444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Quick Service Restaurant market represents one of the most dynamic and rapidly evolving segments within the country’s food service industry. This market encompasses a diverse range of fast-food establishments, including international chains, domestic brands, and emerging cloud kitchen concepts that cater to India’s growing appetite for convenient dining solutions. Market dynamics indicate substantial growth driven by urbanization, changing consumer lifestyles, and increasing disposable income among the middle class population.

Digital transformation has become a cornerstone of market expansion, with online food delivery platforms contributing to 65% of total quick service orders in major metropolitan areas. The market demonstrates remarkable resilience and adaptability, particularly evident during the pandemic period when contactless dining and delivery services became essential business models. Consumer preferences continue to shift toward healthier menu options, regional cuisine adaptations, and premium fast-casual dining experiences.

Regional diversity characterizes the market landscape, with different states showing varying preferences for local versus international cuisine formats. The market benefits from India’s demographic dividend, with 68% of the population under 35 years representing the primary consumer base for quick service restaurants. Technology integration through mobile applications, digital payment systems, and automated ordering processes has revolutionized customer engagement and operational efficiency across the sector.

The India Quick Service Restaurant market refers to the comprehensive ecosystem of fast-food establishments that provide quick meal preparation, limited table service, and convenient dining options across various price points and cuisine categories. This market includes traditional fast-food chains, casual dining outlets with quick service models, food trucks, cloud kitchens, and delivery-only restaurant concepts that prioritize speed, convenience, and affordability for Indian consumers.

Quick Service Restaurants in the Indian context encompass both organized retail chains and unorganized local establishments that focus on rapid food preparation and service delivery. The market definition extends beyond conventional fast food to include regional cuisine adaptations, healthy food options, and premium fast-casual concepts that cater to diverse consumer preferences across urban and semi-urban markets.

Market participants range from global multinational chains adapting their menus for Indian tastes to homegrown brands that have scaled nationally, creating a competitive landscape that emphasizes innovation, localization, and customer experience optimization.

India’s Quick Service Restaurant market demonstrates exceptional growth potential driven by demographic advantages, urbanization trends, and evolving consumer behavior patterns. The market has experienced significant transformation through digital adoption, with delivery platforms becoming integral to business operations and customer acquisition strategies. Market penetration continues to expand beyond tier-1 cities into tier-2 and tier-3 markets, creating new opportunities for both established players and emerging brands.

Consumer spending patterns indicate increasing willingness to pay premium prices for quality, convenience, and unique dining experiences. The market benefits from rising disposable income levels among urban populations and changing lifestyle preferences that prioritize convenience over traditional home cooking. Health consciousness has emerged as a significant trend, with 42% of consumers actively seeking healthier menu options and transparent nutritional information.

Technology integration has become a competitive differentiator, with successful brands investing heavily in mobile applications, loyalty programs, and data analytics to enhance customer engagement and operational efficiency. The market outlook remains optimistic, supported by favorable demographic trends, infrastructure development, and continued urbanization across Indian cities.

Market dynamics reveal several critical insights that shape the competitive landscape and growth trajectory of India’s Quick Service Restaurant sector:

Demographic advantages serve as the primary catalyst for market expansion, with India’s young population demonstrating strong affinity for quick service dining options. The country’s median age of 28 years creates a substantial consumer base that values convenience, speed, and modern dining experiences. Urbanization trends continue to drive market growth, as city populations expand and traditional family structures evolve toward nuclear households with dual-income earners.

Lifestyle changes among urban consumers have fundamentally altered dining patterns, with busy work schedules and longer commute times increasing demand for convenient meal solutions. The rise of working women has particularly influenced household dining decisions, creating opportunities for quick service restaurants to position themselves as practical alternatives to home cooking. Digital connectivity has enabled seamless ordering experiences through smartphone applications and online platforms.

Infrastructure development across Indian cities has improved accessibility to quick service restaurants, while expanding delivery networks have extended market reach into previously underserved areas. Rising disposable income levels, particularly among millennials and Gen Z consumers, have increased spending capacity for dining out and food delivery services. The growing acceptance of Western cuisine alongside traditional Indian flavors has created diverse market opportunities for both international and domestic brands.

