444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India home loan market represents one of the most dynamic and rapidly evolving financial sectors in the country, driven by increasing urbanization, rising disposable incomes, and favorable government policies. Home loan providers across India are experiencing unprecedented demand as millennials and Gen Z consumers enter the housing market with growing confidence and financial stability.

Market dynamics indicate that the sector is witnessing substantial growth, with digital lending platforms and traditional banks competing to capture market share through innovative products and streamlined processes. The market demonstrates remarkable resilience, supported by government initiatives such as the Pradhan Mantri Awas Yojana and various tax benefits that encourage homeownership among middle-income families.

Technological advancement has revolutionized the home loan landscape, with artificial intelligence and machine learning algorithms enabling faster loan approvals and more accurate risk assessments. The integration of digital documentation and online application processes has significantly reduced processing times, with many lenders now offering instant pre-approvals within minutes of application submission.

Regional expansion remains a key focus area, with major financial institutions extending their reach to tier-2 and tier-3 cities where housing demand is growing at accelerated rates. The market benefits from competitive interest rates and flexible repayment options that cater to diverse customer segments across different income brackets.

The India home loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate residential property purchases through structured lending mechanisms. This market encompasses various types of housing finance solutions, including home purchase loans, home construction loans, home improvement loans, and balance transfer facilities offered by banks, non-banking financial companies, and specialized housing finance institutions.

Home loan products in India typically feature competitive interest rates, extended repayment tenures ranging from 10 to 30 years, and loan-to-value ratios that can reach up to 90% of property value for eligible borrowers. The market operates under regulatory oversight from the Reserve Bank of India and other financial authorities, ensuring consumer protection and maintaining systemic stability.

Market participants include public sector banks, private sector banks, housing finance companies, and emerging fintech platforms that leverage technology to streamline the lending process. These institutions offer customized solutions based on borrower profiles, property types, and regional market conditions, creating a diverse and competitive lending environment.

India’s home loan market stands as a cornerstone of the country’s financial services sector, experiencing robust growth driven by demographic advantages, urbanization trends, and supportive regulatory frameworks. The market demonstrates exceptional potential with young demographics comprising a significant portion of loan applicants, reflecting changing lifestyle preferences and increased homeownership aspirations.

Digital transformation has emerged as a critical success factor, with leading institutions investing heavily in technology infrastructure to enhance customer experience and operational efficiency. The adoption of digital-first approaches has resulted in processing time reductions of up to 75% compared to traditional methods, significantly improving customer satisfaction and market competitiveness.

Government support through various housing schemes and tax incentives continues to stimulate demand, particularly among first-time homebuyers. The market benefits from interest rate stability and improved credit accessibility, with lenders expanding their reach to previously underserved segments through innovative product offerings and flexible eligibility criteria.

Competitive intensity remains high, with market players differentiating themselves through customer service excellence, digital capabilities, and specialized product features. The emergence of co-lending partnerships between banks and NBFCs has created new opportunities for market expansion and risk distribution.

Market intelligence reveals several critical insights that shape the India home loan landscape. Customer preferences have shifted significantly toward digital-first experiences, with online applications accounting for over 60% of new loan inquiries across major lending institutions.

Market segmentation analysis indicates that salaried professionals continue to represent the largest borrower category, while self-employed individuals and small business owners constitute a rapidly growing segment with specialized product requirements.

Demographic dividend serves as the primary catalyst for India’s home loan market expansion, with a large population of working-age individuals entering their prime earning years and seeking homeownership opportunities. The nuclear family trend and changing social dynamics have increased housing demand across urban and semi-urban areas.

Government initiatives play a crucial role in market growth, with schemes like Pradhan Mantri Awas Yojana providing substantial subsidies and incentives for first-time homebuyers. Tax benefits under Section 80C and Section 24B of the Income Tax Act make home loans attractive investment options for tax-conscious borrowers.

Urbanization acceleration continues to drive housing demand, with migration patterns from rural to urban areas creating sustained need for residential properties. The development of smart cities and industrial corridors has generated employment opportunities that support loan eligibility and repayment capacity.

Interest rate environment remains conducive to borrowing, with competitive rates and flexible terms making homeownership more accessible. Technological advancement has streamlined loan processing, reduced documentation requirements, and improved overall customer experience, encouraging more applications.

Real estate sector recovery and improved project delivery timelines have restored buyer confidence, leading to increased home loan applications. The implementation of RERA regulations has enhanced transparency and reduced investment risks associated with under-construction properties.

