444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India plastic bottles market represents one of the most dynamic and rapidly expanding segments within the country’s packaging industry. Market dynamics indicate substantial growth driven by increasing consumer demand across beverage, pharmaceutical, and personal care sectors. The market demonstrates robust expansion with a projected compound annual growth rate of 8.2% CAGR through the forecast period, reflecting India’s growing consumption patterns and urbanization trends.

Manufacturing capabilities across India have evolved significantly, with domestic producers investing heavily in advanced blow molding technologies and sustainable production processes. The market encompasses various bottle types including PET bottles, HDPE containers, and specialty pharmaceutical packaging solutions. Regional distribution shows concentrated manufacturing hubs in Maharashtra, Gujarat, and Tamil Nadu, accounting for approximately 65% of total production capacity.

Consumer preferences are increasingly shifting toward lightweight, recyclable packaging solutions, driving innovation in bottle design and material composition. The market benefits from India’s position as a major consumer goods manufacturing hub, with both domestic consumption and export opportunities contributing to sustained growth momentum.

The India plastic bottles market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of plastic bottle packaging solutions across various end-use industries within the Indian subcontinent. This market includes manufacturing facilities, raw material suppliers, technology providers, and end-user industries that collectively drive demand for plastic bottle packaging solutions.

Market scope extends beyond simple container manufacturing to include value-added services such as custom labeling, specialized closures, and integrated packaging solutions. The sector encompasses both primary packaging for direct consumer products and secondary packaging for industrial applications, serving diverse industries from beverages and pharmaceuticals to chemicals and personal care products.

Industry definition includes all forms of plastic bottles manufactured through various processes including injection blow molding, extrusion blow molding, and stretch blow molding technologies. The market serves as a critical component of India’s broader packaging industry, supporting the country’s manufacturing sector and consumer goods distribution networks.

Strategic analysis reveals the India plastic bottles market experiencing unprecedented growth driven by urbanization, rising disposable incomes, and expanding retail infrastructure. Key market drivers include the booming beverage industry, pharmaceutical sector expansion, and increasing adoption of packaged consumer goods across tier-2 and tier-3 cities.

Market segmentation shows PET bottles dominating with approximately 72% market share, followed by HDPE and other specialized materials. The beverage segment represents the largest end-use application, while pharmaceutical packaging demonstrates the highest growth potential with increasing healthcare awareness and regulatory compliance requirements.

Competitive landscape features a mix of large-scale manufacturers and specialized regional players, with increasing consolidation through strategic acquisitions and partnerships. Technology adoption trends favor sustainable manufacturing processes, lightweight bottle designs, and enhanced barrier properties to extend product shelf life and reduce environmental impact.

Future prospects indicate continued expansion supported by government initiatives promoting manufacturing, increasing export opportunities, and growing emphasis on sustainable packaging solutions that align with global environmental standards.

Market intelligence reveals several critical insights shaping the India plastic bottles market landscape:

Primary growth drivers propelling the India plastic bottles market include demographic shifts, economic development, and changing consumer lifestyles. Urbanization trends continue accelerating, with urban population growth driving increased consumption of packaged beverages, personal care products, and pharmaceutical items requiring plastic bottle packaging.

Economic factors play a crucial role, as rising disposable incomes enable greater spending on packaged consumer goods. The expanding middle class demonstrates increasing preference for branded products, convenience foods, and health-conscious beverage choices, all requiring reliable plastic bottle packaging solutions.

Industry expansion across key end-use sectors provides sustained demand growth. The pharmaceutical industry’s rapid expansion, driven by healthcare awareness and government initiatives, creates substantial demand for specialized bottle packaging. Similarly, the beverage industry benefits from changing consumption patterns favoring packaged water, functional beverages, and premium drink categories.

Infrastructure development supports market growth through improved transportation networks, cold chain facilities, and retail distribution systems. These developments enable broader market reach and support the growth of packaged goods consumption across diverse geographic regions.

