444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India hydrogen peroxide market represents a dynamic and rapidly expanding segment within the country’s chemical industry landscape. Hydrogen peroxide serves as a versatile oxidizing agent with applications spanning across multiple industries including textiles, paper and pulp, healthcare, electronics, and water treatment. The market demonstrates robust growth momentum driven by increasing industrial activities, rising environmental consciousness, and expanding applications in emerging sectors.

Industrial demand continues to surge as manufacturers increasingly adopt hydrogen peroxide for bleaching, disinfection, and oxidation processes. The textile industry, particularly prominent in states like Tamil Nadu, Gujarat, and Maharashtra, represents a significant consumption base with growing demand for eco-friendly bleaching agents. The market exhibits strong growth potential with an estimated 8.2% CAGR projected over the forecast period, reflecting the compound’s expanding utility across diverse applications.

Manufacturing capabilities within India have strengthened considerably, with domestic producers investing in advanced production technologies and capacity expansions. The market benefits from favorable government policies promoting chemical manufacturing under initiatives like Make in India, while simultaneously addressing growing environmental regulations that favor hydrogen peroxide over traditional chlorine-based alternatives.

The India hydrogen peroxide market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of hydrogen peroxide (H2O2) within the Indian subcontinent. Hydrogen peroxide is a chemical compound consisting of two hydrogen atoms and two oxygen atoms, functioning as a powerful oxidizing agent and disinfectant across numerous industrial and commercial applications.

Market dynamics encompass various stakeholders including manufacturers, distributors, end-users, and regulatory bodies that collectively shape the supply chain and consumption patterns. The market includes different concentration grades ranging from 3% pharmaceutical grade to 70% industrial grade, each serving specific application requirements and industry standards.

Commercial significance extends beyond traditional chemical applications, incorporating emerging uses in electronics manufacturing, food processing, and environmental remediation. The market structure reflects India’s industrial diversity, with consumption patterns varying significantly across regions based on local industrial concentrations and manufacturing activities.

Market performance in the India hydrogen peroxide sector demonstrates exceptional resilience and growth trajectory, supported by diversified application portfolios and increasing industrial adoption. The market benefits from strong domestic manufacturing capabilities, strategic geographic positioning, and favorable regulatory environment promoting sustainable chemical alternatives.

Key growth drivers include expanding textile industry operations, increasing paper and pulp production, rising healthcare sector demand, and growing environmental awareness driving adoption of eco-friendly oxidizing agents. The market experiences approximately 65% domestic production meeting local demand, with remaining requirements fulfilled through strategic imports from established global suppliers.

Competitive landscape features both multinational corporations and domestic players, creating a balanced market structure that promotes innovation and competitive pricing. Major applications include textile bleaching accounting for 35% market share, paper and pulp processing, water treatment, and emerging electronics applications driving future growth prospects.

Future outlook remains highly positive with expanding industrial base, increasing quality consciousness, and growing adoption of hydrogen peroxide in novel applications including green chemistry initiatives and advanced oxidation processes for environmental remediation.

Strategic insights reveal several critical factors shaping the India hydrogen peroxide market landscape and future development trajectory:

Primary growth catalysts propelling the India hydrogen peroxide market include robust industrial expansion, environmental regulatory support, and technological advancement across key application sectors. The textile industry growth remains a fundamental driver, with increasing demand for eco-friendly bleaching agents replacing traditional chlorine-based chemicals.

Healthcare sector expansion significantly contributes to market growth through increasing demand for disinfection and sterilization applications. The COVID-19 pandemic accelerated adoption of hydrogen peroxide-based sanitizers and disinfectants, establishing sustained demand patterns for pharmaceutical grade hydrogen peroxide in healthcare facilities and personal care applications.

Water treatment initiatives across municipal and industrial sectors drive substantial consumption growth. Government focus on water quality improvement and wastewater treatment infrastructure development creates expanding opportunities for advanced oxidation processes utilizing hydrogen peroxide for pollutant degradation and water purification.

Electronics manufacturing growth represents an emerging high-value application segment. India’s position as a global electronics manufacturing hub drives demand for ultra-pure hydrogen peroxide in semiconductor fabrication, printed circuit board manufacturing, and electronic component cleaning processes.

Operational challenges within the India hydrogen peroxide market include handling complexities, storage requirements, and transportation limitations that impact market accessibility and cost structures. Product instability necessitates specialized storage conditions and handling procedures, increasing operational costs for end-users and distributors.

