444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Optical Transport Network (OTN) market represents a critical infrastructure segment driving the nation’s digital transformation and telecommunications advancement. Optical Transport Networks serve as the backbone of modern communication systems, enabling high-speed data transmission across vast distances with exceptional reliability and efficiency. The Indian market has witnessed remarkable growth momentum, driven by increasing demand for bandwidth-intensive applications, cloud computing adoption, and the nationwide rollout of 5G networks.

Market dynamics in India reflect the country’s ambitious digital initiatives, including Digital India and Smart Cities Mission, which have accelerated the deployment of advanced optical networking solutions. The market encompasses various technology segments, including wavelength division multiplexing (WDM), dense wavelength division multiplexing (DWDM), and reconfigurable optical add-drop multiplexers (ROADMs). Industry analysis indicates that the market is experiencing robust expansion, with growth rates exceeding 12% CAGR as telecommunications service providers and enterprises invest heavily in network infrastructure modernization.

Regional distribution across India shows concentrated adoption in major metropolitan areas, with Mumbai, Delhi, Bangalore, and Chennai accounting for approximately 65% of market deployment. The government’s focus on improving rural connectivity through initiatives like BharatNet has also created significant opportunities for OTN expansion in tier-2 and tier-3 cities, contributing to the market’s comprehensive geographic reach.

The India Optical Transport Network (OTN) market refers to the comprehensive ecosystem of optical networking technologies, equipment, and services deployed across the country to facilitate high-capacity data transmission and telecommunications infrastructure. Optical Transport Networks utilize fiber-optic technology to transmit data using light signals, enabling unprecedented bandwidth capacity and transmission speeds over long distances with minimal signal degradation.

OTN technology encompasses multiple layers of optical networking protocols and standards that ensure efficient data transport, error correction, and network management capabilities. The market includes hardware components such as optical switches, multiplexers, amplifiers, and transponders, along with associated software solutions for network orchestration and management. Service providers leverage OTN infrastructure to deliver high-speed internet, enterprise connectivity, cloud services, and emerging applications requiring substantial bandwidth resources.

Furthermore, the Indian OTN market represents the convergence of traditional telecommunications infrastructure with next-generation networking technologies, supporting the country’s transition toward a digitally connected economy and enabling innovative services across various industry verticals.

Market leadership in India’s Optical Transport Network sector is characterized by strong participation from both international technology giants and domestic telecommunications equipment manufacturers. The market demonstrates exceptional growth potential, driven by increasing data consumption patterns, enterprise digital transformation initiatives, and government-led infrastructure development programs.

Key market drivers include the rapid expansion of 5G networks, which require robust optical backhaul infrastructure, and the growing adoption of cloud computing services that demand high-capacity connectivity solutions. Data center interconnectivity requirements have also emerged as a significant growth catalyst, with hyperscale data centers requiring advanced OTN solutions to manage inter-facility communications and content delivery networks.

Competitive dynamics reveal a market structure where established global vendors compete alongside emerging Indian companies, creating a diverse ecosystem that benefits from both technological innovation and cost-effective solutions. The market shows strong resilience and adaptability, with vendors continuously evolving their offerings to meet the specific requirements of Indian telecommunications infrastructure and regulatory frameworks.

Investment patterns indicate sustained capital allocation toward network modernization, with telecommunications service providers dedicating approximately 35% of their infrastructure budgets to optical networking upgrades and expansion initiatives.

Strategic insights from comprehensive market analysis reveal several critical factors shaping the India OTN landscape:

Primary growth drivers propelling the India Optical Transport Network market encompass multiple technological and economic factors that create sustained demand for advanced optical networking solutions.

5G Network Deployment represents the most significant driver, as telecommunications operators require robust optical backhaul infrastructure to support the high-bandwidth, low-latency requirements of next-generation wireless networks. The rollout of 5G services across major Indian cities necessitates comprehensive optical transport upgrades, creating substantial market opportunities for OTN vendors and service providers.

Digital transformation initiatives across various industry sectors are driving increased demand for reliable, high-capacity connectivity solutions. Enterprises in banking, healthcare, manufacturing, and e-commerce are investing heavily in optical networking infrastructure to support cloud migration, data analytics, and digital service delivery capabilities.

