444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India preclinical CRO market represents a rapidly expanding segment within the country’s pharmaceutical and biotechnology ecosystem. Preclinical contract research organizations in India have emerged as critical partners for global pharmaceutical companies seeking cost-effective, high-quality research services for drug development and safety testing. The market encompasses a comprehensive range of services including toxicology studies, pharmacokinetic analysis, bioanalytical services, and regulatory compliance support.

Market dynamics indicate robust growth driven by increasing outsourcing trends from developed markets, India’s skilled scientific workforce, and competitive cost advantages. The sector benefits from world-class infrastructure, regulatory harmonization, and growing expertise in specialized therapeutic areas. Growth rates in the preclinical CRO segment have consistently outpaced global averages, with the market experiencing 12.5% annual growth over recent years.

Geographic distribution shows concentration in major pharmaceutical hubs including Hyderabad, Bangalore, Mumbai, and Chennai, where established CROs have developed comprehensive capabilities. The market serves both domestic pharmaceutical companies and international clients, with approximately 70% of services directed toward global markets. Service diversification has expanded beyond traditional toxicology to include specialized areas such as oncology research, immunology studies, and biosimilar development.

The India preclinical CRO market refers to the comprehensive ecosystem of contract research organizations that provide specialized laboratory services and research support for pharmaceutical and biotechnology companies during the early stages of drug development. Preclinical research encompasses all laboratory and animal studies conducted before human clinical trials to evaluate drug safety, efficacy, and pharmacological properties.

Contract research organizations in this market offer diverse services including in vitro testing, in vivo studies, toxicology assessments, pharmacokinetic analysis, and regulatory documentation support. These organizations serve as external partners for pharmaceutical companies, providing specialized expertise, infrastructure, and regulatory compliance capabilities that enable efficient drug development processes.

Market participants range from large multinational CROs with comprehensive service portfolios to specialized boutique organizations focusing on specific therapeutic areas or research methodologies. The sector plays a crucial role in India’s position as a global hub for pharmaceutical research and development, leveraging the country’s scientific talent, cost advantages, and regulatory expertise.

Strategic positioning of India’s preclinical CRO market reflects the country’s emergence as a preferred destination for pharmaceutical outsourcing. The market demonstrates strong fundamentals driven by cost competitiveness, scientific expertise, and regulatory alignment with international standards. Service expansion has evolved from basic toxicology studies to comprehensive drug development support encompassing specialized therapeutic areas.

Market segmentation reveals diverse service categories with toxicology studies representing the largest segment, followed by bioanalytical services and pharmacology research. Client distribution shows balanced demand from both domestic pharmaceutical companies and international sponsors, with 65% of revenue generated from global clients seeking cost-effective research solutions.

Competitive landscape features established players alongside emerging specialized CROs, creating a dynamic environment that fosters innovation and service excellence. Technology adoption has accelerated across the sector, with organizations investing in advanced analytical equipment, digital platforms, and automated systems to enhance efficiency and data quality.

Future trajectory indicates continued expansion driven by increasing pharmaceutical R&D outsourcing, growing complexity of drug development, and India’s strengthening position in global pharmaceutical value chains. Regulatory harmonization and quality standardization initiatives further support market growth and international acceptance of Indian preclinical research services.

Market intelligence reveals several critical insights shaping the India preclinical CRO landscape:

Market maturation is evident through improved service standardization, enhanced quality systems, and stronger regulatory compliance frameworks. Client expectations have evolved toward comprehensive service packages that combine research excellence with regulatory expertise and project management capabilities.

Primary growth drivers propelling the India preclinical CRO market include several interconnected factors that create a favorable environment for sustained expansion. Cost optimization remains a fundamental driver as pharmaceutical companies seek to reduce drug development expenses while maintaining research quality and regulatory compliance.

