444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The India lighting market is a rapidly growing sector within the country’s broader electrical industry. Lighting plays a vital role in various applications, including residential, commercial, industrial, and outdoor spaces. With a population of over 1.3 billion people, India offers a massive potential market for lighting products and solutions.

The term “lighting market” refers to the industry involved in the production, distribution, and sale of lighting fixtures, bulbs, and related accessories. This market encompasses both traditional lighting technologies like incandescent and fluorescent lamps as well as newer, more energy-efficient options like LED (Light-Emitting Diode) lighting.

Executive Summary

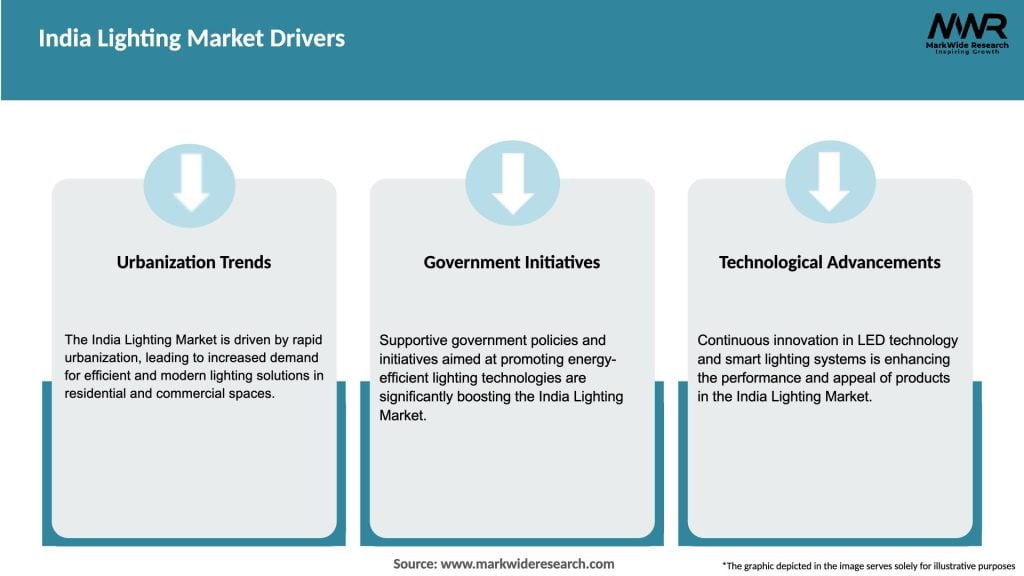

The India lighting market has experienced significant growth in recent years, driven by various factors such as increasing urbanization, government initiatives promoting energy efficiency, and the rising demand for smart lighting solutions. The market is highly competitive, with both domestic and international players vying for market share.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India lighting market is characterized by intense competition and rapid technological advancements. Key market dynamics include:

Regional Analysis

The India lighting market exhibits regional variations in terms of demand and market dynamics. Major regions include:

Competitive Landscape

Leading Companies in the India Lighting Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

