444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India insecticide market represents one of the most dynamic and rapidly evolving agricultural input sectors in the Asia-Pacific region. Agricultural productivity in India heavily depends on effective pest management solutions, making insecticides crucial for maintaining crop yields and food security. The market encompasses a diverse range of chemical formulations, biological alternatives, and integrated pest management solutions designed to protect crops from various insect pests.

Market dynamics indicate robust growth driven by increasing agricultural mechanization, rising awareness about crop protection, and the need to feed India’s growing population. The sector has witnessed significant transformation with the introduction of advanced formulations, precision application technologies, and sustainable pest control methods. Growth rates in the insecticide segment have consistently outpaced other agricultural inputs, reflecting the critical importance of pest management in modern farming practices.

Regional distribution shows concentrated demand in major agricultural states including Punjab, Haryana, Uttar Pradesh, Maharashtra, and Karnataka. The market demonstrates strong seasonal patterns aligned with cropping cycles, with peak demand during kharif and rabi seasons. Technology adoption rates vary significantly across different regions, with progressive farming communities embracing newer formulations and application methods more readily than traditional farming areas.

The India insecticide market refers to the comprehensive ecosystem of chemical and biological products designed to control, repel, or eliminate insect pests that threaten agricultural crops, stored grains, and other agricultural commodities across the Indian subcontinent. This market encompasses various product categories including organophosphates, organochlorines, pyrethroids, neonicotinoids, and emerging biological alternatives.

Insecticide formulations available in the Indian market include emulsifiable concentrates, wettable powders, granules, dusts, and ready-to-use solutions. The market also includes specialized products for specific crops, targeted pest control solutions, and integrated pest management systems. Distribution channels span from traditional agricultural input dealers to modern retail chains and direct-to-farmer digital platforms.

Regulatory framework governing the insecticide market includes registration requirements, safety standards, residue limits, and environmental compliance measures. The market operates under strict guidelines established by the Central Insecticides Board and Registration Committee, ensuring product efficacy and safety for both users and consumers.

Strategic positioning of the India insecticide market reflects the country’s status as a major agricultural economy with diverse cropping patterns and pest challenges. The market demonstrates remarkable resilience and adaptability, continuously evolving to address emerging pest threats and changing agricultural practices. Innovation trends focus on developing more effective, environmentally sustainable, and farmer-friendly solutions.

Market segmentation reveals distinct patterns across product types, application methods, and crop categories. Chemical insecticides continue to dominate market share, while biological alternatives are gaining traction among environmentally conscious farmers. Adoption rates for newer formulations show promising growth, particularly in regions with higher agricultural income levels.

Competitive landscape features both multinational corporations and domestic manufacturers, creating a diverse supplier ecosystem. The market benefits from strong research and development capabilities, extensive distribution networks, and increasing farmer awareness about integrated pest management practices. Growth projections indicate sustained expansion driven by agricultural modernization and food security imperatives.

Primary market drivers include increasing crop intensity, changing pest patterns due to climate variations, and growing awareness about yield optimization. The market demonstrates strong correlation with monsoon patterns, agricultural credit availability, and government support schemes for farmers.

Emerging trends include the development of resistance management strategies, integration of artificial intelligence in pest monitoring, and the rise of subscription-based pest management services. These insights reflect the market’s evolution toward more sophisticated and sustainable pest control solutions.

Agricultural intensification serves as the primary driver for insecticide demand in India. As farmers adopt high-yielding varieties and multiple cropping systems, the need for effective pest management becomes increasingly critical. Crop protection investments directly correlate with potential yield losses, making insecticides essential for maintaining agricultural productivity.

Climate change impacts have altered pest dynamics across different agro-climatic zones, creating new challenges for farmers. Changing temperature and humidity patterns have led to the emergence of new pest species and altered the lifecycle of existing pests. This has increased the demand for specialized insecticide formulations and integrated pest management solutions.

Government initiatives promoting agricultural modernization and food security have indirectly supported insecticide market growth. Schemes providing subsidies for agricultural inputs, crop insurance programs, and extension services have improved farmer access to quality pest management products. Policy support for sustainable agriculture has also encouraged the development of environmentally friendly insecticide alternatives.

