444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India HVDC transmission system market represents a transformative segment within the country’s power infrastructure landscape, driven by the urgent need for efficient long-distance power transmission and grid modernization. High Voltage Direct Current (HVDC) technology has emerged as a critical solution for India’s complex energy distribution challenges, enabling seamless power transfer across vast geographical distances with minimal transmission losses. The market demonstrates robust growth momentum with an impressive 12.5% CAGR projected over the forecast period, reflecting the government’s commitment to renewable energy integration and grid stability enhancement.

India’s power sector transformation has positioned HVDC systems as essential infrastructure components, particularly for connecting remote renewable energy generation sites to major consumption centers. The technology’s superior efficiency in transmitting power over distances exceeding 600 kilometers makes it indispensable for the country’s ambitious renewable energy targets. Grid interconnection projects across different states have accelerated HVDC adoption, with current penetration rates reaching approximately 15% of total transmission capacity, indicating substantial room for expansion.

Market dynamics are significantly influenced by India’s National Solar Mission and wind energy expansion programs, which require sophisticated transmission infrastructure to handle variable renewable energy sources. The integration of smart grid technologies with HVDC systems has created new opportunities for enhanced power quality and system reliability, driving technological innovation and market growth across multiple segments.

The India HVDC transmission system market refers to the comprehensive ecosystem of high-voltage direct current technologies, equipment, and services designed to facilitate efficient long-distance electrical power transmission across the Indian subcontinent. This market encompasses various HVDC configurations including point-to-point transmission lines, multi-terminal systems, and back-to-back converters that enable seamless power flow between different AC networks.

HVDC technology fundamentally differs from traditional alternating current (AC) transmission by converting AC power to DC for transmission and then back to AC at the receiving end. This process eliminates reactive power losses and enables precise power flow control, making it particularly valuable for India’s diverse geographical and electrical challenges. Modern HVDC systems incorporate advanced converter technologies including Line Commutated Converters (LCC) and Voltage Source Converters (VSC), each offering distinct advantages for specific transmission applications.

System components within this market include converter stations, transmission lines, control systems, protection equipment, and associated infrastructure necessary for reliable HVDC operation. The market also encompasses specialized services such as system design, installation, commissioning, and long-term maintenance contracts that ensure optimal performance throughout the system lifecycle.

India’s HVDC transmission system market stands at a pivotal juncture, characterized by accelerating government investments in power infrastructure modernization and renewable energy integration. The market’s expansion is fundamentally driven by the country’s commitment to achieving 500 GW renewable energy capacity by 2030, necessitating sophisticated transmission solutions capable of handling intermittent power sources and long-distance energy transfer.

Key market drivers include the urgent need for grid stability enhancement, reduction of transmission losses currently averaging 18-20% in conventional systems, and the requirement for inter-regional power exchange capabilities. The technology’s ability to reduce transmission losses to below 3% over long distances presents compelling economic advantages that continue to drive adoption across various utility segments.

Regional development patterns show concentrated activity in renewable energy-rich states such as Rajasthan, Gujarat, and Tamil Nadu, where HVDC systems facilitate power evacuation to high-demand metropolitan areas. The market landscape features both domestic and international players, with increasing emphasis on technology transfer and local manufacturing capabilities to support the government’s Make in India initiative.

Future market trajectory indicates sustained growth momentum supported by ongoing policy reforms, technological advancements in converter efficiency, and expanding applications in offshore wind power transmission. The integration of digital technologies and artificial intelligence in HVDC system management represents emerging opportunities for market participants seeking competitive differentiation.

Strategic market insights reveal several critical trends shaping the India HVDC transmission system landscape:

Market maturation indicators suggest a transition from pilot projects to large-scale commercial deployments, with increasing standardization of technical specifications and procurement processes. MarkWide Research analysis indicates that the market is experiencing a fundamental shift toward more sophisticated HVDC applications beyond simple point-to-point transmission.

Primary market drivers propelling India’s HVDC transmission system adoption encompass both policy-driven initiatives and technical necessities arising from the country’s evolving energy landscape.

