444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India laser cutting machine market represents a rapidly expanding segment within the country’s manufacturing and industrial automation landscape. Laser cutting technology has emerged as a critical component driving India’s manufacturing revolution, offering unprecedented precision, efficiency, and versatility across diverse industrial applications. The market encompasses various laser cutting systems, including fiber laser cutting machines, CO2 laser cutters, and crystal laser systems, each serving specific industrial requirements.

Manufacturing sectors across India are increasingly adopting laser cutting solutions to enhance production capabilities and meet growing demand for precision-engineered components. The market demonstrates robust growth momentum, driven by expanding automotive manufacturing, aerospace development, electronics production, and metal fabrication industries. Government initiatives such as Make in India and Digital India have significantly accelerated the adoption of advanced manufacturing technologies, positioning laser cutting machines as essential tools for industrial modernization.

Regional distribution shows concentrated growth in major industrial hubs including Gujarat, Maharashtra, Tamil Nadu, and Karnataka, where manufacturing clusters demand high-precision cutting solutions. The market exhibits strong growth potential with increasing penetration of automation technologies and rising demand for customized manufacturing solutions across various industrial verticals.

The India laser cutting machine market refers to the comprehensive ecosystem of laser-based cutting equipment, technologies, and services operating within India’s manufacturing sector. This market encompasses the design, manufacturing, distribution, and maintenance of various laser cutting systems used for precise material processing across multiple industries.

Laser cutting machines utilize focused laser beams to cut, engrave, or etch materials with exceptional accuracy and minimal material waste. These systems employ different laser technologies including fiber lasers, carbon dioxide lasers, and neodymium lasers, each optimized for specific material types and cutting applications. The market includes both domestic manufacturing of laser cutting equipment and imports of advanced international systems.

Market participants include equipment manufacturers, technology providers, system integrators, service providers, and end-user industries requiring precision cutting solutions. The ecosystem supports various applications from thin sheet metal cutting to thick plate processing, serving industries ranging from automotive and aerospace to electronics and architectural metalwork.

India’s laser cutting machine market demonstrates exceptional growth trajectory, driven by rapid industrialization and increasing adoption of advanced manufacturing technologies. The market benefits from strong government support for manufacturing sector development and growing demand for precision-engineered products across multiple industries.

Key market drivers include expanding automotive production, growing aerospace manufacturing capabilities, increasing electronics manufacturing, and rising demand for customized metal fabrication solutions. The market shows particular strength in fiber laser technology adoption, which offers superior efficiency and lower operating costs compared to traditional cutting methods.

Competitive landscape features both international technology leaders and emerging domestic manufacturers, creating a dynamic market environment with continuous innovation and competitive pricing. The market demonstrates strong potential for sustained growth, supported by increasing industrial automation adoption and expanding manufacturing base across various sectors.

Regional growth patterns indicate concentrated development in established industrial corridors while emerging manufacturing hubs show increasing adoption of laser cutting technologies. The market outlook remains highly positive with expanding applications and technological advancements driving continued market expansion.

Market analysis reveals several critical insights shaping the India laser cutting machine landscape:

Industrial modernization serves as the primary catalyst driving India’s laser cutting machine market expansion. Manufacturing companies increasingly recognize the competitive advantages offered by laser cutting technology, including superior precision, reduced material waste, and enhanced production efficiency.

Government initiatives significantly contribute to market growth through policies promoting advanced manufacturing technologies. The Make in India campaign encourages domestic production capabilities while providing incentives for technology adoption. Additionally, PLI schemes for various manufacturing sectors create favorable conditions for laser cutting machine investments.

Automotive industry expansion represents a major growth driver, with increasing vehicle production requiring precise cutting of various components. The growing electric vehicle segment particularly demands high-precision cutting for battery housings, structural components, and electronic assemblies.

Export competitiveness requirements drive manufacturers to adopt advanced cutting technologies to meet international quality standards. Aerospace manufacturing growth creates demand for ultra-precise cutting capabilities, while expanding electronics production requires miniaturized component manufacturing with exceptional accuracy.

Cost optimization pressures encourage adoption of laser cutting technology due to reduced material waste, lower labor requirements, and improved production efficiency compared to traditional cutting methods.

High initial investment requirements represent the most significant barrier to laser cutting machine adoption, particularly for small and medium enterprises with limited capital resources. Advanced laser cutting systems require substantial upfront costs for equipment procurement, installation, and facility preparation.

