444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India lead-acid battery separator for SLI applications market represents a critical component of the country’s automotive and energy storage ecosystem. SLI applications, encompassing Starting, Lighting, and Ignition systems, form the backbone of automotive electrical systems across passenger vehicles, commercial vehicles, and two-wheelers. The market demonstrates robust growth potential driven by India’s expanding automotive sector, increasing vehicle electrification trends, and rising demand for reliable energy storage solutions.

Battery separators serve as essential components that prevent direct contact between positive and negative electrodes while allowing ionic conductivity in lead-acid batteries. The Indian market benefits from strong domestic manufacturing capabilities, favorable government policies supporting the automotive sector, and growing awareness about advanced battery technologies. Market dynamics indicate sustained growth with the automotive industry’s recovery and increasing adoption of advanced SLI battery systems.

Regional distribution shows concentrated demand in major automotive manufacturing hubs including Tamil Nadu, Maharashtra, Gujarat, and Haryana. The market experiences significant momentum from both original equipment manufacturers (OEMs) and aftermarket segments, with replacement demand contributing substantially to overall market expansion. Growth projections suggest a compound annual growth rate of 8.2% CAGR over the forecast period, reflecting strong underlying demand fundamentals.

The India lead-acid battery separator for SLI applications market refers to the specialized segment focused on manufacturing, distributing, and utilizing microporous separators designed specifically for Starting, Lighting, and Ignition battery systems within the Indian automotive ecosystem. These separators are engineered polymer membranes that maintain electrical isolation between battery electrodes while facilitating electrolyte flow and ionic conductivity essential for optimal battery performance.

SLI applications encompass the primary electrical functions required for vehicle operation, including engine starting systems, lighting circuits, and ignition mechanisms. The separators used in these applications must demonstrate exceptional durability, chemical resistance, and mechanical strength to withstand the demanding automotive environment. Market scope includes various separator technologies such as polyethylene, polypropylene, and advanced composite materials tailored for different vehicle categories and performance requirements.

Market fundamentals reveal a dynamic and expanding landscape for lead-acid battery separators in India’s SLI applications sector. The market benefits from strong automotive industry growth, increasing vehicle production, and rising consumer demand for reliable battery systems. Key growth drivers include expanding commercial vehicle fleets, growing two-wheeler penetration in rural markets, and increasing replacement battery demand from the existing vehicle population.

Technology advancement plays a crucial role in market evolution, with manufacturers focusing on developing high-performance separators that offer improved durability, enhanced safety features, and better thermal stability. The market demonstrates 65% concentration in the automotive OEM segment, while aftermarket applications contribute 35% market share. Competitive dynamics show a mix of domestic manufacturers and international players establishing production facilities to serve the growing Indian market.

Strategic opportunities emerge from government initiatives promoting electric vehicle adoption, infrastructure development projects requiring backup power systems, and increasing focus on energy storage solutions. The market faces challenges related to raw material price volatility and environmental regulations, but overall prospects remain positive with sustained automotive sector growth and technological innovation driving demand expansion.

Market segmentation reveals distinct patterns across vehicle categories and application types. The following insights highlight critical market characteristics:

Automotive sector expansion serves as the primary catalyst for lead-acid battery separator demand in SLI applications. India’s position as a global automotive manufacturing hub drives consistent demand for high-quality battery components. Vehicle production growth across passenger cars, commercial vehicles, and two-wheelers creates sustained market opportunities for separator manufacturers.

Infrastructure development initiatives including smart cities, industrial corridors, and transportation networks generate substantial demand for commercial vehicles equipped with advanced SLI battery systems. The growing logistics and e-commerce sectors require reliable vehicle fleets with dependable starting and electrical systems, directly benefiting separator manufacturers.

Rural market penetration of two-wheelers and small commercial vehicles expands the addressable market significantly. Increasing rural income levels, improved road connectivity, and government schemes promoting vehicle ownership in rural areas create new demand centers for SLI battery applications.

Technology advancement in battery separator materials enhances performance characteristics and extends battery life, driving premium product adoption. Manufacturers investing in research and development create differentiated products that command higher margins while meeting evolving customer requirements for improved reliability and durability.

Raw material price volatility presents significant challenges for separator manufacturers, particularly regarding petroleum-based polymers used in separator production. Fluctuating crude oil prices directly impact production costs and profit margins, requiring manufacturers to implement effective cost management strategies and supply chain optimization.