Renewable energy expansion represents the most significant driver, with India’s commitment to achieving carbon neutrality by 2070 necessitating massive renewable capacity additions. The intermittent nature of solar and wind power requires sophisticated transmission infrastructure capable of managing variable power flows and maintaining grid stability. HVDC systems provide essential flexibility for renewable energy integration, enabling efficient power evacuation from remote generation sites to urban consumption centers.

Grid stability enhancement drives HVDC adoption as India’s power system becomes increasingly complex with diverse generation sources and growing demand variability. Traditional AC transmission faces limitations in managing long-distance power transfer and maintaining synchronization across different regional grids. HVDC technology offers superior control capabilities and the ability to interconnect asynchronous AC systems, providing critical grid stability benefits.

Transmission loss reduction serves as a compelling economic driver, with conventional AC transmission systems experiencing significant power losses over long distances. HVDC systems can reduce transmission losses to below 3% compared to 8-12% typical in AC systems for equivalent distances, resulting in substantial economic benefits and improved energy efficiency.

Government policy support through various schemes and incentives accelerates market growth, including preferential tariffs for renewable energy projects utilizing HVDC transmission and streamlined approval processes for critical transmission infrastructure projects.

Market restraints present significant challenges that may impede the rapid expansion of India’s HVDC transmission system market, requiring strategic approaches to overcome these limitations.

High capital investment requirements represent the primary constraint, as HVDC systems typically require substantially higher upfront costs compared to conventional AC transmission infrastructure. The complex converter stations and specialized equipment necessary for HVDC operation demand significant financial commitments that may strain utility budgets and require innovative financing mechanisms.

Technical complexity poses operational challenges, particularly for utilities with limited experience in HVDC system management. The sophisticated control systems, specialized maintenance requirements, and need for highly trained personnel create barriers to widespread adoption, especially among smaller regional utilities with constrained technical resources.

Limited domestic manufacturing capacity creates dependency on imported equipment and technology, resulting in longer project timelines, currency exchange risks, and reduced local value addition. The specialized nature of HVDC components requires significant technology transfer and manufacturing capability development to achieve self-sufficiency.

Regulatory and approval complexities can delay project implementation, particularly for interstate transmission projects requiring coordination between multiple state electricity regulatory commissions and central authorities. The complex approval processes and varying state-level policies create uncertainties that may discourage private sector participation.

Grid integration challenges arise from the need to ensure compatibility between new HVDC systems and existing AC infrastructure, requiring careful planning and potentially costly system modifications to achieve seamless integration.

Emerging market opportunities in India’s HVDC transmission system sector present substantial potential for growth and innovation across multiple dimensions.

Offshore wind power development creates significant opportunities for specialized HVDC applications, as India explores its vast offshore wind potential along the western and eastern coastlines. Offshore HVDC transmission systems will be essential for connecting remote offshore wind farms to onshore grids, representing a new market segment with substantial growth potential.

Inter-regional grid strengthening offers opportunities for large-scale HVDC projects connecting different regional grids and enabling optimal resource utilization across the country. The development of a truly integrated national grid through strategic HVDC interconnections presents opportunities for both domestic and international technology providers.

Smart grid integration creates opportunities for advanced HVDC systems incorporating digital technologies, artificial intelligence, and IoT capabilities for enhanced system monitoring, predictive maintenance, and autonomous operation. These intelligent HVDC systems can provide superior grid management capabilities and operational efficiency.

Export market potential emerges as Indian companies develop HVDC capabilities, with opportunities to serve neighboring countries and other developing markets facing similar transmission challenges. The development of indigenous HVDC technology and manufacturing capabilities positions India as a potential technology exporter.

Energy storage integration presents opportunities for HVDC systems designed to interface with large-scale battery storage and pumped hydro storage facilities, enabling more sophisticated grid balancing and renewable energy management capabilities.

Market dynamics within India’s HVDC transmission system sector reflect the complex interplay between technological advancement, policy evolution, and economic considerations driving sector transformation.

Technology advancement cycles significantly influence market dynamics, with continuous improvements in converter efficiency, control systems, and system reliability driving adoption rates. The transition from traditional thyristor-based LCC technology to more advanced VSC systems represents a fundamental shift that affects competitive positioning and market opportunities.

