444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India household flour milling machines market represents a rapidly expanding segment within the country’s domestic appliance industry, driven by increasing consumer preference for fresh, home-ground flour and growing health consciousness among Indian households. This market encompasses various types of flour milling equipment designed for residential use, ranging from traditional stone grinders to modern electric flour mills. Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years.

Consumer behavior patterns in India show a significant shift toward home-based food preparation, particularly in the post-pandemic era, which has accelerated demand for household flour milling machines. The market benefits from India’s diverse culinary traditions that require different types of flours, from wheat and rice to various pulses and spices. Regional preferences vary considerably, with northern states showing higher demand for wheat flour mills while southern regions prefer multi-grain capabilities.

Technology advancement has transformed the household flour milling landscape, with manufacturers introducing energy-efficient motors, improved grinding mechanisms, and user-friendly designs. The market serves approximately 75% of urban households and 45% of rural households, indicating significant untapped potential in rural markets. Price sensitivity remains a crucial factor, with consumers seeking durable, cost-effective solutions that deliver consistent grinding quality.

The India household flour milling machines market refers to the commercial ecosystem encompassing the manufacturing, distribution, and sales of residential-grade flour grinding equipment designed for domestic use in Indian households. These machines enable consumers to process whole grains, pulses, and spices into fresh flour and powder at home, maintaining nutritional value and ensuring quality control over their food preparation processes.

Product categories within this market include wet grinders, dry grinders, combination units, and specialized milling machines capable of handling various grain types. The market serves the fundamental need for fresh flour production, addressing consumer concerns about commercial flour quality, preservatives, and nutritional degradation. Market participants range from established appliance manufacturers to specialized milling equipment producers, creating a competitive landscape focused on innovation and affordability.

Market performance in the India household flour milling machines sector demonstrates robust growth trajectory, supported by changing consumer preferences and technological innovations. The market has witnessed significant expansion across both urban and rural segments, with urban penetration rates reaching approximately 68% while rural adoption continues to accelerate. Key growth drivers include increasing health awareness, preference for fresh flour, and rising disposable incomes among middle-class households.

Competitive dynamics feature both domestic and international players, with Indian manufacturers holding a dominant market position due to their understanding of local preferences and price-sensitive market conditions. Product innovation focuses on energy efficiency, multi-functionality, and durability, addressing core consumer requirements. The market benefits from strong distribution networks spanning traditional retail, modern trade, and increasingly, e-commerce platforms.

Regional variations significantly influence market development, with different states showing distinct preferences for grinding mechanisms, capacity requirements, and price points. Future prospects appear promising, driven by ongoing urbanization, nuclear family trends, and growing emphasis on food safety and quality. The market is positioned for sustained growth, supported by favorable demographic trends and evolving consumer lifestyles.

Consumer preferences in the Indian household flour milling machines market reveal several critical insights that shape product development and marketing strategies. The following key insights provide comprehensive understanding of market dynamics:

Health and wellness trends serve as the primary catalyst driving growth in India’s household flour milling machines market. Consumers increasingly recognize the nutritional advantages of freshly ground flour, which retains essential vitamins, minerals, and fiber often lost in commercial processing. This health consciousness has intensified following the COVID-19 pandemic, with families prioritizing food safety and quality control through home preparation.

Rising disposable incomes among India’s expanding middle class enable greater investment in kitchen appliances that enhance food quality and convenience. The growing nuclear family structure creates demand for compact, efficient milling solutions that serve smaller household sizes while maintaining versatility. Urbanization trends contribute significantly, as city dwellers seek to maintain traditional food preparation methods despite busy lifestyles.

Government initiatives promoting food security and nutrition awareness indirectly support market growth by encouraging home-based food preparation. The Make in India campaign has also boosted domestic manufacturing capabilities, improving product availability and affordability. Technological advancements in motor efficiency, grinding mechanisms, and user interface design make modern flour mills more attractive to tech-savvy consumers.

