444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India plastic packaging film market represents one of the most dynamic and rapidly expanding segments within the country’s packaging industry. Market dynamics indicate substantial growth driven by increasing consumer demand, urbanization, and the expansion of organized retail sectors. The market encompasses various film types including polyethylene, polypropylene, polyester, and specialty films used across multiple industries.

Growth trajectories show the market experiencing robust expansion at a CAGR of 8.2%, reflecting the strong demand from food and beverage, pharmaceutical, and consumer goods sectors. Regional distribution reveals significant concentration in industrial hubs across Maharashtra, Gujarat, Tamil Nadu, and Karnataka, with emerging opportunities in tier-2 and tier-3 cities.

Technology adoption has accelerated significantly, with manufacturers investing in advanced extrusion technologies, multi-layer film production, and sustainable packaging solutions. The market benefits from favorable government policies promoting manufacturing under initiatives like Make in India, while simultaneously addressing environmental concerns through recyclable and biodegradable film innovations.

Consumer behavior shifts toward convenience packaging, e-commerce growth, and food safety awareness continue to drive demand for high-performance plastic packaging films. The market demonstrates resilience with 65% market share concentrated among organized players, while the remaining segment comprises small and medium enterprises serving regional markets.

The India plastic packaging film market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of flexible plastic films used for packaging applications across various industries in India. These films serve as protective barriers, preserving product quality, extending shelf life, and providing convenient packaging solutions for consumers and businesses.

Plastic packaging films include various polymer-based materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and specialized barrier films. These materials undergo extrusion, casting, or blown film processes to create flexible packaging solutions with specific properties like moisture resistance, oxygen barrier, printability, and heat sealability.

Market scope encompasses primary packaging films directly in contact with products, secondary packaging for bundling and protection, and tertiary packaging for transportation and storage. The market serves diverse end-use industries including food and beverages, pharmaceuticals, personal care, textiles, and industrial applications.

Value chain participants include raw material suppliers, film manufacturers, converters, brand owners, and recycling companies. The market operates through various distribution channels including direct sales, distributors, and online platforms, serving both domestic consumption and export markets across neighboring countries.

Market performance demonstrates exceptional growth momentum driven by India’s expanding consumer base, rising disposable incomes, and increasing preference for packaged goods. The market benefits from strong fundamentals including robust manufacturing capabilities, skilled workforce, and strategic geographic location for serving regional markets.

Key growth drivers include the rapid expansion of the food processing industry, pharmaceutical sector growth, e-commerce boom, and increasing awareness about food safety and hygiene. Government initiatives supporting manufacturing, foreign direct investment policies, and infrastructure development create favorable conditions for market expansion.

Technology landscape shows significant advancement with manufacturers adopting multi-layer co-extrusion technologies, barrier coating applications, and sustainable packaging innovations. Innovation focus centers on developing recyclable films, bio-based materials, and smart packaging solutions incorporating RFID and QR code technologies.

Competitive dynamics reveal a market structure with established multinational corporations, strong domestic players, and numerous regional manufacturers. Market consolidation trends indicate increasing merger and acquisition activities as companies seek to expand production capacities, enhance technological capabilities, and strengthen distribution networks.

Future prospects remain highly optimistic with projected growth rates of 12.5% annually in emerging segments like flexible pouches, stand-up pouches, and specialty barrier films. The market demonstrates resilience against economic fluctuations due to essential nature of packaging across critical industries.

Market segmentation reveals diverse applications with food packaging representing the largest segment, followed by pharmaceutical and personal care applications. Product innovation drives market differentiation with manufacturers developing specialized films for specific applications like retort pouches, vacuum packaging, and modified atmosphere packaging.

Consumer preferences increasingly favor convenient packaging formats like resealable pouches, easy-open films, and portion-controlled packaging. Brand differentiation drives demand for high-quality printing, premium finishes, and innovative packaging designs that enhance shelf appeal and consumer experience.

