444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The packaged food products market in India occupies a pivotal position within the country’s consumer goods landscape. It encompasses a wide array of products ranging from snacks, ready-to-eat meals, dairy products, beverages, to bakery items, catering to the diverse culinary preferences of Indian consumers. This market segment is witnessing significant growth driven by factors such as urbanization, changing lifestyles, increasing disposable incomes, and a burgeoning middle-class population.

Meaning

The India packaged food products market refers to the sector dedicated to the production, distribution, and consumption of a diverse range of processed food items that are packaged for convenience, shelf-life extension, and ease of transportation. These products undergo various processing methods, including preservation, packaging, and labeling, to ensure quality, safety, and compliance with regulatory standards.

Executive Summary

The India packaged food products market is experiencing robust growth, fueled by urbanization, shifting consumer preferences towards convenience foods, and an expanding retail landscape. This market offers lucrative opportunities for manufacturers, retailers, and investors, but it also presents challenges such as changing consumer trends, regulatory compliance, and intense competition. Understanding key market insights, trends, and dynamics is essential for stakeholders to capitalize on emerging opportunities and navigate market challenges effectively.

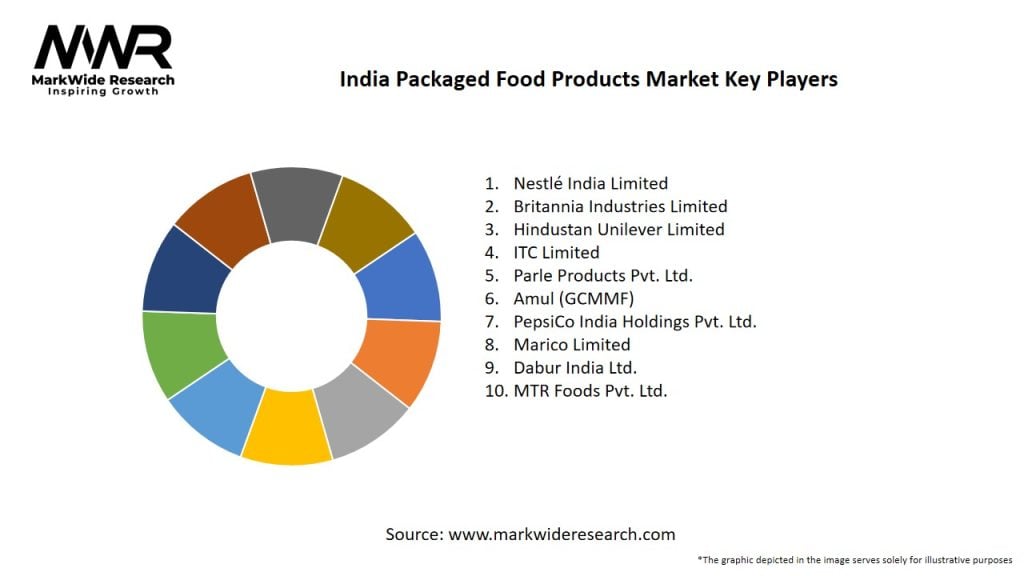

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India packaged food products market operates in a dynamic environment characterized by evolving consumer preferences, technological advancements, regulatory changes, and competitive pressures. These dynamics influence market trends, product innovation, pricing strategies, and distribution channels, necessitating agility and adaptability among industry players to capitalize on emerging opportunities and mitigate risks.

Regional Analysis

The India packaged food products market exhibits regional variations in consumption patterns, preferences, and demand drivers. Key regions such as North India, South India, East India, West India, and Central India have distinct culinary traditions, demographics, and consumer preferences that influence the demand for packaged food products. Understanding regional nuances and preferences is essential for manufacturers to tailor their product offerings and marketing strategies to specific regional markets.

Competitive Landscape

Leading Companies in India Packaged Food Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

