444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India lighting industry market represents one of the most dynamic and rapidly evolving sectors within the country’s manufacturing landscape. Market dynamics indicate substantial growth potential driven by urbanization, infrastructure development, and the nationwide transition to energy-efficient lighting solutions. The industry encompasses traditional lighting technologies alongside cutting-edge LED innovations, smart lighting systems, and decorative lighting solutions.

Government initiatives such as the LED distribution programs and energy efficiency mandates have fundamentally transformed market dynamics. The sector demonstrates remarkable resilience with consistent growth rates exceeding industry expectations. Manufacturing capabilities have expanded significantly, positioning India as both a major consumer and emerging exporter of lighting products.

Technological advancement remains a key differentiator, with companies investing heavily in research and development. The market experiences robust demand across residential, commercial, and industrial segments, supported by favorable government policies and increasing consumer awareness about energy conservation. Regional distribution shows concentrated activity in major manufacturing hubs while rural penetration continues expanding through targeted government programs.

The India lighting industry market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, and retail of lighting products and solutions across the Indian subcontinent. This market includes traditional incandescent and fluorescent lighting technologies, modern LED systems, smart lighting solutions, decorative fixtures, and specialized industrial lighting applications.

Market scope extends beyond basic illumination products to include advanced lighting control systems, solar-powered lighting solutions, and Internet of Things (IoT) enabled smart lighting networks. The industry serves diverse applications ranging from residential homes and commercial establishments to large-scale infrastructure projects and street lighting initiatives.

Value chain integration encompasses raw material sourcing, component manufacturing, assembly operations, brand development, distribution networks, and after-sales services. The market represents a critical component of India’s broader electrical and electronics manufacturing sector, contributing significantly to employment generation and export earnings.

Strategic positioning of the India lighting industry reflects the country’s transition toward sustainable and energy-efficient lighting solutions. The market demonstrates exceptional growth momentum supported by favorable regulatory frameworks, technological innovations, and increasing consumer adoption of LED technologies. Government support through various schemes and policies has accelerated market transformation.

Competitive landscape features a mix of established multinational corporations, domestic manufacturers, and emerging technology-focused companies. The industry benefits from strong domestic demand while simultaneously developing export capabilities to serve international markets. Manufacturing excellence has improved significantly with companies adopting advanced production technologies and quality management systems.

Market segmentation reveals diverse opportunities across residential, commercial, industrial, and infrastructure applications. The sector experiences particularly strong growth in smart lighting solutions, decorative lighting products, and energy-efficient LED systems. Innovation focus centers on developing products that combine superior performance with cost-effectiveness and environmental sustainability.

Market intelligence reveals several critical insights shaping the India lighting industry landscape. MarkWide Research analysis indicates strong correlation between urbanization rates and lighting market expansion, with metropolitan areas driving premium product adoption.

Primary growth drivers propelling the India lighting industry include comprehensive government initiatives promoting energy efficiency and the nationwide transition to LED technology. Urbanization trends create substantial demand for modern lighting solutions across residential and commercial developments. The Smart Cities Mission generates significant opportunities for advanced lighting infrastructure and intelligent street lighting systems.

Infrastructure development across transportation, healthcare, education, and industrial sectors drives consistent demand for specialized lighting solutions. Rising disposable incomes enable consumers to invest in premium lighting products and decorative fixtures. The Make in India initiative encourages domestic manufacturing, reducing costs and improving product availability.

Energy cost concerns motivate businesses and households to adopt efficient lighting technologies that reduce electricity consumption. Environmental awareness influences purchasing decisions toward sustainable lighting solutions. Technological advancement in LED efficiency and smart lighting capabilities creates new market opportunities and applications.

Commercial sector expansion in retail, hospitality, and office spaces generates demand for sophisticated lighting designs and control systems. Industrial growth requires specialized lighting solutions for manufacturing facilities, warehouses, and logistics centers.

Market challenges include the persistence of price-sensitive consumer segments that prioritize initial cost over long-term efficiency benefits. Quality concerns regarding low-cost LED products impact consumer confidence and market reputation. Counterfeit products create unfair competition and undermine brand value for legitimate manufacturers.

