444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India real estate industry market stands as one of the most dynamic and rapidly evolving sectors in the global economy, representing a cornerstone of India’s economic development and urbanization journey. Market dynamics indicate unprecedented growth driven by demographic shifts, technological advancement, and evolving consumer preferences across residential, commercial, and industrial segments.

Residential real estate continues to dominate the landscape, accounting for approximately 70% market share while commercial and industrial segments demonstrate robust expansion patterns. The sector benefits from favorable government policies, including the Real Estate Regulation and Development Act (RERA), which has enhanced transparency and buyer confidence significantly.

Urban expansion across tier-1 and tier-2 cities drives substantial demand, with metropolitan areas experiencing consistent growth rates of 8-12% annually in property transactions. The integration of smart city initiatives and infrastructure development projects creates additional momentum for sustained market expansion.

Digital transformation revolutionizes traditional real estate operations through proptech solutions, virtual property tours, and online transaction platforms. These technological innovations streamline processes while improving customer experience and operational efficiency across the entire value chain.

The India real estate industry market refers to the comprehensive ecosystem encompassing residential, commercial, and industrial property development, sales, leasing, and management activities across the Indian subcontinent. This sector includes property developers, construction companies, real estate agents, property management firms, and related service providers.

Market participants engage in various activities including land acquisition, project development, property marketing, sales transactions, rental services, and facility management. The industry serves diverse stakeholders from individual homebuyers and investors to multinational corporations seeking office spaces and industrial facilities.

Regulatory framework governs market operations through RERA compliance, environmental clearances, and local municipal approvals. The sector operates within established legal structures ensuring transparency, accountability, and consumer protection while facilitating sustainable development practices.

Strategic analysis reveals the India real estate industry market experiencing transformational growth driven by urbanization, demographic dividend, and economic prosperity. The sector demonstrates resilience despite global economic uncertainties, maintaining steady growth trajectories across multiple segments.

Key performance indicators highlight sustained demand growth with residential segment leading market expansion at 9.5% CAGR over recent years. Commercial real estate, particularly office spaces and retail developments, shows remarkable recovery with occupancy rates improving to 85% average levels across major metropolitan areas.

Investment flows from domestic and international sources continue strengthening market fundamentals. Foreign direct investment in real estate reaches significant levels, while domestic institutional investors including pension funds and insurance companies increase their real estate allocations substantially.

Technology adoption accelerates across all market segments, with digital platforms facilitating 45% of property searches and virtual reality tools becoming standard practice for property showcasing. This technological integration enhances operational efficiency while improving customer engagement and satisfaction levels.

Market intelligence reveals several critical insights shaping the India real estate industry landscape:

Urbanization trends represent the primary catalyst driving India real estate industry growth, with rural-to-urban migration creating sustained demand for residential and commercial properties. Metropolitan areas experience consistent population growth, necessitating expanded housing stock and commercial infrastructure development.

Economic prosperity enables increased property purchasing power among middle-class families, while rising income levels support premium segment growth. The expanding services sector creates substantial demand for office spaces, retail outlets, and hospitality infrastructure across major business centers.

Government initiatives including Pradhan Mantri Awas Yojana and Smart Cities Mission provide significant market stimulus through subsidies, infrastructure development, and regulatory reforms. These programs facilitate affordable housing access while promoting sustainable urban development practices.

Financial sector support through competitive home loan rates and flexible financing options makes property ownership accessible to broader population segments. Banking sector initiatives and non-banking financial companies expand credit availability, supporting market growth across all segments.

Infrastructure development projects including metro rail networks, expressways, and airport expansions enhance property connectivity and value appreciation potential. These investments create new growth corridors while improving existing market accessibility and attractiveness.

Regulatory complexities continue challenging market participants through lengthy approval processes and compliance requirements across multiple government levels. These bureaucratic hurdles increase project timelines and development costs, potentially impacting overall market efficiency and growth rates.

High capital requirements for property development and acquisition limit market participation, particularly affecting small and medium-scale developers. Land acquisition costs in prime locations create significant barriers to entry while constraining affordable housing development initiatives.

Economic volatility influences buyer sentiment and investment decisions, with interest rate fluctuations affecting affordability and demand patterns. Global economic uncertainties create cautious investor behavior, potentially slowing market momentum during challenging periods.

