444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India integrated facility management market represents a rapidly evolving sector that encompasses comprehensive property and infrastructure management services across diverse industries. Integrated facility management combines multiple service disciplines under a single contract, including maintenance, security, housekeeping, catering, landscaping, and technical services. The Indian market has experienced remarkable transformation driven by urbanization, corporate expansion, and increasing focus on operational efficiency.

Market dynamics indicate substantial growth potential as organizations increasingly recognize the strategic value of outsourcing non-core activities to specialized service providers. The sector benefits from India’s expanding commercial real estate footprint, growing manufacturing base, and rising adoption of smart building technologies. Corporate clients across sectors including information technology, healthcare, manufacturing, retail, and government are driving demand for comprehensive facility management solutions.

Service integration has become a key differentiator, with leading providers offering end-to-end solutions that combine hard services (technical maintenance, engineering) and soft services (cleaning, security, catering). The market demonstrates strong growth momentum with 12.5% CAGR projected over the forecast period, reflecting increasing outsourcing trends and operational optimization requirements across Indian enterprises.

The India integrated facility management market refers to the comprehensive outsourcing of multiple facility-related services under unified contracts, enabling organizations to focus on core business activities while ensuring optimal building operations and maintenance standards.

Integrated facility management encompasses a holistic approach to property management that combines various service categories into seamless operational frameworks. This includes technical services such as HVAC maintenance, electrical systems management, plumbing, and fire safety systems, alongside soft services including housekeeping, security, landscaping, waste management, and catering services. Service providers act as single points of contact, coordinating multiple service disciplines to deliver consistent quality and operational efficiency.

Strategic outsourcing through integrated facility management enables organizations to reduce operational complexities, achieve cost efficiencies, and access specialized expertise without maintaining in-house capabilities. The model promotes standardization of service delivery, improved compliance management, and enhanced focus on core business objectives while ensuring optimal facility performance and occupant satisfaction.

Market expansion in India’s integrated facility management sector reflects the country’s rapid economic development and increasing sophistication of business operations. The sector has evolved from basic maintenance services to comprehensive facility management solutions that incorporate advanced technologies, sustainability practices, and data-driven optimization strategies.

Key growth drivers include expanding commercial real estate development, increasing corporate focus on operational efficiency, and growing awareness of facility management’s strategic importance. The market benefits from 65% adoption rate among large enterprises, while small and medium enterprises represent significant untapped potential. Technology integration has become increasingly important, with IoT sensors, predictive maintenance systems, and digital platforms enhancing service delivery capabilities.

Service diversification continues expanding beyond traditional maintenance and cleaning services to include specialized offerings such as energy management, sustainability consulting, space optimization, and workplace experience enhancement. The sector demonstrates resilience and adaptability, with providers successfully navigating challenges while capitalizing on emerging opportunities in smart buildings, green facility management, and digital transformation initiatives.

Market segmentation reveals distinct patterns across service categories, client sectors, and geographical regions. The following insights highlight critical market characteristics:

Market maturation is evident through increasing service standardization, professional certification requirements, and sophisticated performance measurement systems. Client expectations have evolved significantly, demanding transparent reporting, predictive maintenance capabilities, and measurable operational improvements from facility management partners.

Urbanization acceleration serves as a primary market driver, with India’s urban population growth creating substantial demand for professional facility management services. Commercial real estate expansion in major metropolitan areas generates continuous requirements for comprehensive facility management solutions across office complexes, shopping centers, industrial facilities, and residential developments.

Corporate efficiency initiatives drive outsourcing decisions as organizations seek to optimize operational costs while maintaining service quality standards. Companies increasingly recognize that facility management outsourcing enables better resource allocation, reduces administrative overhead, and provides access to specialized expertise and advanced technologies. Cost optimization through integrated service delivery typically achieves 15-25% operational savings compared to managing multiple service providers independently.

Regulatory compliance requirements across safety, environmental, and labor standards necessitate professional facility management expertise. Technology advancement in building automation, energy management, and predictive maintenance creates opportunities for enhanced service delivery and operational optimization. Workforce dynamics including skilled labor shortages and increasing service quality expectations further support market growth as organizations seek reliable, professional facility management partners.

Cost sensitivity remains a significant market restraint, particularly among small and medium enterprises that may perceive integrated facility management as expensive compared to in-house operations or fragmented service arrangements. Initial implementation costs and transition complexities can deter potential clients from adopting comprehensive facility management solutions.