Technical expertise shortage constrains market growth as laser cutting technology requires specialized knowledge for operation, programming, and maintenance. The limited availability of trained technicians and operators creates challenges for companies seeking to implement laser cutting solutions.

Power infrastructure limitations in certain regions affect laser cutting machine performance, as these systems require stable, high-quality electrical supply for optimal operation. Power fluctuations can damage sensitive laser components and affect cutting quality.

Import dependency for advanced laser components and systems creates cost pressures due to currency fluctuations and import duties. Supply chain disruptions can affect equipment availability and maintenance service delivery.

Competition from traditional cutting methods remains significant in price-sensitive market segments where conventional cutting technologies offer adequate performance at lower costs. Maintenance complexity and associated costs can deter adoption among companies lacking technical infrastructure.

Emerging manufacturing sectors present substantial growth opportunities for laser cutting machine adoption. The expanding renewable energy sector, particularly solar panel manufacturing and wind turbine component production, requires precise cutting capabilities for various materials.

Medical device manufacturing represents a high-growth opportunity segment, with increasing demand for precision-cut medical components and surgical instruments. The growing pharmaceutical packaging industry also creates opportunities for specialized laser cutting applications.

Infrastructure development projects across India generate demand for architectural metalwork and structural components requiring precision cutting. Smart city initiatives create opportunities for customized metal fabrication and decorative cutting applications.

Export market expansion offers significant growth potential as Indian manufacturers increasingly serve international markets requiring high-precision components. Defense manufacturing under the Atmanirbhar Bharat initiative creates opportunities for specialized laser cutting applications.

Technology advancement opportunities include development of application-specific laser cutting solutions, integration with Industry 4.0 technologies, and creation of cost-effective systems for small-scale manufacturers. Service sector expansion presents opportunities for job work services and equipment leasing models.

Market dynamics in India’s laser cutting machine sector reflect the complex interplay between technological advancement, industrial demand, and economic factors. The market demonstrates strong momentum driven by increasing manufacturing sophistication and growing quality requirements across various industries.

Demand patterns show seasonal variations aligned with industrial production cycles, with peak demand typically occurring during festival seasons when manufacturing activities intensify. Technology evolution continuously shapes market dynamics as newer laser technologies offer improved performance and cost-effectiveness.

Competitive pressures drive continuous innovation and pricing optimization, benefiting end-users through improved technology access and competitive pricing. Supply chain dynamics influence market stability, with domestic manufacturing capabilities gradually reducing import dependency for certain components.

Regulatory environment impacts market development through safety standards, environmental regulations, and trade policies affecting equipment imports and technology transfer. Economic cycles influence capital investment decisions, with economic growth periods typically correlating with increased laser cutting machine adoption.

Technological convergence with automation, artificial intelligence, and IoT technologies creates new market dynamics, enabling advanced applications and improved operational efficiency.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into India’s laser cutting machine market. The research approach combines primary and secondary data collection methods to provide holistic market understanding.

Primary research involves extensive interviews with industry stakeholders including equipment manufacturers, distributors, system integrators, and end-user companies across various industrial sectors. Survey methodologies capture quantitative data on market preferences, adoption patterns, and growth projections from representative market participants.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to validate primary findings and identify market trends. Market sizing utilizes bottom-up and top-down approaches to ensure accuracy in growth projections and market segmentation analysis.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure research reliability. Regional analysis incorporates state-wise industrial data, manufacturing statistics, and economic indicators to provide comprehensive geographic insights.

Trend analysis employs historical data examination and forward-looking projections to identify market patterns and future growth opportunities across different market segments and applications.

Western India dominates the laser cutting machine market, with Gujarat and Maharashtra leading adoption due to concentrated automotive, chemical, and heavy engineering industries. Gujarat’s industrial infrastructure supports approximately 35% market share, driven by extensive automotive manufacturing and metal fabrication activities.

Southern regions demonstrate strong growth momentum, with Tamil Nadu and Karnataka emerging as significant markets due to expanding aerospace, electronics, and automotive sectors. Bangalore’s aerospace cluster drives demand for high-precision laser cutting solutions, while Chennai’s automotive hub creates substantial market opportunities.

Northern states show increasing adoption, particularly in Delhi NCR and Punjab, driven by automotive component manufacturing and agricultural equipment production. Haryana’s industrial growth contributes significantly to regional market expansion.

