444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India Passenger Vehicles Lubricants Market refers to the sector that deals with the production, distribution, and consumption of lubricants specifically designed for passenger vehicles in India. Lubricants play a vital role in ensuring the smooth functioning and longevity of various vehicle components, such as engines, transmissions, and differentials. These lubricants reduce friction, heat, and wear between moving parts, thereby enhancing overall vehicle performance and fuel efficiency.

Meaning

The term “India Passenger Vehicles Lubricants Market” refers to the business environment and industry players involved in the production, distribution, and sale of lubricants specifically formulated for passenger vehicles in the Indian market. It includes various types of lubricants, such as engine oils, transmission fluids, and gear oils, that are tailored to meet the specific requirements of passenger vehicles.

Executive Summary

The India Passenger Vehicles Lubricants Market has witnessed significant growth in recent years, driven by the rising demand for passenger vehicles and the increasing focus on vehicle maintenance and performance. With India being one of the world’s largest automobile markets, the demand for high-quality lubricants has been on the rise. The market is characterized by intense competition among both domestic and international lubricant manufacturers, with a wide range of product offerings to cater to the diverse needs of consumers.

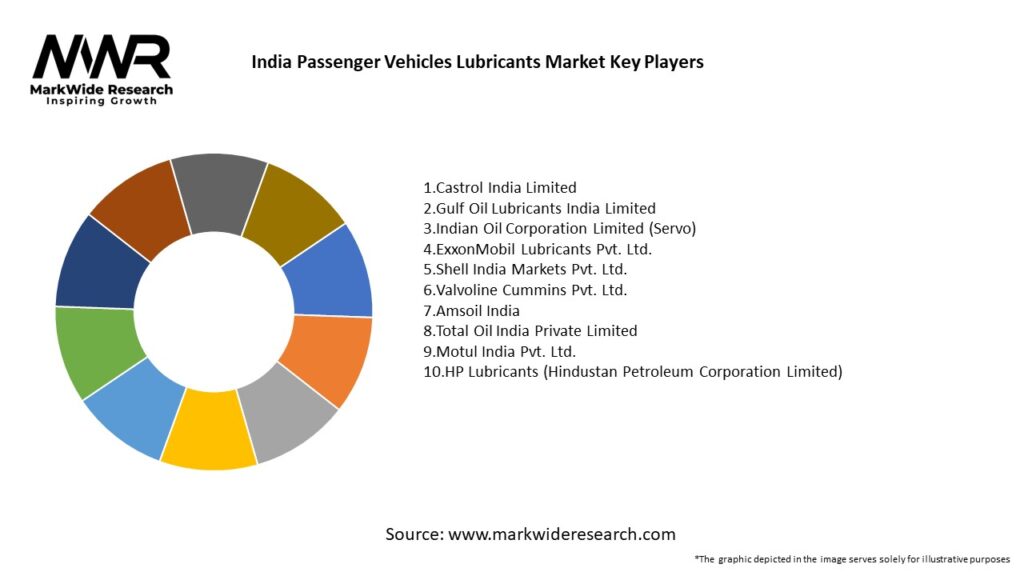

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The India Passenger Vehicles Lubricants Market is driven by several factors that contribute to its growth and development. Some key market drivers include:

Market Restraints

Despite the positive growth prospects, the India Passenger Vehicles Lubricants Market also faces certain challenges and constraints. Some key market restraints include:

Market Opportunities

The India Passenger Vehicles Lubricants Market presents several opportunities for industry participants and stakeholders. These opportunities include:

Market Dynamics

The India Passenger Vehicles Lubricants Market is driven by various market dynamics, including consumer preferences, technological advancements, regulatory policies, and industry competition. These dynamics shape the market landscape and influence the strategies adopted by industry participants.

Consumer preferences play a crucial role in driving the demand for specific types of lubricants. Factors such as vehicle age, brand loyalty, and price sensitivity influence consumer choices. Moreover, increasing awareness about the benefits of using high-quality lubricants and the importance of vehicle maintenance has a positive impact on market growth.