Intense competition presents significant challenges for market participants, with numerous players competing for market share through aggressive pricing strategies and promotional campaigns. The market faces pressure from both organized retail chains and unorganized local vendors who often offer similar products at lower price points. Regulatory compliance requirements, including food safety standards, licensing procedures, and tax obligations, create operational complexities and cost burdens for restaurant operators.

Supply chain challenges affect ingredient sourcing, quality consistency, and cost management, particularly for brands operating across multiple cities with varying local supplier networks. Real estate costs in prime urban locations continue to escalate, impacting profitability and expansion strategies for traditional brick-and-mortar establishments. Labor shortages and high employee turnover rates create operational disruptions and training cost burdens.

Economic sensitivity influences consumer spending patterns during periods of economic uncertainty, with discretionary dining expenses often being the first to be reduced during financial stress. Health concerns regarding processed foods and high-calorie menu items have led to increased scrutiny from health-conscious consumers and regulatory bodies, requiring significant investment in menu reformulation and nutritional transparency.

Tier-2 and tier-3 city expansion represents the most significant growth opportunity, with these markets showing increasing acceptance of quick service restaurant concepts and rising disposable income levels. Cloud kitchen models offer cost-effective expansion strategies that minimize real estate investments while maximizing delivery coverage areas. The growing demand for regional cuisine adaptations creates opportunities for brands to develop location-specific menu offerings that cater to local taste preferences.

Health-focused concepts present substantial market potential as consumer awareness about nutrition and wellness continues to increase. Technology integration opportunities include artificial intelligence for personalized menu recommendations, automated kitchen equipment for improved efficiency, and advanced analytics for demand forecasting and inventory management. Franchise models enable rapid expansion with reduced capital requirements while leveraging local entrepreneurship and market knowledge.

Corporate catering services represent an underexplored segment with significant potential, particularly as office complexes and business parks expand across Indian cities. Breakfast and snacking occasions offer opportunities to increase customer frequency and average transaction values through targeted menu development and promotional strategies. Sustainable practices and eco-friendly packaging solutions can differentiate brands while appealing to environmentally conscious consumers.

Competitive intensity continues to reshape market dynamics as established players and new entrants compete for consumer attention and market share. The market demonstrates cyclical patterns influenced by seasonal demand variations, festival periods, and economic conditions that affect consumer spending behavior. Technology disruption has fundamentally altered traditional restaurant operations, with digital platforms becoming essential for customer acquisition and retention.

Consumer behavior evolution reflects changing preferences toward premium ingredients, authentic flavors, and transparent sourcing practices. The market experiences constant innovation pressure, with brands required to regularly update menu offerings, service formats, and customer engagement strategies to maintain relevance. Delivery economics have become increasingly important as brands balance customer convenience with profitability considerations.

Regulatory environment continues to evolve with new food safety standards, environmental regulations, and labor laws that impact operational procedures and cost structures. Supply chain optimization has become critical for maintaining quality consistency and cost competitiveness across multiple locations. The market demonstrates resilience through adaptation to external challenges, including economic fluctuations, pandemic-related restrictions, and changing consumer preferences.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research involves extensive surveys and interviews with industry stakeholders, including restaurant operators, franchise partners, suppliers, and consumers across different demographic segments and geographic regions. Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements to validate primary findings.

Data collection methods include structured questionnaires administered to restaurant managers and customers, focus group discussions with target consumer segments, and in-depth interviews with industry experts and thought leaders. Market sizing calculations utilize bottom-up and top-down approaches, incorporating store count data, average transaction values, and customer frequency metrics to develop comprehensive market assessments.

Analytical frameworks include competitive benchmarking, SWOT analysis, Porter’s Five Forces assessment, and trend analysis to provide strategic insights for market participants. Quality assurance procedures involve data triangulation, expert validation, and statistical testing to ensure research findings meet professional standards for accuracy and reliability. The methodology incorporates both quantitative metrics and qualitative insights to provide a holistic understanding of market dynamics and future trends.

North India dominates the quick service restaurant landscape, with Delhi NCR representing the largest market concentration due to high population density, strong purchasing power, and established food service infrastructure. The region shows strong preference for North Indian cuisine adaptations alongside international offerings, with 35% market share of total quick service restaurant outlets. Punjab and Haryana demonstrate growing acceptance of quick service concepts, particularly in urban centers and along major highway corridors.