Supply chain optimization remains crucial with manufacturers focusing on reducing lead times, improving inventory management, and enhancing customer service capabilities. Raw material sourcing strategies emphasize securing reliable polymer supplies while managing price volatility through long-term contracts and strategic partnerships.

Demographic advantages position India as a high-growth market with a large and young population, increasing urbanization rates, and rising middle-class consumption patterns. Economic growth supports increased spending on packaged goods, convenience foods, and premium products requiring sophisticated packaging solutions.

Food processing industry expansion drives substantial demand for packaging films as manufacturers seek to extend product shelf life, ensure food safety, and meet regulatory requirements. Cold chain development creates opportunities for specialized barrier films and temperature-sensitive packaging applications.

Pharmaceutical sector growth generates consistent demand for high-quality packaging films meeting stringent regulatory standards. Generic drug manufacturing expansion, medical device production, and healthcare infrastructure development contribute to sustained market growth.

E-commerce proliferation creates new packaging requirements for protective films, tamper-evident solutions, and branded packaging experiences. Digital transformation in retail drives demand for smart packaging technologies and track-and-trace capabilities.

Government policy support through manufacturing incentives, infrastructure development, and ease of doing business reforms creates favorable operating conditions. Foreign investment inflows bring advanced technologies, best practices, and access to global markets.

Consumer lifestyle changes toward convenience, health consciousness, and premium product preferences drive demand for innovative packaging solutions. Brand consciousness increases focus on packaging aesthetics, functionality, and sustainability attributes.

Environmental concerns regarding plastic waste management and ocean pollution create regulatory pressures and consumer resistance toward conventional plastic packaging. Sustainability mandates require significant investments in alternative materials and recycling infrastructure development.

Raw material price volatility affects production costs and profit margins, particularly for petroleum-based polymers subject to crude oil price fluctuations. Supply chain disruptions from global events, trade tensions, or natural disasters impact material availability and pricing stability.

Regulatory compliance requirements across food safety, pharmaceutical standards, and environmental regulations increase operational complexity and compliance costs. Changing regulations regarding single-use plastics and packaging waste management create uncertainty for long-term planning.

Technology investment requirements for advanced manufacturing equipment, quality control systems, and research and development capabilities strain financial resources, particularly for smaller manufacturers. Skilled workforce shortages in technical roles limit production efficiency and innovation capabilities.

Competition intensity from both domestic and international players pressures pricing and profit margins. Market fragmentation with numerous small players creates pricing pressures and limits economies of scale benefits.

Infrastructure limitations in transportation, logistics, and waste management systems affect operational efficiency and environmental impact management. Power supply reliability and cost issues impact manufacturing operations and competitiveness.

Sustainable packaging presents significant growth opportunities as companies develop biodegradable films, recyclable materials, and circular economy solutions. Bio-based polymers and compostable films address environmental concerns while meeting performance requirements.

Smart packaging technologies offer differentiation opportunities through RFID integration, QR codes, temperature indicators, and freshness sensors. Digital printing capabilities enable customization, short-run production, and enhanced brand engagement.

Export market expansion leverages India’s cost advantages and manufacturing capabilities to serve regional markets in Southeast Asia, Middle East, and Africa. Trade agreements and diplomatic relations facilitate market access and competitive positioning.

Specialty applications in medical packaging, agricultural films, and industrial applications provide higher-margin opportunities. Value-added services including converting, printing, and logistics support enhance customer relationships and profitability.

Rural market penetration offers substantial growth potential as infrastructure development and income growth increase packaged goods consumption in smaller towns and villages. Distribution network expansion enables market reach and customer service improvements.

Technology partnerships with international companies provide access to advanced technologies, global best practices, and new market opportunities. Research collaborations with academic institutions drive innovation and competitive advantages.

Supply-demand equilibrium shows strong demand growth outpacing capacity expansion, creating favorable pricing conditions and investment opportunities. Capacity utilization rates averaging 82% across organized players indicate healthy market conditions and expansion potential.

Value chain integration trends show manufacturers expanding into converting operations, while converters invest in film production capabilities. Vertical integration strategies aim to capture higher margins, ensure supply security, and improve customer service.

