444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India magnetic resonance imaging industry market represents one of the most dynamic and rapidly evolving segments within the country’s healthcare technology landscape. Magnetic resonance imaging (MRI) technology has become an indispensable diagnostic tool across Indian hospitals, diagnostic centers, and specialized medical facilities, driving unprecedented growth in adoption and technological advancement.

Market dynamics indicate that India’s MRI industry is experiencing robust expansion, fueled by increasing healthcare awareness, rising disposable incomes, and government initiatives to strengthen medical infrastructure. The market demonstrates a compound annual growth rate (CAGR) of 8.2%, reflecting the strong demand for advanced diagnostic imaging solutions across urban and semi-urban regions.

Healthcare infrastructure development across India has created substantial opportunities for MRI technology providers, with both public and private healthcare sectors investing heavily in modern diagnostic equipment. The market encompasses various MRI system types, including high-field systems, low-field systems, and emerging portable MRI solutions, each serving specific clinical requirements and budget considerations.

Regional distribution shows that metropolitan cities account for approximately 65% of total MRI installations, while tier-2 and tier-3 cities are experiencing accelerated adoption rates. This geographic expansion reflects the democratization of advanced healthcare technologies and the government’s focus on improving medical accessibility across diverse population centers.

The India magnetic resonance imaging industry market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, installation, and servicing of MRI systems specifically within the Indian healthcare sector. This market includes various stakeholders ranging from international technology manufacturers to local distributors, healthcare providers, and specialized service organizations.

Magnetic resonance imaging technology utilizes powerful magnetic fields and radio waves to create detailed images of internal body structures, enabling healthcare professionals to diagnose various medical conditions with exceptional precision. In the Indian context, this market represents the intersection of advanced medical technology adoption and the country’s evolving healthcare infrastructure needs.

Market scope encompasses multiple MRI system categories, including closed MRI systems, open MRI systems, and specialized applications such as cardiac MRI, neurological imaging, and musculoskeletal diagnostics. The industry also includes complementary services such as maintenance contracts, software upgrades, and training programs for medical professionals.

India’s magnetic resonance imaging industry stands at a pivotal juncture, characterized by accelerating technological adoption, expanding healthcare infrastructure, and increasing patient demand for advanced diagnostic services. The market demonstrates remarkable resilience and growth potential, driven by fundamental shifts in healthcare delivery models and diagnostic preferences.

Key growth drivers include the rising prevalence of chronic diseases, increasing healthcare expenditure, and government initiatives promoting medical tourism. The market benefits from a growing middle-class population with enhanced healthcare awareness and willingness to invest in premium diagnostic services, contributing to sustained market expansion.

Technology evolution within the Indian MRI market reflects global trends toward higher resolution imaging, faster scan times, and improved patient comfort. Artificial intelligence integration and advanced imaging protocols are becoming increasingly prevalent, with AI-enhanced MRI systems showing 35% faster diagnostic accuracy compared to conventional systems.

Market challenges include high equipment costs, skilled technician shortages, and infrastructure limitations in rural areas. However, innovative financing models, government healthcare schemes, and technology partnerships are addressing these barriers, creating sustainable growth pathways for market participants.

Strategic market insights reveal several critical trends shaping India’s MRI industry landscape. The market demonstrates strong preference for mid-field MRI systems that balance imaging quality with cost-effectiveness, particularly suitable for India’s diverse healthcare ecosystem.

Primary market drivers propelling India’s MRI industry growth stem from fundamental healthcare transformation and demographic shifts. The increasing prevalence of lifestyle-related diseases, aging population, and enhanced healthcare awareness create sustained demand for advanced diagnostic imaging services.

Government healthcare initiatives play a crucial role in market expansion, with programs like Ayushman Bharat and National Health Mission improving healthcare accessibility and diagnostic service coverage. These initiatives directly impact MRI adoption by expanding insurance coverage and reducing patient financial barriers.

Medical tourism growth significantly contributes to market demand, with India attracting international patients seeking high-quality, cost-effective medical care. Medical tourism accounts for substantial MRI utilization, particularly in specialized procedures requiring advanced imaging capabilities.

Technological advancement drives market evolution through improved imaging quality, reduced scan times, and enhanced patient comfort. Modern MRI systems offer superior diagnostic capabilities while addressing traditional limitations such as claustrophobia and noise levels, expanding patient acceptance and clinical applications.