Environmental concerns represent the most significant challenge facing the India plastic bottles market, with increasing regulatory pressure and consumer awareness regarding plastic waste management. Government regulations implementing single-use plastic restrictions and extended producer responsibility requirements create compliance costs and operational complexities for manufacturers.

Raw material price volatility affects production costs and profit margins, particularly for petroleum-based plastic resins. Fluctuating crude oil prices directly impact PET and HDPE resin costs, creating pricing pressures throughout the supply chain and affecting market competitiveness.

Competition from alternatives poses ongoing challenges, as glass bottles, aluminum cans, and paper-based packaging solutions gain market share in specific applications. Consumer preference shifts toward perceived environmentally friendly alternatives create market share pressures in certain segments.

Infrastructure limitations in waste management and recycling systems hinder the development of circular economy solutions. Inadequate collection and processing facilities for plastic waste recycling limit the industry’s ability to address sustainability concerns effectively.

Sustainable packaging solutions present substantial growth opportunities as manufacturers develop bio-based plastics, enhanced recyclability features, and lightweight bottle designs. Innovation initiatives focusing on biodegradable materials and closed-loop recycling systems position companies favorably for future market demands and regulatory requirements.

Export market expansion offers significant potential, with Indian manufacturers leveraging cost advantages and quality improvements to serve international markets. Growing demand from Southeast Asian, Middle Eastern, and African markets creates opportunities for capacity expansion and revenue diversification.

Pharmaceutical sector growth provides specialized packaging opportunities, particularly for temperature-sensitive medications, child-resistant closures, and tamper-evident packaging solutions. The expanding healthcare sector and increasing generic drug production create sustained demand for high-quality pharmaceutical bottles.

Technology integration opportunities include smart packaging solutions, IoT-enabled tracking systems, and advanced barrier coatings that extend product shelf life. These innovations enable premium pricing and differentiation in competitive market segments.

Supply chain dynamics in the India plastic bottles market reflect complex interactions between raw material suppliers, manufacturers, and end-users. Vertical integration trends show leading companies expanding backward into resin production and forward into specialized packaging services, improving cost control and market responsiveness.

Demand patterns exhibit seasonal variations, with beverage packaging experiencing peak demand during summer months while pharmaceutical packaging maintains steady year-round consumption. Regional variations in demand reflect local consumption patterns, with urban markets driving premium packaging requirements and rural markets emphasizing cost-effective solutions.

Technology adoption rates vary across market segments, with large-scale beverage manufacturers leading in advanced automation and quality control systems. Smaller regional players increasingly invest in modern equipment to meet quality standards and improve operational efficiency, with productivity improvements of 25-30% commonly achieved through technology upgrades.

Regulatory dynamics continue evolving, with state and central government policies affecting production standards, environmental compliance, and market access requirements. These regulatory changes drive industry consolidation and favor companies with strong compliance capabilities and sustainable practices.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, manufacturing facility visits, and detailed surveys of end-user companies across various sectors including beverages, pharmaceuticals, and personal care products.

Secondary research encompasses analysis of government statistics, industry association reports, trade publications, and company financial statements. Data triangulation methods validate findings across multiple sources, ensuring consistency and reliability of market projections and trend analysis.

Market modeling techniques incorporate econometric analysis, regression modeling, and scenario planning to project future market conditions. Regional analysis methodology includes state-wise production data, consumption patterns, and infrastructure development indicators to provide granular market insights.

Industry expert validation ensures research accuracy through consultation with technology providers, raw material suppliers, and end-user companies. This validation process confirms market trends, identifies emerging opportunities, and verifies quantitative projections through industry expertise and practical market knowledge.

Western India dominates the plastic bottles market, with Maharashtra and Gujarat accounting for approximately 45% of national production capacity. Industrial infrastructure advantages include proximity to petrochemical complexes, established transportation networks, and concentration of end-user industries, particularly in the beverage and pharmaceutical sectors.

Southern regions demonstrate strong growth momentum, led by Tamil Nadu and Karnataka, which collectively represent 28% of market share. The region benefits from a robust automotive industry requiring specialized packaging, growing pharmaceutical manufacturing, and increasing export orientation toward Southeast Asian markets.

