444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India plant based meat alternatives market represents one of the most dynamic and rapidly evolving segments within the country’s food industry landscape. Plant-based protein solutions are experiencing unprecedented growth across urban centers, driven by increasing health consciousness, environmental awareness, and evolving dietary preferences among Indian consumers. The market encompasses a diverse range of products including plant-based chicken, mutton alternatives, seafood substitutes, and innovative protein formulations derived from soy, wheat, pea protein, and indigenous ingredients.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate of 12.8%, reflecting strong consumer adoption and investment in manufacturing capabilities. Urban millennials and Gen Z consumers are driving significant demand for sustainable protein alternatives, while traditional vegetarian populations are exploring modern plant-based options that replicate familiar textures and flavors. The integration of advanced food technology with traditional Indian culinary preferences has created unique market opportunities for both domestic and international players.

Regional penetration shows concentrated growth in metropolitan areas including Mumbai, Delhi, Bangalore, and Chennai, where consumer awareness levels reach approximately 68% among target demographics. The market benefits from India’s established vegetarian food culture, extensive agricultural infrastructure for plant proteins, and growing retail distribution networks supporting alternative protein adoption.

The India plant based meat alternatives market refers to the comprehensive ecosystem of food products designed to replicate the taste, texture, and nutritional profile of conventional meat using exclusively plant-derived ingredients and advanced food processing technologies.

Plant-based meat alternatives encompass a wide spectrum of products manufactured from protein sources including soy, wheat gluten, pea protein, mushroom extracts, and innovative combinations of legumes, grains, and vegetables. These products undergo sophisticated processing techniques including extrusion technology, fermentation processes, and flavor enhancement methods to achieve meat-like characteristics while maintaining plant-based integrity.

Market scope includes ready-to-cook products, processed foods, restaurant-grade ingredients, and retail consumer goods targeting both vegetarian and flexitarian consumer segments. The definition extends beyond simple protein substitutes to encompass comprehensive culinary solutions that address texture, flavor, nutritional density, and cooking versatility requirements of modern Indian consumers seeking sustainable protein alternatives.

Market transformation within India’s plant-based meat alternatives sector reflects a fundamental shift in consumer behavior, technological innovation, and investment patterns across the food industry. The sector demonstrates exceptional growth potential driven by health-conscious consumers, environmental sustainability concerns, and increasing disposable income among urban populations.

Key market drivers include rising awareness of lifestyle diseases, with 73% of urban consumers actively seeking healthier protein alternatives, and growing environmental consciousness regarding traditional livestock farming impacts. Technology advancement in food processing, flavor enhancement, and nutritional fortification has enabled manufacturers to create products that closely mimic conventional meat experiences while offering superior nutritional profiles.

Investment landscape shows significant capital inflow from both domestic and international investors, supporting research and development initiatives, manufacturing capacity expansion, and distribution network development. Retail penetration has expanded beyond specialty stores to mainstream supermarkets, online platforms, and quick-service restaurant chains, indicating broad market acceptance and commercial viability.

Competitive dynamics feature a mix of established food companies, innovative startups, and international brands adapting global products for Indian taste preferences. The market benefits from India’s strong agricultural foundation, skilled food processing workforce, and established supply chain infrastructure supporting scalable production capabilities.

Consumer behavior analysis reveals distinct patterns driving market growth and product development strategies across the India plant-based meat alternatives sector:

Market penetration shows strongest growth in tier-1 cities where product availability and consumer education programs have established solid foundations for continued expansion into tier-2 and tier-3 markets.

Health consciousness revolution represents the most significant driver propelling India’s plant-based meat alternatives market forward. Urban consumers increasingly recognize connections between diet and lifestyle diseases, with cardiovascular health concerns motivating dietary transitions toward plant-based proteins. Medical recommendations from healthcare professionals supporting reduced meat consumption have created substantial market demand for nutritionally complete alternatives.

