444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India paints and coatings market represents one of the most dynamic and rapidly evolving sectors within the country’s industrial landscape. Market dynamics indicate substantial growth driven by urbanization, infrastructure development, and increasing consumer awareness about aesthetic and protective coating solutions. The industry encompasses a diverse range of products including decorative paints, industrial coatings, automotive finishes, and specialty coatings designed for various applications across residential, commercial, and industrial segments.

Growth projections for the Indian paints and coatings sector demonstrate remarkable expansion potential, with the market experiencing a compound annual growth rate of approximately 12-15% over recent years. This growth trajectory reflects the country’s robust construction activities, rising disposable incomes, and evolving consumer preferences toward premium and eco-friendly coating solutions. Regional distribution shows concentrated demand in major metropolitan areas, with emerging markets in tier-2 and tier-3 cities contributing significantly to overall market expansion.

Technological advancements continue to reshape the industry landscape, with manufacturers investing heavily in research and development to introduce innovative formulations that offer enhanced durability, environmental compliance, and superior performance characteristics. The market’s evolution reflects broader economic trends, including the government’s focus on infrastructure development, housing initiatives, and industrial modernization programs that collectively drive sustained demand for high-quality paints and coatings across multiple application segments.

The India paints and coatings market refers to the comprehensive ecosystem of manufacturers, distributors, and retailers involved in the production, marketing, and sale of protective and decorative coating solutions across the Indian subcontinent. This market encompasses various product categories including water-based paints, solvent-based coatings, powder coatings, and specialty formulations designed to meet diverse application requirements in residential, commercial, industrial, and automotive sectors.

Market scope extends beyond traditional decorative paints to include advanced coating technologies such as anti-corrosive treatments, fire-resistant formulations, thermal barrier coatings, and environmentally sustainable solutions that align with evolving regulatory standards and consumer preferences. The sector plays a crucial role in supporting India’s construction industry, manufacturing base, and infrastructure development initiatives while contributing significantly to employment generation and economic growth.

Industry definition encompasses both organized and unorganized market segments, with established multinational corporations and domestic manufacturers competing alongside regional players and local paint manufacturers. This diverse competitive landscape reflects the market’s accessibility to various business models while highlighting opportunities for innovation, brand differentiation, and market penetration strategies tailored to India’s unique demographic and economic characteristics.

Strategic analysis of the India paints and coatings market reveals a sector characterized by robust growth fundamentals, increasing market sophistication, and evolving consumer demands that favor quality, sustainability, and aesthetic appeal. The market benefits from favorable demographic trends, including rapid urbanization, growing middle-class population, and increased focus on home improvement and infrastructure development across both urban and rural areas.

Key performance indicators demonstrate the market’s resilience and growth potential, with decorative paints accounting for approximately 70-75% of total market share, while industrial coatings represent a significant and rapidly expanding segment. Market penetration varies considerably across different regions, with southern and western states showing higher consumption rates compared to eastern and northeastern regions, indicating substantial opportunities for geographic expansion and market development.

Competitive dynamics reflect a market dominated by several major players who have established strong brand recognition, extensive distribution networks, and comprehensive product portfolios. However, the sector also provides opportunities for niche players, specialty coating manufacturers, and innovative companies that can address specific market needs or introduce breakthrough technologies that enhance performance, reduce environmental impact, or offer superior value propositions to end-users.

Market intelligence reveals several critical insights that define the current state and future trajectory of India’s paints and coatings industry. Consumer behavior analysis indicates a significant shift toward premium products, with customers increasingly willing to invest in high-quality coatings that offer enhanced durability, aesthetic appeal, and environmental benefits.

Primary growth drivers propelling the India paints and coatings market include robust construction activity supported by government infrastructure initiatives, urban development projects, and the country’s ambitious housing programs. Urbanization trends continue to accelerate, with millions of people migrating to cities annually, creating sustained demand for residential and commercial construction that directly translates to increased paint and coating consumption.

