444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India municipal solid waste management market represents a critical infrastructure sector experiencing unprecedented transformation driven by rapid urbanization, population growth, and evolving regulatory frameworks. Municipal solid waste management encompasses comprehensive systems for collection, transportation, treatment, and disposal of waste generated from residential, commercial, and institutional sources across Indian cities and towns. The market demonstrates robust growth potential with increasing government initiatives, technological adoption, and private sector participation reshaping traditional waste management practices.

Urban India generates substantial volumes of municipal solid waste daily, creating both challenges and opportunities for innovative waste management solutions. The sector encompasses various technologies including waste-to-energy plants, composting facilities, recycling units, and advanced sorting systems. Smart waste management technologies are gaining traction, incorporating IoT sensors, GPS tracking, and data analytics to optimize collection routes and improve operational efficiency by approximately 25-30%.

Government initiatives such as the Swachh Bharat Mission and Smart Cities Mission have catalyzed market growth, promoting sustainable waste management practices and encouraging public-private partnerships. The market benefits from increasing environmental awareness, stricter regulatory compliance requirements, and growing emphasis on circular economy principles. Regional variations in waste generation patterns, infrastructure development, and regulatory implementation create diverse market dynamics across different states and urban centers.

The India municipal solid waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to managing solid waste generated by urban and semi-urban populations across Indian municipalities. This market encompasses the entire waste management value chain from collection and segregation to treatment, recycling, and final disposal, involving both public and private sector stakeholders.

Municipal solid waste includes biodegradable organic waste, recyclable materials such as paper, plastic, and metals, hazardous waste components, and inert materials generated from households, commercial establishments, institutions, and street cleaning activities. The market integrates traditional waste management approaches with modern technologies including automated sorting systems, waste-to-energy conversion, bio-methanation plants, and digital monitoring platforms.

Stakeholders in this market include municipal corporations, waste management companies, technology providers, recycling industries, and regulatory bodies working collaboratively to address India’s growing waste management challenges while creating economic value through resource recovery and environmental protection.

India’s municipal solid waste management market stands at a pivotal transformation point, driven by accelerating urbanization rates and strengthening regulatory frameworks. The market encompasses diverse segments including waste collection services, treatment technologies, recycling operations, and disposal infrastructure, each experiencing distinct growth trajectories and investment patterns.

Key market drivers include rapid urban population growth, increasing per capita waste generation, government policy support, and rising environmental consciousness among citizens and businesses. The sector benefits from technological innovations in waste processing, growing private sector participation, and international funding for sustainable infrastructure projects. Waste-to-energy technologies show particularly strong adoption rates, with capacity utilization improving by approximately 15-20% annually.

Market challenges encompass inadequate infrastructure in tier-2 and tier-3 cities, limited public awareness about waste segregation, financial constraints of municipal bodies, and complex regulatory compliance requirements. However, these challenges create opportunities for innovative solutions, technology deployment, and service delivery models. Digital transformation initiatives are reshaping operational efficiency, with smart waste management systems demonstrating 30-35% improvement in collection efficiency.

Future growth prospects remain robust, supported by continued urbanization, policy reforms, and increasing focus on sustainable development goals. The market shows strong potential for consolidation, technology integration, and expansion into underserved regions across India.

Strategic market insights reveal fundamental shifts in India’s waste management landscape, highlighting both opportunities and challenges shaping sector development:

Rapid urbanization serves as the primary catalyst driving India’s municipal solid waste management market expansion. With urban population growth rates exceeding 2.4% annually, cities face mounting pressure to develop adequate waste management infrastructure and services. Population density increases in metropolitan areas create concentrated waste generation points, necessitating efficient collection and processing systems.

Government policy initiatives provide substantial market momentum through programs like Swachh Bharat Mission, which has allocated significant funding for waste management infrastructure development. Regulatory frameworks including the Solid Waste Management Rules 2016 mandate segregation at source, promote waste-to-energy projects, and encourage private sector participation. These policies create market opportunities while establishing compliance requirements that drive service demand.

Environmental awareness among citizens and businesses is increasing, creating demand for sustainable waste management solutions. Corporate social responsibility initiatives by major companies are driving investment in waste management projects and supporting community-based programs. Climate change concerns and air quality issues in major cities are prompting authorities to prioritize effective waste management as part of environmental protection strategies.