Private healthcare expansion creates substantial market opportunities as private hospitals and diagnostic chains invest in state-of-the-art MRI equipment to differentiate their services and attract quality-conscious patients. This trend accelerates technology adoption and market competition.

Significant market restraints challenge the India MRI industry’s growth trajectory, primarily centered around high capital requirements and operational complexities. The substantial initial investment required for MRI systems creates barriers for smaller healthcare providers and limits market penetration in cost-sensitive segments.

Infrastructure limitations pose considerable challenges, particularly regarding power supply stability, specialized facility requirements, and helium availability for system operation. These infrastructure constraints are especially pronounced in rural and semi-urban areas, limiting geographic market expansion.

Skilled workforce shortage represents a critical bottleneck, with insufficient numbers of qualified MRI technicians, radiologists, and service engineers. This shortage impacts system utilization efficiency and service quality, potentially constraining market growth and operational effectiveness.

Regulatory complexities and lengthy approval processes for medical equipment imports create market entry barriers and delay technology adoption. Compliance requirements and quality certifications add operational costs and complexity for market participants.

Competition from alternative imaging technologies such as CT scans and ultrasound systems, which offer lower costs and simpler operations, creates pricing pressure and limits MRI adoption in certain clinical applications and market segments.

Emerging market opportunities in India’s MRI industry present substantial growth potential across multiple dimensions. The expanding healthcare infrastructure, particularly in tier-2 and tier-3 cities, creates significant opportunities for MRI technology providers to establish market presence and capture growing demand.

Artificial intelligence integration offers transformative opportunities for enhancing diagnostic accuracy, reducing interpretation time, and improving workflow efficiency. AI-powered MRI systems can address radiologist shortage challenges while delivering superior clinical outcomes and operational efficiency.

Portable and compact MRI systems represent emerging opportunities for addressing infrastructure limitations and expanding market reach to smaller healthcare facilities. These innovative solutions can democratize access to advanced imaging technology while reducing operational complexity and costs.

Telemedicine integration creates opportunities for remote MRI interpretation and consultation services, enabling expertise sharing across geographic boundaries and improving diagnostic accessibility in underserved regions. This integration supports the government’s digital health initiatives and expands market reach.

Public-private partnerships offer opportunities for collaborative healthcare infrastructure development, risk sharing, and technology deployment. These partnerships can accelerate market growth while addressing public healthcare needs and private sector profitability requirements.

Complex market dynamics shape India’s MRI industry through interconnected factors influencing supply, demand, and competitive positioning. The market demonstrates cyclical patterns driven by healthcare budget allocations, technology refresh cycles, and regulatory policy changes.

Demand-supply equilibrium shows regional variations, with metropolitan areas experiencing high demand and adequate supply, while rural regions face supply constraints despite growing demand. This imbalance creates opportunities for targeted market development and innovative service delivery models.

Technology lifecycle management influences market dynamics through equipment replacement cycles, upgrade requirements, and service contract renewals. Average MRI system lifecycles of 10-15 years create predictable replacement demand patterns, supporting long-term market planning and investment decisions.

Competitive dynamics intensify as international manufacturers compete with emerging local players and refurbished equipment providers. This competition drives innovation, improves service quality, and creates pricing pressures that benefit end-users while challenging profit margins.

Regulatory dynamics impact market operations through quality standards, import policies, and healthcare regulations. Recent policy changes promoting Make in India initiatives encourage local manufacturing and assembly, potentially reshaping market structure and competitive positioning.

Comprehensive research methodology employed for analyzing India’s MRI industry market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights and projections.

Primary research involves extensive interviews with key stakeholders including MRI manufacturers, healthcare providers, diagnostic center operators, and medical professionals. These interviews provide firsthand insights into market trends, challenges, and opportunities from diverse industry perspectives.

Secondary research encompasses analysis of industry reports, government publications, healthcare statistics, and regulatory documents. This research provides comprehensive market context, historical trends, and regulatory framework understanding essential for accurate market assessment.

Data triangulation methodology ensures research reliability by cross-referencing information from multiple sources and validating findings through independent verification processes. This approach minimizes bias and enhances the credibility of market analysis and projections.

