444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India natural gas industry market represents one of the most dynamic and rapidly evolving energy sectors in the Asia-Pacific region. Natural gas consumption in India has witnessed unprecedented growth, driven by the government’s ambitious plans to increase the share of natural gas in the country’s energy mix from the current 6.2% to 15% by 2030. This transformation reflects India’s commitment to cleaner energy sources and reduced carbon emissions.

Market dynamics indicate a robust expansion trajectory, with the sector experiencing a compound annual growth rate of 8.5% over the past five years. The industry encompasses upstream exploration and production, midstream transportation and storage, and downstream distribution and marketing segments. Government initiatives such as the City Gas Distribution (CGD) network expansion and the National Gas Grid development have significantly accelerated market penetration across urban and rural areas.

Infrastructure development remains a cornerstone of market growth, with extensive pipeline networks, LNG terminals, and storage facilities being established nationwide. The sector’s evolution is characterized by increasing private sector participation, technological advancements in extraction and processing, and growing environmental consciousness among consumers and industries.

The India natural gas industry market refers to the comprehensive ecosystem encompassing the exploration, production, processing, transportation, storage, and distribution of natural gas resources within the Indian subcontinent. This market includes both conventional and unconventional gas sources, imported liquefied natural gas (LNG), and the entire value chain from wellhead to end consumers.

Natural gas serves as a cleaner alternative to coal and oil, offering reduced carbon emissions and improved air quality. The industry encompasses various stakeholders including national oil companies, private exploration firms, pipeline operators, city gas distributors, and industrial consumers. Market scope extends across residential, commercial, industrial, and transportation sectors, with each segment presenting unique growth opportunities and challenges.

Strategic importance of this market lies in its potential to transform India’s energy landscape, reduce import dependency, and support the nation’s climate commitments under international agreements. The industry represents a critical component of India’s energy security strategy and economic development plans.

India’s natural gas industry stands at a pivotal juncture, experiencing transformational growth driven by policy reforms, infrastructure investments, and changing energy consumption patterns. The market demonstrates exceptional potential with domestic production increasing alongside strategic LNG imports to meet growing demand across multiple sectors.

Key growth drivers include government policy support, environmental regulations favoring cleaner fuels, industrial expansion, and urbanization trends. The City Gas Distribution network has expanded to cover over 280 districts, representing approximately 70% of India’s population. This expansion has created substantial opportunities for residential and commercial natural gas adoption.

Market challenges encompass pricing volatility, infrastructure gaps in remote regions, and competition from renewable energy sources. However, the sector’s resilience is evident through consistent investment flows, technological innovations, and strategic partnerships between domestic and international players. Future prospects remain highly favorable, supported by India’s commitment to achieving net-zero emissions and the growing recognition of natural gas as a transition fuel in the clean energy journey.

Strategic market insights reveal several critical trends shaping the India natural gas industry landscape:

Market maturation is evident through improved supply chain efficiency, better price discovery mechanisms, and enhanced consumer awareness about natural gas benefits.

Government policy initiatives serve as the primary catalyst for market expansion, with the National Gas Grid project connecting major consumption centers and production hubs. The Pradhan Mantri Urja Ganga pipeline project exemplifies the government’s commitment to expanding natural gas accessibility across eastern India, creating new demand centers and industrial opportunities.

Environmental regulations increasingly favor natural gas adoption as industries seek to comply with emission norms and sustainability targets. The National Clean Air Programme has accelerated the shift from coal and furnace oil to natural gas in industrial applications, particularly in the National Capital Region and other polluted cities.

Economic factors including competitive pricing compared to liquid fuels, operational efficiency benefits, and reduced maintenance costs drive industrial and commercial adoption. The price pooling mechanism for domestic gas has provided stability and predictability for long-term planning by consumers and distributors.

Urbanization trends and rising living standards have increased residential demand for clean cooking fuel and heating solutions. The expansion of city gas distribution networks has made natural gas accessible to millions of households, supporting the government’s vision of providing clean cooking fuel to all Indian families.

Infrastructure limitations continue to pose significant challenges, particularly in remote and rural areas where pipeline connectivity remains inadequate. The last-mile connectivity issues affect market penetration and limit the potential customer base for natural gas distribution companies.

Price volatility in international LNG markets creates uncertainty for long-term planning and affects the competitiveness of natural gas against other fuels. Import dependency for nearly 50% of consumption exposes the market to global price fluctuations and supply disruptions.