Policy landscape evolution creates dynamic market conditions as government priorities shift and new regulatory frameworks emerge. The emphasis on renewable energy integration and grid modernization continues to shape market demand patterns and investment priorities, with policy stability being crucial for long-term market development.

Competitive intensity varies across different market segments, with established international players competing against emerging domestic companies seeking to develop indigenous capabilities. The balance between technology transfer requirements and competitive pricing creates complex dynamics that influence project awards and market share distribution.

Supply chain considerations affect market dynamics through equipment availability, delivery timelines, and cost structures. The push for domestic manufacturing creates opportunities for local suppliers while potentially disrupting established international supply chains.

Financial market conditions influence project viability through interest rates, currency exchange rates, and availability of project financing. The capital-intensive nature of HVDC projects makes them particularly sensitive to financial market conditions and government funding priorities.

Comprehensive research methodology employed for analyzing India’s HVDC transmission system market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights.

Primary research activities include extensive interviews with key stakeholders across the HVDC value chain, including utility executives, equipment manufacturers, system integrators, and government officials. These interviews provide firsthand insights into market trends, challenges, and opportunities that may not be apparent through secondary research alone.

Secondary research encompasses analysis of government policy documents, utility annual reports, industry publications, and technical papers to understand market fundamentals and regulatory frameworks. This research provides historical context and identifies key trends shaping market development.

Market modeling techniques utilize both top-down and bottom-up approaches to validate market size estimates and growth projections. The top-down approach considers overall power sector investment patterns and transmission infrastructure requirements, while bottom-up analysis examines individual project pipelines and technology adoption rates.

Data validation processes ensure accuracy through cross-referencing multiple sources and conducting expert reviews of findings. The methodology includes sensitivity analysis to account for various scenario outcomes and uncertainty factors that may influence market development.

Regional analysis methodology considers state-level variations in renewable energy resources, power demand patterns, and regulatory environments to provide granular market insights relevant to different geographical segments within India.

Regional market analysis reveals distinct patterns of HVDC transmission system adoption across India’s diverse geographical and economic landscape, with certain states emerging as key growth drivers.

Western India leads HVDC market development, with Gujarat and Rajasthan accounting for approximately 35% of total HVDC capacity due to their abundant renewable energy resources and strategic location for power evacuation. Gujarat’s advanced industrial base and proactive renewable energy policies have created favorable conditions for HVDC project development, while Rajasthan’s vast solar potential necessitates sophisticated transmission infrastructure for power evacuation to distant consumption centers.

Southern India represents another significant market segment, with Tamil Nadu and Karnataka driving HVDC adoption through their renewable energy programs and inter-state power trading requirements. The region’s 22% market share reflects strong industrial demand and progressive utility policies supporting grid modernization initiatives.

Northern India shows growing HVDC interest, particularly in states like Uttar Pradesh and Haryana, where power demand growth and grid stability requirements drive transmission infrastructure investments. The region’s proximity to major consumption centers creates opportunities for HVDC systems connecting remote generation sources to urban load centers.

Eastern India presents emerging opportunities as states like Odisha and Jharkhand develop their renewable energy potential and require transmission infrastructure for power evacuation. The region’s industrial development and mining activities create specific HVDC application opportunities.

Central India serves as a crucial transmission corridor connecting different regional grids, with states like Madhya Pradesh playing strategic roles in inter-regional power transfer through HVDC systems.

Competitive landscape in India’s HVDC transmission system market features a mix of established international technology leaders and emerging domestic players seeking to develop indigenous capabilities.

Market competition dynamics are influenced by technology differentiation, local manufacturing capabilities, and project execution track records. International players leverage their technological expertise and global experience, while domestic companies focus on cost competitiveness and local market understanding.

Strategic partnerships between international technology providers and Indian companies are becoming increasingly common, driven by government preferences for technology transfer and local value addition. These collaborations aim to develop indigenous HVDC manufacturing capabilities while accessing advanced international technologies.