Innovation cycles accelerate as companies invest in research and development to address sustainability challenges, performance requirements, and cost optimization. Product lifecycle management becomes crucial as market demands evolve rapidly.

Customer relationship dynamics shift toward long-term partnerships, collaborative product development, and value-added services. Supply chain collaboration improves efficiency, reduces costs, and enhances responsiveness to market changes.

Pricing mechanisms reflect raw material costs, supply-demand dynamics, and value-added features. Contract structures increasingly include price adjustment mechanisms, volume commitments, and performance guarantees.

Market consolidation continues through mergers, acquisitions, and strategic partnerships as companies seek scale advantages, technology access, and market expansion opportunities. Competitive positioning emphasizes differentiation through quality, service, and innovation rather than price competition alone.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including manufacturers, converters, raw material suppliers, and end-users across different market segments. Data collection involves structured questionnaires, in-depth interviews, and focus group discussions to gather qualitative and quantitative insights.

Secondary research utilizes industry reports, government publications, trade association data, and company financial statements to validate primary findings and provide market context. Database analysis includes production statistics, trade data, and regulatory filings to establish market sizing and growth trends.

Market segmentation analysis employs multiple approaches including product type, application, end-use industry, and geographic region to provide comprehensive market understanding. Cross-validation techniques ensure data accuracy and reliability across different sources and methodologies.

Forecasting models incorporate historical trends, economic indicators, industry drivers, and expert opinions to project future market scenarios. Sensitivity analysis evaluates impact of key variables on market projections and identifies critical success factors.

Quality assurance processes include data triangulation, expert review, and peer validation to ensure research accuracy and credibility. Continuous monitoring updates market intelligence as new information becomes available and market conditions evolve.

Western India dominates market activity with Maharashtra and Gujarat accounting for 38% production capacity due to established industrial infrastructure, port connectivity, and skilled workforce availability. Mumbai-Pune corridor serves as a major hub for packaging film manufacturing and converting operations.

Southern India represents 28% market share with strong presence in Tamil Nadu, Karnataka, and Andhra Pradesh driven by automotive, pharmaceutical, and food processing industries. Bangalore-Chennai belt emerges as an innovation center for advanced packaging technologies and sustainable solutions.

Northern India shows rapid growth with 24% market share concentrated in Delhi NCR, Punjab, and Uttar Pradesh, benefiting from large consumer markets and agricultural processing activities. Infrastructure development in the region supports manufacturing expansion and logistics efficiency.

Eastern India holds 10% market share with growing opportunities in West Bengal and Odisha driven by industrial development and government initiatives. Port connectivity through Kolkata and Paradip facilitates raw material imports and finished goods exports.

Tier-2 cities demonstrate accelerating growth rates as manufacturers establish production facilities closer to emerging consumer markets. Government incentives for industrial development in smaller cities create attractive investment opportunities.

Export hubs develop around major ports with specialized facilities for international market requirements and quality certifications. Regional specialization emerges with different areas focusing on specific product segments or applications.

Market structure demonstrates a mix of large multinational corporations, established domestic companies, and numerous regional players serving specific market segments. Competitive intensity varies across product categories with commodity films showing price competition while specialty films emphasize differentiation.

Strategic positioning varies with companies focusing on different approaches including cost leadership, product differentiation, market specialization, and vertical integration. Innovation capabilities become increasingly important for maintaining competitive advantages and meeting evolving customer requirements.

Market share distribution shows top five players controlling approximately 55% market share while remaining market serves numerous smaller players. Consolidation trends indicate potential for further market concentration through acquisitions and partnerships.

By Material Type: The market segments into polyethylene films, polypropylene films, polyester films, polyamide films, and specialty barrier films. Polyethylene films dominate with 45% market share due to versatility and cost-effectiveness across multiple applications.

By Technology: Production technologies include blown film extrusion, cast film extrusion, and specialty processes like co-extrusion and lamination. Multi-layer technologies gain prominence for enhanced barrier properties and performance characteristics.

