444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The India oral anti-diabetic drug market is a dynamic and rapidly growing sector within the pharmaceutical industry. With a high prevalence of diabetes in the country, there is an increasing demand for effective and affordable oral medications to manage the disease. This market overview will delve into the meaning of oral anti-diabetic drugs, provide key market insights, analyze the market drivers, restraints, and opportunities, discuss the market dynamics, regional analysis, competitive landscape, segmentation, and category-wise insights. Additionally, we will explore the key benefits for industry participants and stakeholders, conduct a SWOT analysis, assess the impact of Covid-19, highlight key industry developments, provide analyst suggestions, present the future outlook, and conclude with a summary of the market.

Oral anti-diabetic drugs are medications that are taken by mouth to help control blood sugar levels in individuals with diabetes. These drugs are designed to improve insulin sensitivity, increase insulin production, and reduce the production of glucose in the liver. They play a crucial role in the management of diabetes by helping patients maintain optimal blood glucose levels and preventing complications associated with the disease.

Executive Summary

The India oral anti-diabetic drug market has been experiencing substantial growth in recent years, driven by the increasing prevalence of diabetes, rising awareness about the importance of disease management, and the availability of a wide range of oral medications. This market offers significant opportunities for pharmaceutical companies to develop innovative drugs and capture a larger market share. However, the market is not without its challenges, including intense competition, regulatory hurdles, and the need for continuous research and development to meet evolving patient needs.

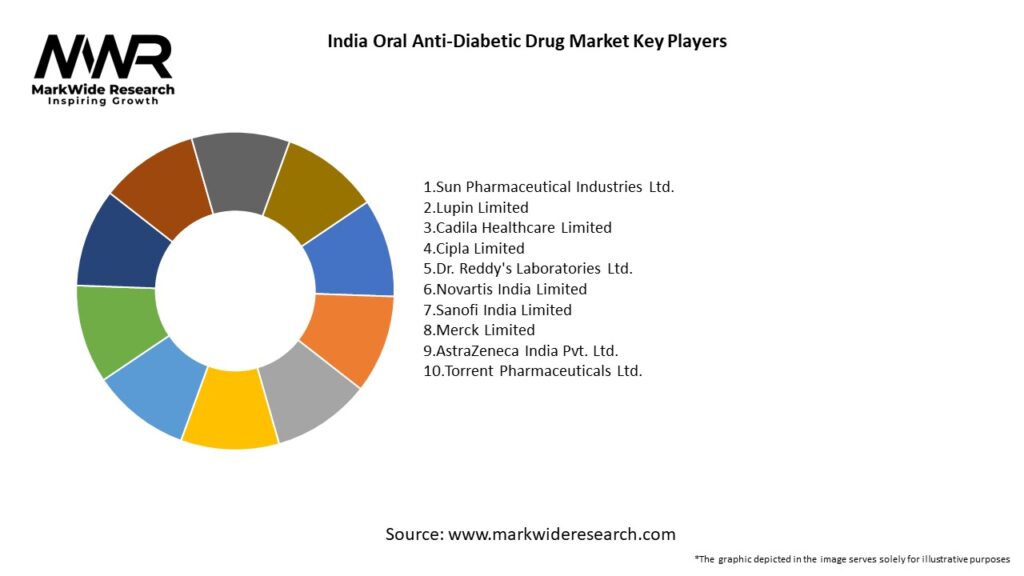

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India oral anti-diabetic drug market is highly dynamic, driven by various factors such as changing demographics, evolving patient needs, advancements in technology, and regulatory developments. The market is characterized by intense competition, with both domestic and multinational pharmaceutical companies vying for market share. Continuous research and development efforts, strategic collaborations, and product innovations are essential for sustained growth in this highly competitive market.

Regional Analysis

The Indian oral anti-diabetic drug market can be segmented into different regions, including North India, South India, East India, and West India. Each region has its own unique characteristics, healthcare infrastructure, and patient demographics. North India, for example, has a high prevalence of diabetes and a growing middle-class population, making it a key market for oral anti-diabetic drugs. South India, on the other hand, has a higher literacy rate and better access to healthcare facilities, leading to increased awareness and demand for these medications.

Competitive Landscape

Leading Companies in the India Oral Anti-Diabetic Drug Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on the type of oral anti-diabetic drugs, including biguanides, sulfonylureas, thiazolidinediones, alpha-glucosidase inhibitors, meglitinides, dipeptidyl peptidase-4 (DPP-4) inhibitors, and sodium-glucose cotransporter-2 (SGLT2) inhibitors. Each class of drugs works in a different way to control blood sugar levels and has its own unique benefits and side effects. Understanding these segments helps healthcare professionals and patients make informed decisions regarding treatment options.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the healthcare industry, including the oral anti-diabetic drug market. Some key effects include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The India oral anti-diabetic drug market is expected to witness steady growth in the coming years. Factors such as the increasing prevalence of diabetes, rising awareness about disease management, advancements in drug delivery systems, and government initiatives to improve healthcare infrastructure will drive market expansion. However, challenges such as pricing pressures, generic competition, and regulatory complexities will need to be addressed. With ongoing research and development efforts, strategic collaborations, and the adoption of innovative technologies, the market presents significant opportunities for industry participants and stakeholders to meet the evolving needs of diabetic patients and improve treatment outcomes.

Conclusion

The India oral anti-diabetic drug market is a dynamic and growing sector driven by the increasing prevalence of diabetes and rising awareness about disease management. Pharmaceutical companies have the opportunity to develop innovative oral anti-diabetic drugs to meet the needs of patients and capture a larger market share. However, pricing pressures, generic competition, and regulatory challenges pose obstacles to market growth. By focusing on patient-centric approaches, embracing technological advancements, and fostering collaborations, industry participants can navigate these challenges and contribute to improved diabetes management and patient outcomes. The future outlook for the market remains positive, with steady growth expected in the coming years.

What is Oral Anti-Diabetic Drug?

Oral Anti-Diabetic Drugs are medications used to manage blood sugar levels in individuals with diabetes. They work by various mechanisms, including increasing insulin sensitivity, stimulating insulin secretion, or reducing glucose production in the liver.

What are the key players in the India Oral Anti-Diabetic Drug Market?

Key players in the India Oral Anti-Diabetic Drug Market include Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, and Lupin Pharmaceuticals, among others.

What are the growth factors driving the India Oral Anti-Diabetic Drug Market?

The growth of the India Oral Anti-Diabetic Drug Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in drug formulations and delivery methods.

What challenges does the India Oral Anti-Diabetic Drug Market face?

The India Oral Anti-Diabetic Drug Market faces challenges such as the high cost of new drug development, regulatory hurdles, and competition from alternative therapies, including insulin and lifestyle modifications.

What opportunities exist in the India Oral Anti-Diabetic Drug Market?

Opportunities in the India Oral Anti-Diabetic Drug Market include the development of novel drug combinations, increasing investment in research and development, and the potential for expanding into rural healthcare markets.

What trends are shaping the India Oral Anti-Diabetic Drug Market?

Trends in the India Oral Anti-Diabetic Drug Market include the rise of personalized medicine, the integration of digital health technologies for monitoring, and a growing focus on patient-centric treatment approaches.

India Oral Anti-Diabetic Drug Market

| Segmentation Details | Description |

|---|---|

| Product Type | Metformin, Sulfonylureas, DPP-4 Inhibitors, SGLT2 Inhibitors |

| Delivery Mode | Oral Tablets, Oral Liquids, Extended-Release Formulations, Combination Therapies |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Oral Anti-Diabetic Drug Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at