444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India industrial valves market represents one of the most dynamic and rapidly expanding segments within the country’s manufacturing ecosystem. Industrial valves serve as critical components across diverse sectors including oil and gas, power generation, water treatment, chemicals, pharmaceuticals, and food processing industries. The market demonstrates robust growth momentum driven by India’s accelerating industrialization, infrastructure development initiatives, and increasing focus on process automation.

Market dynamics indicate substantial expansion opportunities as India continues to emerge as a global manufacturing hub. The sector benefits from government initiatives such as Make in India, which promotes domestic manufacturing capabilities and reduces dependency on imports. Growth projections suggest the market will experience a compound annual growth rate (CAGR) of 8.2% over the forecast period, reflecting strong demand fundamentals and technological advancement adoption.

Regional distribution shows concentrated activity in industrial corridors across Maharashtra, Gujarat, Tamil Nadu, and Andhra Pradesh, where major manufacturing facilities and processing plants drive valve demand. The market encompasses various valve types including gate valves, globe valves, ball valves, butterfly valves, and check valves, each serving specific industrial applications with unique performance requirements.

The India industrial valves market refers to the comprehensive ecosystem of manufacturing, distribution, and application of mechanical devices designed to control, direct, and regulate fluid flow within industrial processes across the Indian subcontinent. These precision-engineered components function as critical control elements that manage the movement of liquids, gases, and slurries through piping systems in various industrial applications.

Industrial valves encompass a broad spectrum of products ranging from simple manual shut-off devices to sophisticated automated control systems integrated with digital monitoring capabilities. The market includes both domestically manufactured products and imported solutions, serving industries that require reliable flow control for operational efficiency, safety compliance, and environmental protection.

Market scope extends beyond traditional manufacturing to include emerging sectors such as renewable energy, smart cities infrastructure, and advanced water management systems. The definition encompasses aftermarket services, maintenance solutions, and technological upgrades that ensure optimal valve performance throughout their operational lifecycle.

Strategic analysis reveals the India industrial valves market positioned for sustained growth driven by multiple convergent factors including rapid industrialization, infrastructure modernization, and increasing emphasis on process efficiency. The market demonstrates strong fundamentals with domestic manufacturing capabilities expanding to meet growing demand while reducing import dependency.

Key growth drivers include government infrastructure investments, expansion of manufacturing sectors, and rising adoption of automation technologies. The power generation sector accounts for approximately 28% of total valve demand, followed by oil and gas operations and chemical processing industries. Technological evolution toward smart valves and IoT-enabled monitoring systems creates new market opportunities.

Competitive landscape features a mix of established international players and emerging domestic manufacturers, with increasing focus on localization strategies to serve the growing market demand. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand their technological capabilities and market reach across diverse industrial segments.

Comprehensive market analysis reveals several critical insights that define the current state and future trajectory of the India industrial valves market:

Primary growth catalysts propelling the India industrial valves market include robust industrialization trends, government policy support, and technological advancement adoption. The Make in India initiative significantly impacts market dynamics by encouraging domestic manufacturing and reducing reliance on imported valve solutions.

Infrastructure development projects across power generation, water treatment, and transportation sectors create substantial demand for industrial valves. The government’s commitment to expanding renewable energy capacity, with targets for solar and wind power installations, drives specialized valve requirements for these emerging applications. Power sector expansion alone contributes to approximately 35% of incremental valve demand annually.

Industrial automation trends accelerate adoption of advanced valve technologies including smart actuators, digital monitoring systems, and predictive maintenance capabilities. Companies increasingly recognize the value of automated valve systems in improving operational efficiency, reducing maintenance costs, and ensuring regulatory compliance across various industrial processes.

Economic growth momentum supports continued expansion of manufacturing sectors including chemicals, pharmaceuticals, food processing, and textiles, each requiring specialized valve solutions tailored to their specific operational requirements and regulatory standards.

Significant challenges facing the India industrial valves market include high initial capital investment requirements, particularly for advanced automated valve systems and smart monitoring technologies. Many small and medium enterprises face budget constraints that limit their ability to upgrade to modern valve solutions despite potential long-term benefits.

Technical complexity associated with advanced valve systems creates implementation challenges, requiring specialized expertise for installation, commissioning, and maintenance. The shortage of skilled technicians familiar with modern valve technologies poses operational difficulties for many industrial facilities seeking to modernize their systems.

Quality concerns regarding some domestically manufactured products impact market confidence, particularly in critical applications where valve failure could result in significant operational disruptions or safety hazards. Standardization issues and varying quality levels across different manufacturers create procurement challenges for industrial buyers.

Import dependency for specialized valve components and advanced materials affects pricing stability and supply chain reliability. Currency fluctuations and international trade policies can significantly impact the cost structure for valve manufacturers and end users requiring imported solutions.