Economic uncertainties and periodic market volatility can impact borrower confidence and loan demand, particularly during periods of job market instability or income fluctuations. The COVID-19 pandemic demonstrated how external shocks can temporarily disrupt lending patterns and borrower behavior.

Regulatory changes and evolving compliance requirements can increase operational costs for lenders, potentially affecting interest rates and product offerings. Risk-based pricing models may limit access for borrowers with lower credit scores or irregular income patterns.

Property price inflation in major metropolitan areas has outpaced income growth, making homeownership challenging for middle-income segments despite available financing options. High property registration costs and stamp duties in certain states add to the overall cost of homeownership.

Credit assessment challenges for self-employed borrowers and those in informal sectors limit market penetration. Documentation requirements and lengthy verification processes can deter potential borrowers, despite ongoing digitization efforts.

Competition from alternative investments such as mutual funds, stocks, and gold can divert potential homebuyers toward other asset classes, particularly during periods of real estate market uncertainty.

Affordable housing segment presents significant expansion opportunities, with government support and developer focus creating a large addressable market. First-time homebuyers in tier-2 and tier-3 cities represent an underserved segment with substantial growth potential.

Digital lending platforms offer opportunities to reach previously inaccessible customer segments through innovative credit assessment methods and streamlined application processes. Artificial intelligence and machine learning applications can enhance risk evaluation and enable more inclusive lending practices.

Green financing and sustainable housing loans align with environmental consciousness trends, offering differentiation opportunities for forward-thinking lenders. Energy-efficient homes and solar-powered properties can command preferential interest rates and terms.

Co-lending partnerships between banks and NBFCs create opportunities for market expansion while optimizing capital utilization and risk distribution. Fintech collaborations can enhance customer experience and operational efficiency through technological innovation.

Rural and semi-urban markets offer untapped potential as infrastructure development and employment opportunities expand beyond major cities. Women borrowers represent a growing segment with specific product requirements and preferences.

Supply-demand equilibrium in the India home loan market reflects the interplay between housing demand, credit availability, and regulatory frameworks. Demand drivers include demographic trends, income growth, and lifestyle changes, while supply factors encompass lender capacity, regulatory policies, and funding costs.

Interest rate cycles significantly influence market dynamics, with rate cuts stimulating demand and rate increases moderating growth. The transmission mechanism from policy rates to lending rates affects borrower behavior and market momentum.

Competitive dynamics have intensified with new market entrants and technological disruption. Traditional banks face competition from specialized housing finance companies and digital lending platforms that offer faster processing and enhanced customer experience.

Risk management practices continue evolving with advanced analytics and alternative data sources enabling more accurate credit assessments. Portfolio diversification across geographic regions and customer segments helps lenders manage concentration risks.

Regulatory evolution shapes market structure and competitive landscape, with policies aimed at promoting financial inclusion while maintaining systemic stability. Consumer protection measures and fair lending practices influence product design and marketing strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of insights. Primary research involves extensive interviews with industry executives, lending professionals, and borrower segments to gather firsthand market intelligence.

Secondary research encompasses analysis of regulatory filings, industry reports, and financial statements from major market participants. Data triangulation methods validate findings across multiple sources to ensure consistency and accuracy.

Quantitative analysis utilizes statistical models to identify trends, correlations, and market patterns. Regression analysis and time series forecasting provide insights into future market trajectories and growth potential.

Qualitative research includes focus group discussions and expert interviews to understand market nuances, customer preferences, and emerging trends. Behavioral analysis examines borrower decision-making processes and factors influencing loan choices.

Market segmentation analysis employs clustering techniques to identify distinct customer groups and their specific requirements. Competitive intelligence gathering provides insights into market positioning and strategic initiatives of key players.

Northern India demonstrates robust market activity, with Delhi NCR leading in loan volumes due to high property values and strong employment opportunities. The region benefits from government presence and corporate headquarters that support stable income profiles among borrowers.

Western India, particularly Maharashtra and Gujarat, shows strong market performance driven by industrial development and commercial activities. Mumbai metropolitan region accounts for a significant portion of high-value loans, while Pune and Ahmedabad contribute to volume growth.

Southern India exhibits consistent growth across multiple cities, with Bangalore, Chennai, and Hyderabad leading in technology sector employment that supports loan demand. The region demonstrates higher digital adoption rates and preference for online loan applications.

Eastern India shows emerging potential, with Kolkata and surrounding areas experiencing gradual market development. Infrastructure improvements and industrial investments are creating new opportunities for market expansion.