Northern markets show expanding consumption patterns driven by urbanization in Delhi NCR, Punjab, and Uttar Pradesh. Market characteristics include strong demand for beverage packaging, growing pharmaceutical requirements, and increasing adoption of packaged consumer goods in tier-2 cities.

Eastern and northeastern regions represent emerging opportunities with improving infrastructure and rising consumer spending. Growth potential remains substantial as distribution networks expand and local manufacturing capabilities develop to serve regional demand patterns more effectively.

Market leadership features a diverse competitive environment with both large integrated players and specialized regional manufacturers competing across different market segments:

Competitive strategies emphasize technological innovation, capacity expansion, and vertical integration to improve cost competitiveness and market responsiveness. Market consolidation trends continue as larger players acquire regional manufacturers to expand geographic reach and production capabilities.

By Material Type:

By Application:

By Capacity:

Beverage packaging represents the most mature and competitive segment, with established players focusing on lightweight designs, enhanced barrier properties, and sustainable materials. Innovation trends include hot-fill capabilities for juice packaging, enhanced UV protection for sensitive products, and improved closure systems for better consumer convenience.

Pharmaceutical packaging demonstrates the highest growth potential, driven by increasing healthcare awareness and regulatory compliance requirements. Specialized features include child-resistant closures, tamper-evident seals, moisture barriers, and serialization capabilities for track-and-trace requirements. This segment commands premium pricing due to stringent quality standards and specialized manufacturing requirements.

Personal care packaging emphasizes aesthetic appeal, functional design, and sustainability features. Market trends include pump dispensers, squeeze bottles with controlled dispensing, and eco-friendly materials appealing to environmentally conscious consumers. Brand differentiation through unique bottle shapes and premium finishes drives innovation in this segment.

Industrial applications focus on chemical compatibility, durability, and cost-effectiveness. Technical requirements include resistance to aggressive chemicals, UV stability for outdoor storage, and specialized closures for safe handling of hazardous materials.

Manufacturers benefit from expanding market opportunities across diverse end-use sectors, enabling revenue diversification and reduced dependence on single market segments. Operational advantages include economies of scale, improved capacity utilization, and opportunities for vertical integration to control raw material costs and supply chain reliability.

End-user industries gain access to innovative packaging solutions that enhance product protection, extend shelf life, and improve consumer convenience. Cost benefits include reduced packaging costs compared to alternative materials, lightweight designs reducing transportation costs, and customization capabilities supporting brand differentiation strategies.

Consumers enjoy improved product accessibility, enhanced convenience features, and better product protection ensuring quality and safety. Sustainability benefits include increasing availability of recyclable packaging options and lightweight designs reducing environmental impact during transportation.

Supply chain stakeholders benefit from standardized packaging formats, improved handling characteristics, and reduced breakage rates compared to glass alternatives. Distribution advantages include space-efficient storage, reduced weight for transportation cost savings, and improved safety during handling and transport operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation emerges as the dominant trend, with manufacturers investing heavily in recyclable materials, biodegradable alternatives, and circular economy initiatives. Innovation focus includes development of bio-based PET, enhanced recycling technologies, and lightweight bottle designs reducing material consumption by 15-20% while maintaining structural integrity.

Smart packaging integration gains momentum through incorporation of QR codes, NFC tags, and temperature indicators that enhance consumer engagement and product traceability. Digital transformation extends to manufacturing processes with IoT-enabled production monitoring, predictive maintenance systems, and automated quality control improving operational efficiency.

Customization capabilities expand as manufacturers invest in flexible production systems enabling small-batch custom orders, unique bottle shapes, and specialized closure systems. Market responsiveness improves through shorter lead times, rapid prototyping capabilities, and collaborative design services supporting brand differentiation strategies.

Regional manufacturing trends favor establishment of production facilities closer to end-user markets, reducing transportation costs and improving supply chain responsiveness. This decentralization strategy supports local market requirements while maintaining cost competitiveness and reducing environmental impact from transportation.