Technological advancement in waste processing equipment, monitoring systems, and treatment technologies is making modern waste management solutions more accessible and cost-effective. Digital platforms for waste collection optimization, citizen engagement, and performance monitoring are improving service delivery and operational transparency.

Financial constraints of municipal corporations represent a significant market restraint, limiting their ability to invest in modern waste management infrastructure and services. Budget limitations often result in inadequate service coverage, outdated equipment, and insufficient maintenance of existing facilities. Many municipalities struggle with revenue collection and face competing priorities for limited financial resources.

Infrastructure deficits in transportation networks, treatment facilities, and disposal sites create operational challenges and limit market growth potential. Land availability for waste processing facilities and landfills is becoming increasingly scarce, particularly in densely populated urban areas. Inadequate road infrastructure in many cities hampers efficient waste collection and transportation operations.

Public awareness gaps regarding waste segregation, recycling practices, and environmental impact continue to challenge effective waste management implementation. Behavioral resistance to new waste management practices and limited citizen participation in segregation initiatives reduce system efficiency and increase operational costs.

Regulatory complexity and inconsistent implementation across different states and municipalities create compliance challenges for service providers. Bureaucratic processes for project approvals, land acquisition, and environmental clearances can significantly delay infrastructure development projects. Coordination challenges between multiple government agencies and departments often slow down project implementation and market development.

Waste-to-energy sector presents substantial growth opportunities as India seeks to address both waste management challenges and energy security concerns. Government incentives for renewable energy projects, including waste-to-energy plants, create favorable investment conditions. The potential for converting municipal solid waste into electricity, biogas, and other energy products offers attractive returns while addressing environmental concerns.

Technology integration opportunities include deploying IoT sensors for smart bins, GPS tracking for collection vehicles, and AI-powered sorting systems for recycling facilities. Digital platforms for citizen engagement, complaint management, and service optimization can significantly improve operational efficiency and customer satisfaction. Mobile applications for waste collection scheduling and payment processing represent growing market segments.

Rural and semi-urban markets offer significant expansion opportunities as these areas develop waste management infrastructure and services. Tier-2 and tier-3 cities present less competitive environments with substantial unmet demand for professional waste management services. Government focus on rural development and sanitation creates supportive conditions for market entry in these regions.

Circular economy initiatives create opportunities for developing integrated waste management solutions that maximize resource recovery and minimize disposal requirements. Material recovery facilities, composting operations, and recycling industries can generate additional revenue streams while supporting sustainable development objectives. Partnerships with manufacturing industries for waste-derived raw materials present collaborative opportunities.

Supply-demand dynamics in India’s municipal solid waste management market reflect the growing gap between waste generation rates and processing capacity. Demand drivers include increasing urban population, rising consumption patterns, and stricter regulatory compliance requirements. Supply constraints include limited infrastructure capacity, skilled workforce shortages, and financial resource limitations affecting service expansion.

Competitive dynamics are evolving as the market transitions from fragmented local operators to organized service providers with advanced capabilities. Market consolidation trends indicate growing presence of large waste management companies acquiring smaller operators and expanding service coverage. International companies are entering the Indian market through joint ventures and technology partnerships, bringing global best practices and advanced solutions.

Pricing dynamics vary significantly across different market segments and geographic regions. Service pricing is influenced by local economic conditions, competition intensity, regulatory requirements, and service quality expectations. Waste-to-energy projects demonstrate improving economic viability with better pricing mechanisms and government support policies.

Innovation dynamics are accelerating with increasing investment in research and development, technology adoption, and process optimization. Collaborative innovation between government agencies, private companies, and academic institutions is driving development of India-specific solutions addressing local market conditions and requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into India’s municipal solid waste management market. Primary research includes structured interviews with industry stakeholders, government officials, waste management companies, technology providers, and municipal corporation representatives across major Indian cities.

Secondary research encompasses analysis of government reports, policy documents, industry publications, company financial statements, and regulatory filings. Data triangulation techniques validate findings across multiple sources, ensuring consistency and reliability of market insights. Industry databases, trade association reports, and academic research papers provide additional analytical depth.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing waste generation patterns, service coverage rates, infrastructure capacity, and investment flows. Qualitative analysis examines market trends, competitive dynamics, regulatory impacts, and technological developments affecting sector growth. Regional analysis considers state-specific policies, urban development patterns, and local market conditions.