Regulatory complexities across different states create operational challenges for companies operating in multiple jurisdictions. Varying state policies, taxation structures, and approval processes can delay project implementation and increase compliance costs.

Competition from renewable energy sources, particularly solar and wind power, poses long-term challenges for natural gas in the power generation sector. The declining costs of renewable technologies and government emphasis on clean energy may limit natural gas growth in certain applications.

Unconventional gas resources including shale gas and coalbed methane present substantial opportunities for domestic production enhancement. Exploration activities in these segments could significantly reduce import dependency and improve energy security.

Industrial cluster development offers opportunities for dedicated gas supply infrastructure and bulk consumption arrangements. Petrochemical complexes and fertilizer plants represent high-volume consumers that can anchor large-scale gas infrastructure projects.

Transportation sector transformation through increased CNG and LNG adoption in commercial vehicles presents significant growth potential. The logistics industry is increasingly recognizing the cost and environmental benefits of gas-powered trucks and buses.

International cooperation and strategic partnerships can accelerate technology transfer, financing, and market development. Cross-border pipeline projects and regional gas trading arrangements could enhance supply security and market efficiency.

Supply-demand dynamics in the India natural gas market reflect a complex interplay of domestic production capabilities, import requirements, and evolving consumption patterns. Demand growth consistently outpaces domestic supply increases, necessitating strategic LNG imports and infrastructure development to maintain market balance.

Pricing mechanisms have evolved significantly with the implementation of market-linked pricing for domestic gas and competitive bidding for LNG imports. Price discovery through gas exchanges and trading platforms is improving market efficiency and transparency.

Seasonal variations in demand, particularly during winter months and festival seasons, create operational challenges and opportunities for storage and supply optimization. Peak shaving capabilities through LNG storage and pipeline flexibility are becoming increasingly important.

Technological advancements in exploration, production, and distribution are enhancing operational efficiency and reducing costs. Digital transformation initiatives including IoT sensors, predictive analytics, and automated systems are improving safety and reliability across the value chain.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary data sources to provide accurate and actionable insights. Primary research includes extensive interviews with industry executives, government officials, and market participants across the natural gas value chain.

Secondary research encompasses analysis of government publications, industry reports, financial statements, and regulatory filings to establish market trends and competitive dynamics. Data validation processes ensure accuracy and reliability of market information and projections.

Quantitative analysis utilizes statistical models and forecasting techniques to project market growth, demand patterns, and investment requirements. Qualitative assessment provides context and strategic insights into market drivers, challenges, and opportunities.

Regional analysis examines state-wise market conditions, policy variations, and infrastructure development to provide granular market understanding. Sector-wise evaluation covers residential, commercial, industrial, and transportation segments to identify specific growth opportunities and challenges.

Western India dominates natural gas consumption, accounting for approximately 40% of total demand, driven by industrial clusters in Gujarat, Maharashtra, and Rajasthan. Gujarat leads in both production and consumption, benefiting from offshore gas fields and well-developed infrastructure.

Northern regions including Delhi, Punjab, and Uttar Pradesh represent rapidly growing markets with expanding city gas distribution networks and industrial adoption. The National Capital Region has witnessed significant growth in CNG vehicle adoption and residential connections.

Southern India presents substantial growth opportunities with increasing industrial development and urbanization in Karnataka, Tamil Nadu, and Andhra Pradesh. LNG import terminals in the region support growing demand from power generation and industrial sectors.

Eastern and northeastern regions are emerging as new frontiers with government initiatives to extend gas infrastructure and develop local consumption markets. The Pradhan Mantri Urja Ganga project is transforming the energy landscape in these traditionally underserved areas.

Market leadership is characterized by a mix of public sector enterprises and private companies operating across different segments of the value chain:

Strategic partnerships and joint ventures are common, particularly for infrastructure development and technology sharing. International collaborations with global energy companies bring expertise and capital to support market expansion.

By Source:

By Application:

By Infrastructure:

Power Generation Segment represents the largest consumption category, driven by the need for flexible and cleaner power generation options. Gas-based power plants offer quick start-up capabilities and lower emissions compared to coal-fired plants, making them ideal for grid balancing and peak load management.

Industrial Applications demonstrate steady growth with fertilizer production being the largest consumer within this segment. Petrochemical industries are increasingly adopting natural gas as both feedstock and fuel, supported by government policies promoting domestic manufacturing.

