customer experience.

Government policy initiatives continue supporting affordable housing development through various schemes and incentives. Recent policy developments focus on streamlining approval processes and providing financial assistance to both developers and homebuyers.

Infrastructure project acceleration including metro expansions, highway development, and smart city initiatives create new residential development opportunities and enhance existing property values across multiple markets.

Institutional investment growth from domestic and international investors brings professional management practices and long-term capital commitment to the residential real estate sector, supporting market maturation and stability.

Market participants should focus on customer-centric approaches that prioritize quality, transparency, and timely delivery to build brand reputation and customer loyalty in increasingly competitive markets. Successful developers will differentiate through superior customer experience and reliable project execution.

Technology adoption should be accelerated across all business functions, from customer acquisition and project management to construction monitoring and after-sales service. Early technology adopters will gain competitive advantages and operational efficiencies that support long-term success.

Geographic diversification strategies should consider emerging tier-2 and tier-3 markets that offer attractive growth opportunities with lower competition and development costs. However, market entry should be supported by thorough local market research and strategic partnerships.

Sustainability initiatives should be integrated into development strategies to meet evolving consumer preferences and regulatory requirements. Green building practices can command premium pricing while supporting long-term market positioning and brand differentiation.

Financial planning should emphasize cash flow management and access to diverse funding sources to navigate market cycles and capitalize on growth opportunities. Strong financial foundations enable sustained growth and market leadership positions.

MWR analysis suggests that successful market participants will combine operational excellence with strategic innovation to capture emerging opportunities while maintaining competitive positioning in established markets.

Long-term growth prospects for India’s residential real estate industry remain highly favorable, supported by continued urbanization, demographic advantages, and government policy support. The sector is expected to maintain robust growth momentum with projected annual growth rates of 7-9% over the next decade.

Market evolution will likely emphasize quality, sustainability, and customer experience as key differentiators. Developers who successfully adapt to changing consumer preferences and regulatory requirements will capture disproportionate market share and profitability.

Technology integration will accelerate across all industry segments, from construction techniques and project management to customer engagement and property management. Digital transformation will become essential for maintaining competitiveness and operational efficiency.

Regional market expansion will continue as tier-2 and tier-3 cities develop economic opportunities and infrastructure connectivity. This expansion will create more balanced national market development and reduce dependence on traditional metropolitan centers.

Investment patterns will likely show increased institutional participation and innovative financing models that support market growth and stability. Professional investment management will enhance overall market standards and practices.

Regulatory environment will continue evolving to enhance transparency, consumer protection, and market efficiency. These developments will support long-term market stability and investor confidence while maintaining growth momentum.

India’s residential real estate industry stands at a pivotal juncture, characterized by strong fundamentals, evolving market dynamics, and substantial growth opportunities. The sector has successfully navigated regulatory changes and market challenges, emerging as a more transparent, organized, and professionally managed industry that attracts diverse stakeholders and investment capital.

Market fundamentals remain robust, supported by favorable demographics, urbanization trends, and government policy initiatives that promote homeownership and inclusive development. The industry’s ability to adapt to changing consumer preferences and regulatory requirements positions it well for sustained long-term growth and market expansion.

Future success will depend on industry participants’ ability to embrace technology, prioritize customer satisfaction, and maintain operational excellence while navigating evolving market conditions. The India residential real estate industry offers compelling opportunities for developers, investors, and stakeholders who approach the market with strategic vision and professional execution capabilities.

What is India Residential Real Estate?

India Residential Real Estate refers to the sector that encompasses the buying, selling, and leasing of residential properties such as apartments, houses, and villas within India. This market is influenced by various factors including urbanization, population growth, and economic development.