Cultural preferences for fresh ingredients remain deeply embedded in Indian culinary traditions, sustaining long-term demand for household milling equipment. The market benefits from seasonal festivals and celebrations that increase flour consumption, creating periodic demand spikes. E-commerce expansion has improved product accessibility, particularly in tier-2 and tier-3 cities where traditional retail presence may be limited.

High initial investment costs represent a significant barrier for price-sensitive consumers, particularly in rural markets where household incomes may be limited. Quality flour milling machines require substantial upfront expenditure, which can deter potential buyers despite long-term benefits. Maintenance requirements and ongoing operational costs, including electricity consumption and periodic servicing, add to the total cost of ownership.

Space constraints in urban households pose challenges for flour mill adoption, as many apartments have limited kitchen storage and counter space. The noise generated by milling operations can be problematic in densely populated residential areas, leading to usage restrictions and neighbor complaints. Technical complexity of some advanced models may intimidate less tech-savvy consumers, particularly elderly users who prefer simpler appliances.

Availability of commercial flour at competitive prices provides an alternative that many consumers find convenient, reducing the perceived necessity of home milling. Quality concerns regarding some lower-priced products have created market skepticism, with consumers experiencing durability issues or poor grinding performance. Seasonal usage patterns mean that flour mills may remain idle for extended periods, raising questions about investment justification.

Infrastructure limitations in rural areas, including unreliable electricity supply and limited service networks, constrain market expansion. Competition from traditional methods such as manual grinding or local mill services continues to influence consumer behavior, particularly among older generations comfortable with established practices.

Rural market penetration presents enormous growth potential, with current household penetration rates of approximately 45% leaving substantial room for expansion. Government rural development programs and improving electricity infrastructure create favorable conditions for market growth in these underserved areas. Product localization strategies that address specific regional grain types and grinding preferences can unlock significant market share.

Smart technology integration offers opportunities to differentiate products through IoT connectivity, mobile app controls, and automated grinding programs. Subscription-based service models for maintenance and spare parts could create recurring revenue streams while addressing consumer concerns about after-sales support. Energy-efficient innovations align with government sustainability initiatives and consumer cost-consciousness.

E-commerce expansion enables manufacturers to reach previously inaccessible markets while reducing distribution costs. Partnership opportunities with grain suppliers, health food retailers, and cooking schools can create integrated value propositions. Export potential exists in neighboring countries with similar culinary traditions and growing Indian diaspora communities worldwide.

Premium segment development targeting affluent consumers willing to pay for advanced features, superior build quality, and enhanced user experience represents a lucrative opportunity. Rental and leasing models could make flour mills accessible to cost-sensitive consumers while generating steady income streams for manufacturers. Corporate partnerships with real estate developers for kitchen appliance packages in new residential projects offer bulk sales opportunities.

Supply chain dynamics in the India household flour milling machines market reflect complex interactions between raw material availability, manufacturing capabilities, and distribution networks. Component sourcing relies heavily on domestic suppliers for motors, grinding stones, and metal fabrication, creating cost advantages but also supply chain vulnerabilities during disruptions. Manufacturing clusters in states like Gujarat, Tamil Nadu, and Punjab have developed specialized expertise in appliance production.

Demand fluctuations follow seasonal patterns aligned with festival seasons, harvest cycles, and wedding seasons when flour consumption increases significantly. Price elasticity varies across market segments, with urban consumers showing greater willingness to pay premium prices for advanced features while rural buyers remain highly price-sensitive. Brand loyalty patterns demonstrate strong regional preferences, with local brands often outperforming national players in specific markets.

Technology adoption rates vary considerably between demographic segments, with younger consumers embracing smart features while older users prefer traditional, simple-to-operate models. Distribution channel evolution shows increasing importance of online sales, which now account for approximately 28% of total market volume. Competitive intensity has increased with new entrants leveraging e-commerce platforms to challenge established players.

Regulatory environment influences product standards, safety requirements, and energy efficiency norms, driving continuous innovation and compliance investments. Economic factors including inflation, currency fluctuations, and interest rates affect both manufacturing costs and consumer purchasing power, creating dynamic market conditions requiring adaptive strategies.