Eastern regions represent emerging markets with growing industrial activities in West Bengal and Odisha. Government initiatives promoting industrial development in eastern states create new opportunities for laser cutting machine adoption.

Regional preferences vary based on local industrial requirements, with coastal regions favoring corrosion-resistant cutting solutions while inland areas focus on heavy-duty applications. Infrastructure development across regions influences market accessibility and service delivery capabilities.

Market competition features a diverse mix of international technology leaders and emerging domestic manufacturers, creating a dynamic competitive environment with continuous innovation and competitive pricing strategies.

Leading international players include:

Domestic manufacturers gaining market presence:

Competitive strategies focus on technology localization, service network expansion, and development of application-specific solutions tailored to Indian market requirements.

Technology-based segmentation reveals distinct market preferences and growth patterns across different laser cutting technologies:

By Laser Type:

By Power Range:

By Application:

Automotive segment analysis reveals strong demand for laser cutting machines driven by increasing vehicle production and growing complexity of automotive components. Electric vehicle manufacturing particularly drives demand for precision cutting of battery housings and structural components.

Metal fabrication category demonstrates steady growth with increasing demand for customized metal products across construction, machinery, and general manufacturing sectors. Architectural metalwork represents a growing sub-segment requiring decorative and precision cutting capabilities.

Electronics manufacturing shows rapid expansion with increasing domestic production of electronic devices and components. Miniaturization trends drive demand for ultra-precise laser cutting capabilities with minimal heat-affected zones.

Aerospace applications require specialized laser cutting solutions meeting stringent quality and precision standards. Defense manufacturing under government initiatives creates additional opportunities for high-precision cutting applications.

Emerging categories include renewable energy component manufacturing, medical device production, and jewelry manufacturing, each requiring specialized laser cutting capabilities tailored to specific material and precision requirements.

Manufacturing companies benefit significantly from laser cutting machine adoption through improved production efficiency, enhanced product quality, and reduced material waste. Precision capabilities enable manufacturers to meet stringent quality requirements while maintaining competitive production costs.

Cost optimization benefits include reduced labor requirements, minimized material waste, and improved production speed compared to traditional cutting methods. Flexibility advantages allow manufacturers to quickly adapt to changing product requirements and customize production for specific customer needs.

Quality improvements through laser cutting technology enable manufacturers to achieve superior edge quality, dimensional accuracy, and repeatability. Automation integration capabilities reduce manual intervention while improving production consistency and workplace safety.

Equipment suppliers benefit from growing market demand and opportunities for technology advancement and service expansion. Service providers gain from increasing requirements for installation, training, and maintenance support services.

Economic benefits extend to the broader manufacturing ecosystem through improved competitiveness, export potential, and job creation in high-skill technical roles. Environmental advantages include reduced material waste and energy efficiency compared to traditional cutting methods.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration represents the most significant trend shaping India’s laser cutting machine market, with manufacturers increasingly adopting fully automated systems incorporating material handling, cutting, and part sorting capabilities. Industry 4.0 adoption drives demand for connected laser cutting systems enabling remote monitoring and predictive maintenance.

Fiber laser dominance continues expanding as manufacturers recognize superior energy efficiency and lower operating costs compared to traditional CO2 laser systems. Power scaling trends show increasing adoption of higher-power systems enabling faster cutting speeds and thicker material processing capabilities.

Customization demand grows as manufacturers seek application-specific laser cutting solutions tailored to unique production requirements. Service integration trends include comprehensive packages combining equipment supply, installation, training, and ongoing maintenance support.

Sustainability focus drives adoption of energy-efficient laser cutting technologies and systems designed for minimal environmental impact. Digitalization trends include advanced software integration for optimized cutting patterns, material utilization, and production planning.

Market democratization occurs through development of cost-effective laser cutting solutions accessible to small and medium enterprises, expanding market reach beyond large manufacturers.

Technology advancement initiatives include development of next-generation fiber laser systems offering improved cutting speeds and enhanced material processing capabilities. Domestic manufacturing expansion sees international companies establishing local production facilities to serve the growing Indian market.

Strategic partnerships between international technology providers and domestic manufacturers create opportunities for technology transfer and market expansion. Research and development investments focus on developing application-specific solutions for emerging market segments.

Service network expansion initiatives by major manufacturers improve customer support and reduce response times across different regions. Training program development addresses skill gaps through comprehensive technical education and certification programs.

Government collaboration projects include initiatives promoting advanced manufacturing technologies and supporting domestic technology development. Export promotion activities help Indian manufacturers access international markets for precision-cut components.

