444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The India payments market has witnessed significant growth in recent years, driven by the rapid digital transformation in the country. With a population of over 1.3 billion people and a booming e-commerce industry, India presents a vast opportunity for payment service providers. The increasing adoption of smartphones and the government’s push for digital payments have further fueled the growth of the payments market.

The India payments market refers to the ecosystem of financial transactions conducted within the country. It encompasses various modes of payment, including cash, cards, mobile wallets, UPI (Unified Payments Interface), and other digital payment methods. The market includes both online and offline transactions, serving diverse sectors such as retail, e-commerce, banking, and more.

Executive Summary

The India payments market is experiencing a transformative phase, transitioning from a predominantly cash-based economy to a digital-first approach. This shift is driven by factors such as government initiatives like demonetization, financial inclusion programs, and the rise of technology-enabled payment solutions. The market is witnessing intense competition among payment service providers, leading to innovation and the development of user-friendly, secure, and convenient payment methods.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

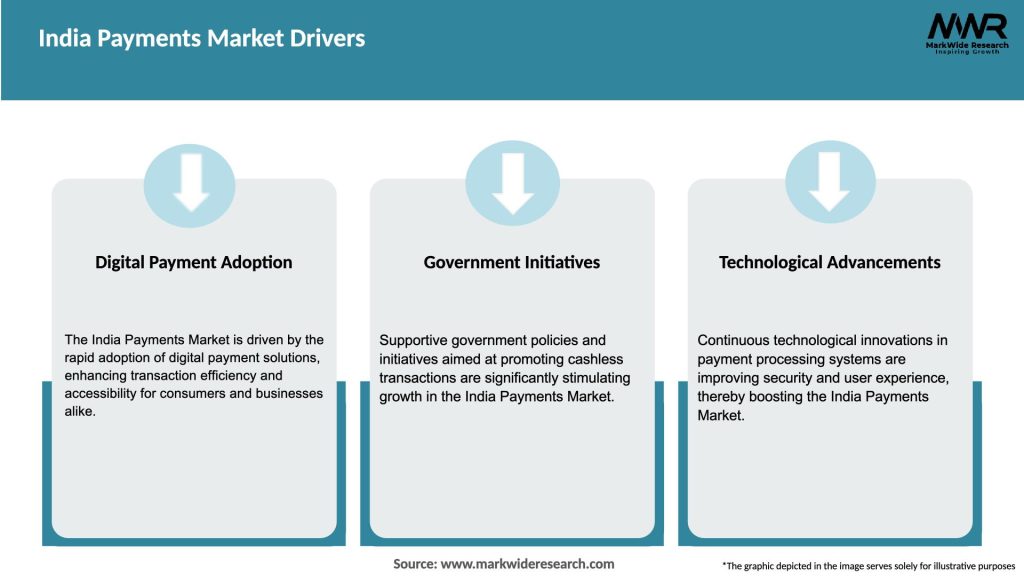

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India payments market is highly dynamic and evolving at a rapid pace. The market dynamics are influenced by factors such as changing consumer behavior, technological advancements, government policies, and competitive forces. Payment service providers need to continuously innovate and adapt to these dynamics to stay relevant and gain a competitive edge.

Regional Analysis

The payments market in India exhibits regional variations in terms of adoption and preferences. Urban centers, such as Mumbai, Delhi, and Bangalore, have higher digital payment penetration compared to rural areas. However, with increasing smartphone penetration and improving internet connectivity, the gap between urban and rural regions is gradually closing. To effectively cater to regional preferences, payment service providers should offer localized solutions and focus on expanding their presence across different regions.

Competitive Landscape

Leading Companies in the India Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India payments market can be segmented based on various factors such as payment method, industry vertical, and user demographics. Payment methods include cards, mobile wallets, UPI, net banking, and more. Industry verticals encompass retail, e-commerce, banking and financial services, travel and hospitality, and others. Demographic segmentation can be based on age groups, income levels, and geographic locations.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the India payments market. With the need for social distancing and reduced physical contact, there has been a surge in digital payment adoption. Contactless payments, UPI transactions, and online shopping have witnessed substantial growth as consumers prioritize safety and hygiene. The pandemic has accelerated the digital transformation of the payments ecosystem, and the shift towards digital payments is expected to continue even after the pandemic subsides.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the India payments market is promising, with sustained growth expected in the coming years. The market will witness further innovation, driven by emerging technologies like artificial intelligence, blockchain, and the Internet of Things. Increasing digital literacy, expanding internet connectivity, and the government’s focus on financial inclusion will further propel the growth of digital payments. Payment service providers that adapt to evolving customer needs, enhance security measures, and offer seamless experiences will thrive in this dynamic market.

Conclusion

The India payments market is undergoing a significant transformation, fueled by the country’s digital revolution and government initiatives promoting digital payments. The market offers immense opportunities for payment service providers to cater to a large and diverse consumer base. To succeed in this competitive landscape, companies need to prioritize convenience, security, and user experience while embracing emerging technologies. As India moves towards a more cashless society, the payments market will continue to evolve, shaping the future of financial transactions in the country.

What is India Payments?

India Payments refers to the various methods and systems used for transferring money and settling transactions in India. This includes digital wallets, bank transfers, and card payments, among others.

What are the key players in the India Payments Market?

Key players in the India Payments Market include Paytm, PhonePe, Google Pay, and Razorpay, which provide a range of digital payment solutions and services to consumers and businesses.

What are the main drivers of growth in the India Payments Market?

The growth of the India Payments Market is driven by increasing smartphone penetration, the rise of e-commerce, and government initiatives promoting digital transactions. Additionally, consumer preference for cashless payments is contributing to this growth.

What challenges does the India Payments Market face?

The India Payments Market faces challenges such as cybersecurity threats, regulatory compliance issues, and the need for infrastructure improvements in rural areas. These factors can hinder the adoption of digital payment solutions.

What opportunities exist in the India Payments Market?

Opportunities in the India Payments Market include the expansion of financial inclusion initiatives, the growth of fintech startups, and the increasing adoption of contactless payment technologies. These trends are likely to enhance the overall payment ecosystem.

What trends are shaping the India Payments Market?

Trends shaping the India Payments Market include the rise of UPI (Unified Payments Interface), the integration of AI for fraud detection, and the growing popularity of QR code payments. These innovations are transforming how transactions are conducted.

India Payments Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, UPI |

| Transaction Type | Online, In-store, Peer-to-peer, Bill Payment |

| Customer Segment | Retail, E-commerce, SMEs, Corporates |

| Service Provider | Banking Institutions, Fintechs, Payment Gateways, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at