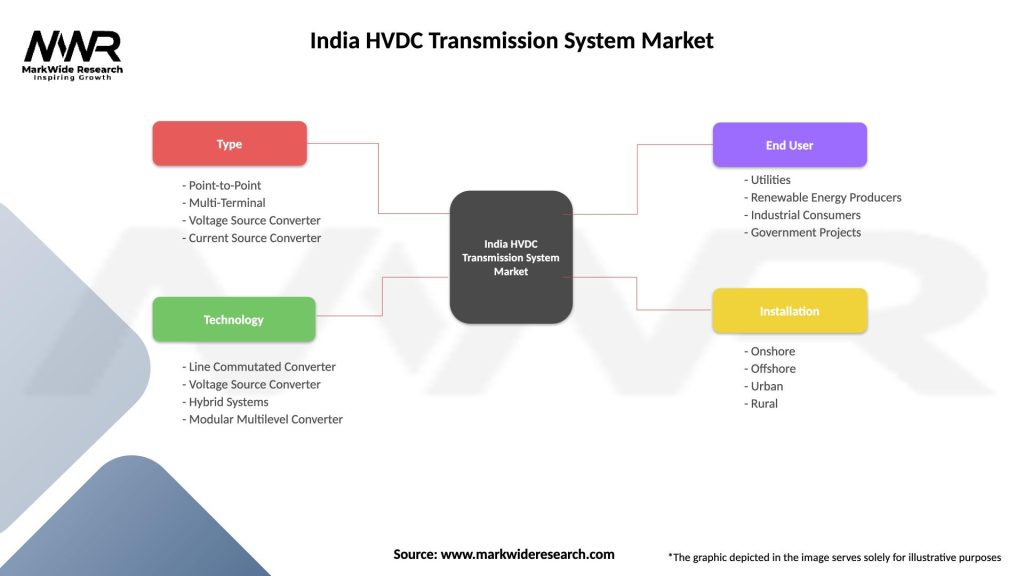

Market segmentation of India’s HVDC transmission system market reveals distinct categories based on technology type, application, and voltage levels, each presenting unique characteristics and growth patterns.

By Technology Type:

By Application:

By Voltage Level:

Category-wise analysis provides detailed insights into specific segments within India’s HVDC transmission system market, revealing distinct growth patterns and market dynamics.

VSC-HVDC Technology Segment demonstrates the strongest growth momentum, with adoption rates increasing by approximately 25% annually due to superior technical capabilities and environmental benefits. This technology’s ability to provide reactive power support and operate with weak AC systems makes it particularly suitable for renewable energy integration applications. Grid operators increasingly prefer VSC technology for its enhanced controllability and reduced harmonic distortion compared to traditional LCC systems.

Renewable Energy Integration Applications represent the largest and fastest-growing market segment, driven by India’s ambitious renewable energy targets and the need for efficient power evacuation from resource-rich regions. Solar power evacuation projects in Rajasthan and Gujarat account for a significant portion of new HVDC installations, while wind power integration drives demand in coastal states like Tamil Nadu and Gujarat.

Ultra-High Voltage (±800 kV) Systems are gaining prominence for long-distance transmission applications, offering superior efficiency and reduced land requirements compared to lower voltage alternatives. These systems are particularly relevant for connecting renewable energy generation centers in western India to consumption centers in northern and eastern regions.

Multi-terminal HVDC Systems represent an emerging category with significant future potential, enabling more flexible grid configurations and optimized power flow management across multiple connection points. MarkWide Research indicates growing utility interest in multi-terminal solutions for complex grid interconnection scenarios.

Industry participants and stakeholders in India’s HVDC transmission system market realize substantial benefits across operational, economic, and strategic dimensions.

Utility Companies benefit from enhanced grid stability, reduced transmission losses, and improved renewable energy integration capabilities. HVDC systems enable utilities to optimize power flow across their networks, reduce operational costs through lower losses, and meet renewable energy integration mandates more effectively. The technology’s superior controllability allows utilities to maintain grid stability even with high penetration of variable renewable energy sources.

Power Generators, particularly renewable energy developers, gain access to distant markets and improved project economics through efficient power evacuation. HVDC transmission enables renewable energy projects in resource-rich but remote locations to connect to high-demand urban centers, expanding the viable geographical area for renewable energy development.

Equipment Manufacturers benefit from growing market demand and opportunities for technology development and local manufacturing. The push for indigenous manufacturing creates opportunities for domestic companies to develop HVDC capabilities while international manufacturers can establish local production facilities to serve the growing Indian market.