Safety concerns associated with hydrogen peroxide handling and storage create barriers for smaller industrial users lacking appropriate infrastructure and safety protocols. Regulatory compliance requirements for hazardous chemical handling impose additional costs and operational complexities, particularly affecting small and medium enterprises.

Price volatility in raw materials, particularly hydrogen and oxygen feedstocks, creates cost pressures affecting market predictability and long-term planning. Energy-intensive production processes make hydrogen peroxide pricing sensitive to electricity cost fluctuations and energy policy changes.

Competition from alternatives in certain applications, including sodium hypochlorite for disinfection and ozone for water treatment, limits market expansion in specific segments. Traditional chemical preferences and established supply relationships create market penetration challenges for hydrogen peroxide adoption in conservative industrial sectors.

Emerging applications present substantial growth opportunities for the India hydrogen peroxide market, particularly in advanced manufacturing sectors and environmental remediation. The green chemistry movement creates expanding demand for environmentally friendly oxidizing agents, positioning hydrogen peroxide favorably against traditional chemical alternatives.

Export market development offers significant potential leveraging India’s cost-competitive manufacturing capabilities and strategic geographic location. Neighboring countries in South Asia and Southeast Asia represent accessible markets for Indian hydrogen peroxide exports, supported by established trade relationships and logistics networks.

Specialty grade development targeting high-value applications in electronics, pharmaceuticals, and food processing creates opportunities for premium pricing and market differentiation. Investment in ultra-pure production capabilities can capture growing demand from technology-intensive industries requiring stringent quality specifications.

Rural market penetration through agricultural applications including soil treatment, crop protection, and livestock disinfection represents untapped potential. Development of agricultural-grade formulations and distribution networks can access India’s vast agricultural sector, creating new consumption bases beyond traditional industrial applications.

Supply-demand equilibrium in the India hydrogen peroxide market reflects complex interactions between production capacity, consumption patterns, and import dependencies. Domestic production capacity continues expanding through new facility investments and existing plant upgrades, gradually reducing import reliance and improving supply security.

Pricing dynamics demonstrate sensitivity to raw material costs, energy prices, and competitive pressures from both domestic and international suppliers. Market pricing typically follows cost-plus models with adjustments for quality specifications, delivery terms, and volume commitments, creating differentiated pricing structures across application segments.

Seasonal variations affect demand patterns, particularly in textile and agricultural applications where production cycles influence consumption requirements. The market experiences peak demand periods during textile manufacturing seasons and agricultural treatment cycles, requiring flexible production and inventory management strategies.

Technological evolution continues reshaping market dynamics through improved production processes, enhanced product stability, and novel application development. According to MarkWide Research analysis, technological advancement drives approximately 15% efficiency improvement in production processes annually, supporting cost competitiveness and market expansion.

Comprehensive market analysis employs multiple research methodologies combining primary data collection, secondary research, and industry expert consultations to ensure accuracy and reliability. Primary research activities include structured interviews with industry stakeholders, manufacturer surveys, and end-user feedback collection across diverse application segments.

Secondary research encompasses analysis of industry reports, government publications, trade statistics, and regulatory documentation to establish market baselines and trend identification. Data validation processes ensure consistency and accuracy through cross-referencing multiple sources and expert verification of key findings.

Market modeling utilizes statistical analysis techniques including regression analysis, trend extrapolation, and scenario modeling to project future market developments. Quantitative analysis incorporates production data, consumption statistics, trade flows, and pricing information to establish comprehensive market understanding.

Industry expert consultations provide qualitative insights into market dynamics, competitive landscape, and future development prospects. Expert opinions from manufacturers, distributors, end-users, and regulatory officials contribute to balanced market perspective and strategic insight development.

Western India dominates the hydrogen peroxide market with Gujarat and Maharashtra accounting for approximately 45% market share driven by concentrated chemical and textile industries. Gujarat’s chemical manufacturing clusters provide integrated supply chains and cost advantages, while Maharashtra’s diverse industrial base creates broad-based demand across multiple applications.

Southern India represents the second-largest regional market with Tamil Nadu and Karnataka leading consumption through textile, electronics, and pharmaceutical industries. The region benefits from established industrial infrastructure, skilled workforce, and proximity to major ports facilitating both domestic distribution and export activities.

Northern India demonstrates growing market potential with expanding industrial activities in Uttar Pradesh, Haryana, and Punjab. The region’s agricultural base creates opportunities for specialty applications, while developing manufacturing sectors drive increasing demand for industrial-grade hydrogen peroxide.