Market modeling utilizes advanced analytical techniques including regression analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and identify key growth drivers and constraints affecting industry development.

Regional market analysis reveals distinct patterns in MRI adoption and growth across India’s diverse geographic landscape. Northern India leads in absolute MRI installations, accounting for approximately 35% of the national market, driven by major metropolitan centers and established healthcare infrastructure.

Western India demonstrates the highest growth rates, with states like Maharashtra and Gujarat showing robust MRI market expansion supported by industrial growth, medical tourism, and private healthcare investment. This region accounts for 28% of total market share with strong future growth potential.

Southern India exhibits balanced growth across multiple states, with Karnataka, Tamil Nadu, and Andhra Pradesh leading adoption rates. The region benefits from strong healthcare infrastructure, medical education institutions, and technology-friendly policies, representing 25% of market distribution.

Eastern India shows emerging growth potential, particularly in West Bengal and Odisha, with increasing healthcare investments and infrastructure development. While currently representing 12% of market share, this region demonstrates accelerating adoption rates and significant future opportunities.

According to MarkWide Research analysis, tier-2 and tier-3 cities across all regions are experiencing 15% higher growth rates compared to metropolitan areas, indicating geographic market diversification and democratization of advanced healthcare technology access.

India’s MRI industry competitive landscape features a diverse mix of international technology leaders, regional distributors, and emerging local players, creating a dynamic and competitive market environment that benefits healthcare providers and patients through innovation and competitive pricing.

Competitive strategies focus on technology differentiation, service excellence, financing flexibility, and local market adaptation. Companies are increasingly investing in artificial intelligence integration, workflow optimization, and patient experience enhancement to maintain competitive advantages.

Market consolidation trends show increasing collaboration between international manufacturers and local partners, creating hybrid business models that combine global technology expertise with local market knowledge and service capabilities.

Market segmentation analysis reveals distinct categories within India’s MRI industry, each serving specific clinical requirements, budget considerations, and operational preferences. This segmentation provides insights into market dynamics and growth opportunities across different technology and application categories.

By Field Strength:

By System Type:

By End-User:

Hospital segment analysis reveals that private hospitals lead MRI adoption with approximately 60% of total installations, driven by competitive differentiation needs and patient service quality requirements. These facilities typically invest in mid-to-high field strength systems to support comprehensive diagnostic services.

Diagnostic center category shows the highest growth rates, expanding at 20% annually as standalone imaging centers capitalize on increasing outpatient diagnostic demand. This segment favors cost-effective, high-throughput MRI systems that maximize patient volume and operational efficiency.

Public hospital segment demonstrates steady growth supported by government healthcare initiatives and infrastructure development programs. These facilities often prioritize reliable, cost-effective MRI systems with comprehensive service support and training programs.

Specialty clinic category emerges as a niche but growing segment, with orthopedic, neurological, and cardiac specialty centers investing in dedicated MRI systems optimized for specific clinical applications and patient populations.

Mobile MRI services represent an innovative category addressing geographic accessibility challenges, particularly in rural and remote areas where permanent MRI installations may not be economically viable or practically feasible.

Healthcare providers benefit significantly from MRI technology adoption through enhanced diagnostic capabilities, improved patient outcomes, and competitive differentiation in the healthcare marketplace. Advanced MRI systems enable early disease detection, precise treatment planning, and reduced need for invasive diagnostic procedures.

Patients gain access to world-class diagnostic imaging services, enabling accurate diagnosis and appropriate treatment selection. Modern MRI systems offer improved comfort, reduced scan times, and enhanced image quality, contributing to better patient experiences and clinical outcomes.

Technology manufacturers benefit from India’s large and growing healthcare market, offering substantial revenue opportunities and market expansion potential. The market provides platforms for technology innovation, local manufacturing development, and long-term service revenue generation.

Healthcare investors find attractive opportunities in India’s MRI market through equipment financing, diagnostic center development, and healthcare infrastructure projects. The market offers stable returns supported by growing healthcare demand and government policy support.

Medical professionals benefit from advanced diagnostic tools that enhance clinical decision-making, improve treatment outcomes, and support professional development through exposure to cutting-edge medical technology and imaging techniques.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the most significant trend transforming India’s MRI industry, with AI-powered imaging analysis improving diagnostic accuracy, reducing interpretation time, and addressing radiologist shortage challenges. This trend accelerates adoption of smart imaging solutions across healthcare facilities.

