444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India Industrial Sensors and Transmitters market has experienced significant growth in recent years. This can be attributed to the increasing adoption of automation and process control systems across various industries such as manufacturing, oil and gas, healthcare, and automotive, among others. Industrial sensors and transmitters play a vital role in collecting and transmitting data regarding temperature, pressure, humidity, flow, and other physical parameters in industrial processes. These devices enable real-time monitoring, control, and optimization of operations, leading to improved efficiency and productivity.

Meaning

Industrial sensors are devices that detect and measure physical properties such as temperature, pressure, humidity, and flow in industrial processes. They convert these physical parameters into electrical signals that can be processed by control systems. Transmitters, on the other hand, are responsible for transmitting these signals to the control systems for further analysis and decision-making.

Executive Summary

The India Industrial Sensors and Transmitters market is witnessing steady growth due to the increasing demand for process automation and control systems in various industries. The market is characterized by the presence of both local and international players offering a wide range of sensor and transmitter products. Key market players are focusing on product innovation and technological advancements to gain a competitive edge in the market.

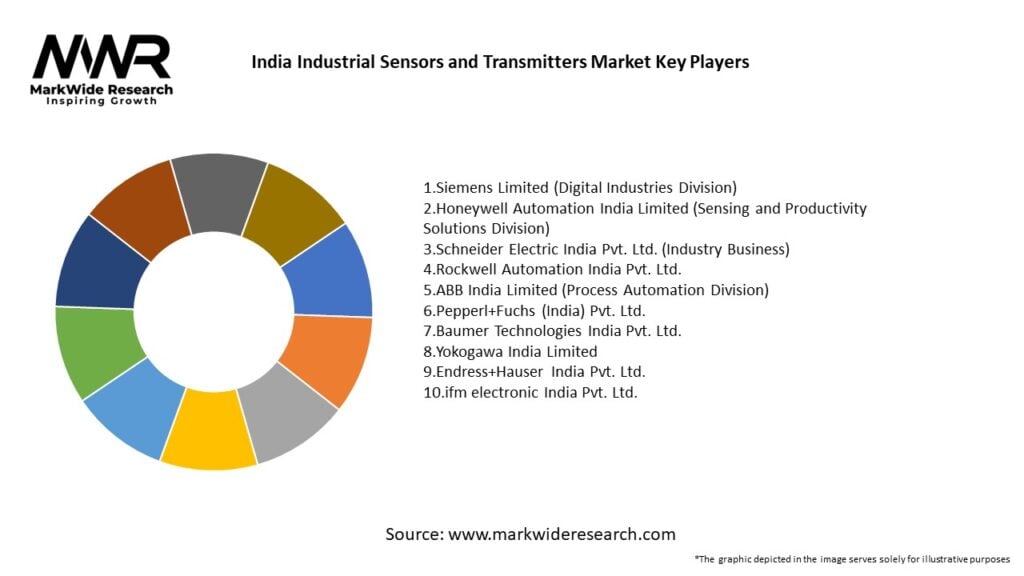

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India Industrial Sensors and Transmitters market is characterized by intense competition among key players. The market is witnessing rapid technological advancements, leading to product innovation and improved performance. Key market players are investing in research and development activities to stay ahead in the competitive landscape. Moreover, strategic partnerships and collaborations are becoming common as companies aim to expand their product portfolios and reach a wider customer base.

Regional Analysis

The Indian Industrial Sensors and Transmitters market is geographically segmented into North, South, East, and West regions. The South region holds the largest market share, primarily due to the presence of major industries such as automotive, electronics, and manufacturing. The North and West regions are also significant contributors to the market, driven by the growing industrial activities in states like Maharashtra, Gujarat, and Delhi.