Government policy support through programs like Digital India and BharatNet continues to create favorable market conditions for optical transport network expansion. These initiatives focus on improving connectivity infrastructure across urban and rural areas, generating consistent demand for OTN solutions and services.

Data center proliferation and the growth of cloud computing services require sophisticated optical interconnection solutions to manage traffic between facilities and ensure optimal performance for distributed applications and content delivery networks.

Market challenges facing the India Optical Transport Network sector include several factors that may impact growth trajectory and adoption rates across different market segments.

High capital expenditure requirements for optical transport network deployment represent a significant barrier, particularly for smaller telecommunications operators and enterprises with limited infrastructure budgets. The substantial upfront investment needed for advanced OTN equipment and installation can delay adoption decisions and extend deployment timelines.

Technical complexity associated with optical networking technologies requires specialized expertise for design, implementation, and maintenance activities. The shortage of skilled professionals with comprehensive OTN knowledge can create deployment challenges and increase operational costs for organizations seeking to implement advanced optical transport solutions.

Regulatory compliance requirements and spectrum allocation policies may impact the pace of optical transport network expansion, particularly in scenarios involving right-of-way permissions and infrastructure sharing agreements between multiple service providers.

Legacy infrastructure compatibility issues can complicate network modernization efforts, as organizations must carefully plan migration strategies to ensure seamless integration between existing systems and new optical transport technologies without disrupting ongoing operations.

Emerging opportunities within the India Optical Transport Network market present significant potential for growth and innovation across multiple application areas and technology segments.

Rural connectivity expansion through government-sponsored broadband initiatives creates substantial opportunities for OTN vendors to participate in nationwide infrastructure development projects. The focus on bridging the digital divide between urban and rural areas generates consistent demand for scalable, cost-effective optical transport solutions.

Edge computing deployment and the proliferation of Internet of Things (IoT) applications require distributed optical networking infrastructure to support low-latency data processing and real-time analytics capabilities. This trend creates new market segments for specialized OTN solutions designed for edge deployment scenarios.

International connectivity requirements, driven by India’s growing role in global digital services and data center operations, present opportunities for submarine cable systems and international optical transport network expansion to support cross-border data flows and cloud service delivery.

Industry-specific solutions tailored for sectors such as healthcare, education, and manufacturing offer opportunities for vendors to develop specialized OTN platforms that address unique connectivity requirements and compliance standards within these vertical markets.

Market dynamics in the India Optical Transport Network sector reflect the complex interplay between technological advancement, regulatory policies, competitive pressures, and evolving customer requirements that shape industry development and growth patterns.

Technological innovation continues to drive market evolution, with vendors introducing advanced coherent optical technologies, software-defined networking capabilities, and artificial intelligence-powered network management solutions. These innovations enable higher capacity transmission, improved network efficiency, and enhanced operational automation, creating competitive advantages for early adopters.

Competitive intensity has increased as both established international vendors and emerging domestic companies compete for market share across different customer segments. This competition drives continuous product innovation, pricing optimization, and service enhancement initiatives that benefit end-users through improved solution offerings and cost-effectiveness.

Customer expectations are evolving toward more flexible, scalable, and cost-effective optical transport solutions that can adapt to changing bandwidth requirements and support emerging applications. Service providers and enterprises increasingly demand solutions that offer operational efficiency improvements of up to 40% compared to legacy networking technologies.

Supply chain considerations have become increasingly important, with organizations seeking vendors that can provide reliable equipment delivery, local support services, and comprehensive maintenance capabilities to ensure optimal network performance and minimize operational disruptions.

Comprehensive research methodology employed for analyzing the India Optical Transport Network market incorporates multiple data collection and analysis techniques to ensure accurate, reliable, and actionable market insights.

Primary research activities include extensive interviews with key industry stakeholders, including telecommunications service providers, equipment vendors, system integrators, and end-user organizations across various industry sectors. These interviews provide valuable insights into market trends, technology adoption patterns, and future requirements that shape market development.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to gather comprehensive market data and validate primary research findings. This approach ensures thorough coverage of market dynamics and competitive landscape factors.

Quantitative analysis techniques are applied to market data to identify growth trends, market share distributions, and forecasting models that support strategic decision-making for market participants. Statistical analysis methods ensure data accuracy and reliability for market projections and trend identification.

Expert validation processes involve consultation with industry experts and technology specialists to verify research findings and ensure that market analysis reflects current industry conditions and future development prospects accurately.