Outsourcing trends from developed markets continue accelerating as pharmaceutical companies focus on core competencies while leveraging specialized external expertise. Indian CROs offer significant cost advantages, with research services typically priced 40-60% lower than comparable services in developed markets, without compromising quality or regulatory standards.

Scientific talent availability represents another crucial driver, with India producing large numbers of qualified researchers, veterinarians, and laboratory professionals. The country’s educational infrastructure supports continuous talent development, ensuring adequate human resources for expanding CRO operations. English proficiency and cultural compatibility further enhance India’s attractiveness for international pharmaceutical companies.

Regulatory environment improvements have strengthened market confidence through enhanced oversight, standardized guidelines, and improved alignment with international regulatory frameworks. Government initiatives supporting pharmaceutical research and development create additional momentum for market growth. Infrastructure development in pharmaceutical clusters provides modern facilities and supporting services that enable CRO expansion.

Technology advancement and digital transformation initiatives enhance research capabilities and operational efficiency, making Indian CROs more competitive globally. Specialized expertise development in emerging therapeutic areas creates new market opportunities and service differentiation possibilities.

Market challenges facing the India preclinical CRO sector include several factors that may limit growth potential or create operational difficulties. Regulatory complexity and evolving compliance requirements demand continuous investment in quality systems and staff training, increasing operational costs and complexity.

Competition intensity has increased significantly as more organizations enter the market, leading to pricing pressure and margin compression. Client concentration in certain CROs creates dependency risks, while project cyclicality can impact revenue stability and resource utilization efficiency.

Talent retention challenges emerge as skilled professionals seek opportunities with higher compensation or career advancement prospects. Infrastructure limitations in some regions may constrain expansion possibilities, while technology investment requirements demand significant capital allocation for equipment upgrades and system modernization.

Regulatory changes in key markets can impact service demand and require adaptation of research protocols and documentation practices. Quality perception issues occasionally arise in international markets, requiring continuous efforts to demonstrate research excellence and regulatory compliance. Currency fluctuations affect pricing competitiveness and profit margins for international projects.

Intellectual property concerns and data security requirements necessitate robust protection systems and compliance frameworks. Animal welfare regulations and ethical considerations require careful management and may limit certain types of research activities.

Emerging opportunities in the India preclinical CRO market present significant potential for growth and expansion across multiple dimensions. Biosimilar development represents a rapidly growing opportunity as pharmaceutical companies seek cost-effective research support for complex biological products requiring extensive preclinical evaluation.

Specialty therapeutic areas offer differentiation opportunities for CROs willing to develop specialized expertise in areas such as rare diseases, pediatric research, and personalized medicine. Technology integration creates opportunities for organizations that invest in advanced analytical platforms, artificial intelligence, and digital research tools.

Regional expansion within India and neighboring markets provides growth avenues for established CROs seeking to broaden their geographic footprint. Service integration opportunities exist for organizations that can provide comprehensive drug development support spanning preclinical through clinical phases.

Partnership development with international pharmaceutical companies, academic institutions, and technology providers can create new business models and revenue streams. Government initiatives supporting pharmaceutical research and manufacturing create additional opportunities for CRO participation in national drug development programs.

Export market expansion to emerging pharmaceutical markets in Asia, Africa, and Latin America offers new client acquisition possibilities. Digital transformation initiatives can enhance operational efficiency and create new service delivery models that differentiate organizations in competitive markets.

Market dynamics in the India preclinical CRO sector reflect complex interactions between supply and demand factors, regulatory influences, and competitive pressures. Demand patterns show increasing preference for comprehensive service packages that combine research excellence with regulatory expertise and project management capabilities.

Supply chain evolution demonstrates growing sophistication as CROs develop specialized capabilities and form strategic partnerships to enhance service offerings. Pricing dynamics reflect competitive pressures while maintaining focus on value delivery and quality assurance. Service innovation drives differentiation as organizations develop unique capabilities in specialized therapeutic areas.