Sustainability initiatives focus on developing environmentally friendly laser cutting technologies and promoting energy-efficient manufacturing practices across the industry.

MarkWide Research analysis suggests that companies should prioritize fiber laser technology adoption due to superior efficiency and lower operating costs. Investment strategies should focus on scalable systems enabling future capacity expansion as business requirements grow.

Market entry recommendations emphasize the importance of comprehensive service support and local technical expertise for successful laser cutting machine adoption. Regional expansion strategies should prioritize established industrial clusters while gradually expanding to emerging manufacturing hubs.

Technology selection should consider specific application requirements, material types, and production volumes to optimize investment returns. Training investments in technical personnel represent critical success factors for effective laser cutting system implementation.

Partnership strategies with established service providers can accelerate market entry and reduce implementation risks for new adopters. Financing solutions including leasing and rental options can improve accessibility for small and medium enterprises.

Future-proofing recommendations include selecting systems with upgrade capabilities and integration potential with emerging technologies such as artificial intelligence and IoT connectivity.

Market projections indicate sustained growth momentum driven by expanding manufacturing activities and increasing adoption of advanced cutting technologies. Technology evolution will continue favoring fiber laser systems while introducing new capabilities for specialized applications.

Industry 4.0 integration will accelerate, creating demand for smart laser cutting systems with advanced connectivity and data analytics capabilities. Automation advancement will drive adoption of fully integrated cutting and material handling systems.

Market expansion will extend beyond traditional manufacturing centers to emerging industrial hubs across different regions. Application diversification will create opportunities in new sectors including renewable energy, medical devices, and advanced materials processing.

Domestic manufacturing capabilities will strengthen through technology transfer and local production initiatives, reducing import dependency and improving cost competitiveness. Service sector growth will expand through specialized job work services and equipment leasing models.

Export opportunities will increase as Indian manufacturers develop capabilities to serve international markets with precision-cut components and assemblies. Sustainability focus will drive development of energy-efficient and environmentally friendly laser cutting technologies.

India’s laser cutting machine market demonstrates exceptional growth potential driven by rapid industrialization, government support for manufacturing advancement, and increasing demand for precision-engineered products across multiple sectors. The market benefits from strong fundamentals including expanding automotive production, growing aerospace capabilities, and increasing electronics manufacturing.

Technology trends favor fiber laser systems due to superior efficiency and cost-effectiveness, while automation integration creates opportunities for advanced manufacturing solutions. Regional development shows concentrated growth in established industrial hubs with expanding opportunities in emerging manufacturing centers.

Market challenges including high initial investments and technical expertise requirements are being addressed through innovative financing solutions and comprehensive training programs. Competitive dynamics create favorable conditions for technology advancement and competitive pricing.

Future prospects remain highly positive with expanding applications, technological advancement, and growing export opportunities supporting sustained market growth. The India laser cutting machine market is well-positioned to capitalize on the country’s manufacturing transformation and contribute significantly to industrial competitiveness and economic development.

What is a Laser Cutting Machine?

A laser cutting machine is a device that uses a high-powered laser beam to cut materials with precision. It is commonly used in industries such as manufacturing, automotive, and aerospace for cutting metals, plastics, and textiles.