City Gas Distribution has emerged as a high-growth segment with residential and commercial connections expanding rapidly. MarkWide Research analysis indicates that household penetration rates are increasing at 12% annually in tier-1 and tier-2 cities.

Transportation Fuel category shows promising growth potential with CNG vehicle adoption accelerating in urban areas. Commercial vehicle operators are recognizing the economic benefits of natural gas, particularly for long-haul trucking and public transportation.

Upstream Companies benefit from improved exploration success rates, enhanced recovery techniques, and favorable government policies supporting domestic production. Technology partnerships with international firms provide access to advanced drilling and production technologies.

Midstream Operators enjoy stable revenue streams from pipeline operations and storage services. Infrastructure investments create long-term assets with regulated returns and strategic market positioning.

Downstream Distributors experience growing customer bases, improved margins through operational efficiency, and opportunities for value-added services. Digital platforms enable better customer engagement and service delivery.

End Consumers benefit from cleaner fuel options, cost savings compared to liquid fuels, and improved air quality. Industrial users achieve operational efficiency, reduced maintenance costs, and compliance with environmental regulations.

Government Stakeholders realize reduced import bills, improved energy security, job creation, and progress toward climate commitments. Tax revenues from the expanding natural gas sector contribute to economic development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation is revolutionizing operations across the natural gas value chain, with companies implementing IoT sensors, predictive maintenance systems, and automated monitoring platforms. Smart grid integration enables better demand forecasting and supply optimization.

Green Gas Initiatives including biogas and hydrogen blending are gaining momentum as the industry explores pathways to reduce carbon intensity. Renewable natural gas projects are being developed to utilize organic waste and agricultural residues.

Customer-Centric Services are evolving with mobile applications, online billing systems, and 24/7 customer support becoming standard offerings. Value-added services such as appliance maintenance and energy efficiency consulting are expanding revenue opportunities.

Strategic Partnerships between domestic and international companies are accelerating technology transfer and market development. Joint ventures for infrastructure development and exploration activities are becoming increasingly common.

Infrastructure Expansion continues at an unprecedented pace with multiple pipeline projects under construction and LNG terminal capacity additions. The National Gas Grid project has achieved significant milestones in connecting major consumption centers.

Policy Reforms including the liberalization of gas pricing and streamlined approval processes have improved market dynamics. Open access regulations for gas pipelines have enhanced competition and consumer choice.

Technology Adoption in exploration and production has led to new gas discoveries and improved recovery rates from existing fields. Enhanced oil recovery techniques are extending the productive life of mature gas fields.

International Agreements for long-term LNG supply have secured energy security while competitive pricing mechanisms have been established. Strategic petroleum reserves are being expanded to include natural gas storage capabilities.

Infrastructure Investment should remain the top priority for industry stakeholders, with focus on last-mile connectivity and storage capacity enhancement. MWR analysis suggests that companies investing in comprehensive infrastructure networks will capture larger market shares.

Technology Integration across operations can significantly improve efficiency and reduce costs. Digital platforms for customer engagement and operational management should be prioritized to enhance competitive positioning.

Strategic Partnerships with international players can accelerate market development and provide access to advanced technologies. Joint ventures for exploration and infrastructure development can optimize resource utilization and risk sharing.

Diversification Strategies including renewable gas production and hydrogen blending can position companies for the energy transition. Sustainability initiatives will become increasingly important for long-term market success.

Long-term growth prospects for the India natural gas industry remain highly favorable, supported by government policy commitments and increasing environmental awareness. The sector is projected to maintain robust growth rates of 7-9% annually over the next decade.

Infrastructure development will continue to be a key growth driver, with the National Gas Grid expected to connect over 90% of the population by 2030. City gas distribution networks will expand to cover additional districts and rural areas.

Domestic production enhancement through unconventional resource development and improved recovery techniques will gradually reduce import dependency. Exploration activities in frontier basins may yield significant new discoveries.

Market maturation will bring improved price discovery mechanisms, enhanced competition, and better consumer services. MarkWide Research projects that the industry will play a crucial role in India’s energy transition and economic development over the coming decades.

India’s natural gas industry stands at the threshold of transformational growth, driven by supportive government policies, expanding infrastructure, and increasing environmental consciousness. The market presents substantial opportunities across the entire value chain, from upstream exploration to downstream distribution.

Strategic investments in infrastructure development, technology adoption, and market expansion will determine the success of industry participants. The sector’s evolution toward cleaner energy solutions positions natural gas as a critical component of India’s sustainable development strategy.

