444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The pant-type adult diaper market in India is experiencing robust growth, driven by factors such as increasing awareness about incontinence management, rising elderly population, and improving healthcare infrastructure. Pant-type adult diapers offer convenience, comfort, and dignity to users, addressing the needs of individuals with urinary or fecal incontinence. With a focus on affordability, quality, and accessibility, manufacturers and retailers in India are well-positioned to capitalize on the growing demand for pant-type adult diapers in the country.

Meaning

Pant-type adult diapers are designed to provide discreet and effective protection for individuals experiencing urinary or fecal incontinence. These diapers feature an underwear-like design with elasticized waistbands and leg openings for a secure and comfortable fit. Pant-type adult diapers offer users confidence and freedom, enabling them to lead active and independent lives without fear of leaks or accidents.

Executive Summary

The pant-type adult diaper market in India is witnessing rapid growth, fueled by demographic trends, changing consumer attitudes, and increasing acceptance of incontinence management products. Manufacturers are focusing on affordability, product innovation, and distribution expansion to cater to the diverse needs of Indian consumers. Understanding key market dynamics, drivers, and challenges is crucial for industry participants seeking to capitalize on the burgeoning demand for pant-type adult diapers in India.

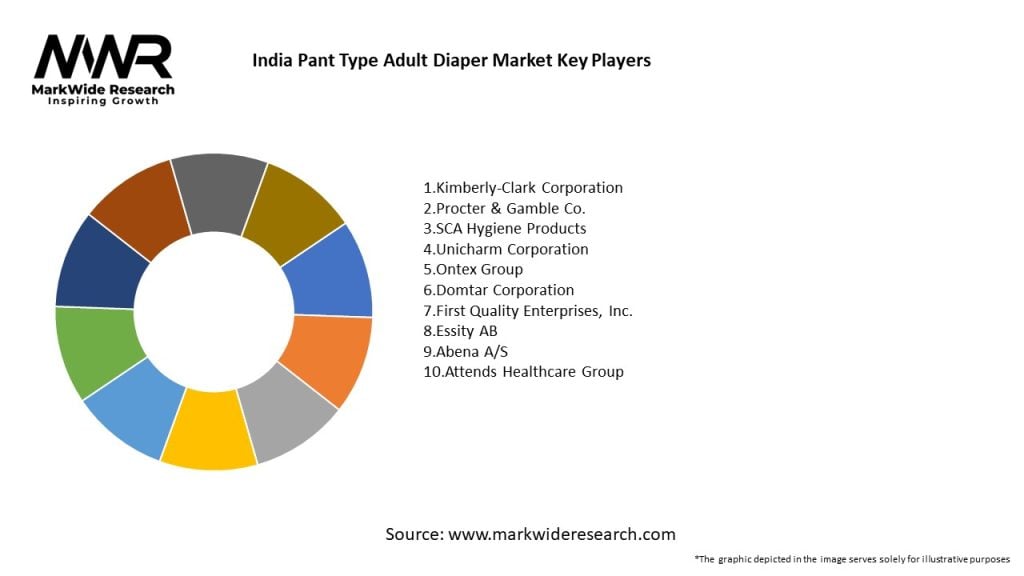

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The pant-type adult diaper market in India operates in a dynamic environment shaped by demographic trends, consumer attitudes, regulatory factors, and technological advancements. Key drivers such as the aging population, increasing healthcare expenditure, and changing consumer preferences fuel market growth. However, cultural stigma, affordability concerns, regulatory compliance, and distribution challenges pose barriers to market expansion. Strategic initiatives focusing on product affordability, rural market expansion, digital marketing, and healthcare partnerships offer opportunities for manufacturers to capitalize on growing demand and address market challenges.

Regional Analysis

The pant-type adult diaper market in India exhibits regional variations influenced by factors such as population density, urbanization levels, healthcare infrastructure, and socioeconomic factors. Urban centers and metropolitan areas with higher concentrations of elderly residents and healthcare facilities tend to have greater demand for incontinence management products, including pant-type adult diapers. Rural and remote regions may face challenges related to product accessibility, distribution, and healthcare service provision, requiring tailored marketing and distribution strategies to address unique regional needs.

Competitive Landscape

Leading Companies in India Pant Type Adult Diaper Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The pant-type adult diaper market in India can be segmented based on various factors such as:

Segmentation allows manufacturers to target specific consumer segments and address their unique needs effectively, enhancing market penetration and customer satisfaction.

Category-wise Insights

Understanding consumer preferences and prioritizing these key attributes in product development and marketing efforts can help manufacturers gain a competitive edge in the Indian pant-type adult diaper market.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis enables businesses to identify strengths, address weaknesses, capitalize on opportunities, and mitigate threats effectively.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the pant-type adult diaper market in India:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the pant-type adult diaper market in India is optimistic, with continued growth expected in the coming years. Demographic trends, increasing awareness about incontinence issues, product innovation, and digital transformation will drive market expansion. However, cultural stigma, affordability concerns, regulatory compliance, and distribution challenges pose barriers to market growth. Strategic initiatives focusing on product diversification, digital marketing, healthcare partnerships, and sustainability can unlock growth opportunities and drive market success in India.

Conclusion

In conclusion, the pant-type adult diaper market in India presents significant opportunities for manufacturers and retailers, driven by demographic shifts, increasing awareness about incontinence, and evolving consumer preferences. Despite challenges such as cultural stigma, affordability concerns, and distribution challenges, strategic initiatives focusing on product innovation, digitalization, healthcare partnerships, and sustainability can drive growth and success in the dynamic Indian market. By understanding key market trends, addressing consumer needs, and leveraging digital technologies, industry participants can position themselves for long-term success and contribute to improving the quality of life for individuals with incontinence in India.

What is Pant Type Adult Diaper?

Pant Type Adult Diapers are absorbent garments designed for adults, providing comfort and protection against incontinence. They are typically worn like regular underwear and are suitable for various situations, including mobility challenges and post-surgery recovery.

What are the key players in the India Pant Type Adult Diaper Market?

Key players in the India Pant Type Adult Diaper Market include Procter & Gamble, Kimberly-Clark, and Huggies, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the India Pant Type Adult Diaper Market?

The growth of the India Pant Type Adult Diaper Market is driven by an increasing aging population, rising awareness about hygiene, and the growing prevalence of incontinence issues. Additionally, the expansion of healthcare facilities contributes to market growth.

What challenges does the India Pant Type Adult Diaper Market face?

The India Pant Type Adult Diaper Market faces challenges such as high product costs and social stigma associated with adult incontinence. Additionally, limited awareness in rural areas can hinder market penetration.

What opportunities exist in the India Pant Type Adult Diaper Market?

Opportunities in the India Pant Type Adult Diaper Market include the development of eco-friendly products and the introduction of innovative designs that enhance comfort and usability. The growing e-commerce sector also presents new distribution channels.

What trends are shaping the India Pant Type Adult Diaper Market?

Trends in the India Pant Type Adult Diaper Market include the increasing demand for discreet and comfortable products, as well as advancements in materials that improve absorbency and skin-friendliness. There is also a rising focus on sustainability in product development.

India Pant Type Adult Diaper Market

| Segmentation Details | Description |

|---|---|

| Product Type | Disposable, Reusable, Biodegradable, Super Absorbent |

| End User | Senior Citizens, Patients, Caregivers, Disabled Individuals |

| Distribution Channel | Online Retail, Pharmacies, Supermarkets, Hospitals |

| Size | Small, Medium, Large, Extra Large |

Leading Companies in India Pant Type Adult Diaper Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at