Client relationship management has become increasingly important as pharmaceutical companies seek long-term partnerships rather than transactional service arrangements. Quality expectations continue rising as international clients demand higher standards and regulatory compliance levels.

Technology adoption accelerates across the sector, with organizations investing in advanced analytical equipment, data management systems, and digital platforms to enhance research capabilities. Regulatory alignment efforts focus on harmonization with international guidelines and standards to facilitate global acceptance of research data.

Market consolidation trends emerge as larger organizations acquire specialized CROs to expand service capabilities and geographic reach. Talent mobility between organizations creates knowledge transfer and capability development across the sector.

Research approach for analyzing the India preclinical CRO market employs comprehensive methodologies combining primary research, secondary analysis, and expert consultation. Primary research involves extensive interviews with industry executives, regulatory officials, and market participants to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, and academic publications to establish market context and validate primary findings. Data triangulation ensures accuracy and reliability by cross-referencing information from multiple sources and methodologies.

Market sizing utilizes bottom-up and top-down approaches to establish comprehensive market parameters and growth projections. Competitive analysis examines market participants across multiple dimensions including service capabilities, geographic presence, client portfolios, and strategic positioning.

Trend analysis identifies emerging patterns and future developments through examination of historical data, current market conditions, and forward-looking indicators. Expert validation ensures research findings align with industry knowledge and market realities through consultation with experienced professionals and thought leaders.

Quality assurance processes include peer review, data verification, and methodology validation to maintain research standards and analytical rigor throughout the study process.

Geographic distribution of India’s preclinical CRO market reveals distinct regional concentrations and specialization patterns. Southern India dominates the market landscape, accounting for approximately 55% of market activity, with major hubs in Hyderabad, Bangalore, and Chennai offering comprehensive research capabilities and modern infrastructure.

Hyderabad has emerged as the leading preclinical research center, hosting numerous established CROs and pharmaceutical companies. The city benefits from government support, educational institutions, and infrastructure development that create a favorable ecosystem for research organizations. Bangalore contributes significantly through its biotechnology focus and technology integration capabilities.

Western India, particularly the Mumbai-Pune corridor, represents approximately 25% of market share and focuses on pharmaceutical research and regulatory services. The region benefits from proximity to major pharmaceutical companies and established research infrastructure. Ahmedabad has developed specialized capabilities in certain therapeutic areas.

Northern India accounts for roughly 15% of market activity, with Delhi and Gurgaon serving as important centers for regulatory affairs and business development activities. Eastern India represents a smaller but growing segment, with Kolkata developing niche capabilities in specific research areas.

Regional specialization has evolved based on local strengths, with some areas focusing on toxicology studies while others emphasize bioanalytical services or specialized therapeutic research. Infrastructure quality and talent availability remain key factors determining regional competitiveness and growth potential.

Market competition in India’s preclinical CRO sector features diverse participants ranging from large multinational organizations to specialized domestic companies. Competitive positioning varies based on service capabilities, therapeutic expertise, geographic presence, and client relationships.

Leading market participants include:

Competitive strategies emphasize service differentiation, quality excellence, technology adoption, and strategic partnerships. Market positioning varies from comprehensive service providers to specialized niche players focusing on specific therapeutic areas or research methodologies.

Strategic alliances and partnerships play crucial roles in competitive positioning, enabling organizations to expand capabilities and access new markets. Investment patterns show continued focus on infrastructure development, technology upgrades, and talent acquisition to maintain competitive advantages.

Market segmentation of India’s preclinical CRO sector reveals diverse service categories and client segments that define market structure and growth patterns. Service-based segmentation represents the primary classification method for understanding market dynamics and competitive positioning.

By Service Type:

By Therapeutic Area:

By Client Type:

Toxicology studies represent the largest and most established category within India’s preclinical CRO market, accounting for approximately 45% of total service revenue. This segment benefits from well-established protocols, regulatory acceptance, and comprehensive infrastructure development across major CRO facilities. Safety assessment services include acute toxicity, chronic toxicity, reproductive toxicity, and specialized studies for regulatory submissions.