Future success will depend on addressing current challenges including infrastructure gaps, price volatility, and regulatory complexities while capitalizing on emerging opportunities in unconventional resources and digital transformation. The industry’s contribution to India’s energy security, economic growth, and environmental goals will continue to expand, making it an essential sector for long-term investment and development focus.

What is Natural Gas?

Natural gas is a fossil fuel primarily composed of methane, used extensively for heating, electricity generation, and as a feedstock in various industrial processes. It plays a crucial role in the energy sector and is considered a cleaner alternative to other fossil fuels.

What are the key players in the India Natural Gas Industry Market?

Key players in the India Natural Gas Industry Market include companies like GAIL (India) Limited, Reliance Industries Limited, and Oil and Natural Gas Corporation (ONGC), among others. These companies are involved in various aspects of natural gas production, distribution, and infrastructure development.

What are the growth factors driving the India Natural Gas Industry Market?

The growth of the India Natural Gas Industry Market is driven by increasing energy demand, government initiatives to promote cleaner fuels, and the expansion of pipeline infrastructure. Additionally, the rising adoption of natural gas in transportation and industrial applications contributes to market growth.

What challenges does the India Natural Gas Industry Market face?

The India Natural Gas Industry Market faces challenges such as regulatory hurdles, fluctuating global gas prices, and the need for significant investment in infrastructure. Additionally, competition from renewable energy sources poses a challenge to the growth of natural gas.

What opportunities exist in the India Natural Gas Industry Market?

Opportunities in the India Natural Gas Industry Market include the potential for expanding LNG import terminals, increasing use of natural gas in transportation, and the development of biogas projects. These factors can enhance energy security and promote sustainable practices.

What trends are shaping the India Natural Gas Industry Market?

Trends shaping the India Natural Gas Industry Market include the shift towards cleaner energy sources, advancements in extraction technologies, and the growing importance of natural gas in achieving energy transition goals. Additionally, the integration of digital technologies in gas management is becoming increasingly relevant.

India Natural Gas Industry Market

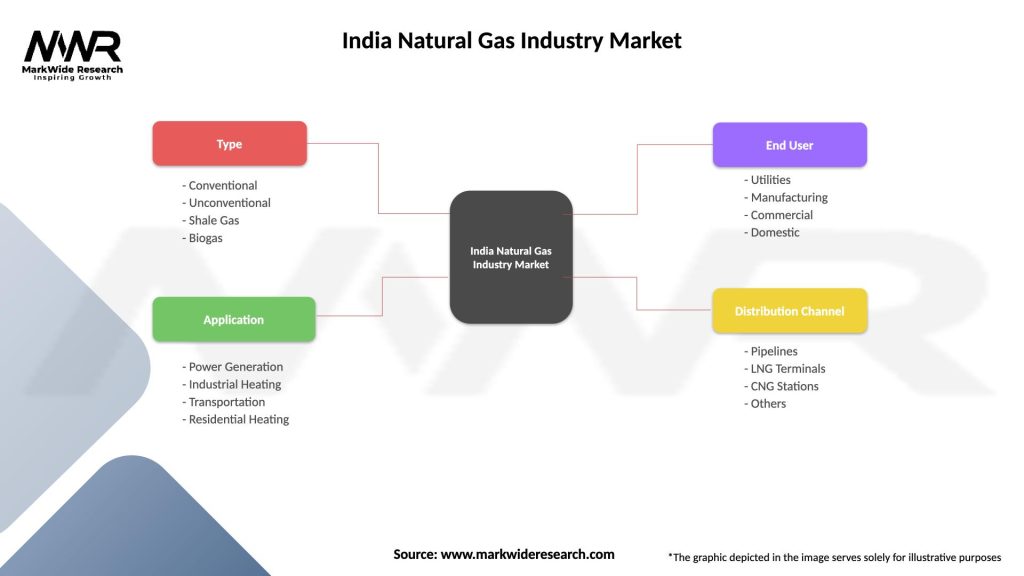

| Segmentation Details | Description |

|---|---|

| Type | Conventional, Unconventional, Shale Gas, Biogas |

| Application | Power Generation, Industrial Heating, Transportation, Residential Heating |

| End User | Utilities, Manufacturing, Commercial, Domestic |

| Distribution Channel | Pipelines, LNG Terminals, CNG Stations, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Natural Gas Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at