444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India lathe machines market represents a cornerstone of the country’s manufacturing ecosystem, driving precision engineering and industrial production across diverse sectors. Lathe machines serve as fundamental metalworking equipment, enabling the creation of cylindrical parts through rotational cutting processes that are essential for automotive, aerospace, defense, and general manufacturing applications.

Market dynamics in India reflect the nation’s ambitious manufacturing initiatives, including the Make in India campaign and the push toward becoming a global manufacturing hub. The market demonstrates robust growth potential, driven by increasing industrialization, infrastructure development, and the rising demand for precision-engineered components across multiple industries.

Technology advancement continues to reshape the landscape, with CNC (Computer Numerical Control) lathe machines gaining significant traction alongside traditional manual variants. The integration of automation, IoT connectivity, and smart manufacturing principles is transforming operational efficiency, with many facilities reporting productivity improvements of 35-40% through modern lathe machine adoption.

Regional distribution shows concentrated activity in industrial clusters across Maharashtra, Tamil Nadu, Gujarat, and Karnataka, where established manufacturing bases drive consistent demand. The market benefits from India’s skilled workforce, competitive manufacturing costs, and strategic government policies supporting industrial growth and technological modernization.

The India lathe machines market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of lathe machines within the Indian subcontinent. These precision engineering tools utilize rotational motion to shape materials, primarily metals, through cutting, drilling, turning, and finishing operations.

Lathe machines function by rotating the workpiece against cutting tools, enabling the creation of cylindrical, conical, and complex geometrical shapes with high precision and repeatability. The market encompasses various categories including manual lathes, semi-automatic systems, and advanced CNC variants that offer programmable control and enhanced accuracy.

Market scope extends beyond equipment sales to include comprehensive services such as installation, training, maintenance, spare parts supply, and technological upgrades. The ecosystem supports diverse end-user industries ranging from small-scale job shops to large automotive manufacturing facilities, each requiring specific machine configurations and capabilities.

Strategic positioning of the India lathe machines market reflects the country’s evolving manufacturing landscape, characterized by increasing automation adoption and quality enhancement initiatives. The market demonstrates strong fundamentals supported by government policies, industrial expansion, and growing export opportunities in precision engineering sectors.

Technology trends indicate a significant shift toward CNC and automated systems, with adoption rates increasing by approximately 25-30% annually among medium and large-scale manufacturers. This transition reflects the industry’s focus on improving productivity, reducing labor dependency, and achieving international quality standards.

Competitive dynamics feature a mix of domestic manufacturers and international players, creating a diverse ecosystem that serves various market segments. Local manufacturers leverage cost advantages and market knowledge, while global players contribute advanced technology and premium solutions for high-end applications.

Growth drivers include expanding automotive production, aerospace industry development, defense manufacturing initiatives, and the increasing emphasis on precision engineering across multiple sectors. The market benefits from India’s position as a global manufacturing destination and the ongoing industrial modernization efforts.

Market segmentation reveals distinct patterns across technology types, applications, and end-user industries, providing strategic opportunities for targeted growth and specialization:

Industrial expansion serves as the primary catalyst for lathe machine demand, with India’s manufacturing sector experiencing sustained growth across multiple industries. The government’s focus on infrastructure development, defense production, and export promotion creates substantial opportunities for precision engineering equipment suppliers.

Automotive sector growth continues to drive significant demand, as vehicle manufacturers and component suppliers require sophisticated machining capabilities for engine parts, transmission components, and precision assemblies. The shift toward electric vehicles introduces new machining requirements, further expanding market opportunities.

Technology modernization initiatives across manufacturing facilities create replacement demand and upgrade opportunities. Companies invest in advanced CNC systems to improve productivity, reduce operational costs, and meet increasingly stringent quality standards demanded by global customers.

Government policies including Make in India, Production Linked Incentive schemes, and industrial promotion programs provide favorable conditions for manufacturing expansion. These initiatives encourage domestic production, technology adoption, and capacity building across various sectors.