Emerging opportunities in the India industrial valves market span multiple dimensions including technological innovation, market expansion, and service diversification. The smart cities initiative creates substantial demand for advanced valve systems in water management, waste treatment, and infrastructure applications.

Digital transformation presents significant opportunities for valve manufacturers to develop IoT-enabled products, predictive maintenance solutions, and integrated monitoring systems. The growing emphasis on Industry 4.0 adoption drives demand for valves that can seamlessly integrate with automated manufacturing systems and provide real-time performance data.

Export potential represents a major growth avenue as Indian manufacturers develop capabilities to serve international markets, particularly in Southeast Asia, Africa, and the Middle East. The cost advantage of Indian manufacturing combined with improving quality standards positions domestic companies favorably for global expansion.

Renewable energy sector expansion creates specialized opportunities for valve manufacturers to develop products tailored to solar thermal, wind power, and biomass applications. The government’s renewable energy targets indicate sustained growth in this segment over the coming decade.

Complex market dynamics shape the India industrial valves landscape through the interplay of demand drivers, supply chain factors, technological evolution, and regulatory influences. Demand patterns show cyclical variations aligned with industrial production cycles and infrastructure investment phases.

Supply chain optimization becomes increasingly critical as manufacturers seek to balance cost efficiency with quality requirements. The trend toward local sourcing gains momentum as companies aim to reduce dependency on imports while supporting domestic manufacturing capabilities. Inventory management strategies evolve to accommodate varying demand patterns across different industrial sectors.

Pricing dynamics reflect raw material cost fluctuations, particularly steel and specialized alloys used in valve manufacturing. The market experiences price pressure from competitive bidding processes while simultaneously facing cost inflation from material and energy inputs. Value engineering approaches help manufacturers optimize product designs for cost-effectiveness without compromising performance.

Technology adoption rates vary significantly across different industrial segments, with larger companies leading in smart valve implementation while smaller enterprises focus on proven conventional technologies. This creates a bifurcated market structure requiring different product strategies and service approaches.

Comprehensive research approach employed for analyzing the India industrial valves market combines primary research, secondary data analysis, and expert consultation to provide accurate market insights. Primary research includes structured interviews with industry executives, valve manufacturers, end-user companies, and distribution partners across major industrial centers.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish market size, growth trends, and competitive positioning. Data triangulation methods ensure accuracy and reliability of market estimates and projections.

Market segmentation analysis utilizes both top-down and bottom-up approaches to validate market size estimates across different valve types, application sectors, and geographic regions. Expert consultation with industry specialists provides qualitative insights into market trends, technological developments, and future growth prospects.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive understanding of market dynamics and competitive landscape. Forecasting models incorporate multiple variables including economic indicators, industrial production data, and infrastructure investment plans.

Geographic distribution of the India industrial valves market shows concentrated activity in key industrial states with Maharashtra leading at approximately 22% market share, followed by Gujarat, Tamil Nadu, and Andhra Pradesh. Western India dominates valve consumption due to the concentration of chemical, petrochemical, and pharmaceutical industries in this region.

Northern states including Punjab, Haryana, and Uttar Pradesh contribute significantly to market demand through power generation projects, food processing industries, and emerging manufacturing facilities. The Delhi National Capital Region serves as a major distribution hub for valve products serving multiple industrial corridors.

Southern India demonstrates strong growth potential with expanding automotive, aerospace, and information technology sectors driving valve demand. Tamil Nadu and Karnataka show particular strength in precision valve applications for high-tech manufacturing processes.

Eastern regions including West Bengal and Odisha benefit from steel industry concentration and mining operations requiring heavy-duty valve solutions. The industrial corridor development in these states creates additional growth opportunities for valve manufacturers and suppliers.

Market competition in the India industrial valves sector features a diverse mix of international corporations, domestic manufacturers, and specialized niche players. Leading companies compete on multiple dimensions including product quality, technological innovation, pricing strategies, and after-sales service capabilities.

Competitive strategies emphasize localization, technology transfer, and strategic partnerships to serve the growing Indian market effectively while maintaining cost competitiveness.