Quality standardization challenges persist across the fragmented service provider landscape, with inconsistent service delivery standards affecting client confidence in outsourcing critical facility operations. Skilled workforce availability constraints limit service provider capabilities, particularly in specialized technical services and emerging technology areas. Regional disparities in service availability and quality create market development challenges in smaller cities and rural areas.

Contract complexity and lengthy procurement processes can delay implementation and increase administrative overhead for both service providers and clients. Technology integration challenges, including legacy system compatibility and cybersecurity concerns, may slow adoption of advanced facility management solutions. Economic volatility and budget constraints can impact client spending on non-core services, affecting market growth momentum during challenging economic periods.

Smart building integration presents substantial opportunities as India’s construction sector increasingly adopts intelligent building technologies. IoT implementation in facility management enables predictive maintenance, energy optimization, and enhanced occupant experiences, creating new service categories and revenue streams for innovative providers.

Sustainability services represent growing opportunities as organizations prioritize environmental responsibility and energy efficiency. Green building certifications, carbon footprint reduction programs, and renewable energy integration create specialized service demands. Healthcare sector expansion offers significant potential, with specialized facility management requirements for hospitals, diagnostic centers, and pharmaceutical facilities driving demand for expert service providers.

Government infrastructure projects including smart cities initiatives, airport modernization, and public facility development create substantial market opportunities. Retail sector growth through mall development and organized retail expansion generates consistent facility management demand. Digital transformation opportunities include developing proprietary technology platforms, mobile applications, and data analytics capabilities that differentiate service offerings and improve operational efficiency.

Competitive intensity continues increasing as both domestic and international players expand their presence in the Indian market. Service differentiation has become crucial, with leading providers investing in technology capabilities, specialized expertise, and comprehensive service portfolios to maintain competitive advantages.

Client relationship management emphasizes long-term partnerships over transactional service arrangements, with successful providers demonstrating consistent value delivery and operational improvements. Performance measurement systems have become sophisticated, incorporating key performance indicators, service level agreements, and continuous improvement frameworks that ensure accountability and drive service excellence.

Technology adoption accelerates across the sector, with digital platforms enabling real-time monitoring, automated reporting, and predictive maintenance capabilities. Workforce development initiatives focus on skill enhancement, professional certification, and technology training to meet evolving client requirements. Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand service capabilities and geographical reach.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, facility managers, service providers, and end-users across various sectors and geographical regions. Secondary research incorporates analysis of industry reports, company financial statements, government publications, and trade association data.

Data collection methodologies include structured surveys, in-depth interviews, focus group discussions, and expert consultations with industry professionals. Market sizing utilizes bottom-up and top-down approaches, incorporating service provider revenues, client spending patterns, and market penetration analysis across different segments and regions.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning evaluation to provide comprehensive market understanding. Validation processes ensure data accuracy through triangulation of multiple sources, expert review, and statistical analysis. Forecasting models incorporate historical trends, current market dynamics, and future growth drivers to project market development trajectories.

Mumbai metropolitan region leads the integrated facility management market, accounting for approximately 28% market share due to its concentration of corporate headquarters, commercial real estate, and financial services companies. Service sophistication is highest in Mumbai, with advanced technology integration and comprehensive service portfolios meeting demanding client requirements.

Delhi NCR region represents the second-largest market with 24% market share, driven by government facilities, multinational corporations, and expanding commercial developments. Bangalore demonstrates strong growth momentum with 18% market share, reflecting the city’s IT sector concentration and modern office infrastructure requirements.

Chennai and Hyderabad collectively account for 15% market share, benefiting from automotive industry presence, IT services expansion, and healthcare sector growth. Pune shows significant potential with 8% market share, driven by manufacturing sector requirements and emerging commercial developments. Tier-2 cities including Ahmedabad, Kolkata, and Kochi represent 7% combined market share but demonstrate the highest growth rates as regional business centers develop and attract corporate investments.

Market leadership is distributed among several major players, each with distinct competitive advantages and service specializations. The competitive environment demonstrates both domestic expertise and international best practices.

Competitive differentiation focuses on service quality, technology integration, sustainability practices, and client relationship management. Strategic partnerships with technology providers, equipment manufacturers, and specialized service companies enhance competitive positioning and service capabilities.

Service-based segmentation reveals distinct market categories with varying growth patterns and client requirements:

By Service Type:

By End-User Industry:

By Contract Type:

Hard services category demonstrates steady growth driven by increasing technical complexity of modern buildings and equipment. HVAC maintenance represents the largest component within hard services, accounting for significant service revenues due to India’s climate requirements and energy efficiency focus. Electrical services show strong growth with building automation and smart technology integration.