West India led by Mumbai and Pune markets, accounts for significant market activity with 28% of total market presence. The region exhibits sophisticated consumer preferences and willingness to experiment with diverse cuisine options. Gujarat presents unique opportunities due to vegetarian dietary preferences and growing urban populations, while Goa benefits from tourism-driven demand for quick service options.

South India represents a rapidly growing market segment with 25% market share, driven by Bangalore, Chennai, and Hyderabad metropolitan areas. The region shows strong preference for regional cuisine integration and health-conscious menu options. East India centered around Kolkata demonstrates emerging potential with increasing acceptance of quick service restaurant concepts, though market penetration remains relatively lower at 12% market share compared to other regions.

Market leadership is distributed among several key players who have established strong brand recognition and operational excellence across multiple cities. The competitive environment includes both international chains that have successfully localized their offerings and domestic brands that have scaled nationally through franchise models and strategic partnerships.

Emerging players include cloud kitchen brands, regional chains expanding nationally, and innovative concepts focusing on specific cuisine categories or dietary preferences. Competition intensity drives continuous innovation in menu development, service delivery, and customer engagement strategies.

By Cuisine Type:

By Service Model:

By Price Segment:

By Location Type:

Pizza Segment maintains strong market position with consistent demand across all age groups and geographic regions. The category benefits from successful localization strategies including Indian toppings, vegetarian options, and spice level customization. Digital ordering has become particularly important for pizza brands, with mobile applications driving customer loyalty and repeat purchases.

Burger Category demonstrates steady growth through menu innovation and value pricing strategies. Successful brands have adapted international burger concepts with Indian flavors, vegetarian patties, and regional sauce preferences. Premium burger concepts are gaining traction among urban consumers willing to pay higher prices for quality ingredients and unique flavor combinations.

Indian Fast Food represents significant opportunity as consumers seek convenient access to traditional cuisine in quick service format. Brands focusing on regional specialties, street food adaptations, and authentic flavors are experiencing strong growth. Health-conscious variants of traditional Indian dishes are attracting health-aware consumers seeking familiar flavors with improved nutritional profiles.

Coffee and Beverages category has expanded beyond traditional coffee shops to include quick service restaurants offering comprehensive beverage menus. Cold beverages and innovative drink combinations are driving category growth, particularly during summer months and in warmer climate regions.

Restaurant Operators benefit from scalable business models that enable rapid expansion with standardized operations and proven customer acquisition strategies. The quick service format allows for efficient labor utilization, reduced operational complexity, and higher table turnover rates compared to traditional dining establishments. Technology integration provides valuable customer data for personalized marketing and operational optimization.

Franchise Partners gain access to established brand recognition, proven business systems, and ongoing operational support that reduces entrepreneurial risk while providing local business ownership opportunities. Supply chain advantages through centralized procurement and quality standards ensure consistent product delivery and cost optimization.

Suppliers and Vendors benefit from stable, high-volume demand for ingredients, packaging materials, and equipment from established quick service restaurant chains. Long-term partnerships with successful brands provide revenue predictability and growth opportunities as restaurant networks expand.

Real Estate Developers find quick service restaurants to be attractive tenants that drive foot traffic to shopping centers, office complexes, and mixed-use developments. Anchor tenant benefits include reliable rental income and enhanced property value through increased commercial activity.

Technology Providers have opportunities to develop specialized solutions for point-of-sale systems, inventory management, customer relationship management, and delivery logistics optimization. Digital transformation initiatives create ongoing demand for innovative technology solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Operations have become essential for competitive success, with leading brands investing heavily in mobile applications, online ordering platforms, and customer data analytics. Contactless dining experiences gained prominence during the pandemic and continue to influence customer expectations for hygiene and convenience. Artificial intelligence applications include chatbot customer service, predictive inventory management, and personalized menu recommendations.

Health and Wellness Focus drives menu innovation toward lower-calorie options, fresh ingredients, and transparent nutritional information. Plant-based alternatives are gaining acceptance among health-conscious consumers and vegetarian demographics. Organic ingredients and locally-sourced produce are becoming differentiating factors for premium positioning strategies.

Hyperlocal Customization enables brands to adapt menu offerings, pricing strategies, and marketing messages to specific regional preferences and cultural nuances. Regional cuisine integration helps international brands gain acceptance while domestic brands expand beyond their home markets. Festival and seasonal menus create excitement and drive customer engagement throughout the year.