Bioanalytical services constitute a rapidly growing category driven by increasing demand for pharmacokinetic analysis and biomarker research. This segment demonstrates strong growth potential as pharmaceutical companies require sophisticated analytical support for complex molecules and biosimilar development. Method development and validation services represent high-value components within this category.

Pharmacology research encompasses efficacy studies and mechanism of action research across diverse therapeutic areas. This category shows increasing specialization as CROs develop expertise in specific disease areas and research methodologies. Disease model development and translational research capabilities differentiate leading service providers.

DMPK services focus on drug metabolism and pharmacokinetics, representing a specialized but growing segment. ADME studies and drug interaction research require sophisticated analytical capabilities and specialized expertise. This category benefits from increasing complexity of drug development and regulatory requirements.

Chemistry services include analytical chemistry, formulation development, and stability studies that support drug development processes. This segment demonstrates steady growth driven by pharmaceutical companies’ need for comprehensive analytical support throughout preclinical development phases.

Pharmaceutical companies benefit significantly from engaging India’s preclinical CRO market through multiple value propositions. Cost optimization represents the primary benefit, with research services typically available at 40-60% lower costs compared to developed markets while maintaining international quality standards and regulatory compliance.

Access to expertise enables pharmaceutical companies to leverage specialized knowledge and capabilities without internal investment in infrastructure and personnel. Scalability advantages allow companies to adjust research capacity based on project requirements and development timelines. Risk mitigation occurs through partnering with experienced CROs that understand regulatory requirements and quality standards.

CRO organizations benefit from market participation through revenue diversification, capability development, and international exposure. Business growth opportunities arise from expanding client relationships and service offerings. Technology advancement occurs through client requirements and competitive pressures that drive innovation and modernization.

Government stakeholders benefit through economic development, employment generation, and positioning India as a global pharmaceutical research hub. Export revenue generation contributes to economic growth while skill development enhances the country’s human capital in pharmaceutical research.

Academic institutions benefit through collaboration opportunities, research funding, and practical training for students and researchers. Knowledge transfer between industry and academia enhances research capabilities and educational programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a fundamental trend reshaping India’s preclinical CRO market through adoption of advanced technologies and data management systems. Artificial intelligence and machine learning applications enhance research efficiency and data analysis capabilities. Cloud-based platforms improve collaboration and data sharing with international clients.

Specialization trends show CROs developing focused expertise in specific therapeutic areas or research methodologies to differentiate their service offerings. Oncology research, immunology studies, and rare disease research represent growing specialization areas. Biosimilar development has emerged as a significant trend driven by patent expirations and cost pressures.

Quality enhancement initiatives focus on achieving international accreditation and certification standards to improve global acceptance of research data. GLP compliance and regulatory harmonization efforts strengthen market credibility and client confidence.

Partnership evolution shows movement toward strategic long-term relationships rather than transactional service arrangements. Risk-sharing models and outcome-based pricing create new business models that align CRO and client interests. Integrated service delivery combines multiple research capabilities under comprehensive service packages.

Sustainability focus includes adoption of environmentally responsible practices and animal welfare considerations in research protocols. Alternative testing methods and 3R principles (replacement, reduction, refinement) influence research methodology development.

Infrastructure expansion continues across major CRO organizations with significant investments in new facilities and equipment upgrades. Syngene International has expanded its research capabilities through facility enhancements and technology adoption. GVK Biosciences has strengthened its integrated research platform through strategic investments.

Regulatory developments include enhanced guidelines for preclinical research and improved alignment with international standards. Central Drugs Standard Control Organization has implemented updated regulations supporting research quality and compliance. Animal welfare regulations have been strengthened to ensure ethical research practices.

Technology adoption accelerates across the sector with organizations investing in advanced analytical platforms, automation systems, and digital research tools. Laboratory information management systems and electronic data capture platforms improve research efficiency and data quality.