Export competitiveness requirements drive manufacturers to invest in precision equipment capable of meeting international quality standards. The growing global demand for Indian-manufactured components necessitates advanced machining capabilities and consistent quality delivery.

High capital investment requirements present significant barriers, particularly for small and medium enterprises seeking to upgrade their machining capabilities. Advanced CNC systems require substantial upfront costs, often challenging for businesses with limited financial resources or uncertain return projections.

Skilled workforce shortage constrains market growth, as modern lathe machines require specialized technical knowledge for operation, programming, and maintenance. The gap between available skills and industry requirements creates operational challenges and limits technology adoption rates.

Import dependency for critical components and advanced technology creates vulnerability to supply chain disruptions and currency fluctuations. Many sophisticated systems rely on imported components, affecting cost predictability and delivery schedules.

Economic uncertainties and cyclical demand patterns in key end-user industries create investment hesitation among potential buyers. Manufacturing companies often delay capital equipment purchases during economic downturns or uncertain market conditions.

Maintenance complexity of advanced systems requires specialized service capabilities and spare parts availability. Limited local service infrastructure for sophisticated equipment can increase operational costs and downtime risks for end users.

Digital transformation initiatives create substantial opportunities for smart lathe machine solutions incorporating IoT connectivity, predictive maintenance, and data analytics capabilities. Manufacturers increasingly seek equipment that integrates with digital factory ecosystems and provides operational insights.

Aerospace industry expansion presents significant growth potential, as India develops domestic aircraft manufacturing capabilities and component supply chains. The sector’s stringent precision requirements align well with advanced lathe machine capabilities and create premium market segments.

Defense manufacturing initiatives under the Atmanirbhar Bharat program generate demand for sophisticated machining equipment capable of producing critical defense components. This sector offers stable, long-term contracts and opportunities for specialized equipment development.

Export market development provides expansion opportunities as Indian manufacturers build global supply chain relationships. The growing international recognition of Indian manufacturing quality creates demand for precision equipment capable of meeting export standards.

Technology partnerships between domestic and international players can accelerate innovation and market development. Collaborative arrangements enable knowledge transfer, technology localization, and development of India-specific solutions that address local market requirements.

Supply chain evolution reflects the market’s maturation, with established networks connecting manufacturers, distributors, and end users across India’s industrial landscape. The ecosystem demonstrates increasing sophistication in logistics, service delivery, and customer support capabilities.

Competitive intensity drives continuous innovation and value proposition enhancement among market participants. Companies differentiate through technology advancement, service quality, financing options, and specialized solutions for specific industry applications.

Customer expectations evolve toward comprehensive solutions encompassing equipment, training, maintenance, and ongoing support. End users increasingly value long-term partnerships over transactional relationships, emphasizing total cost of ownership and operational efficiency.

Technology integration accelerates as manufacturers seek equipment that seamlessly connects with existing production systems and digital infrastructure. The demand for interoperable solutions drives development of standardized interfaces and communication protocols.

Regulatory compliance requirements influence equipment specifications and operational procedures, particularly in industries with stringent quality and safety standards. Manufacturers must ensure their equipment meets evolving regulatory requirements and industry certifications.

Comprehensive analysis of the India lathe machines market employs multiple research approaches to ensure accuracy and depth of insights. The methodology combines primary research through industry interviews, secondary data analysis, and market observation to develop a complete understanding of market dynamics.

Primary research involves extensive consultations with industry stakeholders including manufacturers, distributors, end users, and technology providers. These interactions provide real-time market insights, trend identification, and validation of secondary research findings.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements. This approach ensures comprehensive coverage of market segments, competitive landscape, and regulatory environment factors.

Market segmentation analysis examines various categorization approaches including technology type, application area, end-user industry, and geographical distribution. This detailed segmentation enables precise market sizing and opportunity identification across different market segments.