Sustainability Initiatives include eco-friendly packaging, waste reduction programs, and energy-efficient operations that appeal to environmentally conscious consumers. Social responsibility programs focusing on community engagement and employee welfare enhance brand reputation and customer loyalty.

Technology Integration has accelerated with major brands launching comprehensive mobile applications that integrate ordering, payment, loyalty programs, and customer feedback systems. MarkWide Research analysis indicates that successful digital transformation initiatives have resulted in 25-30% improvement in customer retention rates and operational efficiency metrics.

Cloud Kitchen Expansion has emerged as a dominant growth strategy, with established brands and new entrants investing in delivery-only operations to reduce real estate costs while expanding market coverage. Ghost kitchen networks enable multiple brand operations from single locations, optimizing kitchen utilization and delivery logistics.

Strategic Partnerships between quick service restaurants and delivery platforms have evolved into comprehensive collaborations including exclusive menu items, co-branded marketing campaigns, and shared customer data insights. Corporate acquisitions and mergers continue to reshape the competitive landscape as companies seek scale advantages and market consolidation.

Menu Innovation focuses on health-conscious options, regional flavor adaptations, and premium ingredient integration to differentiate brands and justify pricing strategies. Limited-time offers and seasonal menu items create customer excitement and drive trial of new products while maintaining core menu stability.

Market Entry Strategy should prioritize tier-2 and tier-3 cities where competition is less intense and consumer acceptance of quick service concepts is growing rapidly. Franchise models offer effective expansion strategies that leverage local market knowledge while minimizing capital requirements and operational complexity. Digital-first approach is essential for customer acquisition and retention in competitive urban markets.

Menu Development must balance international appeal with local taste preferences, incorporating regional ingredients and cooking styles that resonate with target demographics. Health-focused offerings should be integrated throughout menu categories rather than relegated to separate healthy sections. Price positioning requires careful consideration of local economic conditions and competitive landscape dynamics.

Operational Excellence demands investment in staff training, quality control systems, and supply chain optimization to ensure consistent customer experiences across multiple locations. Technology adoption should focus on customer-facing applications that enhance convenience while providing valuable data for business optimization. Sustainability practices will become increasingly important for brand differentiation and regulatory compliance.

Partnership Strategy should include delivery platform collaborations, supplier relationship optimization, and strategic alliances with complementary businesses to enhance market reach and operational efficiency. MWR recommends focusing on long-term brand building rather than short-term promotional tactics to establish sustainable competitive advantages.

Market expansion is expected to continue at a robust pace, driven by ongoing urbanization, rising disposable incomes, and evolving consumer lifestyle preferences. Tier-2 and tier-3 cities will represent the primary growth frontier, with successful brands adapting their concepts for smaller market dynamics and local preferences. Digital transformation will deepen with advanced analytics, artificial intelligence, and automation becoming standard operational tools.

Health and wellness trends will increasingly influence menu development and brand positioning strategies, with consumers demanding greater transparency in ingredient sourcing and nutritional content. Sustainability initiatives will evolve from optional differentiators to essential business practices as environmental consciousness grows among consumers and regulators.

Technology innovation will continue reshaping customer experiences through personalized recommendations, predictive ordering, and seamless omnichannel integration. Cloud kitchen models are projected to expand significantly, potentially representing 40-45% of new market entries over the next five years. Consolidation trends may accelerate as successful brands acquire smaller players to gain market share and operational scale advantages.

Consumer expectations will continue evolving toward premium experiences at accessible price points, requiring brands to innovate continuously in product quality, service delivery, and customer engagement strategies. MarkWide Research projects that brands successfully adapting to these trends will achieve sustainable competitive advantages in India’s dynamic quick service restaurant market.

India’s Quick Service Restaurant market presents exceptional opportunities for growth and innovation, supported by favorable demographic trends, increasing urbanization, and evolving consumer preferences toward convenient dining solutions. The market has demonstrated remarkable resilience and adaptability, particularly through digital transformation initiatives that have revolutionized customer engagement and operational efficiency.

Success factors include strategic market positioning, menu localization, technology integration, and operational excellence that ensures consistent quality across multiple locations. Brands that effectively balance international appeal with local preferences while maintaining competitive pricing will be best positioned for sustainable growth. Future market leaders will be those who embrace digital-first strategies, prioritize health and sustainability, and successfully expand into emerging tier-2 and tier-3 markets.