Construction challenges including skilled labor shortages, raw material price volatility, and environmental compliance requirements increase project costs and completion timelines. These operational constraints affect profitability while potentially impacting delivery schedules and customer satisfaction.

Market oversupply in certain segments and locations creates pricing pressures while extending inventory clearance periods. This imbalance affects developer cash flows and may influence future project planning and market entry strategies.

Affordable housing segment presents substantial growth opportunities driven by government support and increasing demand from lower-income groups. This segment benefits from policy incentives while addressing critical housing shortages across urban and rural markets.

Technology integration offers transformative opportunities through artificial intelligence, blockchain, and Internet of Things applications in property management and customer service. These innovations can enhance operational efficiency while creating new revenue streams and competitive advantages.

Sustainable development initiatives create opportunities for green building certifications and eco-friendly construction practices. Environmental consciousness among buyers and regulatory requirements drive demand for sustainable real estate solutions and energy-efficient properties.

Regional expansion into tier-2 and tier-3 cities provides significant growth potential with lower land costs and emerging economic opportunities. These markets offer attractive returns while benefiting from improving infrastructure and increasing urbanization rates.

Alternative investment products including REITs and fractional ownership platforms democratize real estate investment access while providing liquidity options for traditional property investments. These financial innovations expand market participation and investment diversification opportunities.

Supply-demand equilibrium varies significantly across different market segments and geographical regions, with metropolitan areas experiencing tight supply conditions while peripheral locations show balanced or oversupply situations. This dynamic creates pricing variations and investment opportunities across different market segments.

Price appreciation patterns demonstrate steady growth in established markets while emerging locations show higher volatility and potential returns. Market maturity levels influence pricing stability, with developed areas providing consistent appreciation while growth corridors offer higher risk-reward profiles.

Buyer preferences evolve toward ready-to-move properties and branded developments, influencing developer strategies and project planning approaches. Quality consciousness and amenity expectations drive premium segment growth while value-oriented segments focus on affordability and location advantages.

Investment patterns show increasing institutional participation alongside traditional individual buyers, creating market depth and stability. Professional investors bring sophisticated analysis and long-term perspectives while contributing to market professionalization and transparency improvements.

Regulatory evolution continues shaping market operations through RERA implementation and ongoing policy refinements. These changes enhance market transparency while establishing standardized practices and consumer protection mechanisms across the industry.

Comprehensive analysis employs multiple research approaches including primary data collection through industry interviews, surveys, and market observations combined with extensive secondary research from government publications, industry reports, and regulatory filings.

Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification procedures. Statistical analysis techniques provide quantitative insights while qualitative assessments offer contextual understanding of market trends and dynamics.