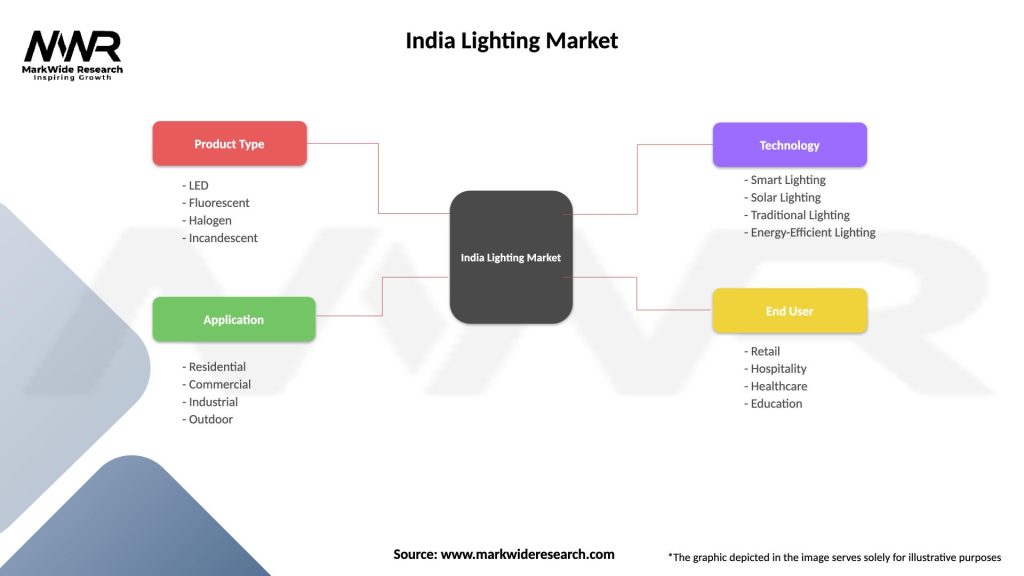

The India lighting market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the India lighting market. The nationwide lockdowns and disruptions in supply chains resulted in temporary setbacks. However, with the gradual lifting of restrictions and the resumption of economic activities, the market has shown signs of recovery. The pandemic also highlighted the importance of energy-efficient lighting solutions and the adoption of smart lighting systems for hygiene and safety purposes.

Key Industry Developments

Analyst Suggestions

Future Outlook

The India lighting market is poised for substantial growth in the coming years. Factors such as urbanization, government initiatives promoting energy efficiency, and the increasing adoption of smart lighting solutions will drive market expansion. The demand for energy-efficient lighting and the development of sustainable lighting solutions will be key areas of focus for industry players. Collaborations, technological advancements, and product customization will play significant roles in shaping the future of the market.

Conclusion

The India lighting market offers immense potential for growth, driven by factors such as urbanization, government initiatives, and the increasing demand for energy-efficient and smart lighting solutions. Industry participants should focus on innovation, market segmentation, and collaboration with distribution channels to tap into this evolving market. By understanding customer needs, investing in R&D, and leveraging government support, companies can position themselves for success in the competitive landscape of the India lighting market.

What is Lighting?

Lighting refers to the deliberate use of light to achieve practical or aesthetic effects in various environments, including residential, commercial, and industrial spaces. It encompasses a range of products such as bulbs, fixtures, and smart lighting systems.

What are the key players in the India Lighting Market?

Key players in the India Lighting Market include Philips Lighting, Havells India, Syska LED, and Bajaj Electricals. These companies are known for their innovative lighting solutions and extensive distribution networks, among others.

What are the growth factors driving the India Lighting Market?

The India Lighting Market is driven by factors such as increasing urbanization, rising disposable incomes, and a growing emphasis on energy-efficient lighting solutions. Additionally, the adoption of smart lighting technologies is contributing to market growth.

What challenges does the India Lighting Market face?

The India Lighting Market faces challenges such as high competition among manufacturers and fluctuating raw material prices. Additionally, the lack of awareness regarding energy-efficient products can hinder market expansion.

What opportunities exist in the India Lighting Market?

Opportunities in the India Lighting Market include the growing demand for smart lighting solutions and the increasing focus on sustainable lighting technologies. The expansion of infrastructure projects also presents significant growth potential.

What trends are shaping the India Lighting Market?

Trends in the India Lighting Market include the shift towards LED lighting, the integration of IoT in lighting systems, and the rising popularity of solar-powered lighting solutions. These trends reflect a broader movement towards energy efficiency and sustainability.

India Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | LED, Fluorescent, Halogen, Incandescent |

| Application | Residential, Commercial, Industrial, Outdoor |

| Technology | Smart Lighting, Solar Lighting, Traditional Lighting, Energy-Efficient Lighting |

| End User | Retail, Hospitality, Healthcare, Education |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Lighting Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at