Market dynamics will continue evolving as consumer expectations rise and competition intensifies, requiring continuous innovation and strategic adaptation. The India Quick Service Restaurant market represents a compelling investment opportunity for stakeholders who understand local market nuances and can execute scalable business models that deliver value to increasingly sophisticated Indian consumers.

What is Quick Service Restaurant?

Quick Service Restaurants (QSR) are dining establishments that offer fast food and quick meals, typically with limited table service. They focus on speed, convenience, and affordability, catering to a wide range of consumers seeking quick dining options.

What are the key players in the India Quick Service Restaurant Market?

Key players in the India Quick Service Restaurant Market include Domino’s Pizza, McDonald’s, and KFC, which are known for their extensive menus and strong brand presence. These companies compete on factors such as menu variety, pricing, and customer service, among others.

What are the growth factors driving the India Quick Service Restaurant Market?

The growth of the India Quick Service Restaurant Market is driven by increasing urbanization, changing consumer lifestyles, and a growing preference for convenience foods. Additionally, the rise of food delivery services has further boosted the demand for QSRs.

What challenges does the India Quick Service Restaurant Market face?

The India Quick Service Restaurant Market faces challenges such as intense competition, fluctuating food prices, and changing consumer preferences towards healthier options. These factors can impact profitability and operational efficiency for QSRs.

What opportunities exist in the India Quick Service Restaurant Market?

Opportunities in the India Quick Service Restaurant Market include expanding into tier two and tier three cities, introducing healthier menu options, and leveraging technology for enhanced customer experience. These strategies can help QSRs tap into new customer segments.

What trends are shaping the India Quick Service Restaurant Market?

Trends shaping the India Quick Service Restaurant Market include the increasing popularity of online food ordering, the incorporation of local flavors into menus, and a focus on sustainability practices. These trends reflect changing consumer preferences and the evolving competitive landscape.

India Quick Service Restaurant Market

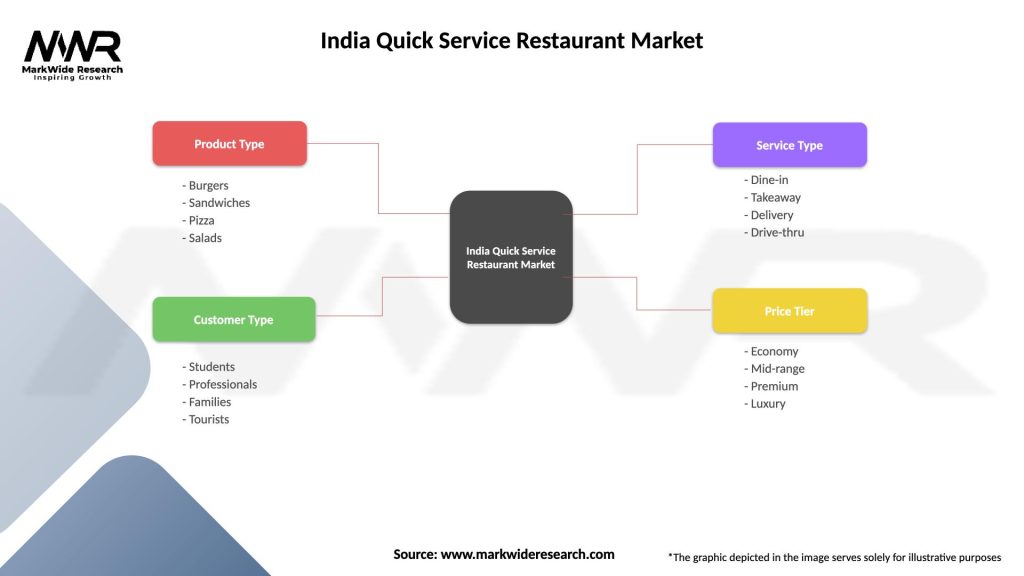

| Segmentation Details | Description |

|---|---|

| Product Type | Burgers, Sandwiches, Pizza, Salads |

| Customer Type | Students, Professionals, Families, Tourists |

| Service Type | Dine-in, Takeaway, Delivery, Drive-thru |

| Price Tier | Economy, Mid-range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Quick Service Restaurant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at