Environmental sustainability awareness continues gaining momentum among educated consumers who understand the environmental impact of conventional livestock farming. Water conservation, reduced greenhouse gas emissions, and land use efficiency associated with plant-based protein production resonate strongly with environmentally conscious demographics. Climate change concerns and sustainable living practices drive consumer willingness to adopt alternative protein sources.

Technological advancement in food processing enables manufacturers to create increasingly sophisticated products that closely replicate meat textures, flavors, and cooking characteristics. Innovation in protein extraction, flavor enhancement, and nutritional fortification has eliminated many traditional barriers to plant-based meat adoption. Food science breakthroughs continue expanding product possibilities and improving consumer acceptance rates.

Investment and infrastructure development provide essential support for market expansion through improved manufacturing capabilities, distribution networks, and research facilities. Government initiatives promoting food processing industries and sustainable agriculture create favorable conditions for plant-based protein development. Retail expansion and e-commerce growth facilitate broader product accessibility across diverse consumer segments.

Price premium challenges continue limiting market penetration among price-sensitive consumer segments who find plant-based alternatives significantly more expensive than conventional protein sources. Manufacturing costs associated with specialized ingredients, processing technology, and quality control systems result in higher retail prices that restrict mass market adoption. Economic considerations particularly impact middle-income households where food budget constraints influence purchasing decisions.

Taste and texture limitations remain significant barriers despite technological improvements, with many consumers finding current products insufficient replacements for traditional meat experiences. Sensory expectations regarding mouthfeel, juiciness, and flavor complexity often exceed current product capabilities. Cooking behavior differences between plant-based and conventional proteins require consumer education and adaptation.

Limited product variety and availability constraints restrict consumer choice and market growth potential. Distribution challenges in tier-2 and tier-3 cities limit accessibility for significant population segments interested in trying plant-based alternatives. Cold chain infrastructure requirements for many products create logistical complexities and cost implications for retailers and consumers.

Consumer awareness gaps regarding nutritional benefits, preparation methods, and product differentiation slow market development. Marketing investment requirements for consumer education and brand building strain resources of emerging companies. Cultural resistance from traditional food communities and skepticism about processed foods create additional market entry barriers.

Tier-2 and tier-3 city expansion presents enormous growth potential as urbanization, income growth, and health awareness spread beyond metropolitan areas. Market penetration rates in smaller cities remain below 15%, indicating substantial untapped demand for plant-based protein alternatives. Distribution network development and localized marketing strategies can unlock significant consumer bases in emerging urban centers.

Product innovation opportunities exist in developing India-specific formulations incorporating traditional ingredients, regional flavors, and familiar textures. Indigenous protein sources including jackfruit, banana peels, and regional legumes offer unique differentiation possibilities. Fusion products combining international plant-based technology with Indian culinary traditions can create compelling market propositions.

Food service sector integration provides substantial growth avenues through partnerships with restaurants, hotels, and institutional catering services. Quick-service restaurant chains increasingly seek plant-based menu options to attract health-conscious consumers. Corporate cafeterias and educational institutions represent significant volume opportunities for bulk supply arrangements.

Export market development leverages India’s cost advantages and growing expertise in plant-based food manufacturing. International demand for affordable, high-quality plant-based proteins creates opportunities for Indian manufacturers to serve global markets. Regulatory approvals and quality certifications can position Indian companies as competitive suppliers in developed markets seeking cost-effective alternatives.

Supply chain evolution demonstrates increasing sophistication as manufacturers develop integrated systems connecting agricultural inputs, processing facilities, and distribution networks. Vertical integration strategies enable better quality control, cost management, and supply security for key ingredients. Farmer partnerships ensure consistent raw material availability while supporting agricultural communities transitioning to high-value crop production.