Competitive Landscape

Leading Companies in the India Industrial Sensors and Transmitters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India Industrial Sensors and Transmitters market can be segmented based on type, application, and end-user industries. By type, the market can be categorized into temperature sensors, pressure sensors, humidity sensors, flow sensors, level sensors, and others. By application, the market can be segmented into process control, monitoring and inspection, data acquisition, and others. Based on end-user industries, the market can be divided into automotive, manufacturing, oil and gas, healthcare, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the India Industrial Sensors and Transmitters market. The initial phase of the pandemic led to disruptions in the supply chain, reduced industrial activities, and uncertainties in the market. However, as industries gradually resumed operations and adapted to the new normal, the demand for automation and control systems increased.

The pandemic acted as a catalyst for digital transformation and automation, with industries realizing the importance of remote monitoring and control. This drove the adoption of industrial sensors and transmitters for ensuring operational continuity, maintaining productivity, and minimizing human intervention.

Furthermore, the healthcare sector witnessed a surge in demand for sensors and transmitters for patient monitoring, ventilators, and temperature control in vaccine storage facilities. The increased focus on healthcare infrastructure and the need for accurate data collection to combat the pandemic created new opportunities for the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The India Industrial Sensors and Transmitters market is poised for significant growth in the coming years. The increasing adoption of automation and control systems, coupled with technological advancements, will continue to drive market expansion. The demand for wireless sensor networks, IoT-enabled sensors, and integration with AI and ML technologies will shape the future of the market.

Furthermore, the emphasis on healthcare infrastructure development, precision farming, and digitalization initiatives will create new opportunities. Market players need to focus on innovation, partnerships, and talent development to capitalize on these opportunities and maintain a competitive edge.

Conclusion

The India Industrial Sensors and Transmitters market is witnessing steady growth, driven by the increasing adoption of automation and control systems across various industries. The market offers significant opportunities for companies to provide innovative sensor and transmitter solutions to meet industry-specific requirements.

While challenges such as high initial costs and a shortage of skilled professionals exist, strategic initiatives, such as government support, technological advancements, and partnerships, can help overcome these barriers. The market’s future looks promising, with a focus on wireless networks, IoT integration, and AI-enabled analytics, paving the way for improved efficiency, productivity, and cost savings in industrial processes.

What is Industrial Sensors and Transmitters?

Industrial sensors and transmitters are devices used to measure physical properties such as temperature, pressure, and flow in various industrial applications. They convert these measurements into signals that can be monitored and analyzed for process control and automation.

What are the key players in the India Industrial Sensors and Transmitters Market?

Key players in the India Industrial Sensors and Transmitters Market include Siemens, Honeywell, and ABB, which provide a range of products for industrial automation and control systems, among others.

What are the growth factors driving the India Industrial Sensors and Transmitters Market?

The growth of the India Industrial Sensors and Transmitters Market is driven by increasing automation in manufacturing, the demand for real-time monitoring in industries, and the rise of smart factories that utilize advanced sensor technologies.

What challenges does the India Industrial Sensors and Transmitters Market face?

Challenges in the India Industrial Sensors and Transmitters Market include the high cost of advanced sensor technologies, the need for skilled personnel to manage and maintain these systems, and issues related to data security and integration with existing infrastructure.

What opportunities exist in the India Industrial Sensors and Transmitters Market?

Opportunities in the India Industrial Sensors and Transmitters Market include the growing adoption of IoT technologies, the expansion of renewable energy sectors, and the increasing focus on predictive maintenance in industrial operations.

What trends are shaping the India Industrial Sensors and Transmitters Market?

Trends in the India Industrial Sensors and Transmitters Market include the integration of artificial intelligence for data analysis, the development of wireless sensor networks, and the increasing use of miniaturized sensors in various applications.

India Industrial Sensors and Transmitters Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pressure Sensors, Temperature Sensors, Flow Sensors, Level Sensors |

| Technology | Analog, Digital, Wireless, Smart |

| End User | Manufacturing, Oil & Gas, Automotive, Aerospace |

| Application | Process Automation, Environmental Monitoring, Safety Systems, Quality Control |

Leading Companies in the India Industrial Sensors and Transmitters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at