Technological advancements in lubricant formulations, manufacturing processes, and packaging have enabled manufacturers to introduce superior-quality lubricants that meet the evolving needs of modern vehicles. The development of synthetic lubricants, biodegradable lubricants, and lubricants with extended drain intervals has significantly contributed to market growth.

Regulatory policies, such as emission norms and fuel efficiency standards, influence the type of lubricants used in vehicles. The implementation of stricter regulations has prompted lubricant manufacturers to focus on developing eco-friendly lubricants that minimize environmental impact and comply with the prescribed standards.

The India Passenger Vehicles Lubricants Market is highly competitive, with numerous domestic and international players vying for market share. Manufacturers employ various strategies such as product differentiation, competitive pricing, marketing campaigns, and mergers and acquisitions to gain a competitive edge.

Regional Analysis

The India Passenger Vehicles Lubricants Market exhibits regional variations in terms of demand and consumption patterns. Major regions analyzed in the market include:

Each region presents unique market dynamics, such as consumer preferences, industrial growth, and infrastructure development, which influence the demand for passenger vehicle lubricants.

Competitive Landscape

Leading Companies in India Passenger Vehicles Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India Passenger Vehicles Lubricants Market can be segmented based on various factors, including lubricant type, vehicle type, and distribution channel.

Based on lubricant type, the market can be segmented into:

Based on vehicle type, the market can be segmented into:

Based on the distribution channel, the market can be segmented into:

Segmentation allows lubricant manufacturers to target specific customer segments and cater to their unique requirements, thereby enhancing their market presence and customer satisfaction.

Category-wise Insights

Each category of lubricants in the India Passenger Vehicles Lubricants Market offers specific insights and trends. Some category-wise insights include:

Understanding the specific trends and insights within each lubricant category enables manufacturers to develop targeted strategies and meet the evolving demands of consumers.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the India Passenger Vehicles Lubricants Market can benefit in several ways. Some key benefits include:

SWOT Analysis

A SWOT analysis provides a comprehensive assessment of the strengths, weaknesses, opportunities, and threats in the India Passenger Vehicles Lubricants Market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding the strengths, weaknesses, opportunities, and threats helps industry participants formulate effective strategies and mitigate potential risks.

Market Key Trends

The India Passenger Vehicles Lubricants Market is characterized by several key trends that shape its growth and development. Some notable trends include:

Understanding these key trends enables industry participants to align their strategies and offerings with the evolving needs of consumers and the market.

Covid-19 Impact

The outbreak of the COVID-19 pandemic had a significant impact on the India Passenger Vehicles Lubricants Market. The lockdown measures, restrictions on mobility, and economic uncertainty resulted in a temporary decline in vehicle sales and overall demand for lubricants. However, the market has shown resilience and demonstrated signs of recovery as the situation improved.

During the pandemic, the demand for lubricants from the passenger vehicles segment was affected due to reduced vehicle usage, travel restrictions, and disruptions in the automotive supply chain. The decline in vehicle sales, particularly during the initial phases of the pandemic, had a direct impact on the lubricant market.

However, as the restrictions eased and economic activities resumed, the market witnessed a gradual recovery. The pent-up demand for vehicles, along with the increasing focus on personal mobility, has driven the demand for lubricants. Moreover, as vehicle owners emphasized proper maintenance to ensure optimal performance, the market experienced a rebound in lubricant sales.

The pandemic also accelerated certain trends in the market. The shift towards e-commerce platforms for purchasing lubricants gained momentum, with consumers preferring contactless transactions and doorstep deliveries. Additionally, the focus on health and hygiene led to increased awareness about the importance of vehicle cleanliness, creating opportunities for the sale of cleaning and maintenance products, including lubricants.