Regional market distribution across India demonstrates significant variation in Optical Transport Network adoption and deployment patterns, reflecting differences in economic development, infrastructure maturity, and digital transformation initiatives.

Western India leads market adoption, with Maharashtra and Gujarat accounting for approximately 28% of total market deployment. The region benefits from strong industrial presence, advanced telecommunications infrastructure, and significant enterprise demand for high-capacity connectivity solutions. Mumbai serves as a critical hub for international connectivity and data center operations, driving substantial OTN infrastructure investments.

Southern India represents another major market segment, with Karnataka, Tamil Nadu, and Telangana contributing approximately 25% of market share. The region’s thriving information technology sector, coupled with significant government support for digital initiatives, creates robust demand for advanced optical transport networks. Bangalore and Chennai emerge as key deployment centers for enterprise and service provider OTN solutions.

Northern India, led by the National Capital Region, accounts for roughly 22% of market activity. Government presence, financial services concentration, and growing enterprise adoption drive consistent demand for optical networking infrastructure in this region.

Eastern and Central India represent emerging markets with significant growth potential, particularly as government connectivity initiatives expand optical transport network deployment to previously underserved areas.

Competitive dynamics in the India Optical Transport Network market feature a diverse ecosystem of international technology leaders, domestic equipment manufacturers, and specialized service providers competing across different market segments and customer categories.

Market leaders include established global vendors that have developed comprehensive OTN portfolios and strong local presence:

Domestic players are gaining market traction through cost-effective solutions and localized support services, contributing to competitive market dynamics and customer choice expansion.

Market segmentation analysis reveals distinct categories within the India Optical Transport Network market, each characterized by specific technology requirements, customer preferences, and growth dynamics.

By Technology:

By Application:

By End-User:

Technology category analysis provides detailed insights into the performance and adoption patterns of different Optical Transport Network solutions within the Indian market context.

DWDM Systems dominate the high-capacity transmission segment, with service providers investing heavily in next-generation coherent technologies that offer improved spectral efficiency and transmission reach. These systems enable operators to maximize fiber infrastructure utilization while supporting growing bandwidth demands from 5G networks and cloud applications. Market adoption rates for advanced DWDM solutions have increased by approximately 18% annually as operators modernize their core networks.

OTN Switching solutions are gaining prominence as organizations seek more flexible and automated network management capabilities. These platforms enable dynamic bandwidth allocation, service provisioning, and network optimization that reduce operational complexity and improve service delivery efficiency. Software-defined networking integration within OTN switching platforms has become a key differentiator for vendor selection.

Coherent Optical technologies represent the fastest-growing category, driven by their ability to deliver ultra-high capacity transmission over existing fiber infrastructure without requiring additional fiber deployment. These solutions are particularly attractive for operators seeking to increase network capacity while minimizing infrastructure investment and deployment timelines.

Metro and Access optical transport solutions are experiencing strong growth as operators extend high-capacity connectivity to edge locations and support distributed computing architectures required for 5G and IoT applications.

Stakeholder benefits from India’s Optical Transport Network market development extend across multiple participant categories, creating value for technology vendors, service providers, end-users, and the broader digital economy ecosystem.

For Telecommunications Service Providers:

For Enterprise Customers:

For Technology Vendors:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the India Optical Transport Network market reflect technological evolution, changing customer requirements, and broader industry transformation patterns that influence solution development and deployment strategies.

Software-Defined Networking Integration represents a major trend, with OTN vendors incorporating SDN capabilities to enable programmable network management, automated service provisioning, and dynamic resource allocation. This trend addresses operator requirements for network agility and operational efficiency improvements.

Artificial Intelligence and Machine Learning adoption within optical transport networks is accelerating, enabling predictive maintenance, automated fault detection, and intelligent traffic optimization. These capabilities help operators achieve network performance improvements of up to 25% while reducing operational costs.

Edge Computing Support has become increasingly important as OTN solutions evolve to support distributed computing architectures and low-latency applications. Vendors are developing specialized solutions for edge deployment scenarios that require compact, power-efficient optical transport capabilities.

Open Networking Standards adoption is growing, with operators seeking vendor-agnostic solutions that provide flexibility in equipment selection and reduce vendor lock-in risks. This trend promotes interoperability and competition within the OTN ecosystem.