Primary research for analyzing the India household flour milling machines market involved comprehensive surveys and interviews with key stakeholders across the value chain. Consumer surveys were conducted across major metropolitan areas and rural regions, gathering insights from over 2,500 households regarding usage patterns, preferences, and purchase decisions. Industry expert interviews with manufacturers, distributors, and retailers provided detailed understanding of market dynamics and competitive landscape.

Secondary research encompassed analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary findings. Market observation techniques included retail outlet visits, online marketplace analysis, and product demonstration attendance to understand consumer behavior and sales processes. Data triangulation methods ensured accuracy and reliability of research findings.

Quantitative analysis employed statistical modeling to project market trends, segment performance, and growth trajectories based on historical data and current market indicators. Qualitative assessment focused on understanding consumer motivations, brand perceptions, and emerging trends that quantitative data alone cannot capture. Regional analysis required customized research approaches to account for diverse market conditions across different states and urban-rural divides.

Technology assessment involved evaluation of product innovations, manufacturing processes, and emerging technologies that could impact market development. Competitive intelligence gathering through public sources, trade shows, and industry networking provided insights into competitor strategies and market positioning. Validation processes included cross-referencing findings with industry associations and expert panels to ensure research accuracy and relevance.

Northern India represents the largest regional market for household flour milling machines, driven by wheat-centric dietary patterns and strong cultural preferences for fresh flour. States like Punjab, Haryana, and Uttar Pradesh show high adoption rates, with household penetration reaching approximately 72% in urban areas. Consumer preferences in this region favor high-capacity machines capable of handling large quantities of wheat and other grains for extended families.

Western India demonstrates sophisticated market characteristics with consumers showing willingness to invest in premium, feature-rich products. Maharashtra and Gujarat lead in terms of market value, with urban consumers particularly interested in multi-functional machines that can handle diverse grinding requirements. Industrial presence in this region also supports local manufacturing and innovation development.

Southern India exhibits unique market dynamics with strong preference for wet grinding capabilities alongside dry milling functions. Tamil Nadu, Karnataka, and Andhra Pradesh show distinct product preferences aligned with regional culinary traditions requiring rice flour, lentil grinding, and spice processing. Market penetration in urban southern cities reaches approximately 65%, with growing rural adoption.

Eastern India represents an emerging market with significant growth potential, though current penetration rates remain lower at around 38% in urban areas. West Bengal and Odisha show increasing interest in household milling solutions, driven by rising incomes and changing lifestyle patterns. Infrastructure development and improved electricity access are key factors supporting market expansion in this region.

Central India demonstrates steady growth with consumers showing practical approach to product selection, prioritizing durability and value for money. Madhya Pradesh and Chhattisgarh markets are characterized by price sensitivity and preference for locally manufactured products with strong service support networks.

Market leadership in India’s household flour milling machines sector is distributed among several established players, each with distinct competitive advantages and market positioning strategies. The competitive environment features both domestic manufacturers with deep local market understanding and international brands leveraging advanced technology and global expertise.

Competitive strategies focus on product differentiation through technology integration, energy efficiency improvements, and enhanced user experience. Price competition remains intense, particularly in the entry-level segment, while premium brands compete on features, build quality, and after-sales service. Distribution expansion through online channels has become crucial for market share growth and customer reach.

By Product Type: The market segmentation reveals distinct categories serving different consumer needs and preferences. Dry grinders dominate the market with approximately 55% market share, primarily used for wheat, rice, and spice grinding. Wet grinders account for 25% market share, particularly popular in South India for batter preparation. Combination units offering both wet and dry grinding capabilities represent 20% market share, appealing to consumers seeking versatility and space efficiency.

By Capacity: Market segmentation by grinding capacity reflects diverse household requirements and usage patterns. Small capacity units (up to 1 kg) serve nuclear families and occasional users, representing 35% market share. Medium capacity machines (1-2 kg) cater to average households with regular usage, accounting for 45% market share. Large capacity units (above 2 kg) target extended families and heavy users, comprising 20% market share.