The long-term impact of the pandemic on the market will depend on factors such as the pace of economic recovery, consumer sentiment, and government policies related to the automotive industry. However, with the growing demand for passenger vehicles and the need for maintenance and performance optimization, the India Passenger Vehicles Lubricants Market is expected to regain its growth trajectory.

Key Industry Developments

The India Passenger Vehicles Lubricants Market has witnessed several key industry developments in recent years. Some notable developments include:

These industry developments reflect the commitment of lubricant manufacturers to meet the changing needs of consumers, comply with regulatory requirements, and stay ahead in a competitive market.

Analyst Suggestions

Based on the analysis of the India Passenger Vehicles Lubricants Market, analysts suggest the following strategies for industry participants:

Future Outlook

The future outlook for the India Passenger Vehicles Lubricants Market is promising, driven by factors such as the growing demand for passenger vehicles, technological advancements, and the focus on vehicle maintenance and performance. The market is expected to witness steady growth in the coming years, with opportunities for industry participants to capitalize on.

The increasing disposable income, urbanization, and improving road infrastructure in India are likely to contribute to the growth of the passenger vehicle market. This, in turn, will drive the demand for high-quality lubricants to ensure proper vehicle maintenance and performance.

Technological advancements will continue to shape the market, with lubricant manufacturers focusing on developing innovative formulations to meet the evolving needs of modern vehicles. The shift towards synthetic lubricants, low-viscosity oils, and lubricants with enhanced fuel efficiency is expected to gain further momentum.

Environmental sustainability will be a key focus area, with manufacturers investing in the development of eco-friendly lubricants and adopting sustainable manufacturing practices. Compliance with emission norms, reduced environmental impact, and waste management will be crucial for long-term success in the market.

Collaborations with OEMs, automotive dealerships, and service centers will play a vital role in market expansion, distribution network growth, and customer engagement. Strengthening these partnerships will provide industry participants with a competitive advantage and access to a wider customer base.

Conclusion

In conclusion, the India Passenger Vehicles Lubricants Market presents significant growth opportunities for industry participants. By focusing on product differentiation, distribution network expansion, technological advancements, environmental sustainability, and strategic partnerships, lubricant manufacturers can position themselves for long-term success in this dynamic and competitive market.

What is Passenger Vehicles Lubricants?

Passenger vehicles lubricants are specialized oils and fluids designed to reduce friction and wear in the engines and components of passenger vehicles, ensuring optimal performance and longevity.

What are the key players in the India Passenger Vehicles Lubricants Market?

Key players in the India Passenger Vehicles Lubricants Market include Indian Oil Corporation, Bharat Petroleum, and Castrol India, among others.

What are the growth factors driving the India Passenger Vehicles Lubricants Market?

The growth of the India Passenger Vehicles Lubricants Market is driven by increasing vehicle production, rising consumer awareness about vehicle maintenance, and the growing demand for high-performance lubricants.

What challenges does the India Passenger Vehicles Lubricants Market face?

The India Passenger Vehicles Lubricants Market faces challenges such as fluctuating raw material prices, stringent environmental regulations, and the increasing adoption of electric vehicles, which require different lubrication solutions.

What opportunities exist in the India Passenger Vehicles Lubricants Market?

Opportunities in the India Passenger Vehicles Lubricants Market include the development of bio-based lubricants, advancements in synthetic lubricants, and the expansion of the automotive sector, which can drive demand for innovative lubrication solutions.

What trends are shaping the India Passenger Vehicles Lubricants Market?

Trends in the India Passenger Vehicles Lubricants Market include the shift towards synthetic and high-mileage lubricants, increased focus on sustainability, and the integration of smart technologies in lubricant formulations.

India Passenger Vehicles Lubricants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Brake Fluid, Grease |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Fleet Operators |

| Application | Passenger Cars, SUVs, Light Trucks, Vans |

| Distribution Channel | Retail Stores, Online Platforms, Service Stations, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in India Passenger Vehicles Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at