Portable MRI technology gains momentum as a revolutionary trend enabling point-of-care imaging and expanding healthcare access to remote and underserved regions. These compact systems address infrastructure limitations while maintaining diagnostic quality standards.

Value-based healthcare models influence MRI adoption patterns, with healthcare providers focusing on technology solutions that demonstrate clear clinical outcomes and cost-effectiveness. This trend drives demand for systems with proven efficiency and patient outcome improvements.

Telemedicine integration creates new opportunities for remote MRI interpretation and consultation services, enabling expertise sharing across geographic boundaries and improving diagnostic accessibility in underserved regions.

Sustainability focus drives demand for energy-efficient MRI systems with reduced environmental impact and operational costs. Green technology adoption becomes increasingly important for healthcare providers seeking to reduce carbon footprints and operational expenses.

Recent industry developments demonstrate accelerating innovation and market evolution within India’s MRI sector. Major manufacturers are establishing local assembly facilities and service centers to better serve the Indian market while reducing costs and improving service responsiveness.

Government initiatives including the Production Linked Incentive (PLI) scheme for medical devices encourage domestic manufacturing and technology development, potentially reshaping market dynamics and competitive positioning in favor of local production capabilities.

Strategic partnerships between international technology providers and Indian healthcare organizations create innovative business models combining global expertise with local market knowledge and operational capabilities.

Technology breakthroughs in helium-free MRI systems address operational cost concerns and supply chain dependencies, making MRI technology more accessible and sustainable for Indian healthcare providers.

MWR data indicates that recent regulatory approvals for AI-enhanced MRI systems are accelerating adoption of intelligent imaging solutions, with several major hospitals implementing these technologies to improve diagnostic efficiency and clinical outcomes.

Market entry strategies should focus on understanding regional healthcare needs, regulatory requirements, and competitive dynamics. International manufacturers should consider local partnerships and assembly operations to improve cost competitiveness and market responsiveness.

Technology positioning recommendations emphasize the importance of offering comprehensive solutions including equipment, service, training, and financing options. Successful market participants provide integrated value propositions addressing multiple customer needs and operational challenges.

Geographic expansion strategies should prioritize tier-2 and tier-3 cities where market growth rates exceed metropolitan areas. These markets require adapted technology solutions, flexible financing models, and local service capabilities.

Innovation investment should focus on artificial intelligence integration, portable systems development, and workflow optimization solutions that address specific Indian market needs and operational constraints.

Service excellence becomes a critical differentiator in competitive markets, with comprehensive maintenance programs, rapid response capabilities, and continuous training support essential for long-term customer relationships and market success.

India’s MRI industry future outlook appears exceptionally promising, with multiple growth drivers converging to create sustained market expansion opportunities. The market is projected to maintain robust growth rates driven by healthcare infrastructure development, technology advancement, and increasing diagnostic demand.

Technology evolution will continue transforming the market through AI integration, portable systems, and workflow optimization solutions. These innovations will address current market constraints while creating new application opportunities and market segments.

Geographic expansion into rural and semi-urban markets will accelerate as infrastructure development and healthcare accessibility initiatives create new demand centers. Mobile MRI services and telemedicine integration will play crucial roles in this expansion.

Market maturation will lead to increased focus on service excellence, technology differentiation, and value-based healthcare models. Successful companies will be those that adapt to evolving customer needs while maintaining technological leadership and operational efficiency.

According to MarkWide Research projections, the market will experience continued growth with technology adoption rates increasing by 25% over the next five years, driven by government healthcare initiatives, private sector investment, and increasing patient awareness of advanced diagnostic capabilities.

India’s magnetic resonance imaging industry market stands at an inflection point characterized by tremendous growth potential, technological innovation, and expanding healthcare accessibility. The market demonstrates remarkable resilience and adaptability, successfully navigating challenges while capitalizing on emerging opportunities.

Key success factors for market participants include technology leadership, service excellence, local market adaptation, and innovative financing solutions. Companies that effectively combine global expertise with local market understanding will be best positioned to capture growth opportunities and build sustainable competitive advantages.