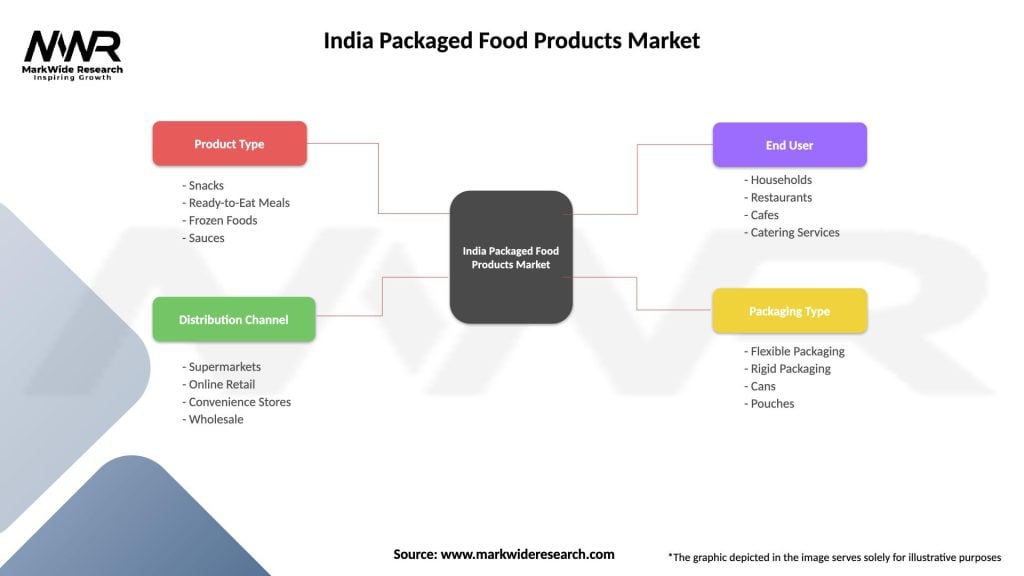

Segmentation

The India packaged food products market can be segmented based on various factors such as product type, distribution channel, packaging type, and consumer preferences. Common segmentation categories include:

Segmentation enables manufacturers to identify niche market segments, target specific consumer groups, and customize their product offerings and marketing strategies accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The India packaged food products market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the India packaged food products market provides insights into its strengths, weaknesses, opportunities, and threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a profound impact on the India packaged food products market, leading to changes in consumer behavior, supply chain disruptions, and shifts in demand dynamics. Key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The India packaged food products market is poised for continued growth in the coming years, driven by factors such as urbanization, changing lifestyles, and increasing consumer awareness about health and wellness. Manufacturers will need to adapt to evolving consumer preferences, invest in product innovation, and embrace digital transformation to stay competitive in the dynamic market landscape.

Conclusion

The India packaged food products market presents significant opportunities for manufacturers, retailers, and investors amidst changing consumer preferences, urbanization, and increasing disposable incomes. While the market offers growth potential, challenges such as regulatory compliance, supply chain disruptions, and intense competition necessitate strategic planning and agility among industry players. By focusing on product innovation, digital marketing, sustainability practices, and quality assurance, manufacturers can capitalize on emerging opportunities and navigate market dynamics effectively, contributing to the growth and development of the Indian packaged food industry.

What is Packaged Food Products?

Packaged food products refer to food items that are processed and packaged for convenience, including snacks, ready-to-eat meals, and beverages. These products are designed for easy consumption and often have a longer shelf life compared to fresh foods.

What are the key players in the India Packaged Food Products Market?

Key players in the India Packaged Food Products Market include Nestlé India, Britannia Industries, ITC Limited, and Parle Products. These companies are known for their diverse range of packaged food offerings, catering to various consumer preferences.

What are the growth factors driving the India Packaged Food Products Market?

The growth of the India Packaged Food Products Market is driven by increasing urbanization, changing consumer lifestyles, and a growing preference for convenience foods. Additionally, the rise in disposable incomes and the expansion of retail channels contribute to market growth.

What challenges does the India Packaged Food Products Market face?

The India Packaged Food Products Market faces challenges such as intense competition, fluctuating raw material prices, and changing consumer preferences towards healthier options. These factors can impact profitability and market dynamics.

What opportunities exist in the India Packaged Food Products Market?

Opportunities in the India Packaged Food Products Market include the growing demand for organic and health-focused products, innovations in packaging technology, and the expansion of e-commerce platforms for food distribution. These trends can enhance market reach and consumer engagement.

What trends are shaping the India Packaged Food Products Market?

Trends shaping the India Packaged Food Products Market include the rise of plant-based foods, increased focus on sustainability in packaging, and the popularity of ethnic and regional flavors. These trends reflect changing consumer preferences and a shift towards healthier eating habits.

India Packaged Food Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Snacks, Ready-to-Eat Meals, Frozen Foods, Sauces |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesale |

| End User | Households, Restaurants, Cafes, Catering Services |

| Packaging Type | Flexible Packaging, Rigid Packaging, Cans, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in India Packaged Food Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at