Technical complexity in smart lighting systems creates implementation challenges for traditional electrical contractors and installers. Infrastructure limitations in rural areas restrict market penetration despite government initiatives. Import dependency for critical components exposes manufacturers to supply chain disruptions and currency fluctuations.

Regulatory compliance requirements increase operational costs and complexity for manufacturers. Rapid technological change creates inventory risks and requires continuous investment in product development. Market fragmentation with numerous small players intensifies price competition and margin pressure.

Consumer education remains necessary to communicate the benefits of premium lighting solutions over basic alternatives. Installation complexity for advanced lighting systems may deter some potential customers from adopting new technologies.

Emerging opportunities in the India lighting industry center on the integration of artificial intelligence and machine learning technologies into lighting control systems. Solar-powered lighting presents significant potential for off-grid applications and sustainable infrastructure development. Horticultural lighting for indoor farming and greenhouse applications represents a rapidly expanding niche market.

Export market development offers substantial growth potential as Indian manufacturers build quality reputations and cost competitiveness. Retrofit opportunities in existing buildings and infrastructure create ongoing demand for lighting upgrades and modernization projects. Customization services for architectural and decorative lighting applications command premium pricing.

Healthcare lighting solutions for hospitals and medical facilities require specialized products with growth potential. Automotive lighting components present opportunities as India’s vehicle manufacturing sector expands. Emergency and safety lighting systems gain importance with stricter building codes and safety regulations.

Integration with renewable energy systems creates opportunities for comprehensive energy solutions. Subscription-based lighting services and lighting-as-a-service models offer new revenue streams and customer relationships.

Dynamic market forces shape the competitive landscape through continuous technological innovation and evolving customer expectations. Supply chain optimization becomes increasingly critical as manufacturers balance cost efficiency with quality requirements. The industry experiences consolidation trends as smaller players seek partnerships or acquisition opportunities with larger companies.

Digital transformation influences both product development and customer engagement strategies. E-commerce growth changes distribution patterns and enables direct-to-consumer sales models. Sustainability requirements drive product lifecycle considerations and circular economy initiatives.

Regional market variations require customized approaches for different geographic areas and customer segments. Seasonal demand patterns influence production planning and inventory management strategies. Technology convergence between lighting and other building systems creates integrated solution opportunities.

Investment flows into the sector support capacity expansion and technology development. Skill development initiatives address workforce requirements for advanced manufacturing and installation services.

Comprehensive research approach combines primary and secondary data collection methods to provide accurate market intelligence. Primary research includes structured interviews with industry executives, manufacturers, distributors, and end-users across different market segments and geographic regions.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and trade association data. Market surveys capture consumer preferences, purchasing behavior, and satisfaction levels with existing lighting products and services.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification. Quantitative analysis employs statistical methods to identify trends, correlations, and market patterns. Qualitative insights provide context and depth to numerical data through expert opinions and industry observations.

Market modeling techniques project future trends based on historical data, current market conditions, and identified growth drivers. Competitive intelligence gathering includes analysis of company strategies, product portfolios, and market positioning.

Regional market distribution reveals significant variations in demand patterns, growth rates, and competitive dynamics across different Indian states and territories. Northern regions demonstrate strong demand for residential and commercial lighting solutions, driven by urban development and infrastructure projects. The region accounts for approximately 28% of national market share with particular strength in Delhi NCR and Punjab.

Western India leads in manufacturing capabilities and export activities, with Maharashtra and Gujarat serving as major production hubs. This region contributes roughly 35% of total market volume and houses numerous multinational and domestic lighting companies. Industrial demand remains particularly strong in this region.

Southern states show rapid adoption of smart lighting technologies and premium products, representing about 25% of market share. Karnataka, Tamil Nadu, and Andhra Pradesh drive significant demand through IT sector growth and urban development projects. Technology innovation centers in Bangalore and Chennai contribute to product development.

Eastern regions present emerging opportunities with improving infrastructure and government initiatives. West Bengal and Odisha show accelerating growth rates in lighting adoption. Rural market penetration initiatives gain momentum across all regions, supported by government programs and improving electricity access.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment features intense rivalry across price points, technology capabilities, and distribution reach.