Tier-2 and tier-3 cities across all regions demonstrate the highest growth rates, with market penetration increasing by over 25% annually in many locations. These markets benefit from affordable property prices and improving infrastructure connectivity.

Market leadership remains distributed among several categories of financial institutions, each with distinct competitive advantages and market positioning strategies. Public sector banks maintain significant market share through extensive branch networks and government backing.

Competitive differentiation occurs through interest rate competitiveness, processing speed, customer service quality, and digital experience. New market entrants leverage technology to challenge established players with faster approvals and enhanced user interfaces.

Strategic partnerships between banks and real estate developers create competitive advantages through pre-approved projects and streamlined documentation processes. Co-lending models enable smaller players to compete effectively with larger institutions.

Customer segmentation reveals distinct borrower categories with specific needs and preferences. Salaried professionals represent the largest segment, typically seeking competitive interest rates and flexible repayment options.

By Income Level:

By Employment Type:

By Property Type:

Geographic segmentation shows distinct patterns, with metropolitan areas focusing on high-value loans while smaller cities emphasize volume growth and market penetration strategies.

Home Purchase Loans constitute the largest category, accounting for approximately 75% of total loan volumes. This segment benefits from competitive interest rates and extensive product variations to meet diverse customer requirements.

Home Construction Loans serve customers building properties on owned land, featuring staged disbursement mechanisms tied to construction milestones. These loans require specialized monitoring and technical evaluation capabilities.

Home Improvement Loans address renovation and upgrade requirements, typically featuring shorter tenures and simplified documentation. This category shows strong growth as existing homeowners invest in property enhancements.

Balance Transfer Loans enable borrowers to switch lenders for better terms, creating competitive pressure and customer retention challenges. This category demonstrates high price sensitivity and quick decision-making patterns.

Top-up Loans provide additional funding to existing borrowers, leveraging established relationships and simplified processing. These products offer higher margins and lower acquisition costs for lenders.

Commercial Property Loans serve small business owners and investors, featuring different risk profiles and evaluation criteria compared to residential loans. This segment requires specialized expertise and market knowledge.

Lenders benefit from diversified revenue streams and stable long-term assets that provide predictable cash flows. Home loans typically offer lower default rates compared to unsecured lending products, supporting portfolio quality and profitability.

Borrowers gain access to homeownership through affordable financing options and flexible repayment structures. Tax benefits and asset appreciation potential make home loans attractive investment vehicles for wealth building.

Real estate developers benefit from increased buyer financing availability, supporting sales velocity and project viability. Pre-approved projects and builder tie-ups enhance marketing effectiveness and customer confidence.

Government objectives align with market growth through increased homeownership rates, urban development, and economic stimulus effects. Housing finance supports broader economic goals including employment generation and infrastructure development.

Technology providers find opportunities in digital transformation initiatives, offering solutions for loan origination, risk assessment, and customer management. Fintech partnerships create new revenue streams and market expansion possibilities.

Insurance companies benefit from mandatory home loan insurance requirements, creating stable premium income streams. Credit protection and property insurance products complement lending services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first approach has become the dominant trend, with lenders investing heavily in mobile applications, online portals, and automated processing systems. Artificial intelligence integration enables instant credit decisions and personalized product recommendations.

Customer experience enhancement drives innovation in user interface design, communication channels, and service delivery models. Omnichannel strategies ensure consistent experience across digital and physical touchpoints.

Alternative credit scoring methods incorporate social media data, utility payments, and transaction history to assess creditworthiness beyond traditional parameters. This trend enables financial inclusion for previously underserved segments.

Green financing initiatives promote energy-efficient homes and sustainable construction practices through preferential interest rates and specialized loan products. Environmental consciousness influences both lender strategies and borrower preferences.

Co-lending partnerships between banks and NBFCs optimize capital utilization while expanding market reach. These collaborations enable risk sharing and expertise leveraging for mutual benefit.

Personalization trends focus on customized loan products based on individual financial profiles and preferences. Flexible EMI options and dynamic interest rates cater to diverse customer needs.

Regulatory framework evolution continues shaping market structure, with recent guidelines on digital lending and customer protection influencing operational practices. RBI directives on loan pricing transparency and fair lending practices enhance consumer confidence.

Technology partnerships between traditional lenders and fintech companies accelerate digital transformation initiatives. API integrations enable seamless data sharing and process automation across platforms.

Market consolidation through mergers and acquisitions creates larger, more efficient institutions with enhanced capabilities. Strategic alliances between banks and housing finance companies optimize market coverage and resource utilization.