Government and Regulatory Bodies achieve policy objectives related to renewable energy integration, grid modernization, and energy security through HVDC technology adoption. The technology supports national goals for carbon emission reduction and energy independence while improving overall power system efficiency.

End Consumers ultimately benefit from improved power quality, enhanced supply reliability, and potentially lower electricity costs due to reduced transmission losses and more efficient power system operation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping India’s HVDC transmission system landscape reflect technological evolution, policy developments, and changing industry requirements.

Digital Transformation Integration represents a major trend as HVDC systems incorporate advanced digital technologies including artificial intelligence, machine learning, and IoT capabilities. These smart HVDC systems enable predictive maintenance, autonomous operation, and enhanced grid management capabilities that improve overall system reliability and efficiency.

Modular System Design is gaining traction as manufacturers develop more flexible and scalable HVDC solutions that can be easily expanded or modified based on changing grid requirements. This trend addresses the need for adaptable transmission infrastructure that can evolve with changing power system configurations.

Environmental Sustainability Focus drives development of more environmentally friendly HVDC technologies with reduced carbon footprint and minimal environmental impact. Green HVDC systems incorporate sustainable materials and energy-efficient designs that align with India’s environmental commitments.

Multi-vendor Interoperability becomes increasingly important as utilities seek to avoid vendor lock-in and ensure system flexibility. Standardization efforts and open architecture designs enable integration of equipment from multiple suppliers within single HVDC projects.

Hybrid AC-DC Grid Development emerges as utilities explore optimal combinations of AC and DC transmission technologies to maximize system performance and cost-effectiveness. These hybrid approaches leverage the strengths of both technologies for specific transmission requirements.

Recent industry developments demonstrate the dynamic nature of India’s HVDC transmission system market and indicate future growth directions.

Major Project Announcements include several large-scale HVDC transmission projects connecting renewable energy generation centers to major consumption areas. The Rajasthan-Delhi HVDC transmission project represents one of the largest such initiatives, designed to evacuate solar power from Rajasthan to the national capital region.

Technology Partnerships between international HVDC manufacturers and Indian companies have accelerated, with several joint ventures established to develop local manufacturing capabilities. These partnerships aim to combine international technological expertise with local market knowledge and cost advantages.

Government Policy Initiatives include streamlined approval processes for critical transmission infrastructure and incentives for domestic manufacturing of HVDC equipment. The Production Linked Incentive (PLI) scheme for power equipment manufacturing specifically includes HVDC components, encouraging local production development.

Research and Development Investments by both government institutions and private companies focus on developing indigenous HVDC technologies and improving system performance. Indian Institute of Technology collaborations with industry partners have resulted in several breakthrough developments in HVDC control systems and converter technologies.

Grid Integration Projects demonstrate successful HVDC system implementation, with several operational projects showing significant improvements in transmission efficiency and grid stability. These successful implementations provide confidence for future project development and technology adoption.

Strategic recommendations for stakeholders in India’s HVDC transmission system market focus on capitalizing on growth opportunities while addressing key challenges.

For Utility Companies: Develop comprehensive HVDC implementation strategies that align with renewable energy expansion plans and grid modernization objectives. Invest in technical capability development and establish partnerships with experienced HVDC technology providers to ensure successful project implementation. Consider phased deployment approaches that allow for learning and capability building while managing financial risks.

For Equipment Manufacturers: Establish local manufacturing capabilities to serve the growing Indian market while meeting government preferences for domestic value addition. Invest in technology adaptation to address specific Indian grid requirements and environmental conditions. Develop comprehensive service capabilities including long-term maintenance and support services to differentiate from competitors.

For Government and Regulators: Continue policy support for HVDC technology adoption while streamlining approval processes for critical transmission infrastructure projects. Develop standardized technical specifications and procurement guidelines to reduce project complexity and costs. Support skill development initiatives to ensure adequate technical expertise for HVDC system operation and maintenance.

For Investors: Focus on projects with strong government support and clear revenue mechanisms, particularly those connected to renewable energy development programs. Consider the long-term nature of HVDC investments and ensure adequate risk management for technology and regulatory changes. MWR analysis suggests that early-stage investments in HVDC manufacturing capabilities may offer significant returns as the market expands.