Environmental regulations increasingly focus on battery recycling and disposal, creating compliance costs and operational complexities for manufacturers. Stricter environmental norms require investments in sustainable manufacturing processes and waste management systems, potentially impacting short-term profitability.

Competition from alternative technologies including lithium-ion batteries in certain applications poses long-term challenges to lead-acid battery demand. While SLI applications remain predominantly lead-acid based, gradual technology shifts in premium vehicle segments may impact future growth prospects.

Quality control requirements from automotive OEMs demand significant investments in manufacturing infrastructure and testing capabilities. Meeting stringent quality standards requires continuous process improvements and technology upgrades, increasing operational costs for separator manufacturers.

Export market potential presents substantial growth opportunities for Indian separator manufacturers. The country’s competitive manufacturing costs and improving quality standards position domestic producers to serve regional markets in Southeast Asia, Africa, and the Middle East effectively.

Technology partnerships with international separator manufacturers offer opportunities for knowledge transfer, advanced material development, and access to premium market segments. Collaborative arrangements can accelerate innovation and enhance product portfolios for domestic manufacturers.

Aftermarket expansion through improved distribution networks and brand building initiatives can capture greater market share in the replacement segment. The growing vehicle parc creates sustained demand for replacement batteries and associated components, offering stable revenue streams.

Specialty applications including backup power systems, renewable energy storage, and industrial applications provide diversification opportunities beyond traditional automotive SLI markets. These segments often offer higher margins and less cyclical demand patterns compared to automotive applications.

Supply chain integration plays a crucial role in market dynamics, with leading separator manufacturers establishing strategic relationships with battery producers and automotive OEMs. Vertical integration trends enable better cost control, quality assurance, and supply chain resilience, particularly important in the post-pandemic business environment.

Competitive intensity varies across market segments, with premium applications experiencing less price pressure compared to volume segments. Manufacturers differentiate through product innovation, technical support, and customer service capabilities rather than competing solely on price.

Demand seasonality influences market dynamics, with peak demand periods coinciding with festival seasons and agricultural cycles when vehicle purchases traditionally increase. Manufacturers must manage production capacity and inventory levels to optimize service levels while controlling working capital requirements.

Technology evolution drives continuous product development, with manufacturers investing in advanced materials, improved manufacturing processes, and enhanced performance characteristics. Innovation cycles typically span 3-5 years, requiring sustained research and development investments to maintain competitive positioning.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including separator manufacturers, battery producers, automotive OEMs, and aftermarket distributors. Direct engagement with market participants provides insights into current trends, future requirements, and competitive dynamics shaping the Indian SLI battery separator market.

Secondary research involves analysis of industry reports, government statistics, trade association data, and company financial statements to establish market baselines and validate primary research findings. MarkWide Research utilizes multiple data sources to ensure comprehensive market coverage and analytical accuracy.

Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to develop robust market forecasts. The methodology considers macroeconomic factors, industry-specific drivers, and technological developments that influence market evolution over the forecast period.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure research reliability and accuracy. Quality control measures maintain high standards for data integrity and analytical conclusions throughout the research process.

Southern India dominates the lead-acid battery separator market with 35% regional market share, driven by major automotive manufacturing hubs in Tamil Nadu and Karnataka. The region benefits from established automotive ecosystems, skilled workforce availability, and proximity to key OEM facilities, creating concentrated demand for high-quality separators.

Western India contributes 28% of total market demand, with Maharashtra and Gujarat serving as major automotive and industrial centers. The region’s strong commercial vehicle manufacturing base and growing passenger car production create diverse application opportunities for separator manufacturers.

Northern India represents 22% market share with Delhi NCR and Punjab emerging as significant demand centers. The region’s large aftermarket segment and growing two-wheeler penetration drive separator demand, particularly in replacement applications.

Eastern India accounts for 15% of market demand, with West Bengal and Odisha showing growth potential in commercial vehicle applications. Industrial development initiatives and infrastructure projects create opportunities for separator manufacturers serving this region.

Market structure demonstrates a mix of domestic and international players competing across different market segments and price points. Leading companies focus on product innovation, manufacturing efficiency, and customer relationship management to maintain competitive advantages.

By Material Type:

By Application:

By End-User:

Premium Separator Category demonstrates strong growth potential with 22% annual expansion driven by luxury vehicle adoption and performance-focused applications. This segment commands higher margins and requires advanced manufacturing capabilities, creating opportunities for technology-focused manufacturers.