Expert validation processes involve review by industry specialists, policy experts, and technical consultants to ensure accuracy and relevance of research findings. Continuous monitoring of market developments, policy changes, and industry announcements maintains currency of analytical insights and market projections.

Western India leads the municipal solid waste management market, with states like Maharashtra and Gujarat demonstrating advanced infrastructure development and strong private sector participation. Mumbai and Pune showcase successful public-private partnership models, achieving waste processing efficiency rates of approximately 70-75%. The region benefits from industrial presence, better financial resources, and progressive policy implementation.

Northern India presents significant market opportunities, particularly in the National Capital Region where air quality concerns drive demand for effective waste management solutions. Delhi’s waste management initiatives include large-scale waste-to-energy projects and smart city implementations. States like Punjab and Haryana are developing integrated waste management systems with focus on rural-urban connectivity.

Southern India demonstrates strong market maturity with cities like Bangalore, Chennai, and Hyderabad implementing innovative waste management technologies. Karnataka and Tamil Nadu lead in waste-to-energy adoption, with several operational plants demonstrating commercial viability. The region shows high citizen awareness and participation in waste segregation programs, achieving segregation rates of approximately 60-65%.

Eastern India represents an emerging market with substantial growth potential as cities like Kolkata modernize waste management infrastructure. West Bengal’s initiatives focus on improving collection efficiency and developing processing facilities. The region faces challenges related to infrastructure development but benefits from increasing government investment and policy support.

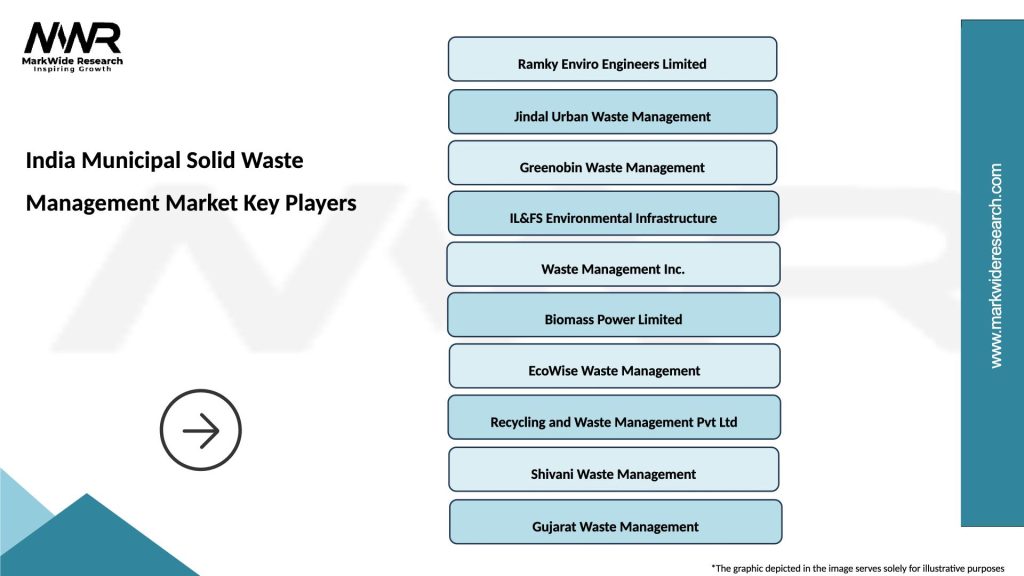

Market leadership in India’s municipal solid waste management sector is distributed among several key players, each bringing distinct capabilities and market positioning:

Competitive strategies include technology innovation, geographic expansion, vertical integration, and strategic partnerships with government agencies and international companies. Market differentiation occurs through service quality, technology adoption, environmental compliance, and cost competitiveness.

By Service Type:

By Waste Type:

By Technology:

Waste Collection Services represent the largest market segment, driven by universal demand across all urban areas. Collection efficiency varies significantly between cities, with tier-1 cities achieving coverage rates of approximately 85-90% while tier-2 cities average 60-70% coverage. Modern collection systems incorporating GPS tracking and route optimization demonstrate substantial efficiency improvements.

Treatment and Processing segment shows rapid growth with increasing adoption of waste-to-energy technologies and composting facilities. Processing capacity utilization rates are improving as operational expertise develops and feedstock supply becomes more reliable. Integrated processing facilities combining multiple treatment technologies show better economic performance and environmental outcomes.