Strategic partnerships between CROs and pharmaceutical companies create new collaboration models and service delivery approaches. International expansion efforts by Indian CROs include establishing operations in key global markets to serve clients more effectively.

Talent development initiatives focus on continuous education and skill enhancement to maintain competitive advantages in specialized research areas. Academic collaborations support research capability development and knowledge transfer between industry and educational institutions.

Strategic recommendations for market participants focus on sustainable growth and competitive positioning in the evolving preclinical CRO landscape. MarkWide Research analysis suggests that organizations should prioritize quality enhancement and regulatory compliance to strengthen international market acceptance and client confidence.

Technology investment represents a critical success factor, with organizations needing to adopt advanced analytical platforms, digital research tools, and data management systems. Automation capabilities and artificial intelligence applications can enhance research efficiency and differentiate service offerings in competitive markets.

Specialization strategies should focus on developing deep expertise in high-growth therapeutic areas such as oncology, immunology, and rare diseases. Biosimilar development capabilities represent significant opportunities for organizations willing to invest in specialized infrastructure and expertise.

Partnership development should emphasize long-term strategic relationships with pharmaceutical companies rather than transactional service arrangements. Risk-sharing models and integrated service delivery can create competitive advantages and improve client retention.

Geographic expansion within India and international markets can provide growth opportunities and risk diversification. Talent retention strategies should include competitive compensation, career development opportunities, and continuous education programs to maintain skilled workforce stability.

Quality systems and regulatory compliance capabilities require continuous investment to meet evolving international standards and client expectations. Sustainability initiatives and ethical research practices will become increasingly important for market acceptance and regulatory compliance.

Market trajectory for India’s preclinical CRO sector indicates continued robust growth driven by increasing pharmaceutical outsourcing trends and India’s strengthening position in global drug development value chains. Growth projections suggest the market will maintain double-digit expansion rates over the next five years, supported by favorable market dynamics and competitive advantages.

Service evolution will continue toward greater specialization and technology integration, with organizations developing advanced capabilities in emerging therapeutic areas and research methodologies. Biosimilar development and personalized medicine research represent significant growth opportunities that will shape future market development.

Technology transformation will accelerate through adoption of artificial intelligence, machine learning, and advanced analytics that enhance research capabilities and operational efficiency. Digital platforms and cloud-based solutions will improve collaboration with international clients and data management capabilities.

Regulatory landscape evolution will continue toward greater harmonization with international standards, improving global acceptance of Indian research data and expanding market opportunities. Quality standards will become increasingly stringent, requiring continuous investment in compliance capabilities and quality systems.

Competitive dynamics will intensify as more organizations enter the market and existing players expand their capabilities. Market consolidation may occur as larger organizations acquire specialized CROs to enhance service portfolios and geographic reach. MWR projections indicate that successful organizations will be those that combine cost competitiveness with quality excellence and specialized expertise.

India’s preclinical CRO market represents a dynamic and rapidly expanding sector that plays a crucial role in global pharmaceutical research and development. The market demonstrates strong fundamentals driven by cost competitiveness, scientific expertise, and regulatory alignment that position India as a preferred destination for pharmaceutical outsourcing.

Market evolution shows continuous advancement in service capabilities, technology adoption, and quality standards that enhance competitiveness and client satisfaction. Growth opportunities in specialized therapeutic areas, biosimilar development, and technology integration provide pathways for sustainable expansion and differentiation.

Strategic success in this market requires balanced focus on cost competitiveness, quality excellence, and specialized expertise development. Organizations that invest in advanced technologies, regulatory compliance, and talent development will be best positioned to capitalize on emerging opportunities and navigate competitive challenges. The India preclinical CRO market continues to strengthen its position as a critical component of the global pharmaceutical research ecosystem, offering significant value to clients while contributing to India’s economic development and scientific advancement.

What is Preclinical CRO?