Standard Separator Category maintains market stability with consistent demand from volume automotive applications. Price competition remains intense in this segment, requiring manufacturers to focus on operational efficiency and cost optimization while maintaining quality standards.

Specialty Separator Category serves niche applications including high-temperature environments, extended-life requirements, and specific performance characteristics. This segment offers differentiation opportunities and premium pricing for manufacturers with specialized capabilities.

Economy Separator Category addresses price-sensitive market segments including entry-level vehicles and cost-conscious aftermarket applications. Success in this category requires efficient manufacturing processes and optimized supply chain management to maintain profitability.

Manufacturers benefit from growing market demand, opportunities for capacity expansion, and potential for technology advancement. The expanding automotive sector provides sustained growth prospects while aftermarket demand offers stable revenue streams with predictable replacement cycles.

Automotive OEMs gain access to reliable separator suppliers, cost-effective solutions, and technical support for battery system optimization. Local manufacturing capabilities reduce supply chain risks and enable faster response to changing requirements.

Battery Producers benefit from competitive separator pricing, quality assurance, and technical collaboration opportunities. Strong supplier relationships enable product innovation and performance improvements while maintaining cost competitiveness.

End Consumers receive improved battery performance, enhanced reliability, and better value propositions through advanced separator technologies. Competition among suppliers drives innovation and cost optimization, ultimately benefiting vehicle owners through improved SLI system performance.

Investors find attractive opportunities in a growing market with strong fundamentals, technological advancement potential, and export market possibilities. The sector offers diversification benefits and exposure to India’s automotive growth story.

Strengths:

Weaknesses:

Opportunities:

Threats:

Advanced Material Development drives innovation in separator technology with focus on enhanced performance characteristics, improved durability, and better thermal stability. Manufacturers invest in research and development to create differentiated products that meet evolving customer requirements and regulatory standards.

Manufacturing Automation transforms production processes with implementation of advanced manufacturing technologies, quality control systems, and process optimization. Automation improves consistency, reduces costs, and enhances competitiveness in global markets.

Sustainability Focus influences product development and manufacturing processes with emphasis on recyclable materials, reduced environmental impact, and circular economy principles. Companies develop eco-friendly separator solutions to meet growing environmental consciousness among customers and regulators.

Supply Chain Localization accelerates as manufacturers seek to reduce dependence on imports and improve supply chain resilience. Local sourcing initiatives and backward integration strategies enhance cost competitiveness and reduce supply chain risks.

Digital Integration transforms business operations through implementation of digital technologies, data analytics, and smart manufacturing systems. Digital transformation improves operational efficiency, customer service, and decision-making capabilities across the value chain.

Capacity Expansion initiatives by leading manufacturers demonstrate confidence in market growth prospects. Several companies announce significant investments in new production facilities and technology upgrades to meet growing demand and enhance competitive positioning.

Technology Partnerships between domestic and international companies accelerate knowledge transfer and product development. Strategic alliances enable access to advanced technologies while leveraging local manufacturing capabilities and market knowledge.

Quality Certifications become increasingly important as automotive OEMs implement stricter supplier requirements. Manufacturers invest in quality management systems and international certifications to meet customer expectations and regulatory compliance.

Research Collaborations with academic institutions and research organizations drive innovation in separator materials and manufacturing processes. These partnerships accelerate technology development and create intellectual property advantages for participating companies.

Market Consolidation trends emerge as larger players acquire smaller manufacturers to achieve economies of scale and expand market presence. Consolidation activities reshape competitive dynamics and create opportunities for operational synergies.

Investment in Technology remains critical for long-term success in the separator market. Companies should prioritize research and development activities, advanced material development, and manufacturing process innovation to maintain competitive advantages and meet evolving customer requirements.

Market Diversification strategies can reduce dependence on automotive applications and create new growth opportunities. Manufacturers should explore industrial applications, energy storage systems, and export markets to build resilient business models.

Supply Chain Optimization becomes essential for managing cost pressures and ensuring reliable operations. Companies should focus on backward integration, local sourcing initiatives, and strategic supplier relationships to enhance supply chain resilience.

Quality Excellence programs must receive continued attention as customer requirements become more stringent. Investment in quality management systems, testing capabilities, and process control technologies will differentiate successful companies from competitors.

