444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India Liquefied Petroleum Gas (LPG) market has witnessed significant growth in recent years, driven by the increasing demand for clean cooking and energy solutions across the country. LPG, commonly known as cooking gas, is a versatile fuel widely used for household cooking, heating, and commercial applications. As a cleaner and more efficient alternative to traditional fuels like wood, coal, and kerosene, LPG has gained popularity, particularly in urban areas, for its convenience and environmental benefits.

Meaning

Liquefied Petroleum Gas (LPG) refers to a flammable hydrocarbon gas mixture, primarily composed of propane and butane. It is derived from natural gas processing and petroleum refining processes. LPG is stored under moderate pressure as a liquid and vaporizes when released from its container. It is colorless and odorless, but an odorant called ethanethiol is added to ensure leak detection. The gas is widely available in portable cylinders and bulk storage tanks.

Executive Summary

The India LPG market has experienced steady growth over the past decade, driven by government initiatives, rising disposable incomes, and the need for cleaner energy sources. The market has witnessed a significant increase in LPG penetration, with a notable rise in the number of households adopting LPG as their primary cooking fuel. The government’s flagship Pradhan Mantri Ujjwala Yojana (PMUY) scheme has played a crucial role in expanding LPG access to rural households and empowering women by providing smoke-free cooking solutions.

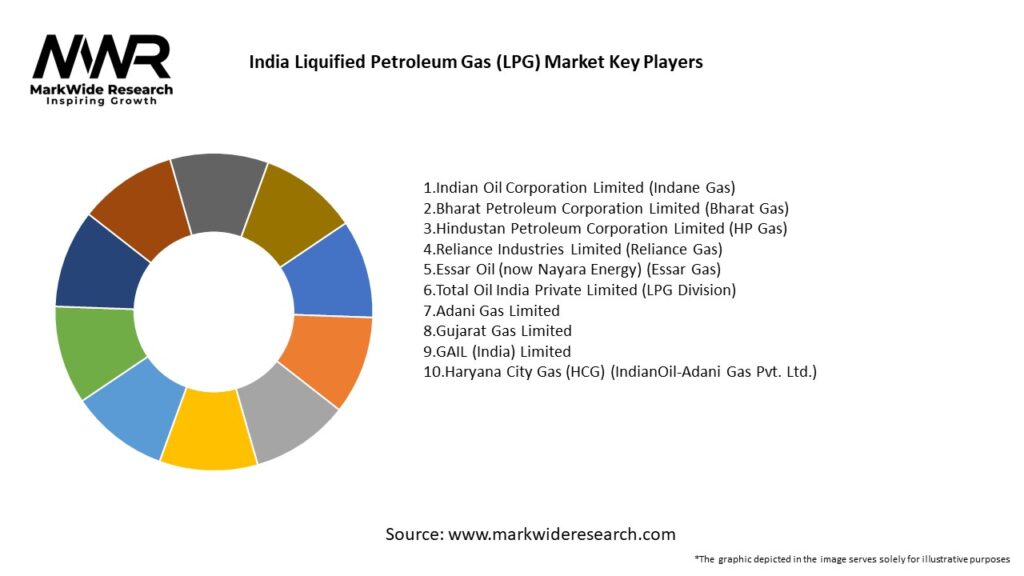

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India LPG market operates in a dynamic environment influenced by various factors, including government policies, economic conditions, and changing consumer preferences. The market has witnessed steady growth, driven by rising consumer awareness, increased urbanization, and supportive government initiatives. The demand for LPG is expected to continue its upward trajectory, fueled by the need for clean and efficient cooking solutions.

Regional Analysis

The LPG market in India exhibits regional variations in terms of consumption patterns and penetration. While urban areas have higher LPG penetration rates, rural regions offer substantial growth potential. Government schemes and awareness campaigns have made significant inroads into rural markets, but further efforts are needed to bridge the urban-rural divide.

Competitive Landscape

Leading Companies in the India Liquified Petroleum Gas (LPG) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