Rising farmer awareness about the economic benefits of timely pest control has significantly boosted market demand. Educational programs, demonstration plots, and digital advisory services have helped farmers understand the importance of preventive pest management. Knowledge transfer initiatives have improved adoption rates of newer formulations and application technologies.

Regulatory challenges pose significant constraints on market growth, particularly regarding the registration and approval of new insecticide molecules. Stringent safety requirements, extensive testing protocols, and lengthy approval processes can delay product launches and increase development costs. Compliance requirements also create barriers for smaller manufacturers seeking to enter the market.

Environmental concerns surrounding chemical insecticide use have led to increased scrutiny and restrictions on certain product categories. Growing awareness about pesticide residues in food products and their impact on beneficial insects has created market resistance. Sustainability pressures are forcing manufacturers to invest heavily in developing eco-friendly alternatives.

Price sensitivity among Indian farmers remains a significant market constraint, particularly for smallholder farmers with limited financial resources. The cost-benefit analysis of insecticide applications often determines purchase decisions, limiting the adoption of premium products. Economic pressures during poor harvest seasons can significantly impact market demand.

Resistance development in target pest populations has reduced the effectiveness of certain insecticide classes, necessitating the development of new active ingredients and resistance management strategies. This challenge requires continuous investment in research and development while potentially reducing the commercial lifespan of existing products.

Biological insecticides represent a significant growth opportunity as farmers and regulators increasingly favor sustainable pest management solutions. The development of microbial pesticides, botanical extracts, and beneficial insect programs offers substantial market potential. Organic farming expansion creates dedicated demand for approved biological control agents.

Precision agriculture adoption opens new avenues for targeted insecticide applications, reducing overall usage while improving efficacy. Integration with drone technology, sensor-based monitoring systems, and artificial intelligence creates opportunities for smart pest management solutions. Technology integration can differentiate products and command premium pricing.

Export market development presents opportunities for Indian insecticide manufacturers to expand beyond domestic markets. Growing demand for agricultural products in neighboring countries and established trade relationships create potential for market expansion. Manufacturing capabilities in India can serve regional markets cost-effectively.

Digital transformation in agriculture offers opportunities to develop comprehensive pest management platforms combining product supply, advisory services, and application support. Mobile applications, e-commerce platforms, and digital payment systems can improve market access and customer engagement. Service integration can create new revenue streams beyond product sales.

Supply chain dynamics in the India insecticide market involve complex interactions between manufacturers, distributors, retailers, and end-users. The market operates through established distribution networks that have evolved to serve diverse agricultural regions with varying infrastructure capabilities. Seasonal fluctuations create significant challenges for inventory management and demand forecasting.

Competitive dynamics feature intense rivalry between established multinational companies and emerging domestic manufacturers. Price competition remains fierce, particularly in commodity insecticide segments, while innovation and brand building drive competition in premium segments. Market share battles often center around distribution network strength and farmer relationships.

Regulatory dynamics continue to shape market evolution through policy changes, safety requirements, and environmental standards. Recent trends toward stricter regulation of certain chemical classes have accelerated the development of alternative solutions. Compliance costs increasingly influence product development and market entry strategies.

Technology dynamics are transforming traditional pest management approaches through digital integration, precision application methods, and data-driven decision making. MarkWide Research analysis indicates that technology adoption rates are accelerating, particularly among larger farming operations and progressive agricultural communities.

Primary research for the India insecticide market analysis involved comprehensive surveys and interviews with key stakeholders across the agricultural value chain. Data collection included farmer surveys, distributor interviews, manufacturer consultations, and expert opinions from agricultural scientists and extension specialists. Field studies were conducted across major agricultural regions to understand regional variations and market dynamics.

Secondary research encompassed analysis of government statistics, industry reports, trade publications, and academic research papers. Data sources included the Ministry of Agriculture, Central Insecticides Board, agricultural universities, and industry associations. Market intelligence was gathered from multiple sources to ensure comprehensive coverage and data validation.

Quantitative analysis involved statistical modeling of market trends, growth patterns, and correlation analysis between various market factors. Time series analysis was employed to identify seasonal patterns and cyclical trends. Forecasting models incorporated multiple variables including agricultural production, weather patterns, and economic indicators.