Trend analysis incorporates historical data review, current market assessment, and future projection development. The approach considers technological advancement, regulatory changes, economic factors, and industry evolution patterns to provide accurate market forecasts.

Western India dominates market activity, with Maharashtra and Gujarat leading in manufacturing concentration and lathe machine adoption. The region benefits from established industrial infrastructure, skilled workforce availability, and proximity to major ports facilitating international trade.

Southern India demonstrates strong growth momentum, particularly in Tamil Nadu and Karnataka, driven by automotive manufacturing, aerospace development, and precision engineering clusters. The region shows adoption rates of approximately 20-25% for advanced CNC systems among manufacturing facilities.

Northern India presents significant opportunities through industrial development in Haryana, Punjab, and Uttar Pradesh. Government initiatives promoting manufacturing in these states create demand for modern machining equipment and technology upgrades.

Eastern India shows emerging potential as infrastructure development and industrial promotion programs gain momentum. West Bengal and Odisha demonstrate increasing manufacturing activity that translates into growing demand for precision machining equipment.

Regional specialization patterns emerge based on local industry concentrations, with automotive hubs requiring different lathe machine specifications compared to general engineering or textile machinery manufacturing centers. This specialization creates opportunities for targeted product development and market positioning.

Market leadership features a diverse ecosystem of domestic and international players, each contributing unique strengths and market positioning strategies:

Technology-based segmentation reveals distinct market categories with varying growth patterns and customer requirements:

Application-based segmentation demonstrates diverse end-use requirements and market opportunities:

CNC lathe machines demonstrate the strongest growth trajectory, with market penetration increasing by 30-35% annually among medium and large manufacturing facilities. These systems offer superior precision, productivity, and automation capabilities that align with India’s manufacturing modernization objectives.

Manual lathe machines maintain relevance in specific applications requiring operator expertise and flexibility. Small-scale manufacturers and specialized job shops continue to rely on these systems for custom work and applications where automation may not be economically justified.

Multi-spindle systems gain traction in high-volume production environments, particularly automotive component manufacturing. These configurations enable simultaneous operations and reduced cycle times, delivering significant productivity improvements for suitable applications.

Vertical lathe machines serve specialized applications requiring heavy workpiece handling and large component machining. Industries such as power generation, mining equipment, and heavy engineering drive demand for these specialized configurations.

Swiss-type lathes address precision requirements in electronics, medical devices, and miniature component manufacturing. The growing demand for high-precision small parts creates opportunities for specialized equipment providers in this segment.

Manufacturers benefit from expanding market opportunities driven by India’s industrial growth and modernization initiatives. The diverse customer base and growing export potential provide multiple revenue streams and business expansion possibilities.

End users gain access to advanced technology solutions that improve productivity, quality, and operational efficiency. Modern lathe machines enable manufacturers to meet international standards and compete effectively in global markets.

Technology providers find substantial opportunities for innovation and market development through partnerships with local manufacturers and end users. The market’s receptiveness to advanced technology creates demand for cutting-edge solutions and services.

Service providers benefit from growing demand for maintenance, training, and support services as the installed base of sophisticated equipment expands. Comprehensive service offerings create recurring revenue opportunities and customer relationship strengthening.

Government stakeholders achieve manufacturing sector development objectives through increased industrial capacity, technology adoption, and export competitiveness. The sector’s growth contributes to employment generation and economic development goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration represents the most significant trend, with manufacturers increasingly adopting CNC systems and automated solutions to improve productivity and reduce labor dependency. MarkWide Research indicates that automation adoption rates have accelerated by approximately 40% in recent years across medium and large manufacturing facilities.

Smart manufacturing initiatives drive demand for connected equipment capable of data collection, analysis, and predictive maintenance. Manufacturers seek lathe machines that integrate with digital factory ecosystems and provide real-time operational insights.