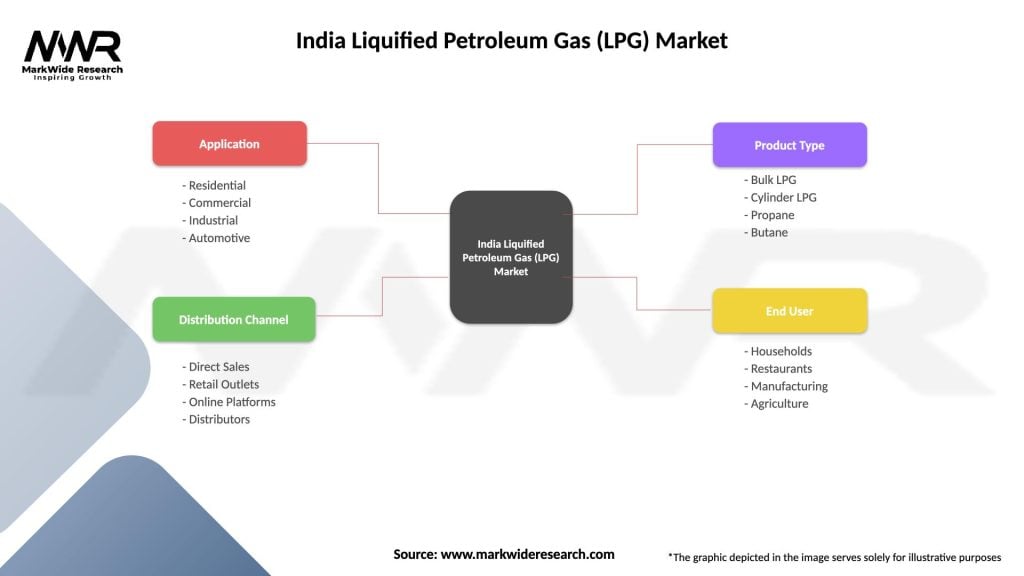

Segmentation

The India LPG market can be segmented based on the type of usage, including domestic, commercial, and industrial applications. Domestic usage accounts for the largest share, driven by household cooking needs. However, commercial and industrial applications offer substantial growth potential, particularly in urban areas.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the India LPG market. While the initial lockdowns and disruptions in supply chains posed challenges, the need for clean cooking solutions and hygiene practices increased demand for LPG. The government’s provision of free LPG cylinders to vulnerable households during the crisis helped ensure uninterrupted access to cooking gas.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the India LPG market looks promising, driven by the government’s commitment to clean cooking and energy solutions, rising urbanization, and increasing consumer awareness. Efforts to expand LPG access to rural areas, diversify applications beyond household cooking, and enhance affordability will shape the market’s growth trajectory.

Conclusion

The India Liquefied Petroleum Gas (LPG) market has witnessed significant growth, fueled by the increasing demand for clean cooking and energy solutions. LPG offers a convenient and cleaner alternative to traditional fuels, addressing environmental concerns and improving health outcomes. Government initiatives, infrastructure development, and rising consumer awareness have contributed to the market’s expansion. As the market evolves, continued efforts to bridge affordability gaps, raise awareness, and tap into untapped segments will unlock the full potential of LPG as a sustainable energy source for India.

What is Liquified Petroleum Gas (LPG)?

Liquified Petroleum Gas (LPG) is a flammable mixture of hydrocarbon gases, primarily propane and butane, used as fuel for heating, cooking, and in vehicles. It is stored in liquid form under pressure and is widely utilized in residential and commercial applications.

What are the key players in the India Liquified Petroleum Gas (LPG) Market?

Key players in the India Liquified Petroleum Gas (LPG) Market include Indian Oil Corporation, Bharat Petroleum Corporation Limited, and Hindustan Petroleum Corporation Limited, among others. These companies dominate the supply and distribution of LPG across the country.

What are the growth factors driving the India Liquified Petroleum Gas (LPG) Market?

The growth of the India Liquified Petroleum Gas (LPG) Market is driven by increasing urbanization, rising disposable incomes, and government initiatives promoting clean cooking fuels. Additionally, the shift from traditional fuels to LPG for cooking and heating is contributing to market expansion.

What challenges does the India Liquified Petroleum Gas (LPG) Market face?

The India Liquified Petroleum Gas (LPG) Market faces challenges such as supply chain disruptions, fluctuating global oil prices, and safety concerns related to storage and transportation. These factors can impact availability and consumer confidence in LPG usage.

What opportunities exist in the India Liquified Petroleum Gas (LPG) Market?

Opportunities in the India Liquified Petroleum Gas (LPG) Market include the expansion of distribution networks in rural areas and the development of LPG as an alternative fuel for vehicles. Additionally, increasing awareness of environmental benefits presents further growth potential.

What trends are shaping the India Liquified Petroleum Gas (LPG) Market?

Trends in the India Liquified Petroleum Gas (LPG) Market include the adoption of smart LPG cylinders with tracking technology and the integration of LPG in hybrid energy systems. Furthermore, there is a growing emphasis on safety standards and regulations to enhance consumer protection.

India Liquified Petroleum Gas (LPG) Market

| Segmentation Details | Description |

|---|---|

| Application | Residential, Commercial, Industrial, Automotive |

| Distribution Channel | Direct Sales, Retail Outlets, Online Platforms, Distributors |

| Product Type | Bulk LPG, Cylinder LPG, Propane, Butane |

| End User | Households, Restaurants, Manufacturing, Agriculture |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Liquified Petroleum Gas (LPG) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at