Economic factors contributing to market expansion include rising disposable incomes, growing middle-class population, and increased consumer spending on home improvement and aesthetic enhancement. The government’s Make in India initiative and focus on manufacturing sector development stimulate demand for industrial coatings, while infrastructure projects including smart cities, highways, and transportation systems require specialized protective coating solutions.

Technological advancement serves as another crucial driver, with manufacturers developing innovative formulations that offer superior performance, environmental compliance, and application convenience. Consumer awareness regarding the importance of quality coatings for asset protection, energy efficiency, and aesthetic value continues to grow, supported by increased access to information and rising education levels across diverse demographic segments.

Significant challenges facing the India paints and coatings market include volatile raw material costs, particularly petroleum-based chemicals and additives that constitute major input components. Price fluctuations in crude oil, titanium dioxide, and other essential raw materials create margin pressure for manufacturers and complicate pricing strategies, especially in price-sensitive market segments where consumers demonstrate high sensitivity to cost variations.

Regulatory compliance requirements present ongoing challenges, as environmental standards become increasingly stringent and manufacturers must invest substantially in research and development to develop compliant formulations. Implementation costs associated with meeting new environmental regulations, worker safety standards, and quality certifications can strain resources, particularly for smaller manufacturers and regional players with limited financial capabilities.

Market fragmentation and intense competition create additional restraints, with numerous players competing on price, quality, and distribution reach. Unorganized sector competition from local manufacturers offering low-cost alternatives can pressure organized players’ market share and profitability, while counterfeit products and quality inconsistencies in some market segments undermine consumer confidence and brand value propositions.

Emerging opportunities in the India paints and coatings market span multiple dimensions, with rural market penetration representing perhaps the most significant growth avenue. Government initiatives including rural housing schemes, village development programs, and agricultural infrastructure projects create substantial demand potential in previously underserved markets where organized paint manufacturers have limited presence.

Sustainability trends offer considerable opportunities for companies that can develop and market environmentally friendly coating solutions. Green building certifications, corporate sustainability commitments, and consumer environmental consciousness drive demand for low-VOC paints, bio-based formulations, and recyclable packaging solutions that align with global sustainability standards and local environmental regulations.

Digital transformation presents opportunities for enhanced customer engagement, improved distribution efficiency, and innovative service delivery models. E-commerce platforms, mobile applications for color selection and project planning, and digital marketing strategies can help manufacturers reach new customer segments, improve brand visibility, and create differentiated value propositions that enhance customer loyalty and market penetration across diverse geographic and demographic markets.

Complex market dynamics characterize the India paints and coatings sector, with multiple interconnected factors influencing supply, demand, pricing, and competitive positioning. Supply chain considerations include raw material availability, manufacturing capacity utilization, and distribution network efficiency, all of which impact market responsiveness and customer satisfaction levels across different regions and application segments.

Demand patterns exhibit seasonal variations, with peak consumption typically occurring during favorable weather conditions for painting activities and construction projects. Regional variations in demand reflect differences in economic development, construction activity levels, consumer preferences, and cultural factors that influence color choices, application methods, and purchasing decisions across India’s diverse geographic and demographic landscape.

Competitive dynamics continue evolving as market leaders invest in capacity expansion, product innovation, and brand building while emerging players seek differentiation through specialized offerings, competitive pricing, or superior customer service. Market consolidation trends suggest ongoing opportunities for strategic partnerships, acquisitions, and collaborative arrangements that can enhance market reach, technical capabilities, and operational efficiency for participating companies.

Comprehensive research methodology employed for analyzing the India paints and coatings market incorporates multiple data collection techniques, analytical frameworks, and validation processes to ensure accuracy, reliability, and actionable insights. Primary research activities include structured interviews with industry executives, manufacturing professionals, distributors, retailers, and end-users across different market segments and geographic regions to capture diverse perspectives and market intelligence.

Secondary research encompasses analysis of industry reports, government publications, trade association data, company financial statements, and regulatory documents to establish market context, historical trends, and competitive landscape understanding. Data triangulation methods ensure consistency and accuracy by cross-referencing information from multiple sources and validating findings through expert consultations and industry feedback mechanisms.