Sustainability Focus is driving development of energy-efficient optical transport solutions that reduce power consumption and environmental impact while maintaining high performance standards.

Recent industry developments highlight the dynamic nature of India’s Optical Transport Network market and demonstrate ongoing innovation, partnership formation, and strategic initiatives that shape market evolution.

Technology Advancement initiatives include the introduction of 400G coherent optical solutions by major vendors, enabling unprecedented transmission capacity over existing fiber infrastructure. These developments support service provider requirements for network capacity expansion without proportional infrastructure investment increases.

Strategic Partnerships between international OTN vendors and Indian system integrators have expanded, creating comprehensive solution delivery capabilities and local support services. These collaborations enhance market accessibility and customer service quality for optical transport network deployments.

Government Procurement programs have accelerated, with major infrastructure projects incorporating advanced OTN solutions to support national connectivity objectives. MarkWide Research analysis indicates that government-sponsored projects account for approximately 30% of annual market activity.

Research and Development investments by both international and domestic companies have increased, focusing on solutions tailored to Indian market requirements, including cost optimization, climate resilience, and integration with existing infrastructure.

Standards Development activities continue to evolve, with Indian participation in international OTN standardization efforts ensuring that local requirements are reflected in global technology specifications.

Strategic recommendations for market participants in India’s Optical Transport Network sector focus on maximizing growth opportunities while addressing market challenges and competitive dynamics effectively.

For Technology Vendors: Develop localized solution portfolios that address specific Indian market requirements, including cost optimization, climate resilience, and integration capabilities with existing infrastructure. Establish strong local partnerships for sales, support, and service delivery to enhance market penetration and customer satisfaction.

For Service Providers: Prioritize network modernization investments that support 5G deployment and enterprise digital transformation requirements. Focus on developing differentiated service offerings that leverage advanced OTN capabilities to create competitive advantages and new revenue streams.

For Enterprises: Evaluate optical transport network solutions as strategic investments that enable digital transformation and support future growth requirements. Consider private network deployments for mission-critical applications that require guaranteed performance and security.

For Government Organizations: Continue supporting infrastructure development programs that promote optical transport network expansion, particularly in underserved regions. Develop policies that encourage innovation and competition while ensuring security and reliability standards.

Investment Focus should prioritize solutions that offer scalability, automation, and integration capabilities to address evolving market requirements and technological advancement trends.

Future market prospects for India’s Optical Transport Network sector indicate sustained growth momentum driven by multiple technological and economic factors that will shape industry development over the next decade.

Technology Evolution will continue advancing toward higher capacity, more efficient optical transport solutions that support emerging applications and service requirements. Coherent optical technologies are expected to achieve mainstream adoption, with market penetration rates projected to reach 75% within the next five years.

5G Network Expansion will remain a primary growth driver, requiring comprehensive optical backhaul infrastructure to support nationwide service deployment. The transition to 5G standalone networks will create additional demand for advanced OTN solutions with enhanced performance characteristics.

Digital Infrastructure development under government initiatives will continue generating substantial market opportunities, particularly for solutions that address rural connectivity and smart city requirements. MWR projections suggest that government-sponsored projects will maintain strong growth trajectories throughout the forecast period.

Enterprise Adoption is expected to accelerate as organizations increasingly recognize the strategic value of private optical transport networks for supporting digital transformation initiatives and ensuring reliable connectivity for business-critical applications.

Innovation Focus will emphasize automation, artificial intelligence integration, and sustainability improvements that address operator requirements for operational efficiency and environmental responsibility.

India’s Optical Transport Network market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s digital transformation journey. The market demonstrates strong growth fundamentals driven by 5G network deployment, enterprise digitalization, government infrastructure initiatives, and the expanding digital economy ecosystem.

Market participants benefit from favorable government policies, growing demand for high-capacity connectivity solutions, and technological advancement opportunities that create competitive advantages and business growth potential. The diverse stakeholder ecosystem, including international vendors, domestic companies, service providers, and end-users, contributes to a vibrant market environment that promotes innovation and customer choice.

Strategic success in this market requires understanding of local requirements, investment in appropriate technologies, and development of comprehensive solution portfolios that address the specific needs of Indian customers across different segments and regions. The market’s evolution toward more automated, intelligent, and sustainable optical transport solutions creates opportunities for vendors that can deliver innovative, cost-effective offerings.