Recycling Operations benefit from growing demand for recycled materials and strengthening supply chains. Material recovery rates are increasing with better segregation practices and advanced sorting technologies. The segment faces challenges related to market volatility for recycled materials and quality consistency requirements from end-users.

Digital Solutions represent an emerging high-growth segment with smart waste management platforms gaining adoption. Technology integration improves operational transparency, citizen engagement, and service optimization. Mobile applications for waste collection scheduling and payment processing show strong user adoption rates in urban areas.

Municipal Corporations benefit from improved service delivery, cost optimization, and enhanced citizen satisfaction through professional waste management services. Operational efficiency gains include reduced manual intervention, better resource utilization, and improved environmental compliance. Public-private partnerships provide access to advanced technologies and specialized expertise without significant capital investment.

Private Service Providers gain access to stable, long-term revenue streams through municipal contracts and growing market demand. Business opportunities include technology deployment, service expansion, and development of integrated solutions addressing multiple waste management needs. Market growth provides opportunities for scaling operations and achieving economies of scale.

Citizens and Communities benefit from cleaner urban environments, improved public health conditions, and better quality of life. Environmental benefits include reduced air and water pollution, better sanitation, and contribution to climate change mitigation through proper waste management. Digital platforms improve service accessibility and citizen engagement in waste management processes.

Environmental Stakeholders benefit from reduced environmental impact, resource conservation, and support for circular economy principles. Sustainability outcomes include reduced greenhouse gas emissions, improved resource recovery rates, and protection of natural ecosystems from waste pollution.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping India’s municipal solid waste management market through IoT integration, data analytics, and mobile platform adoption. Smart waste management systems incorporating sensors, GPS tracking, and automated monitoring are improving operational efficiency by approximately 25-30%. Cities are implementing digital platforms for citizen engagement, complaint management, and service optimization.

Circular economy principles are gaining prominence as stakeholders focus on resource recovery, waste minimization, and sustainable practices. Material recovery facilities are expanding to capture greater value from waste streams, with recovery rates improving significantly in well-managed systems. Integration of recycling operations with waste collection services creates comprehensive value chains.

Public-private partnerships are becoming the preferred model for large-scale waste management projects, combining government oversight with private sector efficiency and innovation. Collaborative approaches enable better resource utilization, risk sharing, and service quality improvements. Long-term contracts provide stability for infrastructure investment and service development.

Decentralized processing solutions are gaining traction, particularly for organic waste management through community-level composting and biogas plants. Localized treatment reduces transportation costs, improves processing efficiency, and creates community ownership of waste management initiatives.

Policy developments include implementation of Extended Producer Responsibility regulations, plastic waste management rules, and construction and demolition waste guidelines. Regulatory frameworks are evolving to address emerging waste streams, promote sustainable practices, and encourage private sector participation. State governments are developing comprehensive waste management policies aligned with national objectives.

Technology advancements include deployment of AI-powered sorting systems, blockchain for waste tracking, and advanced treatment technologies like plasma gasification. Innovation initiatives by startups and established companies are introducing cost-effective solutions for Indian market conditions. Research and development efforts focus on developing indigenous technologies suitable for local waste characteristics.

Infrastructure investments include major waste-to-energy projects, integrated processing facilities, and smart city waste management systems. Capacity expansion projects are addressing processing gaps in major cities, with several large-scale facilities under development. International funding and technical assistance support infrastructure development initiatives.

Market consolidation trends include acquisitions, mergers, and strategic partnerships among waste management companies. Industry collaboration initiatives promote knowledge sharing, best practice adoption, and coordinated market development efforts.

MarkWide Research analysis indicates that successful market participants should prioritize technology integration and service quality differentiation to capture growth opportunities. Strategic recommendations include investing in digital platforms, developing integrated service offerings, and building strong relationships with municipal clients through consistent performance delivery.

Market entry strategies should focus on tier-2 and tier-3 cities where competition is less intense and growth potential remains substantial. Partnership approaches with local operators, technology providers, and government agencies can accelerate market penetration and reduce entry barriers. Companies should develop scalable business models adaptable to different market conditions and client requirements.

Technology investment priorities should emphasize solutions that improve operational efficiency, reduce costs, and enhance service quality. Digital capabilities including mobile applications, IoT integration, and data analytics platforms provide competitive advantages and improve customer satisfaction. Automation technologies can address labor challenges and improve processing consistency.