Analytical techniques include quantitative modeling for market sizing and forecasting, qualitative analysis for trend identification and strategic insights, and comparative analysis for competitive positioning and benchmarking. MarkWide Research methodologies incorporate advanced statistical tools, scenario modeling, and sensitivity analysis to provide robust projections and strategic recommendations that support informed decision-making for industry stakeholders and market participants.

Regional market distribution across India reveals significant variations in consumption patterns, growth rates, and market maturity levels that reflect underlying economic, demographic, and infrastructure development differences. Western India including Maharashtra, Gujarat, and Rajasthan accounts for approximately 35-40% of total market consumption, driven by robust industrial activity, urban development, and established manufacturing bases that support both decorative and industrial coating demand.

Southern regions comprising Karnataka, Tamil Nadu, Andhra Pradesh, and Kerala represent another major consumption center, contributing approximately 25-30% of market share with strong growth in residential construction, IT infrastructure development, and automotive manufacturing that drives diverse coating applications. Northern markets including Delhi, Punjab, Haryana, and Uttar Pradesh show substantial potential with government infrastructure projects and urban expansion initiatives creating sustained demand growth.

Eastern and northeastern regions present significant untapped opportunities, with lower current consumption levels indicating potential for market expansion as economic development accelerates and infrastructure investments increase. Rural market penetration remains relatively low across all regions, suggesting substantial growth opportunities for companies that can develop appropriate distribution strategies, product formulations, and pricing models tailored to rural consumer needs and purchasing patterns.

Market leadership in India’s paints and coatings sector is characterized by several established players who have built strong brand recognition, extensive distribution networks, and comprehensive product portfolios serving diverse customer segments. Competitive positioning reflects different strategic approaches, with some companies focusing on premium segments while others emphasize mass market accessibility and value-oriented offerings.

Market segmentation analysis reveals multiple classification criteria that help understand customer needs, application requirements, and growth opportunities across different product categories and end-user segments. Product-based segmentation provides insights into demand patterns, pricing dynamics, and competitive positioning across various coating formulations and application methods.

By Product Type:

By Technology:

Decorative paints category dominates the Indian market landscape, accounting for the largest share of total consumption and revenue generation. Consumer preferences in this segment increasingly favor premium products offering enhanced durability, aesthetic appeal, and functional benefits such as anti-bacterial properties, easy cleaning, and fade resistance. Color trends reflect evolving lifestyle preferences, with neutral tones, earth colors, and contemporary palettes gaining popularity among urban consumers.

Industrial coatings segment demonstrates robust growth potential driven by manufacturing sector expansion, infrastructure development, and increasing quality standards across various industries. Automotive coatings represent a particularly dynamic subsegment, with growing vehicle production and rising consumer expectations for finish quality and durability driving demand for advanced coating technologies and specialized formulations.

Specialty coatings including marine paints, fire-resistant formulations, and anti-corrosive treatments show strong growth prospects as industries focus on asset protection, safety compliance, and operational efficiency. Powder coatings adoption continues expanding across metal finishing applications, driven by environmental benefits, superior finish quality, and cost-effectiveness compared to traditional liquid coating alternatives.

Manufacturers benefit from India’s paints and coatings market through multiple value creation opportunities including economies of scale, brand building potential, and diversification across product categories and geographic markets. Market expansion strategies enable companies to leverage existing capabilities while exploring new applications, customer segments, and distribution channels that enhance revenue growth and market positioning.

Distributors and retailers gain from the market’s growth through increased sales volumes, improved margins on premium products, and opportunities to expand service offerings including color consultation, application services, and customer education programs. Value-added services create differentiation opportunities and strengthen customer relationships while generating additional revenue streams beyond traditional product sales.

End-users benefit from improved product quality, expanded choice options, competitive pricing, and enhanced customer service as market competition drives innovation and service excellence. Technology advancement provides customers with coating solutions that offer superior performance, environmental benefits, and application convenience while supporting aesthetic preferences and functional requirements across diverse applications and environments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the most significant trend reshaping India’s paints and coatings market, with manufacturers investing heavily in developing environmentally compliant formulations that meet evolving regulatory standards and consumer expectations. Water-based coatings continue gaining market share, with adoption rates increasing approximately 15-20% annually as customers prioritize low-VOC products for health and environmental benefits.