Strategic Partnerships offer opportunities for accelerated growth and technology access. Companies should evaluate collaboration opportunities with international players, technology providers, and downstream customers to enhance competitive positioning.

Market expansion prospects remain positive with sustained automotive sector growth and increasing vehicle penetration across India. MWR analysis indicates continued demand growth driven by urbanization, rising income levels, and infrastructure development initiatives supporting vehicle adoption.

Technology evolution will drive product development with focus on advanced materials, improved performance characteristics, and enhanced durability. Manufacturers investing in innovation and technology partnerships are positioned to capture premium market segments and achieve sustainable growth.

Regional growth opportunities extend beyond traditional automotive hubs as vehicle adoption spreads to tier-2 and tier-3 cities. The expanding aftermarket segment provides stable demand patterns and opportunities for distribution network development.

Export potential creates additional growth avenues as Indian manufacturers develop quality capabilities and cost competitiveness. Regional markets in Southeast Asia, Africa, and the Middle East offer substantial opportunities for market expansion and revenue diversification.

Sustainability trends will influence future product development and manufacturing processes. Companies adapting to environmental requirements and developing eco-friendly solutions will gain competitive advantages in increasingly conscious markets.

The India lead-acid battery separator for SLI applications market demonstrates strong fundamentals and promising growth prospects driven by the country’s expanding automotive sector and increasing vehicle adoption. Market dynamics favor continued expansion with opportunities spanning OEM applications, aftermarket segments, and export markets.

Key success factors include technology innovation, quality excellence, cost competitiveness, and strategic market positioning. Companies that invest in advanced manufacturing capabilities, develop strong customer relationships, and maintain operational efficiency are positioned to capitalize on market opportunities and achieve sustainable growth.

Future market evolution will be shaped by technological advancement, regulatory developments, and changing customer requirements. The transition toward more sophisticated battery systems and increasing focus on sustainability will create both challenges and opportunities for market participants.

Strategic recommendations emphasize the importance of balanced approaches combining organic growth initiatives with strategic partnerships and technology investments. Success in this dynamic market requires continuous adaptation to changing conditions while maintaining focus on core competencies and customer value creation. The outlook remains positive for companies that execute effective strategies and maintain competitive positioning in this evolving market landscape.

What is Lead-Acid Battery Separator for SLI Applications?

Lead-Acid Battery Separator for SLI Applications refers to the materials used to separate the positive and negative plates in lead-acid batteries, specifically designed for starting, lighting, and ignition (SLI) applications. These separators are crucial for preventing short circuits and enhancing the battery’s performance and longevity.

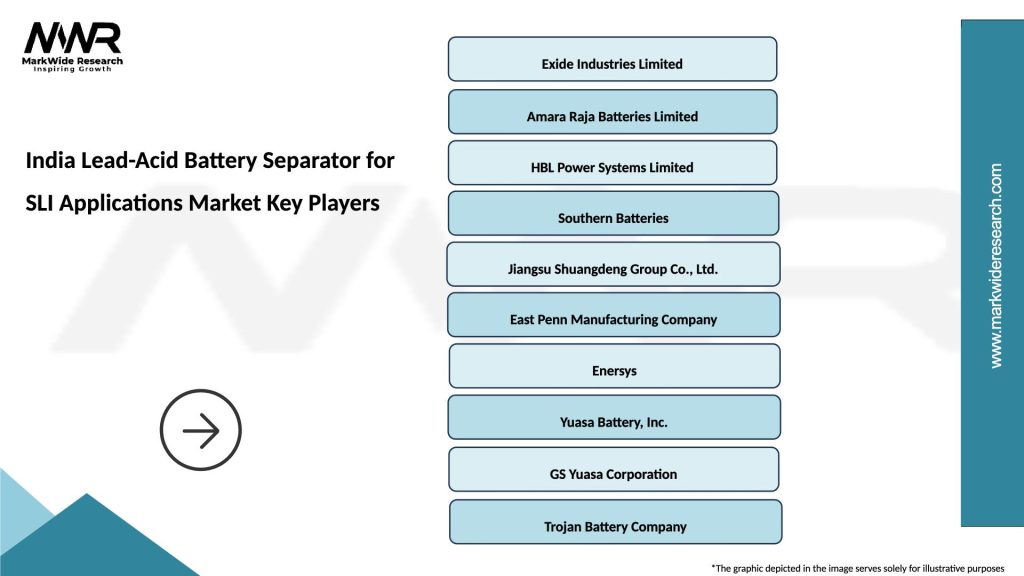

What are the key players in the India Lead-Acid Battery Separator for SLI Applications Market?