Technology adoption patterns show accelerating investment in advanced food processing equipment, automation systems, and quality assurance technologies. Research and development spending has increased by approximately 34% annually as companies prioritize product innovation and process optimization. Collaboration with food technology institutes and international partners enhances technical capabilities and knowledge transfer.

Consumer education initiatives play crucial roles in market development through cooking demonstrations, nutritional awareness programs, and taste testing campaigns. Digital marketing strategies effectively reach target demographics through social media platforms, influencer partnerships, and content marketing. Retail partnerships facilitate in-store promotions, sampling programs, and consumer engagement activities.

Regulatory landscape development provides clearer guidelines for product labeling, safety standards, and marketing claims. Food safety regulations ensure consumer confidence while establishing industry standards for quality and consistency. Government support programs for food processing industries create favorable conditions for investment and expansion in plant-based protein manufacturing.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable, and actionable insights into India’s plant-based meat alternatives market dynamics. Primary research activities include extensive consumer surveys, industry expert interviews, and stakeholder consultations across key market segments and geographic regions.

Consumer behavior studies utilize both quantitative and qualitative research approaches, incorporating online surveys, focus group discussions, and in-depth interviews with target demographics. Sample sizes exceed 2,500 respondents across tier-1, tier-2, and tier-3 cities to ensure representative market insights. Demographic segmentation includes age groups, income levels, dietary preferences, and lifestyle characteristics affecting plant-based protein adoption.

Industry analysis incorporates supply chain mapping, competitive intelligence gathering, and technology trend assessment through manufacturer interviews, distributor consultations, and retail partner discussions. Market sizing methodologies combine top-down and bottom-up approaches using production data, import statistics, and consumption patterns. Forecasting models integrate historical trends, growth drivers, and market constraint factors to project future development scenarios.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. MarkWide Research analytical frameworks incorporate industry best practices and proprietary methodologies developed through extensive experience in food industry market research. Quality assurance protocols maintain research integrity and reliability throughout the analysis process.

Western India leads market development with Maharashtra and Gujarat showing strongest adoption rates and manufacturing concentration. Mumbai metropolitan area demonstrates the highest per-capita consumption of plant-based meat alternatives, supported by diverse population demographics and established retail infrastructure. Market penetration in western regions reaches approximately 45% among target consumer segments, driven by health consciousness and environmental awareness.

Northern India shows rapid growth potential with Delhi NCR serving as a key market hub for both consumption and distribution. Punjab and Haryana benefit from strong agricultural foundations supporting raw material supply chains. Consumer acceptance rates in northern markets have increased by 28% annually as product variety and availability expand through modern retail channels.

Southern India demonstrates sophisticated market development with Bangalore, Chennai, and Hyderabad leading technology adoption and product innovation. Karnataka’s food processing industry provides manufacturing capabilities and technical expertise supporting market growth. Traditional vegetarian populations in southern states show strong interest in modern plant-based alternatives that align with cultural dietary preferences.

Eastern India represents emerging market opportunity with Kolkata and Bhubaneswar showing increasing consumer interest and retail expansion. West Bengal’s food culture creates unique opportunities for fish and seafood alternatives using plant-based ingredients. Market development initiatives focus on consumer education and distribution network establishment in eastern regions.

Market leadership features a dynamic mix of established food companies, innovative startups, and international brands competing across different product categories and consumer segments:

Competitive strategies emphasize product differentiation, brand building, distribution expansion, and strategic partnerships with retailers and food service providers. Innovation investments focus on texture improvement, flavor enhancement, and nutritional optimization to achieve competitive advantages in rapidly evolving market conditions.

By Product Type:

By Source:

By Distribution Channel:

Ready-to-Cook Products dominate consumer preferences with convenience factor driving adoption among busy urban households. Frozen alternatives provide extended shelf life and cooking flexibility while maintaining nutritional integrity. Marinated options offer flavor enhancement and cooking simplification appealing to consumers seeking restaurant-quality experiences at home.