Technology advancement initiatives include major investments in Industry 4.0 manufacturing systems, with leading companies implementing automated production lines, real-time quality monitoring, and predictive maintenance systems. Capacity expansion projects across multiple states indicate strong industry confidence, with new facilities incorporating latest environmental standards and energy-efficient technologies.

Strategic partnerships between manufacturers and end-user companies create integrated supply chain solutions, long-term contracts, and collaborative innovation programs. MarkWide Research analysis indicates increasing vertical integration as beverage companies establish captive bottle manufacturing capabilities to ensure supply security and cost control.

Sustainability initiatives include establishment of plastic waste collection networks, investment in chemical recycling technologies, and development of closed-loop recycling systems. Industry collaboration programs focus on creating industry-wide standards for sustainable packaging and supporting government policy development for effective waste management.

Export market development shows Indian manufacturers establishing overseas production facilities and distribution networks, particularly in Southeast Asia and Africa. These international expansion strategies leverage India’s manufacturing expertise while serving growing markets with local production capabilities.

Strategic recommendations for market participants emphasize the critical importance of sustainability integration across all business operations. Investment priorities should focus on advanced recycling technologies, bio-based material development, and circular economy business models that address environmental concerns while maintaining cost competitiveness.

Technology adoption strategies should prioritize automation, quality control systems, and flexible manufacturing capabilities that enable rapid response to changing market demands. Digital transformation initiatives including IoT integration, data analytics, and predictive maintenance systems provide competitive advantages through improved operational efficiency and reduced downtime.

Market diversification approaches should balance domestic growth opportunities with export market development, particularly in pharmaceutical packaging and specialized applications commanding premium pricing. Geographic expansion strategies should consider regional manufacturing facilities serving local markets while maintaining centralized technology and quality standards.

Partnership strategies should focus on vertical integration opportunities, technology collaborations, and long-term supply agreements with major end-users. MWR analysis suggests that companies investing in comprehensive sustainability programs and advanced manufacturing technologies will achieve superior market positioning and financial performance.

Long-term growth prospects remain highly positive, supported by India’s demographic advantages, economic development, and expanding consumer markets. Market evolution will be shaped by sustainability requirements, technological advancement, and changing consumer preferences favoring environmentally responsible packaging solutions.

Innovation trajectories point toward bio-based materials achieving commercial viability, smart packaging becoming mainstream, and circular economy principles driving business model transformation. Technology integration will enable mass customization, real-time supply chain optimization, and enhanced product traceability throughout the value chain.

Regulatory landscape evolution will continue favoring sustainable practices, extended producer responsibility, and circular economy initiatives. Market adaptation strategies must anticipate stricter environmental standards while capitalizing on opportunities in emerging applications and export markets.

Competitive dynamics will favor companies with strong sustainability credentials, advanced manufacturing capabilities, and diversified market presence. Growth projections indicate sustained expansion at 8-10% annual growth rates through the next decade, driven by domestic consumption growth and increasing export opportunities in developing markets worldwide.

The India plastic bottles market stands at a transformative juncture, balancing tremendous growth opportunities with evolving sustainability requirements and regulatory challenges. Market fundamentals remain strong, supported by demographic trends, economic development, and expanding end-use applications across diverse industry sectors.

Strategic success will depend on companies’ ability to integrate sustainability principles, adopt advanced technologies, and maintain cost competitiveness while serving increasingly sophisticated market demands. Innovation leadership in sustainable materials, smart packaging solutions, and circular economy business models will differentiate market leaders from followers.

Future market development will be characterized by continued consolidation, technology advancement, and geographic expansion as Indian manufacturers leverage their competitive advantages to serve both domestic and international markets. MarkWide Research projects sustained growth momentum driven by urbanization, rising consumer spending, and expanding industrial applications requiring reliable plastic bottle packaging solutions.

Industry transformation toward sustainability, digitalization, and customer-centricity positions the India plastic bottles market for long-term success while contributing to the country’s manufacturing sector growth and export competitiveness in global markets.