By Price Range: Price segmentation demonstrates clear market stratification based on consumer purchasing power and feature requirements. Economy segment products targeting price-sensitive consumers represent 40% market volume. Mid-range products balancing features and affordability account for 45% market share. Premium segment offering advanced features and superior build quality comprises 15% market share but generates disproportionately higher revenue.

By Distribution Channel: Channel segmentation reflects evolving retail landscape and consumer shopping preferences. Traditional retail including appliance stores and local dealers maintains 45% market share. Modern trade through organized retail chains accounts for 27% market share. E-commerce platforms have rapidly gained importance, representing 28% market share with continued growth trajectory.

Dry Grinding Category represents the largest market segment, driven by universal need for wheat flour and spice grinding across Indian households. Consumer preferences in this category prioritize grinding fineness, motor power, and durability. Innovation trends focus on noise reduction, energy efficiency, and improved grinding mechanisms. Market leaders in this category emphasize robust construction and consistent performance to build brand loyalty.

Wet Grinding Category shows strong regional concentration in South India, where traditional food preparation requires batter grinding for items like dosa and idli. Product development emphasizes stone quality, grinding consistency, and easy cleaning features. Seasonal demand patterns align with festival seasons when traditional food preparation increases significantly. Competition intensity remains high with regional players holding strong market positions.

Combination Units Category appeals to space-conscious urban consumers seeking multi-functional appliances. Design challenges involve balancing wet and dry grinding performance while maintaining compact form factors. Price positioning typically falls in the mid-to-premium range, reflecting added complexity and functionality. Market growth in this category is driven by urbanization and changing household structures.

Commercial-Grade Home Units represent an emerging category targeting serious cooking enthusiasts and small-scale food businesses operating from homes. Performance requirements exceed typical household needs, demanding higher capacity and continuous operation capabilities. Market potential remains largely untapped, presenting opportunities for specialized manufacturers.

Manufacturers benefit from the India household flour milling machines market through multiple value creation opportunities. Steady demand growth driven by demographic trends and lifestyle changes provides predictable revenue streams and business expansion possibilities. Local manufacturing advantages include reduced logistics costs, better market responsiveness, and alignment with government initiatives promoting domestic production.

Distributors and Retailers gain from attractive margin structures and growing consumer interest in kitchen appliances. Product diversity across price segments enables serving varied customer bases while maximizing market coverage. After-sales service opportunities create additional revenue streams through maintenance contracts and spare parts sales. E-commerce integration expands market reach beyond traditional geographic limitations.

Consumers realize significant benefits through improved food quality, cost savings, and convenience. Health advantages from fresh flour consumption include better nutrition retention and absence of preservatives. Economic benefits accumulate over time through reduced dependence on commercial flour purchases. Convenience factors include on-demand flour preparation and customized grinding for specific recipes.

Component Suppliers benefit from growing demand for motors, grinding stones, and electronic components. Technology partnerships with manufacturers create opportunities for innovation collaboration and market expansion. Supply chain integration enables better demand forecasting and inventory management. Export opportunities emerge as Indian manufacturers expand internationally.

Service Providers including maintenance technicians and spare parts dealers benefit from expanding installed base requiring ongoing support. Training opportunities exist for developing specialized skills in flour mill servicing and repair. Franchise models enable service network expansion with lower capital requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Technology Integration emerges as a dominant trend, with manufacturers incorporating IoT connectivity, mobile app controls, and automated grinding programs. Consumer interest in smart home appliances drives demand for flour mills with digital interfaces and remote monitoring capabilities. Technology adoption varies by demographic, with younger consumers showing greater enthusiasm for connected features while older users prefer traditional operation methods.

Energy Efficiency Focus reflects growing environmental consciousness and rising electricity costs. Manufacturers are developing motors with improved power consumption profiles and implementing energy-saving features. Government initiatives promoting energy-efficient appliances through rating systems and incentives support this trend. Consumer awareness of operational costs increasingly influences purchase decisions.