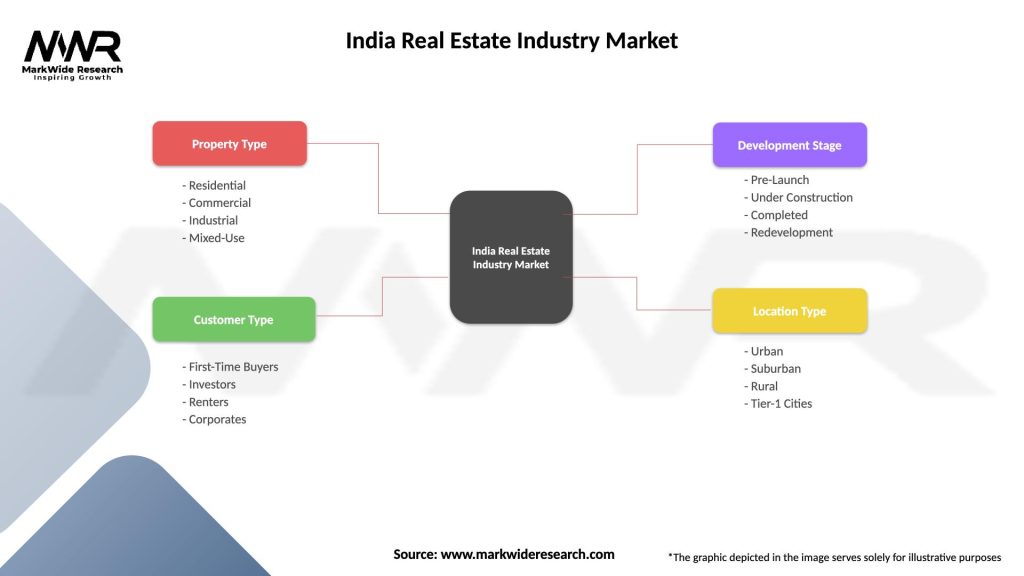

Market segmentation analysis examines residential, commercial, and industrial segments across different price points, geographical regions, and customer demographics. This detailed breakdown enables precise market understanding and targeted strategic recommendations.

Trend analysis incorporates historical data patterns with current market indicators to identify emerging opportunities and potential challenges. Forward-looking projections consider multiple scenarios while accounting for economic, regulatory, and technological variables affecting market development.

Stakeholder perspectives integrate insights from developers, investors, buyers, regulatory authorities, and industry experts to provide comprehensive market understanding. This multi-dimensional approach ensures balanced analysis and practical applicability of research findings.

Northern India markets, led by Delhi NCR, demonstrate robust growth with Gurgaon and Noida emerging as major commercial and residential hubs. The region benefits from excellent connectivity and corporate presence, driving sustained demand across all property segments with 65% market concentration in premium developments.

Western India continues dominating the real estate landscape through Mumbai Metropolitan Region and Pune markets. These areas show consistent price appreciation and high absorption rates, particularly in commercial segments where occupancy levels reach 90% in prime locations.

Southern India markets including Bangalore, Chennai, and Hyderabad experience technology sector-driven growth with strong demand for both residential and commercial properties. The region demonstrates 12% annual growth in IT park developments and associated residential projects.

Eastern India shows emerging potential with Kolkata leading regional development initiatives. Government infrastructure investments and industrial growth create new opportunities while improving market accessibility and investment attractiveness across the region.

Central India benefits from strategic location advantages and improving connectivity infrastructure. Cities like Indore and Bhopal demonstrate steady growth patterns while offering attractive investment opportunities with competitive pricing and development potential.

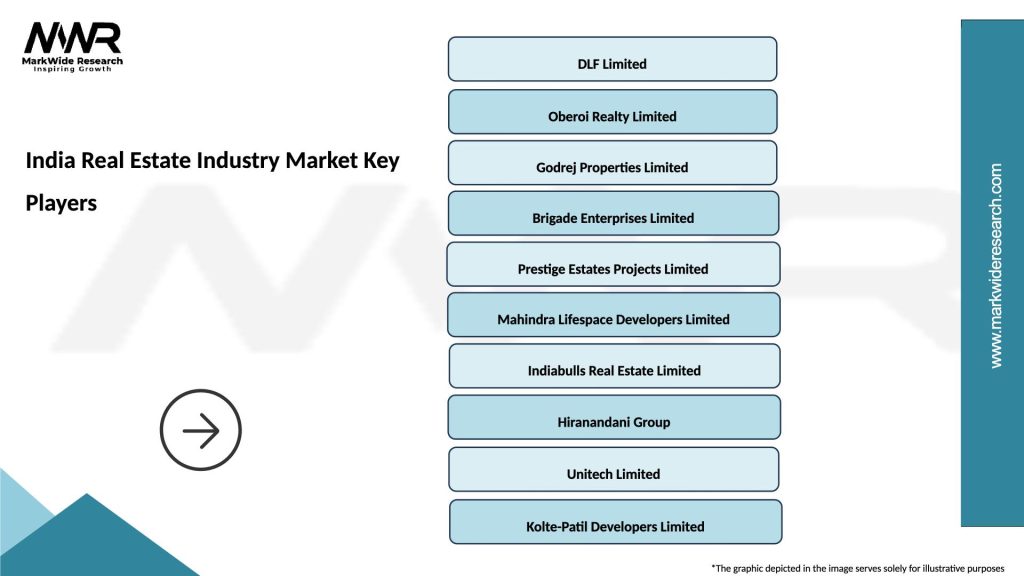

Market leadership remains distributed among several major players, each specializing in different segments and geographical regions:

Competitive strategies emphasize brand building, quality construction, timely delivery, and customer service excellence. Market leaders invest heavily in technology adoption and sustainable development practices while expanding geographical presence through strategic partnerships and acquisitions.