Qualitative assessment included expert interviews, focus group discussions, and case study analysis to understand market nuances and emerging trends. Stakeholder feedback provided insights into market challenges, opportunities, and future expectations. Validation processes ensured data accuracy and reliability through cross-referencing and expert review.

Northern India represents the largest regional market, driven by intensive wheat-rice cropping systems in Punjab, Haryana, and western Uttar Pradesh. This region demonstrates high adoption rates for advanced insecticide formulations and precision application technologies. Market penetration reaches approximately 78% of total farming area, reflecting the region’s progressive agricultural practices.

Western India shows strong demand for cotton-specific insecticides, particularly in Gujarat and Maharashtra. The region’s diverse cropping patterns including cotton, sugarcane, and horticultural crops create varied pest management requirements. Technology adoption rates in this region exceed 65% for newer formulations, driven by higher agricultural incomes and better extension services.

Southern India demonstrates growing market potential with expanding horticultural production and increasing awareness about integrated pest management. States like Karnataka, Andhra Pradesh, and Tamil Nadu show strong growth in biological insecticide adoption. Regional growth rates have averaged 12.3% annually over the past five years.

Eastern India presents significant untapped potential despite lower current market penetration. Rice-based cropping systems and traditional farming practices create opportunities for market development through farmer education and product innovation. Market development initiatives are showing promising results with 23% growth in adoption rates in recent years.

Market leadership in the India insecticide sector is shared among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment features both global multinational corporations and strong domestic manufacturers, creating a dynamic and diverse marketplace.

Competitive strategies increasingly focus on product differentiation, digital engagement, and sustainable solutions. Companies are investing heavily in research and development, farmer education programs, and distribution network expansion to maintain market position.

By Product Type: The market segmentation reveals distinct patterns across different insecticide categories, each serving specific pest control requirements and application scenarios.

By Application Method: Different application techniques cater to varying farm sizes, crop types, and farmer preferences.

By Crop Category: Market demand varies significantly across different agricultural sectors based on pest pressure and economic importance.

Cereal Crops represent the largest application segment, driven by extensive rice and wheat cultivation across India. Pest management in cereals focuses on stem borers, leaf folders, and aphids, requiring specific insecticide formulations. Market demand in this category shows strong seasonal patterns aligned with cropping cycles and demonstrates consistent growth despite price sensitivity.

Cash Crops including cotton, sugarcane, and oilseeds generate premium market demand due to higher economic stakes and intensive pest pressure. Cotton cultivation particularly drives demand for specialized insecticides targeting bollworm complexes. Technology adoption rates in cash crop segments exceed 70% for advanced formulations.

Horticultural Crops present the fastest-growing market segment, driven by expanding fruit and vegetable production. This category demands specialized products with shorter pre-harvest intervals and lower residue levels. Biological alternatives show particularly strong adoption in horticultural applications, with growth rates exceeding 25% annually.

Plantation Crops including tea, coffee, and spices require specialized pest management approaches due to perennial cropping systems and export quality requirements. This segment demonstrates strong preference for sustainable pest management solutions and integrated approaches. Premium pricing acceptance is higher in this category due to quality considerations.

Farmers benefit from improved crop protection, higher yields, and better quality produce through effective insecticide use. Modern formulations offer enhanced safety profiles, easier application methods, and better economic returns on investment. Risk mitigation through timely pest control helps farmers maintain consistent income and reduces crop loss uncertainties.

Manufacturers gain from expanding market opportunities, technological advancement possibilities, and sustainable business growth. The growing market provides platforms for innovation, brand building, and market share expansion. Research investments in new formulations and application technologies create competitive advantages and premium pricing opportunities.

Distributors and retailers benefit from consistent demand patterns, seasonal business cycles, and opportunities for value-added services. The market structure supports profitable distribution models and long-term business relationships. Service integration opportunities allow distributors to expand beyond product sales into advisory and application services.

Government stakeholders achieve food security objectives, agricultural productivity improvements, and rural economic development through a robust insecticide market. Effective pest management supports agricultural export competitiveness and farmer income enhancement. Regulatory frameworks ensure environmental protection while maintaining agricultural productivity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Agriculture trends are driving significant changes in insecticide preferences, with farmers increasingly adopting integrated pest management approaches. This shift reflects growing environmental awareness and regulatory pressure toward reducing chemical inputs. Biological alternatives are gaining market acceptance, particularly in export-oriented crops where residue concerns are paramount.