Ingredient Solutions serve food service and industrial applications where bulk processing requirements and cost efficiency take priority over consumer packaging. Protein concentrates and textured alternatives enable food manufacturers to develop customized products for specific market segments. Functional ingredients provide binding, texture, and flavor enhancement properties for processed food applications.

Snack Products represent emerging opportunities combining plant-based proteins with convenient consumption formats. Jerky alternatives and protein bars leverage health trends and on-the-go consumption patterns. Crispy alternatives target traditional snack categories while offering improved nutritional profiles and sustainable ingredient sourcing.

Premium Segments focus on organic certification, artisanal production methods, and gourmet flavor profiles targeting affluent consumers willing to pay higher prices for quality and sustainability. Specialty formulations address specific dietary requirements including gluten-free, high-protein, and fortified alternatives. Limited edition products create market excitement and brand differentiation opportunities.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and sustainable business models aligned with global food industry trends. Production scalability enables efficient capacity utilization and cost optimization as market demand grows. Innovation platforms provide competitive differentiation and intellectual property development opportunities supporting long-term market positioning.

Retailers gain access to high-margin product categories attracting health-conscious consumers and driving store traffic. Category expansion opportunities enable retailers to serve evolving consumer preferences while building brand loyalty. Premium positioning supports improved profit margins and customer satisfaction through product quality and variety.

Consumers receive enhanced nutritional options, environmental sustainability benefits, and expanded dietary choices supporting health and wellness goals. Convenience factors simplify meal planning and preparation while maintaining taste satisfaction. Cost savings potential exists through reduced healthcare expenses and efficient protein utilization compared to conventional alternatives.

Investors access rapidly growing market segments with strong fundamentals, scalable business models, and alignment with sustainability trends. Return potential benefits from market expansion, technological advancement, and increasing consumer adoption rates. Portfolio diversification opportunities span manufacturing, technology, distribution, and brand development across the plant-based protein value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Movement drives demand for plant-based alternatives with minimal processing, recognizable ingredients, and transparent supply chains. Consumers increasingly scrutinize product labels seeking natural ingredients and avoiding artificial additives. Organic certification and non-GMO labeling become important differentiators in premium market segments.

Texture Innovation represents a critical frontier as manufacturers invest in advanced processing technologies to achieve meat-like mouthfeel and cooking characteristics. Fiber technology and protein structuring methods enable more authentic sensory experiences. 3D printing applications and cellular agriculture research promise revolutionary texture improvements in future product generations.

Flavor Localization trends show manufacturers adapting global plant-based concepts to Indian taste preferences through spice integration, regional flavor profiles, and traditional cooking method compatibility. Masala-infused products and curry-ready alternatives cater to local culinary traditions. Regional specialization creates opportunities for products targeting specific geographic taste preferences.

Sustainability Messaging becomes increasingly important as environmentally conscious consumers seek products aligned with climate change mitigation and resource conservation goals. Carbon footprint labeling and water usage comparisons help consumers make informed choices. Packaging innovation focuses on biodegradable and recyclable materials supporting overall sustainability positioning.

Manufacturing Capacity Expansion accelerates across the industry with multiple companies announcing new production facilities and equipment upgrades. Automation investments improve production efficiency and quality consistency while reducing labor costs. Regional manufacturing hubs develop in key agricultural areas providing supply chain advantages and local economic benefits.

Strategic Partnerships between plant-based manufacturers and established food companies create distribution synergies and market access opportunities. Retail collaborations expand product placement and consumer visibility in mainstream channels. Technology partnerships with international companies accelerate innovation and knowledge transfer in processing techniques.

Investment Activity shows significant capital inflow from venture capital firms, private equity investors, and strategic corporate investments. Funding rounds support research and development, manufacturing expansion, and marketing initiatives. Government incentives for food processing industries provide additional financial support for plant-based protein development.