By Property Type:

By Price Segment:

By Geography:

Residential segment continues driving overall market growth through sustained demand from end-users and investors. Apartment developments dominate urban markets while independent houses remain popular in suburban and emerging locations. Ready-to-move properties show higher absorption rates compared to under-construction projects, reflecting buyer preference for immediate possession.

Commercial real estate demonstrates strong recovery with office spaces leading demand growth. Co-working spaces and flexible office solutions gain popularity among startups and established companies seeking operational flexibility. Grade A office spaces maintain premium pricing while suburban locations offer cost-effective alternatives with improving connectivity.

Retail real estate adapts to changing consumer behavior through experiential retail concepts and omnichannel strategies. Shopping malls integrate entertainment and dining options while neighborhood retail centers focus on convenience and accessibility. E-commerce integration influences retail space design and operational strategies significantly.

Industrial real estate benefits from manufacturing sector growth and logistics infrastructure development. Warehousing demand increases substantially due to e-commerce expansion while manufacturing facilities require modern infrastructure and connectivity. Logistics parks emerge as high-demand segments with strategic location advantages.

Hospitality segment shows gradual recovery with business travel resumption and domestic tourism growth. Hotel developments focus on operational efficiency and technology integration while service apartments cater to extended stay requirements. Asset-light models gain popularity among hospitality operators and real estate developers.

Developers benefit from sustained demand growth and improving market transparency through RERA compliance. Enhanced buyer confidence and streamlined approval processes create favorable operating conditions while technology adoption improves operational efficiency and customer engagement capabilities.

Investors gain from portfolio diversification opportunities and potential capital appreciation across different property segments. REITs and fractional ownership platforms provide liquidity options while professional property management services ensure steady rental income streams.

Buyers enjoy improved transparency, quality assurance, and consumer protection through regulatory frameworks. Competitive financing options and government incentives make property ownership more accessible while technology platforms simplify property search and transaction processes.

Financial institutions expand business opportunities through real estate lending and investment products. Growing market size and improving regulatory environment reduce risk profiles while creating new revenue streams through mortgage lending and investment banking services.

Government entities achieve urban development objectives through private sector participation and investment. Real estate sector growth contributes significantly to economic development, employment generation, and tax revenue collection while supporting infrastructure development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across all market segments with virtual property tours, online transactions, and AI-powered customer service becoming standard practices. PropTech adoption reaches 60% penetration among leading developers while blockchain technology emerges for property documentation and transaction security.

Sustainable development gains momentum through green building certifications and energy-efficient construction practices. Environmental consciousness among buyers drives demand for eco-friendly properties while regulatory requirements encourage sustainable development approaches across the industry.

Flexible workspace solutions reshape commercial real estate demand patterns with co-working spaces and hybrid office models gaining popularity. This trend influences office space design and leasing strategies while creating new business opportunities for property developers and operators.

Integrated township development becomes preferred approach for large-scale residential projects, combining housing with commercial, educational, and recreational facilities. This comprehensive development model enhances customer value while creating sustainable communities and improving project viability.

Alternative investment platforms democratize real estate investment through REITs, fractional ownership, and crowdfunding options. These financial innovations expand market participation while providing liquidity solutions for traditional property investments and portfolio diversification opportunities.

Regulatory reforms continue enhancing market transparency and consumer protection through RERA implementation and ongoing policy refinements. These developments improve market credibility while establishing standardized practices and accountability mechanisms across the industry.

Technology partnerships between real estate companies and PropTech startups accelerate innovation adoption and operational improvements. MarkWide Research analysis indicates that strategic collaborations drive efficiency gains while enhancing customer experience and competitive positioning.

Infrastructure investments including metro rail projects, expressways, and smart city initiatives create new growth corridors and enhance property values. These developments improve connectivity while opening previously inaccessible areas for real estate development and investment.

Financial sector innovations introduce new lending products and investment vehicles specifically designed for real estate sector requirements. These developments improve capital access while creating specialized financing solutions for different market segments and investor categories.

International collaborations bring global expertise and capital to Indian real estate markets through joint ventures and strategic partnerships. These alliances enhance development capabilities while introducing international best practices and quality standards to local markets.