Product innovation introduces flexible repayment structures, interest rate protection, and value-added services that differentiate market offerings. Customization capabilities enable tailored solutions for specific customer segments.

Infrastructure development in tier-2 and tier-3 cities creates new market opportunities and expands addressable customer base. Smart city initiatives and industrial corridor development support sustained demand growth.

According to MarkWide Research analysis, recent industry developments indicate accelerating digital adoption and increasing focus on customer-centric service delivery models across all market segments.

Market participants should prioritize digital capability development to remain competitive in an increasingly technology-driven landscape. Investment in artificial intelligence and machine learning platforms will enable superior risk assessment and customer experience delivery.

Geographic diversification strategies should focus on tier-2 and tier-3 cities where growth potential remains largely untapped. Local market knowledge and regional partnerships will be critical for successful expansion.

Customer segmentation refinement can improve targeting effectiveness and product-market fit. Data analytics capabilities should be enhanced to identify emerging customer needs and preferences.

Risk management frameworks require continuous evolution to address changing market dynamics and regulatory requirements. Alternative data sources and predictive analytics can improve credit assessment accuracy.

Partnership strategies with real estate developers, fintech companies, and government agencies can create competitive advantages and market access opportunities. Ecosystem approach to service delivery enhances customer value proposition.

Sustainability initiatives should be integrated into product development and marketing strategies to align with evolving customer values and regulatory expectations. Green financing products can differentiate market positioning.

Long-term growth prospects for the India home loan market remain highly positive, supported by favorable demographics, urbanization trends, and government policy support. Market expansion is expected to continue at robust rates, with projected growth of 12-15% annually over the next five years.

Technology integration will deepen significantly, with artificial intelligence, blockchain, and Internet of Things applications transforming various aspects of loan origination, processing, and servicing. Digital-native customers will drive demand for seamless, technology-enabled experiences.

Market penetration in rural and semi-urban areas presents substantial growth opportunities as infrastructure development and employment generation expand beyond major metropolitan centers. Financial inclusion initiatives will support broader market access.

Product innovation will continue evolving toward greater customization and flexibility, with dynamic pricing models and personalized repayment structures becoming standard offerings. Value-added services will differentiate competitive positioning.

Regulatory environment is expected to become more supportive of innovation while maintaining consumer protection standards. Digital lending guidelines will provide clarity for technology adoption and market development.

MWR projections indicate that the market will witness increased consolidation among smaller players while larger institutions expand their digital capabilities and geographic reach to maintain competitive advantages.

The India home loan market represents one of the most dynamic and promising segments within the country’s financial services landscape, driven by powerful demographic trends, supportive government policies, and rapid technological advancement. Market fundamentals remain exceptionally strong, with sustained demand from young, aspirational customers seeking homeownership opportunities across diverse geographic markets.

Digital transformation has emerged as a defining characteristic of market evolution, with leading institutions leveraging artificial intelligence, machine learning, and advanced analytics to enhance customer experience and operational efficiency. The successful integration of technology with traditional lending expertise creates sustainable competitive advantages and improved market accessibility.

Future growth trajectory appears highly favorable, supported by continued urbanization, infrastructure development, and expanding economic opportunities in tier-2 and tier-3 cities. Market participants who successfully combine digital innovation with customer-centric service delivery will be best positioned to capture emerging opportunities and build lasting market leadership.

The India home loan market stands poised for continued expansion, offering significant value creation opportunities for lenders, borrowers, and the broader economy through increased homeownership rates and sustained economic development.

What is Home Loan?

A home loan is a financial product that allows individuals to borrow money from a lender to purchase a residential property. It typically involves a mortgage agreement where the property serves as collateral for the loan.