Soft services category maintains consistent demand across all client sectors, with housekeeping services representing the most standardized and widely adopted service category. Security services demonstrate increasing sophistication with technology integration including access control systems, CCTV monitoring, and integrated security management platforms.

Support services category shows variable growth patterns depending on client requirements and organizational policies. Catering services experience strong demand in corporate environments, while administrative support services vary significantly based on client operational models. Specialized services represent the fastest-growing category, with energy management and sustainability consulting showing particularly strong adoption rates among environmentally conscious organizations.

Cost optimization represents the primary benefit for client organizations, with integrated facility management typically delivering 20-30% cost savings compared to managing multiple service providers independently. Operational efficiency improvements result from standardized processes, professional expertise, and coordinated service delivery that minimizes disruptions and maximizes facility performance.

Risk mitigation benefits include improved compliance management, professional insurance coverage, and specialized expertise in safety and regulatory requirements. Focus enhancement enables organizations to concentrate resources on core business activities while ensuring optimal facility operations through professional service providers.

Service providers benefit from stable, long-term revenue streams, opportunities for service expansion, and economies of scale through integrated service delivery. Technology advancement opportunities enable service differentiation and operational efficiency improvements. Workforce development benefits include career advancement opportunities, professional training, and exposure to diverse client environments and service requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the facility management sector, with IoT sensors, predictive analytics, and mobile applications becoming standard components of service delivery platforms. MarkWide Research analysis indicates that 75% of leading providers have invested significantly in digital capabilities to enhance service quality and operational efficiency.

Sustainability integration has evolved from optional service to mandatory requirement, with clients increasingly demanding green facility management practices, energy efficiency optimization, and carbon footprint reduction programs. Smart building technologies enable real-time monitoring and optimization of energy consumption, waste management, and environmental controls.

Workplace experience enhancement focuses on occupant satisfaction, productivity improvement, and wellness initiatives. Space optimization services help organizations maximize facility utilization while reducing operational costs. Health and safety protocols have gained prominence, with enhanced cleaning procedures, air quality monitoring, and contactless service delivery becoming standard practices.

Technology partnerships between facility management companies and technology providers have accelerated, creating integrated platforms that combine service delivery with advanced analytics and automation capabilities. Acquisition activity continues as companies seek to expand service portfolios and geographical reach through strategic mergers and acquisitions.

Professional certification programs have gained importance, with industry associations and educational institutions developing specialized training programs for facility management professionals. Sustainability certifications including LEED and BREEAM have become increasingly important for service providers seeking to differentiate their offerings.

Government initiatives supporting smart cities development and infrastructure modernization create substantial opportunities for facility management service providers. Regulatory developments in areas such as building safety, environmental compliance, and labor standards continue shaping service delivery requirements and operational practices.

Service diversification should focus on high-value, technology-enabled offerings that demonstrate clear return on investment for clients. Digital capability development is essential for maintaining competitive positioning and meeting evolving client expectations for real-time monitoring, predictive maintenance, and data-driven optimization.

Geographic expansion into tier-2 cities presents significant growth opportunities, but requires careful market entry strategies that account for local service requirements and competitive dynamics. Partnership strategies with technology providers, equipment manufacturers, and specialized service companies can enhance service capabilities while reducing capital investment requirements.

Talent development initiatives should prioritize technical skills, technology proficiency, and customer service excellence to address skilled workforce shortages and improve service quality. Sustainability expertise development is crucial for capturing growing demand for environmental management and energy efficiency services. Client relationship management should emphasize long-term partnerships, performance measurement, and continuous improvement to ensure client retention and expansion opportunities.

Market expansion is projected to continue with strong momentum, driven by ongoing urbanization, commercial real estate development, and increasing corporate focus on operational efficiency. Technology integration will accelerate, with artificial intelligence, machine learning, and automation technologies becoming standard components of facility management service delivery.

Service evolution toward comprehensive workplace solutions will encompass traditional facility management alongside employee experience enhancement, space optimization, and wellness program management. Sustainability requirements will become increasingly stringent, with carbon neutrality goals and circular economy principles driving demand for specialized environmental management services.

Market maturation will result in improved service standardization, professional certification requirements, and sophisticated performance measurement systems. MWR projections indicate that the sector will achieve 85% penetration rate among large enterprises within the next five years, while small and medium enterprise adoption will accelerate through simplified service packages and flexible contract arrangements. Regional expansion into smaller cities will continue as commercial infrastructure development spreads beyond major metropolitan areas.

India’s integrated facility management market represents a dynamic and rapidly evolving sector with substantial growth potential driven by urbanization, corporate expansion, and increasing operational efficiency requirements. The market has demonstrated resilience and adaptability while evolving from basic maintenance services to comprehensive facility management solutions that incorporate advanced technologies and sustainability practices.