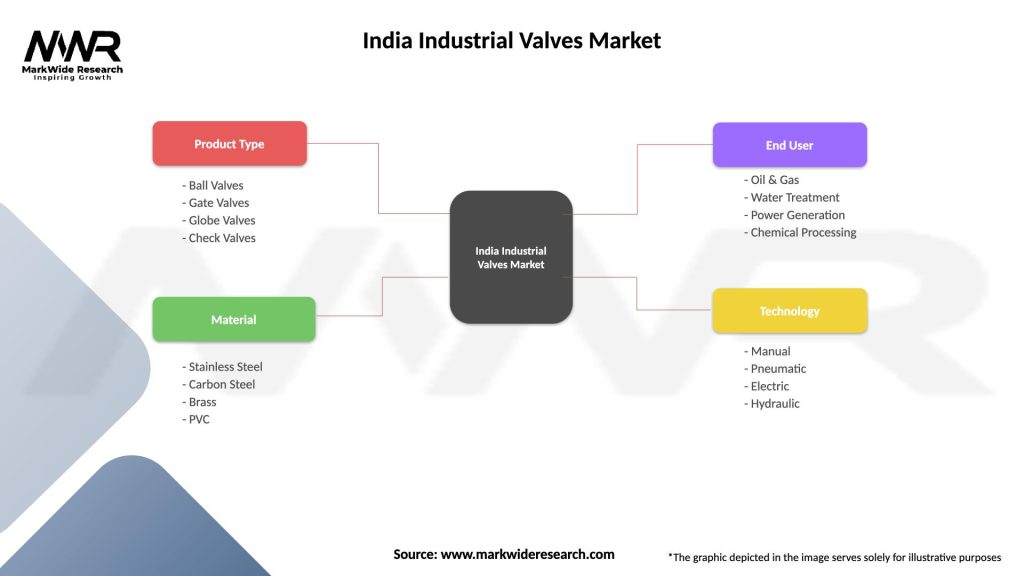

Market segmentation of the India industrial valves market provides detailed analysis across multiple dimensions including product type, application sector, material composition, and end-user industry categories.

By Product Type:

By Application Sector:

Detailed category analysis reveals distinct growth patterns and market dynamics across different valve segments within the India industrial valves market. Control valves represent the fastest-growing category with approximately 12% annual growth rate driven by increasing automation adoption across industrial sectors.

Gate valves maintain the largest market share due to their widespread application in water treatment, power generation, and general industrial processes. These valves benefit from standardized designs and established manufacturing capabilities among domestic producers. Cost competitiveness makes gate valves particularly attractive for large-scale infrastructure projects.

Ball valves show strong growth in oil and gas applications where reliable sealing and quick operation are critical requirements. The segment benefits from increasing exploration activities and pipeline infrastructure development across India. Material innovations in ball valve construction improve performance in corrosive environments.

Butterfly valves gain popularity in water treatment and HVAC applications due to their compact design and cost-effectiveness for large diameter applications. Technology improvements in butterfly valve sealing systems enhance their suitability for critical applications requiring tight shut-off capabilities.

Comprehensive benefits accrue to various stakeholders participating in the India industrial valves market ecosystem, creating value across the entire supply chain from manufacturers to end users.

For Manufacturers:

For End Users:

For Distributors:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the India industrial valves market include digitalization, sustainability focus, and advanced material adoption. Smart valve integration gains momentum as industries embrace Industry 4.0 concepts and seek improved process monitoring capabilities.

IoT connectivity emerges as a critical trend with valve manufacturers developing products that provide real-time performance data, predictive maintenance alerts, and remote monitoring capabilities. This trend shows adoption rates of approximately 15% among large industrial facilities with expectations for significant growth over the next five years.

Sustainability initiatives drive demand for energy-efficient valve solutions and environmentally friendly manufacturing processes. Companies increasingly prioritize lifecycle cost optimization over initial purchase price, creating opportunities for premium valve products that offer superior durability and performance.

Material innovation focuses on corrosion-resistant alloys, advanced polymers, and composite materials that extend valve life and improve performance in challenging applications. Additive manufacturing technologies begin to influence valve production, particularly for complex geometries and customized solutions.

Service-oriented business models gain traction as manufacturers expand beyond product sales to offer comprehensive maintenance, monitoring, and optimization services. This trend creates recurring revenue opportunities and strengthens customer relationships.

Recent industry developments highlight the dynamic nature of the India industrial valves market with significant investments in manufacturing capacity, technology advancement, and market expansion initiatives.

Manufacturing expansion projects include new production facilities established by both domestic and international companies to serve growing market demand. Several major valve manufacturers announced capacity expansion plans representing substantial investment in Indian manufacturing capabilities.

Technology partnerships between Indian companies and international technology leaders facilitate knowledge transfer and capability development in advanced valve technologies. These collaborations focus on smart valve systems, automation integration, and specialized applications for emerging industries.

Acquisition activities reshape the competitive landscape as companies seek to expand their product portfolios, geographic reach, and technological capabilities. Strategic acquisitions enable faster market penetration and access to established customer relationships.

Research and development investments increase significantly as companies recognize the importance of innovation in maintaining competitive advantage. Focus areas include digitalization, material science, and application-specific valve solutions for emerging market segments.

Strategic recommendations for market participants in the India industrial valves sector emphasize the importance of balancing growth opportunities with operational excellence and technological advancement.