Eastern India shows emerging market characteristics with West Bengal and Odisha developing industrial capabilities in steel, chemicals, and textiles. Government initiatives promoting industrial development in eastern states create future growth opportunities for hydrogen peroxide applications in manufacturing and environmental sectors.

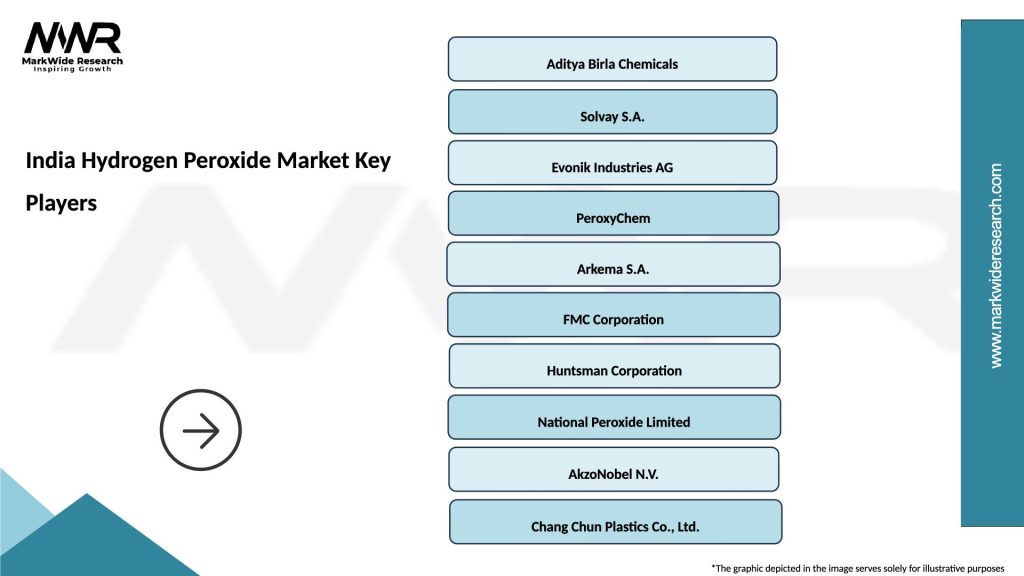

Market leadership in the India hydrogen peroxide sector features a combination of multinational corporations and domestic manufacturers creating competitive dynamics that drive innovation and market development:

By Concentration:

By Application:

By End-User Industry:

Textile Applications dominate the India hydrogen peroxide market with consistent demand from cotton processing, synthetic fiber manufacturing, and garment production facilities. The segment benefits from environmental advantages over chlorine-based bleaching agents, supporting sustainable textile manufacturing practices and export competitiveness.

Paper and Pulp Segment demonstrates steady growth driven by expanding packaging industry and increasing paper consumption. Eco-friendly bleaching processes using hydrogen peroxide align with environmental regulations and consumer preferences for sustainable paper products, creating sustained demand growth.

Water Treatment Applications show accelerating adoption as municipalities and industries invest in advanced treatment technologies. Advanced oxidation processes utilizing hydrogen peroxide effectively treat complex pollutants and emerging contaminants, supporting India’s water quality improvement initiatives.

Healthcare Segment experiences robust growth through hospital disinfection, pharmaceutical manufacturing, and personal care applications. The COVID-19 pandemic established sustained demand patterns for hydrogen peroxide-based sanitizers and disinfectants across healthcare and consumer markets.

Electronics Applications represent the highest-value segment with stringent quality requirements and premium pricing. India’s growing position in global electronics manufacturing drives demand for ultra-pure hydrogen peroxide in semiconductor fabrication and precision cleaning applications.

Manufacturers benefit from expanding market opportunities across diverse application segments, enabling production diversification and risk mitigation. Economies of scale in production facilities support cost competitiveness while technological advancement creates opportunities for premium product development and market differentiation.

End-users gain access to environmentally friendly oxidizing agents that improve process efficiency while meeting regulatory compliance requirements. Hydrogen peroxide adoption enables sustainable manufacturing practices, reduced environmental impact, and enhanced product quality across various industrial applications.

Distributors and suppliers capitalize on growing market demand through expanded product portfolios and geographic coverage. Value-added services including technical support, customized formulations, and logistics optimization create competitive advantages and customer loyalty in the hydrogen peroxide market.

Government and regulatory bodies benefit from industry adoption of cleaner chemical alternatives supporting environmental protection goals and sustainable development objectives. Hydrogen peroxide utilization contributes to reduced water pollution, improved air quality, and enhanced industrial safety standards.