Multi-Functionality Demand drives product development toward versatile machines capable of grinding various materials beyond traditional grains. Urban consumers particularly value appliances that can handle spices, nuts, and specialty grains in addition to wheat and rice. Space optimization considerations in modern kitchens favor compact, multi-purpose equipment over single-function appliances.

Premium Segment Growth indicates evolving consumer preferences toward quality and advanced features. Affluent households show willingness to invest in high-end flour mills with superior build quality, advanced grinding mechanisms, and enhanced user experience. Brand positioning strategies increasingly focus on premium value propositions rather than price competition alone.

Online Sales Expansion transforms distribution dynamics with e-commerce platforms gaining significant market share. Digital marketing strategies become crucial for brand visibility and consumer engagement. Direct-to-consumer sales models enable manufacturers to improve margins while building stronger customer relationships. Rural e-commerce growth expands market accessibility in previously underserved areas.

Product Innovation Initiatives have accelerated across the industry, with manufacturers investing heavily in research and development to create differentiated offerings. Recent launches include flour mills with variable speed controls, automatic shut-off features, and improved grinding stone compositions for better flour quality. Collaboration projects between manufacturers and technology companies are developing smart flour mills with AI-powered grinding optimization.

Manufacturing Capacity Expansion reflects industry confidence in market growth prospects. Major players have announced significant investments in new production facilities and equipment upgrades to meet growing demand. Automation initiatives in manufacturing processes aim to improve quality consistency while reducing production costs. Supply chain optimization projects focus on reducing lead times and improving component availability.

Strategic Partnerships between manufacturers and retail chains have strengthened distribution networks and market presence. E-commerce collaborations enable better online visibility and customer reach. Technology partnerships with component suppliers drive innovation in motor efficiency and grinding mechanisms. Service partnerships expand after-sales support networks, particularly in rural areas.

Market Consolidation Activities include acquisitions of smaller regional players by larger manufacturers seeking to expand market presence and product portfolios. Brand portfolio expansion strategies involve launching sub-brands targeting specific market segments or price points. International expansion initiatives by leading Indian manufacturers target overseas markets with significant Indian populations.

Sustainability Initiatives gain importance as manufacturers adopt environmentally responsible practices in production and product design. Recycling programs for old appliances and sustainable packaging solutions reflect growing environmental consciousness. Energy efficiency improvements align with government policies and consumer preferences for eco-friendly products.

Market Entry Strategies for new participants should focus on identifying underserved market segments or regional gaps in current offerings. MarkWide Research analysis indicates that rural markets present the most significant opportunities, requiring products specifically designed for local preferences and price points. Distribution partnerships with established retail networks can accelerate market penetration while reducing initial investment requirements.

Product Development Priorities should emphasize energy efficiency, durability, and multi-functionality to address core consumer requirements. Innovation investments in smart features and IoT connectivity can create competitive advantages, particularly in urban markets. Quality consistency improvements are essential for building brand trust and customer loyalty in price-sensitive markets.

Pricing Strategies must balance affordability with profitability, considering intense competition and consumer price sensitivity. Value-based pricing approaches that emphasize total cost of ownership and long-term benefits can justify premium positioning. Segmented pricing strategies enable serving diverse market segments while maximizing revenue potential across different consumer groups.

Distribution Optimization should prioritize e-commerce channel development while maintaining strong traditional retail presence. Omnichannel approaches that integrate online and offline experiences can enhance customer engagement and sales conversion. Service network expansion in rural areas is crucial for market development and customer satisfaction.

Brand Building Initiatives should focus on demonstrating product quality, reliability, and customer support capabilities. Digital marketing strategies become increasingly important for reaching younger consumers and building brand awareness. Customer education programs about flour mill benefits and proper usage can drive market adoption and customer satisfaction.

Market growth trajectory for India’s household flour milling machines sector appears robust, with projected expansion driven by demographic trends, urbanization, and evolving consumer preferences. Industry analysts anticipate continued growth at a compound annual growth rate of 8.5% over the next five years, supported by increasing health consciousness and preference for fresh flour preparation. Rural market development represents the most significant growth opportunity, with penetration rates expected to reach 65% by 2028.