Digital Transformation is revolutionizing pest management through mobile applications, satellite monitoring, and artificial intelligence-based pest prediction systems. MWR data indicates that digital advisory services are experiencing rapid adoption rates among tech-savvy farmers, particularly in progressive agricultural regions.

Precision Application technologies are becoming mainstream, with drone-based spraying and variable-rate application systems gaining popularity. These technologies offer improved efficiency, reduced environmental impact, and better pest control outcomes. Technology adoption is accelerating among larger farming operations and custom service providers.

Resistance Management has become a critical focus area, with manufacturers developing rotation strategies and combination products to combat pest resistance. This trend is driving innovation in active ingredient development and formulation technologies. Stewardship programs are becoming essential components of product marketing strategies.

Product Innovation continues to drive industry evolution with the introduction of novel active ingredients, improved formulation technologies, and targeted delivery systems. Recent developments include micro-encapsulation technologies, controlled-release formulations, and combination products offering broader spectrum control.

Regulatory Changes have significantly impacted the industry landscape, with new registration requirements, safety standards, and environmental compliance measures. The phase-out of certain chemical classes has accelerated the development of alternative solutions and created market opportunities for innovative products.

Strategic Partnerships between multinational companies and domestic manufacturers are reshaping competitive dynamics. These collaborations combine global technology expertise with local market knowledge and distribution capabilities. Joint ventures and licensing agreements are becoming common strategies for market expansion.

Digital Initiatives are transforming customer engagement and market access through e-commerce platforms, mobile applications, and digital advisory services. Companies are investing heavily in digital infrastructure to improve farmer connectivity and service delivery capabilities.

Investment Focus should prioritize sustainable product development, digital technology integration, and distribution network strengthening. Companies should allocate resources toward biological alternatives, precision application technologies, and farmer education programs. Research and development investments in resistance management and environmental safety will provide long-term competitive advantages.

Market Entry Strategies for new players should emphasize niche market segments, innovative product offerings, and strategic partnerships with established distributors. Differentiation strategies based on sustainability, efficacy, or cost-effectiveness can help overcome intense competition in commodity segments.

Risk Management approaches should address regulatory uncertainties, climate variability, and market volatility through diversified product portfolios and flexible business models. Companies should develop contingency plans for regulatory changes and invest in alternative product development. Supply chain resilience becomes critical for maintaining market position.

Growth Strategies should focus on expanding into underserved regions, developing value-added services, and building long-term farmer relationships. MarkWide Research analysis suggests that companies combining product excellence with service integration achieve superior market performance and customer loyalty.

Market evolution over the next decade will be characterized by increasing sustainability requirements, technological integration, and regulatory complexity. The industry is expected to witness continued growth driven by agricultural intensification, climate change adaptation needs, and food security imperatives. Innovation cycles will accelerate as companies respond to evolving market demands and regulatory requirements.

Technology integration will transform traditional pest management approaches through artificial intelligence, precision agriculture, and biotechnology applications. Digital platforms will become essential for market access and customer engagement. Automation trends in application technologies will improve efficiency and reduce environmental impact.

Sustainability focus will drive significant changes in product development priorities, with biological alternatives and integrated pest management solutions gaining market share. Environmental stewardship will become a key differentiator for market success. Circular economy principles will influence packaging, distribution, and product lifecycle management.

Market structure is expected to evolve toward greater consolidation, with successful companies expanding through acquisitions, partnerships, and organic growth. Regional players with strong local presence and innovative capabilities will continue to compete effectively against multinational corporations. Growth projections indicate sustained expansion with increasing emphasis on value creation rather than volume growth.

The India insecticide market stands at a critical juncture, balancing traditional agricultural needs with evolving sustainability requirements and technological possibilities. The market demonstrates remarkable resilience and adaptability, continuously evolving to address emerging challenges while maintaining its essential role in agricultural productivity and food security.