Strategic opportunities abound for service providers who can effectively combine service excellence with technology innovation, sustainability expertise, and client relationship management. The sector’s future success will depend on addressing key challenges including skilled workforce development, service quality standardization, and technology integration while capitalizing on emerging opportunities in smart buildings, green facility management, and digital transformation.

Market participants who invest in digital capabilities, sustainability expertise, and comprehensive service portfolios will be best positioned to capture growth opportunities and maintain competitive advantages in this expanding market. The India integrated facility management market is poised for continued expansion as organizations increasingly recognize the strategic value of professional facility management in achieving operational excellence and business success.

What is Integrated Facility Management?

Integrated Facility Management refers to the comprehensive management of multiple facilities and services within an organization, aiming to streamline operations, reduce costs, and enhance service quality. It encompasses various functions such as maintenance, cleaning, security, and space management.

What are the key players in the India Integrated Facility Management Market?

Key players in the India Integrated Facility Management Market include companies like JLL, CBRE, and ISS Facility Services, which provide a range of services from property management to specialized facility solutions, among others.

What are the growth factors driving the India Integrated Facility Management Market?

The growth of the India Integrated Facility Management Market is driven by increasing urbanization, the need for cost-effective facility solutions, and the rising demand for improved workplace environments. Additionally, the expansion of commercial real estate and infrastructure projects contributes to market growth.

What challenges does the India Integrated Facility Management Market face?

The India Integrated Facility Management Market faces challenges such as a lack of skilled workforce, varying regulatory standards, and the need for technological integration. These factors can hinder operational efficiency and service delivery.

What opportunities exist in the India Integrated Facility Management Market?

Opportunities in the India Integrated Facility Management Market include the adoption of smart building technologies, increased outsourcing of facility services, and the growing emphasis on sustainability practices. These trends can lead to innovative service offerings and enhanced operational efficiencies.

What trends are shaping the India Integrated Facility Management Market?

Trends shaping the India Integrated Facility Management Market include the integration of IoT and AI technologies for predictive maintenance, a focus on sustainability and green building practices, and the rise of flexible workspace solutions. These trends are transforming how facilities are managed and operated.

India Integrated Facility Management Market

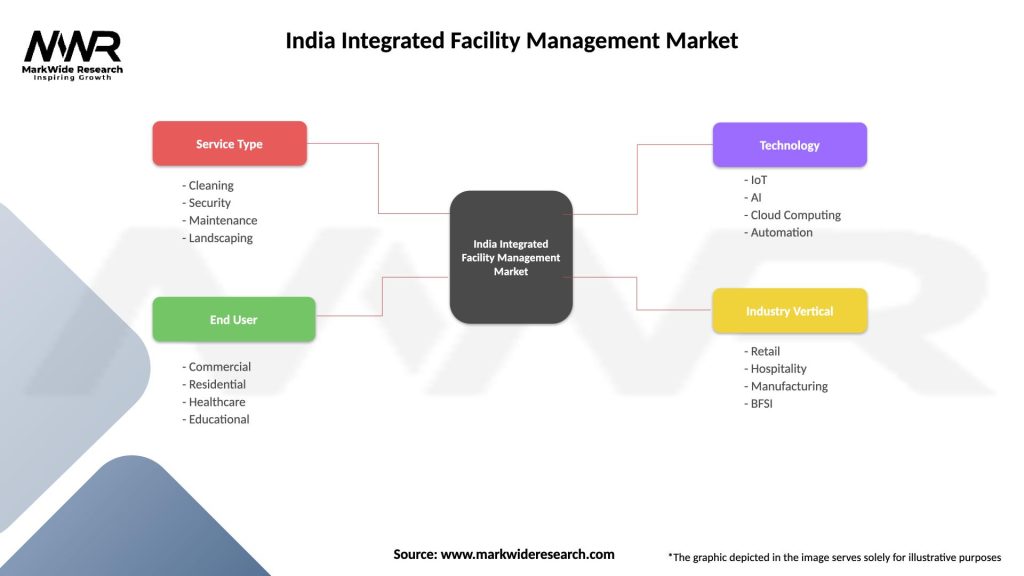

| Segmentation Details | Description |

|---|---|

| Service Type | Cleaning, Security, Maintenance, Landscaping |

| End User | Commercial, Residential, Healthcare, Educational |

| Technology | IoT, AI, Cloud Computing, Automation |

| Industry Vertical | Retail, Hospitality, Manufacturing, BFSI |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Integrated Facility Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at