Competitive strategies include product differentiation, pricing optimization, distribution expansion, and technology innovation. Market consolidation trends create opportunities for strategic partnerships and acquisitions.

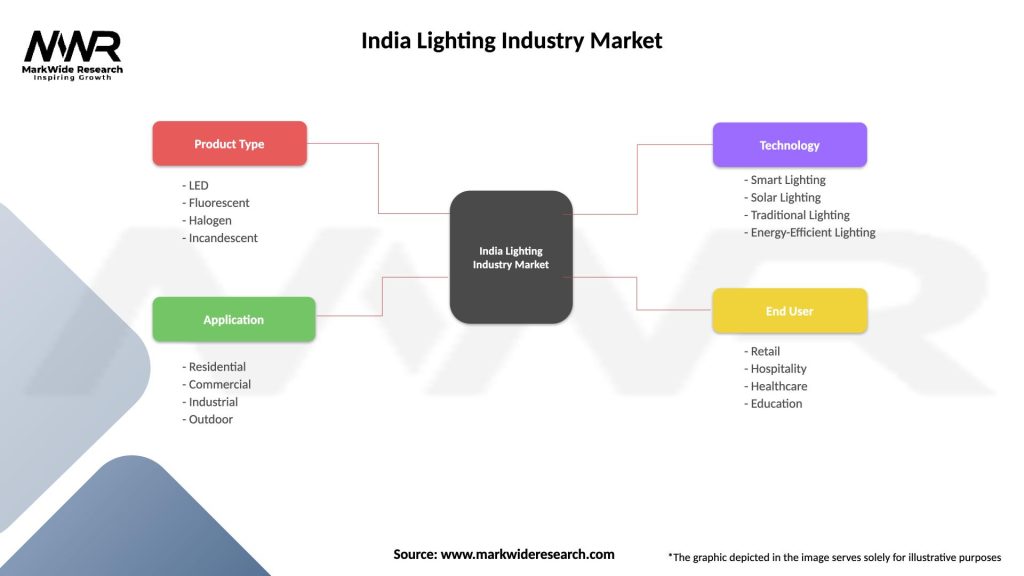

Market segmentation analysis reveals distinct characteristics and growth patterns across different product categories, applications, and customer segments. Technology-based segmentation shows the dominance of LED solutions while traditional technologies maintain presence in specific niches.

By Technology:

By Application:

By Distribution Channel:

Residential lighting demonstrates the highest volume consumption with diverse product requirements ranging from basic illumination to decorative fixtures. Consumer preferences increasingly favor LED technology for energy efficiency and longer lifespan. Smart home integration drives demand for connected lighting solutions with mobile app control and automation capabilities.

Commercial lighting emphasizes performance, reliability, and advanced control systems. Office environments require lighting solutions that support productivity and employee well-being. Retail lighting focuses on creating attractive displays and customer experiences through specialized fixtures and color rendering capabilities.

Industrial lighting prioritizes durability, safety compliance, and energy efficiency in challenging environments. Manufacturing facilities require high-bay lighting solutions with excellent light distribution and minimal maintenance requirements. Warehouse lighting emphasizes uniform illumination and integration with automated systems.

Outdoor lighting serves infrastructure requirements including street lighting, architectural illumination, and security applications. Smart city initiatives drive adoption of intelligent street lighting systems with remote monitoring and control capabilities. Solar-powered solutions gain traction for remote locations and sustainable development projects.

Manufacturers benefit from expanding market opportunities driven by government initiatives and increasing consumer awareness of energy efficiency. Production scaling enables cost optimization and improved competitiveness in domestic and export markets. Technology development creates differentiation opportunities and premium pricing potential.

Distributors and retailers experience growing demand across all product categories with particular strength in LED and smart lighting solutions. Margin improvement opportunities exist through value-added services and premium product positioning. Market expansion into rural areas creates new customer bases and revenue streams.

End customers realize significant benefits through reduced energy consumption, lower maintenance costs, and improved lighting quality. Residential users enjoy enhanced home environments with customizable lighting solutions. Commercial customers achieve operational efficiency improvements and employee satisfaction benefits.