Strategic opportunities abound for companies that can successfully navigate the complex regulatory environment, invest in sustainable innovation, and build strong farmer relationships. The shift toward integrated pest management, biological alternatives, and precision agriculture creates new avenues for growth and differentiation. Market leaders will be those who combine product excellence with service integration and technological innovation.

Future success in the India insecticide market will depend on companies’ ability to balance profitability with sustainability, innovation with affordability, and global expertise with local market understanding. The market’s evolution toward more sophisticated and environmentally responsible pest management solutions presents both challenges and opportunities for industry participants. Long-term growth prospects remain positive, supported by India’s agricultural development trajectory and increasing focus on sustainable farming practices.

What is Insecticide?

Insecticides are chemical substances used to kill or control insects that can damage crops, spread diseases, or cause other harm. They play a crucial role in agriculture by protecting plants and increasing yield.

What are the key companies in the India Insecticide Market?

Key companies in the India Insecticide Market include Bayer CropScience, Syngenta, and UPL Limited, which are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the India Insecticide Market?

The growth of the India Insecticide Market is driven by increasing agricultural productivity, the rising demand for food security, and the adoption of modern farming techniques. Additionally, the expansion of cash crops contributes to market growth.

What challenges does the India Insecticide Market face?

The India Insecticide Market faces challenges such as regulatory hurdles, the emergence of pest resistance, and environmental concerns regarding chemical usage. These factors can impact the effectiveness and acceptance of insecticides.

What opportunities exist in the India Insecticide Market?

Opportunities in the India Insecticide Market include the development of biopesticides, increasing awareness of sustainable agriculture, and the potential for export growth. Innovations in formulation and application methods also present new avenues for growth.

What trends are shaping the India Insecticide Market?

Trends in the India Insecticide Market include a shift towards integrated pest management, the use of precision agriculture technologies, and the growing preference for organic insecticides. These trends reflect a broader movement towards sustainable farming practices.

India Insecticide Market

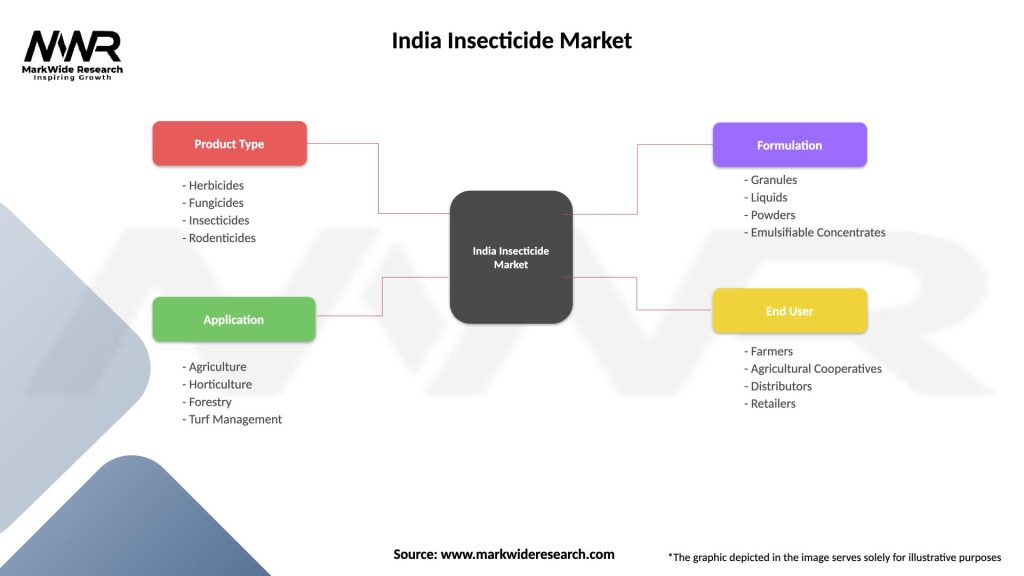

| Segmentation Details | Description |

|---|---|

| Product Type | Herbicides, Fungicides, Insecticides, Rodenticides |

| Application | Agriculture, Horticulture, Forestry, Turf Management |

| Formulation | Granules, Liquids, Powders, Emulsifiable Concentrates |

| End User | Farmers, Agricultural Cooperatives, Distributors, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Insecticide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at