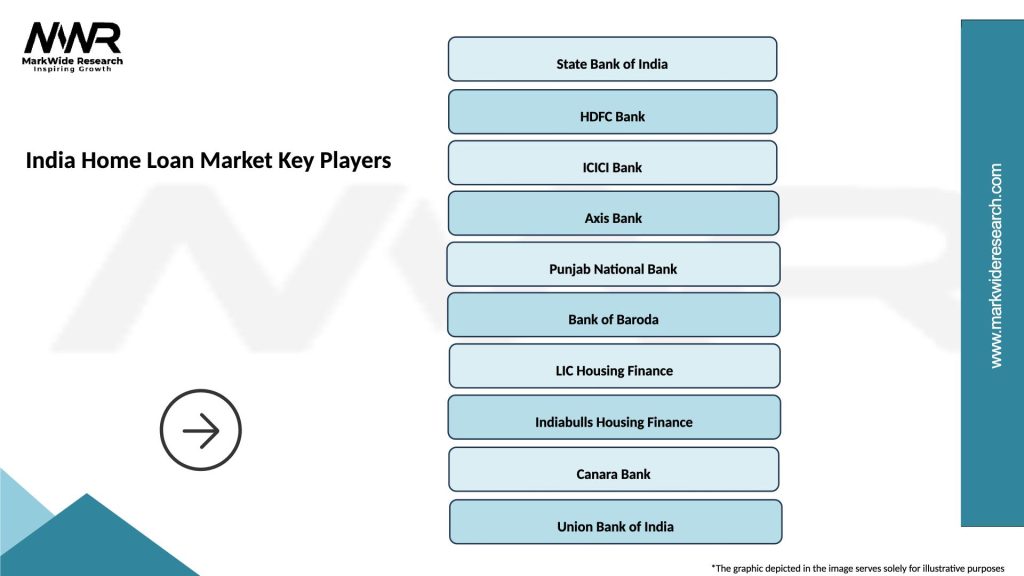

What are the key players in the India Home Loan Market?

Key players in the India Home Loan Market include State Bank of India, HDFC Ltd., ICICI Bank, and Axis Bank, among others. These companies offer a variety of home loan products catering to different customer needs.

What are the main drivers of the India Home Loan Market?

The main drivers of the India Home Loan Market include rising disposable incomes, increasing urbanization, and government initiatives promoting affordable housing. These factors contribute to a growing demand for home loans among consumers.

What challenges does the India Home Loan Market face?

The India Home Loan Market faces challenges such as fluctuating interest rates, regulatory hurdles, and the impact of economic downturns on consumer confidence. These factors can affect loan approvals and repayment rates.

What opportunities exist in the India Home Loan Market?

Opportunities in the India Home Loan Market include the growing trend of digital lending platforms and the increasing demand for green homes. These trends can lead to innovative loan products and expanded customer reach.

What trends are shaping the India Home Loan Market?

Trends shaping the India Home Loan Market include the rise of online home loan applications, personalized loan offerings based on customer profiles, and a focus on sustainable housing solutions. These trends are transforming how consumers access home financing.

India Home Loan Market

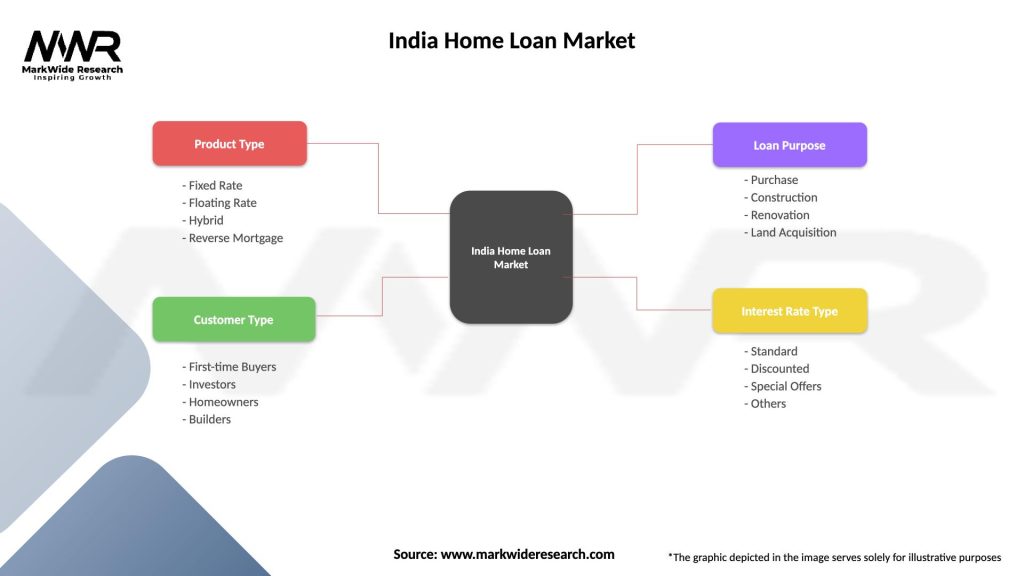

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Rate, Floating Rate, Hybrid, Reverse Mortgage |

| Customer Type | First-time Buyers, Investors, Homeowners, Builders |

| Loan Purpose | Purchase, Construction, Renovation, Land Acquisition |

| Interest Rate Type | Standard, Discounted, Special Offers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Home Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at