Key players in the India Lead-Acid Battery Separator for SLI Applications Market include companies like Entek International LLC, Ahlstrom-Munksjö, and Axiom Materials, among others. These companies are involved in the production and supply of advanced battery separators that meet the growing demand in the automotive sector.

What are the growth factors driving the India Lead-Acid Battery Separator for SLI Applications Market?

The growth of the India Lead-Acid Battery Separator for SLI Applications Market is driven by the increasing demand for vehicles, advancements in battery technology, and the rising need for reliable power sources in automotive applications. Additionally, the expansion of the electric vehicle market is also contributing to this growth.

What challenges does the India Lead-Acid Battery Separator for SLI Applications Market face?

The India Lead-Acid Battery Separator for SLI Applications Market faces challenges such as the environmental concerns related to lead-acid batteries, competition from alternative battery technologies, and fluctuating raw material prices. These factors can impact production costs and market dynamics.

What opportunities exist in the India Lead-Acid Battery Separator for SLI Applications Market?

Opportunities in the India Lead-Acid Battery Separator for SLI Applications Market include the potential for innovation in separator materials, the growing trend of hybrid and electric vehicles, and the increasing focus on renewable energy storage solutions. These trends can lead to new applications and market expansion.

What trends are shaping the India Lead-Acid Battery Separator for SLI Applications Market?

Trends shaping the India Lead-Acid Battery Separator for SLI Applications Market include the development of advanced separator technologies, such as microporous and non-woven separators, and the increasing emphasis on sustainability and recycling in battery production. These innovations are aimed at improving battery efficiency and reducing environmental impact.

India Lead-Acid Battery Separator for SLI Applications Market

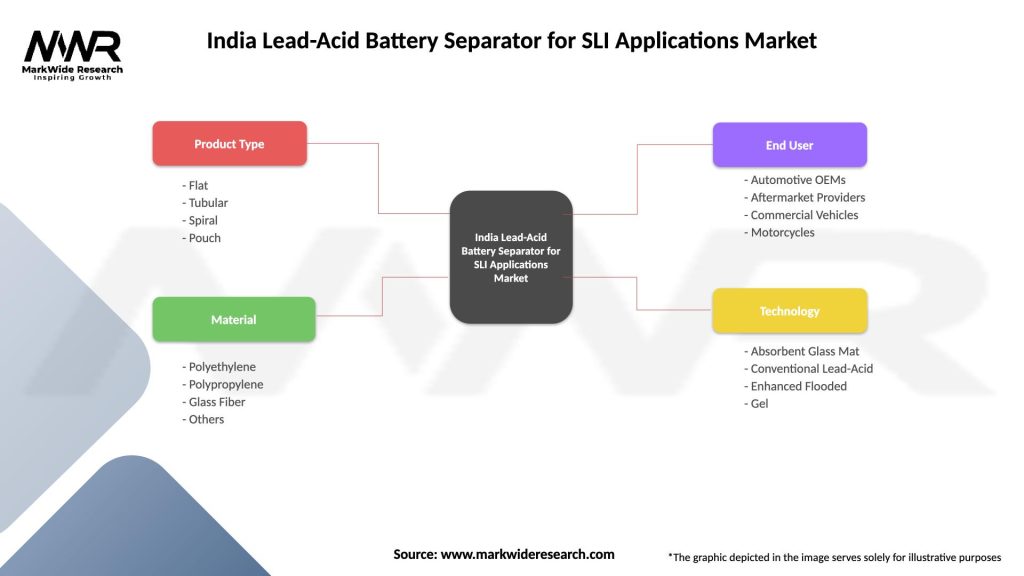

| Segmentation Details | Description |

|---|---|

| Product Type | Flat, Tubular, Spiral, Pouch |

| Material | Polyethylene, Polypropylene, Glass Fiber, Others |

| End User | Automotive OEMs, Aftermarket Providers, Commercial Vehicles, Motorcycles |

| Technology | Absorbent Glass Mat, Conventional Lead-Acid, Enhanced Flooded, Gel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Lead-Acid Battery Separator for SLI Applications Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at