Digital transformation accelerates across the industry, with companies implementing e-commerce platforms, mobile applications for color selection, and digital marketing strategies to enhance customer engagement and market reach. Customization trends reflect growing consumer demand for personalized color solutions, specialty finishes, and application-specific formulations that address unique aesthetic and functional requirements.

Premium product adoption increases as consumers become more quality-conscious and willing to invest in coatings that offer enhanced durability, aesthetic appeal, and functional benefits. MWR analysis indicates that premium segment growth rates exceed overall market expansion, suggesting sustained opportunities for companies that can effectively position and market high-value coating solutions to discerning customers across urban and emerging markets.

Strategic acquisitions and partnerships continue reshaping the competitive landscape, with major players seeking to strengthen market positions, expand product portfolios, and enhance geographic reach through targeted investments and collaborative arrangements. Capacity expansion projects reflect industry confidence in long-term growth prospects, with several manufacturers announcing significant investments in new production facilities and technology upgrades.

Product innovation initiatives focus on developing advanced formulations that address emerging customer needs including anti-viral coatings, smart coatings with self-cleaning properties, and specialized solutions for extreme weather conditions. Sustainability investments include development of bio-based raw materials, recyclable packaging solutions, and manufacturing process improvements that reduce environmental impact and support circular economy principles.

Distribution network expansion efforts target rural markets and tier-2/tier-3 cities through innovative retail formats, dealer development programs, and logistics optimization initiatives. Technology partnerships with international companies provide access to advanced coating technologies, application techniques, and market expertise that enhance competitive positioning and customer value propositions.

Strategic recommendations for market participants emphasize the importance of balancing growth investments with operational efficiency improvements to maintain competitive positioning in an increasingly dynamic market environment. Rural market penetration should be prioritized through targeted product development, appropriate pricing strategies, and distribution network expansion that addresses unique rural customer needs and purchasing patterns.

Innovation focus should concentrate on sustainability, performance enhancement, and customer convenience to differentiate offerings and justify premium positioning in competitive market segments. Digital capabilities require continued investment to support e-commerce growth, customer engagement, and operational efficiency improvements that enhance market responsiveness and customer satisfaction levels.

Partnership strategies can provide access to new technologies, market segments, and geographic regions while sharing investment risks and leveraging complementary capabilities. MarkWide Research analysis suggests that companies pursuing balanced growth strategies combining organic expansion with strategic partnerships achieve superior long-term performance compared to those relying solely on internal development or acquisition-based growth approaches.

Long-term prospects for India’s paints and coatings market remain highly favorable, supported by sustained economic growth, urbanization trends, and infrastructure development initiatives that create robust demand across multiple application segments. Market evolution will likely favor companies that successfully integrate sustainability, innovation, and customer-centricity into their strategic positioning and operational execution.

Growth projections indicate continued expansion at rates exceeding 10-12% annually over the next five years, with rural markets, specialty coatings, and premium segments contributing disproportionately to overall market growth. Technology advancement will drive product differentiation opportunities while environmental regulations create both challenges and opportunities for companies that can develop compliant, high-performance formulations.

Market consolidation trends may accelerate as competitive pressures increase and smaller players seek strategic alternatives to maintain market relevance. International expansion opportunities will likely emerge for Indian manufacturers as they develop technical capabilities, quality standards, and brand recognition that enable successful competition in global markets while leveraging cost advantages and manufacturing expertise developed in the domestic market.

India’s paints and coatings market represents a compelling growth opportunity characterized by favorable demographic trends, robust economic fundamentals, and evolving consumer preferences that support sustained expansion across multiple product categories and application segments. Market dynamics reflect a sector in transition, with traditional competitive advantages being supplemented by innovation capabilities, sustainability focus, and customer-centric strategies that define future success factors.