Technology evolution will likely accelerate, with smart features becoming standard in mid-range and premium products. Artificial intelligence integration may enable automated grinding optimization based on grain type and desired flour consistency. Energy efficiency improvements will continue as environmental concerns and operational costs drive innovation. Connectivity features linking flour mills to smart home ecosystems are expected to gain mainstream adoption.

Market consolidation may intensify as larger players acquire regional manufacturers to expand market presence and product portfolios. International expansion by Indian manufacturers is likely to accelerate, targeting markets with similar culinary traditions and growing Indian diaspora populations. Export potential could contribute significantly to industry growth and revenue diversification.

Consumer behavior evolution toward premium products and advanced features suggests market value growth will outpace volume expansion. Health and wellness trends will continue driving demand for fresh flour preparation capabilities. Sustainability considerations may influence product design and manufacturing processes, with eco-friendly features becoming competitive advantages.

Regulatory environment is expected to evolve toward stricter safety and energy efficiency standards, potentially increasing compliance costs but also driving innovation. Government initiatives supporting domestic manufacturing and rural development will likely benefit the industry. MWR projections indicate that the market will maintain strong growth momentum while evolving toward higher value, technology-enabled products.

The India household flour milling machines market demonstrates exceptional growth potential driven by fundamental demographic trends, cultural preferences, and evolving consumer lifestyles. Market dynamics reveal a sector transitioning from basic functionality toward smart, energy-efficient solutions that address modern household requirements while maintaining traditional food preparation values. Regional diversity creates multiple growth opportunities, with rural markets representing the most significant untapped potential for industry expansion.

Competitive landscape evolution favors manufacturers that can balance innovation with affordability while building strong distribution networks and service capabilities. Technology integration emerges as a key differentiator, though success requires careful consideration of diverse consumer segments and their varying technology adoption rates. Sustainability initiatives and energy efficiency improvements align with government policies and consumer preferences, creating additional value proposition opportunities.

Future success in this market will depend on manufacturers’ ability to understand and serve diverse regional preferences while leveraging economies of scale and technological advancement. Strategic investments in product development, distribution expansion, and brand building will determine market leadership positions. The India household flour milling machines market represents a compelling opportunity for sustained growth and profitability, supported by strong fundamentals and favorable long-term trends that position it as a key segment within India’s expanding consumer appliance industry.

What is Household Flour Milling Machines?

Household flour milling machines are devices designed for grinding grains into flour for personal use. They are commonly used in kitchens to produce fresh flour from various grains such as wheat, rice, and corn.

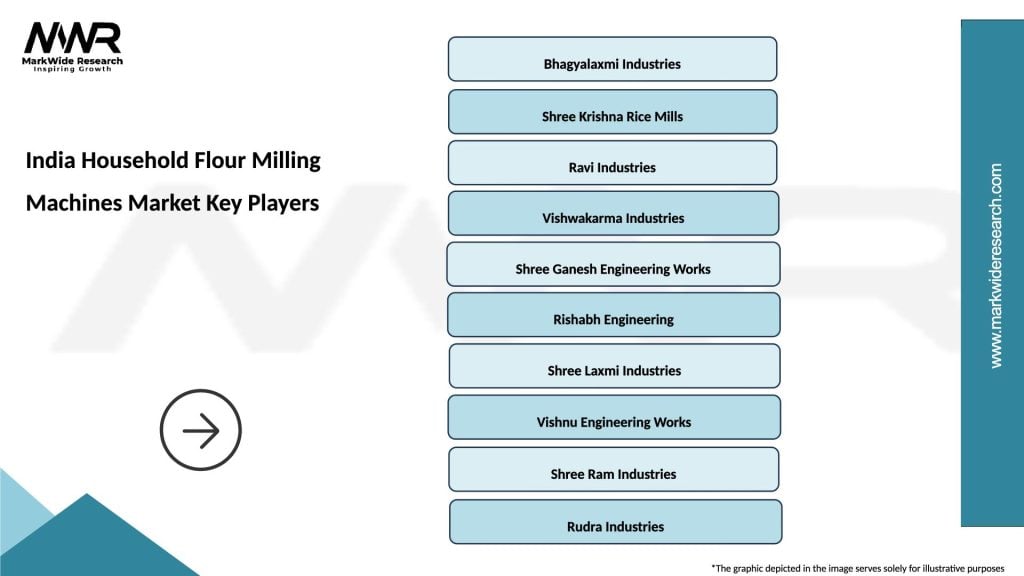

What are the key players in the India Household Flour Milling Machines Market?