Government stakeholders accomplish energy conservation objectives and infrastructure development goals through lighting modernization programs. Environmental benefits include reduced carbon emissions and improved sustainability metrics. Economic development occurs through manufacturing job creation and export revenue generation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends reshape the lighting industry through smart connectivity, mobile app integration, and cloud-based management systems. Internet of Things adoption enables lighting systems to provide data analytics, energy monitoring, and predictive maintenance capabilities. Artificial intelligence integration creates adaptive lighting solutions that respond to occupancy patterns and environmental conditions.

Sustainability focus drives development of circular economy principles in lighting manufacturing and disposal. Solar integration becomes increasingly common for outdoor and off-grid applications. Human-centric lighting concepts gain attention for their potential to improve health, productivity, and well-being through circadian rhythm optimization.

Customization demand increases as customers seek lighting solutions tailored to specific applications and aesthetic preferences. Modular design approaches enable flexible configurations and easy maintenance. Voice control integration with smart home assistants becomes standard in premium lighting products.

Service-oriented models emerge as companies offer lighting-as-a-service and comprehensive maintenance contracts. Data monetization opportunities arise from smart lighting systems that collect valuable information about space utilization and user behavior.

Recent developments in the India lighting industry reflect accelerating innovation and market maturation. MWR analysis indicates significant investment in research and development facilities by major manufacturers. Government initiatives continue expanding with new programs targeting specific sectors and applications.

Technology partnerships between Indian companies and international technology providers accelerate product development and market access. Manufacturing expansion projects increase domestic production capacity and reduce import dependency. Quality certification programs improve product standards and consumer confidence.

Startup ecosystem development brings innovative solutions and business models to the lighting industry. Investment activity increases as venture capital and private equity firms recognize market potential. Export promotion initiatives help Indian manufacturers access international markets and build global brands.

Regulatory updates strengthen energy efficiency requirements and safety standards. Industry associations play increasingly important roles in advocacy, standards development, and market promotion activities.

Strategic recommendations for industry participants emphasize the importance of technology investment and market differentiation. Manufacturers should prioritize LED technology advancement and smart lighting capabilities to maintain competitive advantages. Quality focus remains critical for building brand reputation and customer loyalty in increasingly sophisticated markets.

Distribution strategy optimization should include both traditional retail channels and emerging online platforms. Rural market penetration requires customized approaches with appropriate product offerings and distribution networks. Export development presents significant opportunities for companies with established quality and cost competitiveness.

Innovation investment in areas such as human-centric lighting, IoT integration, and sustainability will create future competitive advantages. Partnership strategies with technology providers, distributors, and system integrators can accelerate market access and capability development.

Customer education initiatives help communicate the value proposition of premium lighting solutions beyond initial purchase price considerations. Service capabilities development enables companies to capture additional revenue streams and strengthen customer relationships.

Future market prospects for the India lighting industry remain exceptionally positive, supported by continued urbanization, infrastructure development, and technology advancement. Growth trajectory is expected to maintain momentum with double-digit expansion rates in key segments including smart lighting and LED solutions.

Technology evolution will continue driving market transformation with increasing integration of artificial intelligence, machine learning, and advanced sensor technologies. 5G connectivity will enable new applications and capabilities in smart lighting systems. Sustainability requirements will become more stringent, favoring companies with strong environmental credentials.

Market consolidation trends are likely to continue as smaller players seek scale advantages through partnerships or acquisitions. International expansion by Indian manufacturers will accelerate, supported by improving quality reputation and cost competitiveness. Government support for manufacturing and export promotion will remain strong.

Consumer sophistication will increase demand for premium products and integrated solutions. Commercial sector growth will drive adoption of advanced lighting control systems and energy management solutions. The industry is projected to achieve sustained growth rates exceeding broader economic expansion.

The India lighting industry market stands at a transformative juncture characterized by robust growth prospects, technological innovation, and expanding market opportunities. Government initiatives promoting energy efficiency and the nationwide LED transition have created a favorable environment for industry expansion and modernization.

Market dynamics reflect the successful transition from traditional lighting technologies to advanced LED and smart lighting solutions. Competitive landscape evolution demonstrates the industry’s maturation with both established players and innovative newcomers contributing to market development. Regional growth patterns indicate balanced expansion across urban and rural markets.