Future market development will be shaped by artificial intelligence integration, portable technology adoption, and geographic expansion into underserved regions. These trends create substantial opportunities for healthcare providers, technology manufacturers, and investors seeking to participate in India’s healthcare transformation.

The convergence of favorable demographics, government support, technological advancement, and increasing healthcare awareness creates a compelling investment thesis for India’s MRI industry. Market participants who recognize and act upon these opportunities will benefit from sustained growth and market leadership positions in one of the world’s most dynamic healthcare markets.

What is Magnetic Resonance Imaging?

Magnetic Resonance Imaging (MRI) is a medical imaging technique used to visualize internal structures of the body in detail. It employs strong magnetic fields and radio waves to generate images, commonly used for diagnosing conditions related to the brain, spine, and joints.

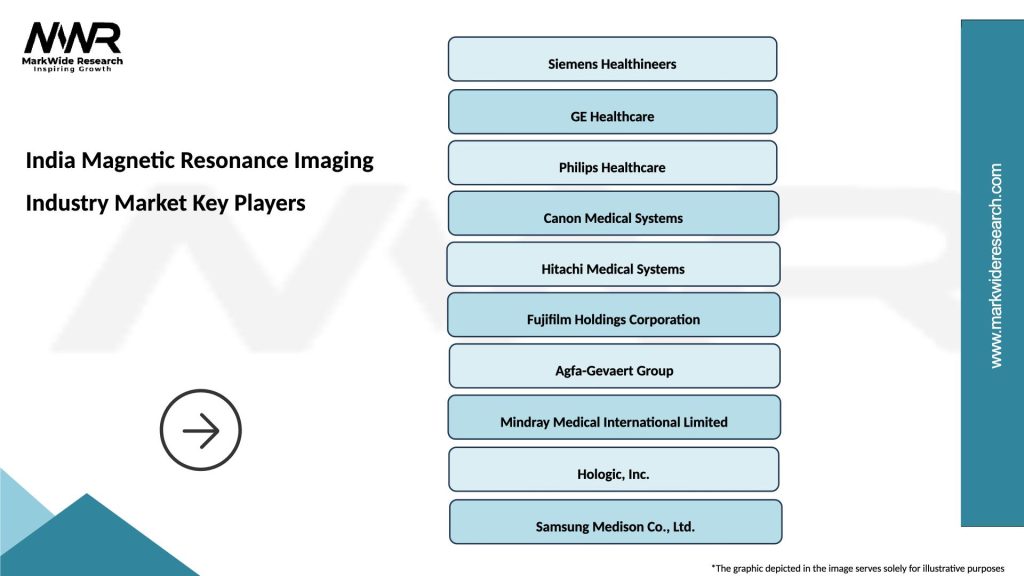

What are the key players in the India Magnetic Resonance Imaging Industry Market?

Key players in the India Magnetic Resonance Imaging Industry Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others. These companies are known for their advanced MRI technologies and innovative imaging solutions.

What are the growth factors driving the India Magnetic Resonance Imaging Industry Market?

The growth of the India Magnetic Resonance Imaging Industry Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in MRI technology, and a growing emphasis on early diagnosis and preventive healthcare.

What challenges does the India Magnetic Resonance Imaging Industry Market face?

The India Magnetic Resonance Imaging Industry Market faces challenges such as high costs of MRI machines, a shortage of trained professionals, and concerns regarding patient safety and comfort during procedures.

What opportunities exist in the India Magnetic Resonance Imaging Industry Market?

Opportunities in the India Magnetic Resonance Imaging Industry Market include the expansion of healthcare infrastructure, increasing investments in medical imaging technologies, and the rising demand for MRI in research and clinical applications.

What trends are shaping the India Magnetic Resonance Imaging Industry Market?

Trends shaping the India Magnetic Resonance Imaging Industry Market include the development of portable MRI machines, the integration of artificial intelligence for image analysis, and the growing use of MRI in personalized medicine and treatment planning.

India Magnetic Resonance Imaging Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Closed MRI, Open MRI, Extremity MRI, Functional MRI |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Imaging Clinics |

| Technology | 3T MRI, 1.5T MRI, Ultra-High Field MRI, Hybrid MRI |

| Application | Neurology, Oncology, Cardiology, Musculoskeletal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Magnetic Resonance Imaging Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at