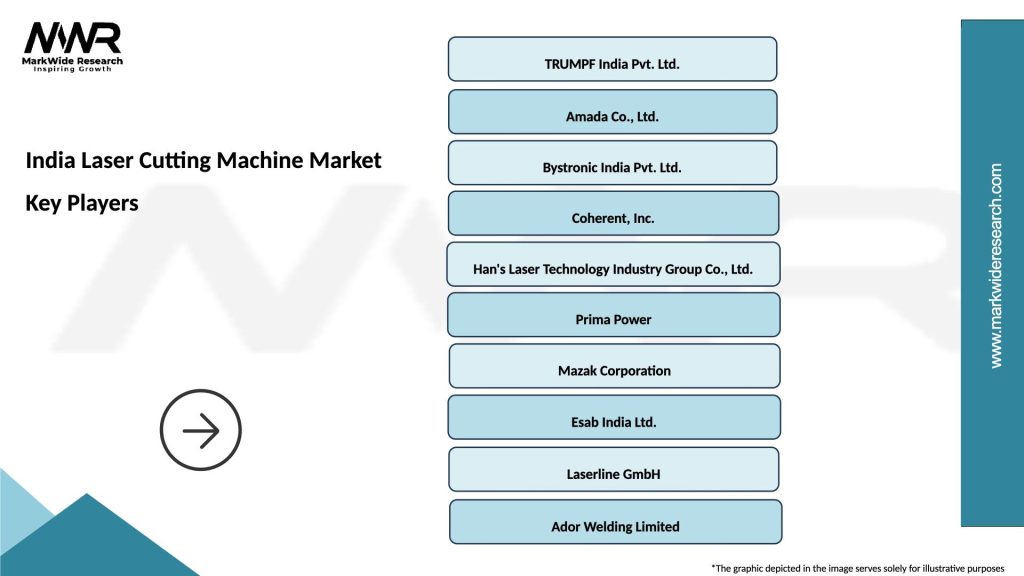

What are the key players in the India Laser Cutting Machine Market?

Key players in the India Laser Cutting Machine Market include companies like TRUMPF, Bystronic, and Amada, which are known for their advanced laser cutting technologies and solutions, among others.

What are the growth factors driving the India Laser Cutting Machine Market?

The growth of the India Laser Cutting Machine Market is driven by increasing demand for automation in manufacturing, the need for precision cutting in various industries, and advancements in laser technology that enhance efficiency and reduce operational costs.

What challenges does the India Laser Cutting Machine Market face?

The India Laser Cutting Machine Market faces challenges such as high initial investment costs, the need for skilled operators, and competition from alternative cutting technologies that may offer lower costs or different capabilities.

What opportunities exist in the India Laser Cutting Machine Market?

Opportunities in the India Laser Cutting Machine Market include the expansion of the automotive and aerospace sectors, increasing adoption of laser cutting in small and medium enterprises, and the potential for innovation in laser technology applications.

What trends are shaping the India Laser Cutting Machine Market?

Trends in the India Laser Cutting Machine Market include the integration of Industry Four Point Zero technologies, such as IoT and AI, into laser cutting processes, as well as a growing focus on sustainability and energy-efficient machines.

India Laser Cutting Machine Market

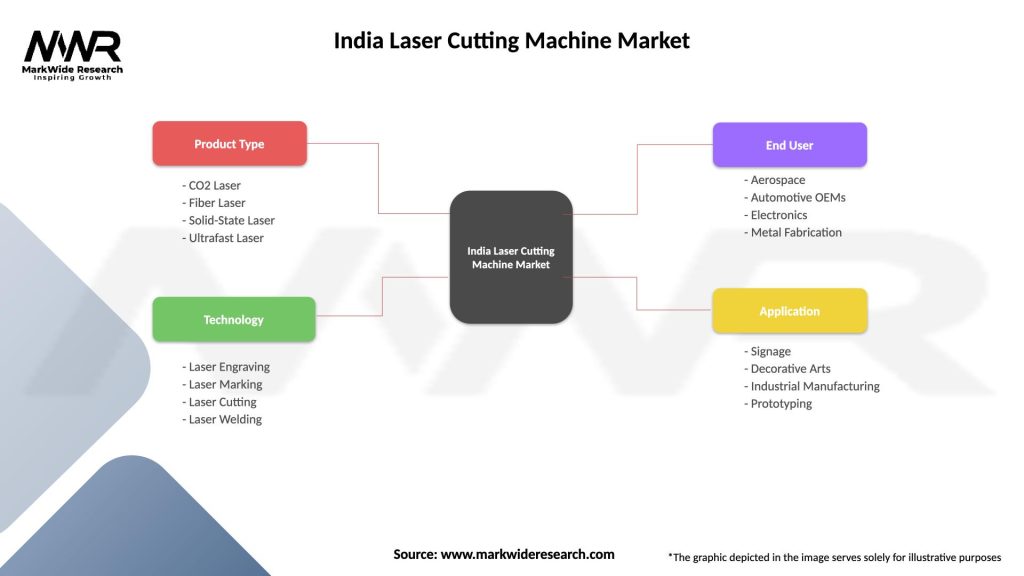

| Segmentation Details | Description |

|---|---|

| Product Type | CO2 Laser, Fiber Laser, Solid-State Laser, Ultrafast Laser |

| Technology | Laser Engraving, Laser Marking, Laser Cutting, Laser Welding |

| End User | Aerospace, Automotive OEMs, Electronics, Metal Fabrication |

| Application | Signage, Decorative Arts, Industrial Manufacturing, Prototyping |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Laser Cutting Machine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at