Customization demand increases as manufacturers require equipment tailored to specific applications and production requirements. Standard configurations give way to specialized solutions designed for particular industries or manufacturing processes.

Service-centric models emerge as customers prioritize total cost of ownership over initial purchase price. Comprehensive service packages including maintenance, training, and support become key differentiators in competitive markets.

Sustainability focus influences equipment selection criteria, with energy efficiency, material optimization, and environmental compliance becoming important considerations for manufacturing facilities pursuing green manufacturing initiatives.

Technology advancement continues through research and development initiatives focused on improving precision, speed, and automation capabilities. Leading manufacturers invest significantly in next-generation CNC systems and intelligent manufacturing solutions.

Manufacturing capacity expansion occurs across multiple regions as companies establish new production facilities and upgrade existing operations. These investments reflect confidence in long-term market growth and demand sustainability.

Strategic partnerships develop between domestic and international players, enabling technology transfer, market access, and collaborative product development. These alliances strengthen the overall market ecosystem and accelerate innovation.

Skill development programs launch through industry-academia collaborations and government initiatives aimed at addressing the technical workforce shortage. These programs focus on modern machining technology operation and maintenance capabilities.

Digital platform development enables improved customer engagement, service delivery, and market reach. Companies invest in digital infrastructure to enhance customer experience and operational efficiency.

Technology investment should prioritize CNC systems and automation solutions that align with India’s manufacturing modernization objectives. Companies should focus on equipment that offers scalability, flexibility, and integration capabilities for future expansion.

Market positioning strategies should emphasize comprehensive solutions encompassing equipment, training, service, and ongoing support. Customers increasingly value long-term partnerships over transactional relationships in equipment procurement decisions.

Regional expansion opportunities exist in emerging industrial clusters and tier-2 cities where manufacturing activity continues to grow. Early market entry in these regions can establish competitive advantages and customer relationships.

Service capability development becomes critical for market success, requiring investment in technical expertise, spare parts inventory, and service network expansion. Strong service capabilities differentiate suppliers and create recurring revenue opportunities.

Partnership strategies should explore collaborations with technology providers, system integrators, and industry specialists to enhance market reach and solution capabilities. Strategic alliances can accelerate market penetration and customer acquisition.

Market trajectory indicates sustained growth driven by India’s manufacturing sector expansion and technology modernization initiatives. The outlook remains positive, supported by government policies, industrial development, and increasing export competitiveness requirements.

Technology evolution will continue toward greater automation, connectivity, and intelligence in lathe machine systems. MWR analysis suggests that smart manufacturing adoption could reach penetration rates of 50-60% among large manufacturing facilities within the next five years.

Market consolidation may occur as smaller players seek partnerships or acquisition opportunities to remain competitive. This consolidation could strengthen market leaders and improve overall industry efficiency and service capabilities.

Export potential will expand as Indian manufacturers build global supply chain relationships and demonstrate quality capabilities. The growing international recognition of Indian manufacturing creates opportunities for equipment suppliers serving export-oriented customers.

Innovation focus will emphasize sustainability, energy efficiency, and digital integration as manufacturers pursue environmentally responsible and technologically advanced solutions. These trends will drive product development and market differentiation strategies.

The India lathe machines market represents a dynamic and growing segment of the country’s manufacturing ecosystem, characterized by technological advancement, increasing automation adoption, and expanding application diversity. The market benefits from strong fundamentals including government support, industrial expansion, and growing export opportunities.

Strategic opportunities exist across multiple dimensions including technology advancement, market expansion, service development, and international partnerships. Companies that successfully navigate the evolving landscape through innovation, customer focus, and comprehensive solution delivery will capture significant market share and growth potential.

Future success will depend on the ability to adapt to changing customer requirements, embrace technological advancement, and build sustainable competitive advantages through superior products and services. The market’s continued evolution toward automation and smart manufacturing creates substantial opportunities for forward-thinking industry participants.