Research institutions find opportunities for collaborative development of novel applications and improved production technologies. Innovation partnerships with industry players drive technological advancement and create intellectual property opportunities in hydrogen peroxide applications and manufacturing processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Focus drives increasing adoption of hydrogen peroxide as industries seek environmentally responsible chemical alternatives. Green chemistry initiatives across manufacturing sectors create expanding demand for zero-residue oxidizing agents, positioning hydrogen peroxide favorably against traditional chlorine-based chemicals.

Quality Enhancement trends emphasize ultra-pure grades and specialized formulations targeting high-value applications. Electronics manufacturing growth demands increasingly stringent purity specifications, driving investment in advanced purification technologies and quality control systems.

Process Integration involves incorporating hydrogen peroxide into comprehensive treatment systems and manufacturing processes. Advanced oxidation processes combining hydrogen peroxide with UV light or ozone create synergistic effects for enhanced treatment efficiency and expanded application possibilities.

Digital Transformation impacts supply chain management, inventory optimization, and customer service delivery. IoT-enabled monitoring systems improve storage safety and product quality while digital platforms enhance distribution efficiency and customer engagement.

Regional Expansion focuses on penetrating tier-2 and tier-3 cities as industrial activities decentralize from major metropolitan areas. Infrastructure development in emerging industrial clusters creates new market opportunities and distribution challenges requiring strategic adaptation.

Capacity Expansion Projects across major manufacturers reflect growing market confidence and demand projections. Gujarat Alkalies and Chemicals Limited announced significant production capacity increases to meet expanding domestic demand and explore export opportunities in neighboring countries.

Technology Upgrades focus on improving production efficiency and product quality through advanced process control systems and automation. Anthraquinone process optimization enables higher yields and reduced energy consumption, supporting cost competitiveness and environmental sustainability.

Strategic Partnerships between international companies and domestic manufacturers facilitate technology transfer and market access. Joint ventures combine global expertise with local market knowledge, accelerating product development and distribution network expansion.

Regulatory Developments include updated safety standards and environmental compliance requirements affecting production and handling practices. Bureau of Indian Standards revisions ensure product quality consistency while promoting safe handling practices across the supply chain.

Research Initiatives target novel applications and improved stabilization technologies. Academic-industry collaborations explore hydrogen peroxide applications in emerging fields including biotechnology, advanced materials, and environmental remediation technologies.

Market participants should prioritize investment in specialty grade production capabilities to capture high-value application segments. Electronics and pharmaceutical applications offer premium pricing opportunities and stable demand patterns, justifying specialized production infrastructure and quality control systems.

Geographic expansion strategies should focus on emerging industrial clusters in tier-2 cities where manufacturing activities are expanding. MWR analysis indicates approximately 25% growth potential in secondary cities as industrial decentralization accelerates and infrastructure development progresses.

Supply chain optimization through strategic inventory positioning and distribution network enhancement can improve market responsiveness and cost efficiency. Regional distribution centers near major consumption areas reduce transportation costs and improve delivery reliability for time-sensitive applications.

Technology investment in production process automation and quality control systems supports long-term competitiveness and operational efficiency. Digital transformation initiatives including IoT monitoring and predictive maintenance can reduce operational costs while improving safety and reliability.

Partnership development with end-user industries creates opportunities for customized solutions and long-term supply relationships. Technical service capabilities including application support and process optimization consulting differentiate suppliers and create customer loyalty.

Long-term prospects for the India hydrogen peroxide market remain highly positive, supported by expanding industrial base, increasing environmental consciousness, and growing adoption in emerging applications. Market growth is expected to accelerate with projected 8.5% CAGR over the next five years, driven by sustained demand across traditional and emerging application segments.

Industrial diversification will continue expanding hydrogen peroxide applications beyond traditional textile and paper industries into high-growth sectors including electronics, biotechnology, and advanced materials. Innovation-driven demand from technology-intensive industries creates opportunities for premium product development and market differentiation.

Export market development presents significant growth potential as Indian manufacturers leverage cost competitiveness and quality improvements to access regional markets. South Asian and Southeast Asian countries represent accessible export destinations with growing industrial activities and increasing demand for chemical intermediates.

Sustainability trends will increasingly favor hydrogen peroxide adoption as industries prioritize environmental compliance and sustainable manufacturing practices. Regulatory support for eco-friendly chemical alternatives creates favorable market conditions for continued growth and market penetration across diverse industrial sectors.