Regulatory Developments include clearer guidelines for plant-based product labeling, safety standards, and nutritional claims. Food safety certifications become standardized across the industry ensuring consumer confidence and quality assurance. Export facilitation measures support Indian manufacturers seeking international market opportunities.

Market Entry Strategies should prioritize consumer education and taste testing programs to overcome initial resistance and build brand awareness. MarkWide Research analysis indicates that successful companies invest heavily in sampling campaigns and cooking demonstrations to showcase product quality and versatility. Partnership approaches with established food brands can accelerate market penetration and consumer acceptance.

Product Development Focus must emphasize texture authenticity and flavor optimization tailored to Indian consumer preferences. Innovation investments should target cooking behavior compatibility and nutritional enhancement to justify premium pricing. Regional customization strategies can create competitive advantages through locally relevant product formulations and marketing approaches.

Distribution Strategy recommendations include multi-channel approaches combining modern retail, online platforms, and food service partnerships. Cold chain infrastructure development remains critical for market expansion beyond tier-1 cities. Pricing strategies should balance profitability requirements with consumer accessibility to achieve sustainable market growth.

Investment Priorities should focus on manufacturing scalability, quality assurance systems, and brand building initiatives. Technology adoption in processing equipment and automation can provide long-term competitive advantages. Supply chain integration strategies ensure ingredient security and cost optimization as market demand grows.

Market trajectory indicates sustained growth momentum driven by increasing health consciousness, environmental awareness, and product innovation across India’s plant-based meat alternatives sector. Consumer adoption rates are projected to accelerate as product quality improvements and price optimization make alternatives more accessible to mainstream markets. Urban expansion and rising disposable incomes create favorable conditions for continued market development.

Technology advancement will drive significant improvements in taste, texture, and nutritional profiles of plant-based alternatives. Processing innovation and ingredient science breakthroughs promise products that closely match or exceed conventional meat experiences. Automation and efficiency improvements will enable cost reductions supporting broader market accessibility and competitive pricing strategies.

Market expansion beyond tier-1 cities represents substantial growth opportunity as distribution infrastructure develops and consumer awareness spreads. Rural market penetration may emerge as income levels rise and modern retail formats expand into smaller towns. Export potential positions Indian manufacturers as competitive suppliers in global plant-based protein markets seeking cost-effective alternatives.

Industry consolidation trends may emerge as successful companies acquire smaller players and international brands establish local partnerships. MWR projections suggest the market will achieve mainstream acceptance levels exceeding 25% among target demographics within the next five years. Innovation ecosystems will continue developing around major urban centers, supporting sustained technological advancement and market growth.

India’s plant-based meat alternatives market stands at a transformative juncture where consumer behavior shifts, technological innovation, and investment momentum converge to create exceptional growth opportunities. The sector demonstrates remarkable potential driven by health consciousness, environmental sustainability concerns, and evolving dietary preferences among urban populations seeking modern protein alternatives.

Market fundamentals remain strong with established vegetarian food culture, robust agricultural infrastructure, and growing consumer acceptance supporting sustained expansion. Innovation investments continue improving product quality, taste authenticity, and nutritional profiles while manufacturing scalability enables cost optimization and broader market accessibility. Distribution network development and retail partnerships facilitate consumer reach across diverse geographic and demographic segments.

Strategic success factors include consumer education, product localization, quality consistency, and competitive pricing strategies that balance profitability with market penetration objectives. Companies that effectively combine technological innovation with cultural adaptation and sustainable business practices will capture significant market share in this rapidly evolving sector. The India plant-based meat alternatives market represents a compelling opportunity for stakeholders committed to meeting growing demand for sustainable, healthy, and convenient protein solutions.

What is Plant Based Meat Alternatives?

Plant Based Meat Alternatives refer to food products designed to replicate the taste, texture, and nutritional profile of traditional meat, using ingredients derived from plants. These alternatives are often made from soy, peas, lentils, and other plant sources, catering to vegetarians, vegans, and flexitarians.