By Application: Primary applications encompass food packaging, pharmaceutical packaging, personal care, industrial packaging, and agricultural films. Food packaging represents the largest segment with diverse sub-categories including fresh produce, processed foods, and beverages.

By End-Use Industry: Key industries include food and beverages, pharmaceuticals, personal care and cosmetics, textiles, chemicals, and agriculture. Cross-industry applications create opportunities for manufacturers to diversify customer bases and reduce market risks.

By Product Form: Market includes rolls, sheets, pouches, and converted products. Converting operations add value through printing, lamination, and fabrication services, creating higher-margin opportunities.

By Distribution Channel: Sales channels encompass direct sales, distributors, online platforms, and export markets. Channel optimization becomes crucial for market reach and customer service effectiveness.

Food Packaging Films demonstrate robust growth driven by processed food consumption, organized retail expansion, and food safety regulations. Innovation focus includes barrier properties, printability, and sustainable materials addressing environmental concerns while maintaining performance standards.

Pharmaceutical Packaging requires specialized films meeting stringent regulatory requirements for moisture protection, chemical compatibility, and tamper evidence. Quality standards drive premium pricing and long-term customer relationships with pharmaceutical manufacturers.

Industrial Films serve diverse applications including construction, automotive, and manufacturing industries. Performance requirements vary significantly across applications, creating opportunities for specialized product development and technical service support.

Agricultural Films support crop protection, greenhouse applications, and soil management. Seasonal demand patterns require careful production planning and inventory management while offering stable long-term growth prospects.

Specialty Films command premium pricing through unique properties like high barrier performance, optical clarity, or specific chemical resistance. Technical expertise and customer collaboration become critical success factors in these segments.

Sustainable Films represent emerging category addressing environmental concerns through recyclable, biodegradable, or bio-based materials. Market acceptance grows as regulatory pressures and consumer awareness drive adoption despite higher costs.

Manufacturers benefit from strong domestic demand growth, export opportunities, and government support for manufacturing sector development. Economies of scale enable cost optimization while technology investments drive product differentiation and market expansion.

Raw Material Suppliers enjoy consistent demand growth and opportunities for value-added products including specialty polymers and additives. Long-term partnerships with film manufacturers provide stable revenue streams and collaborative innovation opportunities.

Converters and Printers access growing markets for value-added services including lamination, printing, and fabrication. Technology investments in digital printing and automation enhance service capabilities and operational efficiency.

End-User Industries benefit from improved packaging solutions offering better product protection, shelf appeal, and consumer convenience. Supply chain partnerships enable customized solutions and responsive service support.

Investors find attractive opportunities in a growing market with strong fundamentals, government support, and export potential. Risk diversification across multiple end-use industries provides stability and growth prospects.

Technology Providers access expanding markets for advanced manufacturing equipment, quality control systems, and automation solutions. Service opportunities include technical support, training, and maintenance services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration drives development of recyclable, biodegradable, and bio-based packaging films as companies respond to environmental concerns and regulatory requirements. Circular economy principles influence product design and end-of-life management strategies.

Smart Packaging Technologies incorporate digital elements like QR codes, RFID tags, and sensors to enhance consumer engagement and supply chain visibility. Internet of Things integration enables real-time monitoring and data collection throughout the packaging lifecycle.

Customization and Personalization trends drive demand for shorter production runs, variable printing, and specialized packaging solutions. Digital printing technologies enable cost-effective customization and rapid market response capabilities.

Barrier Performance Enhancement focuses on developing films with superior protection properties for extended shelf life and product quality maintenance. Multi-layer technologies and specialized coatings address specific barrier requirements across different applications.

Convenience Packaging innovations include resealable features, easy-open designs, and portion control solutions responding to changing consumer lifestyles. User experience becomes a key differentiator in competitive markets.

Supply Chain Optimization emphasizes local sourcing, reduced transportation costs, and improved inventory management. Regional manufacturing strategies balance cost efficiency with market responsiveness and sustainability goals.