Preclinical CRO refers to Contract Research Organizations that provide services to support the development of new drugs and therapies before they enter clinical trials. These services include toxicology studies, pharmacokinetics, and efficacy testing, which are essential for regulatory approval.

What are the key players in the India Preclinical CRO Market?

Key players in the India Preclinical CRO Market include Syngene International, GVK Biosciences, and Labcorp Drug Development, among others. These companies offer a range of preclinical services to pharmaceutical and biotechnology firms.

What are the growth factors driving the India Preclinical CRO Market?

The India Preclinical CRO Market is driven by factors such as the increasing demand for drug development services, the rise in R&D investments by pharmaceutical companies, and the growing trend of outsourcing preclinical studies to specialized organizations.

What challenges does the India Preclinical CRO Market face?

Challenges in the India Preclinical CRO Market include stringent regulatory requirements, the complexity of preclinical studies, and competition from established global CROs. These factors can impact the operational efficiency and profitability of local CROs.

What opportunities exist in the India Preclinical CRO Market?

Opportunities in the India Preclinical CRO Market include the expansion of biopharmaceutical research, increased collaboration between CROs and academic institutions, and the potential for innovation in preclinical testing methodologies.

What trends are shaping the India Preclinical CRO Market?

Trends in the India Preclinical CRO Market include the adoption of advanced technologies such as artificial intelligence and machine learning for data analysis, a focus on personalized medicine, and the increasing use of in vitro and in vivo models for more accurate results.

India Preclinical CRO Market

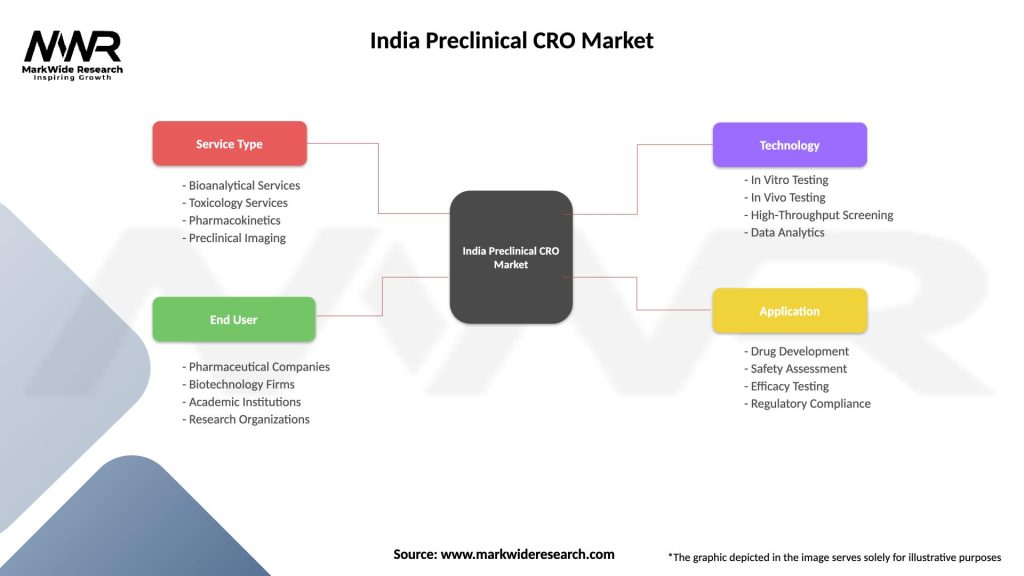

| Segmentation Details | Description |

|---|---|

| Service Type | Bioanalytical Services, Toxicology Services, Pharmacokinetics, Preclinical Imaging |

| End User | Pharmaceutical Companies, Biotechnology Firms, Academic Institutions, Research Organizations |

| Technology | In Vitro Testing, In Vivo Testing, High-Throughput Screening, Data Analytics |

| Application | Drug Development, Safety Assessment, Efficacy Testing, Regulatory Compliance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Preclinical CRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at