The India hydrogen peroxide market demonstrates exceptional growth potential supported by diverse application portfolios, expanding industrial base, and favorable regulatory environment promoting sustainable chemical alternatives. Market dynamics reflect strong domestic manufacturing capabilities, increasing quality consciousness, and growing adoption across traditional and emerging application segments.

Strategic opportunities exist in specialty grade development, export market expansion, and novel application development targeting high-value industries. Competitive advantages through technology investment, supply chain optimization, and customer partnership development will determine long-term market success and profitability.

Future growth prospects remain robust with expanding industrial activities, increasing environmental awareness, and technological advancement driving sustained demand growth. The market’s evolution toward sustainability and quality enhancement positions hydrogen peroxide as a critical chemical intermediate supporting India’s industrial development and environmental protection objectives.

What is Hydrogen Peroxide?

Hydrogen Peroxide is a chemical compound with the formula H2O2, commonly used as a bleaching agent, disinfectant, and oxidizer in various applications, including healthcare, food processing, and environmental management.

What are the key players in the India Hydrogen Peroxide Market?

Key players in the India Hydrogen Peroxide Market include Aditya Birla Chemicals, Solvay, and Evonik Industries, among others.

What are the growth factors driving the India Hydrogen Peroxide Market?

The growth of the India Hydrogen Peroxide Market is driven by increasing demand in the textile and paper industries, rising awareness of hygiene and sanitation, and the expanding use of hydrogen peroxide in wastewater treatment.

What challenges does the India Hydrogen Peroxide Market face?

Challenges in the India Hydrogen Peroxide Market include fluctuating raw material prices, stringent regulations regarding chemical handling, and competition from alternative bleaching agents.

What opportunities exist in the India Hydrogen Peroxide Market?

Opportunities in the India Hydrogen Peroxide Market include the growing demand for eco-friendly products, advancements in production technologies, and the increasing use of hydrogen peroxide in the pharmaceutical sector.

What trends are shaping the India Hydrogen Peroxide Market?

Trends in the India Hydrogen Peroxide Market include a shift towards sustainable production methods, increased adoption in the healthcare sector for sterilization, and innovations in packaging solutions to enhance product stability.

India Hydrogen Peroxide Market

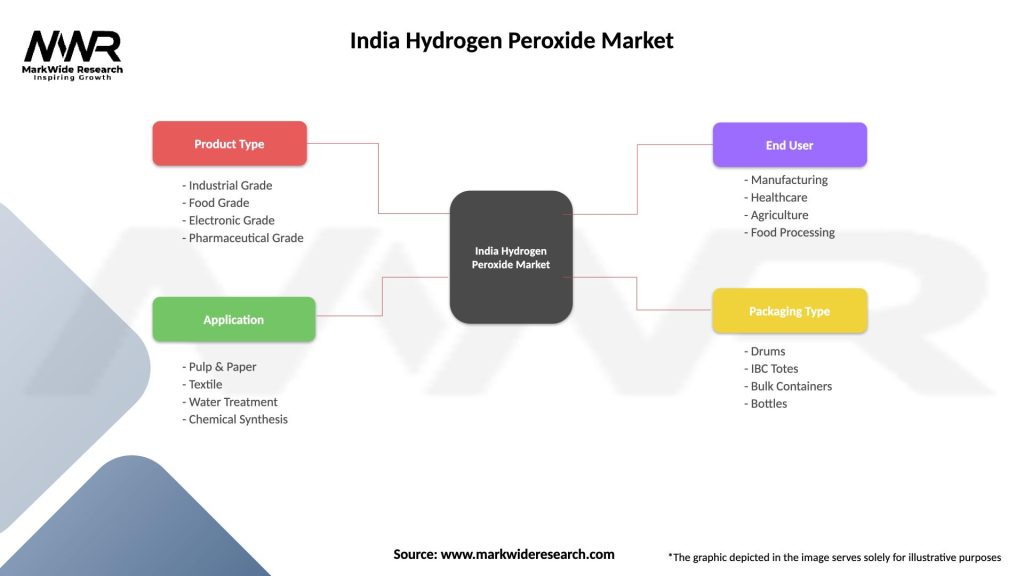

| Segmentation Details | Description |

|---|---|

| Product Type | Industrial Grade, Food Grade, Electronic Grade, Pharmaceutical Grade |

| Application | Pulp & Paper, Textile, Water Treatment, Chemical Synthesis |

| End User | Manufacturing, Healthcare, Agriculture, Food Processing |

| Packaging Type | Drums, IBC Totes, Bulk Containers, Bottles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Hydrogen Peroxide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at