Capacity Expansion initiatives by major manufacturers include new production facilities, technology upgrades, and geographic expansion to meet growing demand. Investment announcements indicate continued confidence in market growth prospects and long-term opportunities.

Technology Partnerships between Indian companies and international technology providers facilitate access to advanced manufacturing processes and product innovations. Knowledge transfer programs enhance local capabilities and competitive positioning.

Sustainability Initiatives include investments in recycling infrastructure, development of biodegradable materials, and implementation of circular economy principles. Industry collaboration addresses environmental challenges through collective action and shared resources.

Regulatory Developments include new standards for food contact materials, pharmaceutical packaging requirements, and environmental compliance. Industry adaptation requires ongoing investment in quality systems and compliance capabilities.

Market Consolidation activities through mergers and acquisitions create larger, more competitive entities with enhanced capabilities and market reach. Strategic alliances enable companies to access new technologies, markets, and customer segments.

Export Market Development includes establishment of international sales offices, quality certifications, and product adaptations for specific regional requirements. Trade promotion activities support market development and brand building in target countries.

Investment Priorities should focus on sustainable packaging technologies, advanced manufacturing capabilities, and market expansion opportunities in high-growth segments. MarkWide Research analysis indicates strong returns for companies investing in innovation and sustainability initiatives.

Strategic Positioning recommendations emphasize differentiation through quality, service, and specialized applications rather than competing solely on price. Value proposition development should address customer-specific requirements and long-term partnership opportunities.

Technology Roadmap planning should include digital transformation, automation, and sustainable material development to maintain competitive advantages. Research and development investments require careful prioritization based on market potential and technical feasibility.

Market Entry Strategies for new players should consider niche segments, regional markets, or specialized applications where established competitors may have limited presence. Partnership approaches can provide faster market access and reduced investment requirements.

Risk Management strategies should address raw material price volatility, regulatory changes, and environmental compliance requirements. Diversification across products, markets, and applications reduces exposure to specific market risks.

Supply Chain Optimization initiatives should focus on local sourcing, inventory management, and customer service enhancement. Digital technologies can improve visibility, efficiency, and responsiveness throughout the value chain.

Growth Projections indicate sustained market expansion with CAGR of 9.1% expected over the next five years, driven by continued industrialization, urbanization, and consumer market development. Market maturation in developed segments creates opportunities for innovation and value addition.

Technology Evolution will focus on sustainable materials, smart packaging features, and advanced barrier properties. Innovation cycles accelerate as companies invest in research and development to address environmental challenges and performance requirements.

Regulatory Environment will continue evolving with increased focus on environmental protection, food safety, and pharmaceutical quality standards. Compliance requirements drive industry transformation toward higher quality and sustainability standards.

Market Structure evolution indicates continued consolidation with larger players gaining market share through acquisitions, capacity expansion, and technology investments. Competitive dynamics shift toward differentiation and value-added services rather than price competition.

Export Opportunities expand as Indian manufacturers develop quality capabilities, international certifications, and market knowledge. MWR projections suggest 15% annual growth in export markets over the medium term.

Sustainability Transformation will reshape the industry as companies develop circular economy solutions, renewable materials, and waste reduction technologies. Consumer acceptance of sustainable packaging grows despite premium pricing, creating viable market opportunities.

The India plastic packaging film market presents exceptional growth opportunities driven by strong domestic demand, favorable demographics, and supportive government policies. Market fundamentals remain robust with consistent demand growth across multiple end-use industries and expanding applications for flexible packaging solutions.

Industry transformation toward sustainability, technology adoption, and value addition creates opportunities for companies willing to invest in innovation and market development. Competitive advantages will increasingly depend on differentiation through quality, service, and specialized capabilities rather than cost leadership alone.

Strategic success requires balanced approaches addressing immediate market opportunities while preparing for long-term industry evolution. Investment priorities should emphasize sustainable technologies, advanced manufacturing capabilities, and market expansion initiatives that align with changing customer requirements and regulatory expectations.