Future success in this dynamic market will depend on companies’ ability to innovate, maintain quality standards, and adapt to evolving customer requirements. The India lighting industry market is well-positioned to continue its growth trajectory while contributing significantly to the country’s manufacturing sector development and energy efficiency objectives.

What is Lighting?

Lighting refers to the deliberate use of light to achieve practical or aesthetic effects in various environments, including residential, commercial, and industrial spaces. It encompasses a range of technologies and products designed to illuminate areas effectively and efficiently.

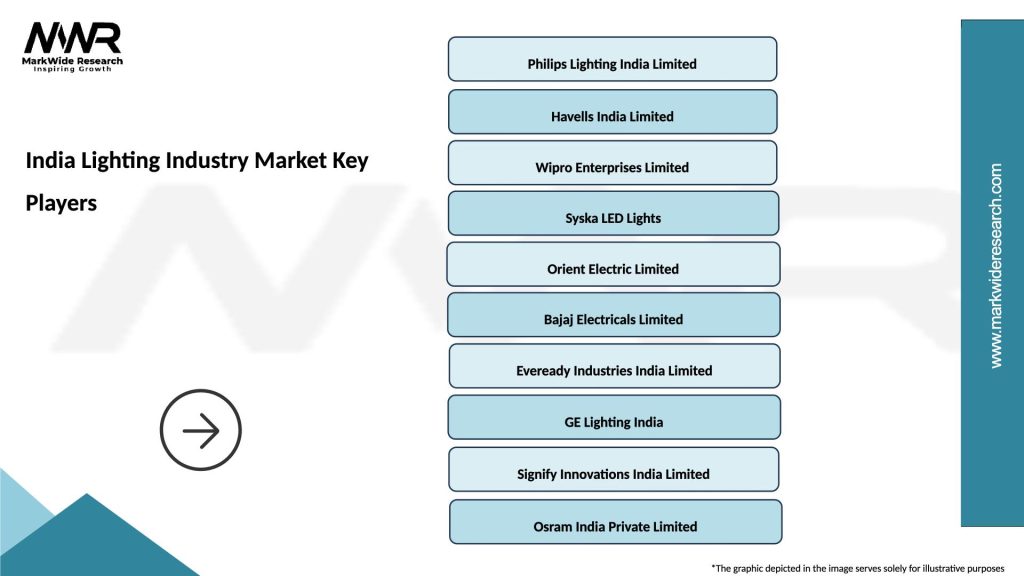

What are the key players in the India Lighting Industry Market?

Key players in the India Lighting Industry Market include Philips Lighting, Havells India, Syska LED, and Bajaj Electricals. These companies are known for their innovative lighting solutions and extensive product ranges, catering to both residential and commercial sectors.

What are the growth factors driving the India Lighting Industry Market?

The growth of the India Lighting Industry Market is driven by increasing urbanization, rising disposable incomes, and a growing focus on energy-efficient lighting solutions. Additionally, government initiatives promoting smart city projects and sustainable lighting technologies are contributing to market expansion.

What challenges does the India Lighting Industry Market face?

The India Lighting Industry Market faces challenges such as intense competition among manufacturers, fluctuating raw material prices, and the need for continuous innovation. Additionally, regulatory compliance and the transition to LED technology can pose hurdles for some companies.

What opportunities exist in the India Lighting Industry Market?

Opportunities in the India Lighting Industry Market include the growing demand for smart lighting solutions and the integration of IoT technologies. Furthermore, the increasing emphasis on sustainable and energy-efficient products presents avenues for growth and innovation.

What trends are shaping the India Lighting Industry Market?

Trends shaping the India Lighting Industry Market include the shift towards LED lighting, the rise of smart lighting systems, and the increasing adoption of solar-powered lighting solutions. These trends reflect a broader movement towards sustainability and energy efficiency in lighting applications.

India Lighting Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | LED, Fluorescent, Halogen, Incandescent |

| Application | Residential, Commercial, Industrial, Outdoor |

| Technology | Smart Lighting, Solar Lighting, Traditional Lighting, Energy-Efficient Lighting |

| End User | Retail, Hospitality, Healthcare, Education |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Lighting Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at