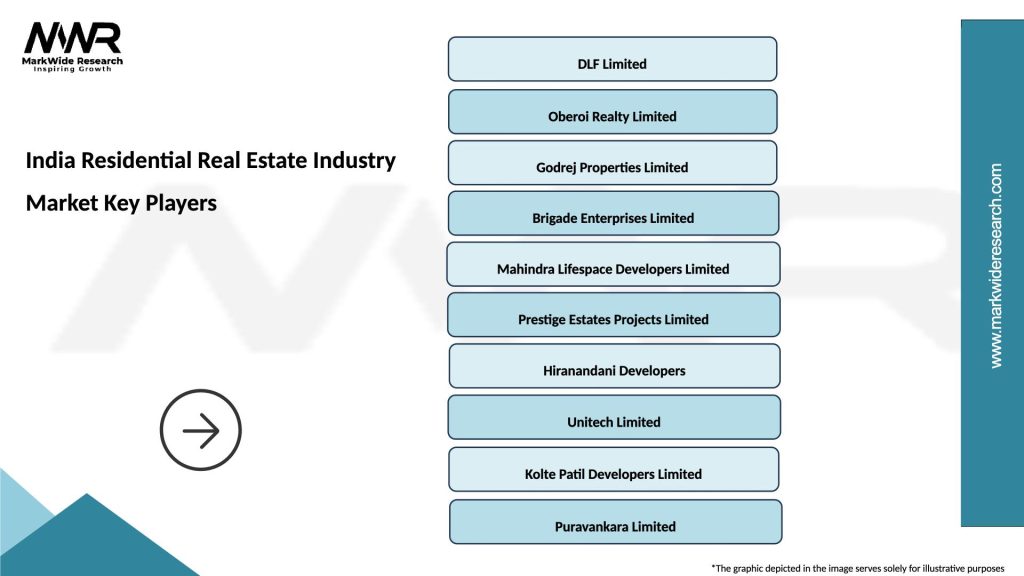

What are the key players in the India Residential Real Estate Industry Market?

Key players in the India Residential Real Estate Industry include DLF Limited, Godrej Properties, Oberoi Realty, and Brigade Enterprises, among others. These companies are involved in various aspects of residential development, including construction, sales, and property management.

What are the main drivers of the India Residential Real Estate Industry Market?

The main drivers of the India Residential Real Estate Industry include increasing urbanization, rising disposable incomes, and government initiatives aimed at promoting affordable housing. Additionally, the growing demand for residential properties in metropolitan areas contributes to market growth.

What challenges does the India Residential Real Estate Industry Market face?

The India Residential Real Estate Industry faces challenges such as regulatory hurdles, fluctuating interest rates, and land acquisition issues. These factors can hinder project timelines and increase costs for developers.

What opportunities exist in the India Residential Real Estate Industry Market?

Opportunities in the India Residential Real Estate Industry include the growing demand for sustainable housing, the rise of smart homes, and the potential for investment in tier two and tier three cities. These trends indicate a shift towards more innovative and eco-friendly residential solutions.

What trends are shaping the India Residential Real Estate Industry Market?

Trends shaping the India Residential Real Estate Industry include the increasing adoption of technology in property management, a focus on affordable housing projects, and the integration of green building practices. These trends reflect changing consumer preferences and regulatory requirements.

India Residential Real Estate Industry Market

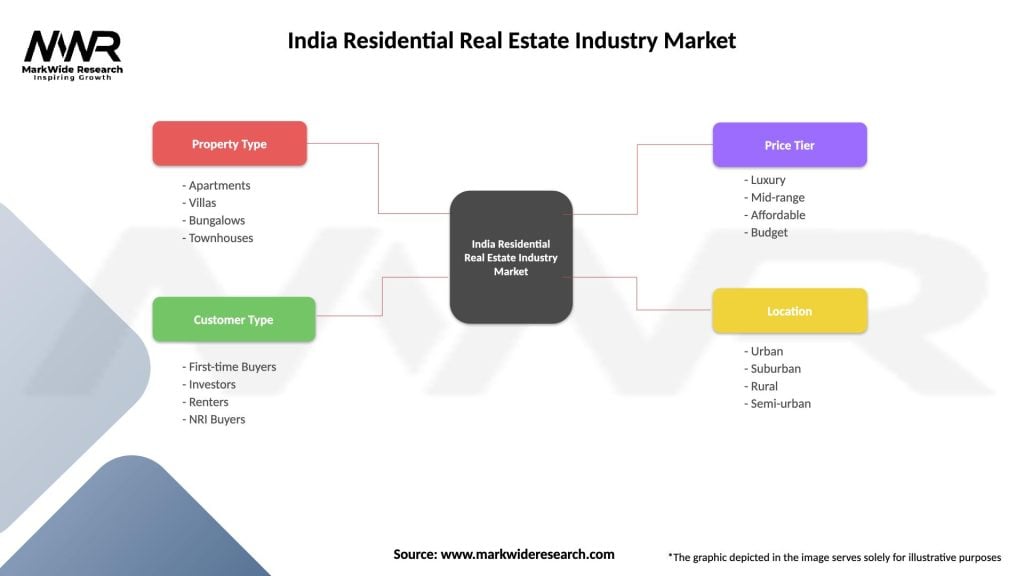

| Segmentation Details | Description |

|---|---|

| Property Type | Apartments, Villas, Bungalows, Townhouses |

| Customer Type | First-time Buyers, Investors, Renters, NRI Buyers |

| Price Tier | Luxury, Mid-range, Affordable, Budget |

| Location | Urban, Suburban, Rural, Semi-urban |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Residential Real Estate Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at