What is Plastic Bottles?

Plastic bottles are containers made from various types of plastic, commonly used for packaging liquids such as beverages, cleaning products, and personal care items. They are lightweight, durable, and can be molded into various shapes and sizes, making them a popular choice in many industries.

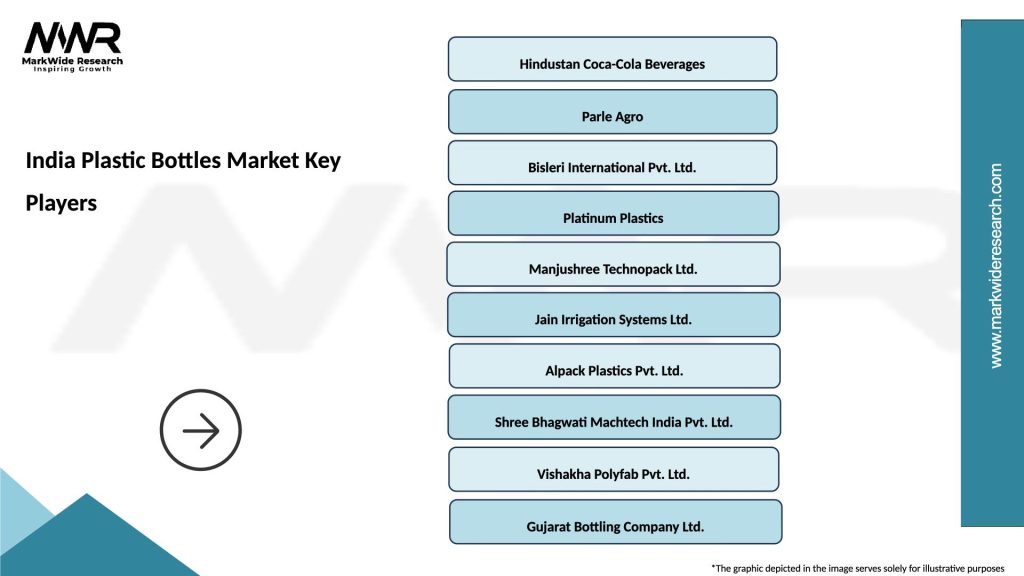

What are the key players in the India Plastic Bottles Market?

Key players in the India Plastic Bottles Market include companies like Hindustan Coca-Cola Beverages, Parle Agro, and Bisleri International, which are known for their significant contributions to the beverage sector. Other notable companies include Manjushree Technopack and Sidel, among others.

What are the growth factors driving the India Plastic Bottles Market?

The growth of the India Plastic Bottles Market is driven by increasing consumer demand for packaged beverages, the rise of e-commerce, and a growing focus on convenience in packaging. Additionally, innovations in bottle design and recycling initiatives are contributing to market expansion.

What challenges does the India Plastic Bottles Market face?

The India Plastic Bottles Market faces challenges such as environmental concerns regarding plastic waste and stringent regulations on plastic usage. Additionally, competition from alternative packaging materials like glass and biodegradable options poses a significant challenge.

What opportunities exist in the India Plastic Bottles Market?

Opportunities in the India Plastic Bottles Market include the development of eco-friendly packaging solutions and the increasing demand for personalized and innovative bottle designs. The growth of the health and wellness sector also presents new avenues for product development.

What trends are shaping the India Plastic Bottles Market?

Trends shaping the India Plastic Bottles Market include a shift towards sustainable packaging solutions, increased use of recycled materials, and the adoption of smart packaging technologies. Additionally, consumer preferences are evolving towards lightweight and portable bottle designs.

India Plastic Bottles Market

| Segmentation Details | Description |

|---|---|

| Product Type | PET, HDPE, LDPE, PVC |

| End User | Food & Beverage, Personal Care, Household, Pharmaceuticals |

| Packaging Type | Single-Serve, Multi-Pack, Bulk, Custom Shapes |

| Application | Cosmetics, Cleaning Agents, Water, Soft Drinks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Plastic Bottles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at