The market’s future trajectory appears highly positive with strong growth prospects, expanding applications, and increasing recognition of India as a competitive manufacturing destination for plastic packaging films serving both domestic and international markets.

What is Plastic Packaging Film?

Plastic packaging film refers to thin layers of plastic used for packaging products, providing protection, preservation, and convenience. It is widely used in various applications, including food packaging, medical supplies, and consumer goods.

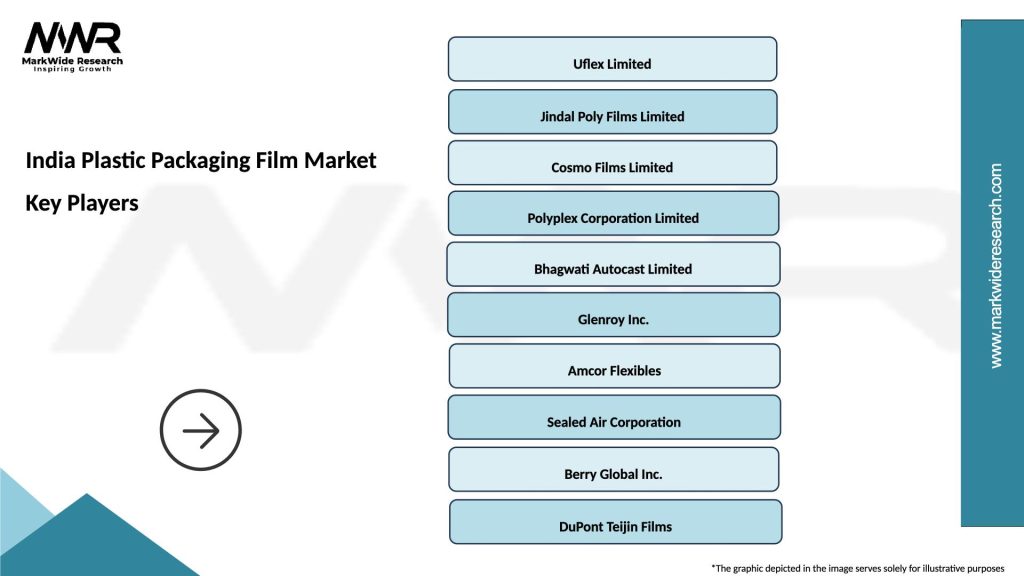

What are the key players in the India Plastic Packaging Film Market?

Key players in the India Plastic Packaging Film Market include companies like Uflex Limited, Jindal Poly Films, and Cosmo Films, which are known for their innovative packaging solutions and extensive product ranges, among others.

What are the growth factors driving the India Plastic Packaging Film Market?

The growth of the India Plastic Packaging Film Market is driven by increasing demand for packaged food, rising e-commerce activities, and the need for sustainable packaging solutions. Additionally, advancements in film technology are enhancing product performance.

What challenges does the India Plastic Packaging Film Market face?

The India Plastic Packaging Film Market faces challenges such as environmental concerns regarding plastic waste, regulatory pressures for sustainable materials, and competition from alternative packaging solutions. These factors can impact market growth and innovation.

What opportunities exist in the India Plastic Packaging Film Market?

Opportunities in the India Plastic Packaging Film Market include the development of biodegradable films, increasing investments in packaging technology, and the expansion of the food and beverage sector. These trends are likely to shape the future of the market.

What trends are shaping the India Plastic Packaging Film Market?

Trends in the India Plastic Packaging Film Market include a shift towards eco-friendly materials, the rise of smart packaging technologies, and customization in packaging designs. These trends are influencing consumer preferences and industry standards.

India Plastic Packaging Film Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyethylene, Polypropylene, Polyvinyl Chloride, Polyester |

| Packaging Type | Flexible Packaging, Rigid Packaging, Pouches, Wraps |

| End Use Industry | Food & Beverage, Pharmaceuticals, Personal Care, Electronics |

| Form | Rolls, Sheets, Bags, Films |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Plastic Packaging Film Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at