What is a Lathe Machine?

A lathe machine is a tool used for shaping materials such as wood, metal, or plastic by rotating the workpiece against a cutting tool. It is commonly used in manufacturing and engineering for tasks like turning, drilling, and threading.

What are the key players in the India Lathe Machines Market?

Key players in the India Lathe Machines Market include Bharat Fritz Werner Limited, HMT Machine Tools Limited, and Jyoti CNC Automation Limited, among others. These companies are known for their innovative designs and high-quality manufacturing processes.

What are the growth factors driving the India Lathe Machines Market?

The growth of the India Lathe Machines Market is driven by the increasing demand for precision engineering in various sectors such as automotive, aerospace, and manufacturing. Additionally, advancements in technology and automation are enhancing production efficiency.

What challenges does the India Lathe Machines Market face?

The India Lathe Machines Market faces challenges such as the high cost of advanced machinery and the need for skilled labor to operate complex machines. Additionally, competition from imported machines can impact local manufacturers.

What opportunities exist in the India Lathe Machines Market?

Opportunities in the India Lathe Machines Market include the growing trend of smart manufacturing and Industry Four Point Zero, which encourages the adoption of automated and connected machines. This shift can lead to increased efficiency and reduced operational costs.

What trends are shaping the India Lathe Machines Market?

Trends in the India Lathe Machines Market include the integration of CNC technology for enhanced precision and productivity, as well as the rise of eco-friendly manufacturing practices. Additionally, there is a growing focus on customization to meet specific industry needs.

India Lathe Machines Market

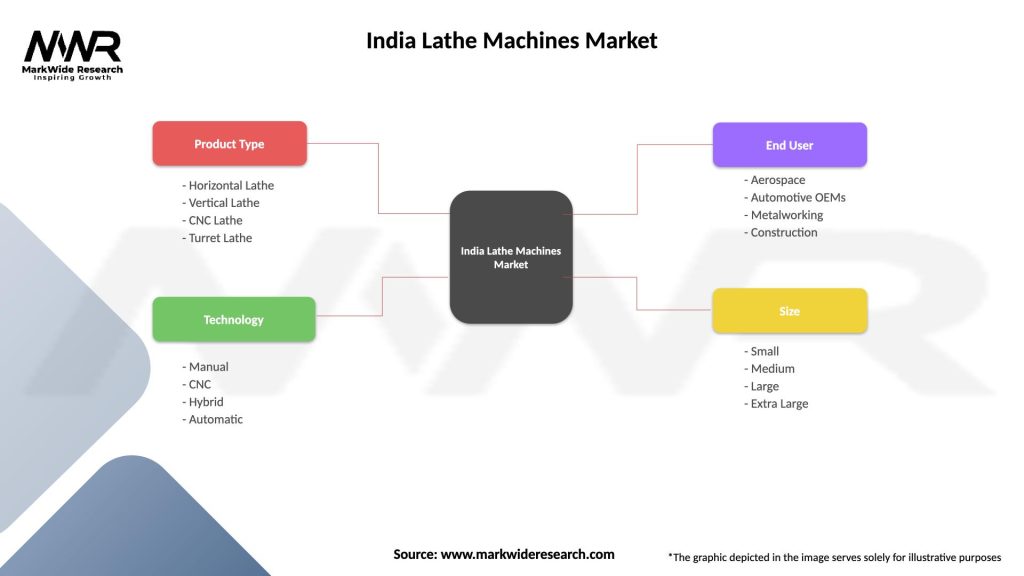

| Segmentation Details | Description |

|---|---|

| Product Type | Horizontal Lathe, Vertical Lathe, CNC Lathe, Turret Lathe |

| Technology | Manual, CNC, Hybrid, Automatic |

| End User | Aerospace, Automotive OEMs, Metalworking, Construction |

| Size | Small, Medium, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Lathe Machines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at