Future market outlook for India’s HVDC transmission system sector indicates sustained growth driven by renewable energy expansion, grid modernization requirements, and technological advancement.

Technology Evolution will continue toward more efficient and intelligent HVDC systems incorporating advanced digital capabilities and improved environmental performance. Next-generation HVDC systems are expected to achieve efficiency levels exceeding 97% while offering enhanced grid services and autonomous operation capabilities.

Market Expansion will be driven by India’s commitment to achieving 500 GW renewable energy capacity by 2030, requiring substantial transmission infrastructure investments. The market is projected to experience robust growth with increasing adoption across all voltage levels and application segments.

Manufacturing Localization will accelerate as domestic companies develop indigenous HVDC capabilities through technology partnerships and government support programs. This trend will reduce import dependency and create opportunities for technology export to other developing markets.

Grid Integration Complexity will increase as power systems incorporate higher levels of renewable energy and require more sophisticated transmission solutions. HVDC systems will play crucial roles in maintaining grid stability and enabling efficient power flow management in these complex grid configurations.

Innovation Focus Areas will include multi-terminal HVDC systems, offshore transmission applications, and integration with energy storage systems. These advanced applications will create new market segments and opportunities for technology differentiation.

India’s HVDC transmission system market represents a critical component of the country’s power sector transformation, driven by ambitious renewable energy targets and the need for efficient long-distance power transmission. The market demonstrates strong growth potential with robust government support, increasing utility adoption, and continuous technological advancement creating favorable conditions for sustained expansion.

Key success factors for market participants include developing local manufacturing capabilities, building technical expertise, and establishing strategic partnerships that combine international technology with local market knowledge. The transition toward more advanced VSC-HVDC technology and integration with digital grid management systems presents significant opportunities for innovation and market differentiation.

Market challenges related to high capital costs, technical complexity, and regulatory coordination require strategic approaches and continued policy support to ensure successful market development. The emphasis on domestic manufacturing and technology transfer creates opportunities for building indigenous capabilities while serving the growing market demand.

Long-term market prospects remain highly positive, supported by India’s renewable energy expansion plans, grid modernization requirements, and the fundamental advantages of HVDC technology for long-distance transmission applications. The market’s evolution toward more sophisticated applications including offshore wind transmission and multi-terminal systems indicates continued growth and innovation opportunities for industry participants committed to this dynamic sector.

What is HVDC Transmission System?

HVDC Transmission System refers to a technology used for transmitting electricity over long distances using direct current. It is particularly beneficial for connecting renewable energy sources, such as wind and solar, to the grid, enhancing efficiency and stability.

What are the key players in the India HVDC Transmission System Market?

Key players in the India HVDC Transmission System Market include Power Grid Corporation of India, Siemens, ABB, and General Electric, among others.

What are the growth factors driving the India HVDC Transmission System Market?

The growth of the India HVDC Transmission System Market is driven by the increasing demand for efficient power transmission, the integration of renewable energy sources, and government initiatives promoting sustainable energy solutions.

What challenges does the India HVDC Transmission System Market face?

Challenges in the India HVDC Transmission System Market include high initial investment costs, technical complexities in implementation, and the need for skilled workforce to manage advanced technologies.

What opportunities exist in the India HVDC Transmission System Market?

Opportunities in the India HVDC Transmission System Market include the expansion of renewable energy projects, advancements in technology, and increasing investments in grid infrastructure to support energy transition.

What trends are shaping the India HVDC Transmission System Market?

Trends in the India HVDC Transmission System Market include the growing adoption of modular multilevel converters, increased focus on smart grid technologies, and the rise of cross-border electricity trading initiatives.

India HVDC Transmission System Market

| Segmentation Details | Description |

|---|---|

| Type | Point-to-Point, Multi-Terminal, Voltage Source Converter, Current Source Converter |

| Technology | Line Commutated Converter, Voltage Source Converter, Hybrid Systems, Modular Multilevel Converter |

| End User | Utilities, Renewable Energy Producers, Industrial Consumers, Government Projects |

| Installation | Onshore, Offshore, Urban, Rural |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India HVDC Transmission System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at