Strategic positioning for market success requires balancing growth investments with operational excellence while maintaining focus on customer needs, environmental responsibility, and technological advancement. Industry participants that successfully navigate the complex interplay of market opportunities, competitive pressures, and regulatory requirements will be well-positioned to capture disproportionate value creation as the market continues its evolution toward greater sophistication and sustainability.

The future trajectory of India’s paints and coatings market promises continued growth, innovation, and value creation opportunities for stakeholders who can effectively adapt to changing market conditions while maintaining focus on quality, customer satisfaction, and sustainable business practices that support long-term competitive advantage and market leadership.

What is Paints & Coatings?

Paints & Coatings refer to substances applied to surfaces to protect, decorate, or enhance their appearance. They are used in various applications, including residential, commercial, and industrial settings.

What are the key players in the India Paints & Coatings Market?

Key players in the India Paints & Coatings Market include Asian Paints, Berger Paints, and Kansai Nerolac, among others. These companies are known for their extensive product ranges and strong market presence.

What are the growth factors driving the India Paints & Coatings Market?

The growth of the India Paints & Coatings Market is driven by increasing urbanization, rising disposable incomes, and a growing demand for decorative paints in residential and commercial sectors.

What challenges does the India Paints & Coatings Market face?

The India Paints & Coatings Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and market dynamics.

What opportunities exist in the India Paints & Coatings Market?

Opportunities in the India Paints & Coatings Market include the growing trend towards eco-friendly and sustainable products, as well as innovations in technology that enhance product performance and durability.

What trends are shaping the India Paints & Coatings Market?

Trends in the India Paints & Coatings Market include the increasing popularity of water-based paints, advancements in color technology, and a shift towards smart coatings that offer additional functionalities.

India Paints & Coatings Market

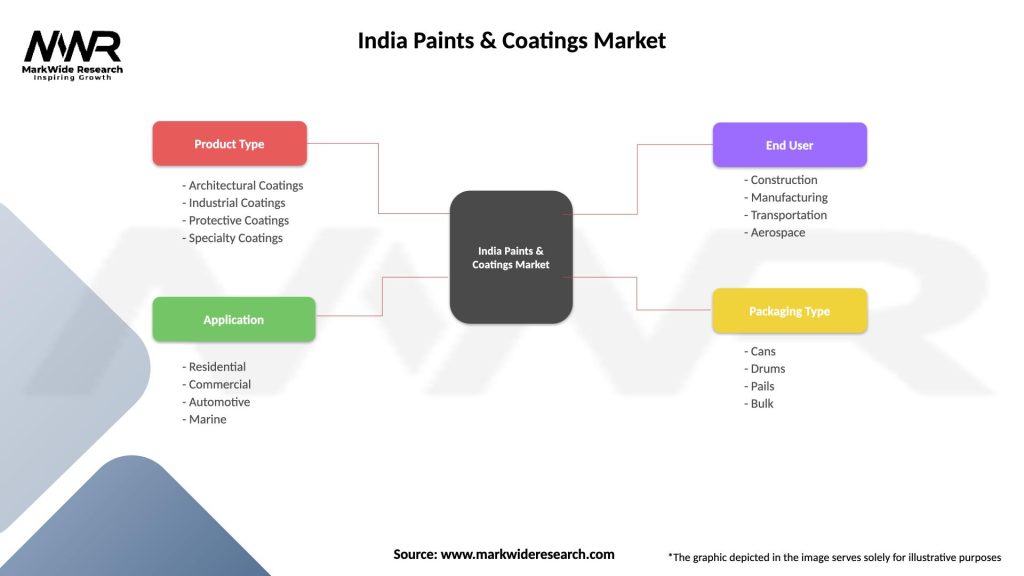

| Segmentation Details | Description |

|---|---|

| Product Type | Architectural Coatings, Industrial Coatings, Protective Coatings, Specialty Coatings |

| Application | Residential, Commercial, Automotive, Marine |

| End User | Construction, Manufacturing, Transportation, Aerospace |

| Packaging Type | Cans, Drums, Pails, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Paints & Coatings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at