Key players in the India Household Flour Milling Machines Market include Natraj, Haystar, and Milcent, among others. These companies are known for their innovative designs and quality products catering to the domestic milling needs.

What are the growth factors driving the India Household Flour Milling Machines Market?

The growth of the India Household Flour Milling Machines Market is driven by increasing health consciousness among consumers, a rising preference for homemade flour, and the convenience of using electric milling machines in households.

What challenges does the India Household Flour Milling Machines Market face?

Challenges in the India Household Flour Milling Machines Market include the high initial cost of advanced machines, competition from traditional grinding methods, and the need for regular maintenance and servicing.

What opportunities exist in the India Household Flour Milling Machines Market?

Opportunities in the India Household Flour Milling Machines Market include the growing trend of organic and gluten-free products, increasing urbanization leading to higher disposable incomes, and the potential for technological advancements in milling technology.

What trends are shaping the India Household Flour Milling Machines Market?

Trends in the India Household Flour Milling Machines Market include the rise of smart kitchen appliances, the integration of IoT technology for enhanced user experience, and a growing focus on energy-efficient machines.

India Household Flour Milling Machines Market

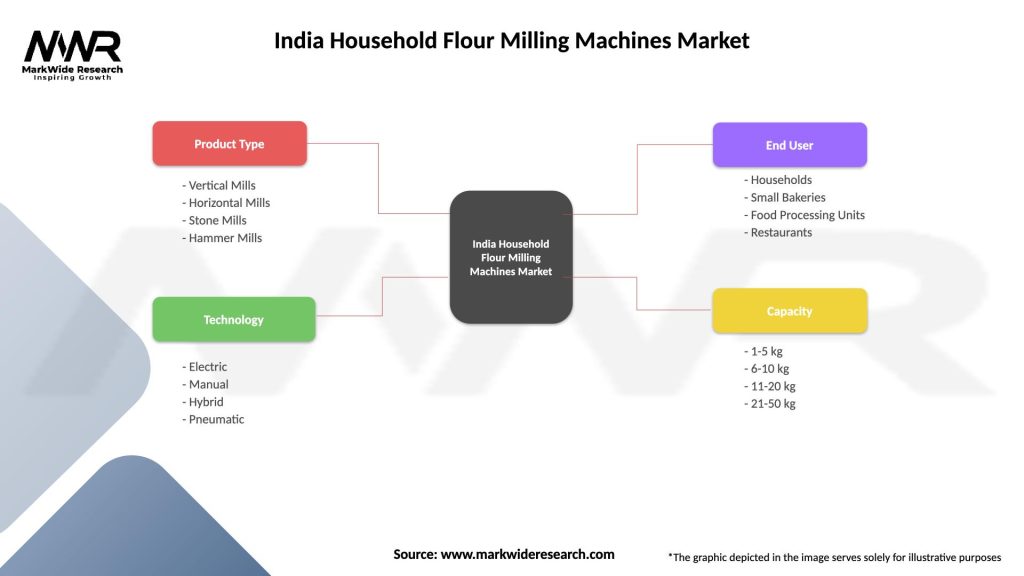

| Segmentation Details | Description |

|---|---|

| Product Type | Vertical Mills, Horizontal Mills, Stone Mills, Hammer Mills |

| Technology | Electric, Manual, Hybrid, Pneumatic |

| End User | Households, Small Bakeries, Food Processing Units, Restaurants |

| Capacity | 1-5 kg, 6-10 kg, 11-20 kg, 21-50 kg |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Household Flour Milling Machines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at