For Manufacturers: MarkWide Research analysis suggests prioritizing investment in smart valve technologies and IoT integration capabilities to capture growing demand for automated solutions. Companies should focus on developing local supply chains to reduce dependency on imported components while maintaining quality standards.

Market positioning strategies should emphasize value proposition beyond price competition, highlighting total cost of ownership, reliability, and service support capabilities. Brand building initiatives become critical for domestic manufacturers seeking to compete with established international players in premium market segments.

For End Users: Industrial companies should evaluate valve procurement strategies to balance cost considerations with long-term performance requirements. Lifecycle cost analysis approaches provide better decision-making frameworks compared to initial purchase price focus alone.

Partnership strategies with reliable valve suppliers enable access to technical expertise, maintenance support, and product customization capabilities. Companies should consider vendor consolidation approaches to improve supply chain efficiency and strengthen supplier relationships.

Long-term prospects for the India industrial valves market remain highly positive with sustained growth expected across multiple dimensions including market size, technological sophistication, and application diversity. Growth projections indicate the market will maintain robust expansion with compound annual growth rates exceeding 8% over the next decade.

Technology evolution will fundamentally transform valve applications with smart systems, predictive maintenance, and integrated automation becoming standard features rather than premium options. Digital transformation initiatives across Indian industries will drive demand for advanced valve solutions capable of seamless integration with automated systems.

Market maturation processes will likely result in consolidation among smaller players while creating opportunities for companies with strong technological capabilities and market positioning. Quality standardization will improve as domestic manufacturers invest in advanced manufacturing processes and quality control systems.

Export growth potential represents a significant opportunity as Indian valve manufacturers develop capabilities to serve international markets. MWR projections suggest export revenues could account for 25% of total industry output within the next seven years, driven by cost competitiveness and improving quality standards.

Sustainability considerations will increasingly influence valve design, manufacturing processes, and application requirements as industries focus on environmental compliance and energy efficiency optimization.

The India industrial valves market stands at a pivotal juncture with exceptional growth opportunities driven by rapid industrialization, infrastructure development, and technological advancement adoption. Market fundamentals remain strong with diverse end-user industries providing sustained demand growth across multiple valve categories and applications.

Strategic positioning for success in this dynamic market requires balancing traditional manufacturing excellence with emerging technology capabilities, particularly in smart valve systems and automation integration. Companies that successfully navigate the transition from conventional products to digitally-enabled solutions will capture disproportionate value in the evolving market landscape.

Future success factors include technological innovation, quality improvement, customer service excellence, and strategic market positioning. The market offers substantial opportunities for both established players and new entrants willing to invest in capabilities development and customer relationship building. Sustained growth momentum across India’s industrial sectors ensures continued expansion of the valve market, making it an attractive investment destination for companies seeking long-term growth opportunities in emerging markets.

What is Industrial Valves?

Industrial valves are mechanical devices used to control the flow of fluids in various applications, including water supply, oil and gas, and chemical processing. They play a crucial role in regulating pressure, flow rate, and direction of fluids in pipelines and systems.

What are the key players in the India Industrial Valves Market?

Key players in the India Industrial Valves Market include companies like Flowserve Corporation, Emerson Electric Co., and Kitz Corporation, which are known for their innovative valve solutions and extensive product ranges, among others.

What are the growth factors driving the India Industrial Valves Market?

The growth of the India Industrial Valves Market is driven by increasing industrialization, the expansion of the oil and gas sector, and the rising demand for water and wastewater management solutions. Additionally, advancements in automation and smart valve technologies are contributing to market growth.

What challenges does the India Industrial Valves Market face?

The India Industrial Valves Market faces challenges such as fluctuating raw material prices, stringent regulatory standards, and the need for regular maintenance and replacement of valves. These factors can impact production costs and operational efficiency.

What opportunities exist in the India Industrial Valves Market?

Opportunities in the India Industrial Valves Market include the growing demand for energy-efficient and sustainable valve solutions, the expansion of renewable energy projects, and the increasing adoption of automation in industrial processes. These trends are expected to create new avenues for growth.

What trends are shaping the India Industrial Valves Market?

Trends shaping the India Industrial Valves Market include the integration of IoT technology for predictive maintenance, the development of smart valves, and a focus on sustainability through eco-friendly materials. These innovations are enhancing operational efficiency and reducing environmental impact.

India Industrial Valves Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ball Valves, Gate Valves, Globe Valves, Check Valves |

| Material | Stainless Steel, Carbon Steel, Brass, PVC |

| End User | Oil & Gas, Water Treatment, Power Generation, Chemical Processing |

| Technology | Manual, Pneumatic, Electric, Hydraulic |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Industrial Valves Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at