Regulatory compliance should be viewed as a competitive advantage rather than a burden, with companies investing in systems and processes that exceed minimum requirements. Environmental performance excellence can differentiate service providers and support premium pricing strategies. Proactive engagement with regulatory authorities helps shape policy development and ensures compliance readiness.

Long-term growth prospects for India’s municipal solid waste management market remain robust, driven by continued urbanization, policy support, and increasing environmental awareness. Market evolution will likely see greater technology integration, service consolidation, and emphasis on sustainable practices. The sector is expected to mature with improved service standards, better infrastructure, and more sophisticated business models.

Technology adoption will accelerate with decreasing costs and improving reliability of advanced waste management solutions. Smart city initiatives will drive demand for integrated digital platforms and IoT-enabled systems. Artificial intelligence and machine learning applications will optimize operations and improve decision-making processes. Waste-to-energy capacity is projected to expand significantly, with efficiency improvements of approximately 20-25% expected over the next five years.

Market structure will likely evolve toward greater consolidation with larger, more capable service providers gaining market share. Regional expansion will continue as successful urban models are adapted for smaller cities and rural areas. International companies may increase their presence through partnerships and acquisitions, bringing global expertise and capital.

Regulatory environment will continue strengthening with more stringent environmental standards, extended producer responsibility requirements, and performance-based contracting models. MWR projections suggest that compliance-focused companies will outperform competitors, with market share gains of approximately 15-20% for leaders in environmental performance. Circular economy principles will become increasingly important in shaping market dynamics and business strategies.

India’s municipal solid waste management market stands at a transformative juncture, presenting substantial opportunities for growth, innovation, and positive environmental impact. The convergence of urbanization pressures, policy support, and technological advancement creates favorable conditions for market expansion and modernization. Strategic positioning in this evolving market requires understanding of local dynamics, regulatory requirements, and citizen expectations.

Success factors for market participants include technology adoption, service quality excellence, regulatory compliance, and sustainable business practices. Companies that invest in digital capabilities, develop integrated solutions, and build strong stakeholder relationships will be best positioned to capture growth opportunities. Market leaders will emerge from those who can effectively balance operational efficiency with environmental responsibility while meeting diverse client needs across India’s varied urban landscape.

The future trajectory of India’s municipal solid waste management market points toward increased professionalization, technology integration, and sustainability focus. As the sector matures, it will play an increasingly important role in supporting India’s sustainable development objectives while creating economic value and improving quality of life for millions of urban residents.

What is Municipal Solid Waste Management?

Municipal Solid Waste Management refers to the processes involved in the collection, treatment, and disposal of solid waste generated in urban areas. This includes various activities such as waste segregation, recycling, composting, and landfill management.

What are the key players in the India Municipal Solid Waste Management Market?

Key players in the India Municipal Solid Waste Management Market include companies like Ramky Enviro Engineers, SUEZ India, and Biome Environmental Solutions, among others. These companies are involved in various aspects of waste management, including collection, treatment, and recycling services.

What are the main drivers of the India Municipal Solid Waste Management Market?

The main drivers of the India Municipal Solid Waste Management Market include rapid urbanization, increasing population, and growing awareness of environmental sustainability. Additionally, government initiatives aimed at improving waste management infrastructure are also contributing to market growth.

What challenges does the India Municipal Solid Waste Management Market face?

The India Municipal Solid Waste Management Market faces challenges such as inadequate infrastructure, lack of public awareness, and regulatory compliance issues. These factors can hinder effective waste management practices and lead to environmental concerns.

What opportunities exist in the India Municipal Solid Waste Management Market?

Opportunities in the India Municipal Solid Waste Management Market include the adoption of advanced waste processing technologies, increased investment in recycling facilities, and the potential for public-private partnerships. These developments can enhance waste management efficiency and sustainability.

What trends are shaping the India Municipal Solid Waste Management Market?

Trends shaping the India Municipal Solid Waste Management Market include the growing emphasis on circular economy practices, the integration of smart waste management solutions, and the rise of community-based waste management initiatives. These trends aim to improve waste reduction and resource recovery.

India Municipal Solid Waste Management Market

| Segmentation Details | Description |

|---|---|

| Type | Organic Waste, Plastic Waste, E-Waste, Hazardous Waste |

| Technology | Composting, Incineration, Landfilling, Anaerobic Digestion |

| End User | Municipalities, Private Sector, NGOs, Households |

| Service Type | Collection, Transportation, Processing, Disposal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Municipal Solid Waste Management Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at