Market participants should prioritize technology adoption and digital transformation initiatives to enhance operational efficiency and customer engagement capabilities. Investment in PropTech solutions and data analytics platforms will provide competitive advantages while improving decision-making processes and market responsiveness.

Developers should focus on quality construction, timely delivery, and customer service excellence to build brand reputation and market credibility. Sustainable development practices and green building certifications will become increasingly important for market differentiation and regulatory compliance.

Investors should consider portfolio diversification across different property segments and geographical regions to optimize risk-return profiles. MWR analysis suggests that emerging markets and alternative investment products offer attractive opportunities for long-term wealth creation and portfolio growth.

Financial institutions should develop specialized real estate financing products and investment solutions to capture growing market opportunities. Technology integration and digital lending platforms will enhance service delivery while reducing operational costs and processing timelines.

Government agencies should continue policy support and infrastructure development initiatives to sustain market growth and address housing shortages. Streamlined approval processes and regulatory clarity will encourage private sector investment while ensuring sustainable urban development practices.

Long-term prospects for the India real estate industry market remain highly positive, driven by sustained urbanization, demographic advantages, and economic growth momentum. The sector is projected to maintain robust growth trajectories with 8-10% annual expansion across key market segments over the next decade.

Technology integration will revolutionize market operations through artificial intelligence, virtual reality, and blockchain applications. These innovations will enhance customer experience while improving operational efficiency and creating new business models and revenue opportunities for market participants.

Sustainable development will become mandatory rather than optional, with environmental regulations and buyer preferences driving green building adoption. This trend will influence construction practices, material selection, and project design while creating premium market segments for eco-friendly properties.

Regional expansion into tier-2 and tier-3 cities will accelerate as infrastructure development and economic opportunities improve market accessibility and attractiveness. These emerging markets will provide significant growth potential while offering competitive advantages through lower costs and government support.

Investment diversification through REITs, fractional ownership, and alternative platforms will expand market participation while providing liquidity solutions for traditional property investments. MarkWide Research projects that these financial innovations will capture 25% market share in real estate investments within the next five years.

The India real estate industry market represents one of the most promising sectors in the global economy, characterized by sustained growth potential, technological innovation, and strong fundamental drivers. Demographic advantages, urbanization trends, and government support create favorable conditions for continued market expansion across all segments.

Market evolution toward greater transparency, quality focus, and customer-centricity positions the industry for sustainable long-term growth. Technology adoption and sustainable development practices will define competitive success while regulatory frameworks ensure market stability and consumer protection.

Strategic opportunities abound for market participants willing to embrace innovation, quality excellence, and customer service leadership. The combination of strong domestic demand, improving infrastructure, and supportive policies creates an environment conducive to sustained growth and value creation for all stakeholders in the India real estate ecosystem.

What is India Real Estate?

India Real Estate refers to the buying, selling, and development of land and properties in India, encompassing residential, commercial, and industrial segments.

What are the key players in the India Real Estate Industry Market?

Key players in the India Real Estate Industry Market include DLF Limited, Godrej Properties, and Oberoi Realty, among others.

What are the main drivers of growth in the India Real Estate Industry Market?

The main drivers of growth in the India Real Estate Industry Market include urbanization, increasing disposable incomes, and government initiatives like affordable housing schemes.

What challenges does the India Real Estate Industry Market face?

Challenges in the India Real Estate Industry Market include regulatory hurdles, fluctuating property prices, and issues related to land acquisition and financing.

What opportunities exist in the India Real Estate Industry Market?

Opportunities in the India Real Estate Industry Market include the rise of smart cities, increased demand for sustainable housing, and the growth of e-commerce driving logistics real estate.

What trends are shaping the India Real Estate Industry Market?

Trends shaping the India Real Estate Industry Market include the adoption of technology in property management, a focus on green buildings, and the increasing popularity of co-working spaces.

India Real Estate Industry Market

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Mixed-Use |

| Customer Type | First-Time Buyers, Investors, Renters, Corporates |

| Development Stage | Pre-Launch, Under Construction, Completed, Redevelopment |

| Location Type | Urban, Suburban, Rural, Tier-1 Cities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Real Estate Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at