What are the key players in the India Plant Based Meat Alternatives Market?

Key players in the India Plant Based Meat Alternatives Market include companies like Beyond Meat, Good Dot, and Veggie Champ, which are known for their innovative products and market presence. These companies are focusing on expanding their product lines and improving the taste and texture of their offerings, among others.

What are the growth factors driving the India Plant Based Meat Alternatives Market?

The India Plant Based Meat Alternatives Market is driven by increasing health consciousness among consumers, a rise in vegetarian and vegan diets, and growing concerns about the environmental impact of meat production. Additionally, advancements in food technology are enhancing product quality and variety.

What challenges does the India Plant Based Meat Alternatives Market face?

Challenges in the India Plant Based Meat Alternatives Market include consumer skepticism regarding the taste and nutritional value of plant-based products, competition from traditional meat products, and regulatory hurdles related to labeling and marketing. These factors can hinder market growth and consumer acceptance.

What opportunities exist in the India Plant Based Meat Alternatives Market?

Opportunities in the India Plant Based Meat Alternatives Market include the potential for product innovation, expansion into new distribution channels, and increasing demand from food service sectors. Additionally, growing awareness of sustainability and health benefits can drive consumer interest.

What trends are shaping the India Plant Based Meat Alternatives Market?

Trends in the India Plant Based Meat Alternatives Market include the rise of clean label products, increased investment in research and development, and the introduction of new flavors and formats. There is also a growing focus on sustainability and ethical sourcing among consumers.

India Plant Based Meat Alternatives Market

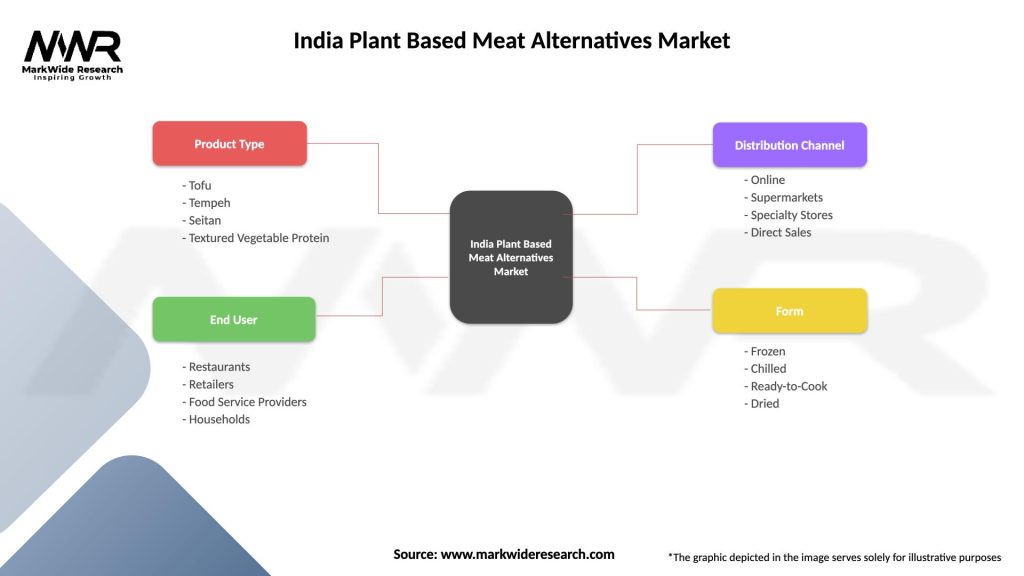

| Segmentation Details | Description |

|---|---|

| Product Type | Tofu, Tempeh, Seitan, Textured Vegetable Protein |

| End User | Restaurants, Retailers, Food Service Providers, Households |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Direct Sales |

| Form | Frozen, Chilled, Ready-to-Cook, Dried |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Plant Based Meat Alternatives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at