Long-term prospects remain highly positive, with sustained growth expected across all market segments as India continues its digital infrastructure development and economic modernization efforts. The India Optical Transport Network market will continue serving as a critical enabler of the nation’s digital economy growth and technological advancement objectives.

What is Optical Transport Network (OTN)?

Optical Transport Network (OTN) refers to a set of optical network elements that provide the functionality of optical transport. It is designed to transport various types of data, including voice, video, and data traffic, over optical fiber networks, ensuring high capacity and reliability.

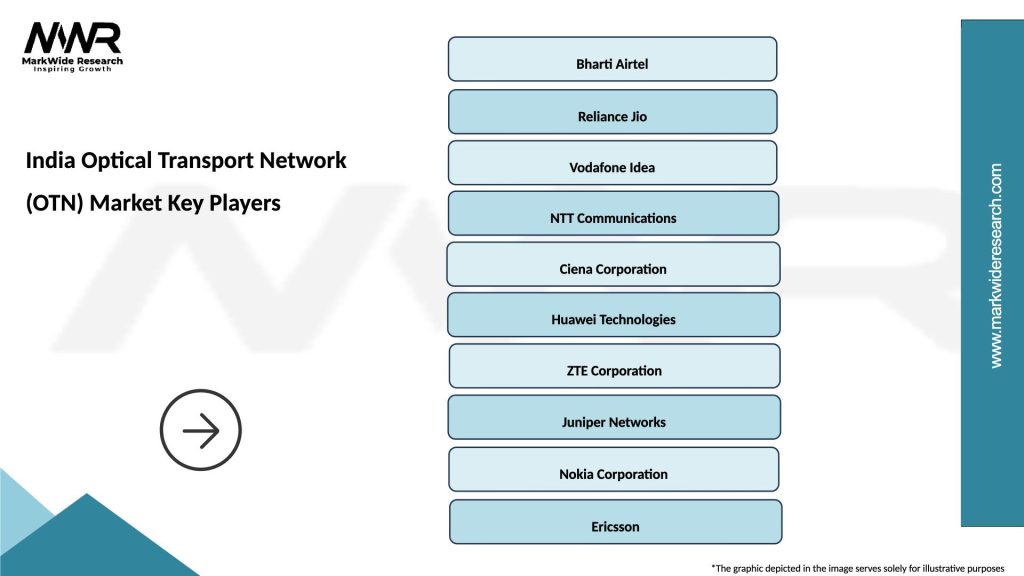

What are the key players in the India Optical Transport Network (OTN) Market?

Key players in the India Optical Transport Network (OTN) Market include companies like Cisco Systems, Nokia, and Huawei Technologies, which provide advanced optical networking solutions and infrastructure, among others.

What are the growth factors driving the India Optical Transport Network (OTN) Market?

The growth of the India Optical Transport Network (OTN) Market is driven by increasing data traffic, the demand for high-speed internet, and the expansion of telecommunications infrastructure. Additionally, the rise of cloud computing and IoT applications is contributing to the market’s growth.

What challenges does the India Optical Transport Network (OTN) Market face?

The India Optical Transport Network (OTN) Market faces challenges such as high installation costs, the complexity of network management, and the need for skilled personnel. Additionally, competition from alternative technologies can hinder market growth.

What opportunities exist in the India Optical Transport Network (OTN) Market?

Opportunities in the India Optical Transport Network (OTN) Market include the increasing adoption of 5G technology, which requires robust optical networks, and the growing demand for enhanced bandwidth and low-latency services. Furthermore, investments in smart city projects present additional growth avenues.

What trends are shaping the India Optical Transport Network (OTN) Market?

Trends shaping the India Optical Transport Network (OTN) Market include the shift towards software-defined networking (SDN) and network function virtualization (NFV), which enhance flexibility and efficiency. Additionally, the integration of AI and machine learning for network optimization is becoming increasingly prevalent.

India Optical Transport Network (OTN) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wavelength Division Multiplexing, Optical Switches, Optical Amplifiers, Routers |

| Technology | Dense Wavelength Division Multiplexing, Time Division Multiplexing, Optical Transport Protocols, Ethernet |

| End User | Telecom Operators, Data Centers, Enterprises, Government Agencies |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Optical Transport Network (OTN) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at